Private banking is a specialized financial service designed to cater to the unique needs of high-net-worth individuals (HNWIs). Unlike traditional retail banking, which offers standardized services to the general public, private banking focuses on delivering personalized, high-touch financial solutions that help affluent clients manage, grow, and protect their wealth. From customized investment strategies and exclusive investment opportunities to estate planning and concierge services, private banking provides a comprehensive suite of services tailored to the complex financial goals of the wealthy. This article explores what private banking is and how it specifically serves the financial interests of high-net-worth individuals, offering them a level of care, exclusivity, and expertise that sets it apart from conventional banking.

What is Private Banking?

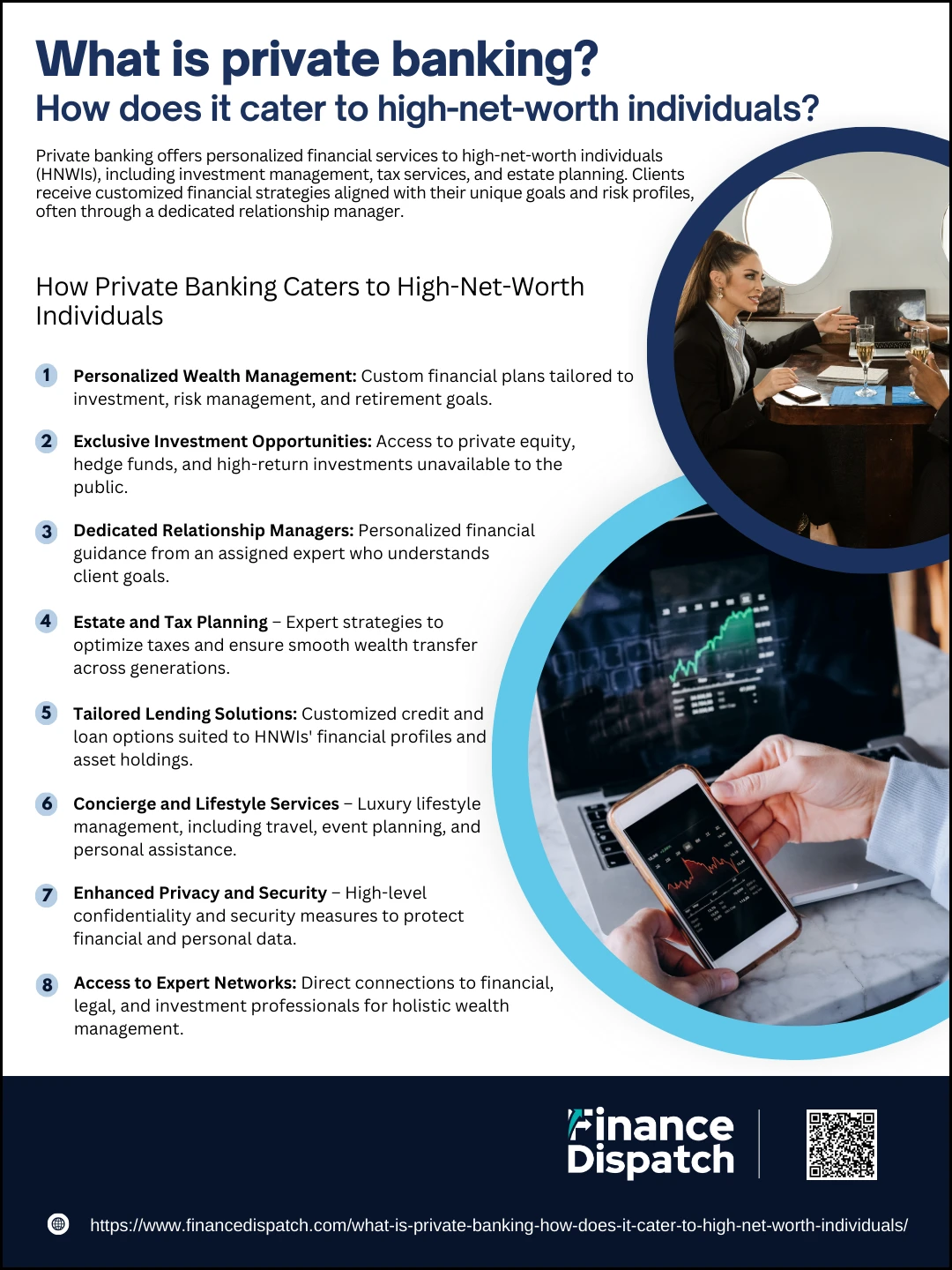

Private banking refers to a personalized and exclusive financial service offered to high-net-worth individuals (HNWIs) who require tailored financial management and wealth preservation strategies. Unlike traditional banking, which serves the general public with standard products and services, private banking focuses on delivering customized solutions that address the complex financial needs of affluent clients. These services often include investment advice, portfolio management, estate and tax planning, and access to exclusive investment opportunities, such as private equity or hedge funds. A dedicated relationship manager or private banker is assigned to each client, ensuring personalized attention and creating a deep understanding of the client’s financial goals, risk tolerance, and long-term aspirations. The primary aim of private banking is to provide a holistic and discreet approach to managing wealth, helping clients grow and safeguard their financial assets.

How Private Banking Caters to High-Net-Worth Individuals

How Private Banking Caters to High-Net-Worth Individuals

Private banking offers high-net-worth individuals (HNWIs) a level of financial management that goes far beyond traditional banking services, tailored specifically to their complex needs. These individuals often have significant assets and diverse financial goals that require personalized strategies to grow and protect their wealth. Private banks provide a dedicated relationship manager who works closely with clients, offering not only banking services but also access to exclusive financial products, expert advice, and wealth management solutions. With a focus on privacy, convenience, and long-term financial planning, private banking ensures that HNWIs can achieve their financial aspirations with the support of professionals who understand their unique situation.

How Private Banking Caters to High-Net-Worth Individuals:

1. Personalized Wealth Management

Private banking creates bespoke financial plans tailored to an individual’s specific goals. This includes crafting investment strategies, optimizing asset allocation, and offering retirement planning services to help clients achieve their financial ambitions while managing risk.

2. Exclusive Investment Opportunities

HNWIs are offered access to investment opportunities not available to the broader public. These may include private equity, hedge funds, real estate ventures, and luxury asset investments. These exclusive products allow for greater diversification and the potential for higher returns, which are often unavailable through traditional retail banking channels.

3. Dedicated Relationship Managers

Each client is assigned a personal relationship manager, who is available to guide them through every aspect of their financial journey. The relationship manager takes the time to fully understand the client’s financial objectives, risk appetite, and long-term goals, ensuring that every decision is aligned with their specific needs.

4. Estate and Tax Planning

High-net-worth individuals often have complex estate and tax considerations. Private banks offer expert advice on structuring assets and creating tax-efficient strategies that reduce liabilities and ensure the smooth transfer of wealth to future generations. This includes assistance with creating trusts, wills, and other estate planning tools.

5. Tailored Lending Solutions

Private banks offer highly customized lending options designed to meet the unique needs of HNWIs. Whether it’s jumbo mortgages for luxury properties, secured loans against investment portfolios, or flexible lines of credit, private banking ensures that clients have access to the best terms and solutions based on their financial profile.

6. Concierge and Lifestyle Services

Beyond financial management, private banking often includes concierge services that cater to clients’ lifestyle needs. From arranging luxury travel and organizing high-end events to providing lifestyle management assistance, private banks ensure that their clients’ personal lives are as well-managed as their finances.

7. Enhanced Privacy and Security

Privacy is of paramount importance to many high-net-worth individuals, and private banks ensure that all client information and transactions are handled with the highest levels of confidentiality. Advanced security protocols are employed to protect personal and financial data, giving clients peace of mind.

8. Access to Expert Networks

Private banking clients benefit from access to a wide range of financial and legal experts. This may include tax advisors, legal professionals, investment analysts, and estate planners, all working together to provide a holistic approach to managing the client’s wealth and addressing any complex financial issues they may face.

Key Services Offered in Private Banking

Private banking provides high-net-worth individuals (HNWIs) with a range of specialized services designed to meet their unique financial needs. Unlike traditional banking, which offers standard products, private banking focuses on personalized, high-touch solutions that help clients manage, grow, and protect their wealth. These services are tailored to each individual’s financial goals, ensuring a comprehensive approach to wealth management. From investment strategies to estate planning and exclusive financial products, private banking provides a holistic service to its affluent clients.

Key Services Offered in Private Banking:

- Personalized Wealth Management: Tailored financial plans and strategies to meet individual investment goals, risk tolerance, and long-term objectives.

- Investment Advisory Services: Access to exclusive investment opportunities, including private equity, hedge funds, and alternative investments not available to the public.

- Estate and Tax Planning: Expert advice on structuring assets, minimizing taxes, and creating a seamless wealth transfer strategy to future generations.

- Customized Lending Solutions: Tailored loans, including jumbo mortgages, secured lines of credit, and real estate financing, specifically designed to align with the client’s financial profile.

- Portfolio Diversification: Creation of diversified investment portfolios that include a range of asset classes, such as stocks, bonds, real estate, and commodities, to manage risk effectively.

- Concierge and Lifestyle Management: Services that go beyond financial management, offering clients assistance with travel, event planning, and access to exclusive lifestyle opportunities.

- Access to Exclusive Investment Products: Opportunities to invest in high-return, exclusive products like private equity, venture capital, and luxury asset funds.

- Risk Management and Asset Protection: Strategies to safeguard wealth, including insurance planning, asset protection through trusts, and diversification to mitigate risks.

- Dedicated Relationship Manager: A personal banker who serves as the main point of contact, providing one-on-one attention and expert advice on all financial matters.

- Global Banking Services: Access to international banking solutions, including foreign exchange, international investments, and cross-border financial planning.

How Does Private Banking Work?

How Does Private Banking Work?

Private banking works by providing personalized financial services to high-net-worth individuals (HNWIs) who require more than what traditional banking can offer. It focuses on creating bespoke financial strategies tailored to the client’s specific needs, goals, and preferences. Clients receive one-on-one attention from relationship managers, who serve as a trusted point of contact for all their banking and wealth management needs. From investment advice to estate planning and exclusive lending solutions, private banking provides a holistic approach to managing wealth, ensuring that every financial decision is aligned with the client’s objectives.

1. Initial Consultation and Onboarding

The process begins with an in-depth consultation where the private banker assesses the client’s financial situation, goals, and risk tolerance. This helps to create a clear picture of the client’s needs, forming the foundation for all future financial strategies.

2. Dedicated Relationship Manager

A dedicated relationship manager is assigned to the client. This person acts as the main point of contact for all banking services, ensuring that the client’s specific requirements are understood and addressed in a personalized manner.

3. Personalized Wealth Management

Based on the client’s goals, a tailored wealth management plan is developed. This includes investment strategies, portfolio diversification, and risk management techniques designed to meet both short-term and long-term objectives.

4. Exclusive Investment Opportunities

Clients are given access to exclusive investment products not typically available to the general public, such as private equity, hedge funds, and alternative investments, helping them diversify their portfolios for higher potential returns.

5. Estate and Tax Planning

Private banking includes strategic estate planning and tax optimization, ensuring that wealth is transferred efficiently to future generations while minimizing tax liabilities. This often involves setting up trusts, wills, and other legal structures.

6. Customized Lending Solutions

Private banks offer customized credit solutions, such as jumbo mortgages or tailored lines of credit, based on the client’s financial profile and lifestyle needs, ensuring they get the best terms available.

7. Continuous Monitoring and Adjustments

Private bankers continuously monitor the client’s portfolio and financial situation, making adjustments as necessary to respond to changes in the market or in the client’s personal circumstances.

8. Access to Concierge and Lifestyle Services

Beyond financial management, private banks often provide concierge services, helping clients with travel arrangements, luxury services, event planning, and other personal needs to enhance their lifestyle.

9. Enhanced Security and Privacy

Privacy and security are key priorities in private banking. All client transactions and personal information are handled with the highest level of confidentiality and safeguarded with advanced security protocols.

10. Global Banking Solutions

For clients with international financial needs, private banks offer global banking services, including currency exchange, offshore investments, and cross-border financial planning, ensuring seamless financial management across borders.

Advantages of Private Banking

Advantages of Private Banking

Private banking offers a range of exclusive benefits that are specifically designed to meet the complex needs of high-net-worth individuals (HNWIs). Unlike traditional banking, which offers standardized solutions for the general public, private banking provides a personalized and comprehensive approach to wealth management. By assigning dedicated relationship managers and offering access to exclusive services, private banking ensures that clients receive tailored financial advice and solutions that align with their unique goals. Here are the key advantages of private banking:

1. Personalized Financial Services

Clients receive bespoke financial planning and wealth management services tailored to their specific needs, including customized investment strategies, tax optimization, and retirement planning.

2. Exclusive Investment Opportunities

Private banking clients gain access to investment products that are not available to the general public, such as private equity, hedge funds, and alternative investments. These opportunities help diversify portfolios and potentially provide higher returns.

3. Dedicated Relationship Manager

A personal banker or relationship manager is assigned to each client, offering them direct access to a trusted financial advisor who understands their financial goals and priorities.

4. Estate and Tax Planning Expertise

Private banks provide expert guidance on estate planning and tax strategies, ensuring that wealth is efficiently transferred to future generations while minimizing tax liabilities.

5. Tailored Lending Solutions

Private banking offers customized lending options, including jumbo mortgages and flexible lines of credit, designed to meet the specific financial profile and needs of each client.

6. Privacy and Security

High-net-worth individuals value their privacy, and private banking ensures that all financial transactions are handled with strict confidentiality. Advanced security measures are employed to protect personal and financial information.

7. Concierge and Lifestyle Services

In addition to financial services, private banks offer concierge services, helping clients with travel arrangements, event planning, luxury purchases, and other personal needs to enhance their lifestyle.

8. Global Banking Solutions

For clients with international financial needs, private banks provide global services such as foreign exchange, cross-border investments, and international estate planning, ensuring that wealth is managed seamlessly across borders.

9. Comprehensive Wealth Management

Private banking provides a holistic approach to managing wealth, integrating various services such as investment management, asset protection, retirement planning, and philanthropic giving under one roof.

10. Access to Expert Networks

Clients benefit from the expertise of a broad network of specialists, including tax advisors, legal professionals, estate planners, and investment experts, who work together to address all aspects of the client’s financial needs.

Disadvantages and Challenges of Private Banking

Disadvantages and Challenges of Private Banking

While private banking offers numerous advantages, it also comes with its own set of challenges and disadvantages that clients should consider before committing to these services. High-net-worth individuals (HNWIs) may encounter issues such as high costs, limited product offerings, or potential conflicts of interest. It is important to weigh these disadvantages alongside the benefits to determine if private banking is the right choice for one’s financial needs.

1. High Costs and Fees

Private banking services often come with significant management fees, transaction costs, and minimum account requirements. These high costs may not always justify the services provided, particularly for clients with smaller portfolios.

2. Limited Product Offerings

Private banks tend to focus on their own proprietary financial products, which may limit the range of investment options available compared to independent wealth management firms or other financial institutions. This could restrict access to more diverse or specialized investment opportunities.

3. Employee Turnover

One of the core benefits of private banking is the close relationship between the client and their personal banker. However, frequent employee turnover in private banks can disrupt this relationship, requiring clients to re-establish trust with new relationship managers, which can be time-consuming and frustrating.

4. Potential Conflicts of Interest

Private bankers are often compensated by the bank, which could lead to a potential conflict of interest, as they may prioritize selling products that generate higher fees for the bank rather than those that are in the best interest of the client.

5. Complexity of Services

The personalized services offered by private banks can sometimes become overwhelming, especially if the client’s financial needs are very complex. Navigating various services, such as tax planning, estate management, and investment strategies, can require significant time and effort.

6. Exclusivity and Eligibility Requirements

Private banking is generally reserved for individuals with substantial wealth, often requiring a minimum of $100,000 to $1 million in investable assets. These exclusivity requirements can exclude a large portion of potential clients, limiting access to the high-quality services of private banking.

7. Limited Transparency

Due to the exclusive nature of private banking, there may be a lack of transparency when it comes to fees, pricing structures, and the performance of investment products. Clients may not always be aware of the exact costs or risks associated with their financial services.

8. Regulatory Constraints

Private banks are subject to stringent regulations, especially in the aftermath of the 2008 financial crisis. While these regulations are designed to protect clients, they may also limit the bank’s ability to offer certain products or services, potentially restricting the flexibility and customization that private banking typically provides.

Who Can Access Private Banking Services?

Private banking services are typically reserved for high-net-worth individuals (HNWIs) who have significant assets to manage. While the exact threshold for eligibility varies between institutions, many private banks require clients to have at least $100,000 to $1 million in investable assets to qualify for their services. Some exclusive institutions may have higher minimum requirements, often in the range of $5 million to $10 million, to access their top-tier offerings. In addition to financial criteria, private banks may also consider factors such as annual income, financial complexity, and long-term wealth management needs when determining eligibility. While private banking is often associated with the ultra-wealthy, certain banks may also extend services to individuals with emerging wealth who are on track to meet these thresholds in the future.

Comparison of Private Banking vs. Wealth Management

Private banking and wealth management both cater to high-net-worth individuals (HNWIs) and provide personalized financial services, but they differ in their scope and the type of services offered. Private banking focuses on providing a holistic suite of banking services tailored to meet the unique financial needs of wealthy clients, while wealth management is a broader, more comprehensive approach that includes financial planning, investment management, and advisory services. While both services aim to help clients preserve and grow their wealth, the distinction lies in the specific services offered and the way they are delivered. Below is a comparison of private banking and wealth management to highlight their key differences:

| Aspect | Private Banking | Wealth Management |

| Primary Focus | Tailored banking services for HNWIs, including deposits, loans, and credit management. | Comprehensive financial planning, investment strategies, and long-term wealth management. |

| Investment Management | Basic investment advice and customized portfolios. | In-depth investment management with access to alternative investments, hedge funds, and private equity. |

| Services Provided | Banking services (accounts, loans, mortgages), estate planning, and concierge services. | Financial planning, tax strategies, retirement planning, estate planning, and philanthropic advising. |

| Target Clients | HNWIs who require personalized banking services. | Individuals seeking holistic financial management, often with a focus on investments. |

| Relationship Model | One dedicated relationship manager or private banker. | Often involves a team of experts, including investment managers, financial planners, and tax advisors. |

| Exclusivity | Generally limited to clients with substantial assets (usually $100,000 to $1 million+). | Wealth management services can cater to a wider range, but often targets clients with higher investable assets (typically $1 million+). |

| Fees | Can be higher due to personalized services, including concierge services. | Fees vary based on the asset under management, often involving a percentage of assets managed. |

| Financial Products | Exclusive banking products, such as private credit lines, mortgages, and specialized savings accounts. | A broader range of investment products, including stocks, bonds, real estate, and hedge funds. |

Real-World Example of Private Banking

Private banking is designed to cater to the specific needs of high-net-worth individuals (HNWIs), offering tailored services and personalized financial strategies. A real-world example can help illustrate how these services work in practice and the value they provide. High-net-worth individuals often face complex financial situations, including managing large investment portfolios, planning for estate transfers, and protecting their wealth across generations. Through private banking, they gain access to a suite of services that streamline and simplify their financial management, ensuring their wealth is effectively managed and preserved.

- Client: A successful entrepreneur, John, with significant assets and a diverse portfolio, seeking tailored financial services to grow and protect his wealth.

- Initial Consultation: The private banker conducts a meeting to understand John’s financial goals, including investment diversification, tax minimization, and wealth transfer to his children.

- Wealth Management Plan: A customized financial strategy is developed, balancing traditional investments with alternative options like private equity, aligned with John’s risk profile and objectives.

- Exclusive Investment Opportunities: John is introduced to high-return, exclusive investment products such as hedge funds and private equity, giving him access to opportunities beyond public markets.

- Estate and Tax Planning: Private banking includes expert estate planning services, such as setting up a trust, to reduce tax liabilities and ensure seamless wealth transfer to future generations.

- Customized Lending Solutions: The bank offers John tailored lending options, such as a luxury mortgage with favorable terms, based on his financial situation and goals.

- Ongoing Monitoring: The private banker continually assesses John’s portfolio, adjusting investments based on market changes and his evolving financial needs.

- Concierge Services: Beyond finance, private banking provides lifestyle services, such as luxury travel arrangements and event planning, offering convenience and personal support.

How to Choose the Right Private Bank

Choosing the right private bank is a crucial decision for high-net-worth individuals (HNWIs) looking to manage and grow their wealth. The ideal private bank should align with your financial goals, offer personalized services, and provide access to exclusive opportunities. With various banks offering different services, it’s essential to evaluate several factors to ensure that the bank can meet your unique needs and provide the level of expertise and service that you expect. Here’s a guide to help you choose the right private bank:

- Reputation and Track Record: Research the bank’s history and client feedback to ensure it has a strong reputation for managing wealth effectively and securely.

- Range of Services Offered: Choose a bank that provides a wide variety of services, from investment management to estate and tax planning, ensuring all your needs are met.

- Personalized Client Service: Ensure the bank offers personalized attention, with a dedicated relationship manager who understands your specific financial goals and needs.

- Fees and Costs: Consider the bank’s fee structure and make sure that it is transparent and aligned with the level of service and expertise offered.

- Investment Philosophy and Strategy: Ensure the bank’s investment approach aligns with your risk tolerance and financial goals, whether conservative or more aggressive.

- Access to Exclusive Investment Products: Look for a bank that offers access to exclusive opportunities like private equity, hedge funds, and luxury assets that are not available to the general public.

- Global Reach and Expertise: If you have international needs, choose a bank with global capabilities and expertise in cross-border financial management.

- Security and Privacy: Ensure the bank has strong security measures and prioritizes the confidentiality of your personal and financial information.

- Specialized Expertise: The right bank should provide access to a network of experts, such as tax advisors and estate planners, to address complex financial matters.

How Private Banking Attracts and Retains HNWIs

Private banking is designed to attract and retain high-net-worth individuals (HNWIs) by offering a unique blend of personalized services, exclusive investment opportunities, and exceptional client care. As HNWIs are accustomed to a high level of attention and expertise, private banks must go beyond the typical banking experience to build lasting relationships. By offering tailored solutions, seamless experiences, and a commitment to confidentiality, private banks create value that ensures client satisfaction and long-term loyalty. Below are some of the ways private banks attract and retain HNWIs:

How Private Banking Attracts and Retains HNWIs:

1. Personalized Financial Solutions

Private banks offer bespoke financial services, creating tailored wealth management plans that address each client’s specific goals, from investment strategies to estate planning.

2. Exclusive Investment Opportunities

Clients gain access to exclusive, high-return investments such as private equity, hedge funds, and luxury asset classes, offering opportunities that aren’t available through regular banking channels.

3. Dedicated Relationship Managers

A personal relationship manager is assigned to each client, ensuring a consistent and high level of service. This personalized attention fosters trust and strengthens the client-bank relationship.

4. Exceptional Customer Service

Private banking provides around-the-clock customer support, offering services that go beyond financial management, such as concierge services, luxury travel planning, and event coordination.

5. Enhanced Privacy and Security

Clients appreciate the privacy and security that private banks offer, with advanced measures in place to safeguard their sensitive financial and personal information.

6. Holistic Wealth Management

Banks offer a comprehensive approach to managing wealth, integrating investment management, tax planning, and estate management under one roof, ensuring a streamlined service.

7. Exclusive Benefits and Perks

Private banks provide HNWIs with additional perks, such as preferential rates on loans, higher interest on savings accounts, and invitations to exclusive events, reinforcing the sense of value.

8. Tailored Lending Solutions

Private banks offer customized lending options, such as jumbo mortgages, secured loans, and flexible lines of credit, to meet the specific financial needs and lifestyle of HNWIs.

9. Continuity and Long-Term Relationships

By maintaining consistent service and adapting to the evolving needs of clients, private banks build long-term relationships, which enhance client retention and satisfaction.

Conclusion

In conclusion, private banking offers high-net-worth individuals (HNWIs) a level of service and expertise that goes far beyond traditional banking, providing tailored financial solutions, exclusive opportunities, and personalized attention. By focusing on the unique needs of wealthy clients, private banks create long-lasting relationships built on trust, confidentiality, and value. The combination of bespoke wealth management, customized lending, and exclusive investment opportunities ensures that HNWIs can effectively manage, grow, and protect their wealth. As private banks continue to evolve, their ability to offer seamless, holistic services will remain a key factor in attracting and retaining clients who seek to preserve and expand their financial legacy.