An investment portfolio is a collection of financial assets designed to help you achieve specific financial objectives. Whether you’re saving for retirement, funding your child’s education, or building wealth, a well-structured portfolio is key to turning your aspirations into reality. It allows you to balance risks and rewards by diversifying your investments across different asset classes such as stocks, bonds, real estate, and cash. Understanding how to create and manage an investment portfolio is essential for navigating the complexities of the financial world and ensuring your money works effectively toward your goals. In this article, you’ll learn what an investment portfolio is and how its structure can help you achieve your financial objectives.

What is an Investment Portfolio?

An investment portfolio is essentially a collection of financial assets that you own, which may include stocks, bonds, mutual funds, real estate, cash, and other investment vehicles. It serves as a personalized blueprint for achieving your financial goals, whether they involve building long-term wealth, generating income, or preserving capital. Each portfolio is unique and reflects the investor’s objectives, risk tolerance, and time horizon. By strategically selecting and managing these assets, an investment portfolio enables you to balance potential risks with expected returns, creating a structured pathway to financial success.

Types of Investment Portfolios

Investment portfolios come in various forms, each tailored to different financial objectives, risk tolerances, and time horizons. By understanding the different types of portfolios, you can choose a strategy that aligns with your goals and effectively manages risks. Below are the main types of investment portfolios:

1. Growth Portfolio

Focused on capital appreciation, a growth portfolio emphasizes high-risk, high-reward assets such as stocks in emerging markets or innovative industries. It is ideal for investors with a long-term horizon and a higher risk tolerance.

2. Income Portfolio

Designed to generate steady income, this portfolio includes assets such as dividend-paying stocks, bonds, and real estate investment trusts (REITs). It suits investors seeking regular cash flow, such as retirees.

3. Balanced Portfolio

Combining growth and income strategies, a balanced portfolio offers a mix of equities and fixed-income securities. It provides moderate risk and reward, making it suitable for investors seeking both stability and growth.

4. Aggressive Portfolio

This portfolio targets maximum returns by investing heavily in high-risk, high-reward assets like small-cap stocks and startups. It is typically adopted by investors willing to accept significant volatility for the possibility of substantial gains.

5. Conservative Portfolio

Prioritizing capital preservation, a conservative portfolio focuses on low-risk investments such as government bonds, blue-chip stocks, and money market instruments. It is ideal for risk-averse investors or those nearing their financial goals.

6. Socially Responsible Portfolio

For investors who want to align their financial goals with their values, this portfolio focuses on companies or assets that adhere to environmental, social, and governance (ESG) principles. It aims to generate returns while promoting ethical practices.

7. Speculative Portfolio

Built around high-risk, high-reward opportunities, speculative portfolios often include assets like cryptocurrency, penny stocks, or emerging market investments. They are suited for experienced investors with a strong appetite for risk.

The Importance of Structuring an Investment Portfolio

The Importance of Structuring an Investment Portfolio

Structuring an investment portfolio goes beyond simply picking a handful of assets. It’s a strategic process that aligns your investments with your unique financial goals, risk tolerance, and time horizon. A well-structured portfolio acts as a roadmap, guiding your financial decisions and providing a framework for achieving short-term and long-term objectives. By carefully balancing different asset classes and diversifying your investments, you reduce the impact of market volatility, maximize potential returns, and ensure that your portfolio grows in a way that aligns with your needs and priorities. Below are the primary reasons why structuring an investment portfolio is vital:

1. Risk Management

Market fluctuations are inevitable, but a diversified portfolio can help spread risk across various asset classes. By not putting all your eggs in one basket, you safeguard your investments against significant losses from any single market event.

2. Goal Alignment

Every financial goal requires a tailored investment approach. Structuring your portfolio allows you to allocate resources effectively, whether you’re saving for retirement, purchasing a home, or building wealth for future generations.

3. Diversification

Including a variety of asset types—such as stocks for growth, bonds for stability, and real estate for income generation—creates a buffer against market instability. This diversification ensures that losses in one area can be offset by gains in another.

4. Optimized Returns

Balancing high-risk, high-reward assets with more stable options can help you achieve consistent returns over time. A structured portfolio ensures that you don’t overexpose yourself to unnecessary risks while still pursuing growth.

5. Adaptability to Changing Needs

Life circumstances and market conditions are always evolving. A structured portfolio allows you to make adjustments as your goals change, ensuring your investments remain relevant and effective.

6. Tax Efficiency

A thoughtfully structured portfolio considers tax implications, helping you minimize tax liabilities and maximize after-tax returns.

7. Peace of Mind

Knowing that your portfolio is designed to weather market ups and downs and align with your specific financial aspirations provides a sense of confidence and security. This reduces emotional decision-making and helps you stay focused on your long-term goals.

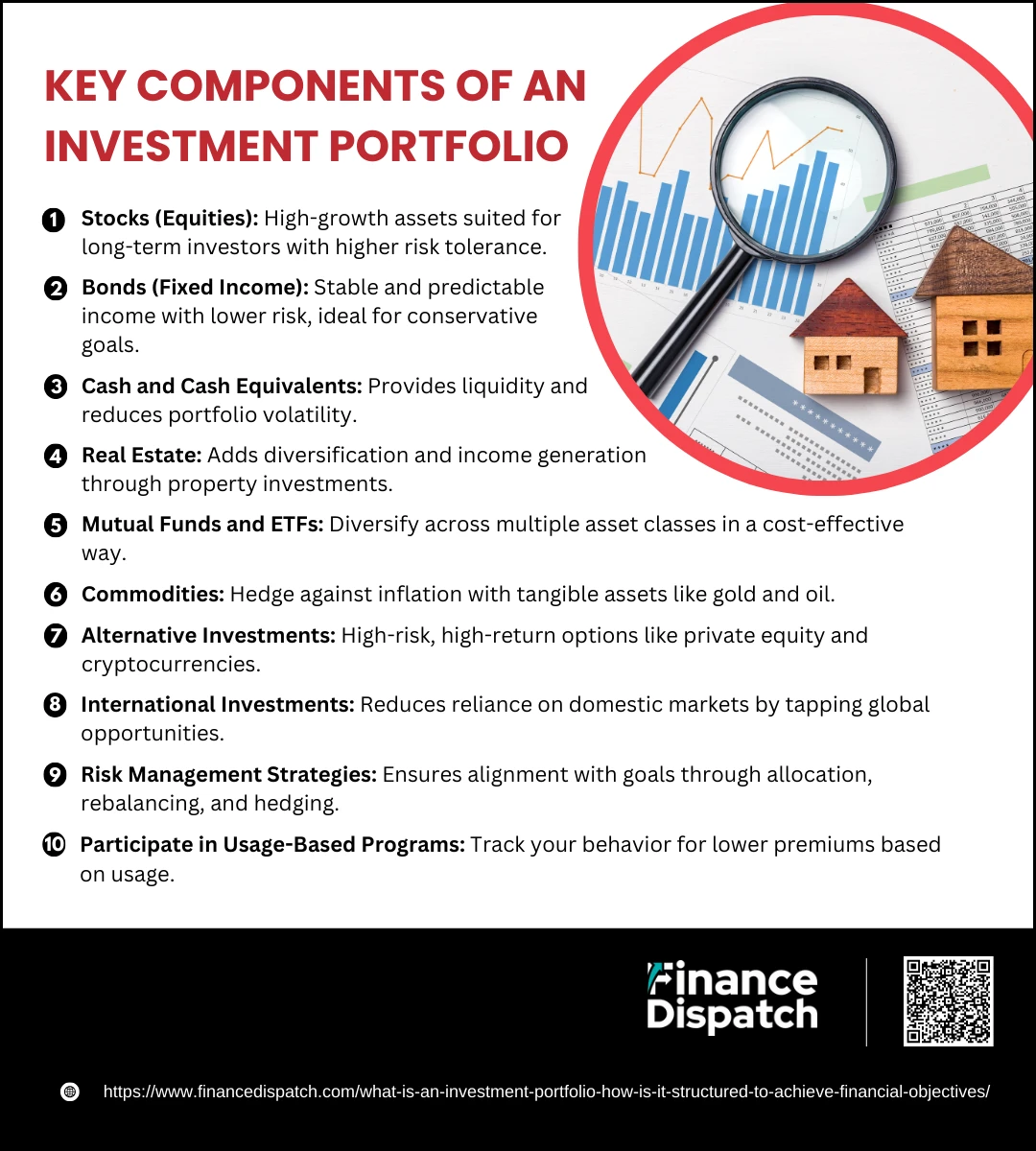

Key Components of an Investment Portfolio

Key Components of an Investment Portfolio

An investment portfolio is a strategic combination of various financial assets tailored to meet your financial objectives. Each component within the portfolio plays a critical role in balancing risk, generating returns, and providing stability. A well-structured portfolio incorporates a diverse range of assets that complement one another, creating a synergy to achieve optimal performance. Below is a deeper look at the essential components of an investment portfolio:

1. Stocks (Equities)

Equities form the backbone of many portfolios due to their high growth potential. They represent ownership in companies and can generate substantial returns through capital appreciation and dividends. However, they are subject to market volatility and are better suited for long-term investors with a higher risk tolerance.

2. Bonds (Fixed Income)

Bonds provide a counterbalance to stocks by offering stability and predictable income. They are loans to governments or corporations, repaid with interest. Bonds help preserve capital and reduce overall portfolio risk, making them ideal for conservative investors or those nearing their financial goals.

3. Cash and Cash Equivalents

Highly liquid assets like savings accounts, certificates of deposit (CDs), and money market funds ensure that you have readily available funds for emergencies or short-term needs. These provide safety and reduce the overall volatility of your portfolio.

4. Real Estate

Real estate adds tangible value and diversification to your portfolio. Properties can generate steady income through rent and potential long-term appreciation. Real Estate Investment Trusts (REITs) offer an accessible way to invest in real estate without directly owning properties.

5. Mutual Funds and ETFs

These pooled investment vehicles allow you to diversify across multiple asset classes, sectors, or geographic regions with a single investment. They are cost-effective and offer professional management, making them an excellent option for investors seeking a balanced approach.

6. Commodities

Physical goods like gold, silver, oil, or agricultural products provide a hedge against inflation and currency fluctuations. Commodities tend to perform well during economic uncertainty, offering a layer of protection to your portfolio.

7. Alternative Investments

This category includes private equity, hedge funds, and cryptocurrencies, which can offer higher returns but come with increased risk and less liquidity. These investments are typically suitable for experienced investors with a robust appetite for risk.

8. International Investments

Incorporating foreign stocks and bonds provides exposure to global markets and reduces dependence on domestic market performance. This geographic diversification helps mitigate risks associated with local economic downturns.

9. Risk Management Strategies

Effective risk management ensures your portfolio remains aligned with your goals. Techniques such as asset allocation, rebalancing, and employing hedging instruments like options can help control risk and enhance portfolio resilience.

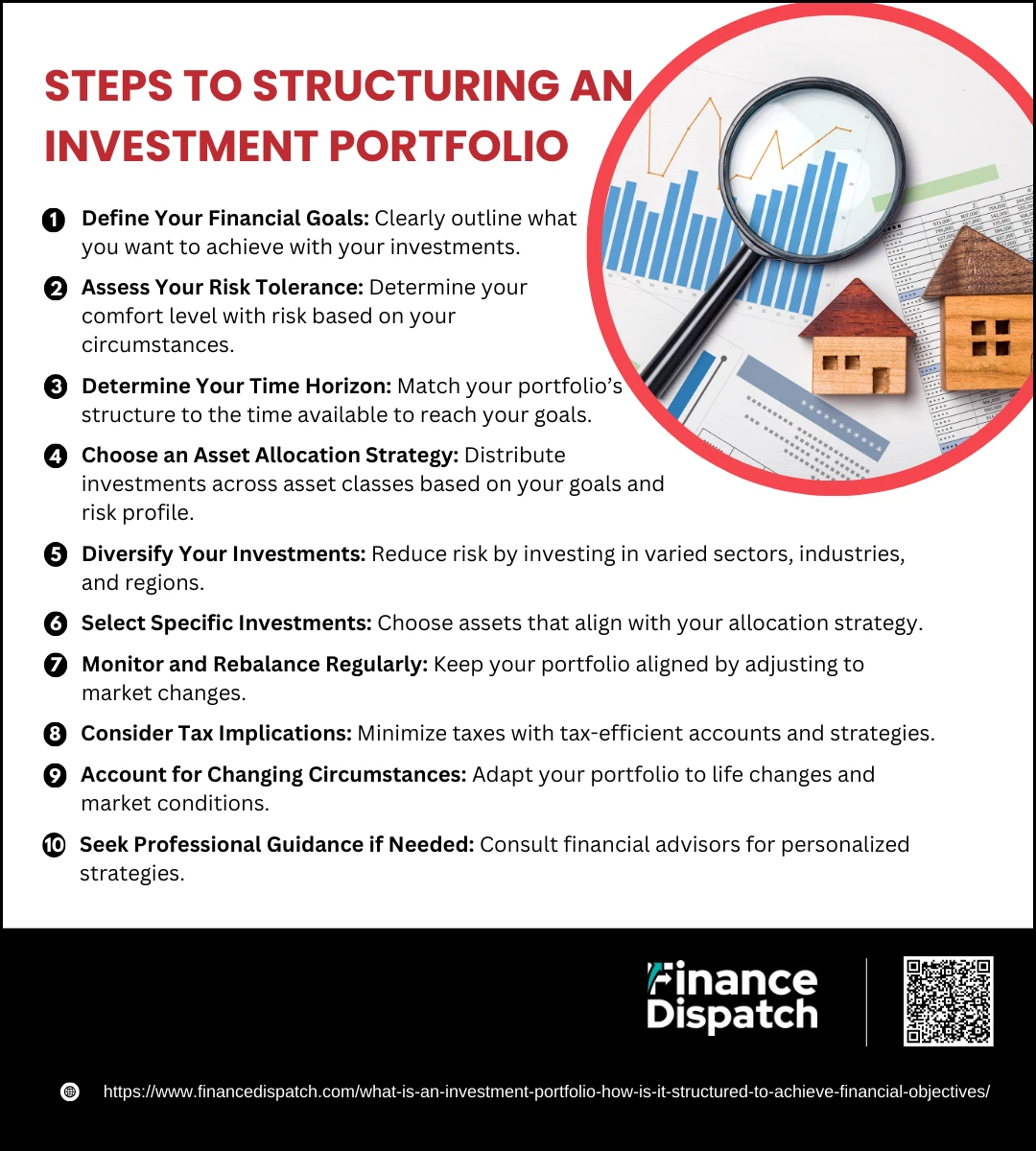

Steps to Structuring an Investment Portfolio

Steps to Structuring an Investment Portfolio

Building an investment portfolio involves more than just picking investments—it’s a deliberate process designed to align with your financial goals, risk tolerance, and time horizon. A well-structured portfolio balances growth potential with risk management and adapts to changing market conditions and personal circumstances. Here’s a detailed look at the essential steps to creating a robust investment portfolio:

1. Define Your Financial Goals

Start by outlining your objectives. Are you saving for retirement, a down payment on a home, or your child’s education? Clearly defining your goals helps shape the structure of your portfolio, including the level of risk and types of assets to include.

2. Assess Your Risk Tolerance

Understanding your risk tolerance is key to making informed investment decisions. Evaluate how much risk you’re comfortable taking based on factors like your age, financial situation, and investment experience. Higher risk often brings higher returns but also more volatility.

3. Determine Your Time Horizon

Your investment timeline significantly influences your portfolio structure. A long-term horizon allows for more aggressive investments, such as stocks, while a short-term goal may require safer, low-volatility assets like bonds or cash equivalents.

4. Choose an Asset Allocation Strategy

Asset allocation involves distributing your investments among different asset classes such as stocks, bonds, real estate, and cash. For example:

- A growth-focused portfolio might include 70% stocks and 30% bonds.

- A conservative portfolio might prioritize bonds and cash for stability.

5. Diversify Your Investments

Diversification reduces risk by spreading investments across various sectors, industries, and regions. Within stocks, consider different market sectors (e.g., technology, healthcare) and geographic regions (e.g., domestic and international markets). Adding alternative investments like real estate or commodities can further enhance diversification.

6. Select Specific Investments

Once your asset allocation is decided, choose specific investments that fit your strategy. For instance, you may invest in index funds for broad market exposure, REITs for real estate, or individual stocks for targeted growth opportunities.

7. Monitor and Rebalance Regularly

Over time, your portfolio may drift from its original allocation due to market movements. Regular monitoring ensures that your investments remain aligned with your goals. Rebalancing involves buying or selling assets to restore your desired allocation. For example, if stocks outperform and exceed their target percentage, you may sell some stocks and reinvest in bonds.

8. Consider Tax Implications

Tax-efficient investing can maximize your returns. For example, holding high-yield investments in tax-advantaged accounts like IRAs or 401(k)s can minimize tax liabilities. Be mindful of capital gains taxes when selling assets.

9. Account for Changing Circumstances

Life changes—such as marriage, starting a family, or nearing retirement—may require adjustments to your portfolio. Regularly revisiting your goals ensures your portfolio remains relevant and effective.

10. Seek Professional Guidance if Needed

If you’re uncertain about any aspect of structuring your portfolio, consulting a financial advisor can be invaluable. They can help you develop a strategy tailored to your unique financial situation and objectives.

Strategies to Achieve Financial Objectives

Strategies to Achieve Financial Objectives

Achieving financial objectives is a dynamic process that requires deliberate planning, consistent effort, and adaptability to changing circumstances. Whether your goal is to save for a major purchase, build an emergency fund, or secure a comfortable retirement, employing the right strategies can provide a clear roadmap to success. Financial goals are not one-size-fits-all, and the approach you take should reflect your unique circumstances, risk tolerance, and long-term aspirations. Below are detailed strategies that can guide you on your financial journey:

1. Set Clear and Realistic Goals

Start with a clear vision of what you want to achieve. Break large goals into smaller, actionable steps. For example, if you’re saving for retirement, set milestones such as saving a specific percentage of your income annually or reaching a target amount by a certain age.

2. Create a Budget and Stick to It

A well-planned budget is the cornerstone of financial success. Track your income and expenses to identify areas where you can cut back. Ensure your budget allocates funds for necessities, savings, debt repayment, and discretionary spending, allowing you to live within your means while progressing toward your objectives.

3. Invest in a Diversified Portfolio

Diversification minimizes risk by spreading your investments across various asset classes. For instance, combine growth-oriented investments like stocks with stable options like bonds. Diversify within asset classes by including different industries and geographic regions to enhance resilience.

4. Adopt a Long-Term Perspective

Financial objectives, especially those related to wealth accumulation or retirement planning, require patience. Resist the temptation to react to short-term market fluctuations. Instead, focus on long-term trends and stick to your plan to achieve steady growth.

5. Automate Your Savings

Automation is a powerful tool to ensure consistency. Set up recurring transfers from your checking account to your savings or investment accounts. This approach enforces discipline and reduces the risk of spending money earmarked for your goals.

6. Monitor and Adjust Your Plans Regularly

Financial plans need to evolve with your life circumstances. Review your progress at regular intervals and make adjustments based on changes in your income, expenses, or goals. For example, if you receive a raise, consider increasing your savings rate.

7. Manage Debt Effectively

High-interest debt can derail your financial plans. Focus on paying down such debts first while maintaining regular payments on other obligations. Avoid taking on new debt unless absolutely necessary and explore refinancing options to lower interest rates.

8. Focus on Tax Efficiency

Tax-advantaged accounts such as IRAs, 401(k)s, and Health Savings Accounts (HSAs) can help you reduce your taxable income while growing your savings. Additionally, consider the tax implications of your investment choices, such as capital gains taxes, and structure your portfolio accordingly.

9. Seek Professional Advice When Necessary

Financial advisors can provide valuable insights and personalized strategies to optimize your investments and savings. They can help you navigate complex decisions, such as estate planning, tax strategies, and retirement planning.

10. Stay Educated on Financial Trends

Keeping up with changes in the financial landscape empowers you to make informed decisions. Whether it’s understanding new investment opportunities, staying updated on market trends, or learning about economic shifts, financial literacy is essential to success.

Examples of Portfolio Structures

The structure of an investment portfolio varies depending on the investor’s financial goals, risk tolerance, and time horizon. A well-designed portfolio allocates assets in a way that balances growth and stability while aligning with specific objectives. Below are examples of common portfolio structures tailored to different investment goals:

| Portfolio Type | Stocks (%) | Bonds (%) | Real Estate (%) | Cash (%) | Risk Level | Objective |

| Growth-Oriented | 70 | 20 | 5 | 5 | High | Maximize capital appreciation |

| Income-Focused | 40 | 50 | 5 | 5 | Moderate | Generate steady income |

| Balanced | 50 | 30 | 10 | 10 | Moderate | Combine growth and stability |

| Aggressive | 80 | 10 | 5 | 5 | Very High | Target high returns with higher risk |

| Conservative | 20 | 60 | 10 | 10 | Low | Prioritize capital preservation |

| Socially Responsible | 60 | 30 | 5 | 5 | Moderate | Align investments with ethical values |

| Short-Term Focused | 10 | 20 | 5 | 65 | Very Low | Maintain liquidity and reduce risk |

| Diversified Global | 50 | 25 | 15 | 10 | Moderate to High | Access global growth opportunities |

Common Mistakes to Avoid in Portfolio Management

Managing an investment portfolio effectively requires careful planning, discipline, and regular oversight. However, even seasoned investors can fall into common traps that hinder their portfolio’s performance and growth. Recognizing and avoiding these mistakes is crucial to achieving long-term financial success. Below are some of the most frequent errors investors make in portfolio management:

- Neglecting Diversification

Relying too heavily on a single asset class or sector increases risk. A well-diversified portfolio spreads investments across various asset types, industries, and geographic regions. - Failing to Rebalance Regularly

Over time, market fluctuations can skew your portfolio’s asset allocation. Neglecting to rebalance can result in a portfolio that no longer aligns with your financial goals or risk tolerance. - Ignoring Risk Tolerance

Investing in high-risk assets without considering your comfort level with market volatility can lead to emotional decisions during downturns. - Chasing Past Performance

Basing investment decisions on assets that have performed well in the past can lead to missed opportunities and exposure to declining trends. - Overlooking Fees and Costs

High fees from mutual funds, ETFs, or advisors can erode your returns over time. Always review and minimize the costs associated with your investments. - Making Emotional Decisions

Allowing fear or greed to dictate your investment choices often leads to poor timing, such as selling during a downturn or buying during a peak. - Underestimating Liquidity Needs

Failing to keep enough cash or liquid assets can create financial strain during emergencies or unexpected expenses. - Timing the Market

Attempting to predict market movements is challenging, even for professionals. A long-term strategy often outperforms frequent buying and selling. - Ignoring Tax Implications

Neglecting to consider the tax impact of your investment decisions, such as capital gains taxes, can significantly reduce your net returns. - Setting Unrealistic Goals

Expecting unrealistically high returns or setting vague financial objectives can lead to disappointment and poor portfolio choices.

Conclusion

A well-structured and thoughtfully managed investment portfolio is essential for achieving your financial objectives, whether they involve building wealth, generating income, or preserving capital. By understanding the key components of a portfolio, employing effective strategies, and avoiding common pitfalls, you can navigate the complexities of the financial markets with confidence. Portfolio management is not a one-time task but an ongoing process that requires regular review and adjustment to align with your evolving goals and market conditions. With discipline, informed decision-making, and, when necessary, professional guidance, you can create a resilient portfolio that supports your financial aspirations and provides a secure foundation for your future.