Managing your money wisely is one of the most essential life skills, yet it’s often overlooked until financial challenges arise. Personal finance goes beyond just budgeting—it’s about creating a roadmap for your financial future by balancing income, expenses, savings, and investments. Whether you’re planning for retirement, saving for your child’s education, or simply aiming to live debt-free, personal finance plays a critical role in shaping your financial health and overall quality of life. In today’s fast-paced world, where expenses are rising and financial uncertainty looms, understanding personal finance is no longer optional—it’s a necessity. This article explores the key aspects of personal finance, its importance, and practical strategies to help you take control of your financial journey and build a secure future.

What is Personal Finance?

Personal finance refers to the process of managing your money to meet both short-term and long-term financial goals. It encompasses a broad range of financial activities, including budgeting, saving, investing, managing debt, and planning for retirement. At its core, personal finance is about understanding your income, controlling your spending, and making informed financial decisions to ensure financial security and independence. It’s not just about growing wealth—it’s also about protecting it through insurance, estate planning, and risk management. Whether you’re saving for a rainy day, buying a home, or planning for retirement, personal finance provides the foundation for financial well-being, empowering you to make confident choices and navigate life’s financial challenges with ease.

Importance of Personal Finance

Importance of Personal Finance

Managing your finances effectively is one of the most valuable skills you can develop for long-term stability and success. Personal finance isn’t just about making money—it’s about using your income wisely to achieve financial goals, prepare for emergencies, and secure your future. In a world of rising expenses and economic uncertainties, understanding personal finance ensures that you have control over your money, rather than your money controlling you. Whether it’s budgeting, saving, investing, or planning for retirement, good financial habits can pave the way for a stress-free and fulfilling life.

Key Reasons Why Personal Finance is Important:

1. Financial Security

Financial security is the foundation of a stress-free life. Personal finance helps you build a financial safety net that can cover unexpected events such as medical emergencies, job loss, or urgent home repairs. By consistently saving and creating an emergency fund, you reduce the risk of financial distress during challenging times. It’s about being prepared for the unknown and ensuring peace of mind in unpredictable situations.

2. Goal Achievement

Financial goals—whether short-term or long-term—are easier to achieve with a solid personal finance plan. Whether you want to buy a home, fund your child’s education, or take a dream vacation, personal finance helps you allocate resources effectively and stay focused on your objectives. Setting clear financial goals and creating a roadmap allows you to measure your progress and celebrate milestones along the way.

3. Debt Management

Uncontrolled debt can become a significant financial burden, limiting your ability to save or invest. Personal finance emphasizes responsible borrowing and disciplined repayment strategies. By prioritizing high-interest debts and avoiding unnecessary loans, you can prevent debt from spiraling out of control. Proper debt management also improves your credit score, opening doors to better financial opportunities.

4. Wealth Building

Wealth isn’t built overnight—it’s a result of disciplined saving and smart investing. Personal finance encourages you to invest in assets such as stocks, bonds, real estate, or mutual funds, which can grow your money over time. By understanding the principles of risk and return, you can make informed investment decisions that align with your financial goals.

5. Stress Reduction

Financial worries are a common source of stress. When you have a clear understanding of your financial situation, a budget in place, and savings set aside, financial anxiety significantly decreases. Personal finance provides you with a sense of control and clarity, allowing you to focus on other aspects of your life without the constant fear of financial instability.

6. Smart Spending Habits

One of the core principles of personal finance is distinguishing between needs and wants. Smart spending habits prevent impulse purchases and ensure that your money is spent on things that truly matter. By creating and sticking to a budget, you can allocate funds to essential expenses, savings, and occasional indulgences without overspending.

7. Retirement Planning

Retirement may seem distant, but planning for it starts now. Personal finance emphasizes the importance of building a retirement fund early through options like 401(k) plans, IRAs, or mutual funds. By contributing regularly and taking advantage of compound interest, you can ensure a financially stable and comfortable retirement without relying solely on social security or family support.

8. Emergency Preparedness

Life is unpredictable, and financial emergencies can arise at any time. An emergency fund acts as a financial cushion, helping you handle unexpected expenses like medical bills, car repairs, or temporary unemployment. Personal finance teaches you to set aside a portion of your income regularly to build and maintain this fund, reducing reliance on loans or credit cards during crises.

9. Informed Decision-Making

Financial literacy is an integral part of personal finance. It equips you with the knowledge and skills to make informed decisions about savings, investments, insurance, and large purchases. Whether it’s choosing the right mortgage plan, assessing investment opportunities, or comparing insurance policies, informed decisions can save you money and prevent costly mistakes.

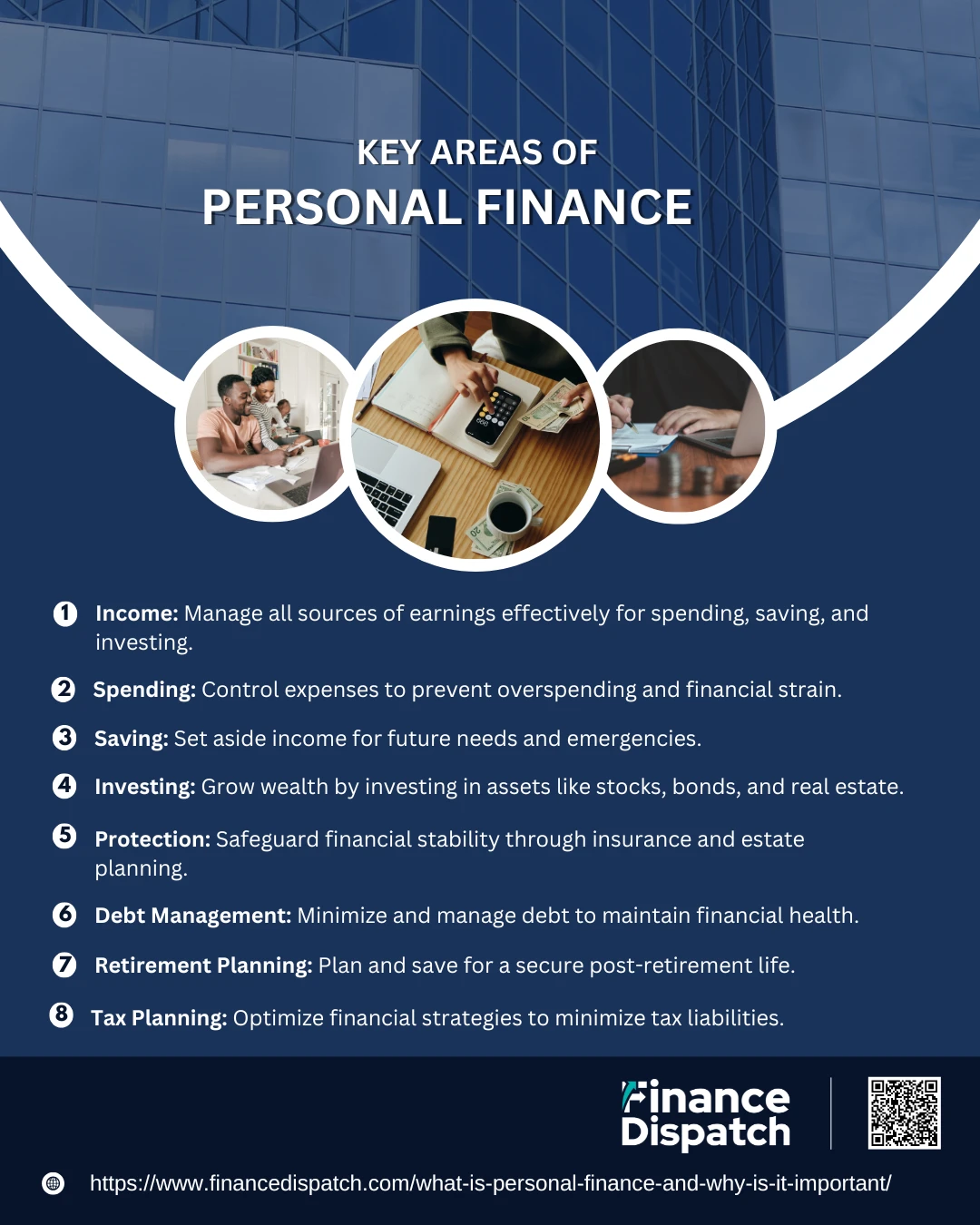

Key Areas of Personal Finance

Key Areas of Personal Finance

Personal finance is the art of managing your money effectively to achieve financial goals and ensure long-term financial security. It encompasses various aspects, including earning, spending, saving, investing, and protecting your wealth. Understanding the key areas of personal finance helps individuals make informed financial decisions, reduce financial stress, and build a secure future. Whether you’re planning for retirement, saving for a major purchase, or simply managing day-to-day expenses, focusing on these core areas is essential for financial well-being.

1. Income

Income is the foundation of personal finance and refers to all sources of cash inflow, including salaries, wages, dividends, bonuses, and rental income. It represents the money you earn, which can be allocated for spending, saving, investing, or protection. Proper income management ensures you’re using your earnings effectively to meet both short-term and long-term financial goals.

2. Spending

Spending involves managing your expenses wisely to ensure you don’t exceed your income. Expenses can be categorized into fixed costs (e.g., rent, loan payments) and variable costs (e.g., entertainment, dining out). Smart spending habits help you avoid debt accumulation and free up resources for saving and investing.

3. Saving

Saving refers to setting aside a portion of your income for future needs or emergencies. An emergency fund, which typically covers 3–12 months of living expenses, is a critical aspect of saving. Savings also act as a financial buffer during periods of income instability and unexpected expenses.

4. Investing

Investing is about growing your money over time by putting it into assets like stocks, bonds, mutual funds, or real estate. The goal of investing is to earn returns and build wealth over time. While it involves risk, strategic investing is essential for meeting long-term goals like retirement, education, or home ownership.

5. Protection

Protection refers to safeguarding your financial well-being through insurance and estate planning. This includes health insurance, life insurance, and retirement plans. Protection ensures that unexpected events, such as illnesses or accidents, don’t derail your financial stability.

6. Debt Management

Debt management focuses on minimizing and controlling debt to prevent financial stress. Prioritizing high-interest debts, such as credit cards, and maintaining responsible borrowing habits are key to managing debt effectively. This approach helps you free up income for savings and investments.

7. Retirement Planning

Retirement planning ensures financial security during your non-working years. It involves contributing to retirement funds, such as 401(k) or IRA accounts, and making informed investment decisions. Starting early allows you to benefit from compound interest and build a substantial retirement fund.

8. Tax Planning

Tax planning is about optimizing your financial decisions to reduce your tax liability. It includes utilizing tax-advantaged accounts, taking advantage of deductions and credits, and ensuring compliance with tax laws. Proper tax planning can free up funds for savings and investments.

Personal Finance Strategies

Personal finance strategies are essential tools for managing your money effectively, achieving financial goals, and securing long-term financial stability. These strategies provide a structured approach to budgeting, saving, investing, and managing debt, allowing you to make informed financial decisions. Whether you’re building an emergency fund, planning for retirement, or reducing debt, having clear strategies in place ensures you stay on track and avoid financial pitfalls. In this article, we’ll explore key personal finance strategies that can help you create a solid financial foundation and navigate life’s financial challenges with confidence.

Key Personal Finance Strategies:

- Know Your Income

Understand your total income, including salary, bonuses, dividends, and any side earnings, to make informed decisions about spending, saving, and investing. - Create and Stick to a Budget

Develop a monthly budget to allocate funds for essentials, savings, and discretionary spending. Use budgeting tools or apps to track and adjust expenses. - Pay Yourself First

Prioritize saving a portion of your income before covering other expenses. Aim to save at least 20% of your earnings every month. - Build an Emergency Fund

Save 3–12 months’ worth of living expenses in a separate, easily accessible account to cover unexpected costs like medical bills or job loss. - Reduce and Manage Debt

Focus on paying off high-interest debts first, such as credit card balances, while avoiding unnecessary borrowing. - Plan for Retirement Early

Start contributing to retirement plans like a 401(k) or IRA as early as possible to benefit from compound interest and tax advantages. - Diversify Your Investments

Spread your investments across different asset classes, such as stocks, bonds, and real estate, to minimize risk and maximize returns. - Monitor Your Credit Score

Regularly check your credit report and maintain a good credit score by paying bills on time and keeping credit utilization low. - Maximize Tax Efficiency

Take advantage of tax deductions, credits, and tax-advantaged accounts to minimize your tax burden and maximize savings. - Set Clear Financial Goals

Define short-term, medium-term, and long-term financial goals, such as buying a home, funding education, or retiring comfortably. - Use Financial Tools and Apps

Leverage financial management apps to automate savings, track expenses, and monitor your financial health. - Seek Professional Advice When Needed

Consult financial planners, tax advisors, or investment professionals to receive tailored financial guidance.

Budgeting: A Core Tool in Personal Finance

Budgeting is the foundation of effective personal finance management. It serves as a roadmap, guiding you on how to allocate your income across essential expenses, savings, debt repayment, and discretionary spending. By creating and following a budget, you gain control over your financial situation, reduce unnecessary spending, and ensure that every dollar has a purpose. Whether you’re working toward short-term goals like paying off credit card debt or long-term objectives like buying a home or saving for retirement, budgeting provides the clarity and discipline needed to stay on track. Below is an example of a basic monthly budget breakdown to illustrate how income can be strategically allocated.

Sample Monthly Budget Breakdown

| Category | Percentage of Income | Description |

| Essential Expenses | 50% | Rent, utilities, groceries, transportation, insurance. |

| Savings | 20% | Emergency fund, retirement accounts, long-term goals. |

| Debt Repayment | 10% | Credit card payments, loan repayments. |

| Discretionary Spending | 15% | Entertainment, dining out, hobbies, shopping. |

| Investments | 5% | Stocks, bonds, mutual funds, or real estate. |

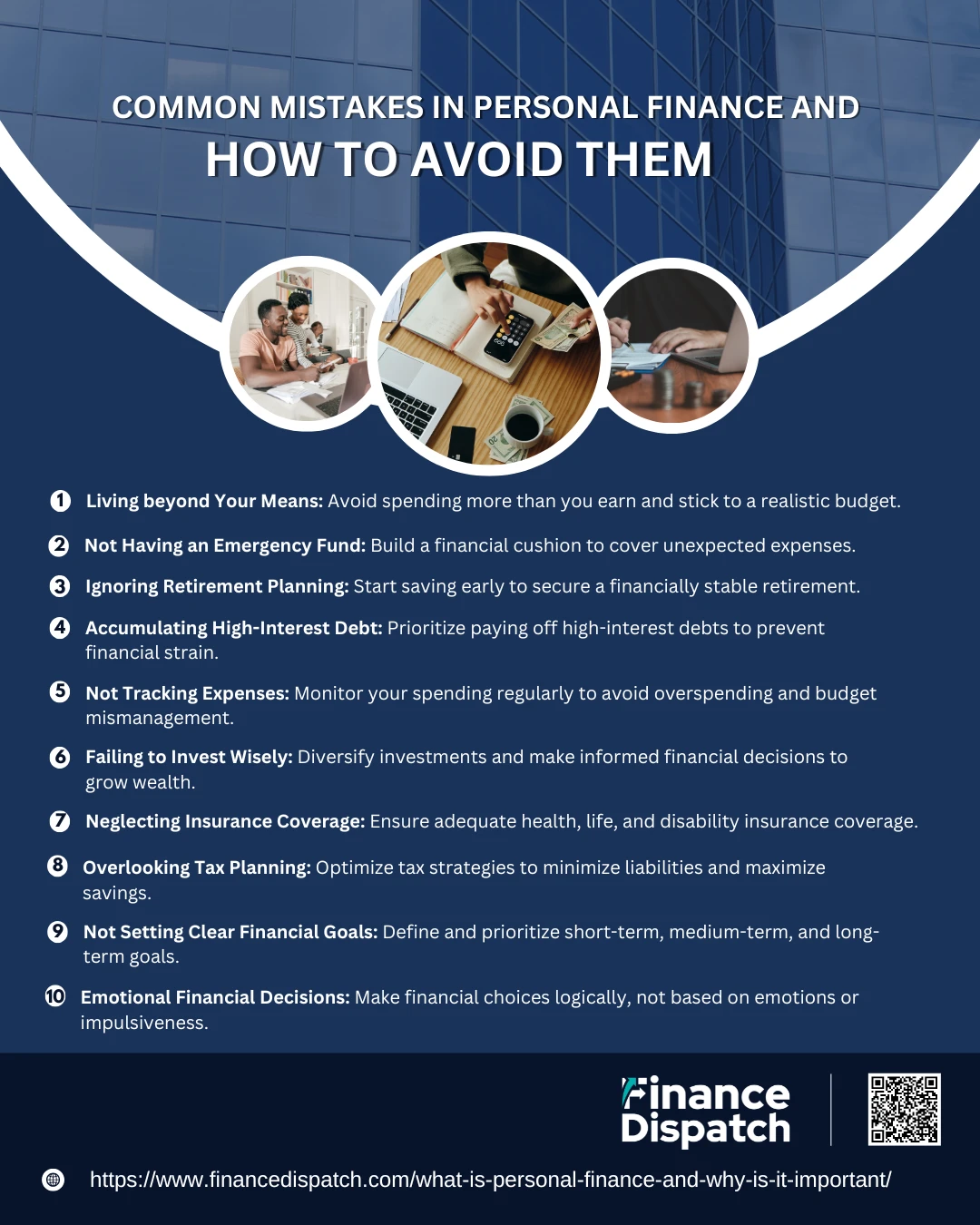

Common Mistakes in Personal Finance and How to Avoid Them

Common Mistakes in Personal Finance and How to Avoid Them

Managing personal finances can feel overwhelming, especially without a clear strategy. Many people unknowingly fall into financial pitfalls that can lead to debt, stress, and missed opportunities for financial growth. Whether it’s overspending, neglecting savings, or failing to plan for retirement, these common mistakes can have long-lasting consequences. The good news is that with awareness and a proactive approach, these mistakes can be avoided. Below are some of the most common personal finance mistakes and practical tips on how to steer clear of them.

1. Living Beyond Your Means

- Mistake: Many people fall into the trap of spending more than they earn, often relying on credit cards or loans to finance their lifestyle. This can quickly lead to overwhelming debt, high-interest payments, and financial instability.

- How to Avoid It: Create a realistic monthly budget based on your actual income, not expected income. Differentiate between needs and wants, and practice mindful spending. If you can’t afford something without borrowing money, reconsider the purchase.

2. Not Having an Emergency Fund

- Mistake: Without an emergency fund, unexpected expenses—such as medical bills, car repairs, or sudden job loss—can force you into debt or financial chaos.

- How to Avoid It: Start by saving a small, manageable portion of your income every month, even if it’s just $20 or $50. Aim to build an emergency fund that can cover at least three to six months of living expenses. Keep this fund in an easily accessible account.

3. Ignoring Retirement Planning

- Mistake: Many people delay saving for retirement, assuming they’ll have time later. However, the earlier you start, the more you benefit from compound interest. Delaying retirement savings can significantly reduce your financial security in later years.

- How to Avoid It: Start contributing to retirement accounts like a 401(k) or IRA as early as possible. Take advantage of employer-matching contributions if available. Even small, consistent contributions over time can grow into a significant retirement fund.

4. Accumulating High-Interest Debt

- Mistake: Credit card debt, payday loans, and other high-interest debts can quickly spiral out of control if not managed properly. The interest payments alone can consume a significant portion of your income.

- How to Avoid It: Prioritize paying off high-interest debt first using methods like the Debt Snowball (smallest balance first) or Debt Avalanche (highest interest first). Avoid using credit cards for unnecessary purchases and aim to pay your balance in full each month.

5. Not Tracking Expenses

- Mistake: Without tracking where your money goes, it’s easy to overspend and lose sight of your financial goals. Small, recurring expenses (like coffee runs or streaming subscriptions) can add up quickly.

- How to Avoid It: Use budgeting tools or mobile apps to monitor and categorize your spending. Regularly review your bank and credit card statements to identify unnecessary expenses and adjust your budget accordingly.

6. Failing to Invest Wisely

- Mistake: Fear, lack of knowledge, or procrastination often prevent people from investing. On the other hand, some people dive into high-risk investments without proper understanding, hoping for quick returns.

- How to Avoid It: Educate yourself about different investment options, such as stocks, bonds, mutual funds, and real estate. Diversify your investments to minimize risk, and consider consulting a financial advisor if you’re unsure where to start.

7. Neglecting Insurance Coverage

- Mistake: Many people underestimate the importance of insurance until it’s too late. Insufficient health, life, or disability insurance can result in financial devastation during emergencies.

- How to Avoid It: Invest in essential insurance policies, such as health insurance, life insurance, and disability insurance. Regularly review your coverage to ensure it meets your needs and protects your assets.

8. Overlooking Tax Planning

- Mistake: Poor tax planning can result in missed deductions, higher tax liabilities, and lost opportunities to save money. Many individuals fail to take advantage of tax-efficient strategies.

- How to Avoid It: Stay informed about tax-saving opportunities, such as retirement account contributions, tax credits, and deductions. Consider consulting a tax professional to optimize your tax strategy.

9. Not Setting Clear Financial Goals

- Mistake: Without clear financial goals, it’s challenging to create a roadmap for saving, spending, and investing. A lack of direction often leads to poor financial decisions.

- How to Avoid It: Set specific, measurable, achievable, relevant, and time-bound (SMART) financial goals. Break them down into short-term (e.g., building an emergency fund), medium-term (e.g., buying a home), and long-term (e.g., retirement savings) objectives.

10. Emotional Financial Decisions

- Mistake: Making financial decisions based on emotions—like fear, greed, or excitement—can lead to impulsive spending, poor investment choices, and unnecessary risks.

- How to Avoid It: Take a step back and evaluate your financial choices logically. Avoid making hasty decisions during market fluctuations or under pressure. Seek professional financial advice if you’re unsure.

The Role of Financial Education

Financial education plays a crucial role in empowering individuals to make informed and effective decisions about their money. In an era where financial products and investment options are becoming increasingly complex, understanding key financial concepts such as budgeting, saving, investing, and debt management is essential for achieving financial stability and long-term security. Financial education goes beyond just managing money—it helps individuals develop critical skills to avoid common financial pitfalls, such as overspending, accumulating high-interest debt, or making poor investment choices. Moreover, it equips people with the knowledge to plan for major life goals, including homeownership, retirement, and funding their children’s education. Whether through school curricula, online resources, or professional financial advisors, continuous financial learning ensures individuals stay adaptable in an ever-changing financial landscape. Ultimately, financial education isn’t just about numbers—it’s about building confidence, reducing financial stress, and creating a roadmap for a secure and prosperous future.

Personal Finance Tools and Resources

In today’s digital age, managing personal finances has become more accessible than ever, thanks to a variety of tools and resources designed to simplify budgeting, saving, investing, and tracking expenses. From mobile apps and online calculators to educational platforms and financial advisors, these tools provide valuable insights and actionable steps to improve financial health. Whether you’re trying to pay off debt, save for retirement, or monitor your credit score, having the right tools at your disposal can make financial management less overwhelming and more efficient. Below are some essential personal finance tools and resources to help you take control of your financial journey.

Essential Personal Finance Tools and Resources:

- Budgeting Apps: Tools like YNAB (You Need a Budget) and PocketGuard help you track expenses, create budgets, and ensure you’re living within your means.

- Expense Tracking Software: Apps like Mint and Goodbudget allow you to categorize and monitor you’re spending habits in real-time.

- Investment Platforms: Online platforms such as Robinhood, E*TRADE, and Vanguard make it easy to start investing in stocks, ETFs, and mutual funds.

- Retirement Planning Tools: Tools like Fidelity Retirement Score and Empower Retirement Planner help you assess your savings progress and plan for a secure retirement.

- Debt Management Tools: Platforms such as Debt Payoff Planner and Undebt.it help create repayment plans for credit cards, loans, and other debts.

- Credit Score Monitoring Services: Services like Credit Karma and Experian provide regular updates on your credit score and offer suggestions for improvement.

- Tax Preparation Software: Tools like TurboTax and H&R Block simplify tax filing and help identify eligible deductions and credits.

- Financial Education Platforms: Websites such as Investopedia, Morningstar Investing Classroom, and EdX offer free financial courses and educational resources.

- Savings and Goal-Tracking Apps: Apps like Qapital and Digit automate savings and help you set and achieve financial goals.

- Financial Advisors: Professional advisors provide personalized financial advice and planning, especially for complex goals like estate planning or high-value investments.

How Personal Finance Impacts Quality of Life

Personal finance plays a fundamental role in shaping the quality of life by providing financial security, reducing stress, and empowering individuals to achieve their goals. When you have control over your finances—whether through budgeting, saving, or investing—you gain a sense of stability and confidence in your ability to handle life’s uncertainties. Financial discipline allows you to build an emergency fund, reduce debt, and plan for major milestones, such as homeownership, education, or retirement, without constant worry about money. Beyond material comfort, effective personal finance management enhances mental and emotional well-being by eliminating the anxiety associated with living paycheck to paycheck or dealing with mounting debt. It also provides the freedom to make choices based on your goals and values, rather than being restricted by financial limitations. In essence, personal finance isn’t just about accumulating wealth—it’s about creating a life where financial concerns don’t overshadow your happiness, health, and overall sense of fulfillment.

Conclusion

Personal finance is more than just managing money—it’s about creating a stable and fulfilling life through informed financial decisions. By understanding key financial concepts like budgeting, saving, investing, and planning for the future, you can build a strong foundation for financial security and independence. Effective personal finance management not only helps you achieve your short-term goals, such as reducing debt or building an emergency fund, but also supports long-term aspirations, like homeownership or a comfortable retirement. It reduces financial stress, empowers you to make confident choices, and provides the freedom to focus on what truly matters. Ultimately, mastering personal finance isn’t about how much money you make, but how well you manage, save, and invest what you have. Take control of your finances today and set yourself on a path to lasting financial well-being and peace of mind.