Dollar-Cost Averaging (DCA) is an investment strategy that helps you minimize the risks associated with market volatility by spreading your investments over time. Instead of investing a lump sum all at once, DCA involves investing a fixed amount of money into a particular asset at regular intervals, regardless of its price. This consistent approach allows you to purchase more shares when prices are low and fewer shares when prices are high, effectively lowering the average cost of your investments over time. By removing the need to time the market, DCA makes investing more accessible and reduces the stress of making emotional decisions. This strategy is particularly beneficial for those new to investing or those looking to build wealth steadily without being overly concerned about short-term market fluctuations.

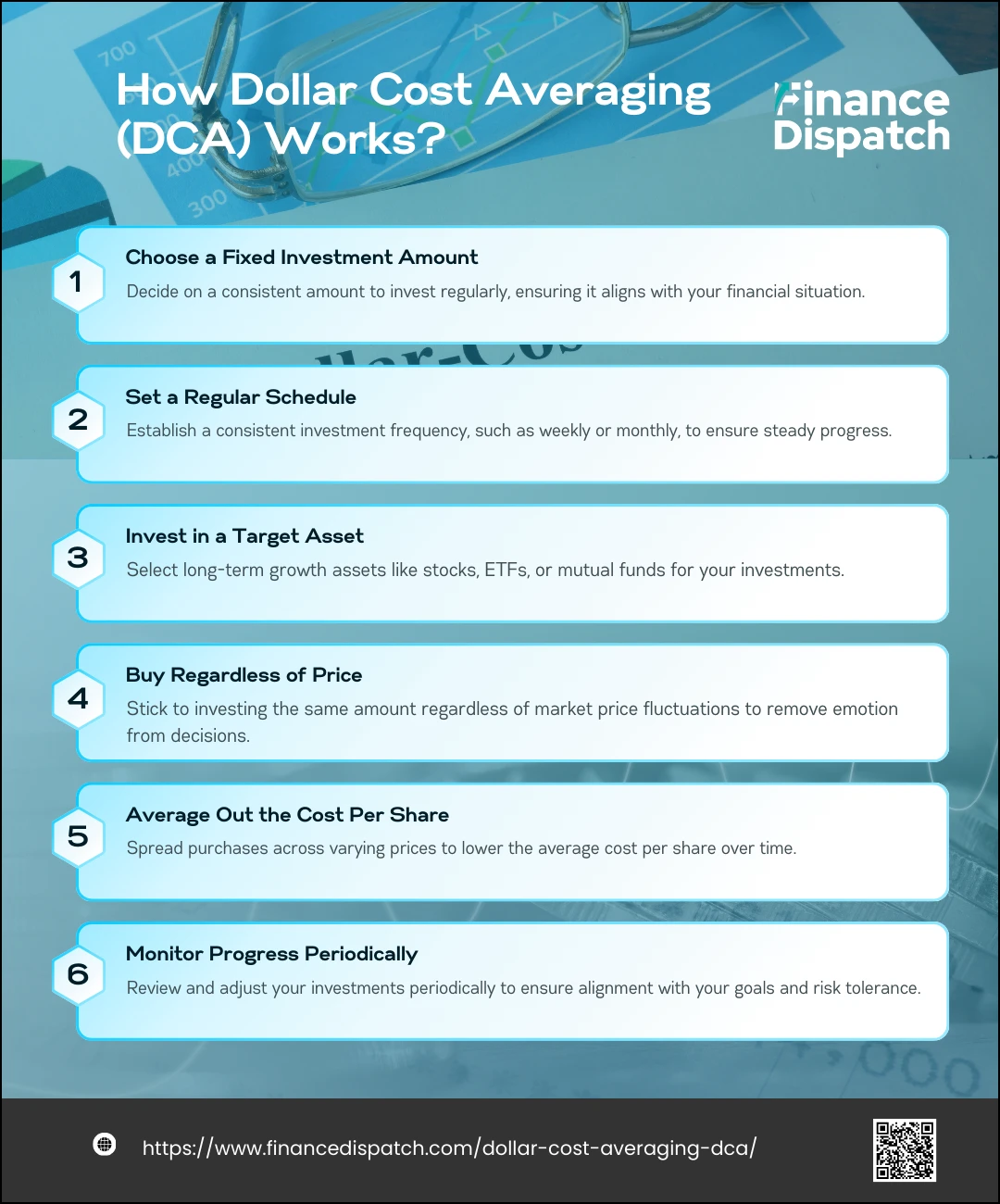

How DCA Works

Dollar-Cost Averaging (DCA) simplifies the often-complicated world of investing by providing a consistent and disciplined approach. By investing a fixed amount regularly, you gradually build your portfolio without worrying about short-term market fluctuations. Let’s explore each step of how DCA works in more detail:

1. Choose a Fixed Investment Amount

The first step in DCA is deciding how much you can invest consistently. This amount should align with your financial situation and not interfere with your everyday expenses or savings goals. For example, you might allocate $100 per month for investing. Even small amounts can grow significantly over time when invested consistently, making DCA an accessible strategy for all investors.

2. Set a Regular Schedule

DCA works best when you stick to a consistent investment schedule. Whether it’s weekly, bi-weekly, or monthly, the frequency depends on what works for you. Many investors choose to align their investments with their paycheck cycle to make it easier. Regular contributions not only ensure steady progress but also remove the guesswork from deciding when to invest.

3. Invest in a Target Asset

Identify the financial asset or assets you want to invest in, such as stocks, mutual funds, ETFs, or cryptocurrencies. It’s essential to focus on long-term investments with strong growth potential. DCA is particularly effective for broad market assets like index funds or diversified portfolios, as these tend to perform well over time.

4. Buy Regardless of Price

One of the core principles of DCA is that you invest the same amount regardless of the asset’s price at the time. This approach takes emotion out of the equation. Instead of hesitating during market dips or rushing to invest during spikes, you simply follow the plan. Over time, this strategy ensures that you buy more shares when prices are low and fewer shares when prices are high.

5. Average Out the Cost Per Share

DCA helps smooth out the cost of your investments by spreading purchases across different price points. For instance, if an asset’s price fluctuates between $10 and $20, your regular investments will capture both the highs and the lows. This results in a lower average cost per share compared to investing a lump sum during a market high. Over time, this averaging effect helps maximize your potential returns.

6. Monitor Progress Periodically

While DCA is a hands-off strategy, periodic reviews are essential. Check whether your investments align with your financial goals and risk tolerance. Rebalance your portfolio if needed, especially if the value of your assets has shifted significantly. These occasional adjustments help keep your strategy on track without requiring constant market monitoring.

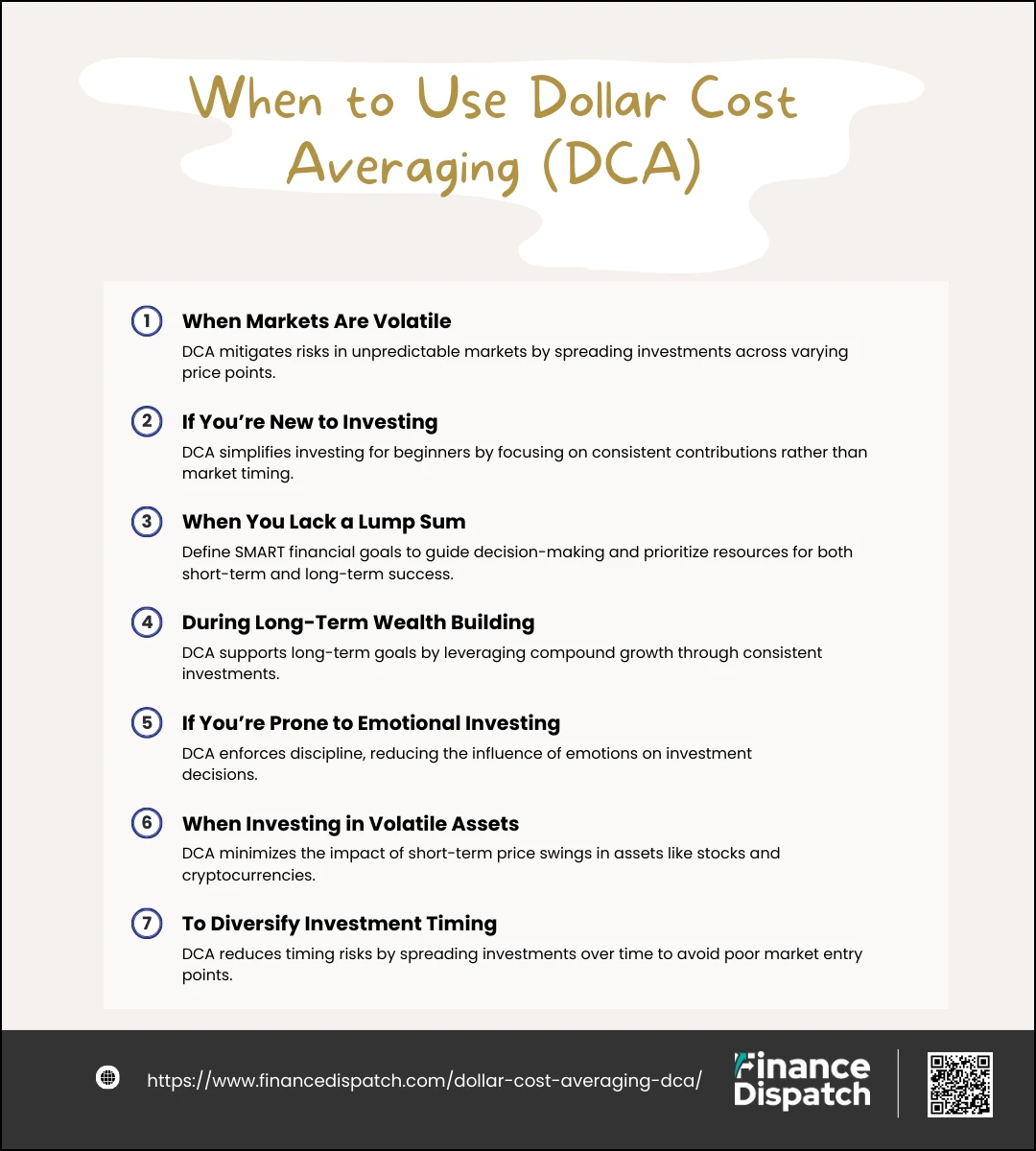

When to Use DCA

Dollar-Cost Averaging (DCA) is a practical investment strategy that fits a wide range of scenarios, particularly those involving uncertainty or long-term financial goals. Below, we delve into the key situations where DCA proves most useful:

1. When Markets Are Volatile

Market volatility can make investing nerve-wracking, as prices swing unpredictably in response to economic news, geopolitical events, or other factors. DCA helps you navigate these turbulent periods by investing consistently, regardless of market conditions. Instead of trying to time the highs and lows, you spread your purchases across varying price points. This reduces the risk of investing a large amount during a peak and allows you to benefit from lower prices during dips.

2. If You’re New to Investing

For beginners, the complexities of market timing and the fear of making mistakes can discourage participation in investing. DCA simplifies the process by focusing on consistency rather than timing. By investing small amounts at regular intervals, you can ease into the investment world, build confidence, and learn how markets work without the pressure of making perfect decisions.

3. When You Lack a Lump Sum

Many people don’t have a significant amount of money to invest all at once. DCA enables you to start investing immediately with smaller amounts, such as a portion of your monthly paycheck. Over time, these incremental investments can grow into a substantial portfolio, proving that you don’t need to be wealthy to begin building wealth.

4. During Long-Term Wealth Building

DCA aligns perfectly with long-term investment goals, such as saving for retirement or funding a child’s education. Regular contributions to accounts like 401(k)s or IRAs over decades ensure you stay invested consistently, regardless of market trends. This approach takes advantage of compound growth, where even small investments made over time can result in significant returns.

5. If You’re Prone to Emotional Investing

Emotional reactions to market swings often lead to poor investment decisions, such as panic selling during downturns or overbuying during peaks. DCA enforces discipline by committing you to a set schedule and amount. This structured approach helps you stay focused on your long-term goals and avoids the pitfalls of emotionally driven investments.

6. When Investing in Volatile Assets

Assets like cryptocurrencies and individual stocks often experience dramatic price swings. For these types of investments, DCA helps smooth out the cost over time, minimizing the impact of short-term volatility. You gradually build your position without exposing your portfolio to the full brunt of a sudden price drop or rally.

7. To Diversify Investment Timing

Investing a large sum all at once carries the risk of poor timing—what if the market crashes right after you invest? DCA spreads your investment over weeks or months, diversifying your entry points and reducing the impact of mistiming. This approach ensures you don’t put all your money into the market at an inopportune moment, providing a safety net against unpredictable market movements.

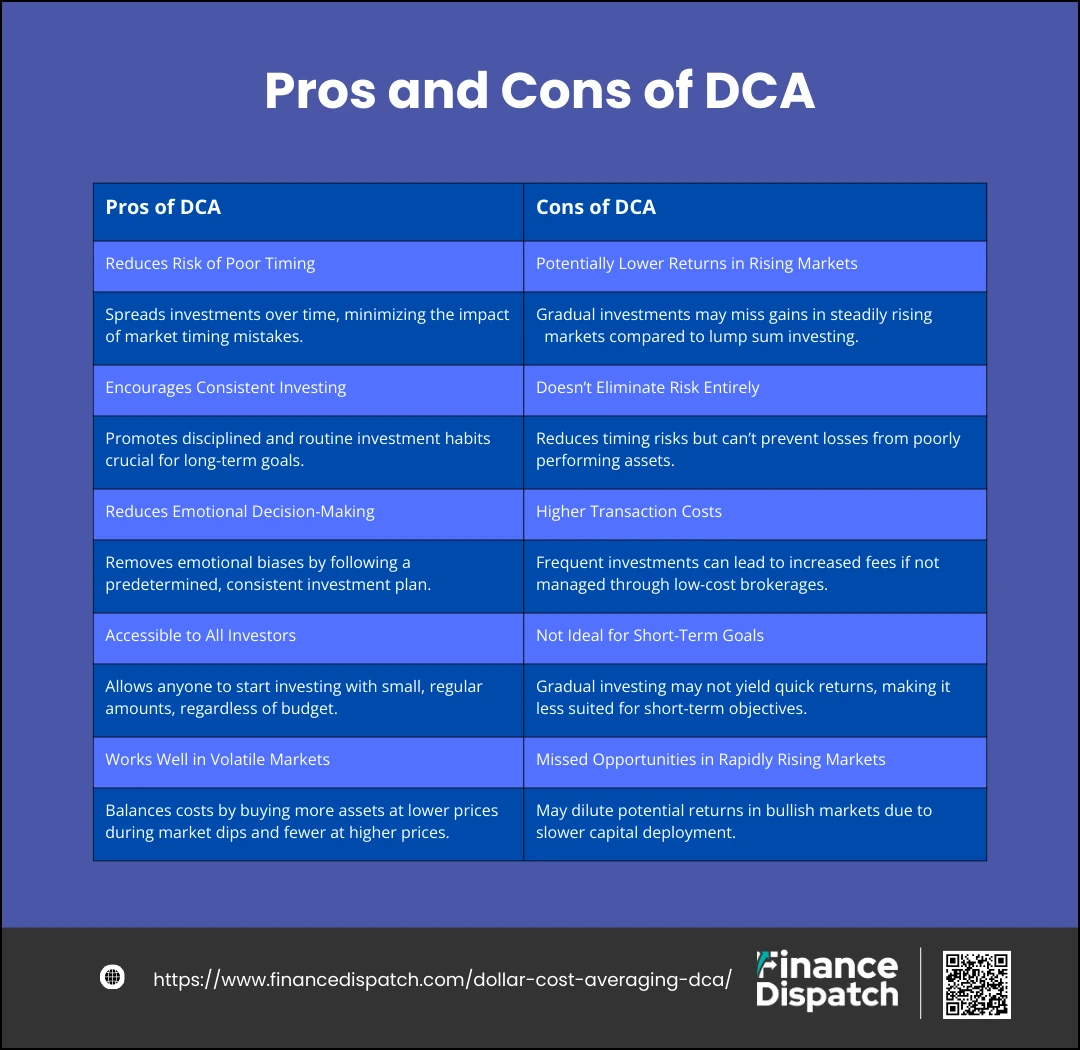

Pros and Cons of DCA

Dollar-Cost Averaging (DCA) offers a balanced approach to investing, with distinct advantages and some limitations depending on your financial goals and market conditions. Here’s an in-depth look at its pros and cons:

Pros of DCA

1. Reduces Risk of Poor Timing

Timing the market is challenging, even for experienced investors. Investing a lump sum at the wrong time—just before a market drop, for instance—can lead to significant losses. DCA minimizes this risk by spreading your investments over time. Regardless of whether the market is up or down, you buy regularly, reducing the likelihood of poor timing. This steady approach allows you to capture both the highs and lows, evening out the impact of market fluctuations over time.

2. Encourages Consistent Investing

One of the most powerful benefits of DCA is that it creates a disciplined habit of investing. By setting a regular schedule, you ensure that investing becomes part of your routine. This consistency is crucial for long-term financial goals like retirement savings, as it keeps your portfolio growing steadily, even during periods of market uncertainty or personal financial challenges.

3. Reduces Emotional Decision-Making

Emotions can be a major hurdle in investing. Many people panic during market downturns, selling off assets at a loss, or become overconfident in a bull market, chasing overpriced investments. DCA removes these emotional reactions by sticking to a predetermined plan. You invest the same amount regularly, regardless of market conditions, which keeps you focused on long-term goals rather than short-term market noise.

4. Accessible to All Investors

Unlike strategies that require a large sum of money upfront, DCA allows you to start investing with smaller amounts. For instance, you can invest as little as $50 or $100 monthly, making it an excellent option for beginners, those with limited budgets, or individuals just starting to build their wealth. This accessibility ensures that anyone can begin their investment journey, regardless of financial capacity.

5. Works Well in Volatile Markets

Market volatility can deter many investors, but DCA thrives in such conditions. When prices dip, your fixed investment buys more shares, and when prices rise, it buys fewer. Over time, this averaging effect balances out your investment costs, helping you accumulate assets at a favorable overall price. This makes DCA an effective tool for navigating unpredictable markets without the stress of market timing.

Cons of DCA

1. Potentially Lower Returns in Rising Markets

In a consistently rising market, DCA can lead to missed opportunities. A lump sum investment allows your money to grow right away, taking full advantage of upward trends. With DCA, however, your funds are introduced gradually, which might result in fewer gains if prices steadily increase over time.

2. Doesn’t Eliminate Risk Entirely

While DCA reduces the risk of market timing, it doesn’t protect you from choosing poor investments. If the asset you’re investing in performs poorly over time, DCA won’t prevent losses. It’s still essential to research and select investments carefully to ensure your portfolio aligns with your goals and risk tolerance.

3. Higher Transaction Costs

Frequent, small investments can lead to higher transaction fees, especially if your brokerage charges fees per trade. These costs can add up over time, particularly for investors contributing smaller amounts regularly. Opting for brokerages with low or no transaction fees can help mitigate this downside.

4. Not Ideal for Short-Term Goals

DCA is best suited for long-term investing, where the averaging effect has time to work. For short-term goals, such as saving for a down payment or a vacation, the gradual nature of DCA might not deliver significant returns quickly enough. In such cases, lump sum investing or other strategies may be more appropriate.

5. Missed Opportunities in Rapidly Rising Markets

In bullish markets, where prices are climbing steadily or rapidly, DCA can underperform compared to a lump sum approach. By spreading out your investments, you might miss out on the full potential gains from an early price increase. While DCA smooths out volatility, it may also dilute your returns in consistently upward-trending conditions.

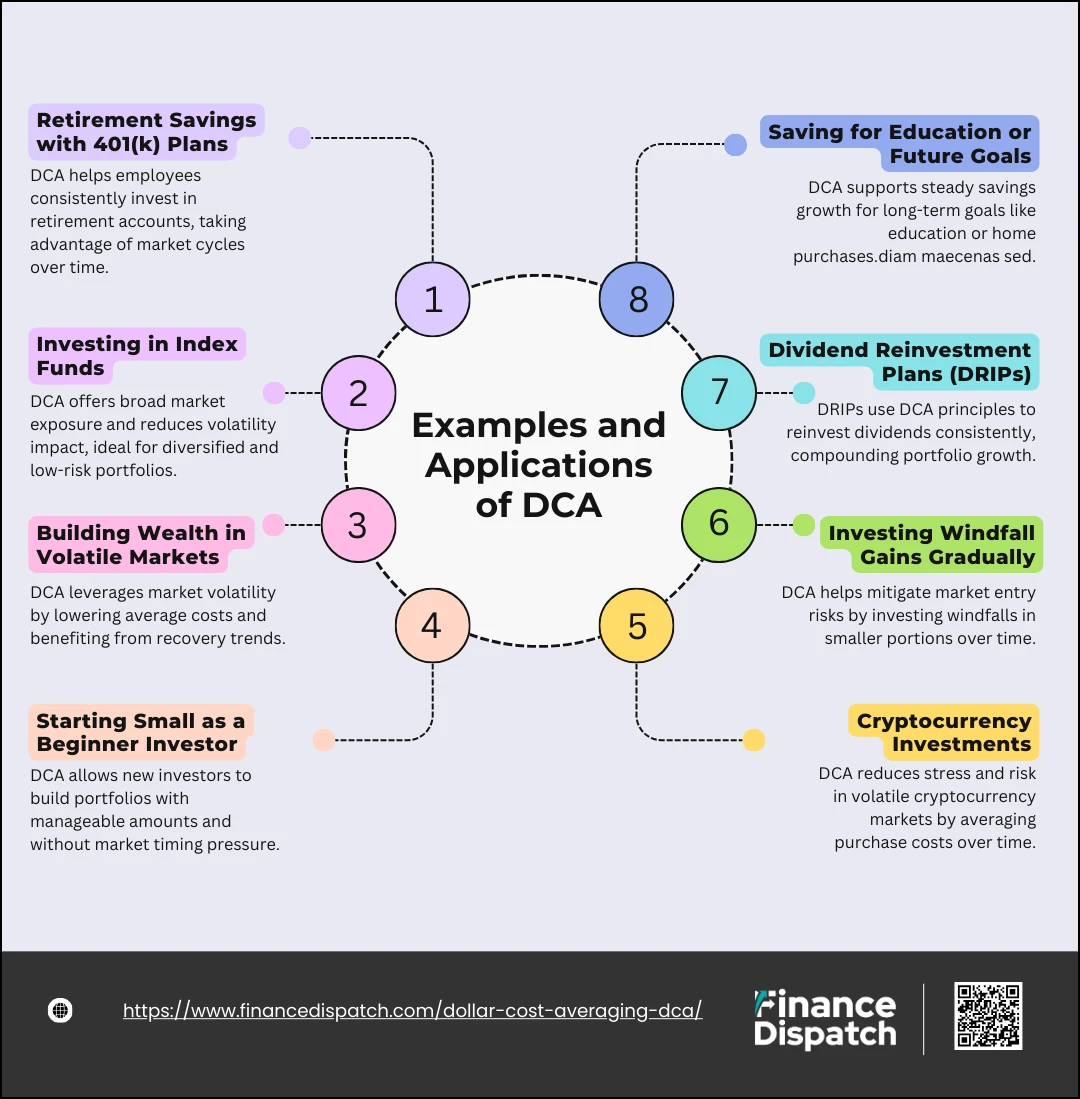

Examples and Applications of DCA

Dollar-Cost Averaging (DCA) is a flexible and effective strategy that suits various financial goals and investment scenarios. Below, we dive deeper into how DCA can be applied in different contexts:

1. Retirement Savings with 401(k) Plans

One of the most common applications of DCA is through workplace retirement plans like 401(k)s. Employees contribute a fixed percentage of their paycheck to their retirement accounts, which is then invested in mutual funds, index funds, or other assets. Since contributions occur regularly, regardless of market conditions, DCA ensures that employees buy more shares during market downturns and fewer shares when prices are high. Over decades, this approach supports long-term wealth growth and helps workers take advantage of market cycles.

2. Investing in Index Funds

Index funds, which track the performance of a market index like the S&P 500, are ideal for DCA. By investing a fixed amount at regular intervals, you gain broad exposure to the market while smoothing out the cost of your investment. This method is particularly effective for investors seeking low-risk, diversified portfolios, as it reduces the impact of market volatility on individual purchases.

3. Building Wealth in Volatile Markets

Volatile markets can be intimidating, but DCA turns this into an advantage. For instance, if a stock alternates between $20 and $40, your consistent investments ensure that you purchase more shares during price drops and fewer during peaks. Over time, this reduces the average cost per share and positions your portfolio to benefit from eventual market recoveries, making volatility work in your favor.

4. Starting Small as a Beginner Investor

For those just beginning their investment journey, DCA is a practical and accessible approach. New investors can start with manageable amounts—such as $50 or $100 monthly—and gradually build their portfolios without the pressure of market timing. This steady investment habit not only grows wealth over time but also helps beginners develop confidence and familiarity with the investment process.

5. Cryptocurrency Investments

Cryptocurrencies like Bitcoin and Ethereum are known for their extreme price volatility, making them a prime candidate for DCA. Rather than trying to predict short-term price movements, investors can allocate a fixed amount to cryptocurrencies each month. This approach reduces the emotional stress of market timing while helping accumulate assets at an average price, regardless of daily fluctuations.

6. Investing Windfall Gains Gradually

Receiving a large sum, such as an inheritance or bonus, can feel overwhelming when deciding how to invest it. Instead of investing the entire amount upfront, you can divide the windfall into smaller portions and invest over time using DCA. This strategy reduces the risk of entering the market at an unfavorable moment and provides a measured way to deploy your funds.

7. Dividend Reinvestment Plans (DRIPs)

Many companies and mutual funds offer DRIPs, where dividends from your investments are automatically reinvested to purchase additional shares. DRIPs essentially operate as a form of DCA because dividends are reinvested at regular intervals, regardless of share prices. Over time, this reinvestment compounds your portfolio’s growth, helping you maximize returns from dividend-paying assets.

8. Saving for Education or Future Goals

DCA is an excellent strategy for long-term goals, such as saving for a child’s education or a future home purchase. By investing regularly in mutual funds, ETFs, or other diversified assets, you build your savings while minimizing the risk of market timing. The steady accumulation of assets ensures you’re prepared when it’s time to meet your financial milestones.

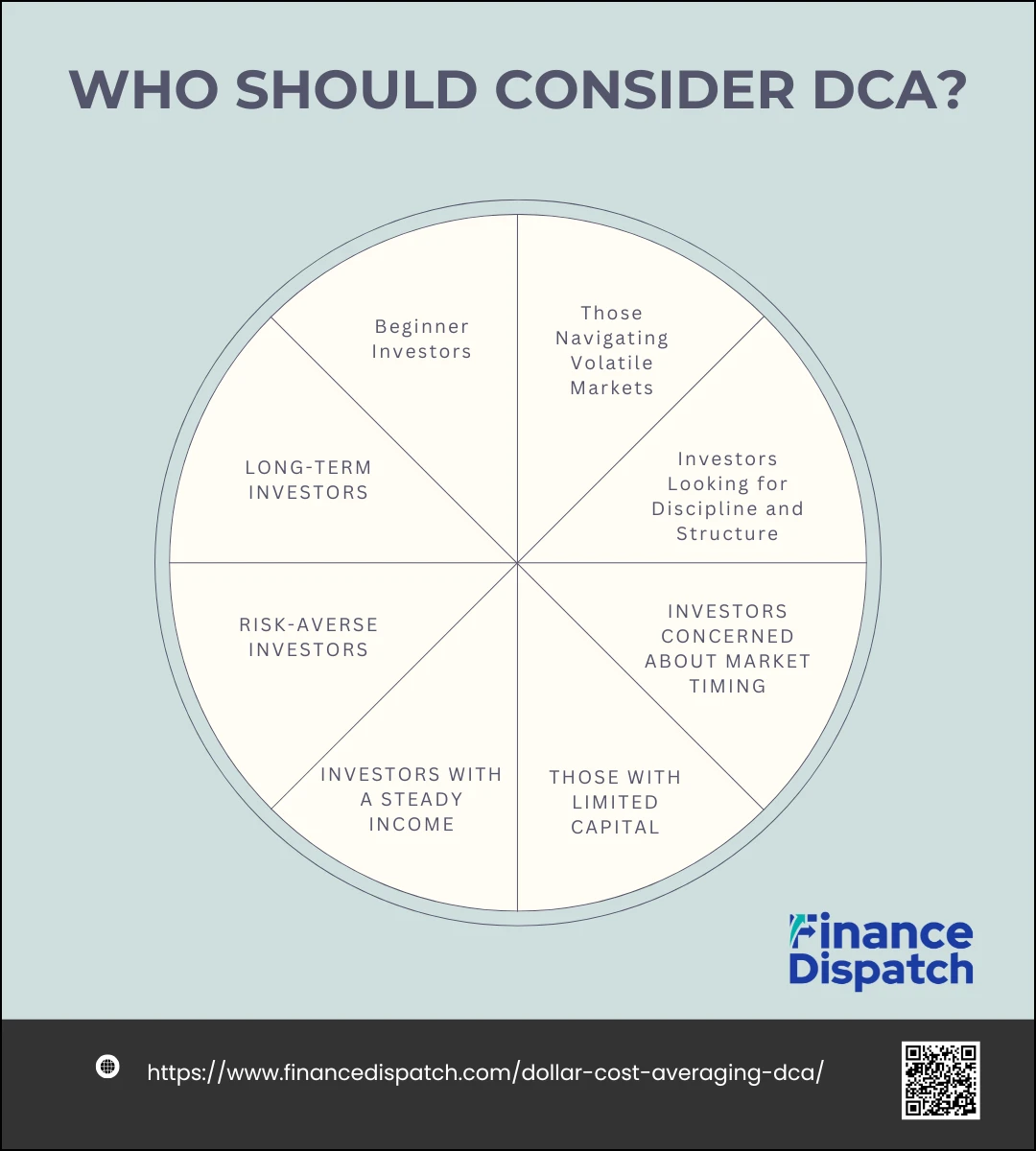

Who Should Consider DCA?

Dollar-Cost Averaging (DCA) offers a steady, disciplined approach to investing, which is why it appeals to a variety of investors. It’s particularly beneficial for those who want to avoid emotional decision-making or market timing and prefer a more consistent way of building wealth. Here’s a deeper dive into the types of investors who should consider DCA:

1. Beginner Investors

For those who are just starting their investment journey, DCA is an excellent strategy. Beginners often feel overwhelmed by the complexity of the market and the uncertainty of when to invest. DCA simplifies the process by automating investments at regular intervals, such as monthly or bi-weekly, which eliminates the need to focus on market timing. Since you don’t need to worry about when the best time to buy is, DCA allows beginners to start building their portfolios without the fear of making costly mistakes.

2. Long-Term Investors

DCA is particularly effective for investors who are saving for long-term goals like retirement, homeownership, or education. With a long-term horizon, DCA helps you build wealth steadily by allowing you to invest regularly over time. Since the strategy is based on consistency rather than timing, you can take advantage of market cycles, buying at different price points. Over the long run, this steady investment approach maximizes your chances of benefiting from compounding returns, which is key to achieving substantial growth.

3. Risk-Averse Investors

If you are risk-averse and reluctant to invest a large sum all at once, DCA offers a more cautious approach. With lump-sum investing, there’s the risk that you could enter the market at a peak, which could lead to immediate losses if the market drops soon after. DCA spreads out your investments over time, reducing the likelihood of making a poor decision based on short-term market movements. This gradual approach helps to smooth out the impact of volatility, making it a more comfortable option for those who prefer to limit their exposure to risk.

4. Investors with a Steady Income

DCA is ideal for individuals with a regular, predictable income, such as salaried employees. Regular contributions from each paycheck—whether monthly or bi-weekly—can be set up automatically, making the process simple and consistent. This approach ensures that you’re investing consistently without having to worry about fluctuations in income or waiting to accumulate large amounts of cash. With a steady income, you can commit to DCA and continue contributing to your portfolio without disruption.

5. Those with Limited Capital

For investors who don’t have a large lump sum to invest upfront, DCA offers an opportunity to start investing with smaller, more manageable amounts. Instead of waiting until you have enough savings to make a significant investment, you can begin with small, regular contributions. This approach is particularly beneficial for those just starting out or individuals who have limited disposable income but still want to grow their wealth over time. Over time, these small, consistent investments add up, allowing you to accumulate wealth gradually.

6. Investors Concerned About Market Timing

Many investors struggle with timing the market, which can lead to missed opportunities or poor decisions. DCA removes the need for market timing altogether. By investing a fixed amount regularly, you are automatically buying when prices are low and when they are high, which averages out the cost of your investments over time. This strategy makes it easier for investors who are unsure when to invest, as it focuses on regularity rather than trying to predict short-term market movements.

7. Investors Looking for Discipline and Structure

DCA offers structure and discipline, which can help investors stick to a plan. Regular, automatic contributions encourage a “set it and forget it” mindset, which can reduce the temptation to make impulsive, emotional decisions. If you’re someone who finds it difficult to stay disciplined and stick to your financial plan, DCA can provide the structure you need to stay on track with your investment goals. It removes the need for constant market monitoring and helps you remain focused on long-term success.

8. Those Navigating Volatile Markets

If you’re investing in a volatile market, such as emerging markets or specific sectors that experience large fluctuations, DCA can be especially beneficial. Markets with frequent ups and downs can make it challenging to know when to buy or sell. DCA helps smooth out the impact of volatility by spreading your investments over time, so you aren’t trying to time the market perfectly. This strategy is ideal for reducing the emotional stress that often comes with investing in volatile environments, as it allows you to stay invested without being overly concerned about short-term price swings.

FAQs

1. Can I use DCA for individual stocks, or is it better suited for funds?

Yes, you can use DCA for individual stocks as well as for funds. However, DCA is often more effective with diversified funds like mutual funds or ETFs because they spread the risk across multiple assets. When applying DCA to individual stocks, you need to be mindful of the risk that comes with investing in a single company, as the performance of one stock can be highly volatile.

2. How does DCA work in a bear market or during a market crash?

In a bear market or during a market crash, DCA can be especially advantageous because you continue investing at regular intervals, buying more shares when prices are low. This lowers the average cost of your investments, allowing you to potentially benefit when the market recovers. However, it’s important to ensure that the assets you’re investing in have long-term growth potential.

3. Is DCA the same as systematic investing?

Yes, DCA is a form of systematic investing. Both strategies involve making regular, automatic investments at set intervals, regardless of market conditions. While DCA is more focused on investing a fixed amount regularly, systematic investing can also refer to more flexible approaches, such as investing varying amounts based on financial goals or market conditions.

4. Can DCA be combined with other investment strategies?

Yes, DCA can be combined with other strategies like lump-sum investing. For example, if you have a large amount of cash to invest, you could start by using a lump-sum approach for part of it and apply DCA to the remainder, allowing you to benefit from both strategies in different market conditions. Combining strategies provides more flexibility depending on your goals and market outlook.

5. Can I stop or adjust my DCA contributions if my financial situation changes?

Yes, you can stop or adjust your DCA contributions if needed. For example, if you experience a change in income or a financial emergency, you can reduce or temporarily stop your regular investments. Similarly, if your financial situation improves, you can increase your contributions. The flexibility of DCA allows you to adjust your strategy as your financial goals and circumstances evolve.