Crypto copy trading is a modern investment strategy that enables you to replicate the trading actions of seasoned cryptocurrency traders. By connecting your account to a platform that facilitates copy trading, you can automatically mirror the trades of experienced investors in real-time. This approach eliminates the need for extensive market research or technical analysis, making it particularly appealing to beginners or those with limited time to trade. Copy trading allows you to benefit from the expertise and strategies of professional traders, offering a way to participate in the dynamic world of cryptocurrency with reduced effort and increased accessibility.

The Evolution of Crypto Copy Trading

Crypto copy trading has come a long way since its inception, evolving into a sophisticated tool for both novice and experienced traders. Initially designed to simplify trading for newcomers, it has transformed into a versatile strategy embraced by diverse investor profiles. Early platforms focused on basic trade replication, but advancements in technology have introduced features like real-time trade execution, risk management tools, and seamless integration with major cryptocurrency exchanges. Social trading elements have further enhanced the experience, fostering a community-driven approach where traders can share strategies and insights. Today, crypto copy trading is not just a convenience; it is a strategic asset that empowers investors to harness market opportunities with greater precision and adaptability.

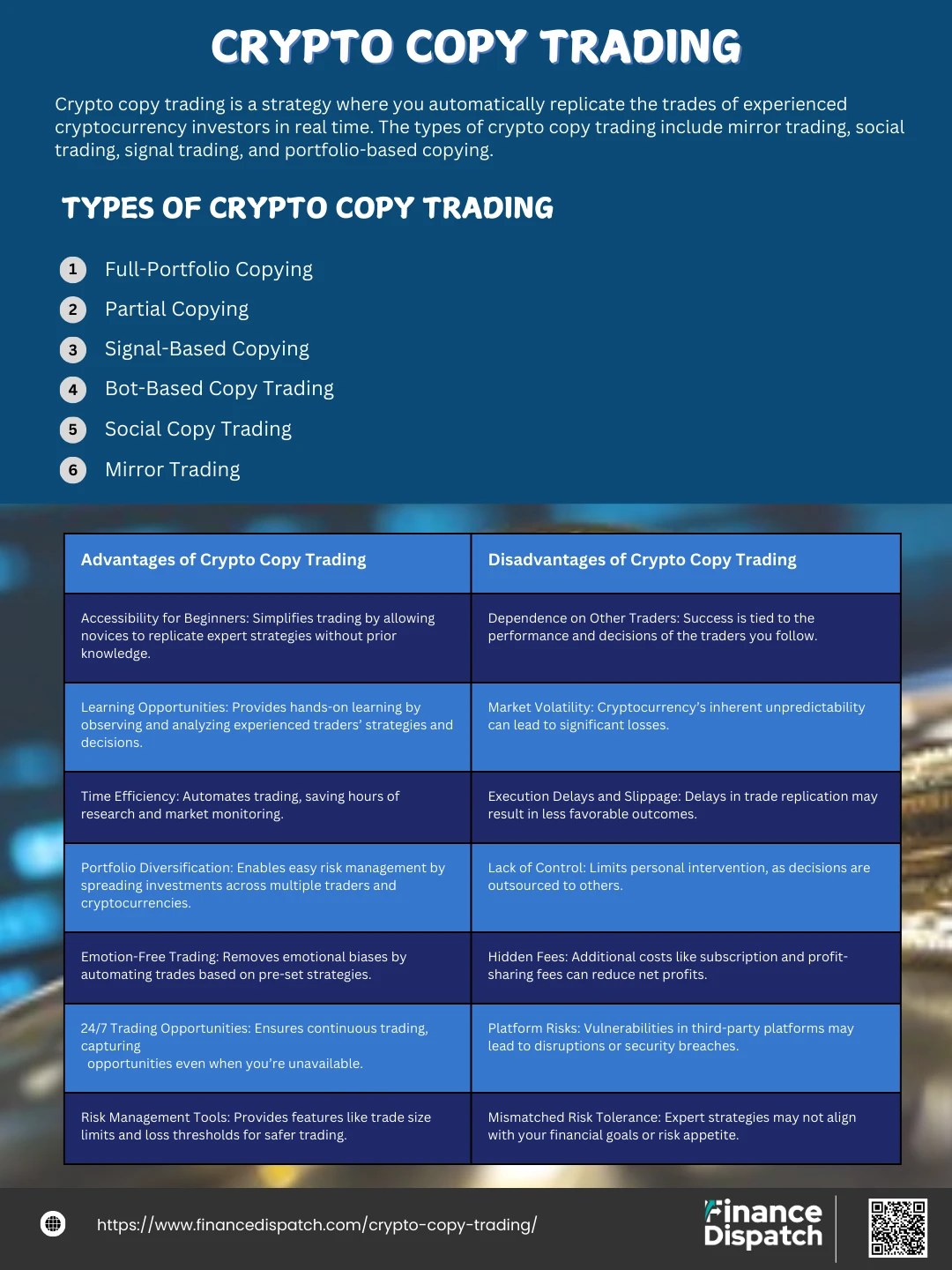

Types of Crypto Copy Trading

Crypto copy trading offers flexibility by providing various methods to replicate the trades of experienced traders. Each type caters to different preferences, trading styles, and levels of involvement. From fully automated processes to semi-manual strategies, understanding the types of crypto copy trading helps you choose the approach that best aligns with your investment goals and risk appetite.

1. Full-Portfolio Copying

With full-portfolio copying, you replicate an expert trader’s entire portfolio, including all trades, assets, and allocations. This method offers a complete, hands-off approach, ideal for beginners or those seeking to follow a proven strategy without making individual decisions. It works well if you trust the trader’s expertise and their ability to diversify effectively. However, it requires faith in their long-term strategy and involves the same level of risk as the trader takes on, which may not always align with your own risk tolerance.

2. Partial Copying

Partial copying allows you to pick and choose specific aspects of a trader’s portfolio to replicate. You can focus on certain assets, strategies, or trades that align with your goals or market insights. This method is excellent for those who want a degree of control and flexibility while leveraging the expertise of seasoned traders. For instance, you might choose to copy a trader’s altcoin positions but avoid their higher-risk leveraged trades. This customization helps tailor your copy trading strategy to your individual risk profile and investment preferences.

3. Signal-Based Copying

Signal-based copying involves receiving trade alerts or recommendations from expert traders or algorithms. These signals typically specify when to buy or sell particular assets. You can choose to act on these signals manually or set up an automated system to execute trades based on them. This type of copy trading suits individuals who want to maintain control over their trades while benefiting from expert advice. However, it requires a level of attentiveness and decision-making to ensure timely execution of the signals.

4. Bot-Based Copy Trading

Bot-based copy trading relies on automated algorithms to replicate trades. These bots are programmed to follow the strategies of expert traders and can operate 24/7, taking advantage of market opportunities even when you’re offline. This type of trading is ideal for those seeking efficiency and speed, as bots execute trades much faster than humans. While bot-based trading can be highly effective, it’s essential to understand the bot’s parameters and the strategies it replicates, as improper setup can lead to losses.

5. Social Copy Trading

Social copy trading combines the technical aspects of trade replication with the social benefits of a community-driven platform. In this type, you follow expert traders and gain insights through their shared strategies and commentary. Social trading platforms often allow direct interaction with traders, fostering an educational environment. This method is especially beneficial for beginners looking to learn while they trade. However, the success of this approach depends on the transparency and reliability of the traders you follow.

6. Mirror Trading

Mirror trading is a fully automated process where your account directly mirrors the trades of an expert trader with no manual intervention. Every trade they make—buying, selling, or exiting—is automatically replicated in your account in real-time. This approach is perfect for investors who want to rely entirely on an expert’s strategy without personal involvement. However, it requires a high level of trust in the trader’s decision-making, as their every action is reflected in your portfolio, including potential mistakes.

Advantages of Crypto Copy Trading

Crypto copy trading offers a unique opportunity to simplify the complexities of cryptocurrency investment by leveraging the expertise of seasoned traders. It opens the market to beginners while providing convenience and strategic benefits for experienced investors. Whether you’re seeking to diversify, save time, or learn from professionals, copy trading offers several advantages that make it a popular choice.

1. Accessibility for Beginners

Crypto copy trading is an excellent entry point for those new to cryptocurrency. It removes the steep learning curve by allowing beginners to replicate the trades of experienced investors. Instead of spending months learning technical analysis or studying market trends, you can start trading immediately by following professionals. This accessibility democratizes the crypto market, making it possible for anyone to participate, regardless of their level of expertise.

2. Learning Opportunities

For those eager to understand the intricacies of cryptocurrency trading, copy trading offers an invaluable learning experience. By observing the actions of seasoned traders, you can learn how they analyze the market, manage risks, and decide when to buy or sell. This hands-on exposure to proven strategies equips you with the skills to eventually develop your own trading approach. It’s like having a mentor, with every trade serving as a lesson.

3. Time Efficiency

Traditional trading requires hours of research, chart analysis, and constant monitoring of the market. With copy trading, the heavy lifting is done for you. Once you’ve selected a trader to follow, their decisions are automatically executed in your account, saving you time and effort. This automation is especially beneficial for those who have other commitments or lack the time to dedicate to full-time trading.

4. Portfolio Diversification

Diversifying your portfolio is a cornerstone of risk management, and copy trading makes it easy to achieve. By following multiple traders with varying strategies, you can spread your investments across different cryptocurrencies, markets, and risk profiles. This diversification reduces the impact of any single market downturn, ensuring more stability in your overall returns.

5. Emotion-Free Trading

One of the biggest pitfalls in trading is letting emotions drive decisions. Fear, greed, or impatience can lead to poor choices and significant losses. Copy trading eliminates this risk by automating the process. Trades are executed based on the strategies of expert traders, not your personal emotional responses, leading to more disciplined and rational trading.

6. 24/7 Trading Opportunities

The cryptocurrency market operates around the clock, and opportunities can arise at any time. With automated copy trading systems, your account remains active even when you’re not monitoring the market. Whether it’s the middle of the night or during your workday, the system ensures you don’t miss out on potential gains.

7. Risk Management Tools

Most copy trading platforms come with built-in risk management features, allowing you to set maximum loss limits, define trade sizes, or allocate only a percentage of your portfolio to specific traders. These tools provide an additional layer of security, helping you mitigate risks and maintain control over your investments.

Disadvantages and Potential Risks of Crypto Copy Trading

While crypto copy trading simplifies trading and offers several benefits, it’s not without its drawbacks and risks. From reliance on other traders to the inherent volatility of the cryptocurrency market, these challenges can impact your trading outcomes. Being aware of these potential pitfalls helps you make informed decisions and implement strategies to mitigate risks.

1. Dependence on Other Traders

One of the biggest drawbacks of copy trading is the reliance on the decisions and performance of the traders you follow. Even experienced traders can make mistakes or misjudge market trends, resulting in losses. If a trader you’re copying enters a losing streak, your portfolio will suffer as well. This dependency means your success is directly tied to their performance, leaving you with limited control over outcomes.

2. Market Volatility

Cryptocurrency markets are notoriously volatile, with prices capable of dramatic changes in short periods. While this volatility can create profit opportunities, it also increases risk. Even the most seasoned traders may struggle to predict sudden market movements, and when these happen, your copied trades may result in unexpected and significant losses.

3. Execution Delays and Slippage

In rapidly changing markets, a slight delay between when a trader places a trade and when it is replicated in your account can cause slippage. This means your trades might be executed at less favorable prices, reducing potential profits or amplifying losses. The risk is particularly high during periods of extreme market activity when prices can change within seconds.

4. Lack of Control

Copy trading involves surrendering control of your trading decisions to another person or an automated system. While this can be convenient, it also means you’re unable to intervene directly in individual trades. This lack of control can be unsettling, especially if the trader’s decisions start to deviate from your financial goals or risk tolerance.

5. Hidden Fees

Many copy trading platforms and expert traders charge fees for their services, which can eat into your profits. These may include subscription fees, profit-sharing agreements, or per-trade fees. Some platforms may not be transparent about these costs upfront, making it essential to read the fine print and calculate how fees impact your net returns.

6. Platform Risks

Copy trading relies on third-party platforms, which can have vulnerabilities. Technical issues such as server outages, software glitches, or slow updates can disrupt trade execution. Additionally, poorly secured platforms may expose your funds to hacking or fraudulent activity. Choosing a reputable and well-secured platform is crucial to mitigating these risks.

7. Mismatched Risk Tolerance

The trading strategies employed by the experts you follow might not align with your own risk tolerance or investment goals. For instance, a trader taking high-risk positions with leverage may expose your account to significant losses that you’re not prepared to handle. Misalignment can lead to financial stress and dissatisfaction with the copy trading process.

8. Overconfidence in Automation

The ease of automation in copy trading can lead to a false sense of security. Some investors may become complacent, assuming the system will manage everything without monitoring or adjustments. This overconfidence can result in missed opportunities, unaddressed underperformance, or unchecked risks in volatile market conditions.

Why Has Crypto Copy Trading Become Popular?

Crypto copy trading has become increasingly popular as it provides an accessible, time-saving, and effective way to engage in the dynamic cryptocurrency market. By enabling users to replicate the trades of seasoned professionals, it simplifies entry for beginners, offers a chance to learn from experts, and supports diversification with ease. This approach appeals to busy individuals who lack the time for extensive research and seasoned investors looking to expand their strategies. Furthermore, the integration of advanced technologies, community features, and round-the-clock trading automation enhances its appeal, making crypto copy trading a versatile tool for anyone seeking to participate in the global cryptocurrency market.

Top Crypto Copy Trading Platforms Compared

Crypto copy trading platforms have become essential tools for investors seeking to mirror the strategies of experienced traders. Each platform offers unique features, fees, and user experiences. Below is a comparison of some leading crypto copy trading platforms to help you make an informed decision.

| Platform Name | Supported Cryptocurrencies | Key Features | Fee Structure | User Experience | Security Measures |

| eToro | Bitcoin, Ethereum, Ripple, and more | Social trading network, CopyTrader feature, in-depth trader profiles | Spread fees, withdrawal fees | User-friendly interface, mobile app available | Two-factor authentication, regulatory compliance |

| 3Commas | Supports over 20 exchanges including Binance, Coinbase Pro | SmartTrade terminal, automated trading bots, portfolio management | Subscription-based pricing | Advanced tools for experienced traders | API key permissions, IP whitelisting |

| Zignaly | Bitcoin, Ethereum, and other major altcoins | Profit-sharing with expert traders, automated trading bots | Performance-based fees | Simple setup, suitable for beginners | Secure API connections, fund safety protocols |

| Covesting | Bitcoin, Ethereum, Litecoin, and more | Copy-trading module integrated with PrimeXBT, performance ratings | Profit-sharing fees | Intuitive dashboard, real-time analytics | SSL encryption, cold storage for funds |

| Shrimpy | Supports multiple exchanges like Binance, Kraken | Social trading, portfolio rebalancing, backtesting | Subscription plans | Clean interface, educational resources | API security, data encryption |

Crypto Copy Trading vs. Mirror Trading vs. Social Trading

Crypto copy trading, mirror trading, and social trading are innovative approaches that simplify trading by leveraging the strategies of others. While all three methods aim to help traders, they differ in execution and purpose. Copy trading focuses on replicating individual trades, mirror trading automates the entire trading strategy of an expert, and social trading emphasizes community-driven learning and interaction. Understanding their distinctions can help you choose the one that best fits your trading style and goals.

| Feature | Crypto Copy Trading | Mirror Trading | Social Trading |

| Definition | Allows replication of specific trades of expert traders, often with customization options. | Fully automates the replication of an expert trader’s entire strategy. | Combines trading with community interaction to share insights and strategies. |

| Level of Automation | Semi-automated; users can customize trades and allocations. | Fully automated; mirrors all trades and strategies without changes. | Manual; users act on shared ideas and execute trades independently. |

| Flexibility | High; users choose traders, trades, and risk levels to copy. | Low; replicates every trade of the chosen trader without adjustment. | High; users can learn, discuss, and create personalized strategies. |

| Learning Opportunities | Provides indirect learning by observing copied trades. | Limited learning due to the lack of user interaction with strategies. | High; fosters education through community discussions and shared insights. |

| User Involvement | Moderate; requires initial setup and periodic monitoring. | Minimal; hands-off once linked to a trader. | High; involves active participation in trading communities. |

| Risk Management | Users can set risk parameters such as trade sizes and stop-loss limits. | Risk entirely depends on the mirrored trader’s strategy. | Risk management is user-controlled based on shared strategies. |

| Target Audience | Suitable for those seeking a balance between automation and control. | Ideal for passive investors preferring a hands-off approach. | Best for those who value collaboration, learning, and manual trading. |

| Popular Platforms | eToro, Zignaly, 3Commas | Covesting, PrimeXBT | eToro, TradingView, StockTwits |

Is Crypto Copy Trading Right for You?

Crypto copy trading can be an excellent choice if you’re looking to ease into cryptocurrency investing with less time commitment, but its suitability depends on your experience, risk tolerance, and investment goals. It offers the chance to learn from seasoned traders, save time with automated trades, and adopt a passive investment style, but it also requires careful monitoring and acceptance of fees, risks, and relinquishing some control.