Imagine being able to own a fraction of a luxury property, a rare painting, or even a share in a high-value company without needing millions in capital. This is now possible through tokenization, a revolutionary process that transforms real-world assets into digital tokens on a blockchain. Tokenization enables fractional ownership, allowing investors to buy and trade small portions of traditionally high-value assets, making investment opportunities more accessible, transparent, and liquid. By leveraging blockchain technology, tokenization eliminates intermediaries, reduces costs, and ensures secure, immutable transactions. As financial markets evolve, tokenization is reshaping asset ownership, unlocking new investment opportunities, and democratizing access to previously exclusive markets. In this article, we explore the concept of tokenization, how it works, and the transformative impact it has on fractional ownership of assets.

What is Tokenization?

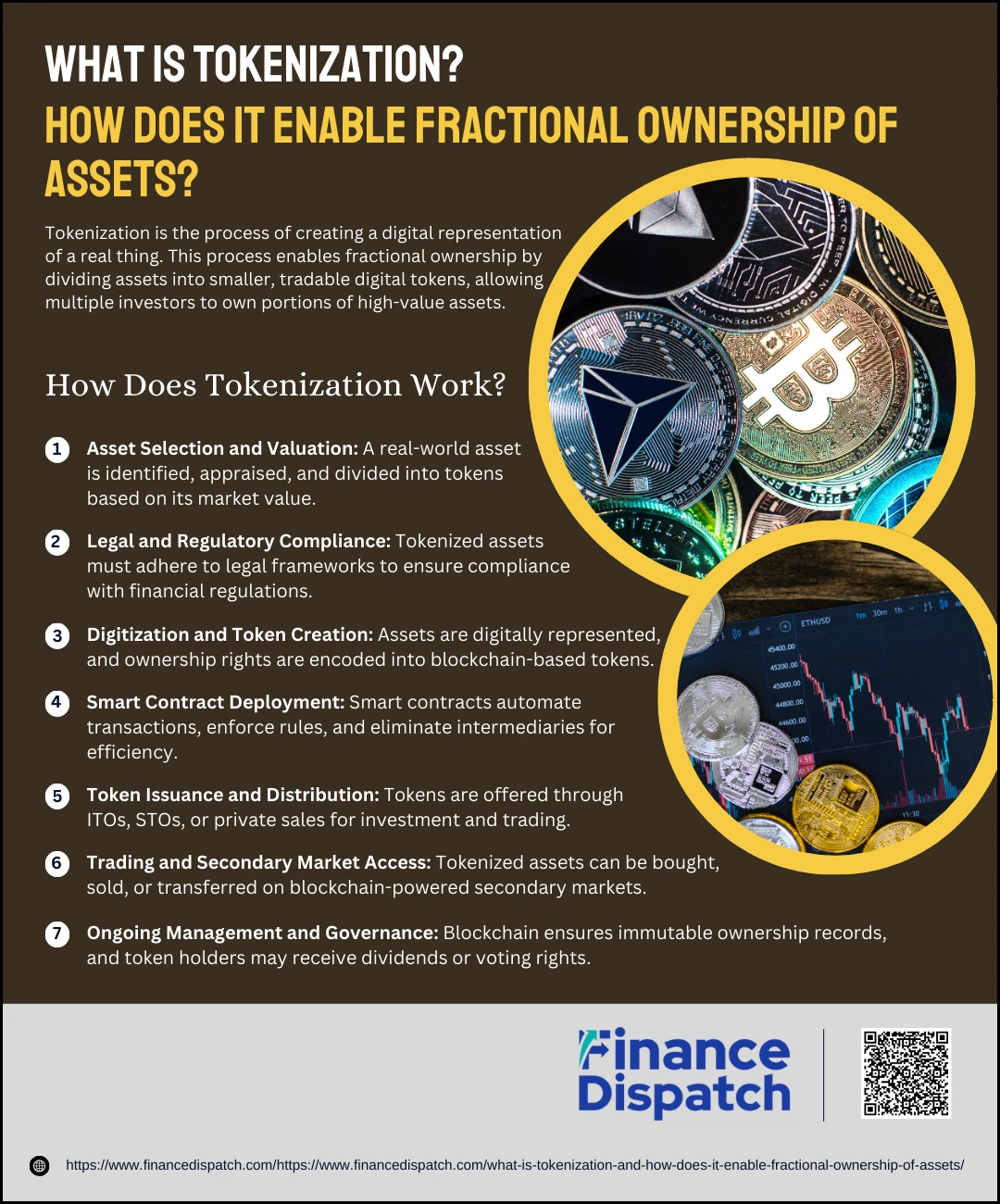

Tokenization is the process of converting ownership rights of a real-world asset into digital tokens that exist on a blockchain. These tokens act as a secure, verifiable representation of the asset, allowing for easy transfer, trade, and fractional ownership. Traditionally, assets like real estate, fine art, commodities, and securities were accessible only to high-net-worth individuals due to their high entry costs and illiquidity. However, with tokenization, these assets can be divided into smaller, tradable units, making them more accessible to a wider range of investors. Unlike traditional asset ownership, which often involves complex legal processes and intermediaries, tokenization automates transactions through smart contracts, ensuring transparency, security, and efficiency. By leveraging blockchain technology, tokenization is transforming the way we perceive and engage with asset ownership, paving the way for a more inclusive and efficient financial ecosystem.

How Does Tokenization Work?

How Does Tokenization Work?

Tokenization is revolutionizing the way we own and trade assets by transforming real-world assets into digital tokens stored on a blockchain. This process enhances security, transparency, and liquidity, making previously illiquid assets—such as real estate, fine art, and private equity—accessible to a wider range of investors. But how exactly does tokenization work? Let’s break it down step by step.

1. Asset Selection and Valuation

A real-world asset, such as property, artwork, or a financial instrument, is identified for tokenization. The asset is then appraised to determine its market value and the number of tokens to be issued.

2. Legal and Regulatory Compliance

Since tokenized assets represent ownership rights, legal frameworks and regulatory requirements must be addressed to ensure compliance. This includes structuring the asset as a security token or a utility token, depending on its use case.

3. Digitization and Token Creation

The asset is converted into a digital format, and ownership rights are encoded into blockchain-based tokens. These tokens can be fractionalized, allowing multiple investors to own a share of the asset.

4. Smart Contract Deployment

Smart contracts are created to govern the issuance, transfer, and management of tokens. These self-executing contracts automate transactions, enforce rules, and eliminate intermediaries, reducing costs and ensuring transparency.

5. Token Issuance and Distribution

Tokens are issued and made available for purchase. Depending on the platform, these tokens can be offered through initial token offerings (ITOs), security token offerings (STOs), or private sales.

6. Trading and Secondary Market Access

Once issued, tokens can be traded on blockchain-powered secondary markets or exchanges, enhancing liquidity. Investors can buy, sell, or transfer their tokenized shares without the traditional barriers of asset ownership.

7. Ongoing Management and Governance

Blockchain technology ensures that ownership records remain immutable and verifiable. Token holders may receive dividends, rental income, or voting rights, depending on the structure of the tokenized asset.

What is Fractional Ownership?

Fractional ownership is a model that allows multiple investors to collectively own a share of a high-value asset instead of purchasing it outright. Traditionally, assets like real estate, luxury goods, fine art, and private equity were accessible only to wealthy individuals due to high capital requirements. However, with fractional ownership, these assets are divided into smaller, more affordable units, enabling a broader range of investors to participate. Each investor holds a proportional share of the asset and may receive dividends, rental income, or appreciation value, depending on the asset type. Tokenization has further revolutionized fractional ownership by digitizing these shares into blockchain-based tokens, allowing for seamless trading, enhanced liquidity, and global accessibility. This modern approach democratizes investment opportunities and removes traditional barriers to asset ownership.

Benefits of Tokenization for Fractional Ownership

Benefits of Tokenization for Fractional Ownership

Tokenization has revolutionized fractional ownership by making investment in high-value assets more accessible, efficient, and secure. Traditionally, assets such as real estate, fine art, commodities, and private equity required significant capital and had limited liquidity. However, with blockchain-powered tokenization, these assets can be digitally represented as tokens, allowing multiple investors to own fractional shares. This process democratizes investment opportunities, increases liquidity, and eliminates the inefficiencies of traditional ownership models. Here’s how tokenization enhances fractional ownership.

1. Increased Liquidity

High-value assets such as real estate and fine art are traditionally illiquid, meaning they take a long time to sell. Tokenization changes this by dividing assets into digital tokens that can be traded on secondary markets, enabling investors to buy or sell their fractional shares instantly.

2. Lower Investment Barriers

By fractionalizing assets, tokenization allows small-scale investors to participate in markets that were once reserved for the wealthy. Instead of needing millions to invest in commercial real estate or rare paintings, investors can now buy smaller portions at a fraction of the total cost.

3. Transparency and Security

Blockchain technology provides an immutable, publicly verifiable ledger where all transactions are recorded. This ensures greater transparency, reduces fraud risks, and guarantees that every fractional owner has a secure record of their asset holdings.

4. Automated Transactions with Smart Contracts

Smart contracts facilitate automated ownership transfers, dividend payments, and regulatory compliance. This eliminates the need for intermediaries such as brokers and banks, reducing transaction costs and making investment processes more efficient.

5. Global Investment Opportunities

Tokenization removes geographical restrictions, allowing investors from around the world to access tokenized assets without complex legal barriers. This global reach increases market participation and makes cross-border investments seamless.

6. Reduced Transaction Costs

Traditional investment methods often involve expensive brokerage fees, legal documentation, and administrative costs. Tokenization eliminates many of these expenses by leveraging blockchain technology and peer-to-peer trading platforms.

7. Improved Market Efficiency

Fractional ownership via tokenization enhances market efficiency by enabling real-time trading, ensuring that asset prices reflect true market demand rather than arbitrary valuations from private deals.

8. Diversification for Risk Management

Investors can spread their capital across multiple tokenized assets, reducing the risk associated with owning a single asset class. Instead of putting all their money into one property or stock, investors can diversify their holdings, mitigating potential losses.

9. Access to Passive Income

Some tokenized assets, such as rental properties, dividend-paying stocks, or intellectual property rights, generate passive income. Fractional owners receive a proportional share of earnings, providing them with a consistent revenue stream.

10. Democratization of Investment

Previously, investment in luxury real estate, rare art, and venture capital was exclusive to high-net-worth individuals and institutions. Tokenization levels the playing field, allowing retail investors to own a piece of valuable assets that were once inaccessible.

Real-World Examples of Tokenized Assets

Real-World Examples of Tokenized Assets

Tokenization is transforming how we invest in and own assets by converting physical and financial assets into digital tokens that can be traded on blockchain networks. This process enhances liquidity, accessibility, and transparency, allowing fractional ownership of high-value assets such as real estate, fine art, commodities, and intellectual property. Many companies and platforms have already implemented tokenization, proving its real-world potential. Here are some notable examples of tokenized assets across different industries.

1. Real Estate – St. Regis Aspen Resort (Aspen Coin)

The St. Regis Aspen Resort, a luxury hotel in Colorado, was tokenized on the blockchain through Aspen Coin, allowing investors to purchase shares in the property. This tokenized model enables fractional ownership, making real estate investment more accessible.

2. Fine Art – TheArtToken (TAT)

TheArtToken (TAT) allows investors to own fractional shares of valuable contemporary and post-war art stored in Swiss vaults. This platform makes investing in high-end art more inclusive and transparent.

3. Commodities – Paxos Gold (PAXG)

Paxos Gold (PAXG) is a tokenized representation of physical gold, where each token is backed by one troy ounce of gold stored in secure vaults. Investors can buy, sell, or trade gold without needing to store it physically.

4. Private Equity – ZERO

ZERO is a blockchain-based platform that facilitates the trading of tokenized private securities. It enables investors to participate in private equity markets with enhanced liquidity and reduced investment barriers.

5. Intellectual Property – Royalty Exchange

Royalty Exchange allows musicians and content creators to tokenize their royalty earnings. Investors can buy shares of music royalties, film rights, and digital content, earning passive income from future sales and streaming revenue.

6. Sports and Entertainment – Socios Fan Tokens

Socios has introduced fan tokens for sports teams like FC Barcelona, Juventus, and Paris Saint-Germain, giving fans access to exclusive content, voting rights, and VIP experiences through blockchain-based ownership.

7. Wine and Whiskey – CaskCoin

CaskCoin enables investors to own shares of rare whiskey casks, providing a new avenue for alternative investments in the luxury spirits market. Each token represents a fraction of the cask’s value.

8. Debt and Loans – Figure’s Blockchain Mortgage

Figure, a financial technology company, has tokenized home equity loans and mortgages using blockchain technology. This innovation reduces paperwork, speeds up processing, and increases transparency in the lending market.

9. Energy and Sustainability – Sun Exchange

Sun Exchange allows individuals to invest in solar energy projects by purchasing tokenized solar cells. These investments generate passive income from the energy sold to businesses and communities.

10. Tokenized Stocks – FTX and Binance Stock Tokens

Platforms like FTX and Binance have introduced stock tokens, representing shares of major companies like Tesla, Apple, and Amazon. These tokens allow fractional ownership of stocks, making investment in top companies more affordable.

Challenges and Risks of Tokenization

Challenges and Risks of Tokenization

Tokenization is reshaping asset ownership, investment, and trading by converting real-world assets into blockchain-based digital tokens. While this innovation enhances liquidity, accessibility, and efficiency, it also presents significant challenges and risks that investors and businesses must navigate. Regulatory uncertainty, security concerns, and market volatility are among the key hurdles that must be addressed to ensure the long-term success and adoption of tokenized assets. Below, we explore some of the biggest challenges and risks associated with tokenization.

1. Regulatory Uncertainty

The legal and regulatory landscape surrounding tokenized assets remains unclear in many countries. Governments and financial regulators are still working to define whether tokenized assets should be classified as securities, commodities, or property rights. Without clear guidelines, businesses face compliance risks, and investors may encounter legal complications when trading tokenized assets across different jurisdictions. Uncertain regulations can also deter institutional adoption, slowing down market growth.

2. Security Vulnerabilities

Despite the decentralized nature of blockchain, security remains a major concern. Smart contracts, which facilitate automated transactions and ownership transfers, can contain coding errors, making them vulnerable to cyberattacks and hacks. If a smart contract is exploited, investors can lose millions in tokenized assets without any way to recover them. Additionally, wallet hacks, phishing scams, and exchange breaches pose further risks to tokenized asset holders.

3. Market Volatility

Many tokenized assets, particularly those in emerging markets, are subject to high volatility. Unlike traditional markets with well-established regulations and institutional backing, tokenized markets can experience rapid price swings due to speculative trading, low liquidity, or external factors such as regulatory crackdowns. This makes tokenized investments riskier, especially for retail investors unfamiliar with crypto markets.

4. Lack of Standardization

The tokenization industry lacks universal standards for asset representation, blockchain protocols, and interoperability between different platforms. This fragmentation makes it difficult for investors to trade tokenized assets across different blockchains or marketplaces. Without standardization, tokenized markets can become inaccessible or inefficient, limiting their adoption among mainstream investors.

5. Legal Ownership and Dispute Resolution

Tokenized assets exist in a digital format, but the underlying assets—such as real estate, commodities, or securities—are governed by traditional legal frameworks. If disputes arise over ownership rights, fraud, or token mismanagement, investors may face difficulties resolving these issues in court. Legal recognition of blockchain-based ownership remains a gray area in many jurisdictions, raising concerns over the enforcement of property rights.

6. Limited Investor Protection

Traditional financial markets are backed by regulatory bodies that provide safeguards against fraud, insider trading, and market manipulation. However, tokenized assets often lack such protections. Many tokenization platforms operate in unregulated environments, increasing the risks of scams, rug pulls, and Ponzi schemes. Without proper oversight, investors may lose funds with little legal recourse.

7. Liquidity Risks

One of the biggest promises of tokenization is increased liquidity, but this is not guaranteed for all assets. If market demand is low, investors may struggle to sell their tokens, making them effectively illiquid. Unlike stocks or bonds, where buyers are readily available, tokenized real estate or collectibles may have long waiting periods before a sale is executed, defeating the purpose of fractional ownership.

8. Custody and Asset Safeguarding

For tokenized assets that represent physical properties, gold, or artwork, there must be a trusted custodian ensuring that the real-world asset exists and remains protected. If the custodian fails to secure the asset properly, investors holding the digital tokens may end up with worthless representations of non-existent or mismanaged assets. This risk makes transparency and trust in custodians a critical issue in asset tokenization.

9. Taxation and Accounting Challenges

The taxation of tokenized assets is still poorly defined in many countries. Investors may be unsure whether their tokenized asset holdings should be classified as capital gains, securities, or digital currencies for tax purposes. Complex reporting requirements and fluctuating asset valuations further complicate accounting for tokenized investments, making compliance difficult for individuals and businesses.

10. Adoption Barriers and Trust Issues

Many traditional investors and financial institutions remain skeptical about blockchain technology and tokenized assets. Concerns over security risks, unclear regulations, and unfamiliarity with digital wallets can deter mainstream adoption. Additionally, many investors are more comfortable with traditional asset ownership models, which they perceive as more secure and legally enforceable. Without greater trust and education, the adoption of tokenized assets may remain limited to niche markets.

Future of Tokenization and Fractional Ownership

The future of tokenization and fractional ownership is set to transform global finance by making asset ownership more accessible, efficient, and liquid. As blockchain technology continues to advance, tokenization will likely expand beyond real estate, fine art, and commodities into financial securities, intellectual property, and even personal assets. Increased regulatory clarity will drive institutional adoption, bringing greater legitimacy and investor protection to tokenized markets. Additionally, the integration of decentralized finance (DeFi) platforms, smart contracts, and cross-chain interoperability will enable seamless trading of fractional assets across global markets. With the rise of security token offerings (STOs) and tokenized stock markets, investors will gain exposure to a wider range of assets with lower entry barriers. As more industries recognize the benefits of blockchain-driven fractional ownership, tokenization is expected to become a mainstream financial model, democratizing investment opportunities and reshaping how people buy, sell, and trade assets worldwide.

Conclusion

Tokenization is redefining asset ownership by digitizing real-world assets and enabling fractional ownership through blockchain technology. By making traditionally illiquid and high-value assets more accessible, tokenization lowers investment barriers, enhances liquidity, and improves transparency. While challenges such as regulatory uncertainty, security concerns, and market volatility remain, ongoing technological advancements and increased institutional adoption are paving the way for a more efficient and democratized financial ecosystem. As tokenization continues to evolve, it has the potential to revolutionize global investment markets, offering investors greater flexibility, security, and opportunities. The future of asset ownership is becoming more inclusive and digital, ensuring that financial markets are no longer limited to a select few but open to a broader and more diverse investor base.