The bond market, often referred to as the debt market or fixed-income market, serves as a cornerstone of the global financial system. It is a marketplace where governments, corporations, and other entities raise capital by issuing bonds to investors. Unlike the stock market, which focuses on equity financing, the bond market facilitates debt financing, allowing issuers to fund large-scale projects, manage debt obligations, or support operational growth. For investors, the bond market offers a stable avenue for income generation and portfolio diversification. This article explores the intricacies of the bond market, its importance in debt financing, and its role in shaping sound investment strategies.

What is a Bond Market?

A bond market is a financial marketplace where debt securities, such as bonds, bills, and notes, are issued and traded. It serves as a platform for governments, corporations, and other entities to raise funds by borrowing from investors. In essence, a bond represents a loan made by an investor to the issuer, with a promise to repay the principal amount along with periodic interest payments, known as coupons. The bond market is divided into two key segments: the primary market, where new bonds are issued directly to investors, and the secondary market, where previously issued bonds are traded among investors. Often referred to as the debt market or fixed-income market, the bond market is a critical component of the global financial system, providing a stable and structured mechanism for funding and investment.

Why is the Bond Market Essential for Debt Financing?

The bond market is a cornerstone of the financial system, facilitating the movement of capital from investors to entities that require funding. By issuing bonds, governments, corporations, and institutions gain access to a flexible and cost-efficient method to finance their projects and operations. Unlike equity financing, bonds do not dilute ownership, and their structured repayment terms make them a preferred choice for long-term funding. Below is a detailed look at why the bond market is indispensable for debt financing.

1. Access to Capital

The bond market provides a reliable avenue for governments and corporations to secure funding for various purposes, such as infrastructure development, technological advancements, or crisis management. For instance, governments issue bonds to finance public projects like highways and schools, while corporations use bonds to fund expansions, acquisitions, or innovation. This access to large pools of capital drives growth and sustains essential operations.

2. Cost-Effective Borrowing

Compared to traditional bank loans, issuing bonds is often more economical for borrowers. The ability to tailor terms—such as interest rates, maturity periods, and repayment schedules—makes bonds a flexible option for raising funds. Lower interest rates on certain types of bonds, such as government or investment-grade bonds, also reduce the overall cost of borrowing.

3. Long-Term Financing

The bond market enables issuers to spread debt repayment over extended periods, often spanning decades. This alleviates short-term financial pressure, allowing entities to focus on growth and operational stability. For example, long-term government bonds like treasury bonds can have maturities of 20 to 30 years, making them ideal for large-scale and enduring projects.

4. Investor Participation

The bond market attracts a diverse array of investors, from individual retail participants to large institutional entities like pension funds, insurance companies, and mutual funds. This broad participation ensures a steady demand for bonds, making it easier for issuers to raise the required funds. Additionally, bonds with varying risk and return profiles cater to different investor preferences.

5. Economic Indicator

Bond market performance serves as a barometer of economic health. Bond yields and prices reflect investor sentiment, interest rate expectations, and inflation trends. Central banks, such as the Federal Reserve, monitor the bond market to guide monetary policy decisions. A stable bond market often indicates economic stability, whereas rising yields or declining prices can signal potential economic challenges.

6. Risk Diversification for Issuers

Accessing the bond market allows issuers to diversify their funding sources, reducing over-reliance on bank loans or equity financing. By tapping into the bond market, corporations and governments can create a balanced financial structure that mitigates the risk of funding shortages or unfavorable loan terms during economic downturns.

7. Stability in Financial Systems

The bond market acts as a stabilizing force in times of financial uncertainty. Unlike volatile stock markets, bonds offer fixed income and predictable returns, making them an attractive choice for conservative investors. This stability ensures that issuers can continue raising capital even during economic downturns, supporting broader economic resilience.

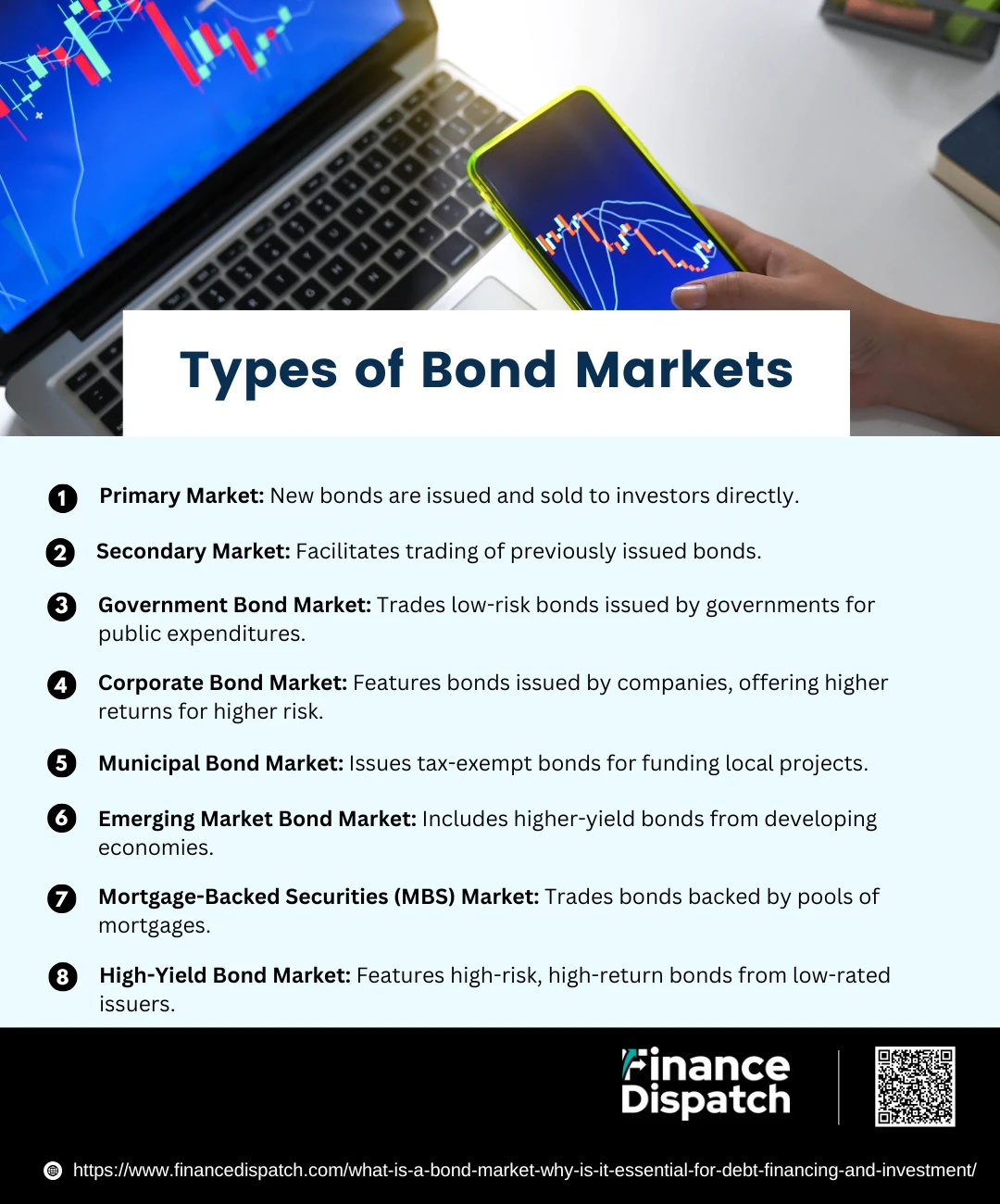

Types of Bonds Markets

The bond market, a vital part of the global financial system, comprises different segments that cater to various needs of issuers and investors. These segments are categorized based on the type of bonds traded or the market structure itself. Understanding these types helps investors make informed decisions and allows issuers to target specific funding avenues efficiently.

Key Types of Bond Markets

1. Primary Market

The primary bond market is where new bonds are issued and sold directly to investors. This is the initial step in the lifecycle of a bond, allowing governments, corporations, and other entities to raise fresh capital. Investors in this market purchase bonds at face value during public offerings or private placements. For issuers, the primary market is an essential platform for generating funds for projects, expansions, or debt refinancing.

2. Secondary Market

The secondary bond market facilitates the trading of bonds that were previously issued in the primary market. Investors buy and sell bonds among themselves, with brokers or exchanges acting as intermediaries. This market provides liquidity, allowing bondholders to exit their investments before maturity. Prices in the secondary market are influenced by interest rates, issuer creditworthiness, and market demand.

3. Government Bond Market

This segment involves the trading of bonds issued by national or local governments to finance public expenditures such as infrastructure, healthcare, and education. Government bonds, such as U.S. Treasury bonds, are considered low-risk due to government backing, making them attractive to conservative investors seeking stability.

4. Corporate Bond Market

Companies issue bonds in the corporate bond market to fund operations, expansion, or debt management. These bonds generally offer higher returns than government bonds to compensate for increased risk. The corporate bond market includes both investment-grade bonds and high-yield (junk) bonds, catering to different risk appetites.

5. Municipal Bond Market

Municipal bonds, or “munis,” are issued by state and local governments to fund public projects like schools, roads, and water systems. These bonds are often tax-exempt, making them attractive to investors seeking tax advantages alongside regular income.

6. Emerging Market Bond Market

Bonds issued by governments and corporations in developing countries form the emerging market bond segment. These bonds offer higher yields to compensate for the increased risk associated with economic and political instability in emerging economies. They are popular among investors looking for growth opportunities.

7. Mortgage-Backed Securities (MBS) Market

This market involves the trading of bonds backed by pools of mortgages. Mortgage-backed securities provide investors with a steady income stream derived from homeowners’ mortgage payments. While historically considered safe, MBS gained notoriety during the 2008 financial crisis due to the subprime mortgage meltdown.

8. High-Yield Bond Market

Also known as the junk bond market, this segment includes bonds issued by companies with lower credit ratings. These bonds offer higher returns to offset their higher risk of default, appealing to investors willing to accept greater risk for potential reward.

How Does the Bond Market Work?

The bond market is an essential component of the global financial system, connecting issuers seeking funding with investors looking for stable returns. Bonds are essentially debt instruments where issuers, such as governments or corporations, borrow money from investors and agree to pay periodic interest and return the principal at maturity. The bond market operates through primary and secondary markets, each playing a distinct role in the bond lifecycle.

How the Bond Market Operates

1. Issuance of Bonds in the Primary Market

In the primary market, bonds are issued for the first time by governments, corporations, or other entities. Investors purchase these bonds directly, providing the issuer with immediate funds for projects, operations, or debt management. Investment banks often underwrite these bonds, setting the terms and facilitating their sale.

2. Trading in the Secondary Market

Once bonds are issued, they can be bought and sold among investors in the secondary market. This trading provides liquidity, allowing bondholders to exit their investments before maturity. The prices of bonds in this market fluctuate based on interest rates, issuer creditworthiness, and market demand.

3. Interest Payments and Coupons

Bonds typically pay periodic interest, known as coupons, to investors. These payments are a fixed percentage of the bond’s face value and are made on predetermined dates, providing a steady income stream for bondholders.

4. Impact of Interest Rates

Interest rates significantly influence the bond market. When interest rates rise, the price of existing bonds falls because newer bonds offer higher returns. Conversely, falling interest rates increase the value of existing bonds with higher yields. This inverse relationship is crucial for investors and issuers.

5. Credit Ratings and Risk Assessment

Credit rating agencies evaluate the creditworthiness of bond issuers and assign ratings that reflect the likelihood of default. Higher-rated bonds are considered safer but offer lower returns, while lower-rated bonds (high-yield or junk bonds) carry higher risk and potential reward.

6. Market Participants

The bond market involves a diverse range of participants, including institutional investors like pension funds and mutual funds, individual investors, brokers, and central banks. Each plays a role in ensuring the market’s efficiency and liquidity.

7. Role of Central Banks

Central banks, such as the Federal Reserve, influence the bond market through monetary policies, including setting interest rates and purchasing government bonds. Their actions impact bond yields and market conditions, affecting both issuers and investors.

8. Settlement and Clearing

The bond market relies on a robust settlement and clearing system to ensure smooth transactions. Bonds are settled through centralized systems, ensuring accurate transfer of ownership and payments between buyers and sellers.

Benefits and Risks of Investing in Bonds

Bonds are a cornerstone of conservative investment strategies, offering predictable returns and lower risk compared to equities. They provide an opportunity for investors to preserve capital while earning regular income through interest payments. However, bond investments are not without their challenges. Market dynamics, creditworthiness, and economic factors can introduce risks that affect their performance. Below is an in-depth look at the key benefits and risks of investing in bonds.

Benefits of Investing in Bonds

- Predictable Income: Bonds provide fixed periodic interest payments, known as coupons. This predictable income stream is particularly valuable for retirees or investors seeking steady cash flow to meet financial obligations.

- Capital Preservation: High-quality bonds, especially government bonds like U.S. Treasuries, are considered safe investments. They are often used by risk-averse investors to safeguard their principal while earning modest returns.

- Portfolio Diversification: Bonds tend to perform differently from equities, offering a hedge against stock market volatility. Including bonds in a portfolio can reduce overall risk and enhance stability during market downturns.

- Tax Advantages: Certain types of bonds, such as municipal bonds, offer tax-free interest income at the federal level and sometimes at the state or local level. This tax efficiency makes them appealing to investors in higher tax brackets.

- Lower Volatility: Bonds, particularly investment-grade options, are less prone to dramatic price swings than stocks, providing a safer haven during times of economic uncertainty.

- Liquidity: Bonds traded in the secondary market offer liquidity, allowing investors to sell their holdings if they need immediate cash. This feature makes them more flexible than other long-term investments.

Risks of Investing in Bonds

- Interest Rate Risk: Bond prices move inversely to interest rates. If rates rise, the value of existing bonds with lower yields declines. This risk is more pronounced for long-term bonds, as they are more sensitive to interest rate changes.

- Credit Risk: Bonds issued by entities with lower credit ratings carry the risk of default, where the issuer fails to make interest payments or return the principal. This is a key consideration for high-yield or junk bonds.

- Inflation Risk: Fixed coupon payments may lose purchasing power in an inflationary environment, eroding the real returns on investment. Inflation-protected bonds like TIPS can mitigate this risk.

- Liquidity Risk: While many bonds are easily tradable, others, especially those from smaller or less-known issuers, may be difficult to sell quickly without taking a significant price cut.

- Reinvestment Risk: If interest rates decline, investors may have to reinvest bond proceeds from maturities or early redemptions at lower rates, reducing their overall returns.

- Market Risk: Broader economic or geopolitical events can negatively impact bond prices. For example, during financial crises, even government bonds may see increased volatility.

Bond Market vs. Stock Market

The bond market and stock market represent two fundamental pillars of the financial system, catering to distinct investment needs and objectives. While the bond market focuses on debt financing, allowing issuers to raise funds with a promise of fixed interest payments, the stock market revolves around equity financing, enabling companies to raise capital by offering ownership shares. Each market has unique characteristics, risk levels, and potential rewards, making them complementary yet different avenues for investors.

Comparison Table: Bond Market vs. Stock Market

| Aspect | Bond Market | Stock Market |

| Definition | Marketplace for debt securities like bonds and notes. | Marketplace for equity securities like stocks. |

| Nature of Investment | Represents a loan made to issuers by investors. | Represents ownership in a company. |

| Return Type | Fixed interest (coupon) payments and principal return. | Capital gains and dividends. |

| Risk Level | Generally lower, especially for government bonds. | Generally higher due to market volatility. |

| Volatility | Low, prices influenced by interest rates and credit. | High, prices influenced by company performance and market sentiment. |

| Investor Preference | Preferred by risk-averse investors seeking stability. | Preferred by risk-tolerant investors seeking growth. |

| Issuer | Governments, corporations, and municipalities. | Corporations offering ownership shares. |

| Time Horizon | Bonds have fixed maturities (short to long-term). | Stocks have no maturity and can be held indefinitely. |

| Liquidity | Secondary market provides liquidity; some bonds less liquid. | High liquidity in stock exchanges. |

| Economic Impact | Reflects economic stability and interest rate trends. | Reflects economic growth and corporate earnings. |

| Risk of Loss | Risk of default, interest rate risk, inflation risk. | Risk of market crashes, company bankruptcies. |

| Example Investments | Treasury bonds, municipal bonds, corporate bonds. | Shares of Apple, Tesla, or Microsoft. |

Importance of Bond Markets for the Economy

The bond market is a critical component of the global economy, providing a robust mechanism for raising capital and ensuring financial stability. Governments, corporations, and municipalities rely on the bond market to fund infrastructure projects, manage public debts, and finance business operations. By offering a platform for debt financing, the bond market supports economic growth and job creation. Additionally, it serves as a vital economic indicator, with bond yields reflecting investor confidence, inflation expectations, and interest rate trends. For investors, the bond market offers a secure and predictable investment avenue, encouraging capital flow even during economic downturns. Its stability and liquidity contribute to the smooth functioning of financial systems, making it indispensable for both developed and emerging economies.

How to Invest in Bonds

Investing in bonds is a simple and effective way to earn steady income and diversify your portfolio. Bonds are debt securities issued by governments, corporations, or municipalities, offering fixed interest payments. Here’s a quick guide to get started:

Steps to Invest in Bonds

1. Understand Bond Types: Explore options like government, corporate, or municipal bonds to match your goals.

2. Set Your Goals: Define your objectives, such as earning income or preserving capital.

3. Assess Risk Tolerance: Choose safer bonds or higher-risk ones depending on your comfort level.

4. Pick Individual Bonds or Funds: Decide between buying individual bonds or bond mutual funds/ETFs.

5. Research Issuers: Check credit ratings to assess the issuer’s reliability.

6. Select a Platform: Use brokerages, government portals, or financial advisors to purchase bonds.

7. Diversify: Spread investments across different bonds to reduce risk.

8. Monitor Interest Rates: Understand how changing rates affect bond prices.

9. Review Regularly: Adjust your portfolio based on market conditions and your goals.

Conclusion

The bond market plays an indispensable role in the global financial system, offering a reliable platform for debt financing and stable investment opportunities. For issuers, it provides a cost-effective way to raise capital for essential projects and operations, while for investors, it ensures predictable returns, portfolio diversification, and capital preservation. Despite its lower risk compared to equities, bonds come with their own set of challenges, such as interest rate and credit risks. However, with careful planning and a clear understanding of market dynamics, bonds can be a valuable component of any investment strategy, contributing to both individual financial security and broader economic stability.