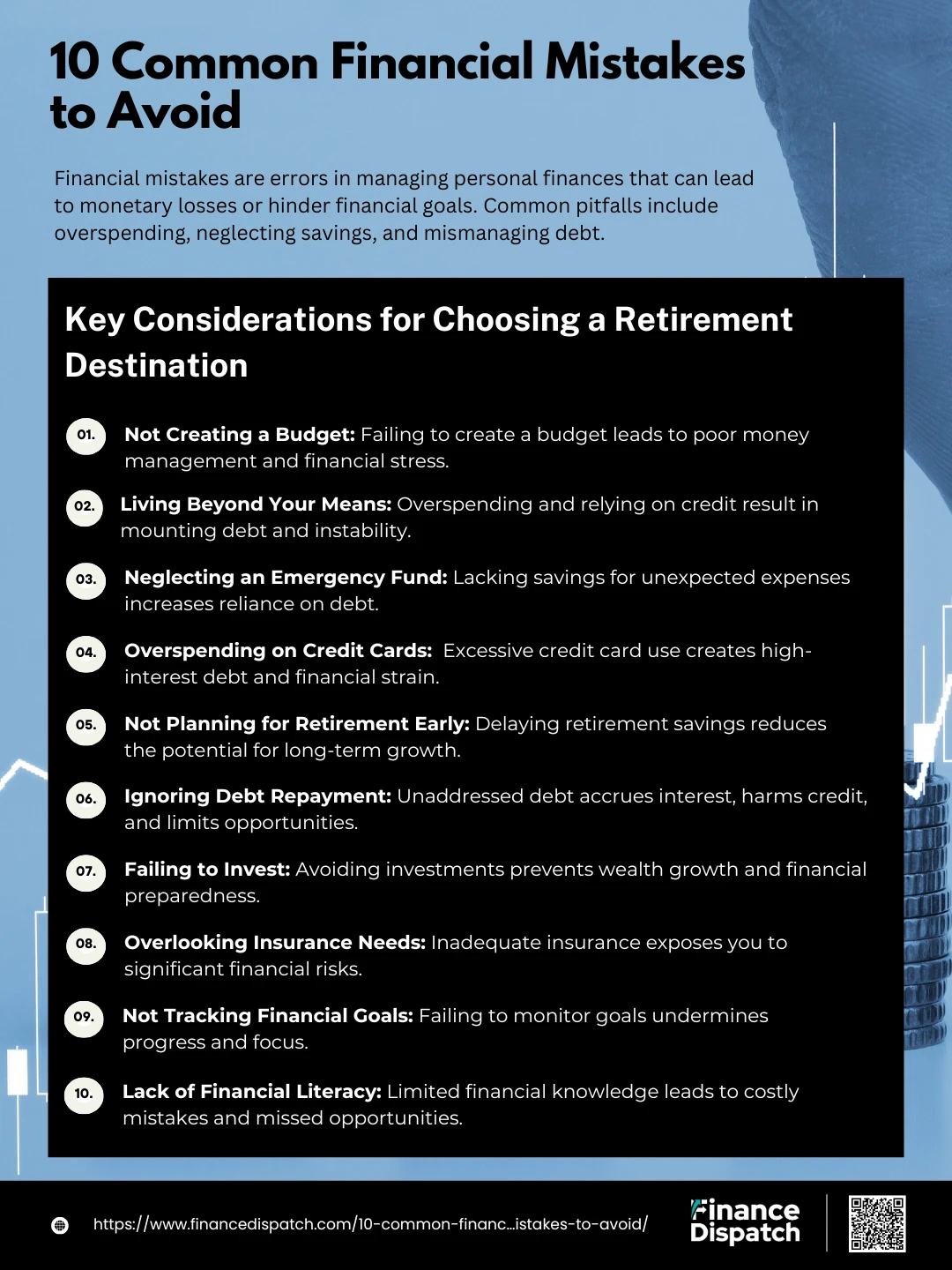

Managing your finances wisely is one of the most important skills you can develop to secure your future and reduce stress in your daily life. Yet, many people unknowingly fall into financial traps that can hinder their progress and lead to long-term challenges. This article, “10 Common Financial Mistakes to Avoid,” is here to guide you through some of the most frequent pitfalls people encounter when handling their money. By understanding these mistakes and learning how to avoid them, you can take meaningful steps toward achieving financial stability and peace of mind.

What is Financial Mistakes?

Financial mistakes are errors or missteps in managing money that can negatively impact your financial health and goals. These mistakes often stem from a lack of planning, poor decision-making, or insufficient knowledge about personal finance. Whether it’s overspending, neglecting to save, or failing to plan for the future, financial mistakes can lead to unnecessary stress and hinder your ability to achieve long-term financial stability. Recognizing these common errors is the first step toward making smarter choices and building a secure financial foundation.

1. Not Creating a Budget

A budget is the foundation of financial stability. Without one, it’s easy to lose track of your spending and miss opportunities to save or invest. A well-structured budget helps you understand where your money is going, ensures you live within your means, and prepares you for unexpected expenses. Neglecting to create a budget can leave you vulnerable to financial stress and poor money management.

Common Budgeting Errors:

- Underestimating regular expenses like groceries or utilities.

- Forgetting to account for irregular costs such as car repairs or medical bills.

- Failing to track small daily purchases that add up over time.

- Setting unrealistic spending limits that are hard to maintain.

- Ignoring the need to adjust your budget for changes in income or expenses.

2. Living Beyond Your Means

Living beyond your means is one of the quickest ways to fall into financial trouble. It happens when you consistently spend more than you earn, often relying on credit cards or loans to make up the difference. While it may seem manageable in the short term, this habit can lead to mounting debt and a lack of financial security. Recognizing the signs and taking steps to live within your means can help you regain control over your finances and achieve lasting stability.

Signs You May Be Living Beyond Your Means:

- Using credit cards to pay for everyday expenses like groceries or utilities.

- Having little to no savings for emergencies or future goals.

- Consistently running out of money before your next paycheck.

- Feeling overwhelmed by debt payments or relying on minimum payments.

- Prioritizing wants, such as luxury items or frequent dining out, over essential needs.

3. Neglecting an Emergency Fund

An emergency fund acts as a financial safety net, providing you with the means to handle unexpected expenses like medical bills, car repairs, or job loss without resorting to debt. Without this crucial buffer, even minor financial setbacks can spiral into major stress and long-term financial challenges. Neglecting to build an emergency fund leaves you vulnerable to relying on credit cards or loans in emergencies, which can quickly lead to mounting debt. By setting aside even a small amount regularly, you can create a fund that offers peace of mind and greater financial resilience.

4. Overspending on Credit Cards

Credit cards are a double-edged sword—they offer convenience and rewards but can lead to financial trouble when misused. Overspending on credit cards often stems from impulse buying or relying on credit to fund a lifestyle beyond your means. The result? Mounting debt, high-interest payments, and financial stress. By understanding the dangers and adopting mindful spending habits, you can use credit cards as a tool rather than a trap.

Key Reasons to Avoid Overspending on Credit Cards:

1. High-Interest Rates:

Credit card debt often carries some of the highest interest rates in personal finance, which can make even small balances grow rapidly. The longer you take to pay off your balance, the more you pay in interest—sometimes far exceeding the original purchase amount.

2. Illusion of Unlimited Spending:

Credit cards create the perception of having more money than you actually do. Without a clear limit in mind, it’s easy to overspend on non-essential items, assuming you’ll handle the payments later. This illusion can lead to habits of unnecessary spending.

3. Debt Accumulation:

Overspending doesn’t feel significant in the moment, but small, repeated charges add up quickly. Before you know it, the balance becomes overwhelming, and paying it off seems impossible, especially when paired with high interest.

4. Minimum Payment Trap:

Making only the minimum payment might feel manageable, but it’s a trap that prolongs your debt for years. This approach primarily pays off interest rather than the principal balance, keeping you in a cycle of debt for far longer than necessary.

5. Impact on Credit Score:

Carrying high balances relative to your credit limit, or missing payments, can harm your credit score. A poor credit score affects your ability to secure loans or favorable interest rates in the future, further complicating your financial health.

6. Missed Savings Opportunities:

Every dollar spent on credit card interest is a missed opportunity for savings or investment. Overspending means you’re diverting funds that could otherwise be used for emergencies, retirement, or personal growth.

5. Not Planning for Retirement Early

Retirement may feel like a distant goal, but delaying your planning can significantly impact your financial future. Without early preparation, you may struggle to accumulate enough savings to maintain your desired lifestyle during retirement. Starting early not only gives you a head start but also allows your money to grow through the power of compounding interest. By consistently contributing to retirement savings, even in small amounts, you can achieve financial independence and avoid the stress of playing catch-up later in life.

Benefits of Early Retirement Planning:

1. Compounding Interest Works in Your Favor:

Compounding interest is a powerful tool that multiplies your savings over time. When you start saving early, the returns on your investments generate additional earnings. For example, investing $100 per month at age 25 can grow significantly more by retirement age than starting the same contributions at 40. The longer your money works for you, the more exponential the growth.

2. Easier to Reach Financial Goals:

Early planning allows you to set achievable and realistic financial goals. Instead of contributing large sums in a short timeframe later, you can spread your savings out over decades, making it less burdensome on your monthly budget. This consistent approach also helps you avoid financial stress as retirement nears.

3. Greater Investment Opportunities:

Younger investors have the advantage of time, allowing them to take on higher-risk investments like stocks, which tend to offer higher returns over the long term. Unlike those closer to retirement, you can afford to ride out market downturns and recover your losses. Diversifying your portfolio early gives your savings the potential for significant growth.

4. Tax Advantages:

Many retirement savings plans, such as 401(k)s and IRAs, offer tax benefits. Starting early means you can maximize these advantages, reducing your taxable income now and allowing your investments to grow tax-deferred or tax-free. Over time, these savings can add up to a substantial amount.

5. Reduces Financial Stress:

Knowing you’re prepared for retirement can alleviate the stress of financial uncertainty. By starting early, you avoid the panic of scrambling to save in your later years, giving you peace of mind and the confidence that you’ll have a secure financial future.

6. Allows for Flexibility in Retirement:

Early planning gives you more freedom to choose how and when you retire. Whether it’s retiring early, traveling the world, pursuing hobbies, or even starting a second career, having a solid financial foundation lets you enjoy your retirement on your terms. You won’t be tied down by the need to continue working just to make ends meet.

6. Ignoring Debt Repayment

Ignoring debt repayment can quickly snowball into a major financial burden. Unpaid debts accrue interest, often at high rates, which makes the total amount owed grow rapidly. This can damage your credit score, limit future financial opportunities, and cause unnecessary stress. Taking proactive steps to address your debts not only improves your financial health but also gives you the freedom to focus on other financial goals.

Debt Types, Consequences, and Solutions:

| Debt Type | Consequence of Neglect | Solution |

| Credit Card Debt | High-interest rates and growing debt | Use the debt snowball or avalanche method to pay off balances faster. |

| Student Loans | Impact on credit score and delayed financial independence | Consider income-based repayment plans or refinancing for lower rates. |

| Personal Loans | Collection actions and credit damage | Consolidate debts for manageable payments or negotiate lower rates. |

| Mortgage Loans | Risk of foreclosure and loss of property | Work with your lender to modify payments or explore refinancing. |

| Auto Loans | Vehicle repossession and credit impact | Refinance for a lower interest rate or sell the vehicle to pay off the loan. |

7. Failing to Invest

Failing to invest is a missed opportunity to grow your wealth and secure your financial future. While saving is essential, investing allows your money to work for you by generating returns over time. Many people avoid investing due to fear, lack of knowledge, or the misconception that it requires large sums of money. However, neglecting to invest can leave you unprepared for major life goals like retirement, education, or buying a home. Understanding the importance of investing and avoiding common mistakes can help you build a stable financial foundation.

Common Investment Mistakes to Avoid:

- Waiting Too Long to Start: Delaying investments reduces the time for your money to grow through compounding returns.

- Not Diversifying Investments: Putting all your money in one asset class increases risk; diversification spreads out potential losses.

- Trying to Time the Market: Attempting to predict market highs and lows can lead to missed opportunities and losses.

- Ignoring Inflation: Keeping all your money in savings accounts may not outpace inflation, eroding your purchasing power over time.

- Overlooking Employer-Sponsored Plans: Failing to take advantage of benefits like a 401(k) or matching contributions is like leaving free money on the table.

- Investing Without a Plan: Making random investments without clear goals can lead to inconsistent returns and missed opportunities.

8. Overlooking Insurance Needs

Insurance is a vital part of any sound financial plan, yet it is often overlooked or undervalued. Whether it’s health, life, or property insurance, having the right coverage can protect you from significant financial setbacks. Without insurance, unexpected events like medical emergencies, accidents, or natural disasters can lead to overwhelming expenses that deplete your savings or drive you into debt. By carefully assessing your needs and securing adequate coverage, you can safeguard your finances, ensure peace of mind, and provide a safety net for yourself and your loved ones.

9. Not Tracking Financial Goals

Setting financial goals is an important step toward building a secure and successful future, but not tracking them can undermine your progress. Without a clear way to monitor your achievements, you risk losing focus, overspending, or falling short of your targets. Tracking your financial goals helps you stay motivated, make necessary adjustments, and celebrate milestones along the way. It’s a powerful way to ensure that your efforts align with your aspirations, whether they involve saving for a home, paying off debt, or planning for retirement.

Simple Tips to Track Financial Goals:

- Use Financial Apps: Leverage apps designed for budgeting and goal tracking to keep a clear record of your progress.

- Set Milestones: Break larger goals into smaller, achievable steps to stay motivated and measure your success.

- Automate Savings: Set up automatic transfers to savings accounts or investment funds to ensure consistent contributions.

- Review Regularly: Schedule regular check-ins to assess your progress and make adjustments as needed.

- Keep Visual Reminders: Create charts or vision boards to visualize your goals and stay inspired.

- Celebrate Achievements: Reward yourself when you reach a milestone to maintain enthusiasm and momentum.

10. Lack of Financial Literacy

Financial literacy is the cornerstone of smart money management, yet many people struggle due to a lack of knowledge about key financial concepts. Without understanding topics like budgeting, investing, debt management, and saving, it’s easy to make costly mistakes that hinder your financial growth. A lack of financial literacy often leads to poor decisions, unnecessary stress, and missed opportunities to build wealth. By educating yourself and utilizing available resources, you can take control of your finances and achieve your goals with confidence.

Resources to Improve Financial Literacy:

- Books: Explore popular personal finance books such as Rich Dad Poor Dad or The Total Money Makeover to gain foundational knowledge.

- Online Courses: Enroll in free or paid courses on platforms like Coursera, Khan Academy, or Udemy for structured learning.

- Financial Apps: Use apps like Mint or You Need a Budget (YNAB) to get hands-on experience with managing money.

- Workshops and Seminars: Attend local or virtual events led by financial experts to deepen your understanding.

- Government Resources: Access educational materials and tools from government websites like MyMoney.gov for trusted advice.

- Financial Advisors: Consult with professionals to receive personalized guidance tailored to your financial situation.

Why Is Having a Well-Defined Financial Plan Important?

A well-defined financial plan is the blueprint for achieving your short-term and long-term financial goals. It helps you take control of your money, ensuring that your spending, saving, and investing align with your aspirations. With a clear plan, you can prioritize expenses, prepare for unexpected events, and work toward milestones like buying a home, funding education, or retiring comfortably. Financial planning also reduces stress by providing a sense of direction and security, allowing you to make informed decisions with confidence. Ultimately, a strong financial plan empowers you to build a stable future and live the life you envision.

Conclusion

Managing your finances effectively is essential for building a secure and stress-free future. By recognizing and avoiding common financial mistakes, such as failing to budget, overspending, neglecting investments, or ignoring debt repayment, you can take control of your money and achieve your goals. Remember, small but consistent efforts—like tracking your financial progress, planning for retirement, and educating yourself about personal finance—can make a big difference over time. Taking proactive steps today not only safeguards your financial health but also provides the peace of mind and freedom to focus on what truly matters in life. Your financial success is in your hands, so start making smart choices now.