You’ve probably heard the buzz around blockchain and cryptocurrencies, but do you truly understand how they’re connected? At the heart of every cryptocurrency transaction lies blockchain technology—a revolutionary system that has reshaped the way we think about digital finance. Blockchain isn’t just about Bitcoin or Ethereum; it’s a groundbreaking technology that enables secure, transparent, and decentralized transactions across a global network. In this article, you’ll dive into the mechanics of blockchain, understand its critical role in powering cryptocurrencies, and explore why it’s considered the backbone of the digital currency revolution. Whether you’re a seasoned investor or just curious about the future of money, this journey into blockchain will give you the insights you need to grasp its transformative potential.

What is Blockchain Technology?

At its core, blockchain technology is a secure, decentralized digital ledger that records transactions across a network of computers. Think of it as a digital spreadsheet duplicated across thousands of systems, where every transaction is transparently recorded and permanently stored. Unlike traditional centralized systems controlled by a single authority, blockchain operates on a peer-to-peer network, ensuring no single entity can manipulate or alter the records. Each transaction is grouped into a “block,” secured with cryptographic hashes, and linked to the previous one, forming an unchangeable “chain.” This structure guarantees transparency, immutability, and security, making blockchain not just a foundation for cryptocurrencies like Bitcoin and Ethereum but also a powerful tool for industries ranging from finance to healthcare. In short, blockchain technology isn’t just a buzzword—it’s the engine driving a more secure and transparent digital future.

The Role of Blockchain in Cryptocurrency

Blockchain is the backbone of cryptocurrency, providing the secure and transparent infrastructure that makes digital currencies like Bitcoin and Ethereum possible. At its core, blockchain acts as a decentralized digital ledger, recording every cryptocurrency transaction across a global network of computers. This eliminates the need for intermediaries, such as banks or payment processors, reducing costs and transaction times while increasing transparency and security. Each transaction is verified by a consensus mechanism, ensuring accuracy and preventing fraud. Once a transaction is recorded on the blockchain, it becomes immutable—it cannot be altered or tampered with. This level of trust and security is critical for cryptocurrencies, as it allows users to transfer value directly to one another without relying on centralized authorities. In essence, blockchain doesn’t just power cryptocurrency; it redefines trust in the digital financial world.

Key Advantages of Blockchain Technology in Cryptocurrencies

Blockchain technology serves as the foundation of cryptocurrencies, offering significant advantages that have revolutionized digital finance. Its decentralized nature eliminates the need for intermediaries, while its transparent and secure design builds trust among users. These features not only streamline transactions but also ensure data integrity and fraud prevention. Below are the key advantages that make blockchain technology indispensable in the world of cryptocurrencies:

1. Decentralization

In traditional finance, banks or payment platforms act as intermediaries to validate transactions. Blockchain eliminates this need by allowing transactions to occur directly between users on a peer-to-peer network. This decentralized model reduces the risk of system failures, fraud, and unnecessary delays, empowering users to have full control over their digital assets.

2. Transparency

Every transaction on a blockchain is recorded on a public ledger, visible to anyone who wants to verify it. This level of transparency prevents dishonest practices, builds accountability, and ensures that no unauthorized changes can be made to the transaction history.

3. Security

Blockchain uses advanced cryptographic algorithms to secure transactions and data. Each block in the chain is encrypted and linked to the previous block through a unique cryptographic hash. This makes altering or tampering with data nearly impossible, ensuring a high level of security for users’ funds and information.

4. Immutability

Once a transaction is recorded on the blockchain, it cannot be changed or deleted. This immutability creates a reliable, permanent historical record of every transaction, reducing the risk of fraud, errors, or data manipulation.

5. Cost Efficiency

Traditional financial transactions often involve multiple intermediaries, resulting in high processing fees. Blockchain removes these intermediaries, allowing for direct transactions and significantly lowering operational costs. This is particularly beneficial for cross-border payments, which are traditionally slow and expensive.

6. Speed

Cross-border transactions in traditional banking systems can take days to settle. Blockchain processes these transactions almost instantly, thanks to its decentralized and automated system. This speed enhances efficiency and allows businesses and individuals to move funds seamlessly across borders.

7. Accessibility

Blockchain technology is open to anyone with an internet connection, making it particularly impactful in regions where traditional banking systems are either underdeveloped or inaccessible. Cryptocurrencies running on blockchain networks provide financial inclusion to unbanked populations, empowering them to participate in the global economy.

8. Trustless Environment

In traditional finance, trust is placed in intermediaries like banks or escrow services to facilitate transactions. Blockchain replaces this need with mathematical algorithms and consensus protocols, ensuring transactions are validated transparently without requiring trust in a third party.

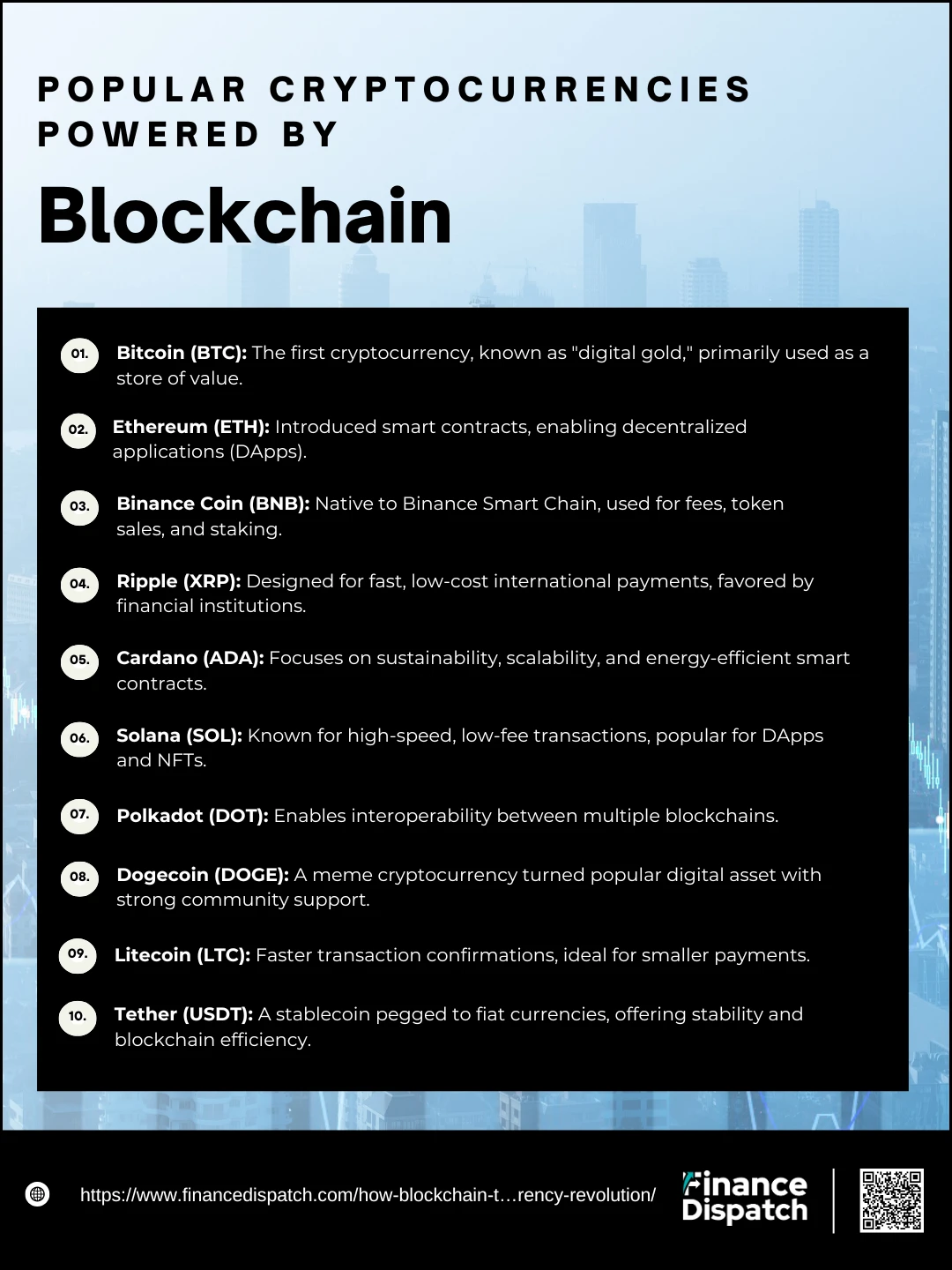

Popular Cryptocurrencies Powered by Blockchain

Blockchain technology serves as the foundation for the world’s most popular cryptocurrencies, enabling secure, transparent, and decentralized transactions. Each cryptocurrency operates on its unique blockchain network, offering distinct features and capabilities. While Bitcoin remains the most recognized cryptocurrency, many others have emerged, each addressing specific challenges and use cases. Below are some of the most prominent cryptocurrencies powered by blockchain technology:

1. Bitcoin (BTC)

Launched in 2009 by the mysterious Satoshi Nakamoto, Bitcoin is the first and most well-known cryptocurrency. Operating on a decentralized blockchain network, it allows peer-to-peer transactions without intermediaries like banks. Known as “digital gold,” Bitcoin is primarily used as a store of value and a hedge against inflation.

2. Ethereum (ETH)

Created by Vitalik Buterin in 2015, Ethereum introduced smart contracts—self-executing agreements written in code. This innovation expanded blockchain’s use cases beyond just financial transactions, enabling the development of decentralized applications (DApps).

3. Binance Coin (BNB)

Originally launched on the Ethereum blockchain, Binance Coin later migrated to its blockchain, Binance Smart Chain (BSC). It serves as the native cryptocurrency of the Binance Exchange and is widely used for transaction fees, token sales, and staking.

4. Ripple (XRP)

Ripple operates on the RippleNet blockchain, offering fast and low-cost cross-border payments. It is primarily designed to facilitate international transactions for financial institutions, making it a preferred choice for banks and payment providers.

5. Cardano (ADA)

Founded by Charles Hoskinson, a co-founder of Ethereum, Cardano focuses on sustainability, scalability, and interoperability. It uses a proof-of-stake consensus mechanism to ensure energy-efficient transactions and secure smart contracts.

6. Solana (SOL)

Known for its high-speed transactions and low fees, Solana has gained significant traction among developers of decentralized applications and non-fungible tokens (NFTs). Its blockchain can handle thousands of transactions per second, making it one of the fastest networks available.

7. Polkadot (DOT)

Polkadot enables multiple blockchains to operate and communicate seamlessly. Its unique multi-chain architecture promotes interoperability, allowing diverse blockchains to share data and assets securely.

8. Dogecoin (DOGE)

Initially created as a joke, Dogecoin gained widespread popularity due to its active online community and endorsements from high-profile figures like Elon Musk. Despite its lighthearted origins, Dogecoin remains a widely traded cryptocurrency.

9. Litecoin (LTC)

Often referred to as the “silver to Bitcoin’s gold,” Litecoin was created to offer faster transaction confirmation times and a more efficient mining process. It is commonly used for smaller, everyday transactions.

10. Tether (USDT)

As a stablecoin, Tether is pegged to traditional fiat currencies like the US dollar. It aims to provide the stability of traditional money while leveraging blockchain’s efficiency and transparency.

How Blockchain Ensures Security in Cryptocurrency Transactions

Security is one of the defining strengths of blockchain technology, making it the backbone of cryptocurrency transactions. Blockchain achieves this by combining cryptographic algorithms, decentralized networks, and consensus mechanisms to create an immutable and transparent system. Each transaction is recorded in a block, verified by multiple nodes, and linked securely to the previous block through cryptographic hashes. This structure makes it nearly impossible for anyone to alter or manipulate transaction data without being detected. Below is a detailed breakdown of the key elements that ensure security in cryptocurrency transactions:

| Security Mechanism | Description | How It Enhances Security |

| Cryptographic Hashing | Transactions are encrypted using cryptographic algorithms like SHA-256. | Ensures data integrity and prevents tampering. |

| Decentralization | Transaction records are stored across multiple nodes in a peer-to-peer network. | Eliminates single points of failure and reduces vulnerability to hacking. |

| Consensus Mechanisms | Transactions are verified by a majority of network participants using methods like Proof of Work (PoW) or Proof of Stake (PoS). | Prevents malicious actors from manipulating transactions. |

| Immutable Ledger | Once a transaction is added to the blockchain, it cannot be altered or deleted. | Creates a permanent and tamper-proof record of all transactions. |

| Digital Signatures | Transactions require private and public cryptographic keys for authorization. | Ensures only authorized users can approve and initiate transactions. |

| Transparency | All transactions are recorded on a public ledger visible to every participant. | Increases accountability and reduces fraudulent activity. |

| Smart Contracts | Self-executing contracts automatically validate and execute transactions when conditions are met. | Reduces the risk of human error and fraud. |

| Time-Stamping | Each transaction is time-stamped and chronologically ordered on the blockchain. | Prevents double-spending and ensures transaction history remains accurate. |

Real-World Applications of Blockchain Beyond Cryptocurrencies

While blockchain technology is most commonly associated with cryptocurrencies like Bitcoin and Ethereum, its potential reaches far beyond digital currencies. The core features of blockchain—decentralization, transparency, immutability, and security—make it an ideal solution for a variety of industries. From healthcare and supply chain management to real estate and digital identity, blockchain is revolutionizing how data is stored, shared, and verified. Below are some key real-world applications of blockchain technology beyond cryptocurrencies:

- Supply Chain Management: Blockchain offers end-to-end transparency and traceability in supply chains, allowing businesses and consumers to track products from manufacturing to delivery, reducing fraud and ensuring authenticity.

- Healthcare Data Security: Patient records can be securely stored on blockchain networks, ensuring data privacy, seamless access for authorized personnel, and prevention of unauthorized tampering.

- Digital Identity Verification: Blockchain-based digital IDs provide secure and tamper-proof identity verification, reducing identity fraud and streamlining authentication processes.

- Smart Contracts: Self-executing contracts automate business processes, ensuring trust and eliminating the need for intermediaries in sectors like real estate, insurance, and legal agreements.

- Voting Systems: Blockchain-based voting platforms offer secure, transparent, and tamper-proof election processes, reducing the risk of fraud and manipulation.

- Financial Services: Beyond cryptocurrencies, blockchain simplifies cross-border payments, reduces transaction fees, and enhances security in financial transactions.

- Intellectual Property Protection: Creators can timestamp their digital content on blockchain, protecting copyrights and ensuring fair compensation for their work.

- Real Estate Transactions: Property records and ownership can be securely stored on blockchain networks, reducing fraud and streamlining title transfers.

- Charity and Donations: Blockchain ensures transparency in charitable donations, allowing donors to track how their funds are being used and ensuring accountability from organizations.

- Energy Trading: Peer-to-peer energy trading on blockchain allows households to buy and sell excess energy securely and transparently without intermediaries.

Challenges Facing Blockchain and Cryptocurrencies

Blockchain and cryptocurrencies have brought transformative changes to digital finance, supply chain management, healthcare, and more. However, despite their potential, they face significant challenges that slow down widespread adoption and integration. Issues such as scalability limitations, regulatory uncertainty, energy inefficiency, and technical complexities continue to pose barriers. These challenges not only affect the performance and trustworthiness of blockchain systems but also limit their mainstream acceptance. Addressing these concerns is essential to unlocking the full potential of blockchain technology and creating a sustainable ecosystem for cryptocurrencies. Below, we’ll dive deeper into the key challenges facing blockchain and cryptocurrencies today:

1. Scalability Issues

One of the most significant challenges for blockchain networks is scalability. As more users join the network and transaction volumes increase, many blockchains, including Bitcoin and Ethereum, struggle to process transactions quickly and efficiently. Congested networks result in slow transaction speeds and higher fees, making them less practical for large-scale commercial use. Solutions like Layer 2 technologies and sharding are being developed, but scalability remains a persistent issue.

2. Energy Consumption

Proof of Work (PoW) consensus mechanisms, used by major cryptocurrencies like Bitcoin, require immense computational power to validate transactions and secure the network. This process consumes vast amounts of electricity, raising environmental concerns and making blockchain networks less sustainable. Although newer consensus mechanisms like Proof of Stake (PoS) are more energy-efficient, the environmental impact of blockchain mining continues to be a point of contention.

3. Regulatory Uncertainty

Governments worldwide are still grappling with how to regulate blockchain and cryptocurrencies. Some countries have embraced the technology, while others have imposed strict regulations or outright bans. Inconsistent regulatory frameworks create uncertainty for businesses, developers, and investors, hindering innovation and global adoption. Clear and balanced regulations are essential for fostering trust and ensuring compliance.

4. Security Risks

While blockchain itself is highly secure due to cryptographic encryption and decentralized consensus mechanisms, vulnerabilities exist in surrounding systems such as cryptocurrency exchanges, wallets, and third-party platforms. Hacks, phishing attacks, and fraud schemes have resulted in billions of dollars in losses. Strengthening security across the entire cryptocurrency ecosystem remains a critical challenge.

5. User Adoption and Technical Complexity

Blockchain technology is still in its early stages, and for many users, it remains overly technical and complex. Concepts like private keys, digital wallets, and decentralized networks can be intimidating for non-technical individuals. Additionally, the lack of user-friendly interfaces and intuitive applications makes it difficult for average users to engage with blockchain platforms effectively.

6. Volatility in Cryptocurrencies

Cryptocurrencies are known for their extreme price volatility, with values often swinging dramatically within short periods. This volatility undermines their use as a stable store of value or a reliable medium of exchange. Stablecoins aim to address this issue by pegging their value to traditional assets, but broader market stability remains elusive.

7. Integration with Existing Systems

For blockchain to gain mainstream adoption, it must integrate seamlessly with existing financial and business systems. However, many legacy systems are not designed to interact with blockchain technology. The cost and complexity of upgrading infrastructure to accommodate blockchain solutions often deter organizations from pursuing integration.

8. Privacy Concerns

While blockchain offers transparency through public ledgers, this feature can also create privacy concerns. Transaction details, although pseudonymous, are visible to everyone on the network. In some cases, this transparency may expose sensitive financial information, deterring individuals and businesses from using blockchain platforms.

9. Decentralization vs. Control

Decentralization is one of blockchain’s core strengths, but it also introduces challenges. Governments, regulatory authorities, and financial institutions often find it difficult to monitor and control decentralized networks. This lack of centralized oversight can lead to misuse and resistance from traditional authorities, slowing adoption.

10. Environmental Impact

Beyond energy consumption, blockchain mining generates significant electronic waste. The frequent replacement of mining hardware due to technological advancements contributes to environmental harm. Balancing blockchain’s technological benefits with environmental responsibility remains a challenge.

The Future of Blockchain in Cryptocurrency

The future of blockchain in cryptocurrency looks incredibly promising, with innovations and advancements set to redefine the global financial landscape. As blockchain technology continues to mature, scalability issues are being addressed through solutions like Layer 2 networks and improved consensus mechanisms such as Proof of Stake (PoS). These enhancements aim to make blockchain faster, more energy-efficient, and capable of handling larger transaction volumes. Regulatory clarity is also expected to improve, providing a more stable environment for businesses, investors, and users. Decentralized finance (DeFi), non-fungible tokens (NFTs), and Central Bank Digital Currencies (CBDCs) are just a few areas where blockchain’s influence is expanding rapidly. With greater integration into industries such as healthcare, real estate, and supply chain management, blockchain will likely transcend its association with cryptocurrencies and become a fundamental part of everyday digital interactions. For cryptocurrencies, this means improved security, enhanced privacy options, and broader mainstream acceptance. As blockchain evolves, it’s clear that its role in powering digital currencies will only grow, driving a future where financial systems are more transparent, inclusive, and resilient.

Conclusion

Blockchain technology has proven to be much more than just the foundation of cryptocurrencies—it’s a transformative force reshaping finance, business, and digital innovation. Its core principles of decentralization, transparency, security, and immutability have addressed long-standing challenges in trust, efficiency, and data integrity. While cryptocurrencies like Bitcoin and Ethereum remain the most well-known applications, blockchain’s potential extends into industries such as healthcare, supply chain management, and digital identity verification. However, challenges like scalability, regulatory uncertainty, and environmental concerns still need to be addressed for blockchain to reach its full potential. As the technology matures and adoption grows, blockchain will play an even more critical role in creating a future where financial systems are more inclusive, secure, and transparent. The revolution has only just begun, and those who understand and embrace blockchain now will be well-positioned to thrive in this digital era.