Filing taxes can often feel like a daunting task, but understanding key concepts like tax deductions can make a significant difference in your overall tax liability. A tax deduction is an expense that reduces your taxable income, helping you pay less in taxes. Whether you’re filing as an individual or managing business taxes, claiming the right deductions can have a substantial impact on how much you owe or how large your tax refund might be. In this article, we’ll explore what tax deductions are, how they work, and how they can help reduce your taxable income, ultimately saving you money come tax season.

What is a Tax Deduction?

What is a Tax Deduction?

A tax deduction is an expense that you can subtract from your total income to reduce the amount of income that is subject to taxation. Essentially, tax deductions lower your taxable income, which can result in paying less in taxes. Common examples of tax deductions include mortgage interest, student loan interest, medical expenses, and contributions to retirement accounts. By reducing your taxable income, these deductions help you keep more of your earnings and potentially lower your overall tax bill. Tax deductions can be claimed either through a standard deduction or by itemizing specific expenses, depending on which option benefits you the most.

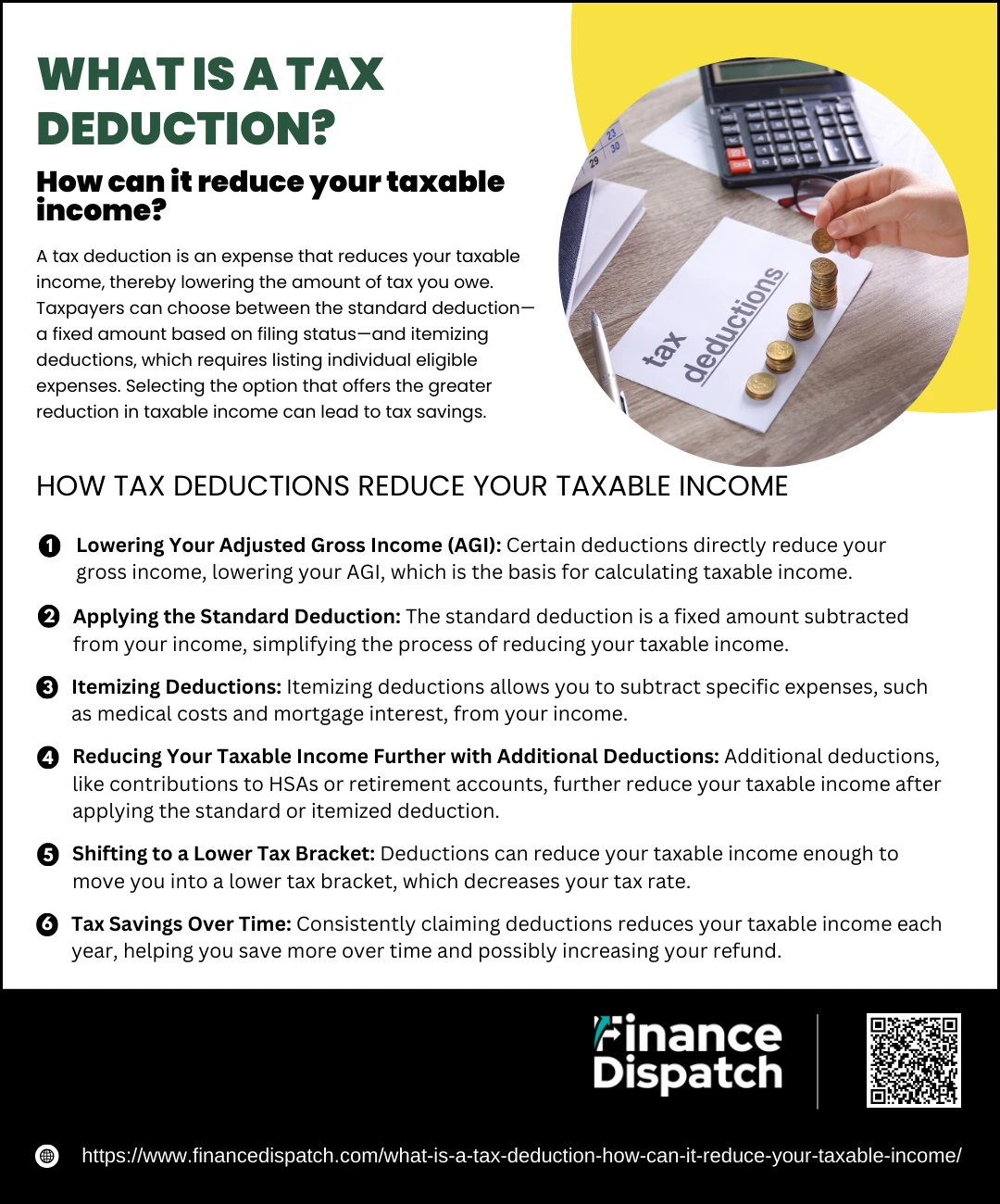

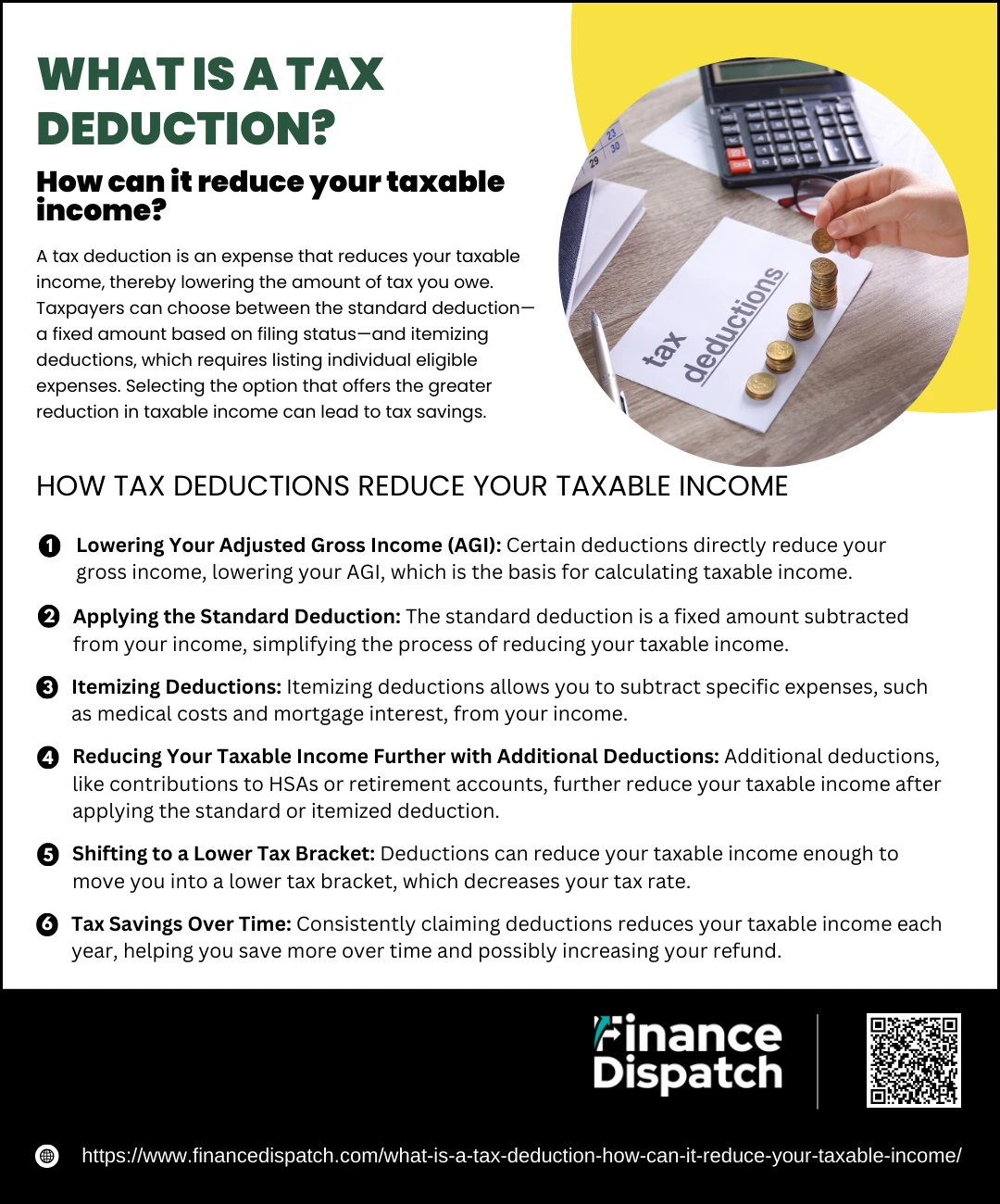

How Tax Deductions Reduce Your Taxable Income

Tax deductions reduce your taxable income by allowing you to subtract certain expenses from your total income before calculating how much tax you owe. This means that the more deductions you can claim, the less income is left to be taxed, which can lower the overall amount you pay in taxes. Whether you’re eligible for a standard deduction or choose to itemize your deductions, they all work to reduce the amount of your income that is subject to taxation.

1. Lowering Your Adjusted Gross Income (AGI)

Before applying standard or itemized deductions, some tax deductions are used to reduce your AGI directly. For example, contributing to a 401(k) or making payments toward student loans can reduce your gross income, leading to a lower AGI, which is the starting point for calculating taxable income.

2. Applying the Standard Deduction

If you choose the standard deduction, a fixed amount is subtracted from your gross income, reducing your taxable income. For 2024, for instance, single filers can subtract $14,600 from their income. This deduction doesn’t require listing individual expenses, making it a simple way to reduce taxable income.

3. Itemizing Deductions

If your deductible expenses are greater than the standard deduction, you can choose to itemize them. This includes expenses such as medical costs, mortgage interest, and state taxes. When you itemize, you list these expenses on a Schedule A form, and the total amount is subtracted from your income.

4. Reducing Your Taxable Income Further with Additional Deductions

After calculating your AGI and deciding whether to use the standard or itemized deduction, you can subtract additional deductions for specific expenses. For example, contributions to Health Savings Accounts (HSAs) or retirement accounts like IRAs can be deducted, which further reduces your taxable income.

5. Shifting to a Lower Tax Bracket

Deductions can potentially lower your taxable income enough to move you into a lower tax bracket. This means that a smaller percentage of your income will be taxed. For example, if your income is reduced from $60,000 to $50,000, you may move from a 22% tax bracket to a 12% bracket, saving you money.

6. Tax Savings Over Time

Claiming deductions not only reduces the taxes you owe in the current year but can also have a cumulative effect over time. By consistently lowering your taxable income through various deductions, you can save more each year and even potentially increase your refund, especially if you’re eligible for deductions like student loan interest or charitable contributions.

How Tax Deductions Work

How Tax Deductions Work

Tax deductions are a powerful tool that help individuals and businesses reduce their taxable income, ultimately lowering the amount of tax they owe. By subtracting eligible expenses from your total income, tax deductions allow you to pay taxes on a smaller portion of your earnings, which can lead to significant savings. The process can vary depending on whether you opt for the standard deduction or choose to itemize specific expenses. Understanding how tax deductions work can make it easier to manage your finances and optimize your tax returns.

1. Reduce Gross Income

The first step in the tax process is calculating your gross income, which is the total amount of money you’ve earned throughout the year, including salary, interest, and other sources of income. Tax deductions come into play by allowing you to subtract certain eligible expenses from this amount. This helps ensure you’re not taxed on your entire income. For example, if you earn $60,000 and you qualify for $10,000 in deductions, your taxable income is reduced to $50,000.

2. Adjust Your Taxable Income

After calculating your gross income, the next step is determining your taxable income. This is where tax deductions make a difference. Deductions lower your taxable income, which is the number used by the IRS to calculate how much tax you owe. For instance, if you have $60,000 in gross income and $15,000 in deductions, your taxable income would be reduced to $45,000, lowering your overall tax bill.

3. Above-the-Line Deductions

Above-the-line deductions, also known as adjustments to income, reduce your gross income before calculating your adjusted gross income (AGI). These deductions are available regardless of whether you itemize or take the standard deduction. Common above-the-line deductions include contributions to retirement accounts, student loan interest, and contributions to health savings accounts (HSAs). These deductions are beneficial because they lower your AGI, potentially making you eligible for more tax benefits.

4. Below-the-Line Deductions

Below-the-line deductions are subtracted after determining your AGI, further reducing your taxable income. This category includes itemized deductions such as medical expenses, state and local taxes, mortgage interest, and charitable contributions. By reducing your taxable income even further, these deductions can help lower your tax liability and increase your potential refund.

5. Taxable Income Determines Your Tax Bill

Your taxable income, which is the amount after deductions are applied, is the key figure used by the IRS to calculate your tax bill. The more deductions you can claim, the lower your taxable income will be, and thus, the less tax you will owe. For example, if your taxable income is $45,000, you will pay tax on that amount, which is less than if you were taxed on your full $60,000.

6. Shifting to Lower Tax Brackets

Tax brackets are based on your taxable income, with higher incomes being taxed at higher rates. By reducing your taxable income with deductions, you may lower your income to a point where you fall into a lower tax bracket. This can have a significant impact on the amount of taxes you pay. For instance, if your income is reduced enough by deductions, you might move from a 22% tax bracket to a 12% tax bracket, resulting in additional savings.

7. Claiming Deductions Yearly

Tax deductions need to be claimed each year, as your income and eligible expenses may vary. It’s important to keep thorough records and receipts of deductible expenses throughout the year, as this will help ensure that you’re able to claim all available deductions and reduce your tax bill. Whether you use the standard deduction or itemize your deductions, keeping track of your finances will help you maximize your savings and avoid missing out on valuable tax breaks.

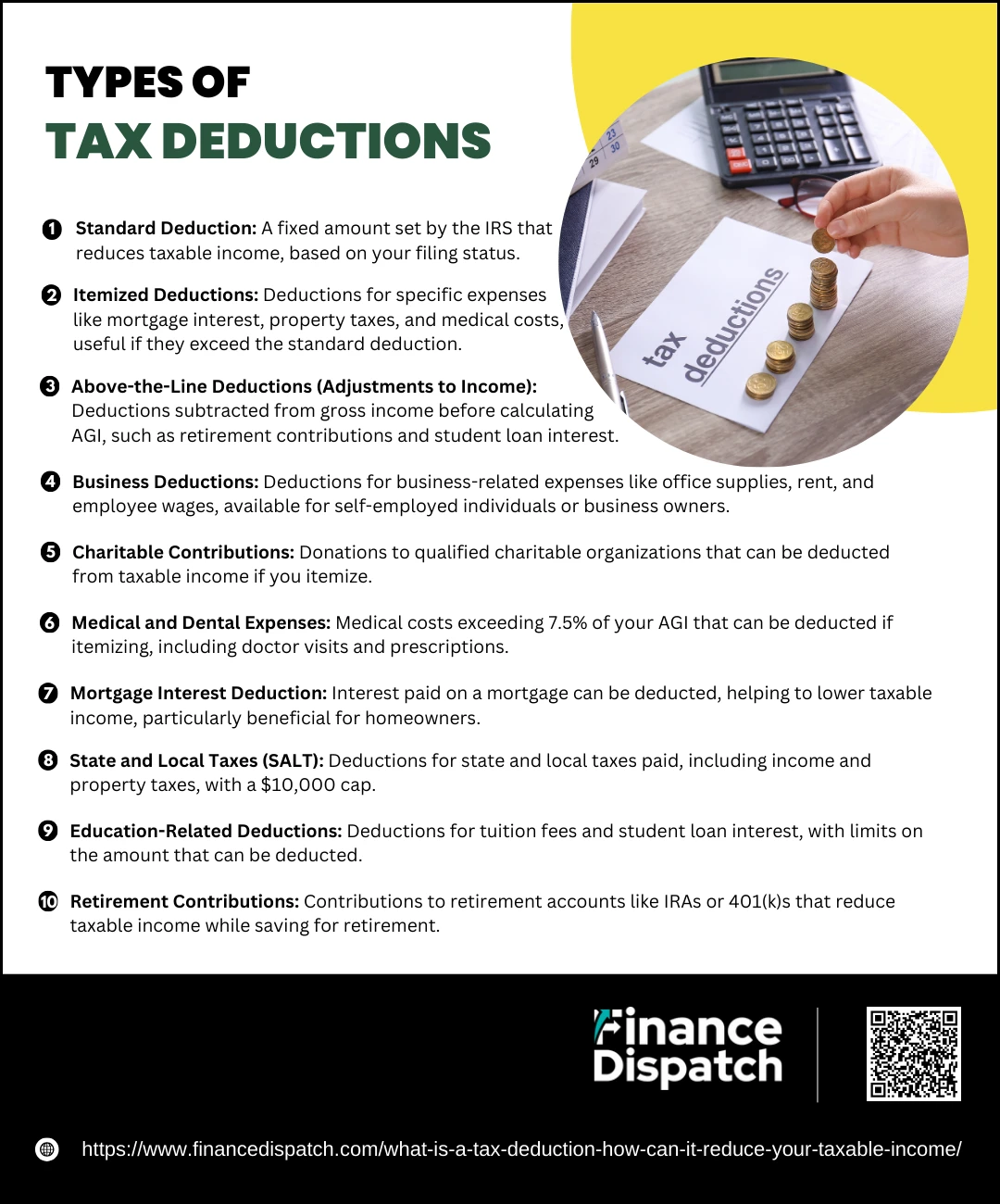

Types of Tax Deductions

Types of Tax Deductions

Tax deductions come in various forms, each designed to help reduce the amount of taxable income, ultimately lowering the amount of tax you owe. Depending on your personal or business situation, you can take advantage of different types of deductions. These deductions can be broadly categorized into two groups: standard deductions and itemized deductions. Additionally, there are specific deductions for particular expenses, such as those related to health care, education, and retirement. Understanding the various types of tax deductions available to you can help you minimize your tax burden and maximize your potential refund.

Types of Tax Deductions:

1. Standard Deduction

This is a fixed amount set by the IRS that reduces your taxable income. Most taxpayers are eligible to claim the standard deduction, which varies depending on your filing status (single, married, or head of household). It’s a simple and straightforward option for those without significant deductible expenses.

2. Itemized Deductions

Itemizing involves listing specific expenses you’ve incurred during the year, which the IRS allows you to deduct. If the total amount of your itemized deductions exceeds the standard deduction, itemizing can help you save more on taxes. Common itemized deductions include mortgage interest, property taxes, and medical expenses.

3. Above-the-Line Deductions (Adjustments to Income)

These deductions are subtracted from your gross income before calculating your adjusted gross income (AGI). They include deductions for things like contributions to retirement accounts, student loan interest, and health savings accounts (HSAs). Above-the-line deductions are especially beneficial because they are available regardless of whether you itemize your deductions.

4. Business Deductions

If you’re self-employed or own a business, you can claim a wide range of business-related deductions. These can include expenses like office supplies, rent, utilities, employee wages, and business-related travel costs. These deductions help reduce your business’s taxable income.

5. Charitable Contributions

Donations made to qualified charitable organizations can be deducted from your taxable income. This includes both cash and non-cash donations, such as clothing or other goods. If you itemize your deductions, charitable contributions can help lower your tax liability.

6. Medical and Dental Expenses

If your medical expenses exceed 7.5% of your adjusted gross income (AGI) for the year, you may be able to deduct them. This includes costs like doctor visits, prescriptions, and certain medical treatments. Keep in mind that you must itemize deductions to claim medical expenses.

7. Mortgage Interest Deduction

Homeowners can deduct the interest paid on their mortgage, up to a certain limit. This is especially beneficial for those with large mortgages and can significantly reduce taxable income. It’s an itemized deduction that helps lower the overall cost of homeownership.

8. State and Local Taxes (SALT)

You can deduct state and local taxes paid, including income taxes or sales taxes, as well as property taxes. However, the SALT deduction is capped at $10,000, so higher-income taxpayers may not fully benefit from this deduction.

9. Education-Related Deductions

There are several deductions available for education-related expenses. These may include tuition fees, student loan interest, and other educational costs. For instance, you can deduct up to $2,500 in student loan interest under certain conditions.

10. Retirement Contributions

Contributions to qualified retirement accounts like a 401(k) or IRA can reduce your taxable income. These contributions are typically deducted from your gross income, allowing you to save for retirement while lowering your current tax liability.

Standard Deduction vs. Itemized Deduction

When filing your taxes, one of the key decisions you’ll need to make is whether to take the standard deduction or to itemize your deductions. Both options reduce your taxable income, but they do so in different ways. The standard deduction is a fixed amount set by the IRS, and it’s typically simpler to claim. On the other hand, itemized deductions require you to list specific expenses you’ve incurred throughout the year, such as mortgage interest, medical costs, and charitable contributions. The choice between the two depends on which method provides the greatest tax benefit for your situation.

Standard Deduction vs. Itemized Deduction

| Feature | Standard Deduction | Itemized Deduction |

| Definition | A fixed amount deducted from your taxable income. | A list of specific expenses that reduce your taxable income. |

| Eligibility | Available to all taxpayers. | Available to taxpayers who have significant deductible expenses. |

| Simplicity | Simple and quick to claim. | Requires listing individual expenses and keeping detailed records. |

| Common Expenses | No need to list individual expenses. | Includes expenses like mortgage interest, state taxes, medical expenses, and charitable donations. |

| Tax Benefit | Provides a set amount to reduce taxable income. | Can provide a larger deduction if total expenses exceed the standard deduction amount. |

| Claiming Process | Automatically applied when filing. | Requires completing Schedule A and listing all deductible expenses. |

| Limitations | The amount depends on your filing status. | No limit on the total amount, but certain expenses have specific caps. |

| Most Beneficial For | Individuals or families with minimal deductions. | Taxpayers with significant expenses that exceed the standard deduction. |

| Flexibility | Fixed for each tax year. | Can vary significantly from year to year depending on your expenses. |

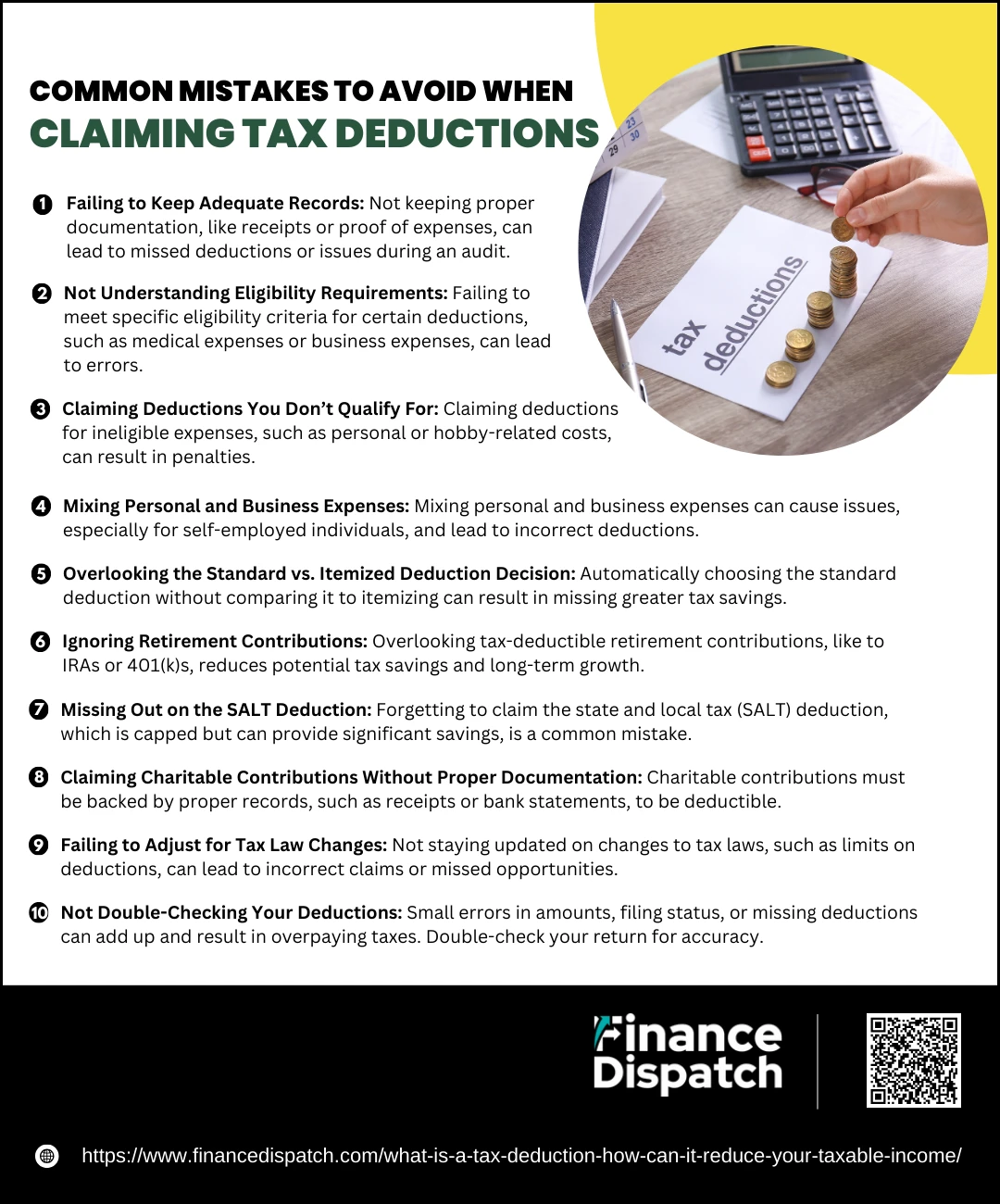

Common Mistakes to Avoid When Claiming Tax Deductions

Common Mistakes to Avoid When Claiming Tax Deductions

Claiming tax deductions can significantly reduce your taxable income, but it’s easy to make mistakes that could cost you in the long run. Whether you’re filing as an individual or as a business owner, it’s important to be aware of the common pitfalls that could lead to missed savings or errors on your tax return. By avoiding these common mistakes, you can ensure that you’re making the most of available deductions and staying compliant with tax laws.

Common Mistakes to Avoid When Claiming Tax Deductions:

1. Failing to Keep Adequate Records

One of the most common mistakes is not keeping proper documentation of your expenses. Whether it’s receipts for medical expenses or proof of charitable donations, failing to document these can lead to missed deductions or issues during an audit.

2. Not Understanding Eligibility Requirements

Many deductions have specific eligibility rules. For example, medical expenses can only be deducted if they exceed a certain percentage of your adjusted gross income (AGI). Make sure you meet the eligibility criteria before claiming a deduction.

3. Claiming Deductions You Don’t Qualify For

It’s easy to accidentally claim deductions for expenses that don’t qualify. For instance, personal expenses or hobby-related expenses often cannot be deducted as business expenses. Be careful and ensure that the expenses align with IRS guidelines.

4. Mixing Personal and Business Expenses

If you’re self-employed or run a business, it’s crucial to separate your personal and business expenses. Attempting to deduct personal expenses, even if they are partly used for business, can result in penalties.

5. Overlooking the Standard vs. Itemized Deduction Decision

Many taxpayers automatically choose the standard deduction, but if your itemized deductions exceed the standard deduction, itemizing could save you more money. Always compare both options to determine which offers the greatest benefit.

6. Ignoring Retirement Contributions

Contributions to retirement accounts like IRAs or 401(k)s are often tax-deductible but are commonly overlooked. Maximize these contributions to reduce your taxable income and benefit from long-term savings.

7. Missing Out on the SALT Deduction

The state and local tax (SALT) deduction can help reduce your taxable income, but it has limitations. Be sure you are taking advantage of this deduction if it applies to your situation, as it can add up to significant savings.

8. Claiming Charitable Contributions Without Proper Documentation

Charitable donations are deductible, but only if you can provide proof. Always keep records, such as receipts or bank statements, for donations made, and ensure that the organization is eligible for tax-deductible contributions.

9. Failing to Adjust for Tax Law Changes

Tax laws change regularly, and what worked one year may not be applicable the next. Make sure you are aware of any new rules or limits that may affect your deductions, such as changes to the mortgage interest deduction or health care-related deductions.

10. Not Double-Checking Your Deductions

Small errors like incorrect amounts, wrong filing statuses, or missing deductions can add up. Double-check your tax return to ensure all deductions are correctly claimed and that no opportunities for savings have been missed.

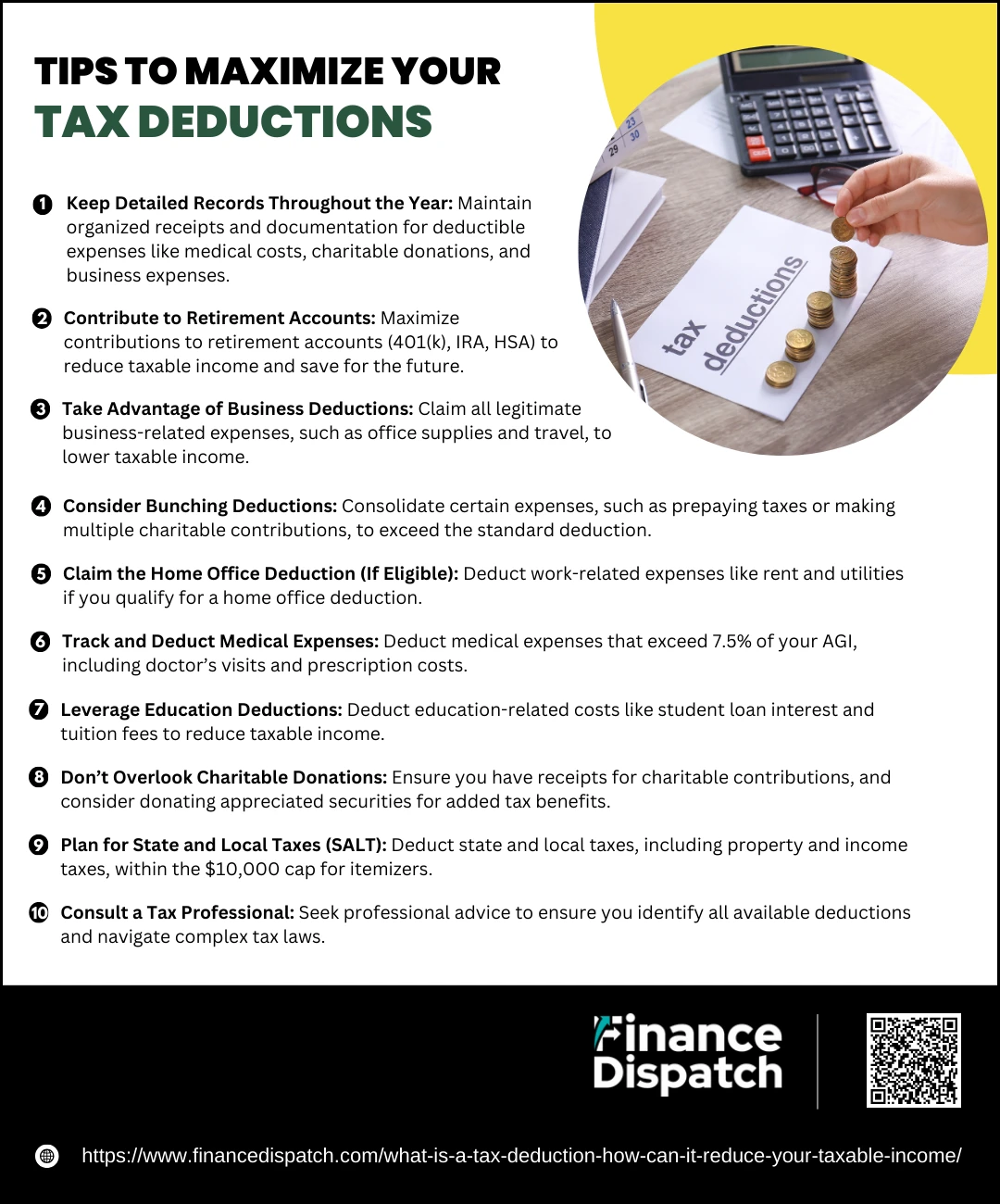

Tips to Maximize Your Tax Deductions

Tips to Maximize Your Tax Deductions

Maximizing your tax deductions is one of the most effective ways to reduce your taxable income and ultimately lower the amount of taxes you owe. By carefully planning your deductions and staying organized throughout the year, you can ensure that you’re taking full advantage of all the opportunities available to you. Whether you’re an individual taxpayer or a business owner, there are several strategies you can use to maximize your tax savings and avoid leaving money on the table.

Tips to Maximize Your Tax Deductions:

1. Keep Detailed Records Throughout the Year

Staying organized is key. Keep receipts, invoices, and any relevant documentation for expenses that might be deductible, such as medical costs, charitable contributions, and business-related expenses. The more detailed your records, the easier it will be to claim all eligible deductions when tax time arrives.

2. Contribute to Retirement Accounts

Contributions to retirement accounts like a 401(k), IRA, or HSA are often deductible. Maximize these contributions to reduce your taxable income while saving for your future. Remember that some accounts, such as IRAs, have annual contribution limits, so be sure to contribute the maximum amount.

3. Take Advantage of Business Deductions

If you’re self-employed or run a business, make sure to claim all legitimate business expenses, such as office supplies, travel, and home office costs. Keep track of your work-related expenses and consult a tax professional to ensure you’re not missing out on deductions like the Qualified Business Income deduction.

4. Consider Bunching Deductions

If your deductions are close to the standard deduction threshold, consider “bunching” your deductions. This means consolidating certain expenses into one year to exceed the standard deduction, such as prepaying property taxes or making multiple years’ worth of charitable contributions in one tax year.

5. Claim the Home Office Deduction (If Eligible)

If you work from home, you may be eligible to claim a home office deduction. Ensure you meet the IRS criteria for a dedicated space used regularly and exclusively for business. This can include expenses like rent, utilities, and office supplies.

6. Track and Deduct Medical Expenses

If your medical expenses exceed 7.5% of your adjusted gross income (AGI), you can deduct them. Keep track of medical costs like doctor’s visits, prescription drugs, and insurance premiums, especially if they add up over the course of the year.

7. Leverage Education Deductions

If you’re paying for education, either for yourself or a dependent, you may be eligible for tax deductions. Student loan interest, tuition, and other related expenses can often be deducted or qualify for tax credits, helping reduce your taxable income.

8. Don’t Overlook Charitable Donations

Charitable donations are deductible, but only if you keep proper records. Whether you’re donating cash or goods, make sure you have receipts and documentation for any contributions made throughout the year. Consider donating appreciated securities or property, which could offer additional tax benefits.

9. Plan for State and Local Taxes (SALT)

If you itemize your deductions, don’t forget to claim your state and local taxes, including property taxes and state income taxes. Keep in mind that the SALT deduction is capped at $10,000, so maximize your eligible deductions within that limit.

10. Consult a Tax Professional

Tax laws can be complex, and a professional can help you identify all available deductions, ensuring that you’re not missing anything. A tax advisor can also help you navigate new tax laws and provide personalized advice based on your financial situation.

Conclusion

In conclusion, understanding and maximizing your tax deductions is an essential part of effective tax planning. By keeping organized records, taking full advantage of retirement contributions, business-related expenses, and other eligible deductions, you can significantly reduce your taxable income and minimize the amount of taxes you owe. It’s important to stay informed about the various deductions available to you each year, as tax laws and thresholds may change. Whether you’re filing as an individual or managing business taxes, a thoughtful approach to deductions can lead to substantial savings. If in doubt, consulting a tax professional can help ensure you’re making the most of your deductions and staying compliant with tax regulations.