Starting a business requires capital, and for many entrepreneurs, securing funding through traditional means—such as bank loans or venture capital—can be a challenge. This is where crowdfunding has emerged as a game-changing alternative. Crowdfunding allows startups to raise money from a large pool of individuals, typically through online platforms, by offering incentives like product rewards, equity stakes, or simply relying on goodwill. It not only provides essential financial support but also serves as a powerful marketing tool, enabling startups to validate their ideas, engage early adopters, and build a community of loyal supporters. In this article, we explore what crowdfunding is, how it works, and why it has become a vital funding avenue for startups looking to bring their innovations to life.

What is Crowdfunding?

Crowdfunding is a modern fundraising method that enables individuals, startups, and businesses to raise capital from a large number of people, typically via online platforms. Instead of relying on traditional financing methods like bank loans or venture capital, crowdfunding allows entrepreneurs to tap into a broad audience of potential backers who contribute small amounts of money to support a project, product, or business idea. Depending on the type of crowdfunding, backers may receive rewards, equity shares, loan repayments with interest, or simply donate without expecting anything in return. This approach not only provides necessary funding but also helps validate business ideas, build a customer base, and create brand awareness even before a product launches.

Key Crowdfunding Platforms for Startups

Choosing the right crowdfunding platform is crucial for a startup’s success, as different platforms cater to specific funding models and industries. Some platforms focus on rewards-based crowdfunding, ideal for launching innovative products, while others specialize in equity crowdfunding, allowing investors to gain a stake in the company. Whether a startup seeks financial backing, market validation, or community engagement, selecting the best platform can make a significant difference in achieving its funding goals. Below is a comparison of some of the most popular crowdfunding platforms for startups.

Comparison of Popular Crowdfunding Platforms

| Platform | Funding Type | Best For | Key Features |

| Kickstarter | Rewards-Based | Creative projects, tech startups | All-or-nothing funding, global reach |

| Indiegogo | Rewards & Flexible Funding | Innovative products, startups | Flexible & fixed funding, long-term campaigns |

| GoFundMe | Donation-Based | Personal causes, social impact | No platform fees, quick fundraising |

| SeedInvest | Equity-Based | High-growth startups, investors | SEC-regulated, accredited investors |

| WeFunder | Equity-Based | Small businesses, early-stage startups | Low investment threshold, community-driven funding |

| Crowdcube | Equity-Based | European startups, early-stage companies | Investor networking, regulatory compliance |

| Fundable | Equity & Rewards-Based | Startups & small businesses | Allows both equity and rewards campaigns |

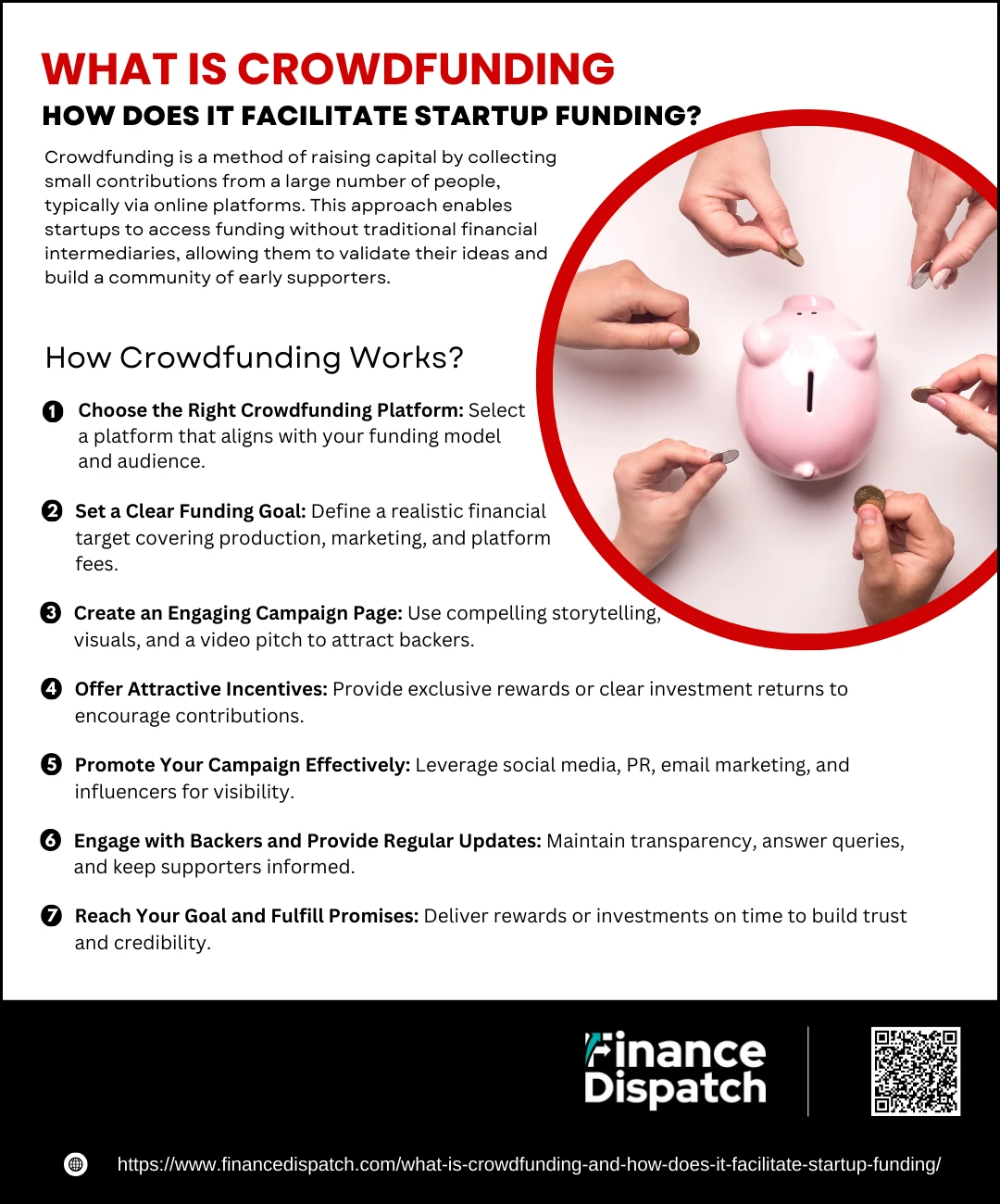

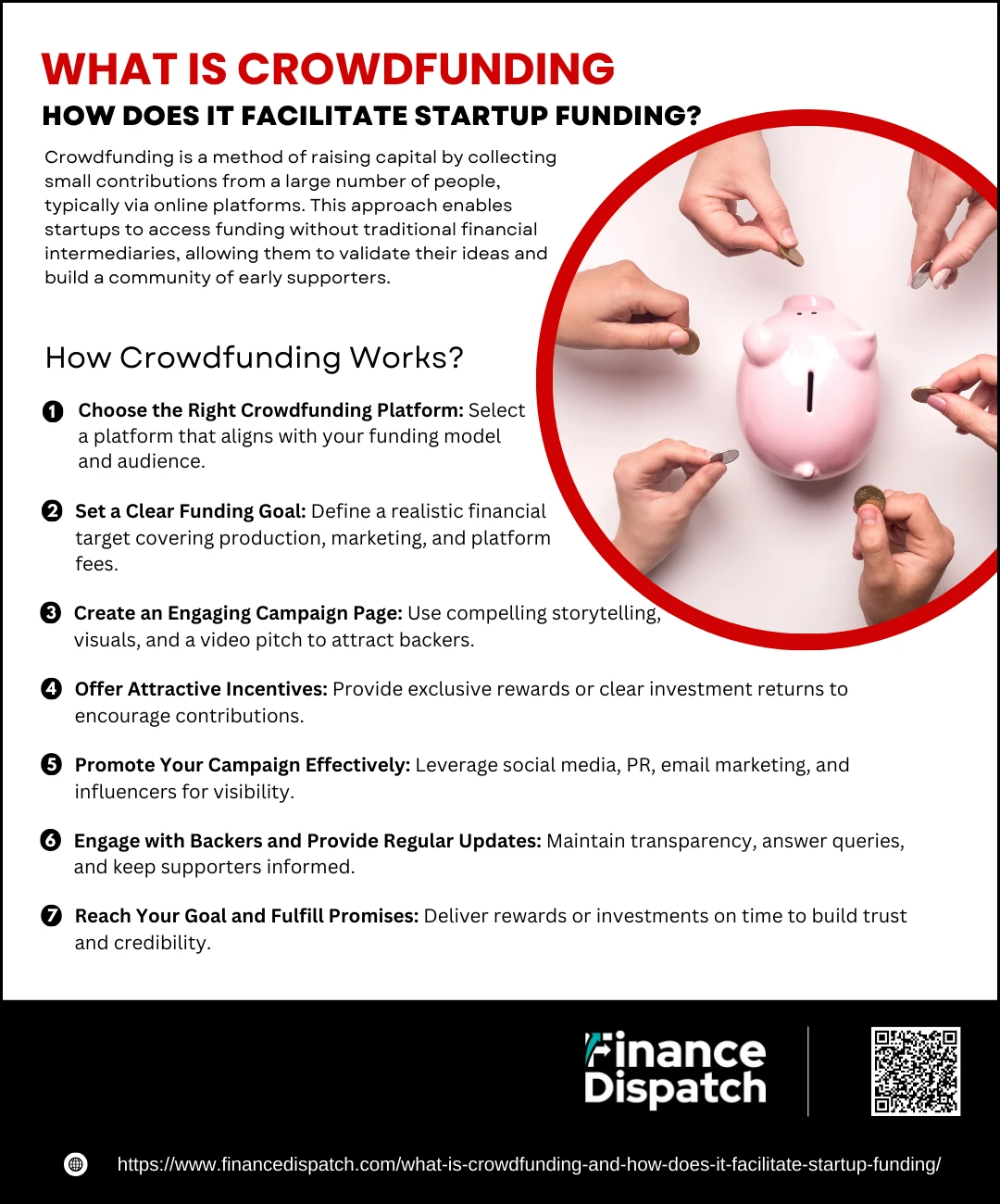

How Crowdfunding Works?

How Crowdfunding Works?

Crowdfunding is a fundraising approach that enables startups, businesses, and individuals to collect small contributions from a large group of people, typically through online platforms. This method eliminates the need for traditional financial backing, such as bank loans or venture capital, by leveraging public interest and community support. Whether through rewards, equity shares, or donations, crowdfunding allows entrepreneurs to validate their ideas, secure funding, and build a loyal customer base. However, success requires careful planning, compelling storytelling, and strategic promotion. Below are the key steps involved in running a successful crowdfunding campaign.

Steps to Launch a Crowdfunding Campaign

Steps to Launch a Crowdfunding Campaign

1. Choose the Right Crowdfunding Platform

Selecting a suitable platform is crucial for campaign success. Different platforms cater to various funding models—Kickstarter and Indiegogo are ideal for product launches, SeedInvest and Crowdcube specialize in equity crowdfunding, while GoFundMe is best for donation-based causes. Understanding the platform’s fee structure, funding terms, and audience reach is essential.

2. Set a Clear Funding Goal

A well-defined financial target ensures credibility and transparency. Consider production costs, marketing expenses, and potential platform fees while setting the goal. Some platforms operate on an all-or-nothing basis, meaning funds are only received if the goal is met, while others allow flexible funding.

3. Create an Engaging Campaign Page

First impressions matter. A strong campaign page should include a compelling story, high-quality visuals, and a clear value proposition. Backers are more likely to invest in a project that has a well-crafted narrative and showcases why it matters. A video pitch can further enhance credibility and attract more contributions.

4. Offer Attractive Incentives

In rewards-based crowdfunding, backers expect exclusive perks in return for their support. These could include early access to the product, special discounts, or limited-edition merchandise. In equity-based crowdfunding, clearly outline potential investment returns and benefits to attract serious investors.

5. Promote Your Campaign Effectively

Promotion is key to reaching potential backers. Utilize multiple marketing channels such as social media, email newsletters, press releases, and influencer partnerships. Engaging content and targeted outreach help drive traffic to the campaign page, increasing chances of success.

6. Engage with Backers and Provide Regular Updates

Building trust with supporters is vital. Answering questions promptly, providing updates on campaign progress, and expressing gratitude can enhance credibility and encourage additional contributions. Transparency in communication fosters a strong community around the project.

7. Reach Your Goal and Fulfill Promises

Once the campaign reaches its target, ensure that funds are allocated as promised. For product-based campaigns, deliver rewards on time. For equity crowdfunding, maintain investor relations and provide business progress reports. Successfully fulfilling commitments strengthens the brand’s reputation and paves the way for future fundraising efforts.

Types of Crowdfunding Models

Crowdfunding comes in various forms, each designed to cater to different fundraising needs and objectives. Whether an entrepreneur is launching a new product, raising capital for a startup, or supporting a social cause, choosing the right crowdfunding model is essential for success. Some models offer financial returns to investors, while others rely on goodwill and non-monetary rewards. Below are the four primary types of crowdfunding models, each with unique advantages and applications.

1. Rewards-Based Crowdfunding

This model allows backers to contribute funds in exchange for a reward, typically an early version of a product, a special discount, or exclusive merchandise. It is widely used by startups and creative projects looking to validate their ideas while securing initial funding. Platforms like Kickstarter and Indiegogo are popular for rewards-based crowdfunding.

2. Equity-Based Crowdfunding

Equity crowdfunding enables investors to receive company shares in return for their financial support. This model is ideal for startups and early-stage businesses that need substantial capital to grow. Unlike rewards-based crowdfunding, backers in this model become partial owners and may benefit from the company’s future profits. Platforms like SeedInvest and Crowdcube specialize in equity crowdfunding.

3. Debt-Based Crowdfunding (Peer-to-Peer Lending)

Also known as peer-to-peer (P2P) lending, this model allows businesses or individuals to borrow money from multiple investors with the promise of repayment plus interest. It functions like a loan but is crowdfunded by a group rather than a financial institution. This is beneficial for startups and small businesses that may not qualify for traditional bank loans. LendingClub and Funding Circle are notable platforms for debt-based crowdfunding.

4. Donation-Based Crowdfunding

In this model, backers contribute money without expecting any financial return or rewards. It is commonly used for charitable causes, medical emergencies, disaster relief efforts, and nonprofit organizations. GoFundMe is one of the most recognized platforms for donation-based crowdfunding, allowing individuals and organizations to raise funds for meaningful causes.

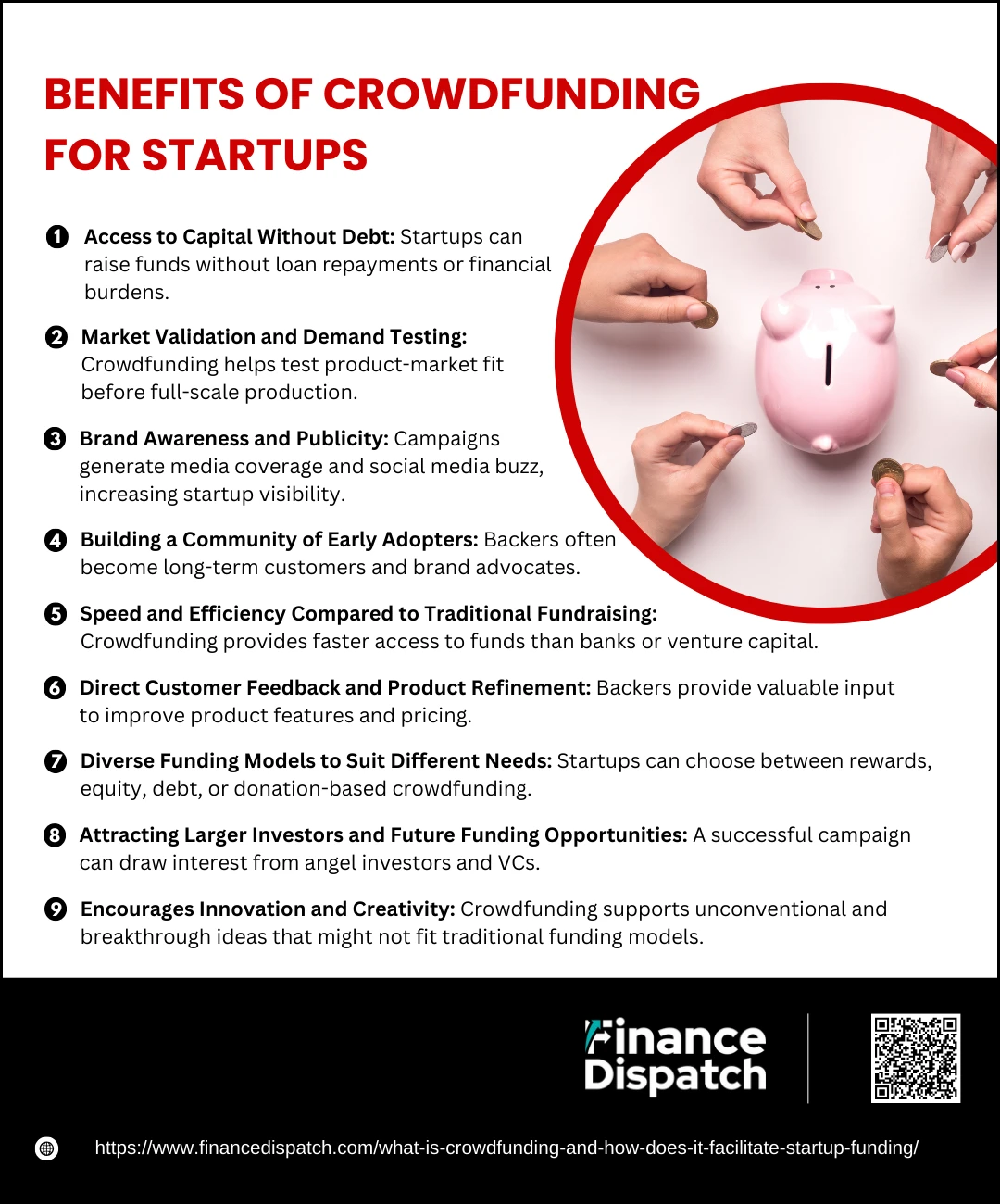

Benefits of Crowdfunding for Startups

Benefits of Crowdfunding for Startups

Crowdfunding has emerged as a powerful tool for startups seeking financial support without the constraints of traditional funding sources like bank loans or venture capital. By allowing entrepreneurs to raise capital from a large number of backers, crowdfunding provides not only financial backing but also market validation, exposure, and customer engagement. This approach enables startups to test their ideas, attract early adopters, and build a loyal community of supporters. Whether through rewards, equity, or donations, crowdfunding creates opportunities for startups to scale and succeed in highly competitive markets. Below are some of the key benefits that make crowdfunding an attractive option for startups.

Key Benefits of Crowdfunding for Startups:

1. Access to Capital Without Debt

Unlike loans that require repayment with interest, crowdfunding allows startups to raise funds without financial burdens. This means entrepreneurs can focus on business growth without the pressure of monthly loan payments.

2. Market Validation and Demand Testing

Crowdfunding helps startups test their product-market fit before mass production. If a campaign attracts a high number of backers, it indicates strong market demand, reducing risks associated with launching a new product or service.

3. Brand Awareness and Publicity

A well-executed crowdfunding campaign generates media attention and social media buzz, helping startups gain visibility even before their product officially launches. Platforms like Kickstarter and Indiegogo provide exposure to a global audience.

4. Building a Community of Early Adopters

Backers of crowdfunding campaigns often become loyal customers and brand advocates. This community support not only provides initial funding but also leads to word-of-mouth marketing, further expanding a startup’s reach.

5. Speed and Efficiency Compared to Traditional Fundraising

Raising funds through venture capital or bank loans often involves lengthy approval processes, strict credit checks, and legal complexities. Crowdfunding, on the other hand, allows startups to launch campaigns quickly and start receiving funds in a matter of weeks.

6. Direct Customer Feedback and Product Refinement

Crowdfunding platforms provide an opportunity for entrepreneurs to interact directly with backers, gather feedback, and make necessary improvements before the final product launch. This helps in refining features, pricing, and overall market positioning.

7. Diverse Funding Models to Suit Different Needs

Startups can choose between various crowdfunding models:

- Rewards-Based – Backers receive early access or exclusive products.

- Equity-Based – Investors receive company shares in exchange for funding.

- Debt-Based – Startups raise money as a loan with an agreed repayment plan.

- Donation-Based – Supporters contribute funds without expecting returns, commonly used for social enterprises.

8. Attracting Larger Investors and Future Funding Opportunities

A successful crowdfunding campaign can serve as proof of concept for angel investors and venture capitalists. If a startup demonstrates strong demand through crowdfunding, it increases its chances of securing further investment from institutional investors.

9. Encourages Innovation and Creativity

Since crowdfunding doesn’t require startups to fit into traditional investment models, entrepreneurs can bring unique and unconventional ideas to life. Many breakthrough products, including the Oculus Rift and Pebble Smartwatch, were initially crowdfunded before becoming major successes.

Challenges and Risks of Crowdfunding

Challenges and Risks of Crowdfunding

While crowdfunding offers numerous benefits for startups, it is not without its challenges and risks. Launching a successful campaign requires careful planning, strong marketing efforts, and continuous engagement with backers. Additionally, competition is fierce, and not all crowdfunding campaigns reach their funding goals. Startups must also navigate platform fees, backer expectations, and potential intellectual property risks. Below are some of the major challenges and risks that entrepreneurs should consider before launching a crowdfunding campaign.

1. Uncertain Funding Success

Crowdfunding is not a guaranteed source of capital. Many campaigns fail to reach their funding goals due to insufficient marketing, lack of a compelling pitch, or weak engagement. Some platforms operate on an “all-or-nothing” model, meaning that if the target is not met, the startup receives no funds at all.

2. Intense Competition

Thousands of crowdfunding campaigns launch every day, making it difficult for a startup to stand out. Entrepreneurs need a strong, unique value proposition and a well-crafted marketing strategy to attract backers. Without proper promotion, a campaign may struggle to gain visibility.

3. High Marketing and Advertising Costs

A successful crowdfunding campaign requires continuous promotion through social media, email marketing, influencer outreach, and even paid advertising. These marketing efforts can be costly, and startups may need to invest in professional video production, graphic design, and public relations to make their campaign appealing.

4. Risk of Idea Theft

Publicly sharing a business idea, product concept, or innovation on a crowdfunding platform exposes it to competitors. Without proper intellectual property protection, such as patents or trademarks, there is a risk that others may copy or improve upon the idea before the original creator can bring it to market.

5. Managing Backer Expectations and Pressure

Once a campaign is successfully funded, backers expect timely updates and product deliveries. Delays in production, unforeseen challenges, or changes in business direction can lead to frustration among supporters. Startups that fail to meet expectations risk damaging their reputation and future credibility.

6. Platform Fees and Hidden Costs

Most crowdfunding platforms charge a percentage of the funds raised, typically ranging from 5% to 10%, in addition to payment processing fees. Other costs, such as manufacturing, shipping rewards, and taxes, can further reduce the actual amount a startup receives from the campaign.

7. Risk of Overpromising and Under-Delivering

To attract backers, startups often make ambitious promises regarding product features, quality, and delivery timelines. If these promises are not met, backers may demand refunds, leave negative reviews, or even pursue legal action. It is essential for entrepreneurs to set realistic expectations and ensure they can fulfill their commitments.

8. Logistical Challenges in Fulfilling Rewards

For rewards-based crowdfunding, delivering promised incentives on time can be complex, especially for startups without prior experience in manufacturing or logistics. Unexpected production delays, shipping issues, or cost overruns can lead to dissatisfied backers and financial strain.

9. Regulatory and Legal Compliance

Equity-based crowdfunding, in particular, is subject to strict financial regulations that vary by country. Startups must ensure compliance with securities laws, reporting requirements, and investor protection measures. Failing to adhere to these regulations can result in legal complications and financial penalties.

10. Long-Term Business Sustainability

While crowdfunding can provide an initial boost in capital, it does not guarantee long-term financial stability. Some startups secure funding but struggle to maintain momentum after the campaign ends. Entrepreneurs must have a clear post-campaign strategy to sustain growth and manage operational costs.

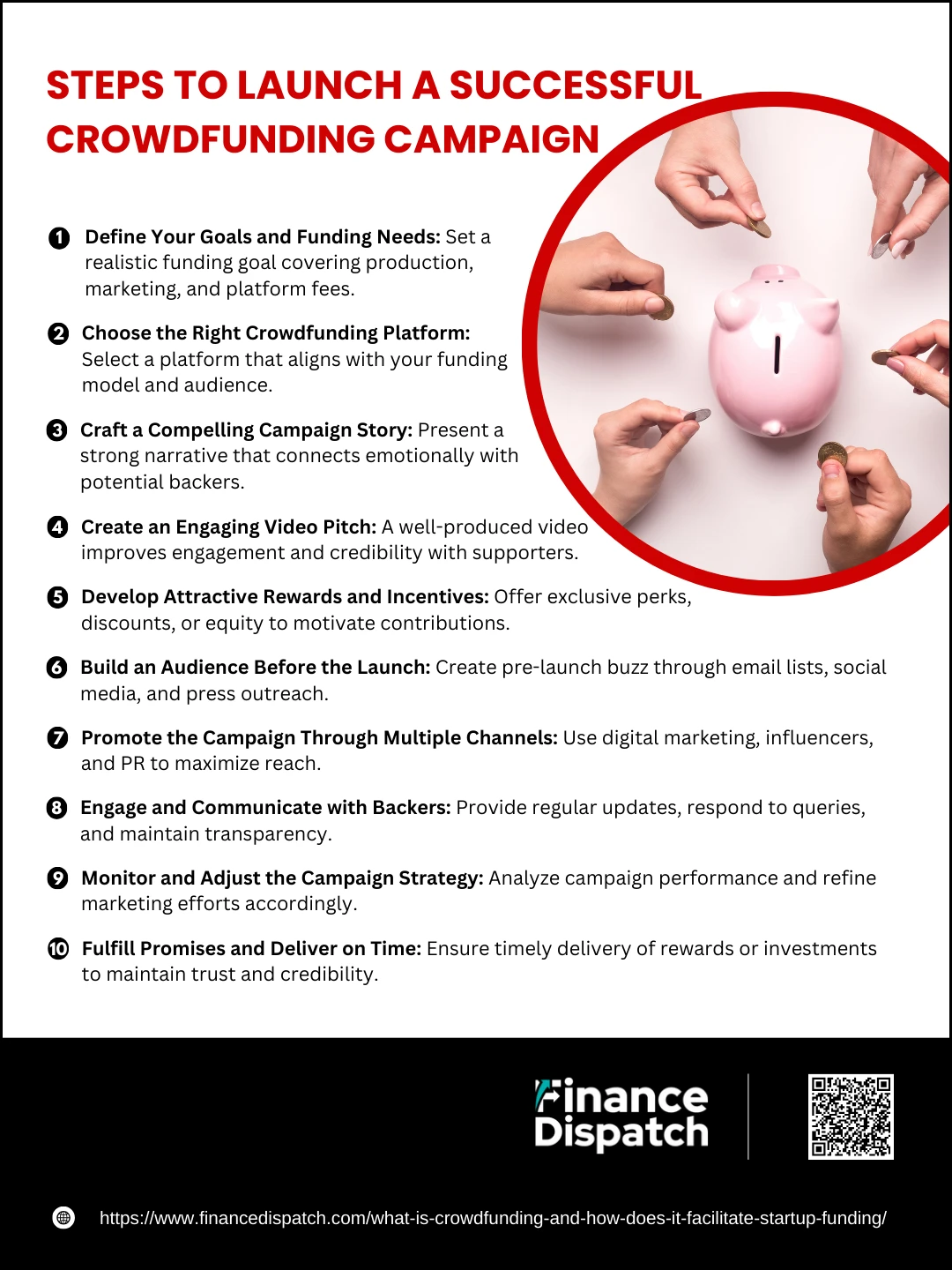

How Startups Can Launch a Successful Crowdfunding Campaign

How Startups Can Launch a Successful Crowdfunding Campaign

Crowdfunding has become a popular way for startups to raise capital, validate business ideas, and build a loyal customer base. However, simply launching a campaign does not guarantee success. With thousands of projects competing for attention, startups need a well-structured plan, compelling storytelling, and strong promotional strategies to stand out. A successful crowdfunding campaign requires careful preparation, ongoing engagement, and transparent communication with backers. Below are the key steps startups should follow to increase their chances of a successful crowdfunding campaign.

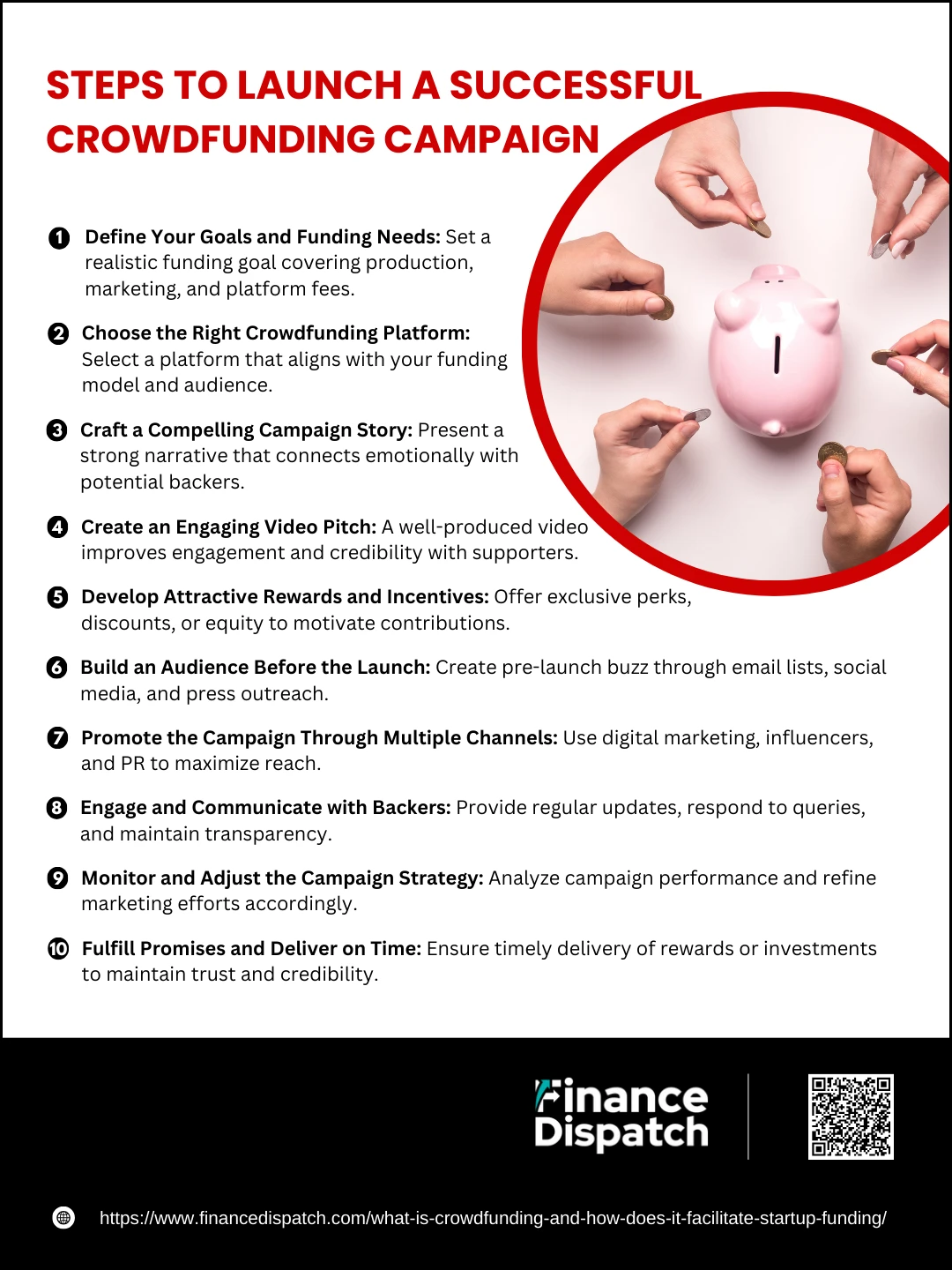

Steps to Launch a Successful Crowdfunding Campaign

1. Define Your Goals and Funding Needs

Before launching a campaign, determine how much capital is required and what it will be used for. Set a realistic funding goal that covers production, marketing, platform fees, and unforeseen expenses. Clearly communicate why the funding is needed and how it will benefit backers.

2. Choose the Right Crowdfunding Platform

Selecting the appropriate platform is crucial for reaching the right audience. Platforms like Kickstarter and Indiegogo are ideal for rewards-based campaigns, while SeedInvest and Crowdcube cater to equity crowdfunding. Research each platform’s funding model, fees, and audience demographics before making a decision.

3. Craft a Compelling Campaign Story

A successful crowdfunding campaign tells a captivating story that resonates with potential backers. Clearly explain the problem your product or service solves, share the startup’s journey, and highlight what makes it unique. Use engaging visuals, high-quality images, and an emotional connection to attract supporters.

4. Create an Engaging Video Pitch

Campaigns with a well-produced video tend to perform better than those without one. The video should introduce the team, explain the product or idea, and showcase why it’s worth backing. Keep it short, engaging, and professional to capture attention quickly.

5. Develop Attractive Rewards and Incentives

If using a rewards-based model, offer compelling incentives that motivate people to contribute. Early-bird discounts, limited-edition products, or exclusive experiences can encourage backers to support the campaign. Ensure the rewards are realistic and can be delivered on time.

6. Build an Audience Before the Launch

A strong pre-launch strategy can significantly impact campaign success. Start by building an email list, engaging with potential backers on social media, and creating buzz around the campaign. The more people are aware of the project before launch, the higher the chances of early momentum.

7. Promote the Campaign Through Multiple Channels

Crowdfunding campaigns need continuous promotion to reach potential backers. Use social media, press releases, email marketing, influencer collaborations, and paid ads to maximize visibility. Engaging content and targeted outreach can drive more traffic to the campaign page.

8. Engage and Communicate with Backers

Interaction with supporters is essential for maintaining trust and excitement. Regularly update backers on campaign progress, answer their questions promptly, and express gratitude for their support. Transparency builds credibility and can lead to more contributions.

9. Monitor and Adjust the Campaign Strategy

Track campaign performance in real time and make necessary adjustments. Analyze which marketing efforts are generating the most engagement and optimize promotional strategies accordingly. If a particular approach isn’t working, pivot and experiment with new tactics.

10. Fulfill Promises and Deliver on Time

After a successful campaign, startups must ensure they deliver rewards or investments as promised. Delays or failures in fulfillment can damage the company’s reputation and future crowdfunding opportunities. Keeping backers informed about progress and challenges helps manage expectations.

Real-Life Success Stories in Crowdfunding

Crowdfunding has empowered startups and creators to bring their ideas to life by securing financial backing from thousands, sometimes millions, of supporters. From cutting-edge technology to creative projects, successful crowdfunding campaigns prove that a strong vision, compelling storytelling, and effective marketing can lead to massive funding. Below are some of the most remarkable crowdfunding success stories.

Notable Crowdfunding Success Stories

- Oculus Rift: Raised $2.4M on Kickstarter to develop a virtual reality headset; later acquired by Facebook for $2B.

- Pebble Smartwatch: Crowdfunded $20M, becoming one of Kickstarter’s highest-funded projects, revolutionizing the smartwatch industry.

- Exploding Kittens: A card game that raised $8.7M from over 219,000 backers, setting a new record for game crowdfunding.

- Monzo Bank: UK-based digital bank raised £1M in just 96 seconds on Crowdcube, proving crowdfunding’s potential for fintech.

- The Coolest Cooler A high-tech cooler raised $13M with features like a built-in blender and Bluetooth speaker.

- BauBax Travel Jacket: A multi-functional travel jacket secured $9.2M, showing the appeal of practical innovation.

- Critical Role: The Legend of Vox Machina: Raised $11.3M to fund an animated series, vastly exceeding its original goal.

Conclusion

Crowdfunding has revolutionized the way startups, innovators, and creators bring their ideas to life, offering an alternative to traditional funding methods. It provides not only financial support but also market validation, brand exposure, and direct engagement with a loyal community of backers. While crowdfunding presents challenges such as competition, fulfillment complexities, and backer expectations, a well-planned campaign with a compelling story and strategic marketing can lead to remarkable success. From tech innovations to creative projects, real-life success stories demonstrate that with the right approach, crowdfunding can be a powerful tool to launch and scale a startup. As the crowdfunding landscape continues to evolve, entrepreneurs must stay adaptable, transparent, and committed to delivering on their promises to maximize their chances of success.