Inflation is a term you’ve likely heard in conversations about rising prices, shrinking savings, and economic uncertainty. But what exactly is it, and why does it matter? At its core, inflation represents the steady increase in the prices of goods and services over time, which directly affects the value of money in your pocket. As prices climb, the purchasing power of your hard-earned dollars diminishes, making everyday essentials like groceries, gas, and housing more expensive. While a moderate level of inflation is a natural sign of a growing economy, unchecked inflation can disrupt financial stability for individuals, businesses, and entire economies. Understanding inflation is crucial for making informed decisions, whether you’re saving for the future, planning a budget, or navigating investment strategies in an ever-changing financial landscape. This article delves into the causes, effects, and strategies for managing inflation, helping you protect your purchasing power and financial well-being.

What is Inflation?

Inflation is the gradual rise in the prices of goods and services across an economy, leading to a decrease in the purchasing power of money. In simpler terms, it means that over time, the same amount of money buys fewer items. For instance, a gallon of milk that cost $2 a decade ago might now cost $4. Inflation is typically measured using tools like the Consumer Price Index (CPI), which tracks price changes for a basket of commonly purchased goods, or the Producer Price Index (PPI), which measures changes in prices at the production level. While a small, steady rate of inflation is considered normal and even beneficial for economic growth, excessive inflation can erode savings, disrupt budgets, and increase living costs, affecting everyone from consumers to businesses.

Causes of Inflation

Inflation arises from multiple factors that can independently or collectively affect an economy’s stability. By understanding the underlying causes, policymakers and individuals can better prepare for and mitigate its impact. Here’s a detailed look at each of the key causes of inflation:

1. Demand-Pull Inflation

Demand-pull inflation happens when the demand for goods and services in an economy surpasses its ability to supply them. This imbalance is often triggered during periods of economic growth, where increased consumer spending, fueled by higher disposable incomes or lower interest rates, leads to heightened demand. For example, when post-pandemic consumer spending surged in 2021-2022, supply chains struggled to keep up, driving prices higher across sectors.

2. Cost-Push Inflation

This type of inflation occurs when the cost of production rises, forcing businesses to increase the prices of their products or services to maintain profitability. Factors contributing to cost-push inflation include rising wages, higher raw material costs, or increased energy prices. For instance, global oil price hikes often lead to higher transportation and production costs, cascading into higher prices for consumers.

3. Built-In Inflation

Also known as wage-price inflation, this occurs when people expect prices to rise, prompting workers to demand higher wages. Employers, in turn, pass these increased costs onto consumers through higher prices, creating a self-reinforcing cycle. For example, if employees anticipate a 5% rise in the cost of living, they may negotiate a similar wage increase, pushing production costs and prices even higher.

4. Increased Money Supply

When central banks or governments increase the money supply—such as by printing more currency or offering extensive financial stimulus—there is often too much money chasing too few goods. This devalues the currency and leads to inflation. For example, pandemic-related stimulus packages in several countries contributed to higher inflation as economies reopened, with spending outpacing production capacity.

5. Supply Chain Disruptions

Interruptions in supply chains—caused by natural disasters, pandemics, or geopolitical conflicts—can severely limit the availability of goods. Shortages lead to higher prices as businesses and consumers compete for limited resources. The COVID-19 pandemic and the Russia-Ukraine conflict are recent examples where supply chain bottlenecks significantly contributed to inflation.

6. Global Economic Shocks

External shocks, such as surging oil prices or trade restrictions, can trigger inflation across multiple economies. For instance, during the oil crises of the 1970s, sharp increases in crude oil prices affected transportation, manufacturing, and energy costs worldwide, leading to widespread inflationary pressure.

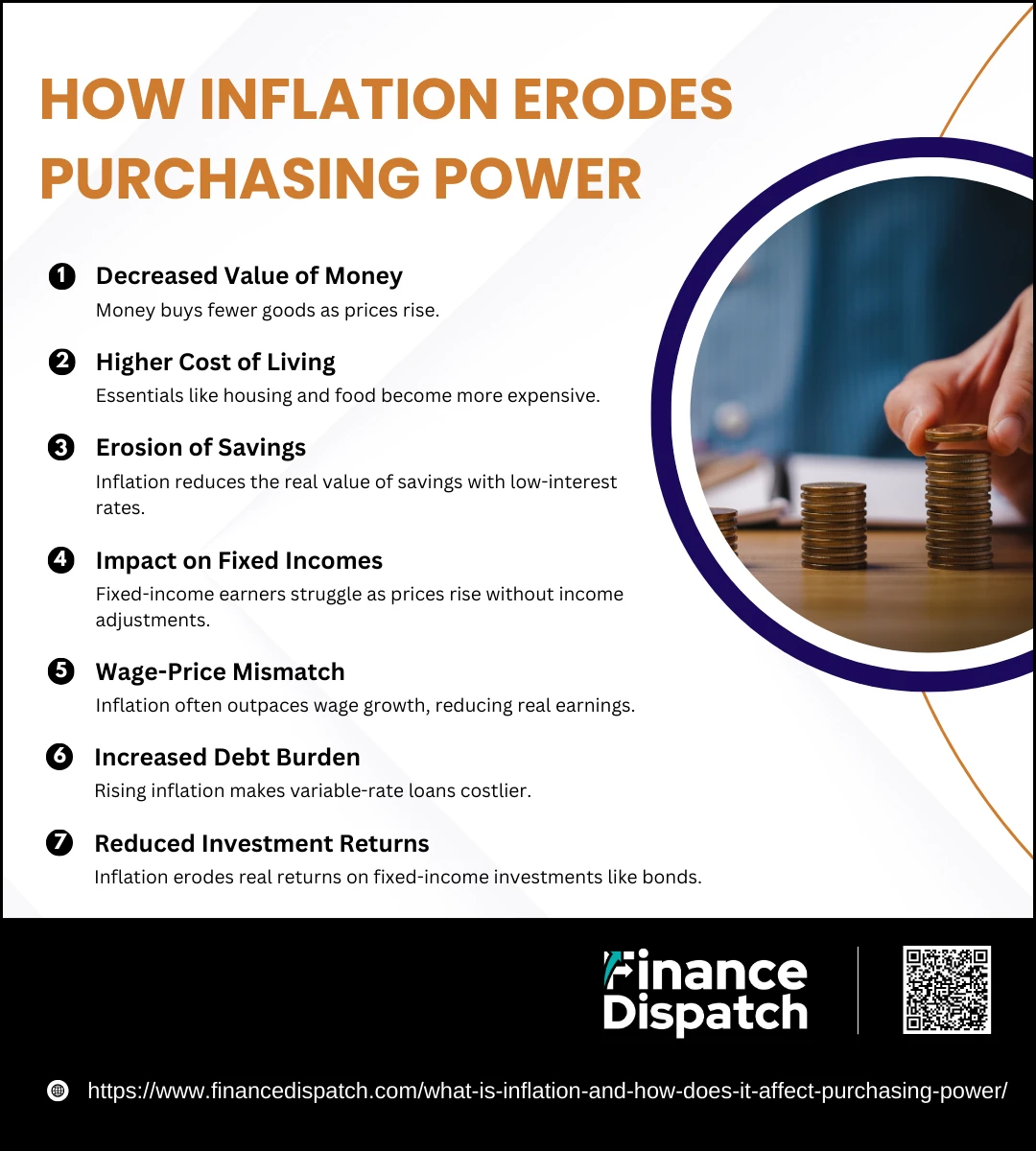

How Inflation Erodes Purchasing Power

Inflation, the persistent rise in prices, diminishes the purchasing power of money, making it increasingly difficult to buy the same quantity of goods or services over time. This erosion of value affects everyone, from individual consumers to businesses and governments, as it impacts financial planning, savings, and overall economic stability. Below are detailed ways inflation erodes purchasing power:

1. Decreased Value of Money

When inflation rises, the currency loses its purchasing power, meaning that you can buy less with the same amount of money. For instance, if inflation is 5% annually, an item that costs $100 today will cost $105 next year, reducing the effective value of your money if your income doesn’t increase proportionally. Over time, this small but consistent erosion can significantly impact personal and household budgets.

2. Higher Cost of Living

Inflation drives up the cost of essentials like food, housing, transportation, and healthcare. This increased cost of living forces households to reallocate their budgets, often reducing discretionary spending or savings to cover basic needs. For instance, housing expenses may grow disproportionately, leaving less money for other expenses.

2. Erosion of Savings

Money kept in traditional savings accounts with low interest rates loses value during inflationary periods. For example, if your savings account earns 2% interest while inflation is at 4%, the real value of your savings declines by 2% each year, effectively reducing your future buying power.

3. Impact on Fixed Incomes

Retirees and others living on fixed incomes are particularly vulnerable to inflation. As prices rise, their income remains stagnant, reducing their ability to cover increasing expenses. This can lead to significant financial challenges, requiring adjustments in lifestyle or reliance on savings.

4. Wage-Price Mismatch

Inflation often outpaces wage growth, creating a gap between earnings and expenses. For example, if wages increase by 3% but inflation is at 5%, the real value of those wages decreases, limiting the purchasing ability of workers and causing financial strain.

5. Increased Debt Burden

While inflation can reduce the real value of fixed-rate debts over time, it also makes adjustable-rate loans more expensive. Borrowers with variable interest rates on mortgages, credit cards, or other loans may find their monthly payments increasing, putting further pressure on their budgets.

6. Reduced Investment Returns

Inflation affects investment returns, particularly in fixed-income assets like bonds. For example, a bond yielding 3% annually offers negative real returns if inflation is 4%. Investors must turn to inflation-hedged assets, such as real estate or commodities, to preserve the value of their portfolios.

Types of Inflation and Their Effects

Inflation, the rise in prices over time, is not a one-size-fits-all phenomenon. It manifests in different forms based on its causes and characteristics, each with distinct effects on the economy. Understanding these types is essential for identifying their root causes and mitigating their impact. Below is an overview of the primary types of inflation and their effects:

| Type of Inflation | Description | Effects |

| Demand-Pull Inflation | Occurs when consumer demand exceeds supply, often during periods of economic growth. | Leads to higher prices across sectors, increased production, and potential overheating of the economy. |

| Cost-Push Inflation | Results from increased production costs, such as higher wages or raw material prices. | Raises consumer prices, reduces profit margins, and can cause a slowdown in production. |

| Built-In Inflation | Arises from the expectation of future inflation, leading to a wage-price spiral. | Creates sustained inflation as businesses and workers adjust prices and wages in anticipation of increases. |

| Hyperinflation | Extreme and rapid inflation, often exceeding 50% per month, caused by excessive money supply or political instability. | Drastically reduces currency value, leads to economic collapse, and erodes consumer and business confidence. |

| Deflationary Inflation | A combination of inflation in some areas and deflation in others, typically seen in uncertain economic periods. | Results in economic imbalances, impacting industries differently and complicating monetary policy. |

| Core Inflation | Excludes volatile items like food and energy to provide a stable measure of inflation trends. | Used for policymaking, but may not reflect the immediate inflation experienced by consumers. |

| Imported Inflation | Arises from higher costs of imported goods due to exchange rate fluctuations or rising global prices. | Increases domestic prices and reduces the purchasing power of imported goods. |

Impact of Inflation on Different Groups

Inflation affects various groups in unique ways, creating winners and losers across the economic spectrum. For consumers, inflation reduces purchasing power, making everyday essentials like food, housing, and transportation more expensive. Those on fixed incomes, such as retirees or individuals reliant on annuities, often struggle the most, as their income does not adjust to rising costs, eroding their ability to maintain their standard of living. Businesses face higher production costs, particularly from increased wages and raw material prices, which can squeeze profit margins and force them to pass costs onto consumers. However, businesses with strong pricing power or investments in inflation-resistant assets often fare better. Investors, too, experience mixed outcomes—while inflation erodes the real returns on bonds and savings, it can benefit those holding real estate, commodities, or stocks in sectors that thrive during inflationary periods. Governments and policymakers face the challenge of balancing inflation control with economic growth, as unchecked inflation can lead to social and economic instability. By understanding its varied impacts, these groups can adopt strategies to mitigate inflation’s adverse effects.

Historical Examples of Inflation

Inflation is a recurring phenomenon that has shaped economies throughout history, often leaving profound economic, political, and social impacts. From ancient empires to modern economies, various factors such as wars, monetary policy, and supply disruptions have triggered inflationary episodes. Below are notable historical examples that illustrate the causes and consequences of inflation:

1. The Roman Empire (3rd Century CE): Facing financial pressures to fund military campaigns, Roman emperors devalued their currency by reducing the silver content in coins. This led to rampant inflation, destabilizing the economy and contributing to the empire’s decline.

2. Weimar Republic, Germany (1920s): Post-World War I reparations and excessive money printing resulted in hyperinflation, where the German mark became nearly worthless, forcing citizens to use wheelbarrows to carry money for basic necessities.

3. United States (1970s): Dubbed “The Great Inflation,” this period saw inflation rates exceeding 10%, driven by oil price shocks and expansive monetary policies. It prompted drastic measures, including sharp interest rate hikes by the Federal Reserve.

4. Zimbabwe (2000s): Poor fiscal management and land reforms led to hyperinflation, peaking at an unimaginable rate of 79.6 billion percent in November 2008. The Zimbabwean dollar eventually collapsed, and the country adopted foreign currencies.

5. Venezuela (2010s-Present): A combination of declining oil revenues, political mismanagement, and excessive money printing has led to ongoing hyperinflation, severely eroding the country’s currency and economic stability.

Strategies to Mitigate Inflation’s Impact

Strategies to Mitigate Inflation’s Impact

Inflation can significantly impact purchasing power, savings, and overall financial stability. However, with the right strategies, individuals, businesses, and governments can minimize these effects and even find opportunities for growth. The key lies in proactive planning, smart investments, and adapting to the changing economic environment. Here’s how various groups can manage inflation effectively:

1. Invest in Inflation-Protected Assets

Assets like Treasury Inflation-Protected Securities (TIPS) adjust their value based on inflation, preserving purchasing power. Similarly, real estate often increases in value during inflation, and commodities like gold and oil provide a hedge against rising prices.

2. Diversify Investment Portfolios

A balanced investment portfolio that includes equities, fixed income, and inflation-resistant assets can reduce risk and optimize returns. Certain sectors, like technology and energy, often perform well during inflationary periods, offering potential gains.

3. Adjust Business Pricing Strategies

Businesses can combat rising costs by adopting dynamic pricing models or adding inflation clauses to contracts. Reducing operational inefficiencies, such as automating processes or sourcing cost-effective suppliers, can also offset inflation’s effects on margins.

4. Focus on Income Growth

Individuals can enhance their earning potential by developing new skills, seeking promotions, or exploring side incomes. Negotiating inflation-adjusted salaries or seeking opportunities in high-demand industries can also help maintain financial stability.

5. Reduce Debt

Inflation can increase borrowing costs, especially for variable-rate loans. Paying off high-interest debt or refinancing into fixed-rate loans protects against rising interest rates, easing the financial burden.

6. Budget for Rising Costs

Both households and businesses should reevaluate their budgets regularly, focusing on essential expenses and cutting back on discretionary spending. Creating an emergency fund can also help cushion the impact of unexpected price hikes.

7. Monitor Inflation Trends

Stay informed about inflation metrics like the Consumer Price Index (CPI) and Producer Price Index (PPI). Timely adjustments in savings, investments, and pricing strategies based on inflation data can protect long-term financial goals.

Conclusion

Inflation is an inevitable aspect of economic cycles, influencing everything from individual purchasing power to national economic policies. While moderate inflation can signal a healthy economy, unchecked or high inflation can erode savings, strain household budgets, and disrupt business operations. Understanding the causes and effects of inflation is essential for individuals, businesses, and policymakers to respond effectively. By adopting strategies such as diversifying investments, reducing debt, and staying informed about inflation trends, it’s possible to safeguard financial stability and even uncover opportunities for growth. In navigating the challenges posed by inflation, proactive planning and adaptability are key to ensuring long-term resilience and success in an ever-changing economic landscape.