In today’s fast-paced digital era, managing your finances has become more convenient than ever, thanks to net banking. Also known as online banking, this revolutionary service allows you to perform a range of banking tasks from the comfort of your home or on the go, eliminating the need to visit a physical bank branch. However, as much as net banking offers ease and efficiency, it also requires you to be vigilant about security. Cyber threats are a growing concern, and understanding the right security measures is essential to protect your finances and personal information. This guide will walk you through the essentials of net banking and the key steps to ensure a safe and secure online banking experience.

What is Net Banking?

Net banking, or online banking, is a digital platform provided by banks that enables you to access and manage your bank account through the internet. It serves as a virtual banking system, allowing you to perform various financial tasks such as transferring funds, paying bills, checking account balances, and even applying for loans, all without visiting a physical branch. With just a secure login and an internet connection, you can complete transactions and monitor your finances anytime, anywhere. This convenience has made net banking a cornerstone of modern financial management, providing users with efficient, paperless, and time-saving solutions for their banking needs.

Essential Security Measures to Use Net Banking Safely

While net banking offers unparalleled convenience, it also requires a proactive approach to security to safeguard your personal and financial information. Cyber threats like phishing, malware, and unauthorized access can pose serious risks if precautions are not taken. By adhering to essential security practices, you can ensure a safe and secure online banking experience.

1. Create Strong Passwords

Passwords act as the first line of defense for your net banking account. To ensure maximum security, create a password that is not only unique but also hard to guess. Avoid using personal information like your name, date of birth, or sequential numbers (e.g., “12345”). Instead, opt for a mix of uppercase and lowercase letters, numbers, and special characters. For example, a strong password might look like this: “P@ssw0rd!2025”. Additionally, update your password regularly and refrain from reusing passwords across multiple platforms.

2. Enable Two-Factor Authentication (2FA)

Two-factor authentication adds an extra layer of security to your net banking. Even if someone manages to get your password, they cannot access your account without the second authentication factor, such as a one-time password (OTP) sent to your mobile or email. Most banks offer this feature, and enabling it significantly reduces the chances of unauthorized access.

3. Avoid Public Wi-Fi for Transactions

Public Wi-Fi networks, like those in cafes or airports, are often unencrypted and can be an easy target for hackers. Using public Wi-Fi to access your net banking account puts your data at risk of interception. Instead, use a private and secure internet connection. If you must access net banking while traveling, consider using a virtual private network (VPN) for an added layer of encryption.

4. Regularly Update Software and Antivirus

Cybercriminals often exploit outdated software to gain unauthorized access to devices. By regularly updating your operating system, browsers, and banking apps, you can patch vulnerabilities and protect against potential threats. Additionally, install a reputable antivirus program to detect and block malicious software that could compromise your banking credentials.

5. Monitor Account Activity Frequently

Frequent monitoring of your bank statements and transaction history helps you quickly identify any suspicious activity. Look for unauthorized transactions, unfamiliar logins, or unusual changes in account settings. Many banks provide instant alerts for transactions; enabling these notifications can keep you informed in real-time.

6. Beware of Phishing Scams

Phishing scams involve fraudsters pretending to be legitimate entities, like your bank, to trick you into sharing sensitive information. Be cautious of emails or messages that urge you to click on suspicious links or ask for your login credentials. Legitimate banks will never ask for sensitive details through email or text. Always access your bank’s website by typing its URL directly into your browser.

7. Log Out After Each Session

When you’re done using net banking, ensure you log out of your account, especially if you are using a shared or public device. Simply closing the browser tab may not terminate the session, leaving your account vulnerable to unauthorized access.

8. Use Secure Websites

Before entering your banking credentials, ensure you’re on the correct and secure website. A secure website will have “https://” at the beginning of its URL and a padlock symbol in the browser’s address bar. Avoid clicking on links from unknown sources and verify the authenticity of the website before proceeding.

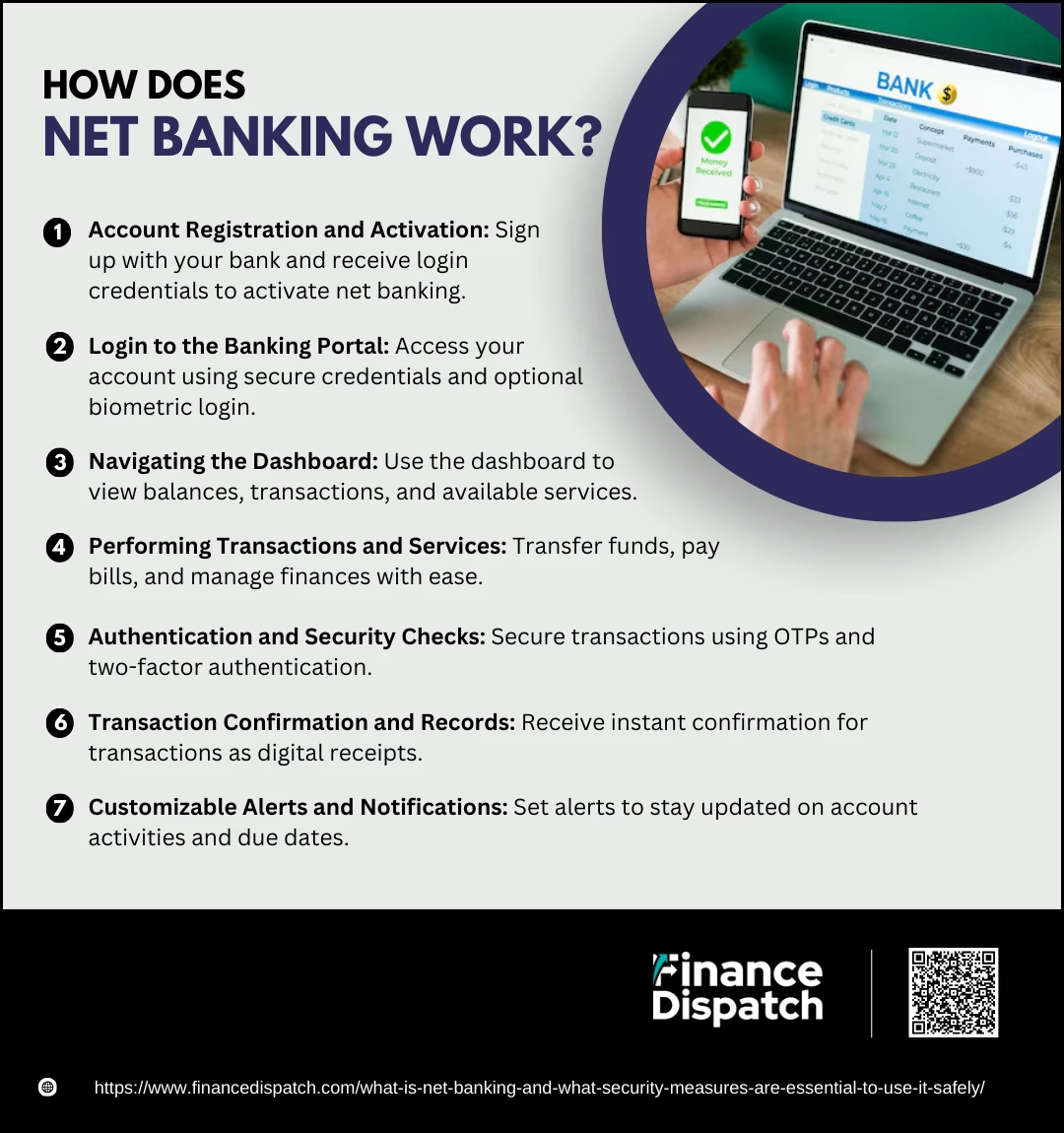

How Does Net Banking Work?

Net banking, also known as online banking, is a convenient way to manage your finances digitally, eliminating the need for in-person visits to a bank. It allows you to perform various banking activities, such as transferring money, paying bills, or checking your account balance, through a secure online portal or mobile application. With user-friendly interfaces and robust security features, net banking makes accessing financial services seamless and efficient. Below is a step-by-step breakdown of how it works:

Steps in the Net Banking Process:

1. Account Registration and Activation

Before you can use net banking, you need to register with your bank. This involves submitting a request, either online or in-person, and receiving credentials like a unique username and password. Some banks may require you to activate the service through an initial login or a PIN.

2. Login to the Banking Portal

Access your bank’s net banking portal or mobile app using your credentials. Most banks also offer biometric login options, such as fingerprint or facial recognition, for enhanced security.

3. Navigating the Dashboard

Once logged in, you’ll be directed to a dashboard displaying all the key information about your accounts, including balances, recent transactions, and available banking services. The dashboard acts as the hub for accessing various features.

4. Performing Transactions and Services

Net banking offers a wide range of features, from transferring funds between accounts (intra-bank and inter-bank transfers) to paying utility bills, recharging mobile phones, and applying for loans. You can also schedule recurring payments or set up standing instructions for automated transactions.

5. Authentication and Security Checks

Banks use advanced security measures to protect your transactions. This often includes one-time passwords (OTPs) sent to your registered mobile number or email, as well as two-factor authentication. These ensure that only authorized users can complete sensitive operations.

6. Transaction Confirmation and Records

After completing a transaction, you’ll receive an instant confirmation through email or SMS. This serves as a digital receipt, allowing you to track and verify all your banking activities.

7. Customizable Alerts and Notifications

Many banks allow you to set up alerts for transactions, low balances, or due dates. This ensures you stay informed about account activities and avoid any missed payments.

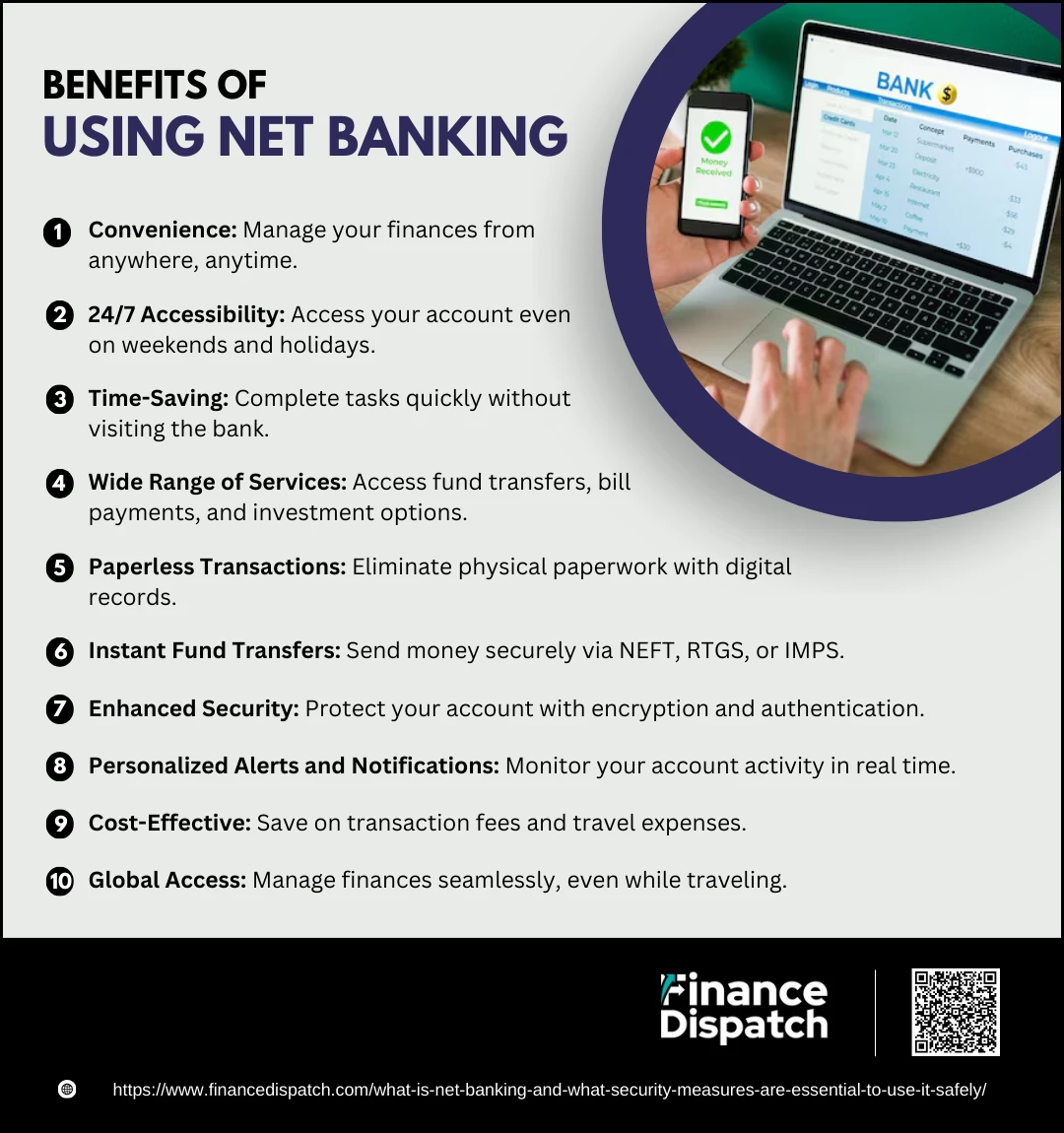

Benefits of Using Net Banking

Net banking is a game-changer in the financial world, offering unparalleled convenience and efficiency. It allows you to manage your finances seamlessly from anywhere, eliminating the need for time-consuming trips to a bank branch. From transferring funds instantly to accessing a range of banking services 24/7, net banking provides an all-in-one platform tailored to your needs. Let’s dive deeper into the benefits that make net banking indispensable:

Key Benefits of Net Banking:

1. Convenience

Net banking eliminates geographical barriers, allowing you to access your account anytime and anywhere. Whether it’s checking your balance, transferring funds, or paying bills, you can manage everything from your phone or computer.

2. 24/7 Accessibility

Unlike traditional banking that operates within fixed hours, net banking is available round-the-clock. This means you can perform transactions and access services even on weekends and holidays.

3. Time-Saving

By providing instant access to your account, net banking saves you the hassle of waiting in long queues. Routine tasks, like paying utility bills or transferring money, can be completed in just a few clicks.

4. Wide Range of Services

Net banking platforms offer a comprehensive suite of services, including fund transfers, online shopping payments, credit card management, and investment options like fixed deposits or mutual funds.

5. Paperless Transactions

Gone are the days of dealing with cumbersome paperwork. With net banking, all your transactions and records are stored digitally, making it an eco-friendly and efficient way to manage finances.

6. Instant Fund Transfers

Net banking provides fast and secure money transfers through options like NEFT (National Electronic Funds Transfer), RTGS (Real-Time Gross Settlement), and IMPS (Immediate Payment Service). These options make sending money to friends, family, or businesses a breeze.

7. Enhanced Security

Security is a cornerstone of net banking. Banks implement encryption, firewalls, and two-factor authentication (2FA) to ensure your transactions and data remain safe from unauthorized access.

8. Personalized Alerts and Notifications

Net banking allows you to set up alerts for various activities, such as low balances, large transactions, or upcoming bill payments, ensuring you stay on top of your finances.

9. Cost-Effective

Many banks offer net banking services free of charge or at a minimal cost. This reduces the need for in-person banking, saving you money on transaction fees and travel expenses.

10. Global Access

Whether you’re traveling locally or internationally, net banking gives you complete access to your account, making it the ideal tool for managing finances while on the move.

Security Risks in Net Banking

Net banking offers unparalleled convenience, but it is not without its risks. Cybercriminals constantly evolve their methods, targeting unsuspecting users through sophisticated schemes. If you’re not vigilant, you could fall victim to fraud or data breaches that compromise your finances and personal information. Understanding the potential security risks is crucial to protecting yourself and enjoying a safe online banking experience. Below, we delve into the most common threats you may encounter while using net banking:

Common Security Risks in Net Banking:

1. Phishing Attacks

Phishing is one of the most prevalent cybercrimes in net banking. Fraudsters create convincing emails or websites that appear identical to your bank’s official communications. These fake platforms trick you into entering sensitive details such as login credentials or OTPs, giving attackers direct access to your account.

2. Malware and Keyloggers

Malicious software can silently infiltrate your device through infected links, email attachments, or downloads. Once installed, it tracks your keystrokes, capturing login information and other private data. This can lead to unauthorized access to your net banking account.

3. Unsecured Public Wi-Fi Networks

While public Wi-Fi is convenient, it’s also a hotspot for cybercriminals. These networks are often unencrypted, allowing hackers to intercept the data you transmit, including your banking credentials and transaction details.

4. Weak Passwords

Using simple, easily guessable passwords, such as “password123” or your birthdate, makes it easier for hackers to breach your account. Reusing passwords across multiple platforms increases this vulnerability.

5. Social Engineering Scams

Scammers often rely on psychological manipulation to obtain confidential information. Posing as bank representatives, they might contact you via phone, email, or SMS, convincing you to reveal your account details or PIN.

6. Outdated Software

Neglecting to update your browser, net banking app, or antivirus software exposes you to security loopholes. Cybercriminals exploit these vulnerabilities to launch attacks on outdated systems.

7. Man-in-the-Middle Attacks (MITM)

In this advanced form of cyberattack, hackers intercept communication between you and your bank’s server. They can eavesdrop, steal data, or alter transaction details without your knowledge.

8. Fake Banking Apps

Fraudulent apps mimic legitimate banking applications to deceive users. If you download these apps, your login credentials and sensitive information may be stolen and misused.

9. Account Takeover Fraud

If attackers gain access to your login credentials, they can take full control of your account. This allows them to initiate unauthorized transactions, change security settings, and withdraw funds.

10. Lack of Two-Factor Authentication (2FA)

Accounts relying solely on a password are significantly more vulnerable to breaches. Two-factor authentication adds an extra layer of protection, requiring a second step, such as an OTP or biometric verification, to access your account.

Comparing Common Security Features of Banks

When it comes to net banking, security is a top priority for banks and customers alike. Banks employ a range of advanced security measures to protect users from cyber threats and unauthorized access. While many features are standard across most financial institutions, the implementation and level of sophistication may vary. Below is a comparison of common security features offered by banks to enhance the safety of online banking.

Table: Comparison of Common Bank Security Features

| Security Feature | Description | Purpose | Availability |

| Two-Factor Authentication (2FA) | Requires an additional verification step, such as OTP or biometric authentication. | Enhances account protection by adding a second layer of security. | Common across most banks. |

| Encryption | Secures data transmission between the user and the bank with end-to-end encryption protocols. | Prevents interception of sensitive data during online transactions. | Standard for all online banking systems. |

| Login Alerts | Sends notifications for every successful or failed login attempt to the registered user. | Helps users monitor account access and detect unauthorized attempts. | Widely available. |

| Biometric Authentication | Uses fingerprint, face recognition, or retina scans for secure login and transaction approvals. | Ensures only the account owner can access the account. | Available in modern banking apps. |

| Fraud Detection Systems | Monitors user behavior and transaction patterns to identify and block suspicious activities. | Protects against fraudulent transactions in real-time. | Common in major banks. |

| Time-Out Sessions | Automatically logs users out after a period of inactivity. | Prevents unauthorized access if the session is left open. | Standard practice. |

| Device Registration | Requires users to register new devices before accessing net banking. | Adds a layer of control over which devices can access the account. | Offered by many banks. |

| Secure Messaging | Provides a safe platform within the banking portal for customer communication. | Prevents sensitive information from being exposed through email or SMS. | Commonly available. |

| Transaction Limits | Sets daily or per-transaction caps for transfers and withdrawals. | Minimizes potential losses in case of unauthorized access. | Adjustable by users in most banks. |

| Token-Based Authentication | Requires a hardware or software token to generate a unique code for login or transactions. | Offers an additional layer of security, especially for high-value transactions. | Used by select banks. |

Tips for Beginners Using Net Banking

Getting started with net banking can feel daunting, but with the right approach, it becomes a secure and efficient way to manage your finances. By following basic security practices and familiarizing yourself with the platform, you can maximize its convenience while safeguarding your information. Below are essential tips to help you get started:

Tips for Beginners:

- Use a secure and trusted device for registration.

- Create a strong, unique password and update it regularly.

- Explore the net banking interface to understand its features.

- Enable two-factor authentication (2FA) for added security.

- Avoid public Wi-Fi when accessing net banking.

- Check your account regularly for unauthorized activities.

- Log out after every session, especially on shared devices.

- Enable alerts for transactions and low balances.

- Access net banking only via official websites or apps.

- Stay informed about common scams like phishing and malware.

Conclusion

Net banking has revolutionized the way you manage your finances, offering unmatched convenience and efficiency. Whether you’re transferring funds, paying bills, or checking account balances, it saves time and effort while providing 24/7 access to banking services. However, with the growing reliance on online platforms, it’s essential to prioritize security by adopting best practices such as using strong passwords, enabling two-factor authentication, and staying vigilant against cyber threats. By understanding the features, benefits, and potential risks of net banking, you can confidently harness its advantages and enjoy a seamless, secure banking experience.