B2B Collections (Business to Business Collections) refers to the process by which businesses collect outstanding payments owed by other businesses. This practice is crucial in maintaining positive cash flow and ensuring that accounts receivable are kept under control. Unlike consumer collections, B2B collections involve unique challenges, such as managing complex, high-value invoices, negotiating with clients who may also be key business partners, and adhering to contract terms that are often negotiated over longer periods. The primary goals of B2B collections are to secure timely payments, maintain strong customer relationships, and minimize bad debt while optimizing the business’s financial health. For Example, a manufacturer supplies raw materials to a retailer with an agreement that payment is due within 30 days. If the retailer fails to pay by the due date, the manufacturer initiates a collections process, which may include sending reminder notices, making follow-up calls, and, if necessary, engaging a collections agency to recover the outstanding debt. This process is crucial for maintaining the manufacturer’s cash flow and financial stability.

Why B2B Collections Are Important

Here’s why B2B collections are essential:

1. Ensures Steady Cash Flow

Cash flow is the lifeblood of any business, especially in B2B environments where transaction amounts are larger and payment terms are often extended. Timely collections mean that funds are available to cover daily operations, from payroll to utility bills and supplier payments. Effective B2B collections prevent cash shortages, which can disrupt operations, delay projects, and limit investment opportunities. A strong collections strategy ensures that cash flows remain predictable, allowing for better resource management and stability.

2. Strengthens Financial Health

Financial health hinges on a business’s ability to manage its assets, and accounts receivable (A/R) is one of the most significant. Unpaid invoices not only represent lost income but also potential cash flow issues that can lead to more debt. By prioritizing B2B collections, businesses reduce the risk of accumulating unpaid debts, keeping the A/R balance manageable. Regular collections also help reduce days sales outstanding (DSO), ensuring that receivables are converted into cash more quickly, reinforcing the financial foundation necessary to weather market changes and economic downturns.

3. Supports Customer Relationships

Strong customer relationships are crucial in B2B transactions, where contracts are often long-term and repeat business is common. A structured collections process enhances communication and clarity about payment expectations, showing customers that the business values transparency and professionalism. Flexible payment options and proactive communication make it easier for clients to settle their accounts without feeling pressured. By handling collections with respect and understanding, companies can maintain positive, long-term relationships with clients, encouraging timely payments while fostering loyalty.

4. Reduces Administrative Burden

Collections can be time-consuming, especially if handled manually. Implementing an efficient B2B collections process, often through automation and clear policies, can streamline workflows for accounts receivable teams. Automated invoicing, reminders, and dunning letters reduce repetitive tasks, allowing team members to focus on more complex and high-value activities, like addressing overdue accounts or analyzing trends. With less time spent on administrative follow-ups, A/R teams can work more productively, ultimately improving overall efficiency and reducing labor costs.

5. Minimizes the Need for Costly Legal Action

Legal action is an expensive last resort in collections and can strain business relationships. A well-structured B2B collections process includes escalating stages—like reminders, demand letters, and negotiations—that help resolve issues before legal action becomes necessary. By addressing overdue accounts early and clearly communicating the consequences of non-payment, businesses can encourage clients to settle their debts voluntarily. This approach not only saves money on legal fees but also maintains goodwill with clients, preserving potential future business opportunities.

6. Mitigates Business Risk

Effective collections management allows businesses to identify red flags, such as consistent late payments, which can indicate a client’s financial instability. Monitoring accounts closely helps businesses make informed decisions about credit terms, reducing the risk of bad debt. Proactively managing collections also allows companies to take timely corrective actions, such as adjusting payment terms, renegotiating contracts, or seeking collateral. This reduces the likelihood of substantial financial losses and protects the business from unexpected cash flow issues.

7. Improves Business Planning and Forecasting

Accurate cash flow forecasting is critical for strategic business planning. Consistent collections improve the reliability of cash flow projections, allowing companies to plan for growth, investments, and other financial commitments confidently. Regular inflows from collections make it easier to budget for expenses and allocate resources effectively. Additionally, having clear insights into accounts receivable performance helps finance teams make more informed decisions about credit policies, payment terms, and client management.

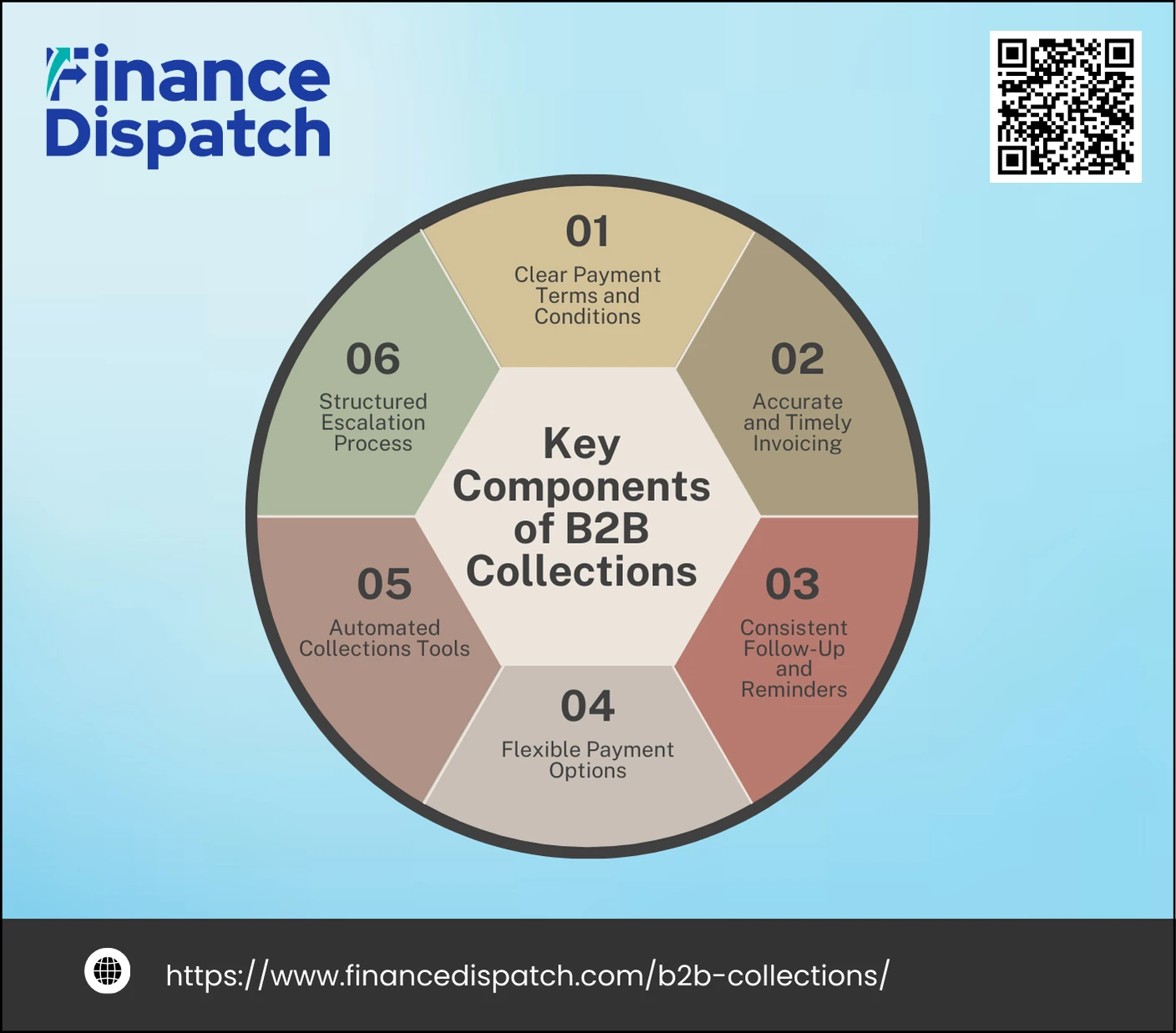

Key Components of B2B Collections

At the core of an effective B2B collections process are several key components that ensure timely and efficient payment recovery from business clients. Each component works together to create a streamlined system that promotes consistent cash flow, minimizes the risk of unpaid invoices, and maintains strong business relationships. By establishing a well-defined approach to collections, businesses can reduce delays, prevent misunderstandings, and improve their overall financial health. Here are the essential components of B2B collections:

1. Clear Payment Terms and Conditions

Setting clear payment terms at the beginning of a client relationship establishes expectations for both parties. This includes detailing due dates, acceptable payment methods, and any late fees or penalties that may apply to overdue payments. These terms should be communicated in writing, whether in contracts, invoices, or other documentation, and discussed verbally if possible. When clients fully understand the payment expectations, there’s less room for confusion, reducing the likelihood of disputes and late payments down the line. Additionally, clearly outlined terms help your business maintain a professional stance, showing clients that your collections process is structured and reliable.

2. Accurate and Timely Invoicing

An accurate, detailed invoice is one of the most effective tools for securing timely payments. Invoicing should occur as soon as goods or services are delivered, ensuring that clients have all the necessary payment details in front of them without delay. Each invoice should include essential information such as the due date, itemized charges, client account details, and payment instructions. Errors or missing details in invoices can lead to delays and payment disputes, which not only prolong the collections process but can also harm the client relationship. By making sure invoices are accurate and timely, businesses can minimize these issues and encourage faster payment processing.

3. Consistent Follow-Up and Reminders

Following up with clients is critical for maintaining a consistent cash flow. A structured approach to follow-ups—whether through automated reminders, personalized emails, or phone calls—keeps payment deadlines on the client’s radar and demonstrates your company’s commitment to timely payments. Consistent follow-ups are especially helpful in cases where invoices might be overlooked or deprioritized. Establishing a schedule for reminders (e.g., 15, 30, and 45 days past due) ensures that clients are gently nudged toward making payments without feeling overwhelmed. This proactive approach often resolves overdue accounts before they escalate, maintaining a positive client relationship while ensuring that payments are collected.

4. Flexible Payment Options

Offering various payment options can make it easier for clients to settle their accounts promptly. Providing online payment portals, ACH transfers, credit card options, or even installment plans can help clients find the method that works best for them, especially if they face cash flow challenges. Flexibility demonstrates a client-focused approach, making clients feel valued and supported. It also minimizes payment barriers, increasing the likelihood of timely payments. Flexible payment options are particularly valuable for larger invoices or clients with seasonal cash flows, as they allow these clients to fulfill their payment obligations in a way that aligns with their financial situation.

5. Automated Collections Tools

Automation tools play a significant role in modern B2B collections, reducing manual tasks and enhancing efficiency. Collections software can automate invoicing, send reminders at scheduled intervals, track payment history, and flag overdue accounts, all while generating useful reports and data insights. Automated collections systems provide a consistent follow-up structure, ensuring no account slips through the cracks. They also free up time for collections teams to focus on high-priority or complex cases, rather than spending hours on routine administrative work. This use of technology optimizes the collections process, improving cash flow management and enhancing the overall efficiency of accounts receivable operations.

6. Structured Escalation Process

A well-defined escalation process is essential when follow-ups and reminders aren’t enough to prompt payment. This process outlines the steps to take if a payment becomes severely overdue, including when to send demand letters, initiate negotiation efforts, or hand the account over to a third-party collection agency. An escalation process provides clear guidelines for collections teams, allowing them to proceed confidently while maintaining a professional tone. It also signals to clients that the business takes overdue payments seriously. By setting thresholds for escalation, businesses can recover overdue funds without damaging client relationships or resorting to legal action prematurely.

7. Regular Reporting and Monitoring

Monitoring collections performance is critical to optimizing the process and identifying areas for improvement. Tracking key metrics like days sales outstanding (DSO), collection effectiveness index (CEI), and average payment time provides insights into the efficiency of your collections strategy. Regular reporting enables accounts receivable teams to spot trends, adjust tactics, and identify problematic accounts early on. This data-driven approach ensures that collections efforts are aligned with business goals and allows for more accurate cash flow forecasting. By continuously reviewing performance, businesses can make informed adjustments to their collections process, ultimately improving cash flow and reducing overdue accounts.

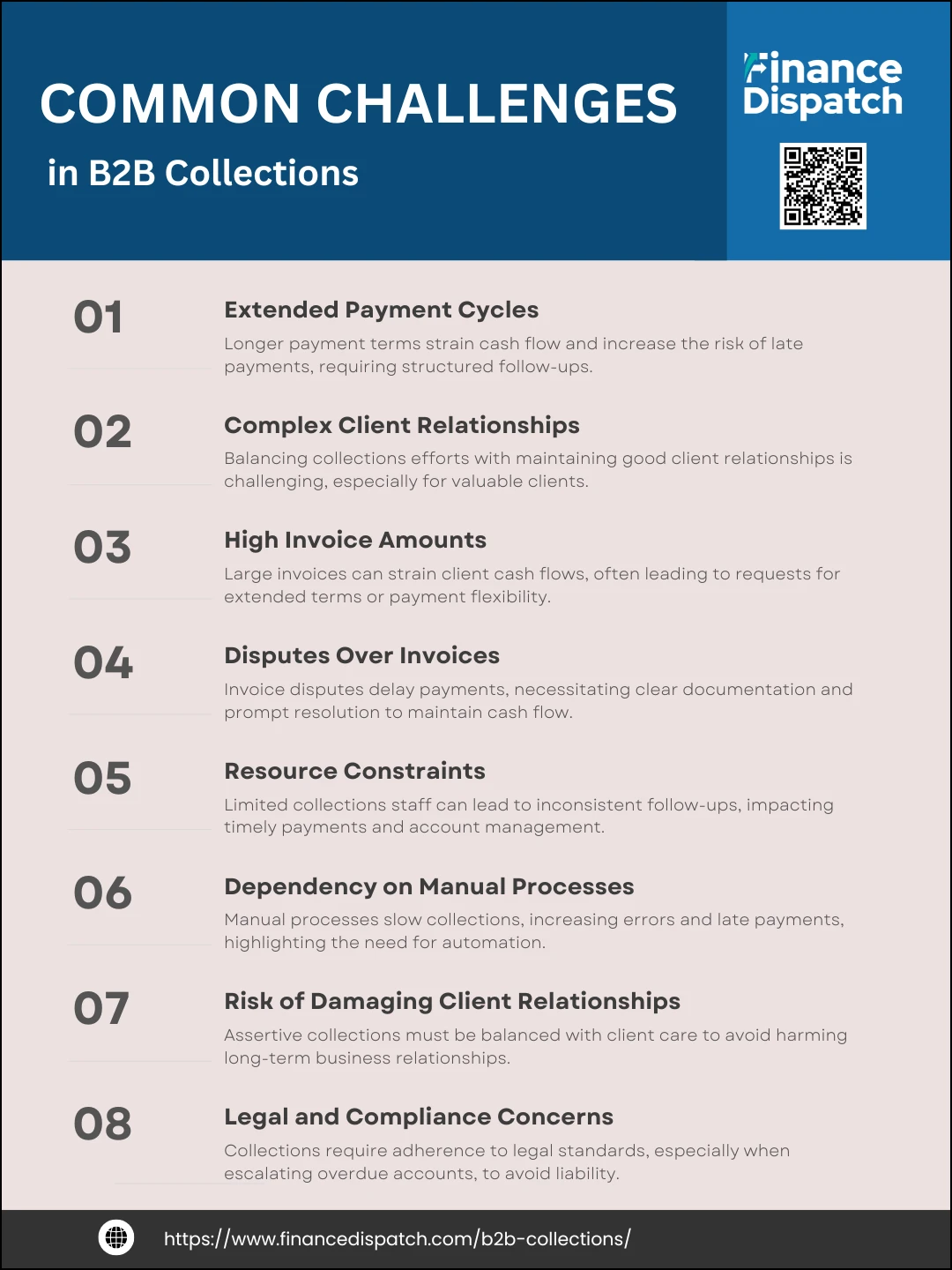

Common Challenges in B2B Collections

B2B collections can be challenging, as they often involve larger invoice amounts, extended payment terms, and complex client relationships. Businesses must balance the need for prompt payment with maintaining positive client partnerships, all while navigating the unique difficulties that arise in B2B collections. Recognizing and addressing these challenges is key to improving the efficiency and effectiveness of the collections process. Here are some common challenges faced in B2B collections:

1. Extended Payment Cycles

In B2B transactions, payment terms are often set for longer periods, such as 30, 60, or even 90 days post-invoice. These extended cycles mean that businesses may wait months before receiving payment, which can strain cash flow and create challenges in managing working capital. Additionally, the longer the payment cycle, the greater the risk of late or missed payments, as clients may deprioritize older invoices. To manage this challenge, businesses need a structured follow-up process and often implement periodic reminders to ensure clients are aware of upcoming due dates.

2. Complex Client Relationships

B2B relationships are generally long-term, involving recurring transactions and significant investments from both parties. This complexity makes collections tricky, as businesses may be hesitant to push too hard for fear of damaging the relationship. Often, collections teams have to navigate maintaining goodwill while still enforcing payment terms. The challenge lies in finding a balance that encourages timely payments without negatively impacting the partnership, especially with high-value or strategically important clients.

3. High Invoice Amounts

B2B invoices tend to be for larger sums, which can strain a client’s cash flow, especially if they are managing multiple high-value accounts. Larger amounts increase the likelihood that clients may request extended payment terms, installment plans, or even negotiate discounts. High-value invoices also mean that delayed payments can have a significant impact on a business’s cash flow, making it essential for collections teams to closely monitor these accounts and offer flexible yet firm options to ensure payment without jeopardizing client relationships.

4. Disputes Over Invoices

Invoice disputes are a common source of delay in B2B collections, often stemming from disagreements about the terms, quantities, services rendered, or pricing. These disputes can significantly hinder the collections process, as payment is typically paused until the issue is resolved. Resolving disputes requires clear documentation, effective communication, and sometimes negotiation to reach a satisfactory resolution. The time and resources spent on handling disputes can slow down collections, making it critical to have clear, documented agreements and to address any client concerns promptly.

5. Resource Constraints

Many businesses, especially smaller ones, may lack dedicated collections personnel, which can lead to inconsistent or delayed follow-ups. Often, collections responsibilities fall on already busy accounts receivable (A/R) teams, who may struggle to prioritize overdue accounts amidst other tasks. Limited resources can mean that collections teams cannot give each account the attention it needs, resulting in longer payment times and a greater risk of delinquent accounts. Effective B2B collections require dedicated resources or automated tools to handle high-volume collections more efficiently.

6. Dependency on Manual Processes

Manual tracking, invoicing, and follow-ups can be time-consuming and error-prone. As a business grows and the volume of clients and invoices increases, manual processes can become inefficient, leading to missed follow-ups or overlooked accounts. Inconsistent collections due to manual processes also increase the risk of late payments. Without automated systems, it’s difficult to streamline the collections process, keep track of outstanding invoices, or prioritize accounts effectively. Automation reduces errors, improves consistency, and frees up team members to focus on complex cases.

7. Risk of Damaging Client Relationships

B2B collections require a firm stance on payment, but an overly aggressive approach can harm long-standing client relationships. A delicate balance must be maintained between asserting the importance of timely payment and respecting the client’s position. If clients feel pressured or that their relationship is undervalued, they may seek alternative suppliers. Collections teams often have to tailor their approach, using professional but persistent communication to secure payment without jeopardizing future business. This balance is essential to sustain client relationships while keeping cash flow steady.

8. Legal and Compliance Concerns

B2B collections are subject to varying legal and compliance requirements depending on the region and industry. Businesses must understand these legal frameworks to avoid potential compliance issues or lawsuits, particularly when accounts are escalated to third-party collections or legal action. Navigating these legal requirements can be complex, as some jurisdictions have specific guidelines on collections practices, interest on overdue amounts, or permissible escalation steps. Compliance often requires additional resources or specialized knowledge to ensure that collections efforts align with legal standards and reduce the risk of potential liabilities.

Role of Technology in B2B Collections

Technology plays a transformative role in B2B collections, streamlining the entire process from invoicing to follow-ups, and reducing the likelihood of overdue payments. Automated systems, data analytics, and digital payment platforms provide businesses with tools to optimize their collections efforts, ensuring timely payments while freeing up resources to focus on high-value tasks. Leveraging technology not only enhances efficiency but also improves client relationships by making the payment process smoother and more transparent. Here’s a look at the key technological tools and their roles in B2B collections:

| Technology Tool | Role in B2B Collections | Benefits |

| Automated Invoicing | Sends invoices immediately upon service delivery or product shipment, ensuring prompt billing. | Reduces manual effort, minimizes errors, and accelerates cash flow. |

| Automated Follow-Ups | Schedules and sends reminders for upcoming and overdue payments automatically. | Ensures consistent follow-up, reduces risk of missed reminders, and encourages timely payment. |

| Data Analytics & Reporting | Analyzes payment patterns and collections performance, identifying trends and high-risk accounts. | Enables data-driven decisions, prioritizes collections efforts, and improves overall strategy. |

| Digital Payment Platforms | Provides clients with convenient online payment options, including ACH, credit cards, and bank transfers. | Increases payment convenience, reduces friction, and enhances client satisfaction. |

| Collections Management Software | Centralizes accounts receivable data, automates tracking, and flags overdue accounts. | Improves collections workflow, organizes account data, and supports efficient follow-up processes. |

| Client Portals | Allows clients to view their invoices, make payments, and track their payment history through a secure portal. | Enhances client transparency, fosters accountability, and reduces administrative queries. |

| Escalation Management Tools | Manages the escalation process, issuing demand letters and initiating third-party collections as needed. | Ensures timely escalation, supports professional communication, and reduces time to resolution. |

| Machine Learning Algorithms | Predicts payment behavior and identifies clients likely to delay payments. | Enables proactive collections, optimizes follow-up timing, and improves cash flow forecasting. |

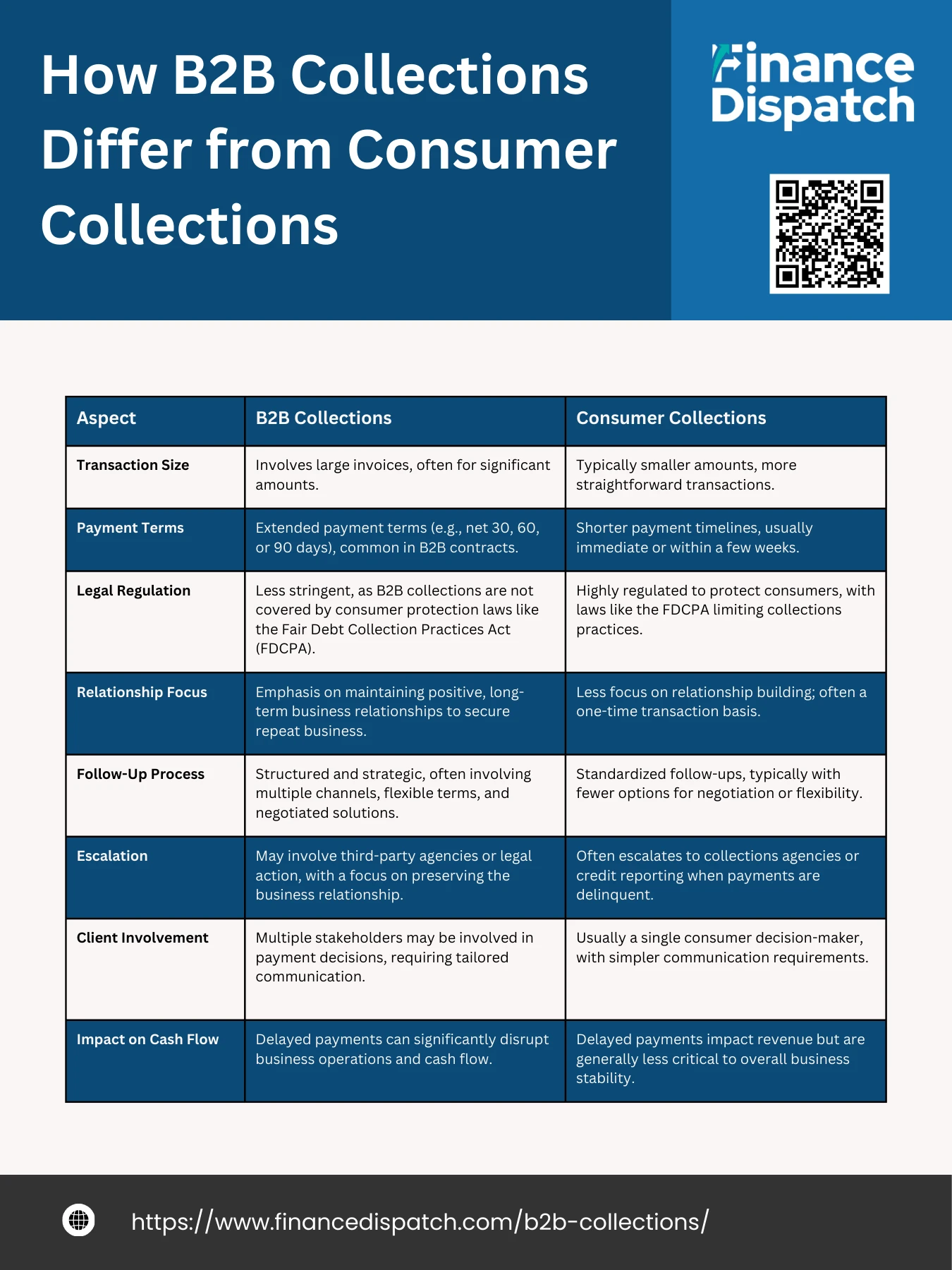

How B2B Collections Differ from Consumer Collections

B2B collections differ from consumer collections in several key ways, reflecting the unique nature of business transactions. In B2B collections, invoices are often larger and involve extended payment terms, making timely collections essential for maintaining cash flow and operational stability. While consumer collections are typically regulated by strict laws to protect individual consumers, B2B collections allow for a more flexible approach since they involve commercial entities. B2B collections also focus on maintaining long-term client relationships, as these relationships often represent significant revenue and repeat business, whereas consumer collections are more transactional. Here’s a breakdown of the primary differences between B2B and consumer collections:

| Aspect | B2B Collections | Consumer Collections |

| Transaction Size | Involves large invoices, often for significant amounts. | Typically smaller amounts, more straightforward transactions. |

| Payment Terms | Extended payment terms (e.g., net 30, 60, or 90 days), common in B2B contracts. | Shorter payment timelines, usually immediate or within a few weeks. |

| Legal Regulation | Less stringent, as B2B collections are not covered by consumer protection laws like the Fair Debt Collection Practices Act (FDCPA). | Highly regulated to protect consumers, with laws like the FDCPA limiting collections practices. |

| Relationship Focus | Emphasis on maintaining positive, long-term business relationships to secure repeat business. | Less focus on relationship building; often a one-time transaction basis. |

| Follow-Up Process | Structured and strategic, often involving multiple channels, flexible terms, and negotiated solutions. | Standardized follow-ups, typically with fewer options for negotiation or flexibility. |

| Escalation | May involve third-party agencies or legal action, with a focus on preserving the business relationship. | Often escalates to collections agencies or credit reporting when payments are delinquent. |

| Client Involvement | Multiple stakeholders may be involved in payment decisions, requiring tailored communication. | Usually a single consumer decision-maker, with simpler communication requirements. |

| Impact on Cash Flow | Delayed payments can significantly disrupt business operations and cash flow. | Delayed payments impact revenue but are generally less critical to overall business stability. |

Conclusion

Automating the B2B collections process offers a strategic advantage, enabling businesses to streamline operations, improve cash flow, and reduce the likelihood of overdue accounts. By implementing tools such as automated invoicing, scheduled reminders, and digital payment options, companies can ensure timely payments while minimizing manual effort. Automation also supports data-driven insights, allowing businesses to analyze payment patterns, prioritize high-risk accounts, and continuously refine their collections strategies. Moreover, with features like client portals and flexible payment options, businesses enhance the client experience, promoting transparency and fostering positive, long-term relationships. In today’s fast-paced business landscape, an automated collections process isn’t just an efficiency boost; it’s essential for maintaining financial stability and optimizing accounts receivable management.