When starting a business, one of the first hurdles you’ll face is funding. For many entrepreneurs, bootstrapping offers a practical and empowering solution. But what exactly is bootstrapping? At its core, bootstrapping means building a business using your own resources—personal savings, operating revenue, or even help from friends and family—without relying on external investors or loans. This approach allows you to maintain full control of your venture while fostering creativity and resourcefulness. In this article, we’ll explore the concept of bootstrapping, its strategies, and its potential advantages and challenges, helping you determine if it’s the right path for your entrepreneurial journey.

Key Features of Bootstrapping

Bootstrapping is a unique approach to starting and growing a business that relies entirely on your own resources rather than external funding. It demands resourcefulness, discipline, and a keen focus on maximizing what you have while minimizing unnecessary costs. For many entrepreneurs, bootstrapping not only builds a solid foundation for their business but also fosters a deep sense of ownership and creativity.

Key Features of Bootstrapping:

- Self-Financed Approach: Entrepreneurs use personal savings, revenue from initial sales, or small personal loans to fund the business.

- Full Ownership and Control: No outside investors mean you retain complete control over decisions and profits.

- Cost-Effective Operations: Emphasis on lean business models, frugal spending, and efficient use of resources.

- Creative Problem-Solving: Limited resources encourage innovative solutions and unconventional strategies.

- Gradual Growth: Expansion happens organically, based on cash flow and reinvested profits.

- High Risk and Reward: The entrepreneur bears all financial risks but stands to reap all the rewards of success.

- Focus on Profitability: Prioritizing cash flow and sustainable practices over rapid scaling.

- Independence from External Influence: Freedom to follow your vision without investor demands or interference.

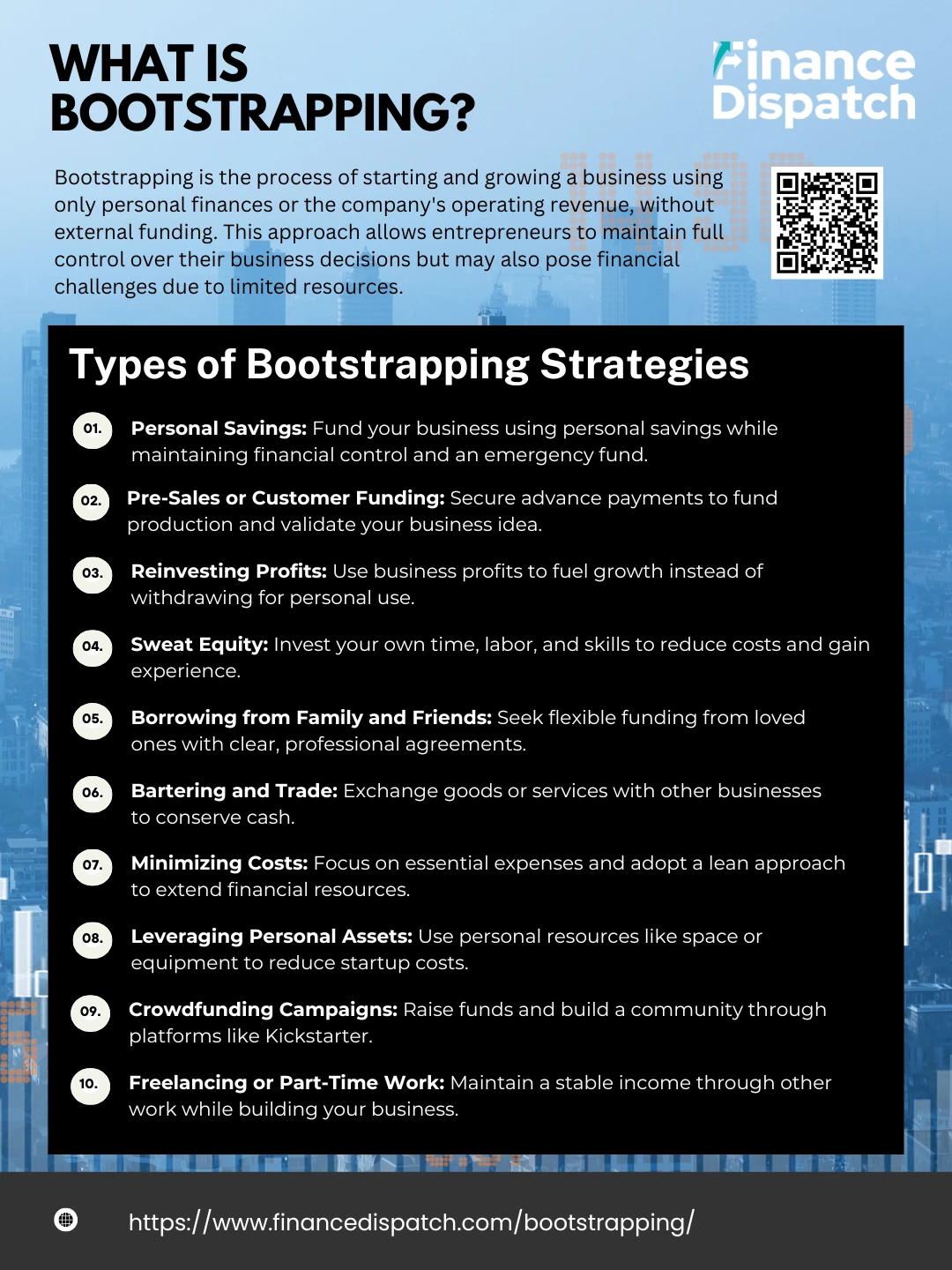

Types of Bootstrapping Strategies

Bootstrapping involves a variety of strategies, each designed to help entrepreneurs creatively manage their limited resources. Below is a detailed explanation of some common approaches to bootstrapping that can help you grow your business while keeping financial risks in check.

1. Personal Savings

Using your personal savings to fund your business allows you to maintain full control and independence. This strategy is straightforward and requires no external approval or credit checks. However, it demands a well-thought-out financial plan to prevent the exhaustion of your reserves. Setting aside an emergency fund separate from your business budget is critical to ensure you can manage personal financial obligations while supporting your entrepreneurial goals.

2. Pre-Sales or Customer Funding

Pre-sales involve securing advance payments from customers for products or services not yet delivered. This approach not only provides the initial capital to produce goods but also validates your business idea by gauging customer interest. Transparency and timely delivery are essential to maintaining customer trust. For example, many tech startups use pre-sales to fund software development by offering early-bird discounts to future users.

3. Reinvesting Profits

Instead of withdrawing profits for personal use, reinvesting them back into the business can fuel growth. This self-sustaining model prioritizes business expansion over immediate personal gains. For instance, profits can be used to upgrade equipment, increase inventory, or invest in marketing efforts. While this approach requires patience, it can strengthen your business without incurring debt.

4. Sweat Equity

Sweat equity means contributing your own labor, skills, and time rather than money. For example, you might handle everything from accounting to marketing in the early stages of your business. This strategy reduces costs and gives you hands-on experience in every aspect of the business. However, it can be physically and mentally taxing, requiring excellent time management and a willingness to learn new skills.

5. Borrowing from Family and Friends

Turning to family and friends for financial support can be a flexible and accessible option. This strategy often involves fewer formalities than bank loans and can come with more favorable terms. However, it’s crucial to treat these arrangements professionally by clearly documenting loan terms, repayment schedules, or equity shares to avoid misunderstandings or strained relationships.

6. Bartering and Trade

Bartering allows you to exchange goods or services with other businesses, conserving cash while meeting operational needs. For instance, if you’re a web developer, you could build a website for a printer in exchange for free printing services. This approach fosters collaborative relationships and reduces reliance on financial resources but requires careful negotiation to ensure mutual benefits.

7. Minimizing Costs

A lean approach to business operations involves cutting unnecessary expenses and focusing on essentials. For example, instead of renting office space, you can work remotely, and instead of buying new equipment, you can purchase refurbished items. Cost minimization helps extend your financial runway and ensures that every dollar spent contributes directly to business growth.

8. Leveraging Personal Assets

Using personal resources like a car for deliveries, a garage for storage, or a spare room as an office eliminates the need for initial investments. While this strategy reduces startup costs, it’s important to document the use of personal assets for business purposes for tax and accounting accuracy.

9. Crowdfunding Campaigns

Crowdfunding platforms such as Kickstarter and Indiegogo enable you to raise funds by presenting your business idea to a wide audience. Backers contribute money in exchange for perks like early access to products or branded merchandise. This approach not only generates capital but also builds a community of supporters who can act as early adopters and advocates for your brand.

10. Freelancing or Part-Time Work

Keeping a part-time job or freelancing while starting your business provides a stable income stream, reducing financial pressure. This dual-focus strategy ensures that you can fund your basic needs while gradually building your business. It requires balancing your time effectively and prioritizing tasks to maintain progress in both areas.

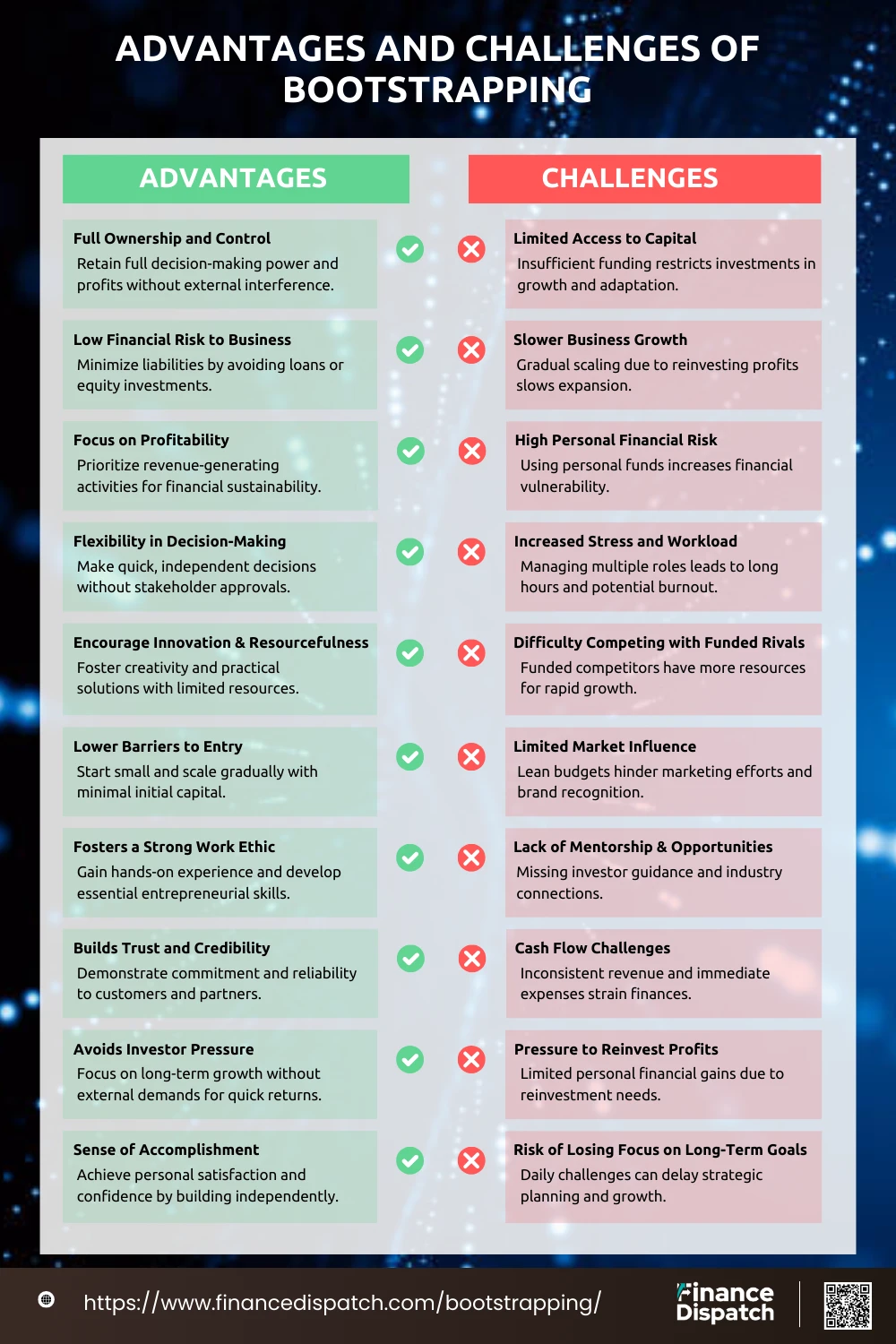

Advantages of Bootstrapping

Bootstrapping offers entrepreneurs a unique opportunity to grow their businesses independently, relying on creativity, resourcefulness, and their own capital. By avoiding external funding, business owners retain full control and ownership while learning to operate within lean constraints. This approach fosters innovation and sustainable practices that can lead to long-term success.

1. Full Ownership and Control

When you bootstrap your business, you are in charge of every aspect, from daily operations to strategic direction. Without external investors, you don’t need to justify your decisions or gain approval from others. This ensures that your vision and values guide the business without compromise, and all the profits remain solely yours.

2. Low Financial Risk to Business

Bootstrapping minimizes financial liabilities by avoiding loans or equity investments. Since you are not tied to repayment schedules or investor expectations, the financial burden on the business remains low. This approach allows you to focus on growth without the pressure of meeting external financial obligations.

3. Focus on Profitability

Self-funding your business encourages you to build a model that generates revenue quickly. Every dollar spent must contribute directly to the business’s success, pushing you to prioritize activities that lead to immediate profitability. This focus lays a strong foundation for long-term financial health and sustainability.

4. Flexibility in Decision-Making

With no external stakeholders to satisfy, you have complete freedom to experiment, pivot, or implement changes based on your insights. Whether it’s adjusting your product offerings or exploring new markets, you can make swift decisions without delays caused by investor approvals or conflicting opinions.

5. Encourages Innovation and Resourcefulness

Bootstrapping forces you to think outside the box and innovate with limited resources. Whether it’s finding cost-effective marketing strategies, repurposing materials, or bartering with other businesses, the constraints of bootstrapping push you to find creative and practical solutions to everyday challenges.

6. Lower Barriers to Entry

Starting a business with minimal resources makes entrepreneurship accessible to a broader audience. You don’t need to wait for large capital investments; instead, you can start small, test your ideas, and scale progressively as revenues increase, allowing you to enter the market sooner.

7. Fosters a Strong Work Ethic

As a bootstrapper, you often take on multiple roles to minimize costs, such as handling accounting, marketing, or customer service yourself. This hands-on involvement develops a strong work ethic and deep understanding of the business, equipping you with valuable skills for future challenges.

8. Builds Trust and Credibility

Self-funded businesses are often viewed as reliable and committed by customers, partners, and even future investors. The effort and dedication involved in bootstrapping demonstrate a strong belief in your product or service, enhancing your reputation in the market.

9. Avoids Investor Pressure

External investors often come with expectations for quick returns or influence over the business’s direction. Bootstrapping eliminates this pressure, allowing you to focus on building a business aligned with your goals. You can prioritize long-term growth and maintain creative control without external interference.

10. Sense of Accomplishment

There’s immense personal and professional satisfaction in knowing you’ve built your business independently. The pride that comes from creating something entirely your own strengthens your confidence and reinforces your entrepreneurial spirit, inspiring you to tackle new challenges and scale your venture.

Challenges of Bootstrapping

Bootstrapping can be an empowering way to start a business, but it’s not without its difficulties. The lack of external funding often means entrepreneurs must navigate financial constraints, personal risks, and slower growth. While the independence and control are appealing, the challenges of bootstrapping require resilience, resourcefulness, and careful planning to overcome.

1. Limited Access to Capital

Bootstrapped businesses often struggle with insufficient funding, which limits their ability to invest in essential areas such as product development, marketing, or scaling operations. Entrepreneurs must rely on personal savings, customer revenue, or cost-cutting measures, making it challenging to seize growth opportunities or adapt to unexpected expenses.

2. Slower Business Growth

Without substantial funding, scaling a business becomes a gradual process dependent on reinvesting profits. This slower growth can hinder your ability to expand into new markets, develop advanced products, or keep pace with competitors, especially in fast-moving industries where speed is critical.

3. High Personal Financial Risk

Bootstrapping often requires using personal savings, assets, or loans, putting your financial security at risk. If the business fails, you could face significant personal losses, impacting your credit, savings, or even personal relationships with family and friends who may have contributed financially.

4. Increased Stress and Workload

To save costs, bootstrapping entrepreneurs typically take on multiple roles, such as managing operations, marketing, and customer service. This can lead to long working hours and heightened stress, potentially resulting in burnout and decreased productivity over time.

5. Difficulty Competing with Funded Rivals

Competitors with external funding often have access to better resources, enabling them to launch aggressive marketing campaigns, hire top talent, and rapidly develop new products. This disparity can make it difficult for bootstrapped businesses to establish themselves in competitive markets.

6. Limited Market Influence

Operating on a lean budget restricts your ability to invest in marketing and outreach. Without strong advertising or promotional activities, it’s harder to attract new customers, build brand recognition, or establish a strong presence in your industry.

7. Lack of Mentorship and Networking Opportunities

Funded startups often benefit from investors’ strategic guidance, industry expertise, and professional networks. Bootstrapped businesses miss out on these valuable connections, making it harder to gain insights, secure partnerships, or access resources that could accelerate growth.

8. Cash Flow Challenges

Maintaining steady cash flow is crucial but difficult when revenue generation is inconsistent and expenses are immediate. Delayed payments from customers or unexpected costs can strain your finances, disrupting operations or stalling progress.

9. Pressure to Reinvest Profits

Bootstrapping necessitates reinvesting profits back into the business to sustain growth, often leaving little for personal use. This can delay financial rewards for the entrepreneur and create tension between managing the company’s needs and securing personal stability.

10. Risk of Losing Focus on Long-Term Goals

Focusing on daily operational challenges can make it difficult to plan for the future. Limited resources and constant problem-solving may push long-term goals, such as expanding into new markets or innovating products, to the backburner, slowing the overall growth trajectory.

Real-Life Examples of Successful Bootstrapped Businesses

Bootstrapping has proven to be a viable path for building successful businesses, even in highly competitive markets. Many globally recognized companies started with minimal resources, relying on creativity, hard work, and reinvested profits. These inspiring examples showcase how entrepreneurs turned challenges into opportunities, building strong foundations for sustainable growth.

Real-Life Examples of Successful Bootstrapped Businesses

1. Mailchimp

Initially a side project of a design agency, Mailchimp grew into one of the most successful email marketing platforms without external funding. By focusing on customer-centric innovation and a freemium model, it achieved over $700 million in annual revenue before being acquired by Intuit for $12 billion.

2. Spanx

Sara Blakely launched Spanx with $5,000 from her savings, designing and testing her product personally. Through innovative marketing and hands-on development, she turned Spanx into a billion-dollar shapewear empire, retaining full ownership along the way.

3. GoPro

Founder Nick Woodman started GoPro by selling bead belts to fund his camera prototype. Working from his parents’ house, he built the company into a market leader in action cameras, valued at over $1 billion.

4. Basecamp

What began as a web design consultancy turned into a highly successful project management software company. Basecamp’s founders bootstrapped their way by leveraging client revenue, eventually building multiple products and writing best-selling books on entrepreneurship.

5. GitHub

GitHub started as a weekend project with founders funding the domain and basic operational costs themselves. The platform became a global hub for developers, attracting millions of users before being acquired by Microsoft for $7.5 billion.

6. Patagonia

Yvon Chouinard started Patagonia by selling hand-forged climbing gear out of his car. The company grew into a global outdoor clothing brand, known for its commitment to sustainability and environmental causes.

7. Tough Mudder

Founders of this extreme obstacle course business invested $20,000 of personal funds to get started. By creating unique, community-driven experiences, Tough Mudder became a multi-million-dollar company with events worldwide.

8. Plenty of Fish

Founder Markus Frind developed the dating platform alone, running it from his apartment with minimal costs. The site attracted millions of users before being acquired by Match Group for over $500 million.

9. BiggerPockets

This real estate community platform began with no external funding, focusing on providing value through free content and networking. It grew to over 2 million members, becoming a leader in its niche.

10. Shopify

Shopify began as a small snowboarding e-commerce site before evolving into a platform for other businesses. It was bootstrapped for six years before gaining external funding and is now worth over $160 billion.

Comparing Bootstrapping with External Funding

When starting a business, one of the key decisions entrepreneurs face is whether to bootstrap or seek external funding. Both approaches have distinct advantages and challenges, influencing factors like control, growth speed, and financial risk. Understanding the differences between these strategies can help you choose the one that best aligns with your goals and resources.

Comparing Bootstrapping with External Funding

| Aspect | Bootstrapping | External Funding |

| Control | Full control over business decisions and operations. | Decision-making shared with investors or stakeholders. |

| Ownership | Founders retain 100% ownership. | Ownership diluted due to investor equity stakes. |

| Funding Availability | Limited to personal savings and business revenue. | Access to substantial capital for rapid scaling. |

| Growth Speed | Gradual and organic, driven by reinvested profits. | Rapid growth facilitated by significant resources. |

| Financial Risk | High personal financial risk for the entrepreneur. | Risk shared with investors but may include debt obligations. |

| Networking Opportunities | Limited to personal connections and resources. | Access to mentors, industry connections, and expertise. |

| Operational Flexibility | High flexibility with no external interference. | Limited flexibility due to investor expectations. |

| Market Perception | Seen as self-reliant and committed. | May gain credibility due to backing by notable investors. |

| Stress Levels | High, as the entrepreneur handles multiple roles. | Shared workload, but investor demands may add pressure. |

| Long-Term Goals | Prioritized over short-term gains. | Often focused on achieving high returns for investors. |

Is Bootstrapping Right for Your Business?

Deciding whether bootstrapping is the right path for your business depends on your goals, resources, and risk tolerance. Bootstrapping is ideal for entrepreneurs who value complete ownership and control, have limited capital needs, and are prepared to grow their business gradually. It encourages innovation, resourcefulness, and financial discipline, making it a great option for businesses with low startup costs or those that can generate revenue quickly. However, if your business requires significant upfront investment, rapid scaling, or access to extensive networks, external funding might be a better fit. Ultimately, the choice between bootstrapping and external funding should align with your long-term vision and the unique demands of your business model.

Conclusion

Bootstrapping is a powerful and rewarding approach for building a business, offering the benefits of independence, full control, and fostering innovation. While it comes with challenges like limited resources and slower growth, it equips entrepreneurs with resilience, resourcefulness, and a deep understanding of their operations. For those who are willing to take calculated risks and focus on sustainable, organic growth, bootstrapping can lay the foundation for long-term success. Ultimately, the decision to bootstrap or seek external funding depends on your business goals, financial needs, and personal vision. With the right mindset and strategy, bootstrapping can transform your entrepreneurial dream into a thriving reality.