Investing in the stock market can be intimidating, especially when faced with unpredictable market swings and the challenge of timing your investments just right. That’s where dollar-cost averaging (DCA) comes in—a strategy designed to simplify investing while reducing risk. By consistently investing a fixed amount of money at regular intervals, DCA takes the guesswork out of market timing and helps you stay disciplined, even during periods of uncertainty. This article will explore what dollar-cost averaging is, why it has become a favored approach for both new and experienced investors, and how it can help you achieve your long-term financial goals with ease.

What is Dollar-Cost Averaging (DCA)?

Dollar-cost averaging (DCA) is an investment strategy that involves consistently investing a fixed amount of money at regular intervals, regardless of market conditions. This approach allows you to purchase more shares when prices are low and fewer shares when prices are high, effectively lowering the average cost per share over time. DCA is particularly appealing because it eliminates the need to time the market, a notoriously difficult task even for seasoned investors. By focusing on regular investments rather than short-term market fluctuations, DCA promotes discipline and helps investors mitigate the emotional decisions that often come with market volatility.

Why Is Dollar-Cost Averaging a Popular Strategy?

Dollar-cost averaging (DCA) has become a preferred investment approach because of its simplicity, accessibility, and effectiveness in managing risk. By investing a fixed amount regularly, DCA eliminates the stress of trying to time the market and encourages a steady, long-term focus. This makes it especially suitable for those looking to build wealth gradually while avoiding the pitfalls of emotional decision-making during market volatility.

Reasons for Dollar-Cost Averaging’s Popularity

1. Reduces Market Timing Pressure

One of the most challenging aspects of investing is determining the perfect time to buy or sell. DCA takes this burden away by spreading investments over time. You don’t need to worry about whether the market is at its peak or bottom—this strategy ensures you’re always investing systematically, regardless of market conditions.

2. Promotes Consistency

Investing regularly, regardless of the amount, cultivates a habit of saving and investing. Over time, these small, consistent investments add up, creating a robust portfolio. This consistency is particularly helpful for those who struggle to set aside funds for investing or are new to managing their finances.

3. Mitigates Market Volatility

Market fluctuations can be daunting, especially for inexperienced investors. DCA helps smooth out these ups and downs by purchasing more shares when prices are low and fewer shares when prices are high. This results in a lower average cost per share over time, reducing the impact of volatility on your portfolio.

4. Accessible to All Investors

DCA doesn’t require a large initial investment. Instead, it allows you to start small and gradually build your investment portfolio. This makes it an excellent option for young investors, those with limited disposable income, or anyone looking for a manageable way to start their investment journey.

5. Emotional Control

Investing can be highly emotional, with fear during market downturns and greed during upswings driving impulsive decisions. DCA helps counteract these tendencies by automating investments, keeping you focused on your plan rather than reacting to short-term market movements.

6. Long-Term Focus

DCA aligns well with long-term financial goals, such as retirement or funding a child’s education. By making regular contributions, you benefit from the power of compounding and stay on track toward achieving your objectives without being distracted by short-term market noise.

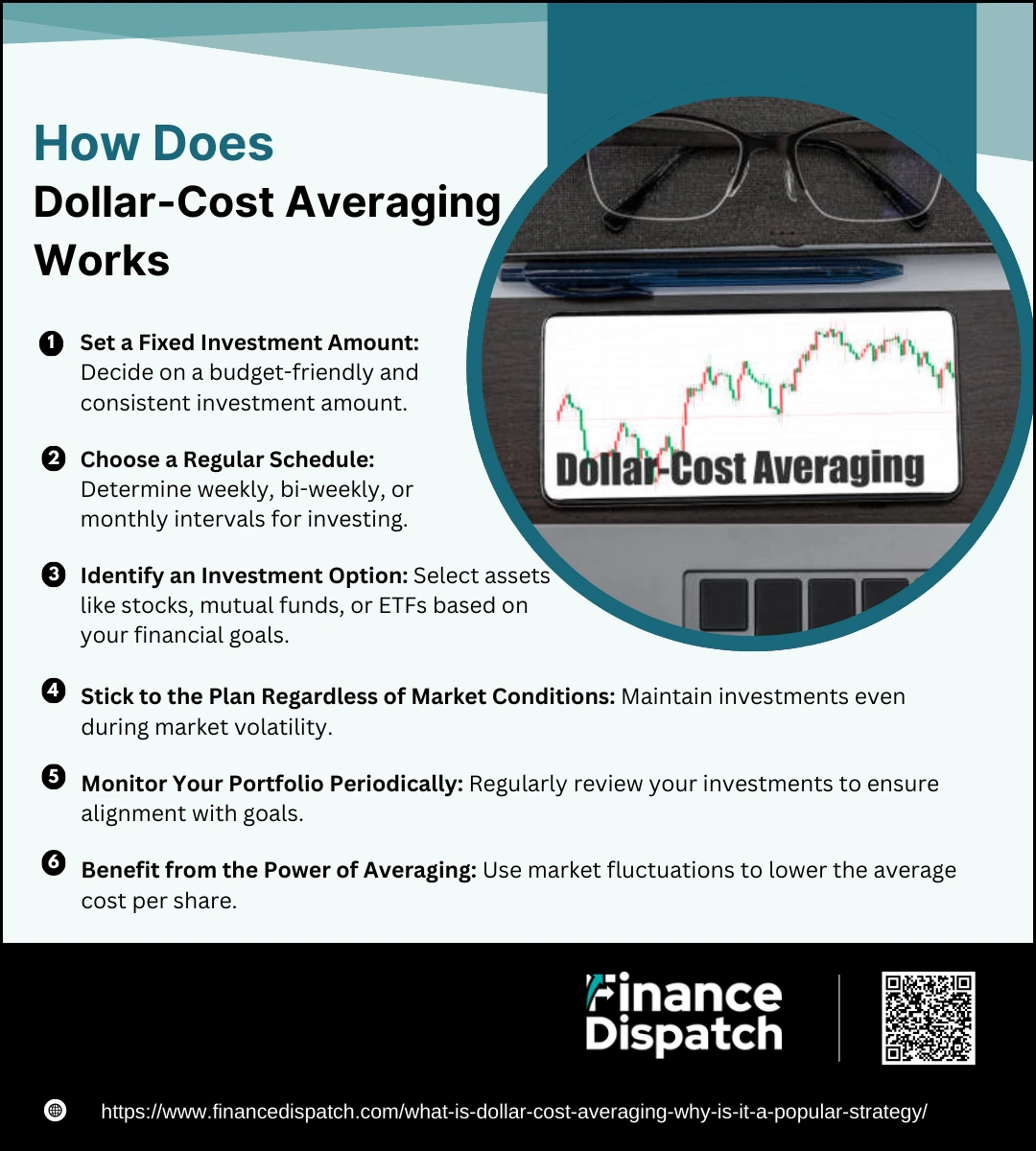

How Dollar-Cost Averaging Works

Dollar-cost averaging (DCA) is a simple and disciplined investment strategy that helps you build wealth steadily over time while minimizing the risks associated with market volatility. Instead of investing a large sum all at once, you divide your investments into smaller, fixed amounts and invest them at regular intervals, regardless of how the market is performing. This approach not only spreads out your investment risk but also takes advantage of fluctuating prices to lower the average cost of your assets. Here’s a detailed breakdown of how DCA works and how you can implement it effectively.

Steps to Implement Dollar-Cost Averaging

1. Set a Fixed Investment Amount

Start by deciding how much you can consistently invest over time. This amount should fit within your budget and align with your long-term financial goals. For example, you might allocate $200 monthly to your DCA plan.

2. Choose a Regular Schedule

Determine how often you’ll invest—whether weekly, bi-weekly, or monthly. Consistency is crucial, as sticking to a schedule ensures that you remain disciplined and benefit from the strategy’s long-term advantages.

3. Identify an Investment Option

Decide on the asset or portfolio you’ll invest in, such as individual stocks, mutual funds, or ETFs. Ideally, choose investments that match your risk tolerance, time horizon, and financial objectives. For instance, beginners may prefer index funds for their diversification and stability.

4. Stick to the Plan Regardless of Market Conditions

One of the key principles of DCA is to remain consistent, even when markets are turbulent. Whether prices are rising or falling, invest the predetermined amount. This eliminates emotional decision-making and ensures you’re always participating in the market.

5. Monitor Your Portfolio Periodically

While DCA doesn’t require frequent adjustments, it’s important to review your portfolio at regular intervals to ensure it aligns with your evolving financial goals. This might involve reallocating funds or increasing your investment amount as your income grows.

6. Benefit from the Power of Averaging

Over time, DCA ensures you buy more shares when prices are low and fewer shares when prices are high. This approach reduces the average cost per share and smooths out the impact of market volatility. For example:

-

- Month 1: Invest $200 at $20/share = 10 shares.

- Month 2: Invest $200 at $25/share = 8 shares.

- Month 3: Invest $200 at $15/share = 13.33 shares.

- Total: $600 invested for 31.33 shares = $19.15 average cost/share.

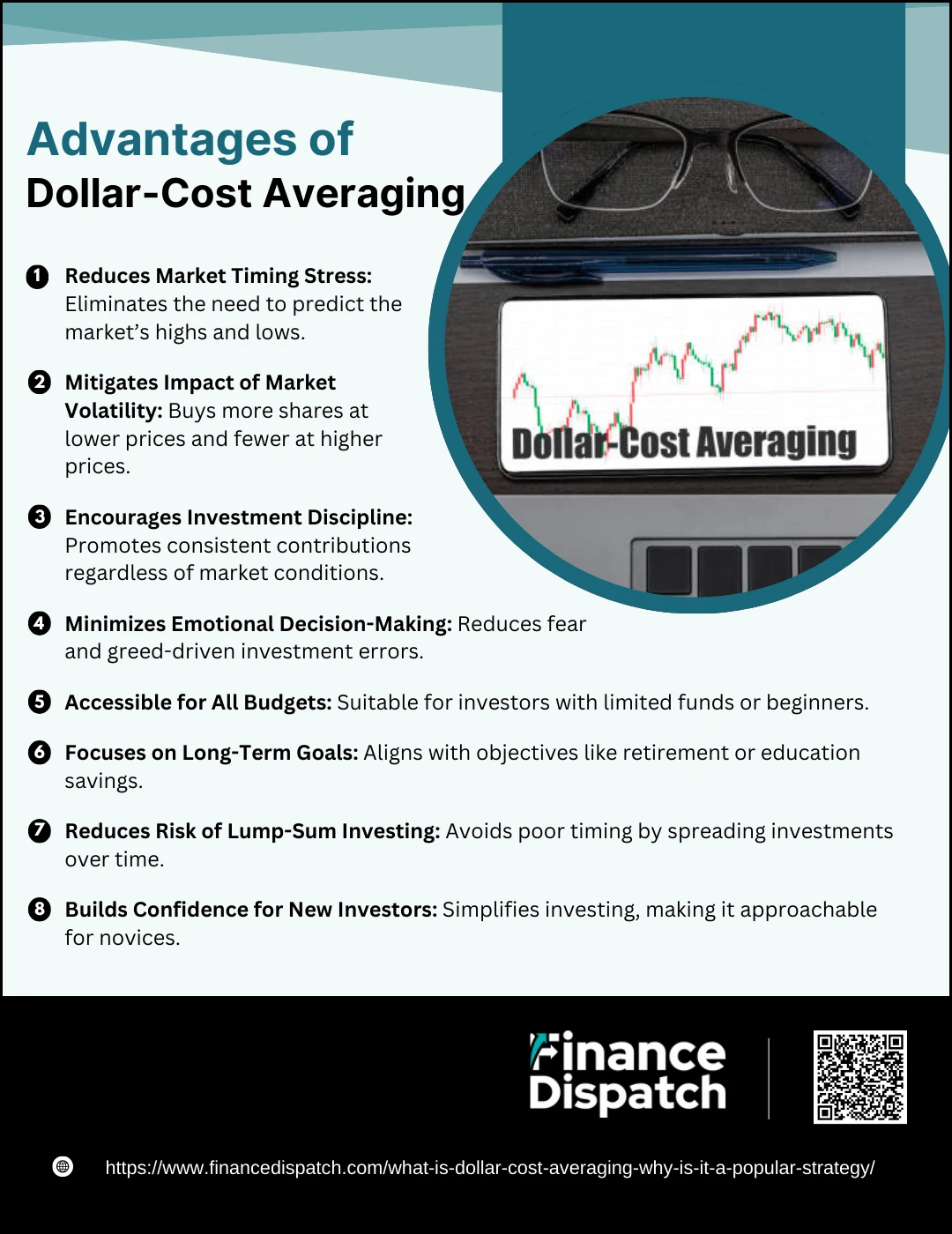

Advantages of Dollar-Cost Averaging

Dollar-cost averaging (DCA) is an investment strategy designed to make the process of investing easier, more disciplined, and less stressful. By investing a fixed amount of money at regular intervals, DCA allows you to avoid the pitfalls of market timing and emotional decision-making, two of the biggest challenges for investors. This strategy works well for both beginners and experienced investors, offering a way to build wealth steadily while minimizing risk. Below, we explore its many advantages in detail.

Key Advantages of Dollar-Cost Averaging

1. Reduces Market Timing Stress

Market timing—trying to predict when prices will rise or fall—is notoriously difficult, even for experts. With DCA, you don’t need to worry about identifying the perfect moment to invest. By committing to regular investments, you smooth out the highs and lows of market prices over time, making investing much more manageable.

2. Mitigates Impact of Market Volatility

Market fluctuations can be unsettling, but DCA turns them into an advantage. You buy more shares when prices are low and fewer shares when prices are high. This helps lower your average cost per share, ensuring that you’re not overly exposed to high prices. Over time, this can significantly reduce the impact of market volatility on your portfolio.

3. Encourages Investment Discipline

One of the greatest challenges in investing is maintaining consistency. DCA helps build this discipline by requiring regular contributions, regardless of market conditions. This steady approach ensures that you stay invested and avoid procrastination or reactive decision-making.

4. Minimizes Emotional Decision-Making

Emotional reactions to market swings—such as selling during a downturn or buying during a surge—can lead to poor financial outcomes. DCA automates your investments, allowing you to stick to a plan without being swayed by fear or greed. This reduces the likelihood of making impulsive or irrational investment choices.

5. Accessible for All Budgets

DCA is an inclusive strategy that doesn’t require a large upfront investment. Even with a small amount, you can start building your portfolio. This makes DCA particularly appealing to beginners or those with limited capital who want to get started without feeling overwhelmed.

6. Focuses on Long-Term Goals

DCA aligns perfectly with long-term financial objectives, such as retirement savings or funding future expenses. By consistently investing over a long period, you benefit from compounding returns, which magnify your wealth-building efforts over time.

7. Reduces Risk of Lump-Sum Investing

Investing a large amount at one time carries the risk of poor timing, such as investing just before a market drop. DCA spreads your investment over months or years, reducing the likelihood of putting all your money in at a market peak.

8. Builds Confidence for New Investors

For beginners, the stock market can be intimidating. DCA simplifies the process by focusing on regular contributions rather than complex decision-making. This encourages new investors to participate confidently, knowing that they’re taking a measured and thoughtful approach.

Limitations of Dollar-Cost Averaging

Dollar-cost averaging (DCA) is widely regarded as a reliable strategy for reducing risk and simplifying the investment process. However, it’s not a one-size-fits-all approach. While DCA can mitigate some challenges of investing, it also comes with notable limitations that investors should consider. By understanding these drawbacks, you can decide if DCA aligns with your financial goals and market expectations.

Key Limitations of Dollar-Cost Averaging

1. May Miss Out on Higher Returns

DCA spreads investments over time, which can be a disadvantage in a market that’s consistently rising. A lump-sum investment made at the beginning of a bull market would generally outperform DCA, as the funds are fully invested earlier, benefiting more from the market’s upward momentum.

2. Does Not Eliminate Risk Entirely

While DCA reduces the impact of market volatility, it doesn’t shield you from risks like a prolonged market downturn. If markets consistently decline over an extended period, even regular investments may lose value, and you might face significant losses.

3. Requires Long-Term Consistency

The effectiveness of DCA depends on regular and disciplined contributions. Any interruption in your investment schedule, whether due to financial constraints or oversight, can reduce the overall impact of the strategy. Maintaining this discipline over years or decades can be challenging.

4. Potentially Higher Transaction Costs

Since DCA involves frequent investments, the associated transaction fees can add up, especially when investing in assets like individual stocks or funds with high trading costs. These fees can erode returns, particularly for small investment amounts.

5. Less Impactful with Small Investment Amounts

If the investment amounts are small, the benefits of cost averaging may not significantly outweigh the costs, particularly if transaction fees represent a large proportion of the total investment. This can diminish the financial advantages of the strategy.

6. May Not Be Optimal in Certain Markets

DCA is less effective in steadily rising markets, where the average cost per share may be higher than if a lump-sum investment had been made at the outset. In such scenarios, DCA can result in missed opportunities for higher returns.

7. Delayed Full Investment

Because DCA spreads investments over time, a portion of your capital remains uninvested in the early stages. This uninvested money may miss out on growth opportunities if the market rises during this period, resulting in slower portfolio growth.

8. Psychological Challenges During Downturns

While DCA encourages investing during market lows, it can still be emotionally challenging to see your portfolio lose value during a bear market. This emotional strain can lead some investors to abandon the strategy, undermining its effectiveness.

9. Not Always Cost-Effective for Lump-Sum Funds

If you have a large sum of money to invest, DCA might not be the most efficient strategy. Lump-sum investing may provide better returns, especially in a stable or rising market, as it puts the full amount to work immediately, maximizing growth potential.

Real-Life Example of Dollar-Cost Averaging

To better understand how dollar-cost averaging (DCA) works, let’s look at a real-life example. Imagine you decide to invest $200 each month in a stock. The stock price fluctuates over several months due to market conditions. By sticking to your plan and investing consistently, you purchase more shares when the price is low and fewer shares when the price is high, which helps lower your average cost per share over time. Here’s how it might look:

Dollar-Cost Averaging Example Table

| Month | Investment Amount ($) | Stock Price ($) | Shares Bought | Total Shares Owned | Total Investment ($) | Average Cost per Share ($) |

| January | 200 | 20 | 10.00 | 10.00 | 200 | 20.00 |

| February | 200 | 25 | 8.00 | 18.00 | 400 | 22.22 |

| March | 200 | 15 | 13.33 | 31.33 | 600 | 19.14 |

| April | 200 | 18 | 11.11 | 42.44 | 800 | 18.86 |

| May | 200 | 22 | 9.09 | 51.53 | 1,000 | 19.41 |

Is Dollar-Cost Averaging Right for You?

Dollar-cost averaging (DCA) can be an excellent strategy for many investors, but its suitability depends on your financial goals, risk tolerance, and investment preferences. If you’re new to investing or feel uneasy about market volatility, DCA offers a structured approach that reduces the pressure of timing the market. It’s particularly beneficial for those who prefer steady, disciplined investing over long periods, such as saving for retirement or other major life goals. However, if you have a large sum of money to invest and are comfortable with higher risks, other strategies like lump-sum investing might provide greater returns in a rising market. To determine if DCA is right for you, consider your budget, financial objectives, and how comfortable you are with market fluctuations.

Conclusion

Dollar-cost averaging is a simple yet powerful investment strategy that offers a disciplined approach to building wealth over time. By investing a fixed amount at regular intervals, you can reduce the emotional stress of market fluctuations and avoid the pitfalls of trying to time the market. While it may not be suitable for every situation, particularly in consistently rising markets, its ability to smooth out volatility and encourage consistent investing makes it a popular choice for many. Whether you’re a beginner or an experienced investor, DCA provides a reliable way to achieve long-term financial goals with confidence and stability.