If you’ve been paying attention to the financial world lately, you’ve probably heard about Decentralized Finance, or DeFi, making waves across global markets. DeFi isn’t just a buzzword—it’s a transformative shift in how we think about money, investments, and financial independence. Built on blockchain technology, DeFi removes traditional intermediaries like banks and brokers, giving you direct control over your financial transactions. But beyond the technology lies an incredible investment opportunity: DeFi tokens. These digital assets are more than just speculative instruments; they’re the backbone of a rapidly growing financial ecosystem. In this article, you’ll discover what makes DeFi tokens unique, why they’re gaining traction, and how they could become a game-changing addition to your investment portfolio. Whether you’re an experienced investor or someone just starting to explore digital assets, understanding DeFi tokens might just be your next big financial move.

What are DeFi Tokens?

DeFi tokens are the lifeblood of decentralized finance platforms, acting as digital assets that power a wide range of financial services without relying on traditional intermediaries like banks or financial institutions. Built primarily on blockchain networks such as Ethereum, these tokens facilitate various activities, including lending, borrowing, trading, and even governance of decentralized protocols. Unlike traditional financial assets, DeFi tokens are not bound by geographic restrictions or banking hours—they operate 24/7 on a global scale. Each token serves a specific purpose within its ecosystem. Some act as governance tokens, giving holders a voice in decision-making processes, while others provide liquidity or are used to pay transaction fees. What sets DeFi tokens apart is their ability to create financial opportunities that are transparent, secure, and accessible to anyone with an internet connection. As the DeFi space continues to grow, these tokens are becoming essential tools for unlocking the full potential of decentralized financial systems.

How DeFi Tokens Work

At their core, DeFi tokens are digital assets that operate on blockchain networks to enable decentralized financial services. Unlike traditional finance, which relies on intermediaries like banks or brokers, DeFi tokens use smart contracts—self-executing agreements written in code—to facilitate transactions, lending, borrowing, and other financial activities. These tokens aren’t just digital currencies; they often serve specific purposes within their ecosystems, such as governance, liquidity provision, or as rewards for participation. With transparency, security, and global accessibility baked into their design, DeFi tokens empower users to take full control of their financial interactions.

- Governance: Token holders can vote on platform upgrades, changes, and future developments, giving them a say in how the protocol operates.

- Liquidity Provision: Users can deposit their tokens into liquidity pools, enabling smoother trading on decentralized exchanges while earning rewards.

- Yield Farming: Tokens can be staked or locked into smart contracts to earn interest or additional tokens over time.

- Collateralization: DeFi tokens are often used as collateral for loans within decentralized lending platforms.

- Transaction Fees: Some tokens are used to pay fees for transactions or services on their respective platforms.

- Rewards and Incentives: Platforms often reward users with DeFi tokens for participating in activities like trading, staking, or providing liquidity.

- Access to Services: Certain DeFi tokens grant users access to premium features or exclusive financial products on their platforms.

Benefits of Investing in DeFi Tokens

Investing in DeFi tokens has become an exciting opportunity for individuals seeking financial growth, independence, and access to innovative financial tools. Unlike traditional financial systems, which rely on centralized institutions like banks and brokers, DeFi operates on blockchain technology, offering a decentralized, transparent, and globally accessible financial ecosystem. DeFi tokens act as the backbone of this ecosystem, serving various purposes, from governance and liquidity provision to collateralization and yield farming. They aren’t just digital assets; they represent ownership, access, and participation in decentralized financial services. Whether you’re an experienced investor or just starting out, understanding the benefits of DeFi tokens can help you leverage this emerging financial revolution for significant long-term rewards.

Top Benefits of Investing in DeFi Tokens:

1. Decentralized Control: DeFi tokens remove the need for intermediaries like banks or financial service providers. You have full control over your assets, transactions, and financial decisions without relying on third-party approvals.

2. Global Accessibility: With just an internet connection, you can participate in the DeFi ecosystem from anywhere in the world. There are no barriers based on geography, credit scores, or financial history.

3.Transparency: All transactions on a DeFi platform are recorded on a public blockchain, offering unmatched visibility and accountability. This reduces fraud, corruption, and manipulation.

4. High Earning Potential: DeFi tokens offer opportunities for earning substantial returns through yield farming, liquidity mining, and staking, enabling investors to generate passive income.

5. Liquidity Provision Rewards: By contributing DeFi tokens to liquidity pools on decentralized exchanges, you can earn rewards in the form of fees, additional tokens, or interest payouts.

6. Governance Rights: Many DeFi tokens come with voting rights, allowing holders to participate in protocol governance. This means you can have a direct say in decisions regarding platform upgrades, tokenomics, and future developments.

7. Lower Transaction Costs: DeFi platforms often have significantly lower transaction fees compared to traditional financial systems, making them cost-effective for both small and large transactions.

8. Innovation and Growth Opportunities: The DeFi space is constantly evolving, introducing new financial products and services. Early adoption of promising projects can lead to substantial returns on investment.

9. Financial Inclusion: DeFi tokens democratize access to financial services, enabling individuals who are underserved or unbanked by traditional financial institutions to participate in global financial markets.

10. Portfolio Diversification: Investing in DeFi tokens allows you to diversify your financial portfolio beyond traditional stocks, bonds, or real estate, offering exposure to innovative digital assets.

Risks and Challenges of DeFi Investments

Decentralized Finance (DeFi) offers exciting opportunities for financial growth, but it’s not without its pitfalls. From smart contract vulnerabilities to market volatility, here are the key risks and challenges every DeFi investor should know.

1. Smart Contract Vulnerabilities: DeFi platforms rely heavily on smart contracts, and poorly written or unaudited code can be exploited by hackers, resulting in significant financial losses.

2. Market Volatility: Cryptocurrency markets are notoriously volatile, and DeFi tokens are no exception. Prices can swing dramatically within hours, leading to substantial gains—or losses.

3. Liquidity Risks: DeFi platforms depend on liquidity pools. If users rapidly withdraw their assets, it can lead to liquidity shortages, causing disruptions in lending, borrowing, and trading activities.

4. Regulatory Uncertainty: Governments and regulatory bodies worldwide are still figuring out how to handle DeFi. Sudden changes in regulations can affect the value and usability of DeFi tokens.

5. Governance Risks: While governance tokens allow users to participate in decision-making, they can also lead to power concentration if a small group of holders accumulates a significant portion of the tokens.

6. Custody Risks: In DeFi, you are responsible for securing your private keys and wallet access. Losing your private keys means losing access to your assets permanently.

7. Scams and Fraud: The decentralized nature of DeFi also attracts malicious actors who create fraudulent projects or execute “rug pulls,” where developers suddenly abandon a project and drain user funds.

8. Complexity and User Error: DeFi platforms often require technical knowledge for proper use. Mistakes, like sending funds to the wrong address or mismanaging wallets, can lead to irreversible losses.

9. Dependency on Stablecoins: Many DeFi systems rely on stablecoins like USDT or DAI, and their stability is critical. Any de-pegging event or regulatory action affecting these stablecoins can destabilize the entire ecosystem.

10. Network Congestion and High Gas Fees: DeFi platforms, especially those on Ethereum, can face network congestion during high activity periods, resulting in slower transactions and exorbitantly high transaction fees.

Comparing Traditional Investments vs. DeFi Investments

The world of finance is rapidly evolving, with Decentralized Finance (DeFi) emerging as a powerful alternative to traditional investment options. While traditional investments rely on centralized institutions like banks, stock exchanges, and brokers, DeFi leverages blockchain technology to offer a decentralized, transparent, and global financial ecosystem. Each approach has its strengths, weaknesses, and unique characteristics that appeal to different types of investors. Understanding the differences between traditional and DeFi investments is essential for making informed financial decisions. Below is a side-by-side comparison to highlight the key distinctions between the two investment models.

| Aspect | Traditional Investments | DeFi Investments |

| Control Over Assets | Managed by intermediaries (e.g., banks, brokers). | Full control with users holding private keys. |

| Accessibility | Restricted by geography, banking systems, and regulations. | Globally accessible with just an internet connection. |

| Transaction Speed | Slower, often takes days for clearing and settlement. | Instant or near-instant transactions. |

| Transparency | Limited visibility; data is often private. | Full transparency via public blockchain ledgers. |

| Security | Backed by government regulations and insurance (e.g., FDIC). | Vulnerable to smart contract bugs, hacking risks. |

| Investment Options | Stocks, bonds, mutual funds, real estate. | Lending, staking, liquidity mining, yield farming, governance tokens. |

| Fees and Costs | Higher fees due to intermediaries. | Lower fees, but subject to gas fees during congestion. |

| Returns | Stable but often lower returns. | Potential for high returns, but with significant risk. |

| Regulation | Heavily regulated with clear legal frameworks. | Largely unregulated; evolving legal landscape. |

| Risk Level | Moderate risk with government protections. | High risk due to volatility, smart contract failures, and regulatory uncertainty. |

| Innovation Speed | Slower due to bureaucratic processes. | Rapid innovation and frequent protocol upgrades. |

Top DeFi Tokens to Watch in 2025

The world of decentralized finance (DeFi) continues to evolve, offering innovative financial solutions that bypass traditional intermediaries like banks and brokers. As DeFi protocols expand and blockchain technology advances, certain tokens are emerging as frontrunners, driving growth, innovation, and adoption across the sector. These tokens not only facilitate financial transactions but also serve as governance tools, provide liquidity, and enable lending and borrowing services. With 2024 expected to bring further advancements and mainstream adoption of DeFi technologies, keeping an eye on the most promising tokens can help investors stay ahead of the curve. Below are some of the top DeFi tokens poised to make significant impacts in the coming year.

1. Retik Finance (RETIK)

Retik Finance has rapidly established itself as an all-star in the DeFi space. Known for its innovative DeFi debit cards and AI-powered peer-to-peer lending system, Retik bridges the gap between crypto assets and real-world usability. Its Smart Crypto Payment Gateway allows seamless business transactions, eliminating traditional financial bottlenecks. With impressive early presale success and growing investor confidence, Retik is set to make waves in 2024.

2. Raydium (RAY)

Raydium, built on the Solana blockchain, is a decentralized exchange (DEX) and automated market maker (AMM). Known for its fast transaction speeds and low fees, Raydium integrates with Solana’s order book to provide superior liquidity and minimize price slippage. With the Solana ecosystem gaining traction, Raydium is expected to be a top contender in the DeFi space in 2024.

3. Curve DAO Token (CRV)

Curve Finance is the leading platform for stablecoin swaps, providing efficient, low-slippage trading. Its native token, CRV, is central to platform governance and liquidity incentives. Users who stake CRV earn additional rewards, making it an attractive investment choice. As stablecoin adoption grows, Curve’s role in DeFi remains indispensable.

4. Ankr (ANKR)

Ankr serves as the backbone of many DeFi protocols, providing essential blockchain infrastructure through decentralized node hosting and API solutions. Developers rely on Ankr to deploy and manage blockchain nodes efficiently. As DeFi adoption scales globally, the demand for Ankr’s services is set to surge in 2024.

5. JUST (JST)

Built on the TRON blockchain, JUST focuses on decentralized lending and borrowing. It allows users to deposit real-world assets as collateral and borrow stablecoins in return. This real-world asset integration into DeFi positions JUST as a unique and promising token for the coming year.

6. Aave (AAVE)

Aave remains one of the most trusted DeFi lending and borrowing platforms. Known for features like flash loans and collateral swaps, Aave provides innovative financial services while maintaining robust security. Its governance token, AAVE, continues to attract both retail and institutional investors.

7. Uniswap (UNI)

Uniswap, one of the largest decentralized exchanges (DEX), allows peer-to-peer token trading without intermediaries. Its native token, UNI, provides governance rights, enabling holders to vote on protocol upgrades and development initiatives. With DeFi trading volumes increasing, UNI remains a key player in the ecosystem.

8. Synthetix (SNX)

Synthetix facilitates the creation and trading of synthetic assets, representing real-world commodities, currencies, and financial instruments. This allows users to gain exposure to traditional assets through decentralized platforms. With growing interest in synthetic asset trading, SNX is positioned for significant growth.

9. Maker (MKR)

MakerDAO governs the DAI stablecoin, one of the most widely used decentralized stablecoins in the DeFi ecosystem. MKR holders participate in governance, ensuring stability and transparency in the DAI ecosystem. As stablecoins become more integrated into financial systems, MakerDAO’s importance continues to rise.

10. PancakeSwap (CAKE)

Operating on Binance Smart Chain (BSC), PancakeSwap is a leading decentralized exchange known for low fees, user-friendly interfaces, and robust liquidity pools. Its token, CAKE, is used for staking, liquidity provision, and governance. With the BSC network expanding, PancakeSwap remains a critical platform in the DeFi landscape.

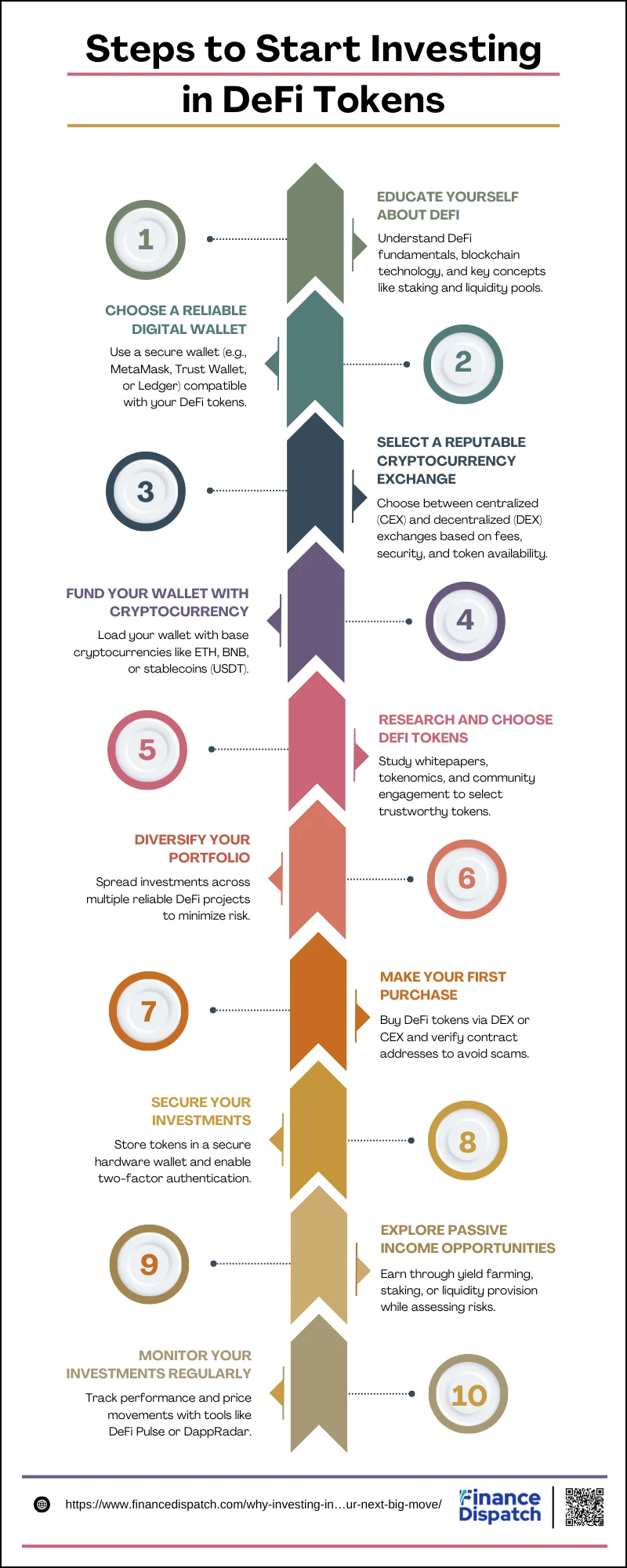

Steps to Start Investing in DeFi Tokens:

1. Educate Yourself about DeFi

Before you invest, take the time to understand the fundamentals of decentralized finance, how blockchain technology works, and the specific purpose of DeFi tokens. Read whitepapers, follow trusted DeFi resources, and learn about key concepts such as liquidity pools, staking, and governance tokens.

2. Choose a Reliable Digital Wallet

To store and manage your DeFi tokens, you’ll need a secure digital wallet. Popular options include MetaMask, Trust Wallet, and Ledger (a hardware wallet for extra security). Make sure the wallet you choose supports the tokens you plan to invest in.

3. Select a Reputable Cryptocurrency Exchange

DeFi tokens are typically available on both centralized exchanges (CEXs) like Binance and Coinbase, and decentralized exchanges (DEXs) like Uniswap and PancakeSwap. Research the best platform based on fees, security, and token availability.

4. Fund Your Wallet with Cryptocurrency

To buy DeFi tokens, you’ll need to have a base cryptocurrency such as Ethereum (ETH), Binance Coin (BNB), or stablecoins like USDT in your wallet. You can purchase these from an exchange and transfer them to your wallet.

5. Research and Choose DeFi Tokens

Not all DeFi tokens are created equal. Study the project’s whitepaper, team, use case, tokenomics, and community engagement. Look for tokens with strong utility, audited smart contracts, and transparent governance systems.

6. Diversify Your Portfolio

Avoid putting all your funds into a single token. Diversify across multiple reliable DeFi projects to reduce risk and balance potential returns.

7. Make Your First Purchase

Connect your wallet to a decentralized exchange (DEX) or use a centralized exchange to purchase your chosen DeFi tokens. Double-check the contract address of the token to avoid scams.

8. Secure Your Investments

After purchasing your tokens, transfer them to a secure wallet, preferably a hardware wallet for long-term storage. Enable two-factor authentication (2FA) and keep your recovery phrases safe and offline.

9. Explore Passive Income Opportunities

Many DeFi tokens offer opportunities for passive income through yield farming, staking, or providing liquidity to decentralized exchanges. Understand the risks and rewards of these methods before committing your tokens.

10. Monitor Your Investments Regularly

DeFi markets can be highly volatile. Use tools like DeFi Pulse, DappRadar, or portfolio trackers to monitor your investments, performance, and token price movements.

11. Stay Informed and Adapt

The DeFi space is constantly evolving, with new opportunities and risks emerging regularly. Stay updated by following DeFi news, joining community forums, and engaging with project updates.

12. Have an Exit Strategy

Plan your profit targets and risk limits in advance. Know when to sell, reinvest, or rebalance your portfolio to avoid emotional decision-making during market fluctuations.