Imagine having a steady stream of income flowing into your bank account without the need to work a traditional 9-to-5 job. This is the essence of passive income—money earned with little to no daily effort once the initial work is done. Unlike active income, which requires continuous labor to earn money, passive income allows you to build financial security, gain more control over your time, and create long-term wealth. In today’s fast-paced world, relying solely on a single source of income can be risky, making passive income a crucial element in financial planning. Whether through investments, rental properties, digital businesses, or royalties, passive income offers a sustainable way to achieve financial freedom and economic stability. This article explores what passive income is, its various forms, and why it is essential for building sustainable wealth.

What is Passive Income?

Passive income is money earned with minimal ongoing effort after an initial investment of time, money, or resources. Unlike active income, which requires continuous labor—such as a salary or wages—passive income allows you to generate earnings even when you’re not actively working. Common sources of passive income include rental properties, dividend-paying stocks, interest from savings accounts or bonds, royalties from books or creative works, and automated online businesses. While passive income isn’t entirely effortless—most streams require upfront effort and occasional maintenance—it provides a way to earn money without being tied to a fixed schedule. By diversifying income streams through passive earnings, individuals can achieve financial stability, reduce dependence on a single paycheck, and work toward long-term wealth accumulation.

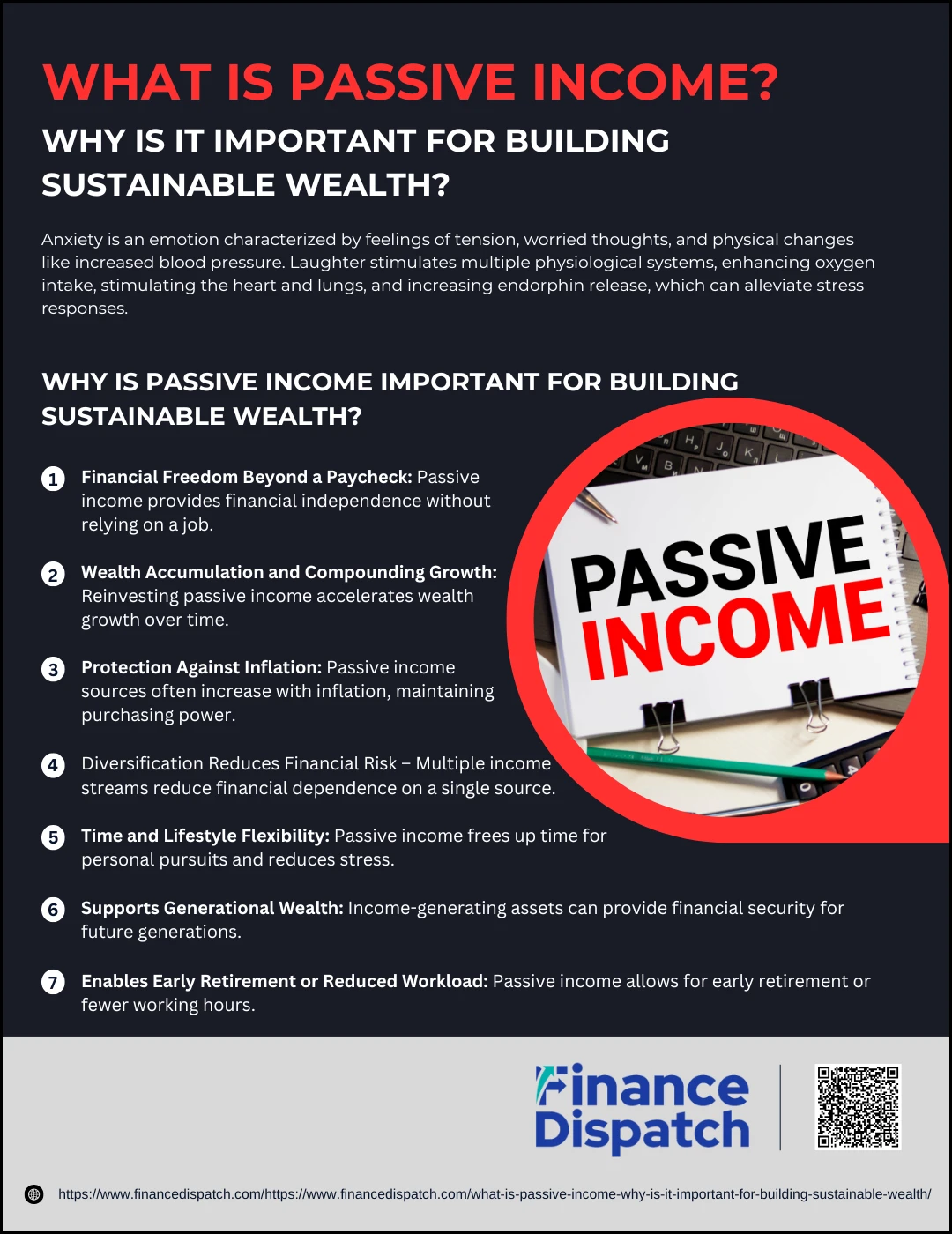

Why is Passive Income Important for Building Sustainable Wealth?

Why is Passive Income Important for Building Sustainable Wealth?

Building wealth isn’t just about earning a high salary—it’s about creating sustainable income streams that continue to generate money over time. Passive income is crucial for long-term financial stability because it allows you to earn money even when you’re not actively working. Unlike a traditional job, which requires constant effort in exchange for a paycheck, passive income provides ongoing earnings from investments, rental properties, or digital ventures with minimal maintenance. This makes it a powerful tool for achieving financial freedom, reducing financial stress, and ensuring long-term prosperity. Below are the key reasons why passive income is essential for building sustainable wealth.

1. Financial Freedom Beyond a Paycheck

Relying solely on a paycheck ties you to a job, limiting your financial growth and personal freedom. Passive income breaks this cycle by allowing you to earn money without clocking in every day. Whether it’s dividends from investments, rental income, or royalties from creative work, passive income ensures that you continue to generate revenue, giving you the flexibility to pursue your passions, take risks, or even retire early.

2. Wealth Accumulation and Compounding Growth

Many passive income streams, such as dividend stocks and real estate, benefit from compounding returns. When earnings are reinvested, they generate even more income over time, significantly accelerating wealth accumulation. Instead of simply saving money from your paycheck, passive income allows your assets to work for you, growing exponentially without additional effort.

3. Protection Against Inflation

Inflation reduces the purchasing power of money, making it crucial to have income sources that grow over time. Passive income—especially from real estate, stocks, and business investments—often rises with inflation, ensuring that your standard of living is maintained without needing to chase higher wages.

4. Diversification Reduces Financial Risk

Relying on a single source of income is financially risky. Job loss, market downturns, or unexpected expenses can significantly impact financial stability. Passive income provides multiple revenue streams, reducing reliance on any one paycheck and helping you navigate economic downturns or financial hardships with confidence.

5. Time and Lifestyle Flexibility

Unlike traditional jobs that demand your time and energy, passive income allows you to earn while you sleep. Whether through automated digital businesses, investments, or rental properties, you can free up time for family, hobbies, or travel while still maintaining financial security. This flexibility enhances your quality of life, reducing stress and providing more control over your daily schedule.

6. Supports Generational Wealth

Passive income is not just about financial security for yourself—it’s a legacy-building tool. By investing in income-producing assets, such as real estate, stocks, or online businesses, you can create wealth that continues to support your family for generations. Instead of passing down debt or financial struggles, you can leave behind assets that provide long-term financial security for your loved ones.

7. Enables Early Retirement or Reduced Workload

With a strong passive income foundation, you can retire early or reduce work hours without worrying about financial instability. Instead of waiting until traditional retirement age, passive income allows you to step away from full-time work earlier, giving you more time to enjoy life, travel, and pursue personal passions while still maintaining a steady income.

8. Provides Stability During Economic Uncertainty

Recessions, job layoffs, and unexpected financial emergencies can disrupt traditional income streams. Having multiple passive income sources acts as a financial safety net, ensuring that you have money coming in even during uncertain times. Whether it’s rental income, dividends, or online earnings, passive income can protect your financial well-being when the economy fluctuates.

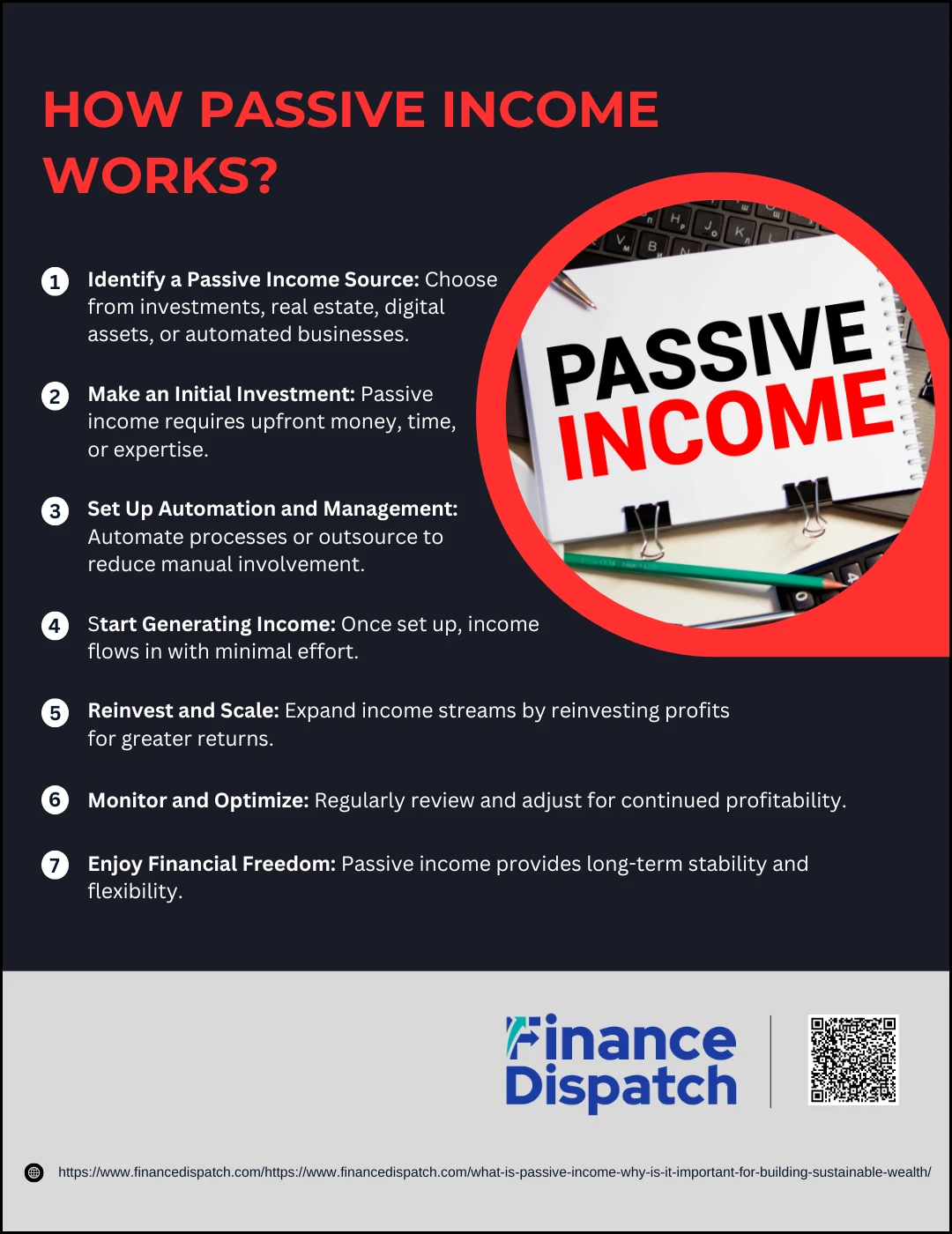

How Passive Income Works?

How Passive Income Works?

Passive income is a financial strategy that allows you to earn money with minimal day-to-day effort once the initial work is done. Unlike active income, which requires constant labor in exchange for a paycheck, passive income continues to generate revenue over time. This can come from investments, rental properties, digital products, or automated businesses. While it may require upfront time, money, or expertise, passive income provides long-term financial security, flexibility, and the potential for wealth accumulation. Below is a step-by-step breakdown of how passive income works and how you can get started.

1. Identify a Passive Income Source

The first step in building passive income is choosing a source that aligns with your skills, interests, and financial goals. Some common options include:

- Investments: Stocks, bonds, REITs, or mutual funds that generate dividends or interest.

- Real Estate: Rental properties that provide consistent monthly income.

- Digital Assets: E-books, online courses, or mobile apps that generate recurring sales.

- Automated Businesses: Dropshipping, print-on-demand, or affiliate marketing that earns revenue without constant management.

2. Make an Initial Investment

Most passive income streams require an upfront investment—this could be money (buying real estate or stocks), time (creating an online course or book), or expertise (building a business that runs on automation). The effort you put in at the beginning determines how much maintenance is needed later.

3. Set Up Automation and Management

To make income truly passive, it’s important to automate processes or use outsourcing. This includes:

- Investments: Setting up dividend reinvestment plans (DRIPs) or robo-advisors.

- Real Estate: Hiring property managers for rental properties.

- Digital Businesses: Using automated tools for email marketing, payment processing, and product fulfillment.

4. Start Generating Income

Once your passive income source is set up, it begins generating revenue with minimal intervention. The more diversified your income streams, the more stable your earnings will be. Some passive income sources provide regular payouts, such as rental income or stock dividends, while others may generate lump sums over time, like book royalties or course sales.

5. Reinvest and Scale

To maximize earnings, it’s essential to reinvest profits into additional income streams. For example:

- Reinvest dividends to compound returns.

- Buy more rental properties to increase cash flow.

- Expand an online business by adding more products or services.

6. Monitor and Optimize

Even passive income requires occasional monitoring to ensure it remains profitable. This could mean adjusting investments, maintaining rental properties, updating digital content, or scaling a business to increase efficiency and earnings. The key is to minimize active involvement while maximizing returns.

7. Enjoy Financial Freedom

As your passive income grows, you gain financial security and flexibility. Whether your goal is early retirement, reducing work hours, or simply supplementing your income, passive income gives you the ability to earn money without being tied to a job.

Common Myths about Passive Income

Passive income is often seen as a shortcut to wealth, but many misconceptions surround this concept. While it offers financial freedom and long-term wealth-building opportunities, passive income is not a magical way to get rich overnight. Many people misunderstand what it takes to build and sustain passive income streams, leading to unrealistic expectations. Let’s debunk some of the most common myths about passive income.

Myth #1: Passive Income Requires No Work

- Passive income is not 100% effortless—most streams require upfront investment of time, money, or skills.

- Businesses, investments, and digital products need maintenance, updates, or monitoring to remain profitable.

Myth #2: You Need a Lot of Money to Start

- Some passive income sources, like stocks, real estate, or businesses, require capital, but others don’t.

- Low-cost options like affiliate marketing, content creation, and digital products can generate passive income with minimal investment.

Myth #3: Passive Income is a Get-Rich-Quick Scheme

- Many people believe passive income means instant money, but it often takes months or years to build.

- The most successful passive income sources—like real estate or online businesses—grow over time with proper planning.

Myth #4: Once Set Up, It Runs Itself Forever

- Passive income reduces effort but doesn’t eliminate it—rental properties need management, businesses need updates, and investments require tracking.

- Some sources decline without maintenance, requiring occasional tweaks to remain profitable.

Myth #5: Only Entrepreneurs Can Earn Passive Income

- You don’t need to start a business to earn passive income—anyone can invest in stocks, REITs, or high-yield savings.

- Creating digital content, licensing photography, or renting out property are non-business passive income options.

Myth #6: Passive Income is Risk-Free

- Every income stream carries risks—stock markets fluctuate, rental properties require upkeep, and businesses can fail.

- Risk can be managed through diversification, research, and strategic investment choices.

Myth #7: Passive Income Replaces Active Income Instantly

- Most people start passive income as a side income before it grows enough to replace a full-time job.

- It takes time, consistency, and multiple income streams to fully replace active earnings.

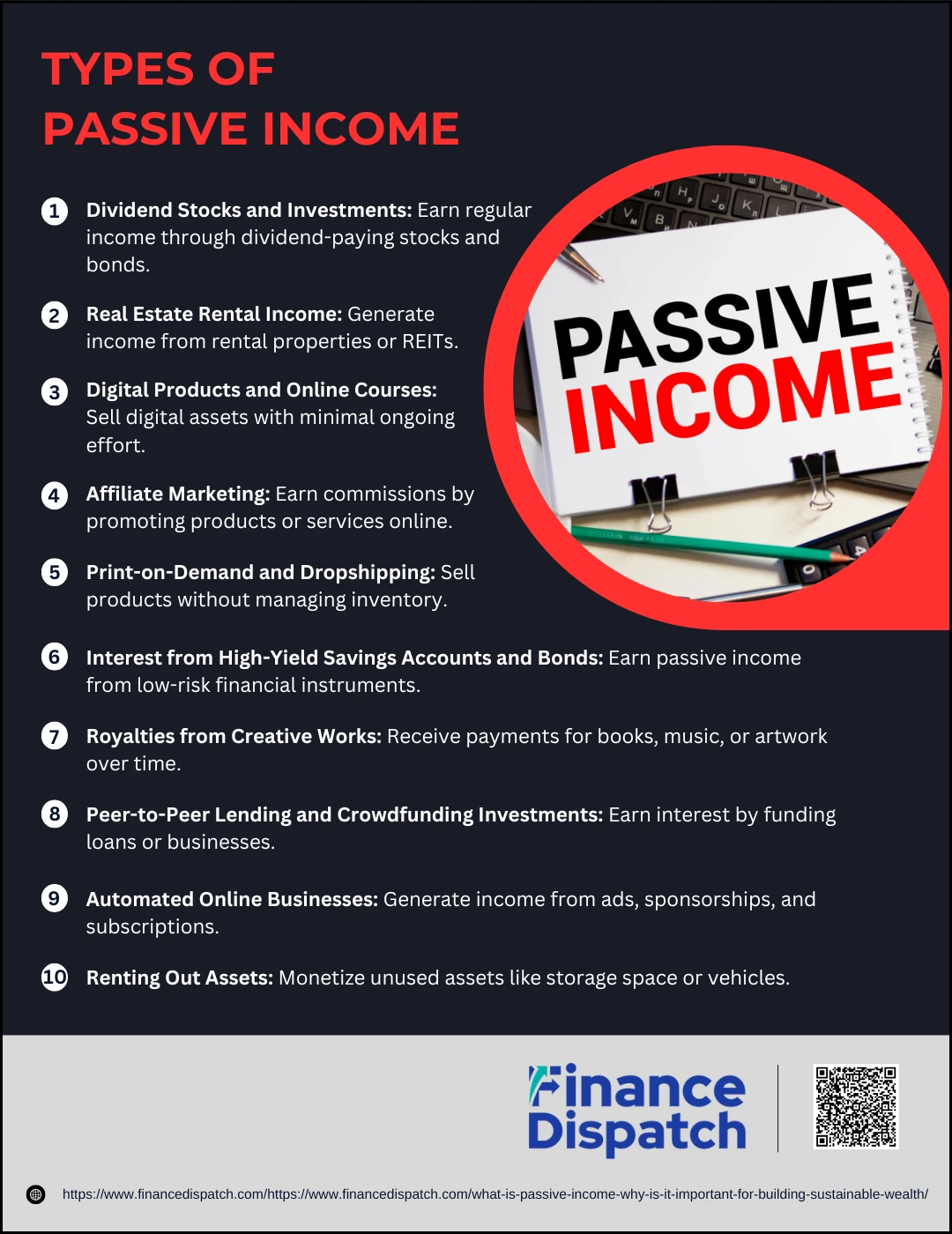

Types of Passive Income

Types of Passive Income

Passive income comes in many forms, allowing individuals to earn money with minimal ongoing effort. Whether through investments, real estate, or digital businesses, passive income provides financial stability and long-term wealth-building opportunities. However, not all passive income sources work the same way—some require upfront capital, while others rely on time and skill investment. Below are the most common types of passive income and how they work.

1. Dividend Stocks and Investments

Investing in dividend-paying stocks, ETFs, or bonds allows you to earn regular income without selling your assets. Many companies distribute profits to shareholders in the form of dividends, creating a steady passive income stream.

2. Real Estate Rental Income

Owning rental properties is a classic passive income method. Landlords earn money through rent while benefiting from property value appreciation. Those who don’t want to manage properties directly can invest in Real Estate Investment Trusts (REITs) for a more hands-off approach.

3. Digital Products and Online Courses

Creating and selling e-books, online courses, stock photos, or digital templates can generate passive income indefinitely. Once developed, these digital assets require little maintenance and can be sold repeatedly without additional effort.

4. Affiliate Marketing

Affiliate marketing allows individuals to earn commissions by promoting products or services through blogs, websites, or social media. By sharing affiliate links, you earn a percentage of sales without handling inventory or customer service.

5. Print-on-Demand and Dropshipping

Print-on-demand and dropshipping businesses let you sell products without managing inventory. Suppliers handle production and shipping, while you earn profits from sales made through an online store.

6. Interest from High-Yield Savings Accounts and Bonds

Keeping money in high-yield savings accounts, certificates of deposit (CDs), or government bonds earns interest over time. These low-risk investments provide a passive way to grow your money.

7. Royalties from Creative Works

Authors, musicians, and artists can earn passive income through royalties from book sales, music streaming, or licensing creative works. Once published or licensed, these assets generate income for years.

8. Peer-to-Peer Lending and Crowdfunding Investments

Platforms like peer-to-peer (P2P) lending and crowdfunding allow individuals to invest in loans or businesses in exchange for interest payments or equity returns.

9. Automated Online Businesses

Websites, blogs, and YouTube channels can generate passive income through advertising, sponsorships, and subscriptions. Once established, these platforms continue to earn revenue with minimal updates.

10. Renting Out Assets

If you own valuable assets like storage space, vehicles, or equipment, you can rent them out for passive income. Platforms like Airbnb, Turo, and Neighbor allow individuals to monetize unused property or items.

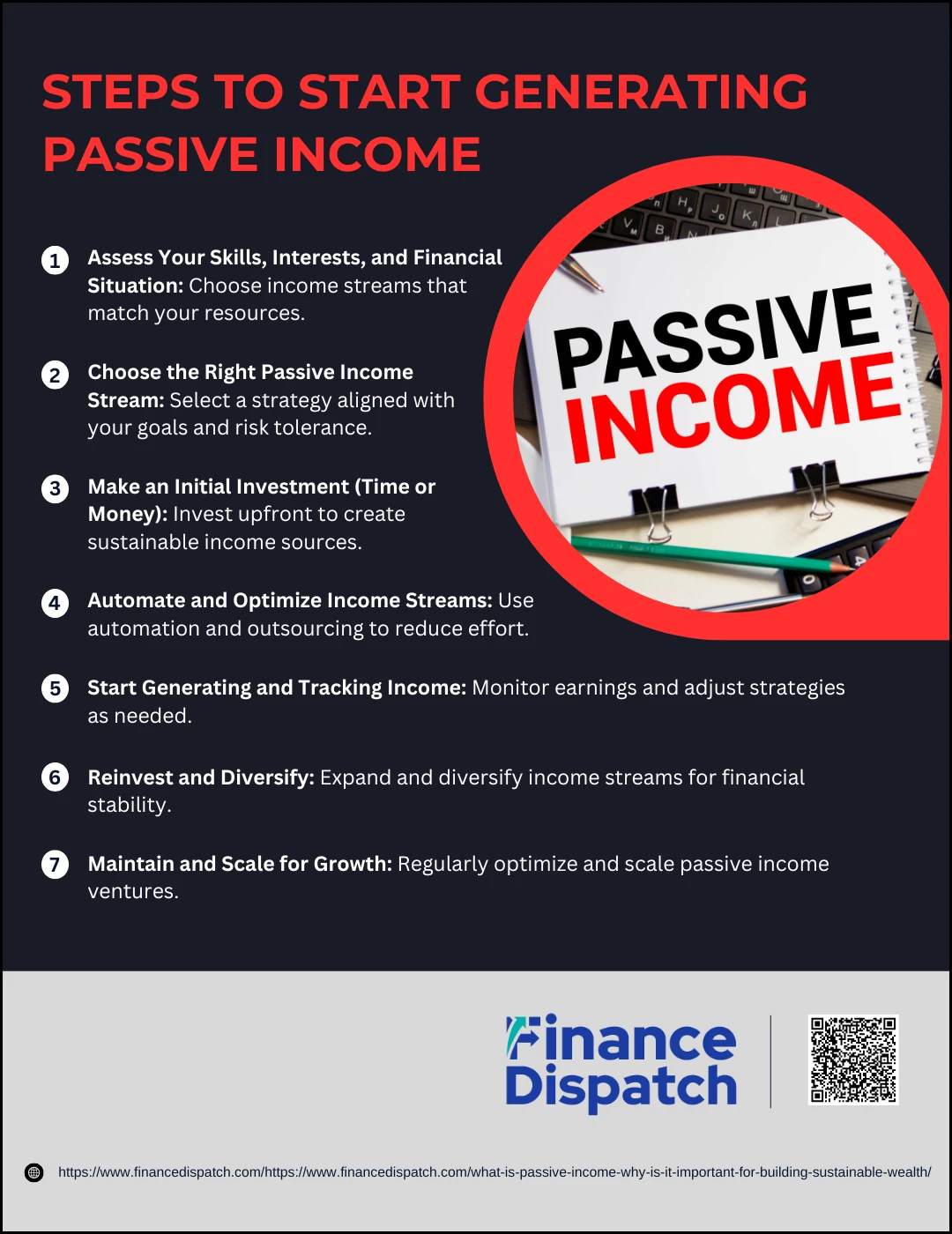

Steps to Start Generating Passive Income

Steps to Start Generating Passive Income

Earning passive income doesn’t happen overnight—it requires planning, investment, and effort upfront before it starts generating money on its own. Whether you’re looking to supplement your salary, achieve financial freedom, or retire early, building passive income streams can help you reach those goals. The key is to choose the right income source, automate where possible, and reinvest profits for long-term sustainability. Below are the essential steps to start generating passive income and build financial stability.

1. Assess Your Skills, Interests, and Financial Situation

Before diving into passive income, evaluate your current skills, financial resources, and interests. Some income streams require substantial capital investment, like real estate and stock dividends, while others rely on knowledge and creativity, such as selling digital products or affiliate marketing. Consider your risk tolerance and long-term financial goals when selecting a passive income strategy. If you prefer hands-off investments, stocks and bonds may be a better fit, while those comfortable with business operations might explore e-commerce or rental properties.

2. Choose the Right Passive Income Stream

With many passive income options available, selecting the right one is crucial. Investment-based sources like dividend stocks and real estate generate passive income with financial capital, where as digital ventures like blogging, online courses, and mobile apps require time and expertise. Research the advantages and risks of different income streams and start with one or two to avoid spreading yourself too thin. Passive income is most effective when strategically chosen to align with your financial and personal capabilities.

3. Make an Initial Investment (Time or Money)

Every passive income stream requires an initial investment—whether in time, money, or both. If you’re investing in dividend stocks or real estate, capital is required to start generating returns. If you’re building an online business or digital product, the investment may be in time and effort, such as creating a website, writing an e-book, or recording an online course. While passive income eventually reduces active involvement, the initial setup stage is critical for long-term success.

4. Automate and Optimize Income Streams

To truly make passive income work, automation plays a key role. Investments can be automated through dividend reinvestment plans (DRIPs) and robo-advisors, while digital businesses can utilize automated marketing, payment processing, and content scheduling. For rental properties, hiring a property manager can reduce your responsibilities. The goal is to minimize ongoing involvement so that the income stream continues to generate earnings with little maintenance. Optimizing processes also ensures efficiency and maximizes profits.

5. Start Generating and Tracking Income

Once your passive income stream is in place, monitor its performance to identify trends and potential improvements. Track rental income, stock dividends, online sales, or other revenue sources using financial tools or spreadsheets. Passive income does not always yield immediate returns, so patience is essential. Some income streams take months or even years to become significant, but consistent tracking will help you fine-tune your approach and measure long-term growth.

6. Reinvest and Diversify

To maximize your earnings, reinvest your passive income into additional income streams. This could mean purchasing more dividend stocks, expanding your real estate portfolio, or creating more digital products. Diversification is also essential—relying on a single source of passive income can be risky. A combination of investments, real estate, and online businesses can provide financial stability and protection from market fluctuations. Reinvesting profits and scaling up successful ventures accelerates the process of building long-term wealth.

7. Maintain and Scale for Growth

Even though passive income requires minimal effort, occasional maintenance is still necessary. Investments should be reviewed periodically, digital content may need updates, and real estate properties require upkeep. As your income streams grow, consider scaling them by increasing investments, optimizing automation, or launching additional passive income ventures. Long-term success requires adaptability, and those who refine and expand their passive income strategies will see the most significant financial benefits.

Challenges of Building Passive Income

While passive income is a great way to achieve financial freedom, it comes with several challenges that can make the process more difficult than expected. Many income streams require a high initial investment, time-intensive setup, and ongoing maintenance before they start generating significant earnings. Additionally, market risks, legal barriers, and scaling difficulties can slow down progress. Below are the key challenges of building passive income that individuals should be aware of.

Common Challenges:

1. High Initial Investment: Many sources like real estate and dividend stocks require significant upfront capital.

2. Time-Intensive Setup: Most passive income streams take months or even years before generating steady income.

3. Market Risks and Uncertainty: Stock fluctuations, real estate downturns, and online business competition can impact earnings.

4. Ongoing Maintenance: Rental properties, blogs, and digital businesses require continuous updates and management.

5. Long Time to See Profitable Returns: Patience is required as most passive income sources grow gradually.

6. Lack of Expertise: Financial literacy, investment knowledge, and business skills are essential for success.

7. Scaling Challenges: Expanding income streams may require additional capital, outsourcing, or automation.

8. Tax and Legal Issues: Understanding tax obligations and legal structures is crucial to avoid penalties and maximize profits.

Passive Income vs. Active Income – Which is Better?

When it comes to earning money, there are two main types of income: passive income and active income. Active income is what most people rely on—it requires continuous work in exchange for a paycheck, such as a salary or hourly wage. On the other hand, passive income allows you to earn money with minimal ongoing effort after an initial investment of time or money. While both income types have their advantages and disadvantages, choosing the right one depends on financial goals, lifestyle preferences, and risk tolerance. Below is a detailed comparison of passive income vs. active income to help determine which is better for your needs.

Comparison of Passive Income and Active Income

| Factor | Passive Income | Active Income |

| Definition | Earnings that require minimal effort after initial setup. | Income that requires continuous work and effort. |

| Examples | Rental income, dividends, digital products, affiliate marketing. | Salaries, wages, freelance work, business consulting. |

| Time Investment | Requires initial work but little ongoing effort. | Requires daily or regular work to earn money. |

| Earning Potential | Can grow exponentially over time. | Limited by hours worked and job role. |

| Risk Factor | Varies depending on investment type; some require capital. | Lower risk, but job loss or health issues can impact income. |

| Scalability | Highly scalable—earnings can increase without proportional effort. | Limited—income growth depends on promotions, raises, or working more hours. |

| Flexibility | More flexibility in time and location; can earn while traveling or sleeping. | Requires fixed work hours or commitments. |

| Consistency | May take time to become stable; earnings can fluctuate. | More predictable, with regular paychecks. |

| Effort Required | Requires setup, investment, and occasional maintenance. | Requires continuous effort to keep earning. |

| Best For | Long-term wealth-building and financial independence. | Immediate income needs and job security. |

Conclusion

Both passive income and active income play important roles in financial stability, and neither is inherently better than the other. Active income provides immediate financial security and predictable earnings, making it essential for covering daily expenses. However, passive income offers long-term wealth-building potential, financial freedom, and the ability to earn money with minimal ongoing effort. The best approach is to leverage both—using active income to support current needs while gradually building passive income streams for future financial independence. By creating a balance between these two income types, individuals can achieve greater financial security, reduce reliance on a paycheck, and ultimately enjoy more time, flexibility, and financial growth.