If you’re passionate about altcoins and the dynamic world of cryptocurrency, finding the right decentralized exchange (DEX) can make all the difference in your trading experience. Unlike traditional exchanges, DEXs empower you with enhanced privacy, control over your funds, and access to a wide variety of altcoins—all without relying on intermediaries. In this guide, you’ll discover the best decentralized exchanges tailored to altcoin enthusiasts, exploring their standout features, benefits, and how they cater to both seasoned traders and newcomers. Whether you’re looking for a secure platform, low fees, or a diverse selection of tokens, this article will help you navigate the exciting landscape of decentralized trading.

What Are Decentralized Exchanges?

Decentralized exchanges (DEXs) are peer-to-peer trading platforms that operate without the need for a central authority or intermediary. Unlike traditional centralized exchanges, which hold users’ funds and control transactions, DEXs leverage blockchain technology and smart contracts to facilitate direct trades between users. This structure ensures that you retain full control over your private keys and assets, enhancing security and reducing the risk of hacks or breaches. DEXs also prioritize user privacy, as they typically don’t require personal information or identity verification. With transparency built into their blockchain-based operations, all transactions are recorded publicly, fostering trust and accountability. Decentralized exchanges are revolutionizing the crypto space by providing a secure, autonomous, and censorship-resistant way to trade digital assets, making them an increasingly popular choice for altcoin enthusiasts and crypto investors.

Why Choose Decentralized Exchanges for Altcoins?

Decentralized exchanges offer a compelling alternative for trading altcoins, especially for those who value security, privacy, and control. Unlike centralized platforms, DEXs allow you to maintain full ownership of your funds and private keys, eliminating the need to trust a third party with your assets. These exchanges also offer greater privacy, as they typically do not require identity verification, enabling you to trade anonymously. Additionally, DEXs often support a wide array of altcoins, including lesser-known tokens, giving you access to unique investment opportunities. The peer-to-peer nature of decentralized exchanges ensures transparency and resilience against censorship, making them ideal for traders in jurisdictions with restrictive regulations. With lower fees, enhanced autonomy, and an emphasis on user empowerment, DEXs are the perfect choice for altcoin enthusiasts looking for a secure and versatile trading experience.

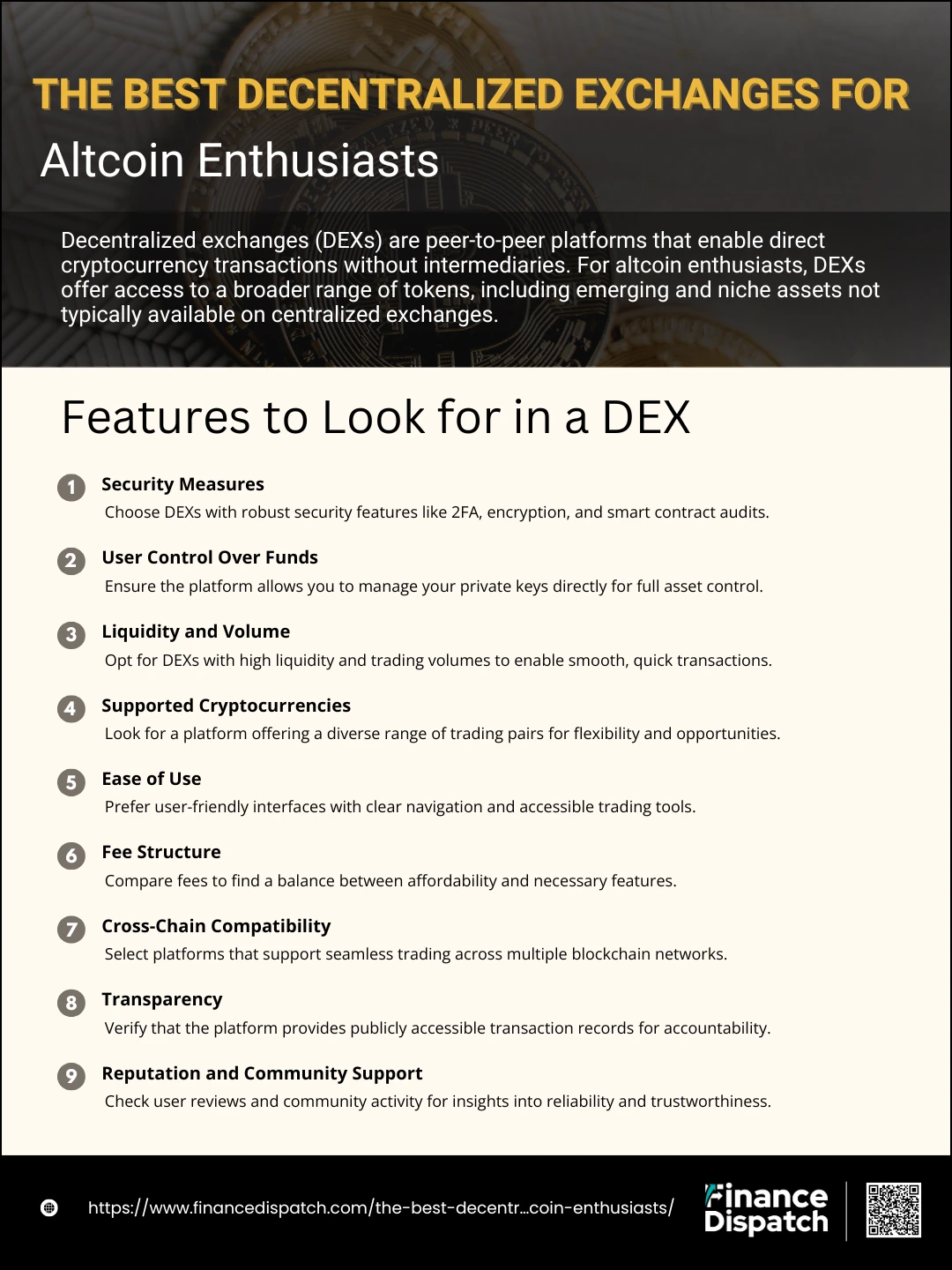

Features to Look for in a DEX

When exploring decentralized exchanges (DEXs), it’s crucial to identify platforms that align with your trading needs and preferences. A good DEX should not only provide a secure and transparent trading environment but also offer features that make your trading experience smooth and rewarding. With the growing popularity of altcoins, choosing a DEX with the right tools and capabilities can empower you to diversify your portfolio while maintaining full control over your assets. Here’s a detailed breakdown of the features to prioritize:

- Security Measures: Security should always be a top priority. Look for DEXs that implement two-factor authentication, encryption, and regular smart contract audits. These features protect your funds and prevent vulnerabilities from being exploited.

- User Control Over Funds: One of the biggest advantages of a DEX is retaining custody of your assets. Ensure the platform allows you to manage your private keys directly, offering complete control over your funds and reducing the risk of third-party interference.

- Liquidity and Volume: High liquidity and substantial trading volumes are essential for seamless transactions. Platforms with better liquidity reduce slippage and ensure your orders are executed quickly, regardless of their size.

- Supported Cryptocurrencies: A diverse selection of cryptocurrencies is a major advantage. Whether you’re trading popular altcoins or exploring niche tokens, a broad range of trading pairs ensures flexibility and investment opportunities.

- Ease of Use: Intuitive platforms with clear navigation, accessible trading tools, and easy wallet integration make a huge difference, especially for beginners or those seeking a hassle-free experience.

- Fee Structure: Trading fees and network costs can significantly impact your profits. Compare fee structures across DEXs to find one that balances affordability with the features you need.

- Cross-Chain Compatibility: With the increasing use of multiple blockchain ecosystems, cross-chain compatibility allows you to trade assets seamlessly between different networks, expanding your trading options.

- Transparency: Transparency is a hallmark of DEXs. Look for platforms that provide publicly accessible transaction records on the blockchain, ensuring fairness and accountability.

- Reputation and Community Support: A platform’s reputation can give you insights into its reliability. Read user reviews and check for active community engagement, which often reflects strong support and trustworthiness.

Top Decentralized Exchanges for Altcoin Enthusiasts

Decentralized exchanges (DEXs) have revolutionized the way traders access and manage altcoins, providing secure, transparent, and user-controlled platforms for trading. For altcoin enthusiasts, choosing the right DEX is essential for a seamless trading experience. From low fees to cross-chain compatibility, the top DEXs offer a range of features to meet diverse needs. Below is a table summarizing some of the leading decentralized exchanges and what sets them apart:

| Exchange | Unique Features | Supported Blockchains | Best For |

| Uniswap | Automated Market Maker (AMM) model, wide range of ERC-20 tokens | Ethereum | Broad token selection and liquidity |

| PancakeSwap | Low transaction fees, yield farming, and staking | Binance Smart Chain | Cost-effective trading and DeFi features |

| Curve Finance | Focus on stablecoin trading, minimal slippage | Ethereum | Stablecoin enthusiasts |

| 1inch | DEX aggregator for optimal prices across platforms | Ethereum, Binance Smart Chain, Polygon | Maximizing trade efficiency |

| SushiSwap | Community-driven governance, yield farming, and lending features | Ethereum, Binance Smart Chain, Avalanche | Comprehensive DeFi services |

| Balancer | Multi-token liquidity pools, automated portfolio management | Ethereum, Polygon | Advanced portfolio rebalancing |

| IDEX | Hybrid model combining centralized and decentralized exchange features | Ethereum, Binance Smart Chain, Polkadot | Fast trades with on-chain settlement |

| 0x Protocol | Liquidity aggregation, custom trading solutions for developers | Ethereum | Developers and custom trading platforms |

| ApeSwap | Cross-chain swaps, staking, and governance opportunities | Binance Smart Chain, Ethereum | Cross-chain token swaps |

| Kine Protocol | Layer 2 support, high leverage trading options | Ethereum, Binance Smart Chain, Avalanche | Advanced traders seeking leverage |

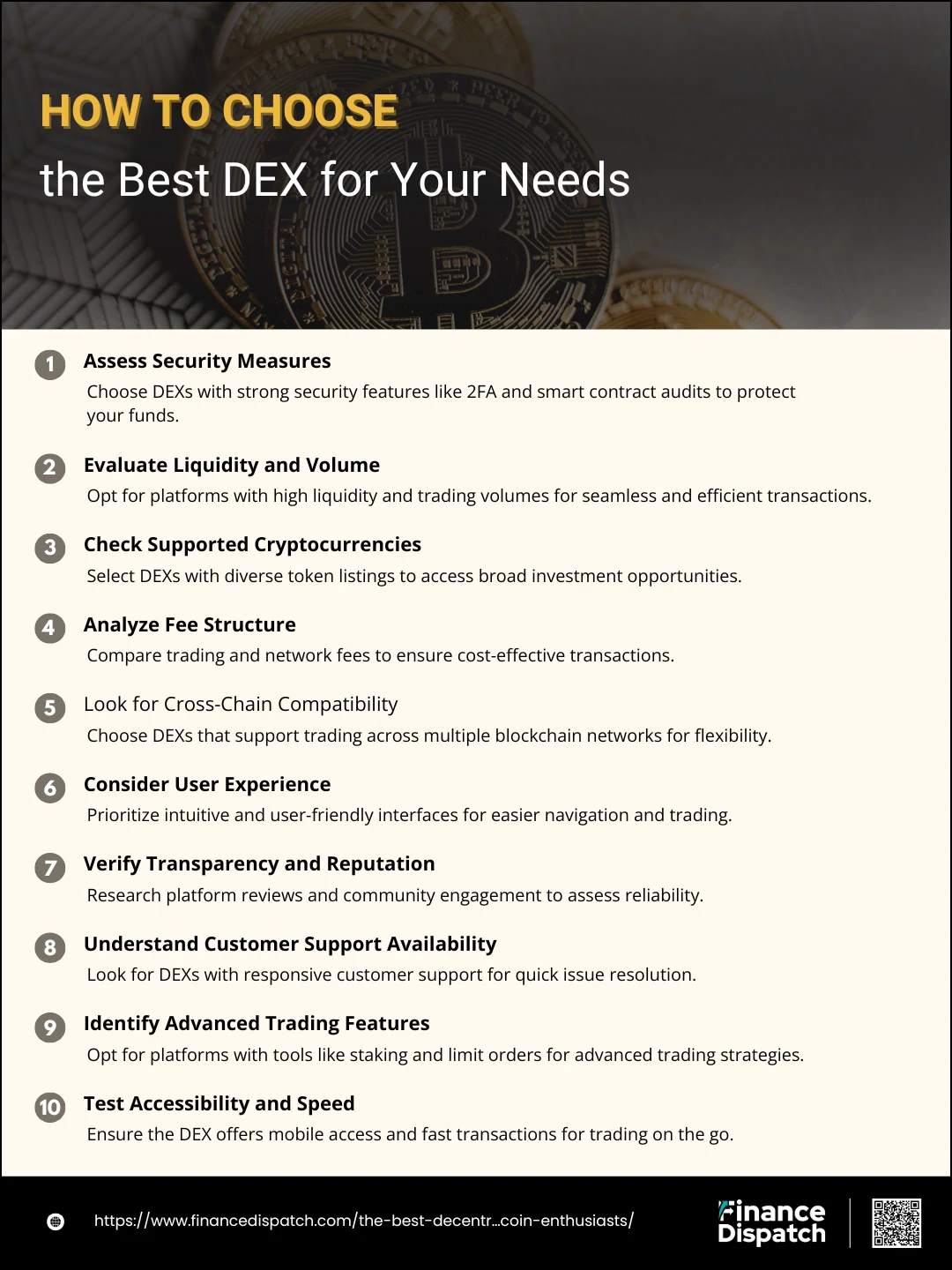

How to Choose the Best DEX for Your Needs

Choosing the best decentralized exchange (DEX) for your needs is not just about picking a popular platform; it’s about aligning the platform’s features with your trading preferences and priorities. Whether you value security, liquidity, or advanced trading tools, evaluating each DEX carefully ensures a smooth and efficient trading experience. To help you navigate the options and make an informed decision, here’s a detailed step-by-step guide:

1. Assess Security Measures

Security is paramount in cryptocurrency trading. Look for DEXs that prioritize user protection through advanced features like two-factor authentication, biometric verification, and smart contract audits. Ensure the platform is transparent about its security practices and that you maintain full control of your private keys, reducing the risk of breaches or hacks.

2. Evaluate Liquidity and Volume

Liquidity determines how easily and quickly you can execute trades without significant price fluctuations. High-volume DEXs typically offer better liquidity, ensuring smooth and seamless transactions even for larger trades. Check daily trading statistics to confirm the platform’s activity level.

3. Check Supported Cryptocurrencies

If you’re an altcoin enthusiast, a DEX with a broad range of token support is essential. Look for platforms that list both popular and niche tokens, giving you access to diverse investment opportunities. This flexibility allows you to explore new markets and diversify your portfolio.

4. Analyze Fee Structure

Trading fees and network costs can eat into your profits, especially for frequent traders. Compare the fee structures of different DEXs, including trading, deposit, and withdrawal fees, as well as gas costs. Opt for a DEX with a transparent and cost-effective pricing model.

5. Look for Cross-Chain Compatibility

In a world where multiple blockchains coexist, cross-chain compatibility can greatly enhance your trading options. Choose a DEX that supports cross-chain swaps, enabling you to trade assets across Ethereum, Binance Smart Chain, Polygon, and other networks seamlessly.

6. Consider User Experience

An intuitive interface and straightforward navigation can make or break your experience with a DEX. Platforms with easy wallet integration, responsive design, and user-friendly layouts are especially helpful for beginners, allowing them to start trading without a steep learning curve.

7. Verify Transparency and Reputation

Trust is critical in the decentralized world. Research the platform’s history, read user reviews, and check for active community engagement. DEXs that maintain transparent blockchain transaction records and have a strong reputation for reliability are more likely to meet your expectations.

8. Understand Customer Support Availability

Even in decentralized trading, technical issues or questions can arise. Look for platforms with responsive customer support through live chat, email, or dedicated help centers. Quick resolutions can save you time and frustration.

9. Identify Advanced Trading Features

Experienced traders should consider DEXs offering advanced functionalities like limit orders, staking, yield farming, and market analytics. These tools enhance your ability to manage risk, optimize profits, and execute sophisticated trading strategies.

10. Test Accessibility and Speed

Accessibility is key, especially if you trade on the go. Check if the DEX offers mobile apps or responsive web interfaces. Additionally, evaluate the platform’s transaction speed to avoid delays during crucial trades, particularly in volatile markets.

Advantages and Disadvantages of DEX Exchanges

Decentralized exchanges (DEXs) have gained significant traction in the cryptocurrency world, offering traders a unique, decentralized way to buy, sell, and manage digital assets. Unlike centralized exchanges, DEXs operate without intermediaries, using blockchain technology and smart contracts to facilitate peer-to-peer transactions. While they provide numerous benefits such as enhanced privacy and security, they also come with challenges that may not suit every trader’s needs. Here’s a closer look at the advantages and disadvantages of DEXs:

Advantages of DEX Exchanges

1. Enhanced Security

With no centralized entity holding your funds, the risk of large-scale hacks is greatly reduced. You maintain full control over your private keys and assets, significantly enhancing security.

2. Greater Privacy

DEXs often bypass the need for identity verification (KYC/AML), allowing you to trade anonymously without sharing sensitive personal information, which is a key benefit for privacy-conscious users.

3. Complete Control Over Funds

DEXs enable you to trade directly from your wallet, eliminating the need to deposit assets into an exchange. This reduces the risks associated with exchange failures or fraud.

4. Censorship Resistance

Decentralized platforms are blockchain-based and operate independently of centralized authorities. This makes them resistant to shutdowns, government interference, and regulatory pressures, ensuring unrestricted access for users worldwide.

5. Wide Range of Tokens

DEXs often list new and emerging tokens that centralized exchanges might not support, providing access to a broader and more diverse range of investment opportunities.

6. Transparency

All transactions are recorded on the blockchain, ensuring full transparency and accountability. You can verify every trade and transaction history on the network.

7. Lower Fees

Without intermediaries, DEXs often have lower trading fees. While network costs (e.g., gas fees) apply, overall expenses can be reduced compared to centralized platforms.

Disadvantages of DEX Exchanges

1. Lower Liquidity

DEXs often suffer from lower trading volumes compared to centralized exchanges. This can lead to challenges in executing trades quickly and efficiently, especially for large orders.

2. Complexity for Beginners

Managing private keys and interacting with blockchain wallets can be daunting for newcomers. The lack of centralized support can make the learning curve steeper for those unfamiliar with decentralized trading.

3. Limited Customer Support

DEXs rarely offer customer service. If you encounter technical issues or lose access to your wallet, there’s no help desk to assist you.

4. Vulnerability to Smart Contract Bugs

While smart contracts automate trading, they are not immune to coding vulnerabilities or bugs. An exploit in the contract can lead to significant financial losses if not audited thoroughly.

5. Slow Transactions

Network congestion on blockchains like Ethereum can result in slower transaction times and increased gas fees, particularly during high trading activity.

6. Limited Trading Features

Advanced trading options like margin trading, stop-loss orders, and futures contracts are often unavailable on DEXs, which can be a disadvantage for traders seeking more sophisticated tools.

7. Risk of Losing Private Keys

In a DEX environment, you are fully responsible for safeguarding your private keys. Losing them means losing access to your funds, with no recovery options available.

8. Regulatory Uncertainty

While DEXs are resistant to censorship, their regulatory status remains ambiguous in many jurisdictions. This could pose risks for users in regions with strict financial laws.

9. Potential for High Fees in Congested Networks

Although DEXs often have lower trading fees, network fees like Ethereum’s gas costs can spike during periods of high activity, making trades expensive.

Tips for Maximizing Your Experience with DEXs

To make the most of your decentralized exchange (DEX) trading experience, it’s essential to adopt strategies that enhance security, efficiency, and profitability. Here are some practical tips to help you navigate DEXs like a pro:

1. Prioritize Security

- Use a hardware wallet: Protect your private keys with a hardware wallet to reduce the risk of hacks.

- Enable multi-factor authentication: While DEXs may not offer this directly, securing your associated email and other accounts adds an extra layer of protection.

- Double-check smart contract addresses: Ensure you’re interacting with the correct smart contracts to avoid phishing scams or fraudulent tokens.

2. Optimize Your Trading Costs

- Monitor gas fees: Network fees, especially on Ethereum, can fluctuate significantly. Use tools like gas trackers to trade when fees are lower.

- Batch your transactions: If possible, combine multiple trades into fewer transactions to save on fees.

3. Research and Stay Informed

- Understand the tokens: Research the altcoins you want to trade to evaluate their potential and associated risks.

- Stay updated on DEX developments: Join forums, follow DEX-related news, and participate in communities to learn about upgrades and new features.

4. Leverage Advanced Features

- Use DEX aggregators: Platforms like 1inch can help you find the best prices across multiple DEXs.

- Explore staking and liquidity pools: Earn passive income by staking tokens or providing liquidity on supported DEXs.

5. Test with Small Transactions

- Start small: Test the platform with a minor transaction to familiarize yourself with its interface and ensure smooth execution.

- Check transaction details: Double-check gas settings, recipient addresses, and token amounts before confirming trades.

6. Manage Your Wallet Responsibly

- Backup your seed phrases: Store them securely in multiple physical locations to avoid losing access to your funds.

- Use multiple wallets: Segregate your trading, long-term holding, and experimental funds into different wallets for better organization and risk management.

7. Plan Your Trades

- Set goals and limits: Determine your entry and exit points and stick to your trading strategy.

- Avoid FOMO: Resist impulsive trades driven by market hype, as DEXs often feature volatile assets.

8. Stay Vigilant Against Scams

- Verify token authenticity: Cross-check token contracts on reliable sources like the official project website or blockchain explorers.

- Avoid too-good-to-be-true offers: Scammers often exploit decentralized platforms with enticing but fraudulent schemes.

Conclusion

Decentralized exchanges (DEXs) have emerged as a revolutionary tool in the cryptocurrency space, offering unparalleled control, security, and flexibility for traders, particularly altcoin enthusiasts. While they provide significant benefits like enhanced privacy, direct ownership of funds, and access to diverse tokens, they also come with challenges such as lower liquidity and a steeper learning curve for beginners. By understanding their advantages and limitations, evaluating platforms based on your specific needs, and adopting best practices, you can unlock the full potential of DEXs. Whether you’re a seasoned trader seeking autonomy or a newcomer exploring the decentralized landscape, DEXs empower you to engage with the crypto market on your terms, fostering a more transparent and inclusive trading ecosystem.