In the rapidly evolving digital economy, tokenization has emerged as a groundbreaking innovation, transforming the way we perceive ownership and trade assets. At its core, tokenization is the process of converting real-world assets—such as real estate, artwork, commodities, and financial instruments—into digital tokens that are securely stored and managed on a blockchain. This shift not only enhances liquidity and accessibility but also streamlines transactions by eliminating intermediaries and ensuring transparency and security. By leveraging smart contracts and decentralized networks, tokenization enables fractional ownership, allowing investors worldwide to participate in markets that were once restricted to a select few. In this article, we will explore what tokenization is, how it works, and how it revolutionizes asset management by seamlessly converting physical assets into digital tokens on the blockchain.

What is Tokenization?

Tokenization is the process of converting real-world assets or rights into digital tokens that can be stored, transferred, and traded on a blockchain network. These tokens serve as a digital representation of tangible assets like real estate, gold, and artwork, or intangible assets such as intellectual property, voting rights, and financial securities. Unlike traditional asset management, which often involves complex paperwork and intermediaries, tokenization leverages blockchain technology to enable secure, transparent, and efficient transactions. By using smart contracts, tokenized assets can be programmed with specific rules, such as automatic dividend payments or ownership transfers, reducing the need for third-party oversight. This innovation not only democratizes access to high-value assets by allowing fractional ownership but also enhances liquidity, making it easier for investors to buy, sell, and trade assets globally.

How Does Tokenization Transform Physical Assets into Digital Tokens on Blockchain?

How Does Tokenization Transform Physical Assets into Digital Tokens on Blockchain?

The process of tokenization is revolutionizing the way physical assets are owned, traded, and managed. Traditionally, investing in high-value assets like real estate, gold, fine art, and commodities required large capital and involved complex legal procedures with multiple intermediaries. Tokenization simplifies this process by converting these tangible assets into digital tokens that can be stored, transferred, and traded on a blockchain network. This transformation enhances liquidity, transparency, and accessibility, allowing fractional ownership, where multiple investors can own and trade small portions of valuable assets. Blockchain technology ensures that transactions are secure, tamper-proof, and automated, reducing costs and eliminating intermediaries. Below is a detailed breakdown of how this transformation occurs.

1. Asset Identification

Before an asset can be tokenized, it must be identified and classified. This includes tangible assets like real estate, precious metals, artwork, or commodities. The asset must have verifiable ownership and value to ensure its legitimacy in the tokenization process.

2. Asset Valuation

A professional appraisal is conducted to determine the market value of the asset. This ensures that each digital token accurately represents a specific portion or the entire asset. Proper valuation is essential for investor trust and regulatory compliance.

3. Legal Compliance

Since tokenization involves the creation of digital financial assets, it must comply with regulatory frameworks based on the asset’s nature and jurisdiction. This includes securities laws, ownership rights, and anti-money laundering (AML) regulations. Legal experts ensure that the tokenized asset abides by the necessary rules and investor protections.

4. Digitization of the Asset

The physical asset’s details, including ownership records, transaction history, and valuation reports, are converted into a digital format and stored securely on a blockchain ledger. This ensures immutability, traceability, and fraud prevention.

5. Blockchain Integration

The digitized asset data is recorded on a decentralized blockchain network, making it tamper-proof, verifiable, and accessible to authorized stakeholders. This integration ensures that ownership records cannot be altered or manipulated.

6. Smart Contract Deployment

Smart contracts are self-executing agreements coded on the blockchain that automatically enforce ownership rules, dividend distributions, and compliance requirements. These eliminate the need for middlemen such as brokers, reducing transaction costs and improving efficiency.

7. Token Creation

The asset is divided into digital tokens, which represent ownership rights. These tokens can be:

- Fungible tokens – Interchangeable and represent equal portions of an asset (e.g., security tokens for real estate investments).

- Non-fungible tokens (NFTs) – Unique and used for one-of-a-kind assets, such as artwork, collectibles, or rare items.

8. Trading & Ownership Transfer

The tokens are listed on decentralized exchanges (DEXs) or private trading platforms, allowing investors to buy, sell, and transfer ownership without intermediaries. This enables global participation, as investors from anywhere can own fractional shares of high-value assets with minimal barriers.

How Does Tokenization Work?

How Does Tokenization Work?

Tokenization is a process that converts real-world assets or sensitive data into digital tokens that can be stored, transferred, and traded on a blockchain network. This transformation enhances security, transparency, and accessibility while reducing dependency on intermediaries and lowering transaction costs. By utilizing smart contracts, tokenization automates ownership verification, compliance, and asset transfers, making transactions faster and more efficient. Whether applied to financial assets, real estate, intellectual property, or digital collectibles, tokenization allows fractional ownership, enabling investors worldwide to participate in markets that were previously inaccessible. Below is a detailed breakdown of how tokenization works.

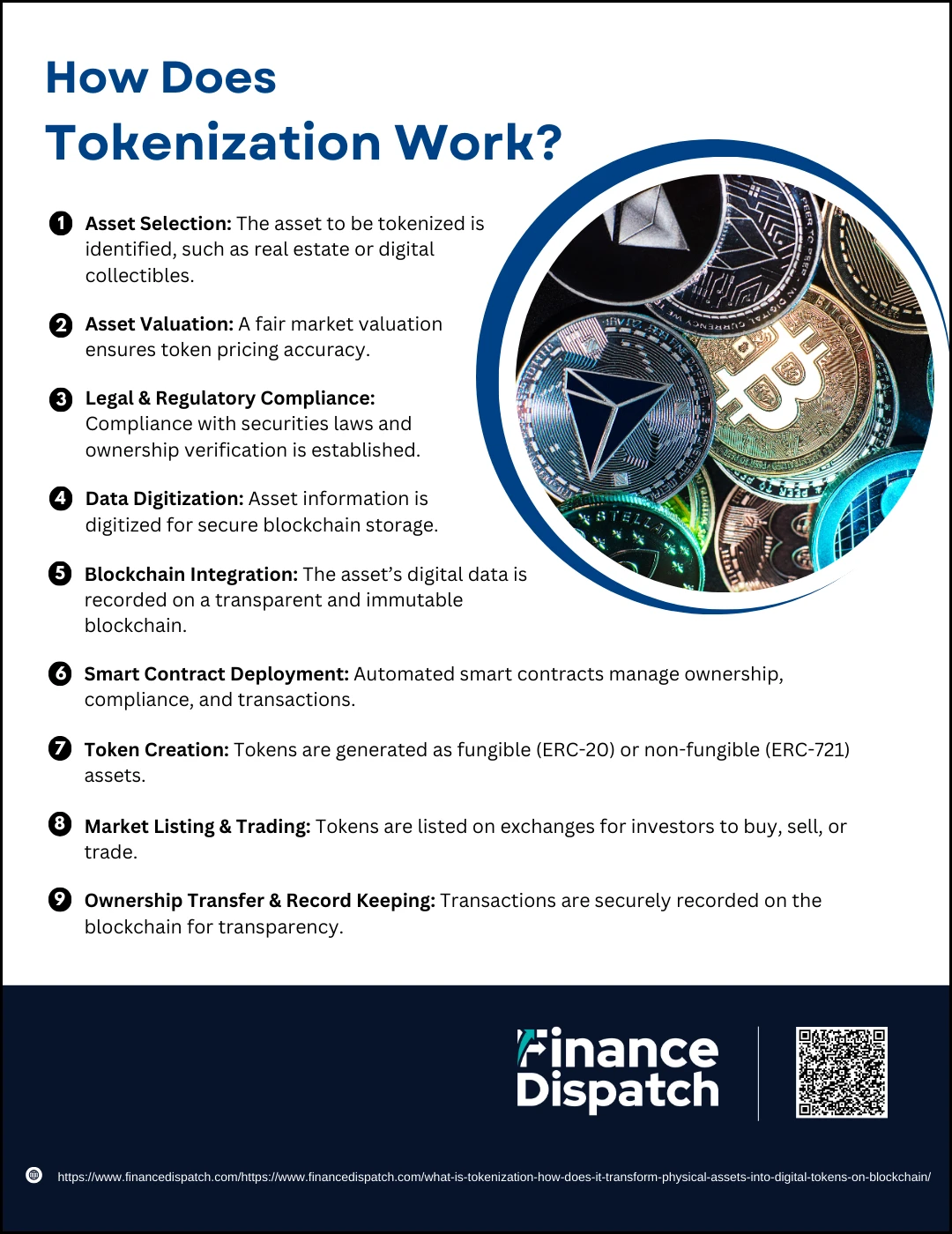

Step-by-Step Process of Tokenization

1. Asset Selection

The first step in tokenization is identifying the asset to be digitized. This can include real estate, stocks, commodities, luxury goods, artwork, patents, or even digital assets such as in-game items or music rights.

2. Asset Valuation

A professional valuation is conducted to assess the fair market value of the asset. This valuation ensures that the issued digital tokens accurately reflect the asset’s worth, making it easier to establish trust and transparency in trading.

3. Legal & Regulatory Compliance

Tokenization must comply with regional and international regulations to ensure legitimate ownership and secure trading. This step involves legal documentation, ownership verification, and adherence to securities laws, particularly for assets like stocks and real estate.

4. Data Digitization

All relevant asset details, ownership history, and legal documentation are digitized and stored securely. This step ensures that the digital representation of the asset is accurate and verifiable on the blockchain.

5. Blockchain Integration

The asset’s digital information is recorded on a blockchain, providing immutability, transparency, and security. Blockchain acts as a public ledger, ensuring that ownership and transaction details cannot be altered or tampered with.

6. Smart Contract Deployment

Smart contracts are programmed to automate ownership rights, transaction conditions, and compliance checks. These contracts execute automatically when predefined conditions are met, removing the need for third-party intermediaries.

7. Token Creation

Digital tokens are created to represent fractional or full ownership of the asset. These tokens can be:

- Fungible Tokens (ERC-20, BEP-20, etc.) – Identical and interchangeable, like stocks or shares.

- Non-Fungible Tokens (NFTs, ERC-721, ERC-1155) – Unique and indivisible, representing distinct assets such as art or real estate.

8. Market Listing & Trading

The tokens are listed on decentralized exchanges (DEXs) or specialized tokenized asset platforms, where investors can buy, sell, or trade them. This allows for global participation, breaking down traditional investment barriers.

9. Ownership Transfer & Record Keeping

Each transaction is automatically recorded on the blockchain, ensuring a secure, transparent, and tamper-proof history of asset ownership. Smart contracts facilitate instant and secure asset transfers, reducing processing time compared to traditional methods.

Types of Tokens in Blockchain

Types of Tokens in Blockchain

Blockchain technology enables the creation of digital tokens that represent various types of assets and utilities. These tokens serve different purposes, from facilitating transactions and granting access to services to representing ownership of real-world assets. Depending on their functionality, blockchain tokens can be categorized into different types, each with distinct characteristics and use cases. Below are the most common types of tokens in blockchain.

1. Security Tokens

Security tokens represent ownership in real-world assets such as stocks, bonds, real estate, or commodities. These tokens are regulated similarly to traditional securities, ensuring legal compliance and investor protection. They provide benefits like dividends, voting rights, or profit-sharing to token holders.

2. Utility Tokens

Utility tokens grant access to specific products, services, or features within a blockchain ecosystem. Unlike security tokens, they do not represent ownership of an asset but serve as a payment method or access key within a decentralized platform. Examples include Ethereum’s ETH (for transaction fees) and Binance Coin (BNB) for exchange services.

3. Currency Tokens

Also known as cryptocurrencies, these tokens act as a medium of exchange for goods and services. They are designed to be fungible, secure, and decentralized, making them an alternative to traditional fiat currencies. Examples include Bitcoin (BTC), Ethereum (ETH), and stablecoins like USDT (Tether), which are pegged to fiat currencies.

4. Non-Fungible Tokens (NFTs)

NFTs are unique and indivisible tokens that represent ownership of digital or physical assets, such as art, music, collectibles, real estate, or in-game items. Unlike fungible tokens, each NFT has a distinct value and cannot be exchanged on a one-to-one basis. Examples include CryptoPunks, Bored Ape Yacht Club (BAYC), and digital art pieces on platforms like OpenSea.

5. Governance Tokens

Governance tokens grant holders voting power within decentralized autonomous organizations (DAOs) or blockchain networks. These tokens allow users to participate in decision-making, influencing project development, upgrades, and policies. Examples include Uniswap’s UNI and MakerDAO’s MKR.

6. Asset-Backed Tokens

These tokens are backed by physical assets such as gold, real estate, or commodities, making them a bridge between traditional finance and blockchain technology. Asset-backed tokens provide stability and transparency, as their value is tied to a tangible asset. Examples include PAX Gold (PAXG) for gold and tokenized real estate projects.

7. Stablecoins

Stablecoins are designed to maintain a stable value by being pegged to an external asset like a fiat currency (USD, EUR) or a commodity (gold). They provide the benefits of blockchain transactions while reducing the volatility associated with traditional cryptocurrencies. Examples include Tether (USDT), USD Coin (USDC), and DAI.

Benefits of Tokenization

Tokenization is revolutionizing asset management and investment by converting real-world assets into digital tokens stored on a blockchain. This process enhances liquidity, security, and transparency, making asset ownership more accessible and efficient. By removing intermediaries and enabling fractional ownership, tokenization lowers barriers to entry and allows a global pool of investors to participate in markets that were once exclusive. Below is a table highlighting the key benefits of tokenization and their impact.

Table: Key Benefits of Tokenization

| Benefit | Description |

| Increased Liquidity | Tokenized assets can be easily divided and traded, enabling faster transactions and eliminating liquidity constraints. |

| Fractional Ownership | Investors can own small fractions of high-value assets like real estate, art, or stocks, making investments more accessible. |

| 24/7 Market Access | Unlike traditional markets, tokenized assets can be traded anytime, anywhere, allowing for round-the-clock transactions. |

| Reduced Transaction Costs | Eliminates intermediaries like brokers and banks, reducing fees and speeding up settlement times. |

| Security & Transparency | Blockchain’s immutability ensures that all transactions are secure, verifiable, and fraud-resistant. |

| Global Investment Opportunities | Tokenization enables borderless transactions, allowing investors from different countries to participate in asset ownership. |

| Automated Smart Contracts | Transactions are executed automatically based on pre-set conditions, eliminating manual processing and minimizing errors. |

| Faster Settlements | Digital transactions settle in minutes rather than days, streamlining processes for buyers and sellers. |

| Increased Accessibility | Small investors can now invest in assets that were previously reserved for institutions and high-net-worth individuals. |

| Diversification of Investment Portfolio | Investors can diversify their portfolios by holding various tokenized assets, reducing risk exposure. |

Real-World Applications of Tokenization

Tokenization is transforming industries by digitizing real-world assets and making them more liquid, accessible, and transparent. By leveraging blockchain technology, tokenization allows fractional ownership, automated transactions, and borderless trading, reducing the reliance on intermediaries and lowering transaction costs. From real estate and finance to supply chain and intellectual property, tokenization is reshaping traditional markets and opening new investment opportunities. Below are some of the key real-world applications of tokenization.

Key Applications of Tokenization

- Real Estate – Tokenizing property enables fractional ownership, allowing investors to buy and trade shares of commercial and residential properties without purchasing the entire asset.

- Art & Collectibles – Non-Fungible Tokens (NFTs) have revolutionized the art market by enabling secure, verifiable ownership of digital and physical artworks, rare collectibles, and music rights.

- Financial Markets – Tokenized stocks, bonds, and other securities provide faster settlements, reduced trading costs, and increased liquidity, making financial markets more efficient.

- Supply Chain Management – Tokenization enhances traceability and transparency, allowing businesses to track goods from production to delivery while preventing fraud and counterfeit products.

- Commodities & Precious Metals – Gold, oil, and agricultural products can be tokenized and traded on blockchain-based platforms, making investment in commodities more accessible to a broader audience.

- Healthcare & Medical Records – Patient records and medical histories can be securely tokenized to provide tamper-proof access while ensuring privacy and regulatory compliance.

- Gaming & Virtual Assets – Tokenization enables gamers to own, trade, and sell in-game assets, such as skins, weapons, and virtual real estate, enhancing player-driven economies.

- Intellectual Property & Royalties – Tokenizing copyrights, patents, and music royalties allows creators to directly monetize their work and ensure fair revenue distribution.

- Crowdfunding & Investments – Tokenized fundraising through Security Token Offerings (STOs) and Initial Coin Offerings (ICOs) enables startups and businesses to raise capital efficiently from global investors.

- Identity Verification & Digital Identity – Personal identification documents, such as passports and driver’s licenses, can be tokenized for secure and verifiable digital identities in decentralized systems.

Challenges of Tokenization

While tokenization offers numerous benefits, including increased liquidity, transparency, and accessibility, its widespread adoption faces several challenges. These challenges arise from regulatory uncertainties, security risks, technical complexities, and market adoption barriers. Since tokenized assets often exist in both digital and physical worlds, ensuring their legitimacy, compliance, and usability requires robust frameworks and governance structures. Below are some of the key challenges that hinder the growth and mass adoption of tokenization.

Key Challenges of Tokenization

1. Regulatory Uncertainty: Many governments have yet to establish clear regulations for tokenized assets, leading to legal ambiguity and potential compliance risks.

2. Security Risks & Fraud: Smart contract vulnerabilities, hacking attempts, and fraud pose risks to tokenized assets, making security a top concern.

3. Market Volatility: The value of tokenized assets can be highly volatile, especially in secondary markets, which can discourage investors.

4. Legal Ownership & Enforcement: Establishing legal rights and ownership recognition for tokenized assets, especially in real estate and commodities, remains a complex challenge.

5. Lack of Standardization: Different blockchain platforms use varied token standards, leading to interoperability issues and making cross-platform transactions difficult.

6. Adoption Barriers: Traditional investors and institutions often hesitate to adopt blockchain-based tokenization due to a lack of understanding and trust.

7. Custodianship & Asset Management: Managing physical assets tied to tokenized representations (e.g., gold or real estate) requires secure storage and verification mechanisms.

8. Scalability Issues: Many blockchain networks struggle with scalability, leading to slow transaction speeds and high costs as adoption increases.

9. Taxation & Accounting Challenges: Governments have not fully developed taxation policies for tokenized assets, making it difficult for investors and businesses to report and comply with tax obligations.

10. User Experience & Accessibility: The complexity of blockchain technology and the need for crypto wallets, private keys, and smart contracts make it challenging for non-technical users to participate.

The Future of Tokenization

The future of tokenization is poised to redefine global asset ownership, investment, and financial markets through increased adoption, regulatory clarity, and technological advancements. As blockchain technology continues to evolve, tokenization is expected to expand beyond traditional assets like real estate and securities to include intellectual property, carbon credits, and even identity verification systems. Regulatory frameworks are gradually adapting to accommodate tokenized financial instruments, which will enhance investor confidence and institutional participation. Additionally, advancements in interoperability between blockchain networks will allow seamless transactions across different platforms, making tokenized assets more accessible and tradable globally. With the rise of decentralized finance (DeFi), security token offerings (STOs), and asset-backed digital tokens, tokenization is set to revolutionize traditional finance by enabling faster settlements, increased liquidity, and broader market participation. As adoption grows, tokenization will play a crucial role in creating a decentralized, transparent, and efficient financial ecosystem, bridging the gap between traditional finance and blockchain-powered economies.

Conclusion

Tokenization is transforming the way we own, trade, and invest in assets, bridging the gap between traditional finance and blockchain technology. By converting physical and digital assets into secure, transparent, and easily tradable tokens, tokenization enhances liquidity, accessibility, and efficiency across multiple industries. Despite challenges such as regulatory uncertainty, security concerns, and market adoption barriers, advancements in blockchain technology, legal frameworks, and institutional acceptance are paving the way for widespread adoption. As more businesses, investors, and governments recognize the potential of tokenized assets, we can expect a future where tokenization revolutionizes global finance, democratizes investment opportunities, and reshapes digital ownership. In this rapidly evolving landscape, tokenization stands as a cornerstone of the next generation of financial markets and digital economies.