Investing in the stock market offers numerous opportunities, and one of the most exciting prospects is participating in an Initial Public Offering (IPO). An IPO marks a company’s transition from private ownership to a publicly traded entity, allowing investors to buy shares for the first time. This process can generate significant profits for early investors, but it also carries risks. Understanding how IPOs work, their benefits, and potential drawbacks is crucial before diving in. In this article, we’ll explore the fundamentals of IPOs, how companies go public, and the strategies you can use to maximize your investment returns.

What is an IPO?

An Initial Public Offering (IPO) is the process through which a private company sells its shares to the public for the first time, allowing investors to buy ownership in the company. This transition from private to public ownership is often referred to as “going public.” Companies pursue IPOs to raise capital for expansion, research and development, debt repayment, or other business needs. The process involves regulatory approvals, financial disclosures, and underwriting by investment banks to determine the stock’s initial price. Once listed on a stock exchange, the company’s shares become available for trading, giving early investors the opportunity to profit from potential price appreciation. However, investing in IPOs carries risks, as newly public companies often experience high volatility in their stock prices.

How Does an IPO Work?

How Does an IPO Work?

An Initial Public Offering (IPO) is a multi-step process that allows a private company to transition into a publicly traded entity. This process involves rigorous financial evaluations, regulatory compliance, and market preparation to ensure a successful stock launch. Going public provides companies with access to large-scale capital, but it also introduces new responsibilities, such as financial transparency and shareholder accountability. Here’s a step-by-step breakdown of how an IPO works:

1. Pre-IPO Preparation

Before a company can go public, it must ensure its financials are in order and meet regulatory requirements. This includes conducting internal audits, preparing financial statements, and assembling a team of legal and financial advisors to guide the process.

2. Choosing Underwriters

The company selects investment banks, known as underwriters, to manage the IPO process. These underwriters help determine the offering price, market the shares, and facilitate the sale to investors. Large financial institutions such as Goldman Sachs or Morgan Stanley often play this role.

3. Filing with the SEC

The company must file an S-1 Registration Statement with the Securities and Exchange Commission (SEC). This document contains crucial details about the company’s finances, management structure, business risks, and plans for the raised capital. The SEC reviews this filing to ensure compliance with investor protection laws.

4. Roadshow & Marketing

To generate investor interest, company executives and underwriters conduct a roadshow, presenting the company’s financial prospects to institutional investors such as hedge funds, pension funds, and mutual funds. These marketing efforts help gauge demand for the IPO shares and influence the final pricing.

5. Pricing the IPO

Once investor demand is assessed, underwriters set the IPO price. This price reflects the company’s valuation and market conditions. The goal is to find a price that balances strong demand with fair valuation, ensuring that both the company and investors benefit.

6. IPO Launch & Public Trading

On the official IPO date, the company’s shares are listed on a stock exchange (such as the New York Stock Exchange (NYSE) or NASDAQ), and public trading begins. Institutional and retail investors can now buy and sell shares in the open market. The stock’s performance on the first day can set the tone for future trading activity.

7. Post-IPO Adjustments

After going public, the company is subject to regulatory obligations, including quarterly earnings reports, financial disclosures, and corporate governance requirements. Additionally, insiders such as founders and early investors may have a lock-up period, preventing them from selling shares immediately to avoid stock price manipulation.

Why Do Companies Go Public?

Why Do Companies Go Public?

For many businesses, an Initial Public Offering (IPO) represents a significant milestone. It is a strategic move that allows private companies to transition into publicly traded entities by offering shares to investors on stock exchanges like the New York Stock Exchange (NYSE) or NASDAQ. Companies go public for a variety of reasons, primarily to raise capital and fuel growth. However, going public also comes with increased responsibilities, regulatory compliance, and scrutiny from investors. Here’s a closer look at why companies choose to go public:

1. Raising Capital for Growth

One of the biggest reasons companies go public is to raise significant capital from investors. This fresh influx of cash can be used for:

- Expanding operations to new markets.

- Investing in research and development (R&D) for new products.

- Scaling production and improving infrastructure.

- Hiring additional workforce and improving business capabilities.

2. Paying Off Debt

Many companies accumulate debt while growing their business. An IPO allows them to raise money to pay off outstanding loans, improve cash flow, and strengthen financial stability. Reducing debt makes the company more attractive to investors, as it lowers interest expenses and enhances profitability.

3. Providing Liquidity for Early Investors

Before an IPO, shares of a company are typically owned by founders, early investors, venture capitalists, and employees with stock options. However, private shares can be difficult to sell. An IPO allows these stakeholders to cash out by selling their shares in the public market, giving them liquidity.

4. Enhancing Brand Recognition and Credibility

Going public increases a company’s market presence and credibility. Being publicly listed:

- Boosts consumer and investor confidence.

- Enhances the company’s reputation and trustworthiness.

- Generates media attention and free publicity.

5. Easier Access to Future Fundraising

Once a company is public, it has better access to additional capital through secondary offerings. Unlike private companies that rely on venture capital or bank loans, public companies can:

- Issue more shares to raise funds.

- Secure better loan terms from financial institutions.

- Leverage their stock value to negotiate deals.

6. Attracting and Retaining Top Talent

A publicly traded company can offer stock options and equity compensation as incentives to employees. This is particularly valuable in attracting high-caliber talent in competitive industries such as technology, finance, and healthcare. Employees who receive stock options are also motivated to contribute to the company’s long-term success, as they benefit directly from stock price appreciation.

7. Using Stock as Acquisition Currency

A strong public stock price gives companies leverage when acquiring other businesses. Instead of paying cash, companies can use their publicly traded shares as part of the deal, making mergers and acquisitions (M&A) more flexible and cost-effective.

8. Competitive Advantage in the Market

Going public can give companies an edge over competitors by demonstrating financial strength and long-term sustainability. A public company’s audited financials, regulatory compliance, and stock market performance make it more attractive to potential business partners and investors.

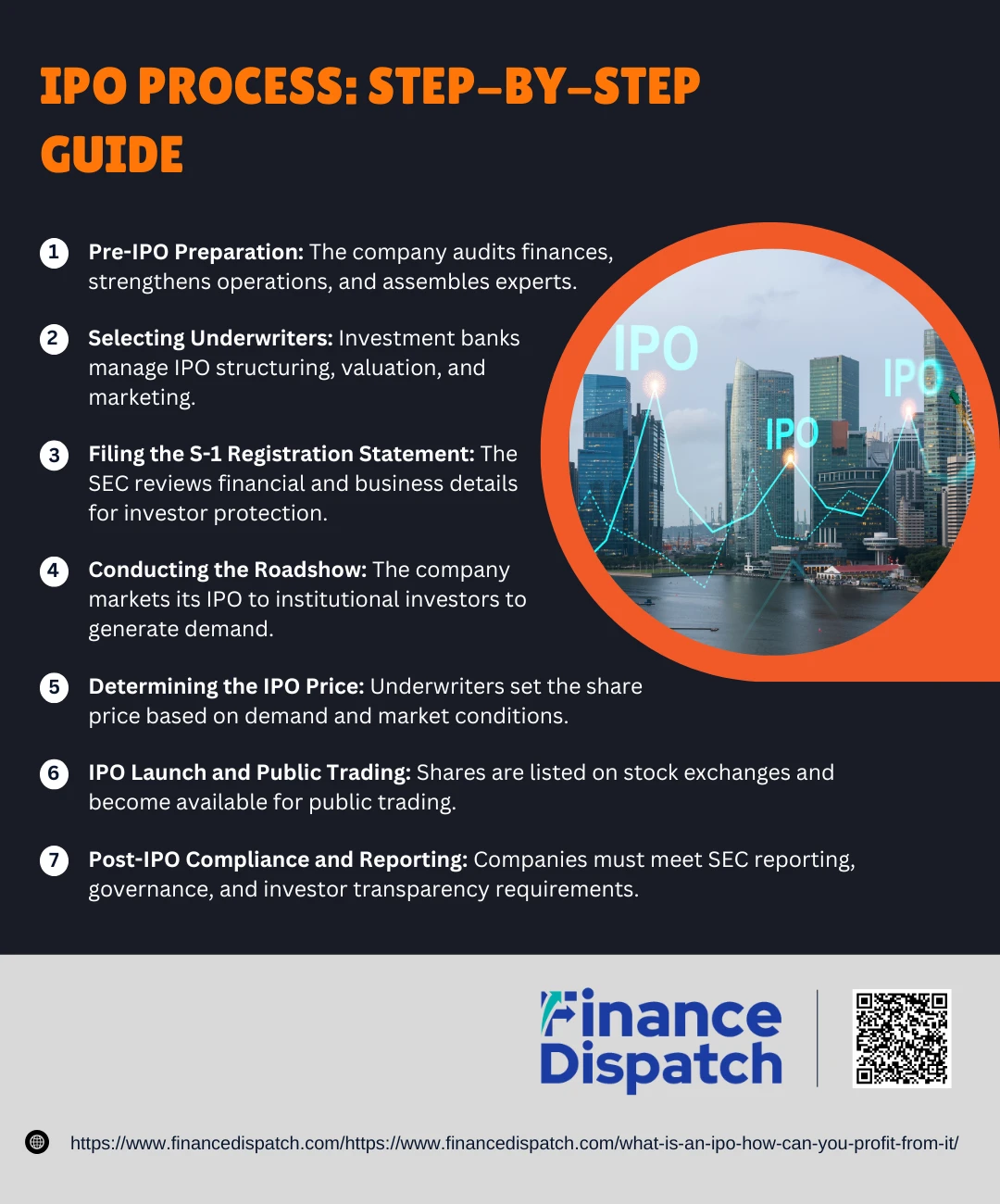

IPO Process: Step-by-Step Guide

IPO Process: Step-by-Step Guide

An Initial Public Offering (IPO) is a structured and highly regulated process that allows a private company to become publicly traded by offering shares on a stock exchange. This transformation helps companies raise capital, gain market visibility, and expand their operations. However, going public involves multiple steps, including financial preparation, legal approvals, and strategic marketing to attract investors. Below is a step-by-step breakdown of how an IPO works.

1. Pre-IPO Preparation

Before a company can go public, it must ensure its financial records are in order and that it meets all regulatory requirements. This phase involves conducting audits, strengthening internal operations, and assembling a team of experts, including investment bankers, lawyers, and accountants. The company also develops a growth strategy to present to potential investors.

2. Selecting Underwriters

To manage the IPO process, the company hires investment banks, known as underwriters. These underwriters help structure the IPO, determine the number of shares to be issued, and assess the company’s valuation. They also take responsibility for marketing the shares to institutional investors and ensuring the IPO’s success in the public market.

3. Filing the S-1 Registration Statement

The company must submit an S-1 Registration Statement to the Securities and Exchange Commission (SEC). This document provides detailed information about the company’s business model, financial performance, management structure, potential risks, and how it plans to use the funds raised from the IPO. The SEC reviews this filing to ensure transparency and investor protection. If needed, the company makes revisions based on SEC feedback before gaining approval.

4. Conducting the Roadshow

Once the SEC approves the registration, the company and underwriters begin promoting the IPO through a roadshow. This involves presenting the company’s business plan, financials, and growth potential to institutional investors, such as hedge funds and mutual funds. The roadshow helps generate demand and investor interest, which influences the final IPO pricing.

5. Determining the IPO Price

After gathering investor feedback from the roadshow, underwriters determine the final IPO price. This price is set based on factors such as market demand, financial performance, and industry conditions. The goal is to establish a price that balances company valuation with investor enthusiasm, ensuring the IPO’s success.

6. IPO Launch and Public Trading

On the official IPO date, the company’s shares are listed on a stock exchange, such as the New York Stock Exchange (NYSE) or NASDAQ. Once trading begins, the general public can buy and sell shares on the open market. Initial trading activity often determines the stock’s short-term performance and sets the stage for future investor sentiment.

7. Post-IPO Compliance and Reporting

After the IPO, the company must adhere to SEC regulations and ongoing financial reporting requirements. This includes quarterly earnings reports, shareholder disclosures, and corporate governance standards. The company’s management must focus on maintaining investor confidence, sustaining business growth, and ensuring long-term stock market success.

How Can You Profit from an IPO?

How Can You Profit from an IPO?

Investing in an Initial Public Offering (IPO) can be an exciting opportunity for investors looking to gain early access to a company’s stock. IPOs often generate significant market buzz, and some newly listed stocks experience rapid price appreciation. However, not all IPOs lead to quick profits, and success depends on understanding the process, conducting thorough research, and using the right investment strategies. Here are several ways you can profit from an IPO.

1. Buying Shares at the IPO Price

One of the most direct ways to profit from an IPO is by purchasing shares at the IPO price before they are available on the open market. This price is typically lower than the stock’s trading price once it starts publicly trading. However, getting IPO shares at the initial offering price is challenging, as they are usually reserved for institutional investors and high-net-worth individuals through brokerage allocations.

2. Flipping IPO Shares for Short-Term Gains

Many investors look for quick profits by flipping IPO shares—buying them at the offering price and selling them shortly after public trading begins. This strategy can be profitable if there is high demand and strong market momentum on the IPO day. However, IPO prices can be volatile, and some stocks may drop after their initial surge, leading to losses for investors who buy at inflated prices.

3. Holding IPO Stocks for Long-Term Growth

Instead of selling immediately, some investors hold IPO stocks for the long run, betting on the company’s growth and potential profitability. If the company performs well, its stock price can appreciate significantly over time. Many well-known companies, such as Amazon, Google (Alphabet), and Apple, have delivered substantial long-term returns for early IPO investors.

4. Investing in IPO-Focused ETFs

For those who want IPO exposure but prefer a diversified approach, IPO exchange-traded funds (ETFs) can be a good option. These funds invest in a basket of newly public companies, reducing the risks associated with investing in a single IPO stock. Some popular IPO ETFs track the performance of recent IPOs, giving investors a chance to benefit from overall market trends.

5. Researching and Selecting High-Quality IPOs

Not all IPOs are created equal. To maximize profit potential, investors should conduct thorough research by:

- Reading the prospectus to understand the company’s financial health and growth potential.

- Assessing underwriters—IPOs managed by reputable investment banks tend to perform better.

- Analyzing market trends—considering whether the industry is growing and if the IPO is launching in favorable market conditions.

6. Watching for Lock-Up Expiration Opportunities

Company insiders, such as founders and executives, are usually restricted from selling shares for a certain period after the IPO, known as the lock-up period (typically 90 to 180 days). When this period expires, stock prices may drop as insiders sell shares. Investors can take advantage of this event by purchasing shares at lower prices if they believe in the company’s long-term potential.

7. Participating in Pre-IPO Investments

For experienced investors, another way to profit from IPOs is by investing in pre-IPO opportunities, such as venture capital funds, private equity, or special purpose acquisition companies (SPACs). These investment vehicles provide early access to companies before they go public, potentially leading to higher returns once the IPO occurs.

Advantages and Disadvantages of an IPO

An Initial Public Offering (IPO) is a major financial event for a company, offering the opportunity to raise capital, expand operations, and gain market credibility. However, going public also comes with increased regulatory requirements, costs, and market volatility. For investors, IPOs can present exciting opportunities for high returns but also carry risks due to stock price fluctuations and limited historical data. Below is a comparison of the advantages and disadvantages of an IPO.

Advantages vs. Disadvantages of an IPO

| Advantages | Disadvantages |

| Access to Capital – Companies can raise significant funds for growth, expansion, and innovation. | High Costs – IPOs involve substantial expenses, including underwriting fees, legal costs, and compliance expenses. |

| Liquidity for Investors – Founders, early investors, and employees can sell shares and realize profits. | Loss of Control – Public companies must answer to shareholders and comply with governance requirements. |

| Enhanced Brand Recognition – Going public increases a company’s credibility and media exposure, attracting new customers and business opportunities. | Stock Price Volatility – Share prices can fluctuate significantly, affecting investor confidence and company valuation. |

| Easier Access to Future Funding – Public companies can raise additional capital through secondary offerings at favorable terms. | Increased Regulatory Scrutiny – Public companies must follow strict financial reporting and SEC regulations. |

| Stock-Based Compensation for Employees – Companies can offer stock options as incentives to attract and retain top talent. | Short-Term Pressure from Shareholders – Investors expect consistent financial performance, which may impact long-term business strategy. |

| Mergers and Acquisitions Leverage – Public companies can use their stock as a currency for acquiring other businesses. | Risk of Overvaluation – If an IPO is overpriced, it can lead to poor stock performance and investor losses. |

Key Risks of Investing in an IPO

Key Risks of Investing in an IPO

Investing in an Initial Public Offering (IPO) can be an exciting opportunity, offering the potential for substantial returns. However, IPOs also come with significant risks, as newly public companies often experience volatility, uncertain financial performance, and regulatory challenges. Since IPO stocks lack a long trading history, investors must carefully evaluate the risks before investing. Below are some key risks associated with investing in an IPO.

1. High Price Volatility

IPO stocks tend to be highly volatile in the early days of trading. The hype surrounding an IPO can lead to inflated stock prices, followed by sudden corrections. This volatility can result in quick gains but also significant losses for investors.

2. Limited Financial History

Unlike established public companies, IPOs often lack a long track record of financial performance. Investors have fewer data points to analyze, making it difficult to assess the company’s profitability, stability, and long-term growth potential.

3. Overvaluation Risk

Some IPOs may be overpriced due to high demand and aggressive marketing by underwriters. If the stock is issued at an inflated price, it may struggle to maintain its value, leading to losses when the initial excitement fades.

4. Lock-Up Period Expiry Effects

Company insiders, such as founders and early investors, are often restricted from selling their shares for a lock-up period (typically 90 to 180 days). When this period expires, a large number of shares may flood the market, driving down the stock price.

5. Uncertain Long-Term Performance

Not all IPOs turn into long-term success stories. Some companies struggle with profitability, competitive pressures, or market downturns, leading to declining stock prices after the initial public offering.

6. Limited Access to IPO Shares

Retail investors often find it difficult to buy IPO shares at the initial offering price, as these are primarily allocated to institutional investors and large clients of investment banks. As a result, many retail investors end up purchasing shares at a higher price once public trading begins.

7. Regulatory and Compliance Risks

Newly public companies must comply with SEC regulations, financial reporting requirements, and corporate governance standards. If a company fails to meet these obligations, it can face fines, lawsuits, or loss of investor confidence.

8. Market Conditions Impact IPO Performance

Broader market conditions, such as economic downturns, interest rate hikes, and geopolitical factors, can affect the performance of IPO stocks. Even strong companies may see their stock prices drop if they go public during a weak market environment.

Strategies for Investing in IPOs Wisely

Strategies for Investing in IPOs Wisely

Investing in an Initial Public Offering (IPO) can be an exciting but risky venture. While some IPOs offer substantial returns, others fail to perform as expected, leading to losses for investors. To increase the chances of success, it’s essential to follow a strategic approach when investing in newly listed companies. Proper research, risk assessment, and timing play a crucial role in making informed investment decisions. Below are key strategies to invest in IPOs wisely.

1. Research the Company Thoroughly

Before investing in an IPO, review the company’s financial statements, business model, competitive position, and industry trends. Read the S-1 Registration Statement, which provides insights into the company’s risks, revenue streams, and growth plans.

2. Analyze the Underwriters

The reputation of the underwriters managing the IPO can indicate the quality and potential success of the offering. IPOs led by reputable investment banks like Goldman Sachs, Morgan Stanley, or JPMorgan Chase often have a better track record than those handled by lesser-known firms.

3. Evaluate the IPO Pricing

Pay close attention to how the IPO is priced. If the offering price is too high, the stock may struggle after public trading begins. If it’s priced conservatively, there may be room for early gains. Comparing the company’s valuation with industry peers can help determine if the price is reasonable.

4. Wait for Market Stabilization

Not all IPOs are worth buying immediately. Some stocks experience high volatility in the first few days or weeks of trading. Waiting until the stock stabilizes can help investors avoid short-term fluctuations and make a more informed decision.

5. Understand the Lock-Up Period

Company insiders, including executives and early investors, are often restricted from selling their shares for 90 to 180 days after the IPO. When the lock-up period expires, a surge in selling could drive the stock price down. Monitoring this timeline can help investors buy at lower prices if a temporary dip occurs.

6. Consider Long-Term Growth Potential

Rather than focusing only on short-term IPO gains, look for companies with strong fundamentals, market demand, and expansion opportunities. Investing in IPOs with a solid long-term growth strategy can lead to sustainable profits.

7. Diversify Your IPO Investments

Instead of putting all your money into a single IPO, consider investing in multiple IPOs or using IPO exchange-traded funds (ETFs). This strategy reduces risk by spreading investments across different companies rather than relying on one to succeed.

8. Monitor Overall Market Conditions

Market conditions significantly impact IPO performance. Investing during a bull market generally increases the chances of success, while IPOs launched during a bear market may struggle to gain investor interest. Keep an eye on economic indicators before making an investment decision.

Alternatives to IPOs

While an Initial Public Offering (IPO) is a common way for companies to raise capital, it is not the only option. Many businesses prefer alternatives that offer lower costs, fewer regulations, and greater control over decision-making. Below are some of the most popular alternatives to IPOs.

- Direct Listing: Companies list existing shares directly on a stock exchange without issuing new shares, avoiding underwriting costs and dilution.

- Special Purpose Acquisition Company (SPAC): A shell company acquires a private firm, allowing it to go public without the traditional IPO process.

- Private Equity and Venture Capital: Businesses raise funds from private investors in exchange for equity, avoiding public market scrutiny.

- Crowdfunding: Startups gather small investments from multiple individuals through online platforms, maintaining control while raising capital.

- Debt Financing: Companies issue bonds or take loans instead of selling shares, raising funds without giving up ownership.

- Strategic Partnerships & Joint Ventures: Firms collaborate with larger companies for funding and expansion, reducing the need for public listing.

- Mergers and Acquisitions (M&A): A company merges with or is acquired by another firm, providing liquidity to founders without going public.

Conclusion

An Initial Public Offering (IPO) is a widely used method for companies to raise capital, but it is not the only path to financial growth. Various alternatives, such as direct listings, SPACs, private equity, crowdfunding, and mergers & acquisitions, provide businesses with flexible options to secure funding while avoiding the complexities of public markets. Each method comes with its own benefits and risks, and the right choice depends on a company’s financial needs, market position, and long-term objectives. For investors, understanding these alternatives can help in making informed decisions when looking for profitable opportunities beyond traditional IPOs.