Planning for retirement is one of the most crucial financial decisions you’ll make, and understanding different retirement savings options can help you maximize your future wealth. Two of the most popular retirement accounts are the Roth IRA and the Traditional IRA, both offering tax advantages to help your savings grow. However, the key difference lies in when you pay taxes—with a Traditional IRA, you receive tax benefits upfront but pay taxes on withdrawals in retirement, while a Roth IRA requires you to pay taxes now in exchange for tax-free withdrawals later. Choosing between these two options depends on your current financial situation, tax bracket, and long-term retirement goals. In this article, we’ll break down how Roth and Traditional IRAs work, their benefits, drawbacks, and how to determine which one is the best fit for your financial future.

What is a Roth IRA?

A Roth IRA (Individual Retirement Account) is a tax-advantaged retirement savings account that allows individuals to contribute after-tax dollars, meaning you pay taxes on your money upfront. The biggest benefit of a Roth IRA is that your investments grow tax-free, and qualified withdrawals in retirement—including both contributions and earnings—are completely tax-free as well. Unlike a Traditional IRA, a Roth IRA does not offer an immediate tax deduction, but it provides greater flexibility with withdrawals and no required minimum distributions (RMDs), making it a valuable tool for long-term retirement planning. This account is especially beneficial for those who expect to be in a higher tax bracket in the future, as it allows them to lock in today’s tax rates and enjoy tax-free income in retirement.

What is a Traditional IRA?

A Traditional IRA is a retirement savings account that offers tax-deferred growth, meaning you contribute pre-tax dollars, and your investments grow without being taxed until you withdraw funds in retirement. One of its key benefits is that contributions may be tax-deductible, which can lower your taxable income in the year you contribute. However, withdrawals in retirement are taxed as ordinary income, and required minimum distributions (RMDs) must begin at age 73. A Traditional IRA is ideal for individuals who expect to be in a lower tax bracket during retirement, as it allows them to defer taxes until they are potentially paying a lower rate. While it provides an immediate tax advantage, it comes with stricter withdrawal rules and potential penalties for early access before age 59½.

Key Differences between Roth IRA and Traditional IRA

Both Roth IRA and Traditional IRA offer valuable tax advantages, but the key difference is when you pay taxes. With a Traditional IRA, you get an immediate tax deduction, and your investments grow tax-deferred, but withdrawals in retirement are taxed as ordinary income. In contrast, a Roth IRA requires you to contribute after-tax money, but your withdrawals—including earnings—are completely tax-free in retirement. Additionally, Roth IRAs have no required minimum distributions (RMDs), while Traditional IRAs mandate withdrawals starting at age 73. Below is a detailed comparison of their main features:

| Feature | Roth IRA | Traditional IRA |

| Tax Treatment | Contributions are made with after-tax dollars, but withdrawals are tax-free. | Contributions are tax-deductible, but withdrawals are taxed as income. |

| Eligibility | Income limits apply; high earners may not qualify. | Available to anyone with earned income, but deductibility depends on income and employer plan participation. |

| Withdrawal Rules | Contributions can be withdrawn anytime tax-free; earnings can be withdrawn tax-free after age 59½ and a five-year holding period. | Early withdrawals before age 59½ incur taxes and a 10% penalty, except in specific cases. |

| Required Minimum Distributions (RMDs) | No RMDs during the account owner’s lifetime. | RMDs are required starting at age 73. |

| Best for | Individuals expecting to be in a higher tax bracket in retirement. | Individuals expecting to be in a lower tax bracket in retirement. |

| Contribution Limits (2024 & 2025) | $7,000 ($8,000 if 50+) | $7,000 ($8,000 if 50+) |

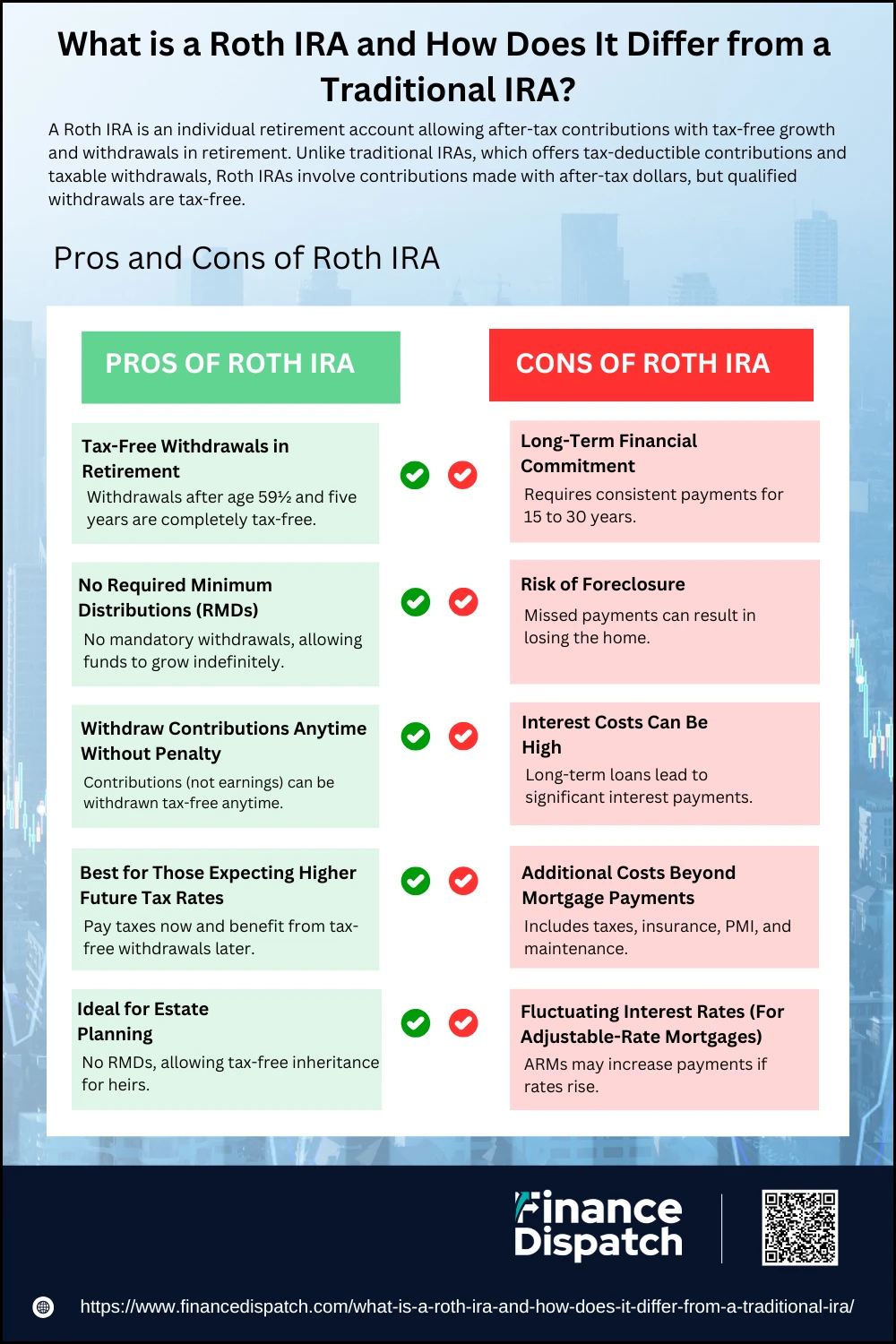

Pros and Cons of Roth IRA

Pros and Cons of Roth IRA

A Roth IRA offers significant long-term benefits, including tax-free withdrawals in retirement and no required minimum distributions (RMDs). However, it also comes with some limitations, such as income restrictions and no immediate tax deductions. Whether a Roth IRA is the right choice depends on your financial situation, tax strategy, and retirement goals. Below are the key advantages and disadvantages of a Roth IRA:

Pros of Roth IRA

1. Tax-Free Withdrawals in Retirement

Once you reach age 59½ and have had the Roth IRA for at least five years, all your withdrawals—including earnings—are completely tax-free. This provides significant savings, especially if you expect to be in a higher tax bracket when you retire.

2. No Required Minimum Distributions (RMDs)

Unlike a Traditional IRA, a Roth IRA does not require you to withdraw money at any specific age. This means your money can continue growing tax-free for as long as you want, making it an excellent option for long-term retirement planning and estate planning.

3. Withdraw Contributions Anytime Without Penalty

You can withdraw the money you contributed to a Roth IRA at any time, tax-free and penalty-free. This flexibility makes it a great option for emergency funds, large expenses, or unexpected financial needs. However, earnings on your investments have stricter withdrawal rules.

4. Best for Those Expecting Higher Future Tax Rates

If you believe you’ll be in a higher tax bracket in retirement, a Roth IRA lets you pay taxes now at your current rate and withdraw tax-free later, reducing your overall tax burden in retirement.

5. Ideal for Estate Planning

Since Roth IRAs don’t have RMDs, they allow your investments to continue growing indefinitely. If passed down to heirs, the funds can be withdrawn tax-free, making it an excellent estate planning tool.

Cons of Roth IRA

1. No Immediate Tax Deduction

Unlike a Traditional IRA, Roth IRA contributions are not tax-deductible. This means you don’t get an immediate tax break, which could be a disadvantage if you need to lower your taxable income in the current year.

2. Income Limits Apply

Not everyone qualifies for a direct Roth IRA contribution. In 2024, single filers must have a Modified Adjusted Gross Income (MAGI) below $161,000 (with phaseouts beginning at $146,000). Married couples filing jointly must earn less than $240,000 to be eligible for full contributions. Those above these limits must use a Backdoor Roth IRA strategy.

3. Five-Year Rule on Earnings Withdrawals

If you withdraw earnings (investment gains) before age 59½ and before the account has been open for five years, you may have to pay income tax and a 10% penalty on those earnings. However, some exceptions apply (e.g., first-time home purchases, disability, or education expenses).

4. Pay Taxes Upfront

Since contributions to a Roth IRA are made with after-tax dollars, you must pay taxes now instead of later. This could be a disadvantage if you need the tax break today.

5. Not Ideal for Lower Tax Brackets

If you expect to be in a lower tax bracket in retirement, a Traditional IRA might make more financial sense, as it allows you to take a tax deduction now and pay taxes later when your income is lower.

Pros and Cons of Traditional IRA

Pros and Cons of Traditional IRA

A Traditional IRA is a tax-advantaged retirement account that allows individuals to contribute pre-tax dollars, reducing their taxable income in the year they contribute. This immediate tax deduction makes it a popular choice for those looking to lower their current tax bill while saving for retirement. However, the trade-off is that withdrawals in retirement are taxed as ordinary income, and required minimum distributions (RMDs) must begin at age 73. While a Traditional IRA offers significant tax benefits upfront, it also comes with withdrawal restrictions and potential penalties for early access. Below are the key advantages and disadvantages of a Traditional IRA to help you determine if it’s the right retirement savings option for you.

Pros of Traditional IRA

1. Immediate Tax Deduction

One of the biggest advantages of a Traditional IRA is that contributions may be tax-deductible, meaning you can deduct the amount you contribute from your taxable income for that year. This benefit is especially useful for individuals in higher tax brackets, as it allows them to lower their current tax liability and potentially save thousands of dollars.

2. Tax-Deferred Growth

Investments inside a Traditional IRA grow tax-deferred, meaning you won’t owe taxes on capital gains, dividends, or interest until you begin making withdrawals. This allows for compounding growth, helping your savings grow faster over time compared to taxable investment accounts.

3. No Income Limits for Contributions

Unlike a Roth IRA, which has income limits that may prevent high earners from contributing, anyone with earned income can contribute to a Traditional IRA. However, the tax deduction eligibility for contributions may be phased out at higher income levels if you or your spouse has access to a workplace retirement plan like a 401(k).

4. Potentially Lower Taxes in Retirement

If you expect to be in a lower tax bracket in retirement, a Traditional IRA can be highly beneficial. You defer taxes now when your income is higher and pay taxes later when your taxable income is expected to be lower, potentially saving you a significant amount in taxes.

5. Can Be Rolled Over to Other Retirement Accounts

If you change jobs or consolidate retirement accounts, a Traditional IRA can be rolled over into a 401(k) (if the plan allows) or converted into a Roth IRA (taxes must be paid on the converted amount). This flexibility allows individuals to adjust their retirement strategy as their financial situation evolves.

Cons of Traditional IRA

1. Taxes on Withdrawals in Retirement

Unlike a Roth IRA, where qualified withdrawals are tax-free, Traditional IRA withdrawals are fully taxed as ordinary income when taken in retirement. If you end up in a higher tax bracket in retirement than when you contributed, you could pay more in taxes on withdrawals than you originally saved in deductions.

2. Required Minimum Distributions (RMDs) at Age 73

Traditional IRA holders must begin taking required minimum distributions (RMDs) at age 73, even if they don’t need the money. These mandatory withdrawals are taxable, and failure to take them on time can result in hefty IRS penalties (up to 25% of the required amount not withdrawn).

3. Early Withdrawal Penalties

If you withdraw funds before age 59½, you will face a 10% penalty on top of paying income taxes on the withdrawal. There are a few exceptions, such as using the funds for a first-time home purchase, disability, or higher education expenses, but in most cases, early withdrawals come with a financial penalty.

4. Tax Deduction Limits for High Earners

While anyone with earned income can contribute to a Traditional IRA, the ability to deduct those contributions on taxes is phased out for higher earners, especially those who participate in an employer-sponsored retirement plan. This makes a Traditional IRA less attractive for individuals in higher income brackets who are also covered by a 401(k).

5. Less Flexibility in Withdrawals Compared to a Roth IRA

Unlike a Roth IRA, which allows you to withdraw contributions tax-free at any time, a Traditional IRA does not provide this flexibility. Every withdrawal before retirement is subject to income tax and potential penalties, making it a less liquid option for those who might need access to their funds early.

Withdrawal Rules and Penalties of Roth IRA and a Traditional IRA

Withdrawal Rules and Penalties of Roth IRA and a Traditional IRA

Understanding the withdrawal rules and potential penalties for Roth and Traditional IRAs is essential for effective retirement planning. While both accounts offer tax-advantaged growth, they have different rules for accessing funds. A Roth IRA provides more flexibility, allowing you to withdraw contributions at any time without taxes or penalties. However, earnings withdrawals before meeting certain conditions may trigger taxes and penalties. In contrast, Traditional IRAs have stricter withdrawal rules, with all distributions taxed as income and penalties for early withdrawals before age 59½. Additionally, Traditional IRAs require mandatory withdrawals (RMDs), while Roth IRAs do not. Below is a breakdown of the withdrawal rules and penalties for each type of IRA.

Roth IRA Withdrawal Rules

1. Withdraw Contributions Anytime: You can withdraw your original contributions at any time, tax-free and penalty-free.

2. Earnings Withdrawals Are Tax-Free After 59½ and 5 Years: To withdraw investment gains tax-free, you must:

- Be at least 59½ years old.

- Have had the Roth IRA for at least five years (the five-year rule).

3. Early Earnings Withdrawals May Be Taxed and Penalized: If you withdraw earnings before meeting the age 59½ and five-year rule, the amount will be:

- Taxable as income.

- Subject to a 10% early withdrawal penalty (unless an exception applies).

4. Exceptions to the 10% Penalty on Earnings: You can withdraw earnings without a penalty (but may still owe taxes) if:

- You use up to $10,000 for a first-time home purchase.

- You become permanently disabled.

- You use the money for qualified higher education expenses.

- The withdrawal is used for certain medical expenses or health insurance if unemployed.

5. No Required Minimum Distributions (RMDs) – Unlike a Traditional IRA, Roth IRAs have no required withdrawals, allowing your money to grow indefinitely.

Traditional IRA Withdrawal Rules

1. Withdrawals Are Taxed as Income: All distributions from a Traditional IRA are taxed as ordinary income at your current tax rate.

2. Early Withdrawals Before 59½ Are Penalized: If you withdraw funds before age 59½, you will pay:

- Income taxes on the withdrawn amount.

- A 10% early withdrawal penalty (unless an exception applies).

3. Exceptions to the 10% Penalty: You may avoid the 10% penalty (but still owe taxes) if the withdrawal is used for:

- First-time home purchase (up to $10,000).

- Permanent disability.

- Qualified education expenses.

- Unreimbursed medical expenses exceeding 7.5% of your Adjusted Gross Income (AGI).

- Health insurance premiums while unemployed.

4. Required Minimum Distributions (RMDs) Start at Age 73: Unlike Roth IRAs, Traditional IRAs require you to begin withdrawing funds at age 73 (RMDs). If you fail to take an RMD, you face a 50% penalty on the required withdrawal amount.

5. No Tax-Free Withdrawals in Retirement: Unlike a Roth IRA, all withdrawals in retirement are fully taxable as income, making tax planning crucial.

Can You Have Both a Roth IRA and a Traditional IRA?

Yes, you can contribute to both a Roth IRA and a Traditional IRA in the same year, as long as your total contributions do not exceed the annual IRS limit. For 2024 and 2025, the combined contribution limit for both accounts is $7,000 (or $8,000 if you’re 50 or older). However, your ability to contribute to a Roth IRA depends on your income level, as higher earners may be restricted. Having both types of IRAs can be a strategic way to diversify your tax advantages, allowing you to take advantage of immediate tax deductions with a Traditional IRA while also securing tax-free withdrawals in retirement with a Roth IRA. This approach provides greater flexibility in retirement, as you can choose which account to withdraw from based on your tax situation at that time. If you’re unsure how to balance contributions between the two, consulting a financial advisor can help tailor a strategy to your long-term goals.

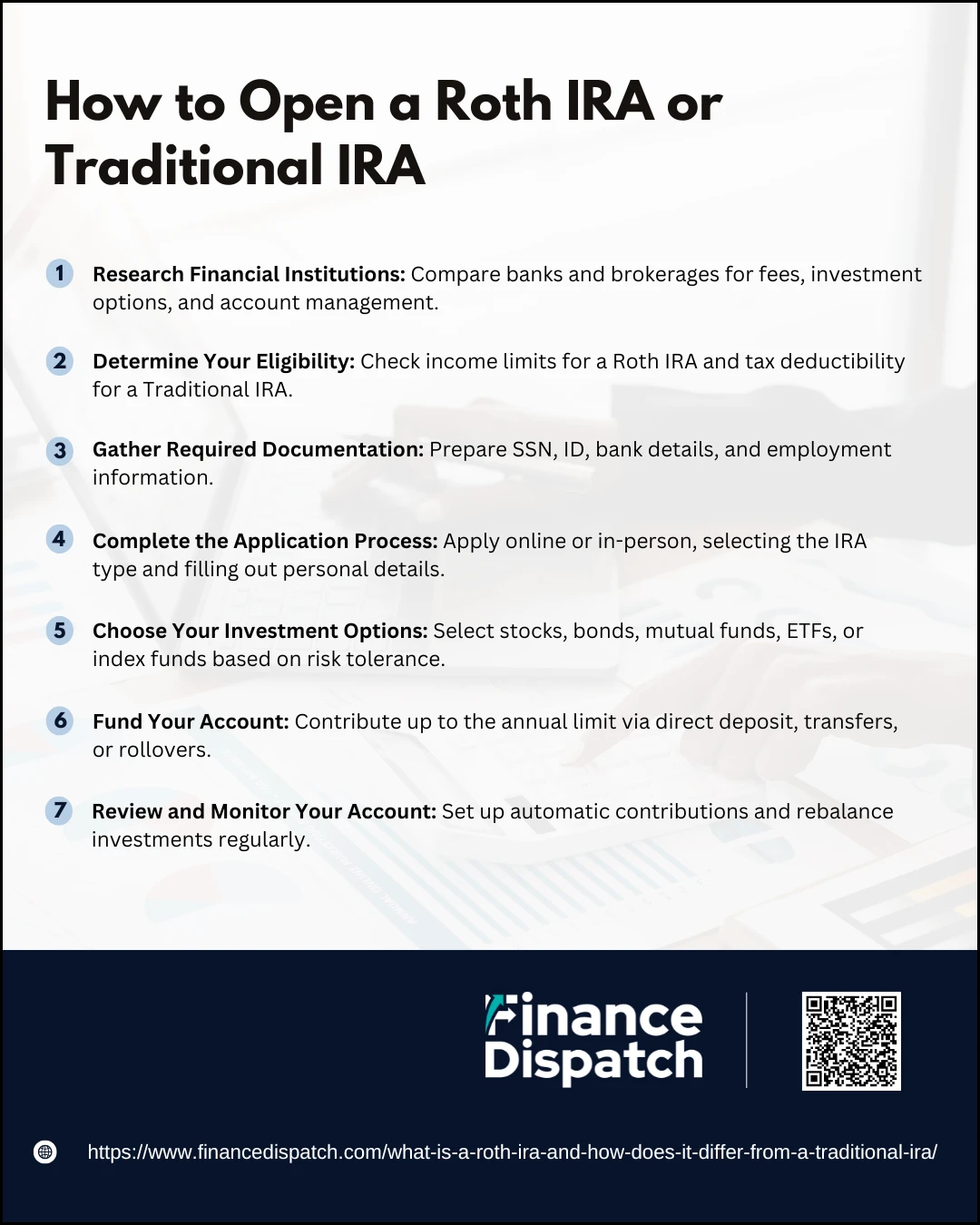

How to Open a Roth IRA or Traditional IRA

How to Open a Roth IRA or Traditional IRA

Getting started with a Roth or Traditional IRA is an essential step toward building a secure retirement. The process is relatively straightforward, and many financial institutions provide the necessary tools to help you open and manage your account. Whether you choose a Roth IRA for its tax-free withdrawals or a Traditional IRA for its immediate tax deductions, you’ll need to follow a series of steps to ensure your account is set up correctly and in line with IRS guidelines. Below is a numerical list outlining the key steps involved in opening either type of IRA:

1. Research Financial Institutions

Compare different banks, brokerages, and online investment platforms that offer IRAs. Look for institutions with low fees, a good selection of investment options, and easy account management. Decide whether you want to open an IRA through a self-directed brokerage (for hands-on investing) or a robo-advisor (for automated, managed investments).

2. Determine Your Eligibility

For a Roth IRA:

- Your ability to contribute depends on income limits.

- In 2024, single filers earning more than $161,000 (MAGI) and married couples earning over $240,000 are not eligible to contribute directly.

For a Traditional IRA:

- Anyone with earned income can contribute, but tax deductibility may be limited if you have a 401(k) or workplace retirement plan.

3. Gather Required Documentation

You will need:

- Social Security Number (SSN) or Taxpayer Identification Number (TIN).

- Government-issued ID (driver’s license or passport).

- Bank account details for funding your IRA.

- Employer and income details (for tax-related verification).

4. Complete the Application Process

Visit the website or physical branch of the bank, brokerage, or financial institution of your choice. Choose between a Roth IRA or Traditional IRA (or both, if eligible). Fill out the application form, which will ask for personal details, income information, and beneficiary designations.

5. Choose Your Investment Options

Once your IRA is open, you will need to decide how to invest your contributions.

Common investment choices within an IRA include:

- Stocks – Higher risk, higher potential returns.

- Bonds – More stable, lower returns.

- Mutual Funds & ETFs – Diversified investments with professional management.

- Index Funds – Passive, low-cost funds that track market performance.

6. Fund Your Account

Decide how much you want to contribute:

In 2024 and 2025, the annual IRA contribution limit is $7,000 ($8,000 if you’re 50 or older).

Funding options include:

- Direct deposit from your bank account.

- Transferring money from another investment account.

- Rolling over funds from a 401(k) or another IRA (if applicable).

7. Review and Monitor Your Account

Set up automatic contributions to maximize tax advantages and long-term growth. Periodically review and rebalance your portfolio to align with your retirement goals and risk tolerance. Stay informed about IRA contribution limits, tax law changes, and investment performance.

Which IRA is Right for You?

Choosing between a Roth IRA and a Traditional IRA depends on your current financial situation, tax strategy, and retirement goals. A Roth IRA is best for those who expect to be in a higher tax bracket in the future, as it allows tax-free withdrawals in retirement. It also offers more flexibility, with no required minimum distributions (RMDs) and penalty-free access to contributions. However, Roth IRAs have income limits that may restrict high earners from contributing directly. On the other hand, a Traditional IRA is ideal for individuals who want an immediate tax deduction, helping to reduce taxable income today. This option works well if you anticipate being in a lower tax bracket during retirement, as withdrawals are taxed at that time. However, Traditional IRAs come with mandatory withdrawals at age 73 and early withdrawal penalties if funds are accessed before 59½. Ultimately, the right choice depends on whether you prefer tax savings now (Traditional IRA) or tax-free income later (Roth IRA). Some individuals choose to contribute to both accounts to diversify their retirement tax advantages and maintain flexibility.

Conclusion

Both Roth IRAs and Traditional IRAs offer valuable tax advantages, but the right choice depends on your financial situation, tax planning strategy, and long-term retirement goals. A Roth IRA provides tax-free withdrawals in retirement, greater flexibility, and no required minimum distributions, making it ideal for those expecting to be in a higher tax bracket in the future. On the other hand, a Traditional IRA offers an immediate tax deduction and tax-deferred growth, making it beneficial for individuals who want to lower their taxable income now and anticipate a lower tax rate in retirement. If you’re unsure which option suits you best, consider diversifying your retirement savings by contributing to both, or consult with a financial advisor to tailor a strategy that maximizes your tax benefits and long-term financial security. No matter which IRA you choose, the key to a successful retirement is consistent contributions, strategic planning, and smart investment decisions.