Life is full of surprises—some delightful, others challenging. While you can’t predict when an unexpected event like a job loss, medical emergency, or urgent home repair will arise, you can prepare for it financially. That’s where an emergency fund comes in. An emergency fund acts as a financial safety net, giving you the stability to tackle unforeseen expenses without resorting to high-interest debt or jeopardizing your long-term savings. In this article, we’ll explore what an emergency fund is, why it’s essential, and how much you should save to safeguard your financial well-being.

What is an Emergency Fund?

An emergency fund is a dedicated reserve of money set aside to cover unexpected financial situations that require immediate attention. Unlike savings earmarked for planned goals like vacations or retirement, an emergency fund is designed specifically for unforeseen events, such as medical emergencies, car repairs, or job loss. It serves as a financial cushion, helping you navigate these challenges without relying on high-interest loans, credit cards, or disrupting your long-term savings. Accessible and secure, this fund is your financial safety net, offering peace of mind when life throws the unexpected your way.

How Much Should You Save?

Deciding how much to save in your emergency fund is an essential step toward financial security. While the general guideline is to save 3 to 6 months’ worth of essential living expenses, the exact amount will vary based on your unique circumstances, such as income stability, dependents, and financial obligations. This fund should be sufficient to help you navigate periods of income loss or unexpected expenses without resorting to debt. Here’s a step-by-step approach to calculate how much you should save:

1. Calculate Monthly Expenses: Begin by listing all your essential monthly costs, including rent or mortgage, utilities, groceries, transportation, insurance, and debt payments. This will give you a baseline for your financial needs.

2. Set a Savings Goal: Multiply your total monthly expenses by 3 to 6 months. For example, if your essential costs are $3,000 per month, aim for $9,000 to $18,000 in your emergency fund.

3. Consider Risk Factors: Adjust your goal based on your circumstances. For instance, if you work in a high-risk industry or have an irregular income, you may want to save closer to 9 or 12 months of expenses.

4. Start Small and Build Gradually: If saving several months’ worth of expenses feels overwhelming, start with a smaller target, such as $1,000, and work your way up. Consistency is key, even if contributions are modest at first.

5. Review and Adjust Regularly: Life changes, such as having a child or taking on a new mortgage, can impact your financial needs. Periodically reassess your savings goal to ensure it remains adequate for your current situation.

Why is an Emergency Fund Important?

An emergency fund is more than just a financial safety net—it’s a cornerstone of financial stability. Life is unpredictable, and unexpected expenses can arise at any moment, whether it’s a medical emergency, car repair, or sudden job loss. Having an emergency fund allows you to handle these situations with confidence, avoiding the stress and long-term consequences of going into debt.

- Instant Access to Cash: Provides readily available funds for urgent expenses.

- Avoids High-Interest Debt: Reduces reliance on credit cards or personal loans during crises.

- Maintains Financial Goals: Protects long-term savings and investments from being depleted.

- Promotes Peace of Mind: Eliminates financial stress by ensuring you’re prepared for the unexpected.

- Supports Financial Independence: Reduces reliance on borrowing or external help during emergencies.

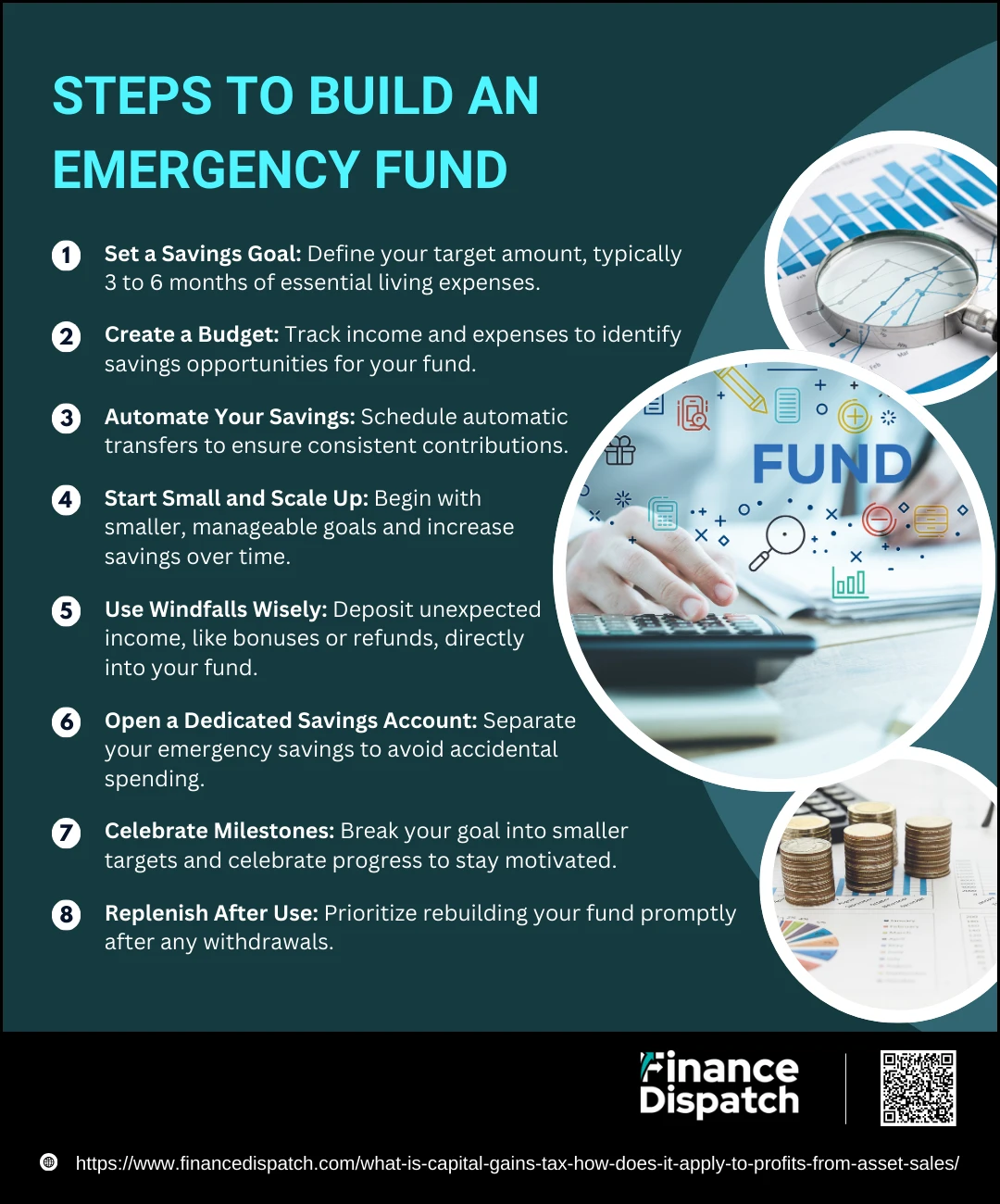

Steps to Build an Emergency Fund

Building an emergency fund is an essential step toward financial security. While it may seem challenging at first, breaking the process into manageable steps makes it achievable. Here’s a detailed guide to help you establish your emergency savings:

1. Set a Savings Goal

Start by determining the total amount you need to save. A common recommendation is 3 to 6 months’ worth of essential living expenses, which include rent or mortgage payments, utilities, groceries, insurance, and transportation. For example, if your monthly expenses are $3,000, your goal should be between $9,000 and $18,000. Having a clear target provides focus and motivation to stick to your plan.

2. Create a Budget

A budget helps you identify how much you can allocate to your emergency fund each month. Begin by tracking your income and expenses to see where your money is going. Look for areas to cut back, such as dining out, subscriptions, or non-essential shopping. Redirect these savings toward building your emergency fund.

3. Automate Your Savings

Setting up automatic transfers ensures consistency and makes saving easier. Arrange for a fixed amount to be transferred from your checking account to a dedicated savings account every payday. This approach eliminates the temptation to spend the money elsewhere and keeps your progress on track.

4. Start Small and Scale Up

If saving a large amount feels overwhelming, start with a smaller, manageable goal, such as $1,000. Contribute small amounts regularly—$10, $20, or $50 per week—and increase the amount as your financial situation improves. Small, consistent contributions can accumulate into a significant fund over time.

5. Use Windfalls Wisely

Unexpected income, such as tax refunds, bonuses, or gifts, can provide an excellent opportunity to boost your emergency fund. Instead of spending windfalls, deposit them directly into your savings account. These one-time contributions can accelerate your progress significantly.

6. Open a Dedicated Savings Account

Keep your emergency fund separate from your regular accounts to avoid accidental spending. Opt for a high-yield savings account to earn interest on your savings. Ensure the account is easily accessible in case of an emergency but not so convenient that you’re tempted to dip into it for non-essential expenses.

7. Celebrate Milestones

Break your overall savings goal into smaller, achievable targets. Celebrate reaching each milestone—for example, saving your first $500 or $1,000. These small victories reinforce positive financial habits and keep you motivated to continue.

8. Replenish After Use

If you need to use your emergency fund, make it a priority to rebuild it as soon as possible. Adjust your budget temporarily to allocate more toward replenishing the fund. This ensures you’re prepared for future unexpected expenses and don’t fall into financial insecurity.

Where to Keep Your Emergency Fund

Choosing the right place to store your emergency fund is just as important as saving for it. The ideal account should keep your money safe, easily accessible, and provide a modest return. While investment accounts may offer higher returns, they also come with risks and delays in access, which are not suitable for emergency funds. Below are some options to consider:

| Account Type | Benefits | Considerations |

| High-Yield Savings Account | Offers higher interest rates compared to traditional savings accounts. Keeps your money liquid. | May require maintaining a minimum balance to earn the highest interest rate. |

| Money Market Account | Combines savings and checking features, offering debit card or check-writing privileges. | May have limited transactions per month and require higher minimum deposits. |

| Traditional Savings Account | Safe and accessible through ATMs or online transfers. | Offers lower interest rates compared to high-yield accounts. |

| Certificates of Deposit (CDs) | Provides higher fixed interest rates for specific terms (e.g., 6 months or 1 year). | Early withdrawal penalties make it less flexible for emergencies. |

| Treasury Bills (T-Bills) | Very secure and offers slightly higher returns. | Requires a minimum holding period before funds are accessible. |

| Offset Account (for Homeowners) | Reduces mortgage interest by offsetting the loan balance with the savings amount. | Only available to individuals with a mortgage and may not suit all borrowers. |

When to Use Your Emergency Fund

An emergency fund is designed to safeguard you during life’s unexpected challenges. It should only be used for genuine emergencies that demand immediate financial attention. These situations are often characterized by being unforeseen, urgent, and essential. Misusing your emergency fund for non-critical expenses can leave you unprepared when a real crisis arises. Knowing when to tap into your emergency fund can help you maintain financial stability while avoiding unnecessary debt. Here are some clear scenarios when using your emergency fund is justified:

1. Job Loss

Losing your primary source of income can be overwhelming. Your emergency fund can help you cover essential expenses, such as rent, utilities, and groceries, while you search for new employment.

2. Medical Emergencies

Unplanned medical or dental expenses, like emergency surgeries, treatments, or hospital stays, can be costly. Use your emergency fund to pay for these unexpected bills, including deductibles and out-of-pocket expenses, to avoid financial strain.

3. Home Repairs

When your home requires immediate and necessary repairs, such as fixing a broken furnace in winter or repairing a leaking roof, your emergency fund can prevent further damage and ensure your living space remains safe and habitable.

4. Car Repairs

Your vehicle is often essential for daily life, especially for commuting to work or school. If your car breaks down or requires critical maintenance, like replacing brakes or fixing an engine issue, your emergency fund ensures you can address these issues promptly.

5. Unexpected Travel

Emergencies sometimes require sudden travel, such as attending a funeral or helping a family member in distress. Your emergency fund can cover transportation, accommodation, and related costs during these difficult times.

6. Natural Disasters

Natural disasters like floods, hurricanes, or earthquakes can disrupt your life unexpectedly. Use your emergency fund to pay for temporary housing, evacuation, or immediate repairs to restore safety and normalcy.

Tips to Replenish Your Fund after Use

Tips to Replenish Your Fund after Use

Tapping into your emergency fund during challenging times is a vital part of financial preparedness, but rebuilding it afterward is just as important. Replenishing your fund ensures you’re ready for future unforeseen expenses and maintains your financial security. While the process may seem daunting, consistent efforts and smart financial choices can help you rebuild your fund efficiently. Here are detailed tips to guide you in restoring your emergency fund:

1. Review and Adjust Your Budget

Take a close look at your spending habits and identify areas to temporarily reduce expenses. This could include cutting back on dining out, canceling unused subscriptions, or opting for budget-friendly alternatives. Direct the savings toward rebuilding your emergency fund.

2. Automate Savings Contributions

Set up an automatic transfer from your checking account to your emergency fund. By automating the process, you ensure consistent contributions without the risk of forgetting or spending the money elsewhere. Even small amounts add up over time.

3. Redirect Windfalls

When you receive unexpected income, such as a tax refund, bonus, or monetary gift, allocate a significant portion—or all of it—toward replenishing your fund. Windfalls can provide a significant boost to your savings without impacting your monthly budget.

4. Take on a Side Hustle

Explore opportunities to earn extra income through side gigs or freelance work. Whether it’s delivering food, offering online tutoring, or selling handmade crafts, dedicating the earnings to your emergency fund can speed up the replenishment process.

5. Sell Unused Items

Declutter your home and sell items you no longer use, such as electronics, furniture, or clothing. Online platforms and local marketplaces make it easy to turn these items into cash for your savings.

6. Pause Non-Essential Expenses

Delay discretionary expenses, such as vacations, luxury purchases, or upgrades, until your emergency fund is fully restored. Focus on the essentials and direct the extra funds toward your savings goal.

7. Use Round-Up Savings Apps

Apps that round up your daily purchases to the nearest dollar and deposit the difference into your savings account are a simple way to grow your fund passively. Over time, these small contributions can make a big impact.

8. Prioritize Rebuilding Over Splurging

While it might be tempting to indulge after overcoming a financial challenge, stay disciplined and prioritize replenishing your fund first. Remind yourself of the peace of mind and security your emergency fund provides.

9. Set a Timeline and Track Progress

Establish a realistic timeline for rebuilding your emergency fund and monitor your progress regularly. Celebrate milestones, such as saving your first $500 or $1,000, to stay motivated and committed.

10. Involve Your Household

If you share financial responsibilities with a partner or family, involve them in the process. Work together to identify savings opportunities and contribute collectively to restoring your emergency fund.

Common Challenges and How to Overcome Them

Common Challenges and How to Overcome Them

Creating and maintaining an emergency fund is an essential part of financial planning, but it’s not without its obstacles. Many individuals face challenges like limited income, competing financial priorities, and the temptation to spend savings. These hurdles can slow down progress, but with the right strategies, you can overcome them and steadily build your emergency fund. Here’s a closer look at common challenges and practical ways to address them:

1. Limited Income

- Challenge: When your income barely covers your basic expenses, it can feel impossible to save.

- Solution: Start with small, manageable contributions. Even saving $5 to $10 per week can add up over time. Look for additional income opportunities, such as freelancing, selling unused items, or taking on a part-time job. Direct any unexpected income, like bonuses or tax refunds, into your emergency fund to boost it quickly.

2. Unexpected Expenses

- Challenge: Recurring unplanned expenses, like car repairs or medical bills, can deplete your savings.

- Solution: Build a small “buffer fund” specifically for minor, unexpected expenses. This separate fund can prevent you from tapping into your main emergency savings for smaller, less critical costs.

3. High Living Costs

- Challenge: Rising costs for essentials like rent, utilities, and groceries leave little room for saving.

- Solution: Reassess your spending and make lifestyle adjustments. For example, consider meal planning to reduce food waste, switch to energy-efficient appliances to lower utility bills, or carpool to save on transportation costs. These small changes can free up money for savings.

4. Lack of Motivation

- Challenge: Saving for emergencies doesn’t provide instant gratification, making it harder to stay committed.

- Solution: Break your overall savings goal into smaller milestones. For instance, aim to save $500 first, then $1,000, and celebrate each achievement. Visualizing your progress with charts or apps can also keep you motivated.

5. Temptation to Spend

- Challenge: Having easy access to your emergency fund makes it tempting to use it for non-urgent purchases.

- Solution: Keep your emergency fund in a high-yield savings account that’s separate from your regular checking account. By creating a slight barrier to access, you reduce the likelihood of impulsive withdrawals.

6. Irregular Income

- Challenge: Freelancers, gig workers, and seasonal employees often face unpredictable earnings, making consistent saving difficult.

- Solution: Save more during high-income months to offset slower periods. Base your budget on your average income rather than peak earnings. Additionally, consider creating a flexible spending plan that adjusts with your income fluctuations.

7. Competing Financial Priorities

- Challenge: Balancing debt repayment, retirement savings, and emergency fund contributions can feel overwhelming.

- Solution: Adopt a proportional approach to your finances. Allocate a percentage of your income to each goal, such as 50% for necessities, 30% for debt repayment, and 20% for savings. Adjust these percentages based on your immediate needs, such as focusing on debt first while setting aside a small amount for your emergency fund.

8. Lack of Financial Education

- Challenge: Not knowing how much to save or where to start can hinder your progress.

- Solution: Use online resources, financial literacy courses, or consult a financial advisor to gain clarity. Begin with the general guideline of saving 3 to 6 months’ worth of living expenses and adjust based on your personal situation.

9. Overwhelming Initial Goals

- Challenge: The idea of saving several months’ worth of expenses can feel unattainable.

- Solution: Break your goal into smaller steps, starting with a target of $500 or $1,000. Celebrate milestones to maintain motivation, and gradually work toward larger savings goals.

10. Stagnant Savings Growth

- Challenge: Storing funds in low-interest accounts may feel unrewarding.

- Solution: Use high-yield savings accounts or money market accounts to earn better interest while keeping your money secure and accessible. These options can provide modest returns without exposing your savings to market risks.

Conclusion

An emergency fund is one of the most important tools for achieving financial security and peace of mind. While building and maintaining it may come with challenges, the rewards far outweigh the effort. This fund acts as a safeguard against unexpected expenses, providing stability and helping you avoid debt during difficult times. By setting realistic goals, adopting consistent saving habits, and staying disciplined, you can create a robust financial cushion that prepares you for life’s uncertainties. Start small, remain committed, and remember that every contribution brings you closer to a more secure future. With an emergency fund in place, you can face challenges with confidence, knowing you’re ready for whatever comes your way.