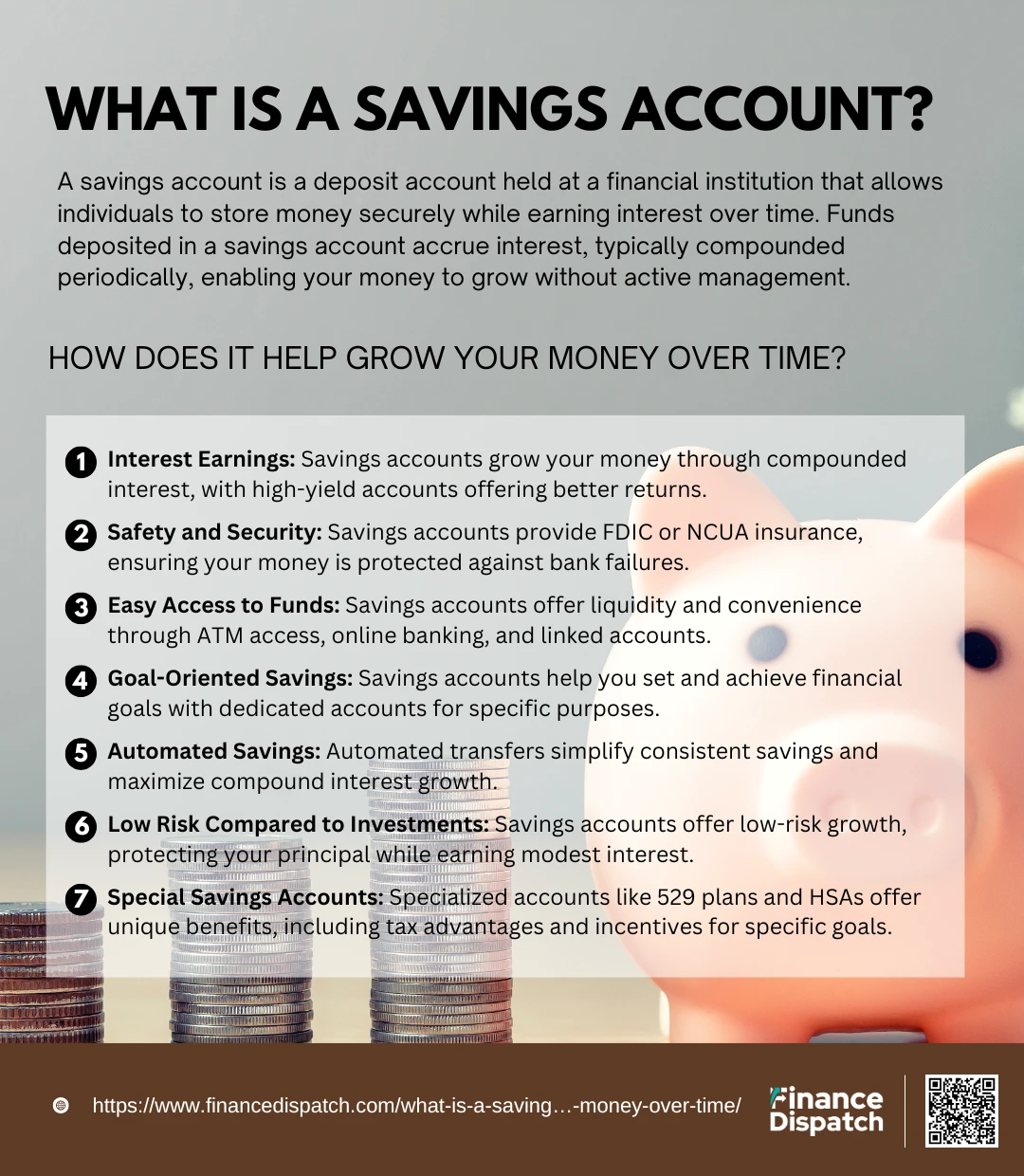

A savings account is a type of bank account designed to help you securely store money while earning interest on your balance. It serves as a financial tool for setting aside funds for short-term goals, emergencies, or future expenses, all while keeping your money easily accessible when needed. Unlike a checking account, which is primarily used for daily transactions, a savings account focuses on growing your funds through interest accumulation. Banks and credit unions typically offer savings accounts, and they are often insured up to $250,000 by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA), ensuring your money remains safe even if the financial institution faces difficulties. With features like minimal risk, interest earnings, and liquidity, savings accounts are an essential component of personal financial planning.

How Savings Accounts Help Grow Your Money Over Time

1. Interest Earnings

Savings accounts are a fundamental financial tool that enable individuals to grow their money over time through interest earnings. When you deposit funds into a savings account, the bank pays you interest, typically compounded periodically, as a reward for holding your money with them. This means that not only do you earn interest on your initial deposit, but over time, you also earn interest on the accumulated interest, leading to exponential growth of your savings. The interest rates offered can vary significantly between traditional savings accounts and high-yield savings accounts (HYSAs), with the latter often providing more competitive rates due to lower overhead costs associated with online banking institutions.

For example, consider an individual who deposits $10,000 into a high-yield savings account offering an annual interest rate of 4.85%. Over the course of a year, without any additional deposits, the account would accrue approximately $485 in interest, bringing the total balance to $10,485. In contrast, a traditional savings account with a lower interest rate would yield significantly less over the same period. By choosing a high-yield savings account, the individual takes advantage of higher interest rates, thereby maximizing the growth potential of their savings over time.

2. Safety and Security

Savings accounts offer a secure place to store your money, providing safety and peace of mind. In the United States, deposits in savings accounts are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor, per insured bank, for each account ownership category. This means that even if a bank fails, your funds are protected up to this limit, ensuring that your savings remain safe. Similarly, credit unions offer equivalent protection through the National Credit Union Administration (NCUA). This federal insurance makes savings accounts a low-risk option for individuals looking to safeguard their funds while earning interest over time.

For instance, if you deposit $200,000 into a savings account at an FDIC-insured bank, your entire balance is protected by federal insurance. This protection ensures that, in the unlikely event of the bank’s insolvency, you would recover your full deposit amount. This level of security is not typically available when keeping large sums of cash at home or investing in higher-risk financial instruments, making savings accounts a prudent choice for preserving your capital.

3. Easy Access to Funds

Savings accounts provide easy access to your funds, allowing you to withdraw money whenever needed without penalties or delays. This liquidity makes them ideal for managing emergency expenses or unexpected financial needs. Many banks offer features such as ATM access, online banking, and mobile apps, enabling you to manage your savings conveniently. Additionally, linking your savings account to a checking account can facilitate seamless transfers and may offer overdraft protection, enhancing your financial flexibility.

For example, if you have a savings account linked to your checking account, you can quickly transfer funds via your bank’s mobile app to cover an unexpected bill, such as a car repair. This immediate access ensures you can address urgent expenses without incurring high-interest debt from credit cards or loans. Furthermore, some savings accounts come with debit cards, allowing direct access to your funds at ATMs, providing both convenience and peace of mind when unforeseen expenses arise.

4. Goal-Oriented Savings

Savings accounts provide easy access to your funds, allowing you to withdraw money whenever needed without penalties or delays. This liquidity makes them ideal for managing emergency expenses or unexpected financial needs. Many banks offer features such as ATM access, online banking, and mobile apps, enabling you to manage your savings conveniently. Additionally, linking your savings account to a checking account can facilitate seamless transfers and may offer overdraft protection, enhancing your financial flexibility.

For example, if you have a savings account linked to your checking account, you can quickly transfer funds via your bank’s mobile app to cover an unexpected bill, such as a car repair. This immediate access ensures you can address urgent expenses without incurring high-interest debt from credit cards or loans. Furthermore, some savings accounts come with debit cards, allowing direct access to your funds at ATMs, providing both convenience and peace of mind when unforeseen expenses arise.

5. Automated Savings

Automated savings involve setting up regular, automatic transfers from your checking account to a savings account, ensuring consistent contributions without manual intervention. This approach fosters disciplined saving habits, reduces the temptation to spend, and leverages the power of compound interest over time. By automating savings, individuals can effortlessly build an emergency fund, save for specific goals, or prepare for retirement, all while simplifying financial management.

For instance, consider an individual who sets up an automatic transfer of $200 from their paycheck into a high-yield savings account every month. Over a year, this person would save $2,400 in principal. Assuming an annual interest rate of 4%, compounded monthly, the account would accrue approximately $49 in interest by the end of the year, bringing the total savings to about $2,449. This automated approach not only ensures regular savings but also takes advantage of compound interest, enhancing the growth of funds over time.

6. Low Risk Compared to Investments

Savings accounts are considered low-risk financial instruments, making them a secure option for individuals looking to grow their money over time without exposure to the volatility associated with investments like stocks or mutual funds. Funds deposited in savings accounts are typically insured by government agencies—such as the Federal Deposit Insurance Corporation (FDIC) in the United States—up to a certain limit, protecting depositors against bank failures. This insurance, combined with the predictable, albeit modest, interest earnings, ensures that the principal amount remains safe, providing peace of mind for conservative savers.

For example, an individual with a low risk tolerance might choose to deposit $50,000 into a high-yield savings account offering an annual interest rate of 4%. Over the course of a year, the account would earn approximately $2,000 in interest, bringing the total balance to $52,000. While this return is modest compared to potential gains from higher-risk investments, the individual benefits from the security of knowing their principal is protected and not subject to market fluctuations.

7. Special Savings Accounts

Special savings accounts are tailored to help individuals achieve specific financial goals by offering unique features and benefits. For instance, 529 college savings plans allow for tax-free growth when funds are used for qualified education expenses, making them ideal for future educational costs. Health Savings Accounts (HSAs) provide triple tax advantages—tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses—serving as both a savings tool for healthcare costs and a supplementary retirement account. Additionally, prize-linked savings accounts incentivize saving by offering chances to win cash prizes instead of traditional interest, appealing to those who enjoy lottery-like rewards without the risk of losing their principal.

For example, a family aiming to save for their child’s college education might open a 529 plan, contributing $200 monthly. Assuming an average annual return of 5%, after 18 years, the account could grow to approximately $68,000, with earnings withdrawn tax-free for educational expenses. Similarly, an individual with a high-deductible health plan could contribute to an HSA, allowing them to save pre-tax dollars for medical expenses, reducing taxable income, and potentially investing the funds for long-term growth. These specialized accounts not only encourage disciplined saving but also offer tax advantages and incentives that enhance the growth of your money over time.

How Does a Savings Account Work?

A savings account is a financial tool offered by banks and credit unions to help individuals securely store money while earning interest over time. It acts as a foundation for personal financial planning, providing a safe place for your funds while still keeping them accessible when needed. Unlike investment options, savings accounts carry minimal risk and are often insured up to $250,000 by the FDIC or NCUA, ensuring the safety of your deposits. Understanding how a savings account works—from opening and managing it to earning interest and making withdrawals—can help you maximize its benefits and grow your money steadily over time.

How a Savings Account Works: Step-by-Step

1. Opening an Account

To start, you’ll need to visit a bank branch or apply online. You’ll be asked to provide identification documents such as your Social Security number, a valid ID, and proof of address. Some accounts may require an initial deposit to activate.

2. Depositing Funds

Once your account is set up, you can deposit money using multiple methods, including direct deposits from your employer, transferring funds from another bank account, depositing checks through mobile banking, or adding cash at a branch or ATM.

3. Earning Interest

Savings accounts pay interest on your deposited balance. The interest is calculated based on the Annual Percentage Yield (APY), and it may compound daily, monthly, or annually. Compounding allows you to earn interest not only on your initial deposit but also on previously earned interest.

4. Withdrawing Money

While savings accounts are designed for holding money rather than frequent transactions, you can withdraw funds through ATMs, online banking transfers, or over-the-counter at a bank branch. However, many accounts limit the number of withdrawals or transfers you can make per month, typically to six.

5. Account Maintenance and Fees

Some savings accounts have minimum balance requirements to avoid monthly maintenance fees. If your balance drops below the required minimum, the bank may charge a fee. It’s essential to understand these rules to prevent unnecessary deductions.

6. Tax on Interest Earned

The interest you earn on your savings account is considered taxable income. If your earnings exceed $10 in a year, your bank will issue a 1099-INT form for tax reporting purposes.

7. Account Management

You can track your savings, monitor transactions, and review interest earnings through online banking portals or mobile banking apps. These tools make it easy to manage your account and ensure it aligns with your financial goals.

Different Types of Savings Accounts

Savings accounts are not a one-size-fits-all financial tool. Depending on your financial goals, lifestyle, and saving habits, there are various types of savings accounts designed to meet specific needs. Whether you’re saving for a rainy day, a child’s education, or retirement, choosing the right savings account can make a significant difference in how effectively your money grows. Below are some of the most common types of savings accounts, each offering unique features and benefits.

1. Traditional Savings Account

This is the most common type of savings account offered by banks and credit unions. It allows you to earn interest on your deposits while keeping your money easily accessible. Traditional savings accounts are ideal for emergency funds or short-term savings goals.

2. High-Yield Savings Account

High-yield savings accounts offer significantly higher interest rates compared to traditional savings accounts. They are often offered by online banks, which have lower overhead costs, enabling them to pass on the savings to customers through better interest rates.

3. Money Market Account (MMA)

A money market account combines the features of a savings account and a checking account. It typically offers higher interest rates and allows limited check-writing and debit card access, making it a flexible savings option.

4. Certificate of Deposit (CD)

A CD is a savings account where you agree to leave your money untouched for a fixed term, ranging from a few months to several years. In return, you receive a higher, fixed interest rate. Early withdrawals usually come with penalties.

5. Kids’ or Teen Savings Account

Designed specifically for children and teenagers, these accounts help teach young people the value of saving money. They often come with lower minimum balance requirements and educational tools to encourage financial literacy.

6. IRA (Individual Retirement Account) Savings Account

IRA savings accounts are specifically designed for retirement savings. They offer tax advantages depending on whether you choose a Traditional IRA (tax-deferred) or a Roth IRA (tax-free withdrawals in retirement).

7. Joint Savings Account

A joint savings account is shared by two or more people, typically spouses or family members. It allows multiple account holders to deposit, withdraw, and manage the account collaboratively.

8. Specialized Savings Account

Some banks offer specialized savings accounts tailored to specific needs, such as wedding savings accounts, vacation funds, or home down payment accounts. These accounts often come with customized features to help you meet your financial goals.

Pros and Cons of Savings Accounts

A savings account is one of the most reliable financial tools for securely storing your money while earning interest. It serves multiple purposes, from building an emergency fund to saving for short-term financial goals. With features like interest earnings, liquidity, and federal insurance protection, savings accounts are a low-risk option for safeguarding your funds. However, they also come with limitations, such as lower interest rates compared to other investment options and withdrawal restrictions. Understanding both the advantages and drawbacks can help you decide if a savings account aligns with your financial goals.

| Pros of Savings Accounts | Cons of Savings Accounts |

| Security: Deposits are insured up to $250,000 by the FDIC or NCUA, ensuring your money is safe even if the bank fails. | Low Interest Rates: Savings accounts often offer lower returns compared to investment options like stocks or certificates of deposit (CDs). |

| Liquidity: Funds are easily accessible via ATMs, online transfers, or in-person withdrawals. | Withdrawal Limits: Many savings accounts limit withdrawals to six per month, with penalties for exceeding this number. |

| Interest Earnings: Earn passive income through compound interest, which grows your savings over time. | Minimum Balance Requirements: Some accounts require a minimum balance to avoid monthly fees or to qualify for higher interest rates. |

| Goal-Oriented Saving: Savings accounts are ideal for building an emergency fund or saving for specific goals like vacations or home purchases. | Temptation to Spend: Easy access to funds might tempt you to withdraw money intended for long-term savings. |

| Automatic Transfers: Many savings accounts allow automated deposits, making consistent saving easier. | Inflation Risk: Interest earned may not always keep up with inflation, potentially reducing your purchasing power over time. |

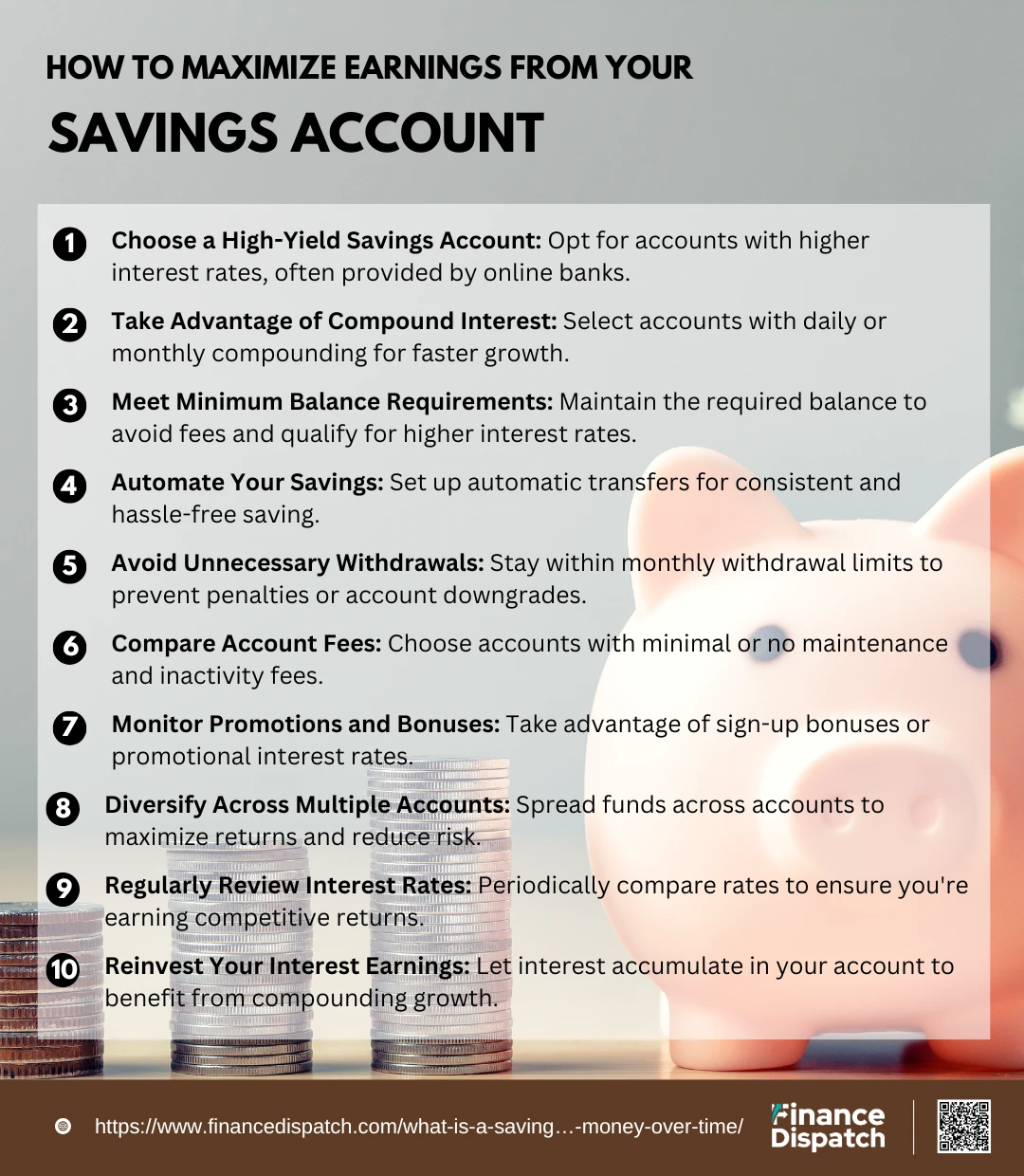

How to Maximize Earnings from Your Savings Account

A savings account is one of the safest and most reliable tools for growing your money over time. While most savings accounts offer interest on your deposits, simply letting your money sit idle won’t always maximize your returns. Interest rates, account fees, withdrawal limits, and compounding frequency can all impact how much your money grows. To make the most of your savings account, you need to adopt a strategic approach. This includes selecting the right type of account, being aware of fees, taking advantage of high-yield options, and maintaining consistent contributions. Below are actionable strategies to help you maximize your earnings from a savings account while avoiding common pitfalls.

- Choose a High-Yield Savings Account: Traditional savings accounts often offer minimal interest rates. High-yield savings accounts, typically available at online banks, provide significantly higher interest rates due to lower operational costs. These accounts are an excellent option if you’re focused on maximizing your returns.

- Take Advantage of Compound Interest: Compound interest allows you to earn interest not only on your initial deposit but also on previously earned interest. Accounts that compound daily or monthly will grow your money faster compared to accounts that compound annually.

- Meet Minimum Balance Requirements: Some savings accounts require a minimum balance to qualify for higher interest rates or to avoid monthly maintenance fees. Be aware of these thresholds and ensure your balance remains above them to maximize your returns.

- Automate Your Savings: Consistency is key to growing your savings. Set up automatic transfers from your checking account to your savings account to ensure you’re regularly contributing without relying on memory or willpower.

- Avoid Unnecessary Withdrawals: Many savings accounts have a monthly withdrawal limit, typically capped at six per month. Exceeding this limit could result in penalties or your account being converted into a checking account, potentially reducing your earnings.

- Compare Account Fees: Monthly maintenance fees, inactivity charges, or penalties for failing to meet minimum balance requirements can eat into your interest earnings. Opt for accounts with minimal or no fees to ensure your savings grow uninterrupted.

- Monitor Promotions and Bonuses: Banks often run promotional campaigns offering sign-up bonuses or higher introductory interest rates. These offers can be an excellent way to jumpstart your savings.

- Diversify Across Multiple Accounts: If you have a substantial amount to save, consider spreading your funds across multiple accounts to take advantage of varying interest rates and promotional benefits.

- Regularly Review Interest Rates: Savings account rates are subject to market fluctuations. Make it a habit to compare your current account’s interest rate with those offered by competitors to ensure you’re earning the best possible returns.

- Reinvest Your Interest Earnings: Instead of withdrawing the interest earned from your savings account, allow it to stay in your account. This will enable your balance to grow faster through compound interest.

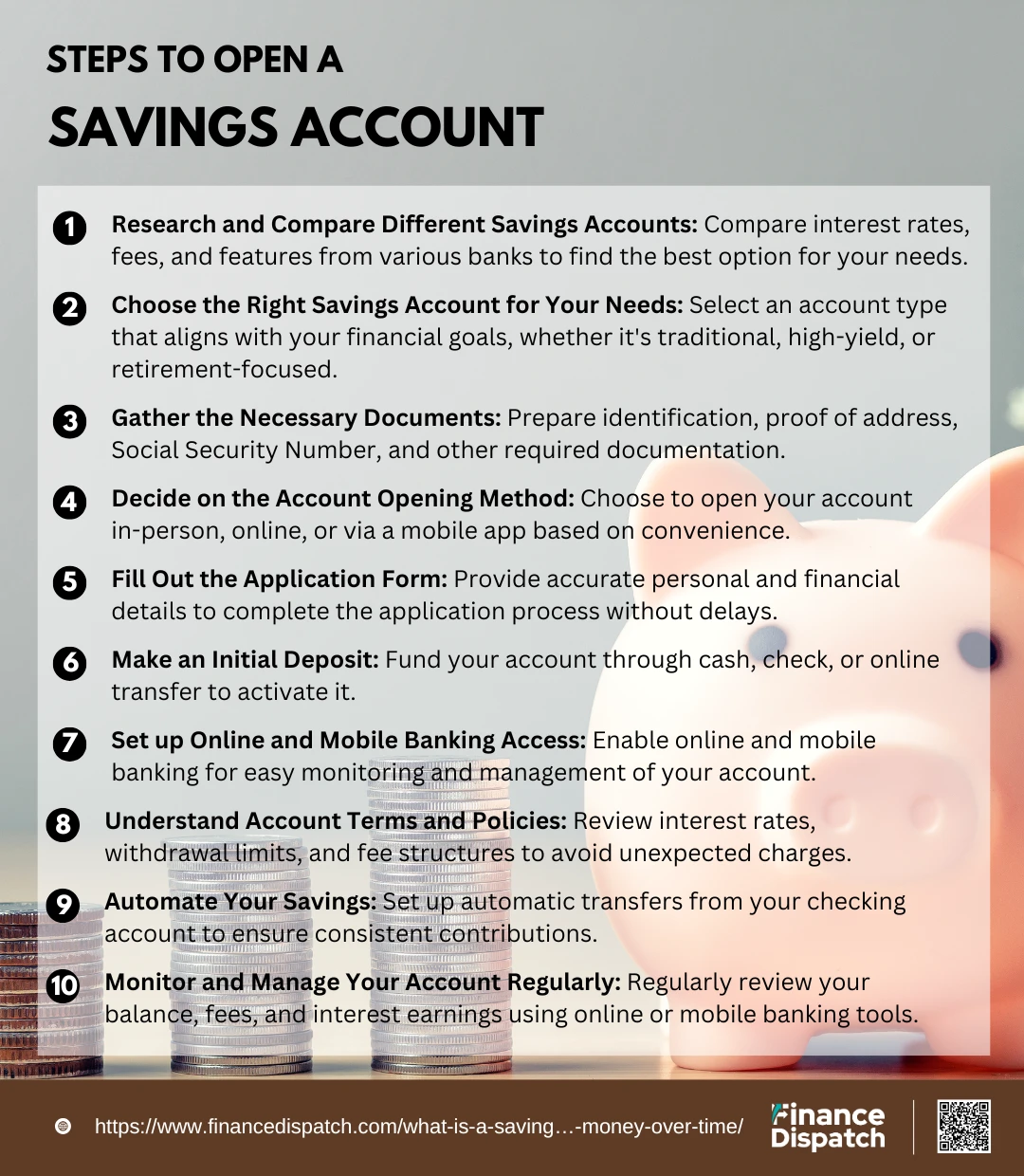

Steps to Open a Savings Account

A savings account is one of the most essential financial tools for managing and growing your money. Whether you’re saving for an emergency fund, a big purchase, or simply to develop better financial habits, a savings account offers a secure place to store your funds while earning interest. Opening a savings account is typically a simple process, but taking the time to choose the right account and understand its terms can make a big difference in how effectively your money grows. From selecting the right account to making your first deposit, each step plays a crucial role in ensuring that your savings account aligns with your financial goals. Below is a detailed guide to help you navigate the process of opening a savings account successfully.

1. Research and Compare Different Savings Accounts

Start by exploring savings account options from various financial institutions, including traditional banks, credit unions, and online banks. Look for key factors such as interest rates (APY), minimum balance requirements, monthly maintenance fees, withdrawal limits, and whether the account is FDIC- or NCUA-insured. High-yield savings accounts, often offered by online banks, may provide better interest rates, while traditional accounts might offer easier branch access and in-person assistance.

2. Choose the Right Savings Account for Your Needs

Different savings accounts cater to different financial goals.

- Traditional Savings Account: Suitable for general savings and short-term goals.

- High-Yield Savings Account: Offers higher interest rates, ideal for maximizing returns.

- Money Market Account: Combines features of savings and checking accounts, offering flexible access.

- Kids’ or Student Savings Account: Tailored for younger savers with educational features and lower fees.

- IRA Savings Account: Designed specifically for retirement savings with tax advantages.

3. Gather the Necessary Documents

Financial institutions require certain documents to verify your identity and eligibility for opening an account. These typically include:

- Government-issued identification (e.g., driver’s license, passport)

- Social Security Number (SSN) or Taxpayer Identification Number (TIN)

- Proof of Address (e.g., utility bill, lease agreement)

- Date of Birth

4. Decide on the Account Opening Method

You can open a savings account through various channels:

- In-person: Visit a bank or credit union branch for face-to-face assistance.

- Online: Many banks and credit unions allow you to open an account entirely online.

- Mobile App: Some financial institutions offer mobile apps for easy account setup.

5. Fill Out the Application Form

Complete the application form accurately, whether online or in person. You’ll be asked to provide personal details, including your full name, contact information, employment details, and identification number. Ensure all information is accurate to avoid delays in processing your application.

6. Make an Initial Deposit

Some savings accounts require an initial deposit to activate the account, while others may allow you to open an account without one. You can deposit money via:

- Cash (in-person branch visit)

- Check deposit

- Online transfer from a linked account

7. Set Up Online and Mobile Banking Access

After your account is active, register for online banking or download the bank’s mobile app. This will allow you to:

- Monitor your balance and transaction history

- Set up automatic transfers from your checking account

- Receive account alerts and updates

8. Understand Account Terms and Policies

Take time to carefully read and understand your account’s terms and conditions, including:

- Interest rates and compounding frequency (daily, monthly, or annually)

- Withdrawal limits (typically six withdrawals per month)

- Minimum balance requirements

- Account maintenance fees and other charges

9. Automate Your Savings

Set up automatic transfers from your checking account or paycheck to your savings account. Automating your savings ensures consistency, reduces the temptation to spend, and helps you stay on track with your financial goals.

10. Monitor and Manage Your Account Regularly

Regularly check your account balance and transaction history through mobile banking apps or online banking portals. Keep an eye on:

- Interest earnings

- Account fees

- Unauthorized transactions

Conclusion

A savings account is more than just a place to store your money—it’s a powerful financial tool that combines security, accessibility, and the potential for growth through interest. Whether you’re building an emergency fund, saving for a specific goal, or simply looking for a safe place to park your money, a savings account provides a reliable foundation for financial stability. By understanding the different types of savings accounts, following the necessary steps to open one, and adopting smart strategies to maximize your earnings, you can ensure your savings work harder for you over time. Regularly monitoring your account, automating contributions, and staying informed about interest rates and fees will further enhance your financial success. In a world of financial uncertainty, a well-managed savings account remains one of the most effective ways to secure your financial future while watching your money grow steadily