Generational wealth is more than just passing down money—it’s about creating a financial legacy that benefits not just your children but also future generations. It includes assets such as real estate, investments, businesses, and financial education that provide long-term stability and opportunities. However, studies show that nearly 70% of generational wealth disappears by the second generation and 90% by the third, often due to poor financial planning, lack of education, and family conflicts. Ensuring that wealth lasts across generations requires more than just accumulating assets—it demands strategic estate planning, financial literacy, and strong family governance. In this article, we’ll explore what generational wealth truly means, why it often fails to endure, and the key steps families can take to preserve and grow their legacy for years to come.

What is Generational Wealth?

Generational wealth refers to financial assets, investments, and valuable resources passed down from one generation to the next, providing long-term financial security for a family. It includes tangible assets like real estate, businesses, stocks, and savings, as well as intangible benefits such as financial literacy, estate planning, and family values. Unlike short-term wealth, which can be easily spent or lost, generational wealth is built with the intention of sustaining and growing financial resources over time. However, accumulating wealth is only part of the equation—the real challenge lies in preserving and successfully transferring it to future generations. Without proper planning, financial education, and governance, wealth can quickly diminish, leaving heirs without the financial stability their predecessors worked hard to create.

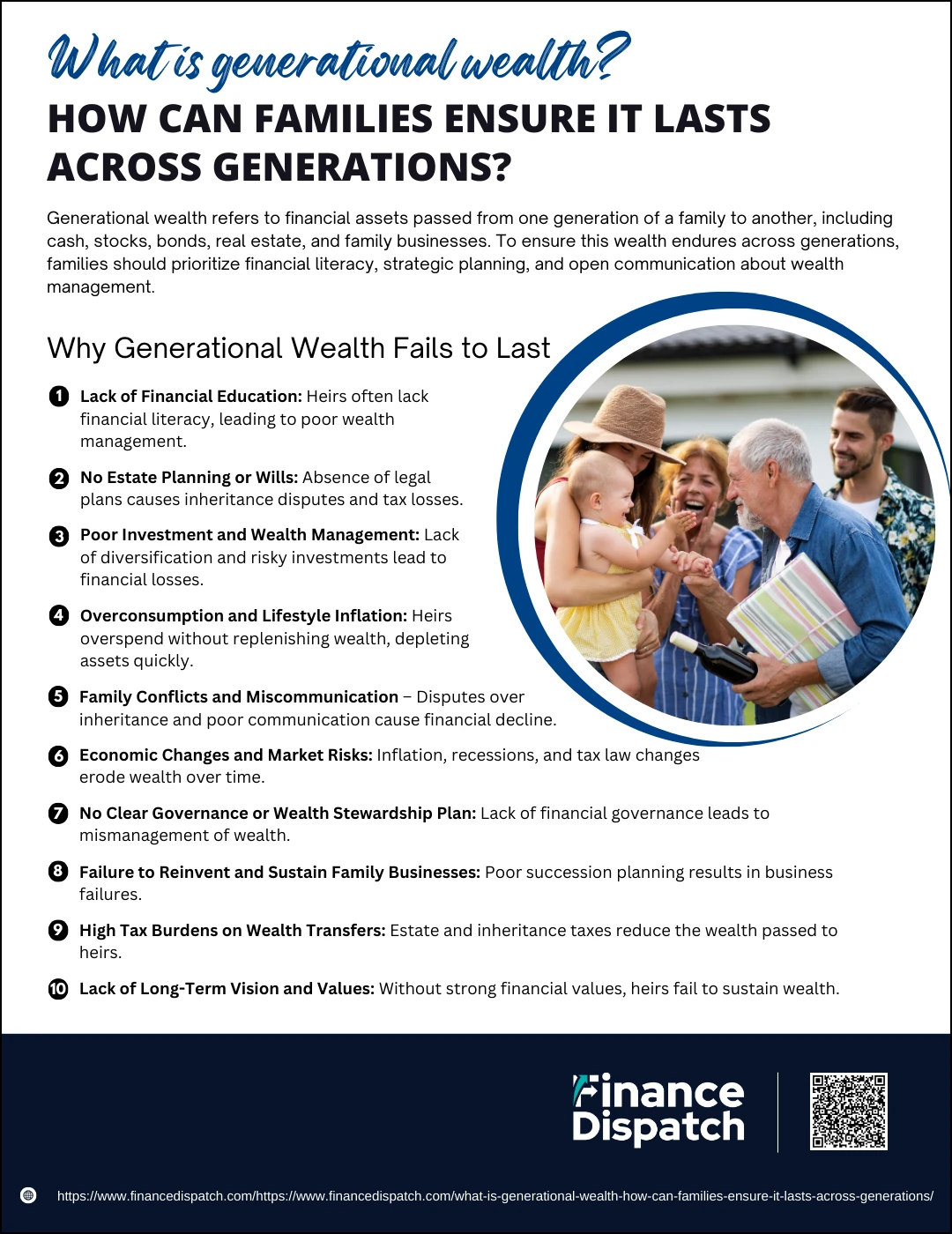

Why Generational Wealth Fails to Last

Why Generational Wealth Fails to Last

Generational wealth is built with the intention of providing financial stability for future family members, but history shows that most fortunes do not survive past the second or third generation. This phenomenon, often called the “shirtsleeves to shirtsleeves in three generations” curse, occurs when inherited wealth is mismanaged, overspent, or lost due to poor planning. Many families focus on accumulating assets but fail to instill financial literacy, set up estate plans, or create a long-term governance structure to ensure wealth is properly managed and grown. As a result, even vast fortunes can erode over time. Below are the key reasons why generational wealth often fails to last and how families can avoid these pitfalls.

1. Lack of Financial Education

One of the biggest reasons generational wealth disappears is that heirs often lack financial knowledge. Without understanding budgeting, investing, taxes, and wealth preservation strategies, many descendants misuse or squander inherited assets. Without proper education, even well-intentioned heirs may make poor investment decisions, fall into debt, or overspend, leading to the rapid depletion of family wealth.

2. No Estate Planning or Wills

Failing to establish a clear estate plan, including wills and trusts, can create chaos among heirs. Without these legal structures, families may face inheritance disputes, court battles, and excessive taxation. Estate taxes, probate costs, and legal fees can significantly reduce the amount of wealth passed down. A lack of transparency and planning often leads to assets being divided inefficiently or falling into the wrong hands.

3. Poor Investment and Wealth Management

Many families make the mistake of not diversifying their investments, putting all their wealth into a single business, property, or stock portfolio. Economic downturns, market crashes, or industry disruptions can wipe out wealth if there is no backup plan. Additionally, without proper financial advisors or investment strategies, heirs may fall victim to high-risk ventures, scams, or unsustainable business decisions.

4. Overconsumption and Lifestyle Inflation

Wealthy families often struggle with spending discipline among younger generations. Without the same work ethic or financial responsibility as the wealth creators, heirs may increase their spending habits without replenishing the wealth. Expensive lifestyles, luxury purchases, and poor financial decisions erode wealth faster than it can grow, leading to financial decline within a generation or two.

5. Family Conflicts and Miscommunication

When families do not openly discuss financial planning, trust issues and conflicts often arise. Disputes over inheritance, business leadership, or asset distribution can divide families and lead to costly legal battles. Without open dialogue and shared financial goals, families risk falling apart financially and emotionally, making wealth preservation even more difficult.

6. Economic Changes and Market Risks

Even the wealthiest families are not immune to inflation, recessions, market crashes, or changes in tax laws. Without active financial management and adaptability, wealth can quickly lose value or become unsustainable. Families that fail to adjust investment strategies, update estate plans, or protect assets from economic risks often see their wealth decline significantly over time.

7. No Clear Governance or Wealth Stewardship Plan

Successful multigenerational wealth requires strong financial governance. This means having family councils, financial mentors, and structured decision-making processes to guide wealth management. Without a governance structure, heirs may lack accountability, make impulsive financial choices, or fail to work together, leading to mismanagement of wealth.

8. Failure to Reinvent and Sustain Family Businesses

For families that build wealth through businesses, failing to adapt to market trends, innovate, or train the next generation can lead to financial collapse. Many heirs either lack the interest or skills to continue the business, causing once-thriving companies to shut down. Without a succession plan, leadership training, or professional business management, family enterprises struggle to survive beyond the founders.

9. High Tax Burdens on Wealth Transfers

Wealth transfers come with significant tax liabilities, including estate taxes, inheritance taxes, and capital gains taxes. Without tax-efficient strategies like trusts, gifting, and charitable donations, families may lose a large percentage of their wealth to the government. Proper planning is essential to minimize taxation and ensure that wealth is preserved for future generations.

10. Lack of Long-Term Vision and Values

Wealth is more than just money—it requires a shared vision, strong family values, and disciplined financial habits. When families fail to instill a sense of purpose, responsibility, and stewardship in younger generations, heirs often lack the motivation or understanding needed to sustain wealth. Families that prioritize financial education, shared goals, and a legacy-focused mindset have a better chance of keeping their wealth intact.

How to Build and Preserve Generational Wealth

Building generational wealth requires long-term financial planning, smart investments, and disciplined money management. However, accumulating wealth is just the first step—preserving it across generations is equally important. Many families lose their wealth within a few generations due to poor financial education, lack of estate planning, and mismanagement. To ensure that wealth endures, families must adopt strategic wealth-building practices and preservation techniques. Below are key steps to help families build and sustain wealth for future generations.

How to Build Generational Wealth

- Invest in Appreciating Assets – Build wealth through real estate, stocks, bonds, and business ownership.

- Leverage Compound Interest – Start investing early to maximize the power of long-term wealth growth.

- Create Multiple Income Streams – Diversify income through side businesses, passive investments, and rental properties.

- Start a Family Business – A well-managed business can generate income for multiple generations if structured correctly.

- Utilize Life Insurance – Provides financial security and liquidity for estate planning.

- Encourage Entrepreneurship – Support younger generations in starting and managing businesses.

- Teach Financial Literacy – Educate family members on saving, investing, budgeting, and responsible wealth management.

How to Preserve Generational Wealth

- Develop an Estate Plan – Set up wills, trusts, and legal protections to prevent wealth from being lost or disputed.

- Minimize Taxes and Legal Costs – Use tax-efficient strategies like gifting, charitable contributions, and trusts to reduce the estate tax burden.

- Diversify Investments – Spread assets across different investment types to reduce risk and increase financial stability.

- Create a Family Governance System – Establish a family council or advisory board to manage wealth responsibly.

- Regularly Review and Update Financial Plans – Adapt investment strategies and estate plans to changing economic conditions and family needs.

- Set Up Financial Safeguards – Use spendthrift trusts and structured distributions to prevent irresponsible spending by heirs.

- Instill Strong Financial Values – Pass down financial discipline, responsible money habits, and long-term thinking to younger generations.

Wealth Preservation Strategies

Accumulating wealth is only part of the journey—preserving it across generations is the real challenge. Without a proper preservation strategy, families risk losing their wealth due to market downturns, mismanagement, excessive taxation, and lack of financial literacy. Implementing smart wealth preservation techniques ensures financial stability, minimizes risks, and allows assets to grow sustainably over time. Below is a table outlining key wealth preservation strategies and how to implement them effectively.

Key Wealth Preservation Strategies

| Strategy | Why It Matters | Implementation |

| Estate Planning | Ensures assets are passed down efficiently and avoids legal disputes. | Create wills, trusts, and power of attorney to protect assets. |

| Diversified Investments | Reduces financial risk and prevents overreliance on a single asset class. | Invest in stocks, bonds, real estate, and alternative assets. |

| Tax-Efficient Wealth Transfer | Minimizes estate and inheritance taxes to preserve more wealth. | Use trusts, gifting strategies, and charitable donations. |

| Financial Education for Heirs | Helps future generations manage wealth responsibly and avoid financial mistakes. | Provide money management training, investment knowledge, and mentorship. |

| Asset Protection Strategies | Shields wealth from lawsuits, creditors, and financial downturns. | Utilize insurance policies, legal protections, and asset allocation. |

| Business Succession Planning | Ensures a smooth transition for family-owned businesses. | Develop a leadership succession plan and train the next generation. |

| Philanthropy and Charitable Giving | Reduces tax liabilities while maintaining family values and legacy. | Establish a charitable foundation or donor-advised fund. |

| Long-Term Investment Approach | Protects wealth from short-term market volatility and ensures sustainable growth. | Focus on low-risk, long-term investments and reinvestment strategies. |

| Regular Wealth Reviews | Keeps financial strategies up to date with economic and personal changes. | Conduct annual reviews of estate plans, investments, and financial goals. |

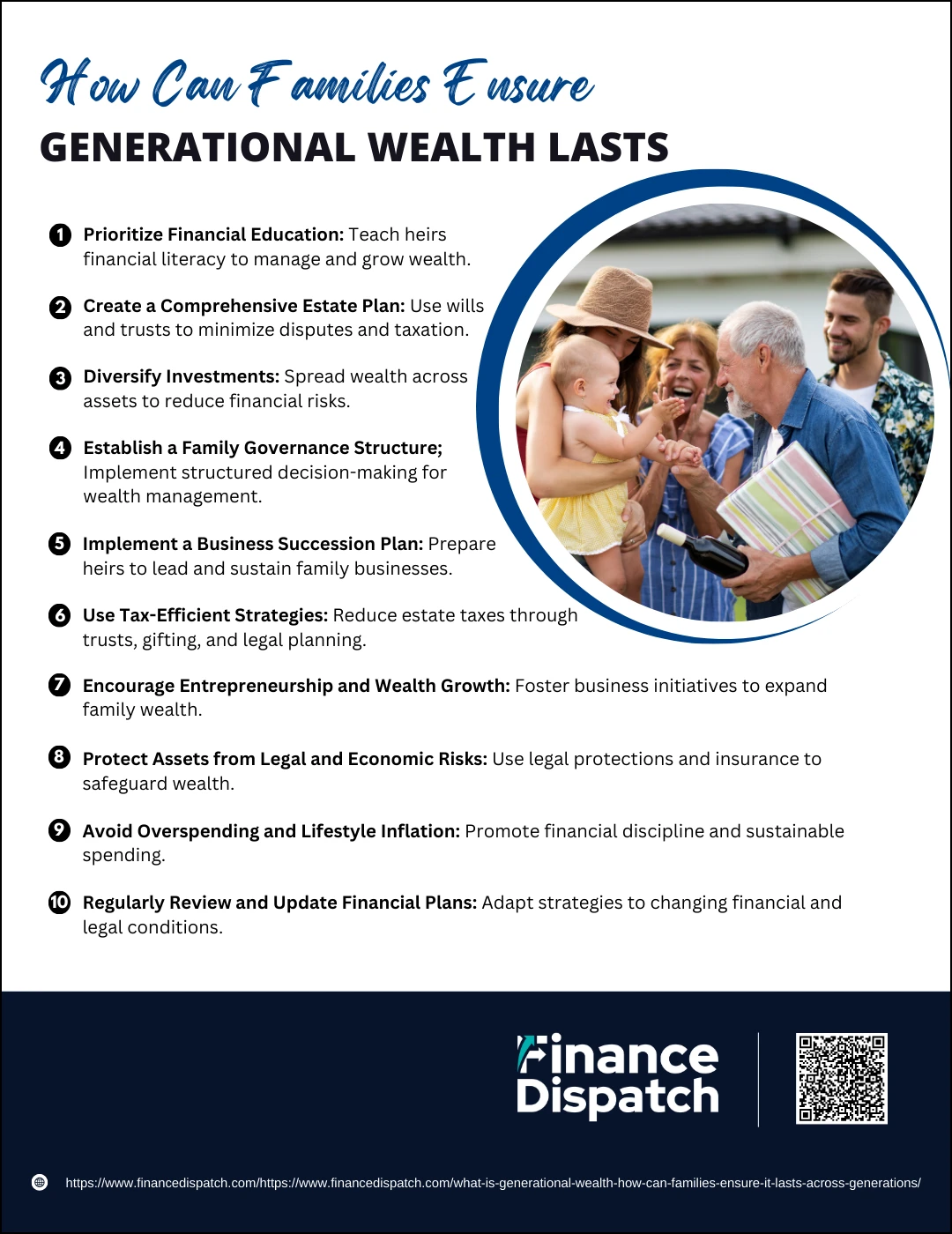

How Can Families Ensure Generational Wealth Lasts?

How Can Families Ensure Generational Wealth Lasts?

Creating generational wealth is an important milestone, but preserving it for future generations requires strategic planning, discipline, and financial literacy. Without proper wealth management, many families experience the “shirtsleeves to shirtsleeves in three generations” phenomenon, where wealth is built by one generation, maintained by the next, and lost by the third. The key to ensuring long-term financial security is implementing proactive wealth preservation and management strategies. Below are ten crucial steps families can take to protect their legacy and ensure wealth lasts for generations.

1. Prioritize Financial Education

Wealth is often lost because heirs lack the financial literacy to manage and grow assets. Families should teach younger generations about budgeting, investing, debt management, and wealth-building strategies to prevent reckless spending or poor financial decisions. Encouraging open conversations about money, savings, and investments from an early age will help future generations make informed financial choices.

2. Create a Comprehensive Estate Plan

A structured estate plan is essential for wealth preservation. Without wills, trusts, and legal directives, families risk inheritance disputes, excessive taxation, and legal complications that can drain wealth. Estate planning helps ensure assets are passed down efficiently, minimizes tax burdens, and prevents legal battles that could diminish family wealth.

3. Diversify Investments

Relying on a single source of wealth, such as a business or real estate, can be risky. Economic downturns, market crashes, or industry disruptions can wipe out wealth if investments are not diversified. Families should spread their assets across stocks, bonds, real estate, private businesses, and alternative investments to reduce financial risks and create long-term stability.

4. Establish a Family Governance Structure

A formal governance system, such as a family council or wealth advisory board, ensures that financial decisions are made strategically and not based on emotion. Setting clear wealth management rules, responsibilities, and decision-making processes can prevent conflicts and mismanagement. Families that actively involve heirs in financial discussions promote a sense of accountability and shared responsibility.

5. Implement a Business Succession Plan

If a family business is part of the wealth, a well-defined succession plan is critical for ensuring its long-term success. Many businesses fail when the next generation lacks interest, leadership skills, or proper training. Families should identify potential successors, train them in leadership and financial management, and establish a plan for transferring ownership in a way that sustains the business.

6. Use Tax-Efficient Strategies

Without proper tax planning, a large portion of generational wealth may be lost to estate taxes, capital gains taxes, and inheritance taxes. Families can use trusts, tax-exempt accounts, charitable contributions, and gifting strategies to reduce the tax burden on heirs and preserve more wealth for future generations. Consulting with financial advisors and tax professionals ensures that wealth is transferred in a tax-efficient manner.

7. Encourage Entrepreneurship and Wealth Growth

Preserving wealth isn’t just about holding onto existing assets—it’s about growing wealth over time. Encouraging younger generations to invest, start businesses, and create new income streams ensures that the family’s financial foundation remains strong. Families can provide mentorship, capital, and financial guidance to support entrepreneurship and wealth-building opportunities.

8. Protect Assets from Legal and Economic Risks

Wealth can be vulnerable to lawsuits, economic downturns, creditors, and mismanagement. To safeguard assets, families should use insurance policies, asset protection trusts, and diversified investments. Ensuring that key assets are legally protected helps prevent financial losses due to unforeseen circumstances.

9. Avoid Overspending and Lifestyle Inflation

Many fortunes are lost due to irresponsible spending and an unsustainable lifestyle. When wealth is inherited without financial discipline, heirs may increase spending without maintaining or growing assets, leading to financial decline. Families should instill values of financial responsibility, prudent spending, and reinvestment to maintain wealth for future generations.

10. Regularly Review and Update Financial Plans

Wealth strategies must adapt to changing financial conditions, economic trends, tax laws, and family dynamics. Regular estate plan reviews, investment strategy updates, and financial goal assessments ensure that the family’s financial legacy remains relevant and secure. Families should work closely with financial advisors, estate planners, and legal professionals to keep their wealth management strategies aligned with long-term objectives.

The Role of Estate Planning in Wealth Transfer

Estate planning plays a vital role in ensuring the smooth transfer of wealth across generations while minimizing financial losses due to taxes, legal disputes, and mismanagement. Without a well-structured estate plan, families risk losing a significant portion of their assets to probate, inheritance disputes, or government-imposed taxes. Estate planning involves wills, trusts, beneficiary designations, and tax-efficient wealth transfer strategies that protect assets and ensure they are distributed according to the individual’s wishes. Additionally, estate planning helps maintain family harmony by clarifying inheritance decisions and reducing the likelihood of conflicts among heirs. Beyond asset distribution, a strong estate plan also includes business succession planning, charitable giving, and financial literacy programs to prepare heirs for responsible wealth management. By implementing a strategic estate plan, families can preserve their financial legacy and provide long-term security for future generations.

Teaching Financial Responsibility to Heirs

Ensuring that wealth lasts across generations requires more than just passing down assets—it demands instilling financial responsibility in heirs. Many families lose their wealth because younger generations lack the necessary money management skills, investment knowledge, and financial discipline to preserve and grow their inheritance. By teaching financial responsibility early, families can equip heirs with the tools to manage wealth wisely, make informed financial decisions, and continue building generational wealth. Below are essential strategies for teaching financial responsibility to heirs.

1. Start Financial Education Early

Introduce children to basic money concepts like saving, budgeting, and investing at a young age to build a strong financial foundation.

2. Encourage Hands-On Money Management

Give heirs real-world financial experience through allowances, investment portfolios, or business ventures to help them learn by doing.

3. Teach the Value of Hard Work

Encourage heirs to earn their own income through jobs, internships, or business initiatives to instill a sense of financial independence.

4. Introduce Budgeting and Smart Spending Habits

Educate heirs on the importance of tracking expenses, setting financial goals, and avoiding unnecessary debt to develop responsible spending habits.

5. Discuss Long-Term Wealth Building

Teach the principles of investing, compound interest, and asset diversification to help heirs understand how to grow wealth over time.

6. Implement Family Financial Meetings

Regular discussions about family wealth, investments, and estate planning help heirs become familiar with financial responsibilities and decision-making.

7. Set Up a Family Trust or Structured Inheritance

Use trusts with spending conditions or staggered distributions to ensure heirs use their inheritance responsibly.

8. Encourage Philanthropy and Giving Back

Teaching heirs about charitable giving and community support fosters financial stewardship and a sense of responsibility toward wealth.

9. Provide Mentorship and Professional Guidance

Pair heirs with financial advisors, business mentors, or wealth managers to help them make informed financial decisions.

10. Lead by Example

Demonstrate financial responsibility, smart investing, and disciplined money management to inspire heirs to follow suit.

The Role of Trusts & Financial Advisors

When it comes to protecting and managing generational wealth, trusts and financial advisors play a critical role in ensuring that assets are preserved, distributed efficiently, and used responsibly by heirs. Trusts offer legal protection, tax benefits, and structured asset management, preventing reckless spending or legal disputes. Meanwhile, financial advisors provide expert guidance on investments, estate planning, and wealth preservation strategies, helping families navigate complex financial decisions. By utilizing both trusts and professional financial advice, families can secure their financial legacy and ensure wealth lasts for generations.

The Importance of Trusts in Wealth Management

- Ensures Controlled Wealth Distribution: Trusts allow assets to be distributed according to specific conditions, preventing heirs from misusing funds.

- Offers Legal Protection: Assets held in trusts are shielded from lawsuits, creditors, and divorce settlements.

- Minimizes Estate Taxes: Certain types of trusts reduce tax liabilities, preserving more wealth for future generations.

- Avoids Probate Delays: Trusts bypass the probate process, ensuring a faster and smoother transfer of assets.

- Provides Long-Term Financial Security: Trusts can be designed to support beneficiaries over time rather than in a lump sum.

The Role of Financial Advisors in Wealth Preservation

- Investment Strategy & Risk Management: Advisors help families diversify investments and make informed financial decisions.

- Estate & Tax Planning: Professional advisors guide families in structuring assets to minimize taxes and maximize benefits.

- Wealth Education for Heirs: Advisors teach younger generations about wealth management, budgeting, and responsible investing.

- Business Succession Planning: For families with businesses, advisors assist in planning leadership transitions and continuity strategies.

- Regular Financial Reviews: Advisors help families adapt financial strategies based on economic conditions and changing family needs.

Success Stories & Cautionary Tales

The journey of generational wealth is filled with both triumphs and failures. Some families successfully preserve and grow their wealth for multiple generations, while others lose it due to poor planning, financial mismanagement, and lack of discipline. Examining both success stories and cautionary tales provides valuable lessons on what works and what to avoid when building and maintaining wealth. Below are real-world examples of families and individuals who either sustained their financial legacy or lost it entirely.

Success Stories: Families Who Sustained Generational Wealth

- The Rockefeller Family – Built a financial empire through strategic investments, philanthropy, and structured wealth management, ensuring their wealth lasted for generations.

- The Rothschild Dynasty – Maintained financial dominance for centuries through business acumen, investment diversification, and family financial governance.

- The Walton Family (Walmart) – Ensured long-term wealth through careful succession planning, reinvesting in business, and disciplined financial strategies.

- The Mars Family (Mars Inc.) – Expanded their fortune by keeping the business family-owned and fostering innovation while maintaining strict financial oversight.

- The Buffetts – Warren Buffett emphasizes frugal living, financial literacy, and philanthropy, ensuring his wealth benefits both his family and society.

Cautionary Tales: Families Who Lost Their Wealth

- The Vanderbilt Family – Despite being one of the richest families in history, they lost their fortune due to lavish spending, lack of financial planning, and failure to reinvest wealth.

- The Guinness Family – Suffered financial decline because of poor wealth management, extravagant lifestyles, and legal disputes over inheritance.

- The Hilton Family – A significant portion of their wealth was lost when Conrad Hilton’s grandson contested the estate, leading to family disputes and mismanaged assets.

- The Hartfords (Great Atlantic & Pacific Tea Company – A&P) – Once a dominant retail empire, their downfall resulted from failure to innovate, poor business management, and market shifts.

- MC Hammer (Celebrity Wealth Loss) – Made millions but lost his fortune due to overspending, bad investments, and lack of financial oversight.

Conclusion

The journey of building and preserving generational wealth is a delicate balance of strategic planning, disciplined financial management, and responsible stewardship. While some families successfully sustain their wealth across generations, others lose it due to poor financial literacy, mismanagement, and lack of foresight. The key to long-term wealth preservation lies in estate planning, investment diversification, financial education, and structured governance. Trusts, financial advisors, and structured inheritance plans play a crucial role in safeguarding assets and ensuring smooth wealth transfers. At the heart of it all, instilling financial responsibility in heirs and fostering a long-term vision can mean the difference between growing a financial legacy or watching it disappear. By learning from both success stories and cautionary tales, families can take proactive steps to ensure their wealth lasts for generations to come.