In today’s fast-paced digital world, financial institutions must strike a balance between security, compliance, and customer convenience. Digital identity verification has emerged as a critical solution to streamline financial onboarding while safeguarding businesses and customers from fraud and identity theft. By leveraging advanced technologies like biometrics, artificial intelligence, and real-time document verification, financial institutions can authenticate customers efficiently without the need for cumbersome manual processes. This not only accelerates customer onboarding but also ensures compliance with stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. In this article, we’ll explore what digital identity verification is, why it’s essential, and how it transforms the financial onboarding experience into a seamless and secure process.

What is Digital Identity Verification?

Digital identity verification is the process of confirming an individual’s identity through digital means, ensuring that they are who they claim to be before granting access to financial services. Unlike traditional in-person verification, which relies on physical documents and face-to-face interactions, digital verification leverages advanced technologies such as biometric authentication, artificial intelligence (AI), and government database checks. This process involves analyzing identity documents, facial recognition, and behavioral patterns to detect fraud and prevent unauthorized access. With the rise of online banking, e-commerce, and fintech services, digital identity verification has become essential for ensuring security, preventing identity theft, and complying with regulatory requirements like Know Your Customer (KYC) and Anti-Money Laundering (AML) laws. By automating identity verification, financial institutions can enhance security, reduce manual errors, and provide customers with a seamless onboarding experience.

Why Financial Institutions Need Digital Identity Verification

Why Financial Institutions Need Digital Identity Verification

The rapid shift towards digital banking and financial services has made identity verification more critical than ever. Traditional verification methods, such as in-person document checks and manual reviews, are not only slow and inefficient but also prone to human error and fraud. With rising cases of identity theft, money laundering, and cyber fraud, financial institutions must adopt a more robust, scalable, and automated approach. Digital identity verification leverages cutting-edge technologies like artificial intelligence (AI), machine learning, biometrics, and real-time document authentication to verify individuals accurately and securely. By automating identity checks, financial institutions can improve compliance, enhance customer trust, and significantly streamline the onboarding process, reducing the time it takes to open an account or approve financial transactions.

Key Reasons Financial Institutions Need Digital Identity Verification

1. Fraud Prevention and Security Enhancement

Financial fraud, including identity theft and account takeovers, has become a major concern for banks and fintech companies. Digital identity verification helps detect fraudulent attempts by analyzing biometric data, facial recognition, and behavioral patterns, reducing risks before they escalate.

2. Regulatory Compliance with KYC and AML

Governments and financial regulatory bodies enforce strict Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations to prevent illegal financial activities. Digital verification automates compliance processes, ensuring institutions meet legal requirements while minimizing manual intervention.

3. Faster Customer Onboarding

Traditional onboarding processes can take days or even weeks due to manual document verification. Digital identity verification accelerates this process by instantly cross-checking information with government databases, allowing customers to open accounts and access financial services within minutes.

4. Reduction in Operational Costs

Manually verifying customer identities requires significant staffing, paperwork, and resources. Digital identity verification minimizes these expenses by automating the process, leading to cost savings in administrative and compliance operations.

5. Seamless Digital Banking Experience

Today’s customers expect instant access to financial services with minimal friction. Digital identity verification provides a seamless experience by enabling remote verification, eliminating the need for in-person visits, and reducing authentication-related delays.

6. Scalability and Global Reach

With the expansion of financial services across borders, digital identity verification ensures institutions can verify international customers efficiently. By integrating global databases and AI-driven risk assessments, financial institutions can scale their operations without geographical restrictions.

7. Enhanced Data Accuracy and Integrity

Manual identity verification often leads to errors in data entry and validation. AI-powered verification systems eliminate these errors by accurately extracting and verifying identity details from submitted documents, reducing the risk of mismatches or inconsistencies.

8. Improved Customer Trust and Retention

Customers are more likely to engage with financial institutions that prioritize security and convenience. A smooth, hassle-free verification process builds trust and encourages long-term customer relationships.

How Digital Identity Verification Streamlines Financial Onboarding

How Digital Identity Verification Streamlines Financial Onboarding

In the financial sector, customer onboarding is a crucial yet complex process that requires identity verification to prevent fraud, ensure compliance, and build trust. Traditional methods of verification, such as manual document checks and in-person authentication, are often time-consuming and prone to errors. Digital identity verification revolutionizes this process by leveraging advanced technologies like biometrics, artificial intelligence (AI), and real-time data authentication. This not only enhances security but also makes onboarding faster, more efficient, and user-friendly. By automating identity checks, financial institutions can significantly reduce operational costs, improve compliance, and provide a seamless customer experience.

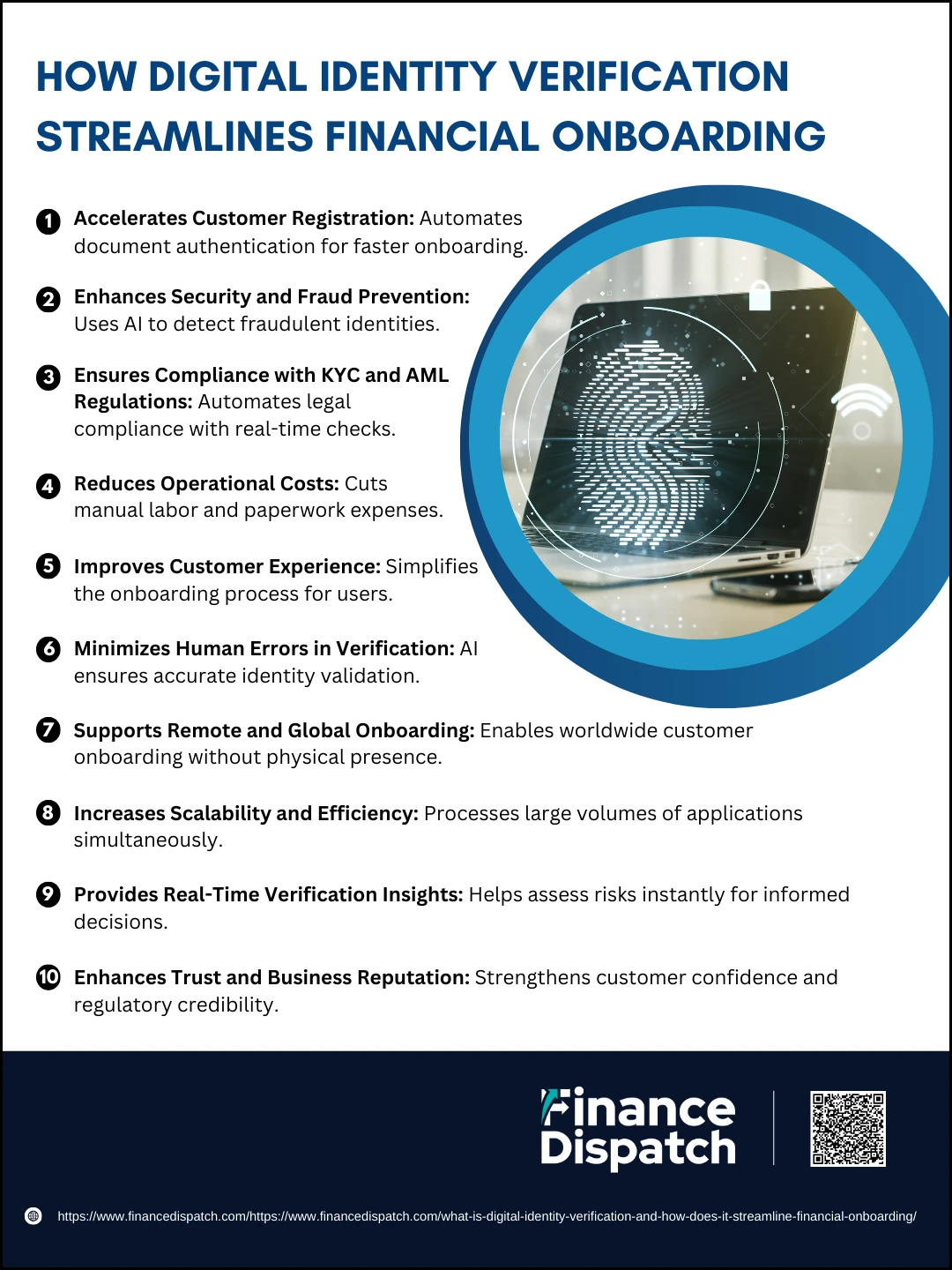

How Digital Identity Verification Enhances Financial Onboarding

1. Accelerates Customer Registration

Digital identity verification automates document authentication and biometric verification, allowing financial institutions to onboard customers in minutes rather than days. This speeds up account opening, loan approvals, and access to financial services.

2. Enhances Security and Fraud Prevention

AI-powered identity verification detects fraudulent activities by analyzing identity documents, facial recognition, and behavioral patterns. This helps financial institutions prevent identity theft, synthetic identity fraud, and unauthorized transactions.

3. Ensures Compliance with KYC and AML Regulations

Financial institutions must adhere to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Digital verification automates compliance by cross-referencing customer information with regulatory databases, ensuring due diligence with minimal manual effort.

4. Reduces Operational Costs

Traditional identity verification requires significant manual labor and administrative costs. By automating the process, digital identity verification reduces the need for paperwork, manual checks, and in-person verification, saving time and resources.

5. Improves Customer Experience

A smooth and hassle-free onboarding process improves customer satisfaction and trust. Digital verification eliminates long wait times, multiple document submissions, and complex authentication steps, making it easier for customers to access financial services.

6. Minimizes Human Errors in Verification

Manual verification processes are prone to errors such as incorrect data entry and document misinterpretation. AI-driven identity verification ensures accurate data collection and authentication, reducing mistakes and rejections.

7. Supports Remote and Global Onboarding

Financial institutions can onboard customers from anywhere in the world without requiring physical presence. Digital verification integrates with global databases and remote authentication tools, enabling seamless cross-border customer onboarding.

8. Increases Scalability and Efficiency

Digital verification solutions can handle large volumes of customer applications simultaneously, allowing financial institutions to scale their operations efficiently while maintaining security and compliance.

9. Provides Real-Time Verification Insights

Financial institutions gain access to real-time identity verification data, allowing them to assess risk levels instantly and make informed decisions on customer approvals or rejections.

10. Enhances Trust and Business Reputation

A robust and secure onboarding process builds customer trust and enhances the institution’s reputation. By prioritizing security and compliance, financial service providers can establish long-term relationships with customers and regulatory bodies.

Key Technologies Used in Digital Identity Verification

Digital identity verification relies on a combination of advanced technologies to authenticate individuals quickly, accurately, and securely. These technologies help financial institutions streamline onboarding, prevent fraud, and comply with regulatory standards like Know Your Customer (KYC) and Anti-Money Laundering (AML). From biometric authentication to artificial intelligence (AI)-driven risk assessment, each technology plays a critical role in ensuring that customers are who they claim to be. By integrating these solutions, financial institutions can enhance security, improve customer experience, and scale their operations efficiently.

Table: Technologies Used in Digital Identity Verification

| Technology | Function |

| Biometric Authentication | Uses facial recognition, fingerprint scanning, and iris detection to verify identities securely. |

| Artificial Intelligence (AI) & Machine Learning | Detects fraud patterns, analyzes behavioral data, and enhances accuracy in verification processes. |

| Optical Character Recognition (OCR) | Extracts and validates data from government-issued documents such as passports and driver’s licenses. |

| Liveness Detection | Ensures that a real person is present during verification to prevent spoofing attempts using photos or videos. |

| Blockchain Technology | Provides a decentralized and tamper-proof verification system for identity records. |

| Two-Factor Authentication (2FA) | Adds an extra layer of security by requiring users to verify their identity through multiple methods (e.g., password + OTP). |

| Document Verification | Uses automated tools to authenticate identity documents against official databases and detect forgery. |

| Device & IP Address Analysis | Identifies suspicious login attempts and verifies user authenticity based on geolocation and device fingerprinting. |

| Database Cross-Referencing | Compares user information with government and financial databases to confirm identity authenticity. |

Benefits of Digital Identity Verification in Finance

Benefits of Digital Identity Verification in Finance

In the modern financial landscape, digital identity verification is no longer a luxury but a necessity. Financial institutions are continuously battling fraudulent activities, regulatory pressures, and the demand for a seamless customer experience. Traditional identity verification methods, such as in-person authentication and manual document review, are slow, costly, and vulnerable to fraud. With the rise of online banking, fintech services, and digital payments, digital identity verification has emerged as a powerful solution to enhance security, prevent financial crimes, and improve efficiency. By utilizing advanced technologies like artificial intelligence (AI), machine learning, biometrics, and document verification, financial institutions can create a fast, secure, and compliant onboarding process that benefits both the organization and its customers.

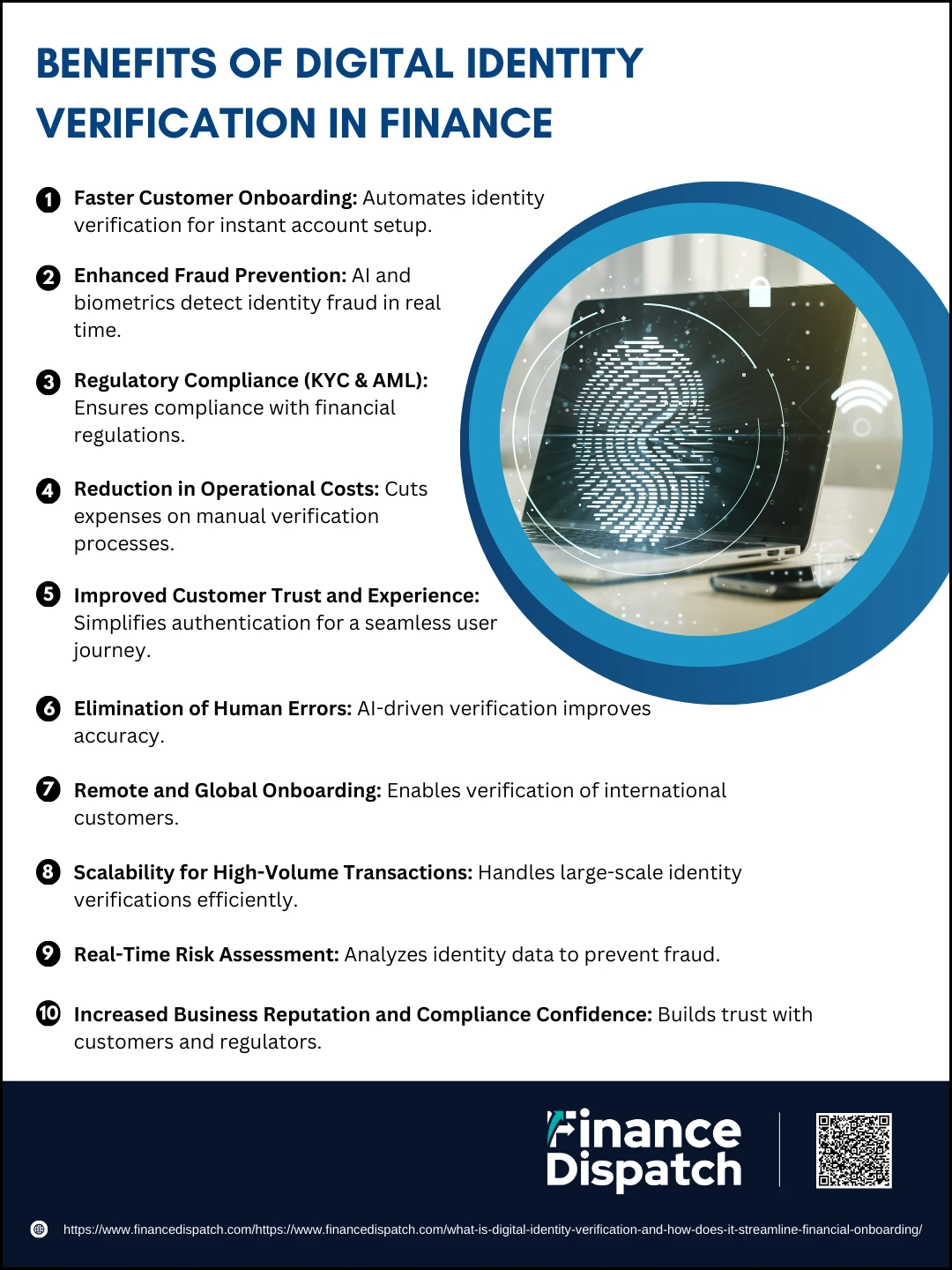

Key Benefits of Digital Identity Verification in Finance

1. Faster Customer Onboarding

Speed is a critical factor in the financial industry. Traditional onboarding processes, such as in-person identity checks and manual verification, can take days or even weeks to complete. Digital identity verification automates document authentication and biometric verification, enabling financial institutions to onboard customers within minutes. This not only improves operational efficiency but also enhances customer satisfaction by providing instant access to banking and financial services.

2. Enhanced Fraud Prevention

Identity theft and fraudulent transactions are major threats in the financial sector. Digital identity verification utilizes AI-powered fraud detection, biometric authentication, and behavioral analytics to identify suspicious patterns and detect fake identities. By verifying customers in real time, financial institutions can mitigate the risks of fraud, money laundering, and account takeovers before they cause financial damage.

3. Regulatory Compliance (KYC & AML)

Financial institutions must comply with stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations to prevent illicit financial activities. Non-compliance can result in heavy fines, reputational damage, and legal consequences. Digital identity verification streamlines compliance by cross-referencing customer data with government and financial regulatory databases, ensuring due diligence while minimizing the administrative burden.

4. Reduction in Operational Costs

Manual identity verification requires significant resources, including staff, paperwork, and physical verification infrastructure. By automating the process, financial institutions can significantly reduce costs related to human labor, document handling, and in-person verification. This allows businesses to allocate resources more efficiently and focus on core financial services rather than tedious administrative tasks.

5. Improved Customer Trust and Experience

Customers today expect a seamless and frictionless experience when accessing financial services. Lengthy verification processes can lead to frustration and customer drop-offs. Digital identity verification simplifies authentication, eliminates unnecessary steps, and allows customers to complete onboarding from the comfort of their homes. A smooth, secure, and user-friendly verification process enhances customer trust and encourages long-term engagement with financial institutions.

6. Elimination of Human Errors

Manual identity verification processes are susceptible to human errors, such as incorrect data entry, misinterpretation of documents, and inconsistencies in customer information. AI-driven verification ensures high accuracy by analyzing data automatically and flagging discrepancies instantly. This minimizes rejection rates due to errors and enhances the reliability of identity verification.

7. Remote and Global Onboarding

With digital banking on the rise, financial institutions need to cater to customers worldwide. Digital identity verification eliminates geographical barriers by enabling remote authentication through online document scanning and biometric checks. This allows financial institutions to onboard customers from different locations without requiring physical presence, making cross-border banking more accessible and scalable.

8. Scalability for High-Volume Transactions

As financial institutions expand their services, handling high volumes of customer applications efficiently becomes a challenge. Digital identity verification solutions are designed to process multiple verifications simultaneously, ensuring that growing customer demands are met without delays. This makes it easier for banks, fintech companies, and payment providers to scale their operations without compromising security.

9. Real-Time Risk Assessment

Digital identity verification goes beyond just authentication—it provides real-time risk assessment by analyzing customer data, device usage, location, and transaction history. Financial institutions can use this data to detect high-risk individuals, prevent fraudulent transactions, and make informed decisions regarding account approvals and fund transfers. This proactive approach helps in reducing financial risks and safeguarding institutions from potential threats.

10. Increased Business Reputation and Compliance Confidence

Financial institutions that implement secure and efficient identity verification measures build a strong reputation for trust and security. Customers are more likely to engage with banks and fintech platforms that prioritize their security and privacy. Additionally, regulatory bodies view compliance-driven financial institutions favorably, reducing the likelihood of fines and legal actions. By adopting digital identity verification, businesses position themselves as reliable, future-ready institutions that prioritize security, compliance, and customer satisfaction.

Real-World Applications in Financial Services

Digital identity verification is a game-changer in financial services, ensuring secure transactions, fraud prevention, and regulatory compliance. As financial institutions move toward digital solutions, verifying customer identities quickly and accurately has become essential. With AI-powered authentication, biometrics, and document verification, digital identity verification enhances security while streamlining processes. From banking to insurance, lending to cryptocurrency, this technology improves efficiency, reduces fraud risks, and enhances customer trust.

Key Applications of Digital Identity Verification in Financial Services

- Customer Onboarding & KYC Compliance – Automates identity verification for faster, more secure customer registration.

- Fraud Prevention & Identity Theft Protection – Detects and blocks fraudulent transactions and unauthorized access.

- Secure Digital Banking & Mobile Payments – Ensures safe user authentication for online banking and mobile transactions.

- Loan & Credit Approval – Verifies borrowers’ identities to prevent fraud and speed up approvals.

- Cryptocurrency & Blockchain Security – Prevents money laundering and secures crypto transactions.

- Insurance & Claims Processing – Authenticates policyholders to prevent fraudulent claims.

- E-commerce & Digital Wallets – Enhances security for online payments and digital wallet access.

- Regulatory Compliance & AML Monitoring – Meets legal requirements for financial transactions and fraud detection.

- Investment & Wealth Management – Protects investor accounts from fraud and unauthorized access.

- Cross-Border Transactions – Verifies identities globally for secure international financial services.

Challenges and Considerations of Digital Identity Verification

While digital identity verification offers numerous advantages in securing financial transactions and preventing fraud, it also comes with its own set of challenges. Financial institutions and businesses must balance security, compliance, and user convenience while implementing verification systems. Issues such as privacy concerns, evolving fraud tactics, and regulatory complexities can impact the effectiveness of digital identity verification. Additionally, technical limitations and user adoption barriers may hinder seamless implementation. Understanding these challenges is essential for organizations to develop a robust and efficient identity verification framework.

Key Challenges and Considerations in Digital Identity Verification

1. Privacy and Data Security Concerns

Collecting and storing personal data for identity verification raises concerns about data breaches, hacking, and unauthorized access. Companies must implement strong encryption and compliance with data protection laws.

2. Regulatory Compliance Complexity

Financial institutions must comply with KYC, AML, GDPR, and other regional regulations, which vary across countries and require constant updates to verification processes.

3. Evolving Fraud Techniques

Cybercriminals continuously develop advanced identity fraud tactics, such as synthetic identity fraud and deepfake attacks, making it necessary for verification systems to stay ahead with AI and machine learning.

4. User Experience and Accessibility Issues

While security is essential, complex verification processes can frustrate users, leading to drop-offs during onboarding. A balance between security and convenience is necessary for higher adoption rates.

5. False Positives and Verification Errors

Automated verification systems may sometimes flag legitimate customers as fraudulent due to inconsistencies in document scans, facial recognition mismatches, or poor-quality images.

6. Integration with Existing Financial Systems

Implementing digital identity verification requires seamless integration with banking platforms, payment gateways, and customer databases, which can be technically challenging.

7. Scalability and Performance Issues

As financial institutions expand globally, their identity verification systems must handle high volumes of users while maintaining speed, accuracy, and compliance with diverse regulatory requirements.

8. Cost of Implementation and Maintenance

Developing and maintaining a robust digital identity verification system requires investment in technology, cybersecurity, and compliance resources, which may be costly for smaller institutions.

9. Accessibility for Underserved Populations

Not all users have government-issued IDs, biometric access, or high-quality internet connectivity, making identity verification difficult for certain demographics.

10. Legal and Ethical Considerations

The ethical use of biometric data and AI-driven verification raises concerns about user consent, discrimination, and potential biases in identity verification models.

The Future of Digital Identity Verification

As digital transactions continue to dominate financial services, the future of digital identity verification is poised for significant advancements. Emerging technologies such as artificial intelligence (AI), blockchain, and decentralized identity systems are revolutionizing how identities are verified, making the process more secure, seamless, and fraud-resistant. AI-powered biometric authentication, real-time risk assessment, and machine learning-driven fraud detection are set to enhance verification accuracy while reducing false positives. Blockchain-based digital identities promise greater privacy and control for users, allowing them to verify their identities without relying on centralized databases. Additionally, the rise of decentralized identity solutions is shifting control back to individuals, enabling them to share only the necessary identity attributes without exposing sensitive personal information. As regulatory requirements evolve and cyber threats become more sophisticated, financial institutions must adopt adaptive, AI-driven verification systems that provide a balance between security, compliance, and user experience. The future of digital identity verification will be defined by automation, trust, and innovation, ensuring safer and more efficient identity authentication in an increasingly digital world.

Conclusion

Digital identity verification has become a cornerstone of modern financial services, offering enhanced security, fraud prevention, and seamless customer onboarding. As financial institutions and businesses continue to navigate an increasingly digital world, adopting robust identity verification solutions is essential to maintaining trust, regulatory compliance, and operational efficiency. While challenges such as privacy concerns, evolving fraud tactics, and regulatory complexities persist, advancements in AI, biometrics, and blockchain are shaping the future of identity authentication. By embracing these innovations, organizations can create a more secure, user-friendly, and scalable verification process that meets the demands of both businesses and consumers. As digital identity verification continues to evolve, its role in financial services will only become more critical, ensuring a safer and more efficient digital ecosystem for years to come.