Active stock-picking is a strategy where you take a hands-on approach to investing by carefully selecting individual stocks rather than investing in a broad market index. It’s a method that requires in-depth research, analysis, and a strategic mindset, as you’re looking to find those stocks that have the potential to outperform the market. While this approach can be rewarding, it also demands effort, expertise, and the ability to stay updated on market trends.

How Active Stock-Picking Works

Active stock-picking is all about making informed decisions by analyzing individual companies and the market conditions that affect their stocks. Unlike passive investing, where you buy into an index or a fund that tracks the market, active stock-picking requires you to dig deeper. It involves selecting stocks you believe will outperform based on research, insights, and sometimes even a gut feeling. Here’s a breakdown of how this approach works:

Steps to Active Stock-Picking

1. Conducting In-Depth Research

The process begins with thorough research into a company’s fundamentals. This means studying its financial statements, management team, business model, and competitive advantages. Investors look for factors that indicate stability, profitability, and growth potential, such as strong earnings, low debt, and consistent revenue.

2. Analyzing Financial Ratios

Financial ratios, like the price-to-earnings (P/E) ratio, return on equity (ROE), and debt-to-equity (D/E) ratio, are essential tools for assessing a company’s financial health. By comparing these ratios to industry averages, you can determine if a stock is overvalued or undervalued, which helps you make more strategic investment choices.

3. Evaluating Market Conditions

Market conditions play a huge role in stock performance. Active investors monitor economic indicators, interest rates, and global events that might affect market trends. This helps in timing stock purchases and sales, which is critical for maximizing returns.

4. Keeping Track of Industry Trends

Understanding the trends within an industry can reveal which companies are positioned for success. For example, growth in the renewable energy sector might suggest opportunities in companies focused on solar technology. Active investors often specialize in specific industries to gain a deeper understanding of the market forces at play.

5. Diversifying the Portfolio

Diversification is a key risk management strategy in active stock-picking. Rather than putting all your money into a single stock, you spread your investments across different sectors, industries, or even asset classes. This way, poor performance in one area can be offset by gains in another.

6. Monitoring and Adjusting the Portfolio

Active investing isn’t a one-time decision. You need to continuously monitor your portfolio and adjust your holdings based on new information. If a company’s outlook changes, it might be time to sell the stock and reinvest in a more promising option. Regular portfolio reviews help you stay on top of your investments.

7. Timing the Market

While timing the market is notoriously difficult, active investors attempt to buy stocks when prices are low and sell when they are high. This requires a keen understanding of market cycles, economic trends, and investor sentiment. Successful timing can lead to significant gains, but it also comes with the risk of missing out if the timing is wrong.

8. Relying on a Mix of Strategies

Active stock-pickers may use a blend of strategies, including growth investing (looking for companies with high growth potential), value investing (finding undervalued stocks), and dividend investing (choosing companies that offer regular dividend payouts). The right mix depends on your investment goals and risk tolerance.

Key Strategies in Active Stock-Picking

Active stock-picking is more than just buying stocks that catch your eye. It involves a strategic approach to selecting and managing investments, aiming to outperform the market. Successful active investors use various strategies to identify opportunities and mitigate risks. Below are some of the key strategies that can help you navigate the complexities of active stock-picking.

1. Fundamental Analysis

This strategy focuses on evaluating a company’s financial health by analyzing its balance sheet, income statement, and cash flow statement. By understanding the company’s assets, liabilities, revenues, and expenses, you can gauge its profitability and long-term stability. Fundamental analysis helps you determine whether a stock is undervalued or overvalued compared to its peers.

2. Technical Analysis

While fundamental analysis looks at the health of the business, technical analysis examines stock price movements and patterns. By analyzing charts, trends, and historical data, you can make predictions about a stock’s future performance. This approach is often used to time entry and exit points, helping you decide when to buy or sell a stock.

3. Growth Investing

Growth investing involves looking for companies that have the potential to grow faster than their peers or the overall market. These are often companies in expanding industries or those introducing innovative products and services. Investors using this strategy look for stocks with high revenue growth, even if it means paying a higher price-to-earnings (P/E) ratio.

4. Value Investing

Value investors seek out stocks that appear to be undervalued by the market. These stocks may be trading at lower prices compared to their intrinsic value, based on factors like earnings, dividends, or assets. The goal is to buy these undervalued stocks at a discount and profit as the market eventually recognizes their true worth. This strategy requires patience and thorough analysis.

5. Dividend Investing

This strategy focuses on companies that regularly pay dividends, providing a steady income stream in addition to potential stock price appreciation. Dividend-paying stocks are often seen as safer, more stable investments, and can be particularly attractive during periods of market volatility. This approach appeals to investors looking for both income and growth.

6. Sector Rotation

Sector rotation involves shifting your investments between different sectors of the economy based on economic cycles. For example, during economic expansion, sectors like technology and consumer discretionary might perform well, while utilities and healthcare might be safer bets during downturns. Active investors use this strategy to capitalize on the strengths of different sectors at different times.

7. Contrarian Investing

This strategy is about going against the crowd. Contrarian investors buy stocks that others are avoiding and sell stocks that others are flocking to. The idea is that the market can overreact, creating opportunities to buy undervalued stocks or sell overvalued ones. It requires a strong conviction and the ability to stand firm in the face of popular opinion.

8. Momentum Investing

Momentum investors focus on stocks that are already showing strong upward trends. The belief is that “winners keep winning,” so they invest in stocks that have been performing well and are expected to continue to do so. This strategy often involves short-term investments and requires constant monitoring of market trends.

9. Risk Management through Diversification

No matter which strategy you choose, diversification is key. By spreading your investments across different sectors, industries, or asset types, you can reduce the impact of a poor-performing stock on your overall portfolio. Effective risk management is about balancing potential returns with the ability to absorb losses.

Advantages and Challenges of Active Stock-Picking

Active stock-picking is a popular investment strategy for those who want to take a hands-on approach and aim to outperform the market. However, it comes with its own set of benefits and difficulties. Understanding both sides can help you decide if this strategy aligns with your investment goals and risk tolerance.

Advantages of Active Stock-Picking

1. Potential for Higher Returns

One of the biggest advantages of active stock-picking is the potential to achieve returns that outperform the market. By carefully selecting stocks, you can target high-growth opportunities that may not be available in a passively managed fund. This can lead to significant gains, especially if you pick the right stocks at the right time.

2. Flexibility in Investment Choices

Active investors have the freedom to choose specific stocks rather than being limited to a set index. This allows you to invest in companies or sectors you believe have strong growth prospects, and you can adjust your portfolio as needed. Flexibility also means you can respond quickly to market changes or emerging trends.

3. Opportunity to Hedge Risks

Active stock-pickers can use strategies like short-selling or buying put options to hedge against potential losses. This means you can actively manage your portfolio to minimize risk, especially during periods of market volatility. Unlike passive investors, you aren’t locked into holding certain stocks and can make defensive moves to protect your capital.

4. Tax Management

Active investors can make decisions that help with tax management, such as selling stocks to offset gains with losses. This strategy, known as tax-loss harvesting, can help reduce the overall tax burden, allowing you to keep more of your investment earnings.

5. Customization of Investment Strategy

With active stock-picking, you can customize your portfolio based on your personal investment goals, whether they’re focused on income, growth, or a mix of both. This tailored approach can be especially beneficial for those with specific financial goals, such as saving for retirement or generating regular income.

Challenges of Active Stock-Picking

1. Higher Costs and Fees

Active stock-picking often involves higher costs than passive investing. You might incur fees for research, transaction costs, and potentially management fees if you use a broker or advisor. These expenses can eat into your profits, making it harder to outperform the market after costs are factored in.

2. Requires Significant Time and Effort

Successful active stock-picking is not a passive activity; it requires extensive research, continuous monitoring of market trends, and an understanding of financial statements. This time-consuming process can be overwhelming, especially for those who are not experienced in analyzing stocks.

3. Risk of Underperformance

While active stock-picking offers the potential for higher returns, there’s also a risk that your chosen stocks may not perform as expected. In fact, many actively managed funds fail to beat their benchmarks consistently. Poor stock choices or misjudging market conditions can lead to underperformance, resulting in financial losses.

4. Market Volatility

Active stock-picking is more susceptible to the effects of market volatility. Rapid changes in stock prices, economic shifts, and unexpected global events can quickly impact your portfolio. Unlike passive strategies that spread risk across a broad index, active strategies can be more vulnerable to sudden downturns.

5. Emotional Decision-Making

Investing actively can sometimes lead to emotional decision-making, where you might react impulsively to short-term market movements. This can result in buying high and selling low, which can hurt your long-term investment performance. Staying disciplined and sticking to your strategy can be challenging in volatile markets.

Where Active Stock-Picking provide better returns

Active stock-picking isn’t always the right choice for every investor, but there are certain situations where it can truly shine. By carefully analyzing specific stocks and adjusting portfolios based on market conditions, active investors can take advantage of opportunities that passive strategies might miss. Here are some scenarios where active stock-picking can excel and potentially provide better returns.

1. Undervalued Stocks and Market Inefficiencies

Active stock-picking thrives in markets where there are inefficiencies or mispriced stocks. Skilled investors can identify undervalued stocks that the broader market has overlooked and capitalize on these opportunities. By conducting thorough research and analysis, active investors can find “hidden gems” that may not be captured by index funds.

2. Small-Cap and Emerging Markets

Small-cap and emerging market stocks often have less analyst coverage compared to large-cap stocks, leading to more opportunities for active stock-pickers. These markets can be less efficient, allowing investors who do their homework to gain an edge. Additionally, the volatility and growth potential in these sectors make them ideal for those looking to outperform the market.

3. Sector-Specific Opportunities

Active investors can target specific sectors that they believe will outperform based on current trends or future projections. For example, if renewable energy is expected to grow rapidly, an active investor might focus on companies within that sector to maximize returns. This flexibility allows them to take advantage of emerging trends before they become mainstream.

4. Volatile Market Conditions

During periods of market volatility, active stock-picking can offer a significant advantage. Unlike passive strategies that are tied to an index, active investors can make quick decisions to adjust their portfolios, such as shifting to defensive stocks during a downturn or taking profits when markets are high. This adaptability can help mitigate risks and protect returns.

5. Event-Driven Strategies

Active stock-picking excels when there are specific events that may impact a company’s stock price, such as mergers, acquisitions, or regulatory changes. Investors can leverage their knowledge to make timely trades that take advantage of these events. This approach requires being constantly informed and ready to act quickly, but it can lead to substantial gains.

6. Customization Based on Investor Goals

One of the key strengths of active stock-picking is the ability to tailor a portfolio to an investor’s specific financial goals. Whether it’s generating steady income through dividend stocks, seeking high growth, or focusing on ethical investments, active investors can build a portfolio that aligns perfectly with their preferences and objectives.

7. Exploiting Short-Term Opportunities

While long-term trends are important, active stock-pickers can also take advantage of short-term market fluctuations. They can buy stocks that are temporarily down due to market overreactions and sell when the stock bounces back. This requires a good understanding of market psychology and the ability to make quick decisions.

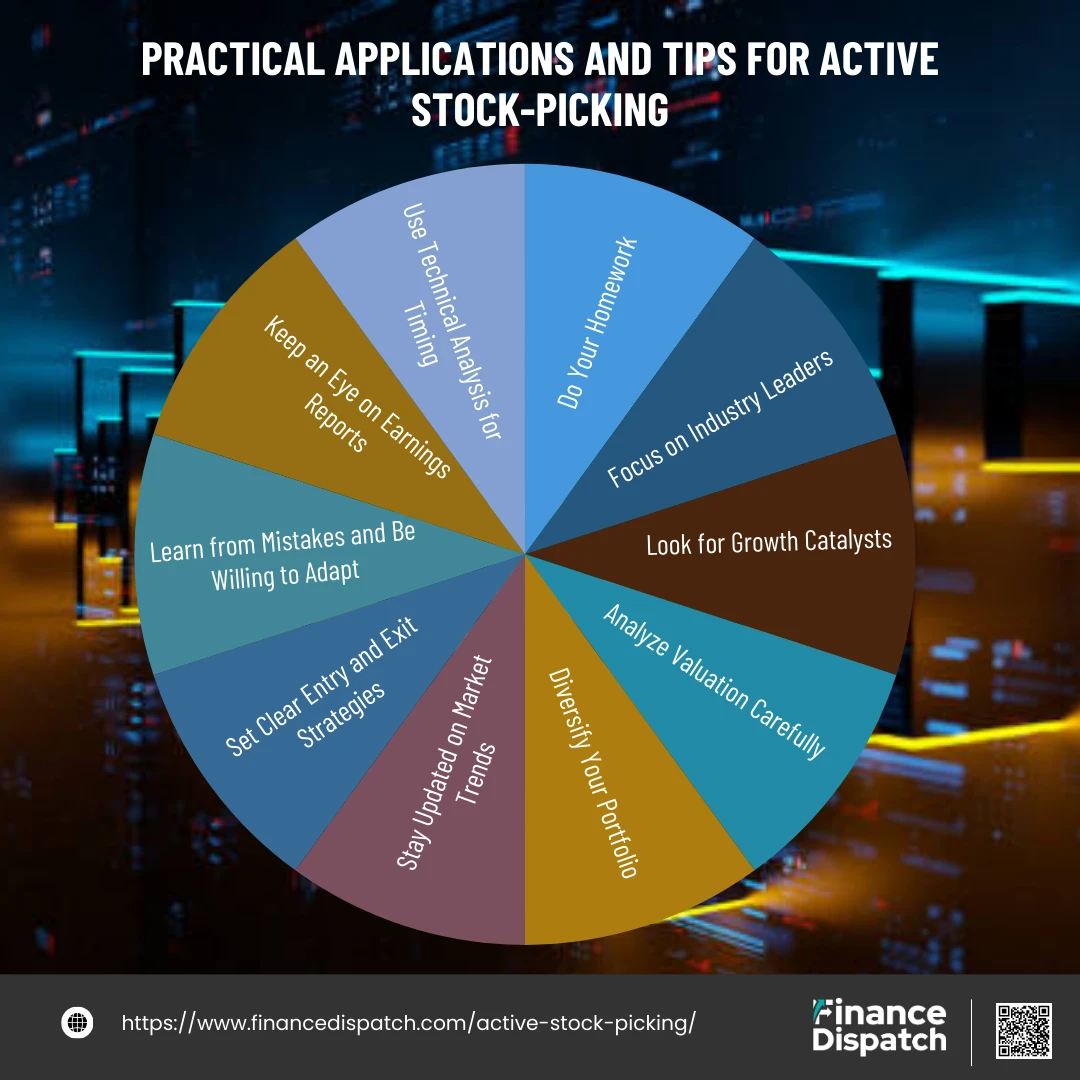

Practical Applications and Tips for Active Stock-Picking

1. Do Your Homework: Conduct Thorough Research

Successful stock-picking starts with thorough research. Dive into a company’s financial statements, understand its business model, and analyze industry trends. Knowing the company’s strengths, weaknesses, opportunities, and threats (SWOT analysis) can give you an edge in making informed decisions.

2. Focus on Industry Leaders

Companies that lead their industry often have a competitive advantage, such as a strong brand, advanced technology, or a loyal customer base. Focusing on these industry leaders can help you build a solid portfolio foundation. However, make sure to assess their growth potential to ensure they continue to outperform.

3. Look for Growth Catalysts

Identify potential growth drivers for a company, such as new product launches, expansion into new markets, or industry innovations. Stocks that have clear growth catalysts are more likely to see a rise in value over time. Keep an eye on company news, earnings reports, and industry trends to spot these opportunities.

4. Analyze Valuation Carefully

Don’t just buy a stock because it looks promising; check if it’s fairly priced. Use valuation metrics like the price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and price-to-book (P/B) ratio to determine if a stock is undervalued or overvalued compared to its peers. Investing in undervalued stocks can lead to substantial gains when the market corrects.

5. Diversify Your Portfolio

While it’s tempting to go all-in on a few promising stocks, diversification is key to managing risk. Spread your investments across different sectors and industries to reduce the impact of a poor-performing stock. This way, even if one stock struggles, your overall portfolio can remain stable.

6. Stay Updated on Market Trends

The stock market is dynamic, and trends can change quickly. Staying updated on the latest market developments, economic indicators, and geopolitical events can help you make timely decisions. Use reliable news sources, financial reports, and analysis tools to keep track of what’s happening in the market.

7. Set Clear Entry and Exit Strategies

Before you invest, determine at what price point you will buy a stock and when you will sell it. Having clear entry and exit strategies prevents you from making impulsive decisions driven by emotions. Use stop-loss orders to limit potential losses, and set target prices to lock in gains when the stock reaches your desired level.

8. Learn from Mistakes and Be Willing to Adapt

Even experienced investors make mistakes. The key is to learn from them and adapt your strategy as needed. Review your investment choices regularly, understand what worked and what didn’t, and adjust your approach accordingly. Active stock-picking is a continuous learning process.

9. Keep an Eye on Earnings Reports

Quarterly earnings reports provide valuable insights into a company’s financial health and future outlook. Pay close attention to key metrics like revenue, net income, and profit margins. Earnings reports can often signal whether a company is on track or facing challenges, helping you make informed investment decisions.

10. Use Technical Analysis for Timing

While fundamental analysis helps you understand a company’s value, technical analysis can assist with timing your trades. Analyzing stock price charts, patterns, and indicators can help you determine when to buy or sell. Combine both approaches for a more balanced and effective stock-picking strategy.

Conclusion

Active stock-picking is a strategy that offers investors the opportunity to potentially outperform the market by carefully selecting individual stocks based on research, analysis, and strategic thinking. Unlike passive investing, which simply tracks a market index, active stock-picking requires a more hands-on approach, with a focus on identifying undervalued assets, capitalizing on market inefficiencies, and adjusting portfolios as market conditions change. While it can be rewarding, it also demands a higher level of commitment, expertise, and risk management.

For investors willing to put in the time and effort, active stock-picking can be an effective way to achieve specific financial goals, whether that means targeting high-growth sectors, generating steady income through dividends, or finding stocks that align with personal values. However, it’s important to acknowledge the challenges, such as higher costs, the need for constant monitoring, and the potential for underperformance. Success in active investing depends on a disciplined approach, thorough research, and the ability to adapt strategies as needed.

Ultimately, the decision to engage in active stock-picking should be guided by your investment objectives, risk tolerance, and the resources you can dedicate to managing your portfolio. Whether you choose to go active or stick with a more passive approach, understanding the principles of stock-picking and staying informed about market trends will help you make smarter, more confident investment choices. In the end, the best investment strategy is one that aligns with your financial aspirations and provides peace of mind on your journey to building wealth.