Certificates of deposit (CDs) are time-bound savings instruments offered by banks and credit unions. When you open a CD, you agree to deposit a certain amount of money for a fixed period—usually ranging from a few months to several years—at a predetermined interest rate. Unlike traditional savings accounts, CDs offer a stable, guaranteed return, as long as you don’t withdraw the funds before the term ends. They are considered low-risk investments, making them an attractive option for those who prioritize safety and predictable income over high returns.

Key Features of CDs

- Fixed Interest Rate: CDs provide a set interest rate for the entire term, so you know exactly how much you’ll earn when the CD matures.

- Time-Bound Commitment: You choose a term length, ranging from as short as three months to as long as five years or more. During this period, your money is locked in.

- FDIC Insurance: CDs are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor, per institution, which means your investment is protected even if the bank fails.

Do’s When Using CDs for Retirement

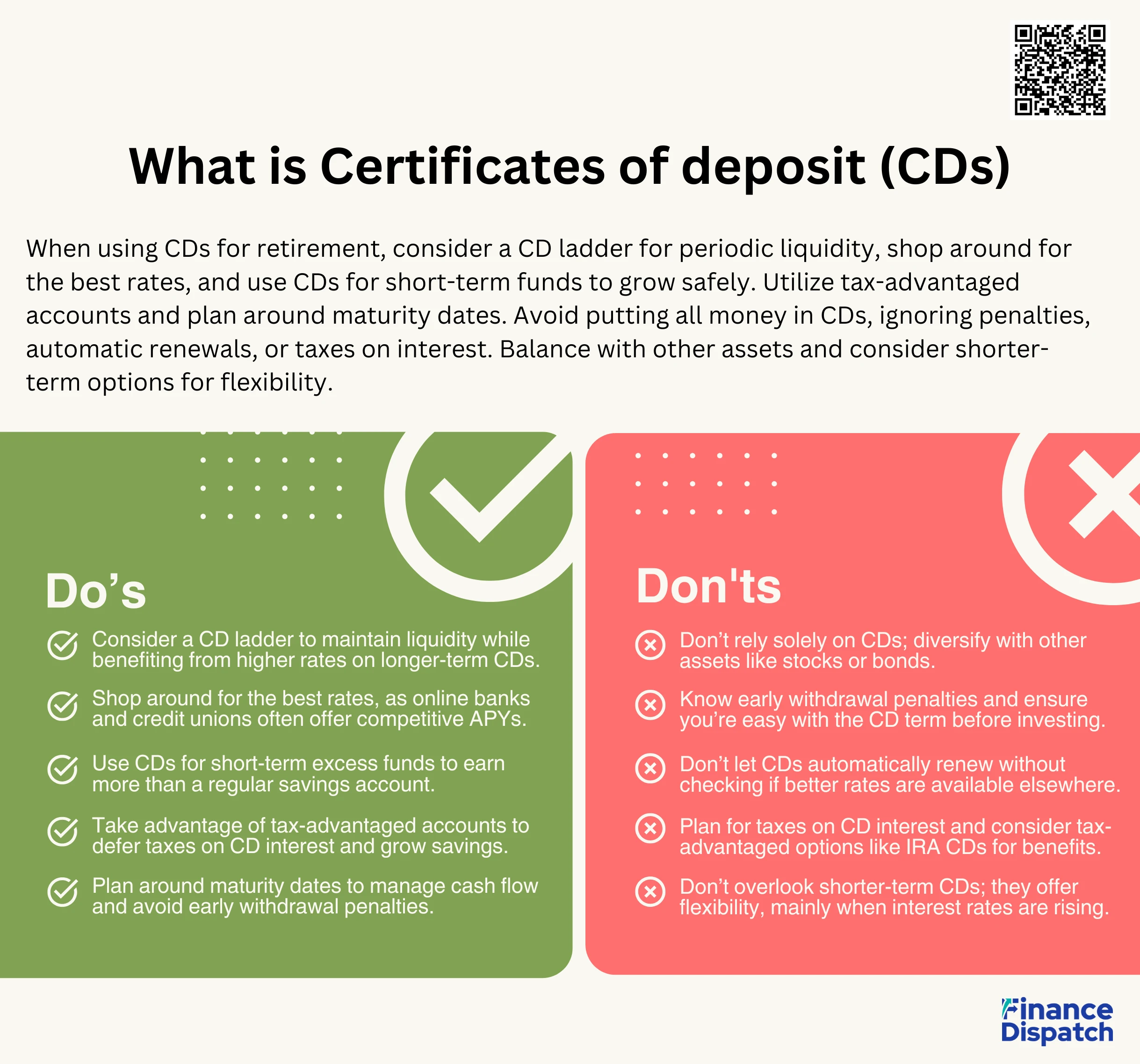

Using certificates of deposit (CDs) for retirement planning can be a smart way to ensure stable, predictable returns, especially if you’re looking to preserve your savings and avoid market risks. However, to make the most out of your CD investments, there are some important practices to keep in mind. By following these “do’s,” you can optimize your savings strategy and avoid common pitfalls.

- Do Consider a CD Ladder

A CD ladder involves dividing your investment across multiple CDs with staggered maturity dates. This way, you can take advantage of higher interest rates on longer-term CDs while still having periodic access to your funds. It’s a great strategy for maintaining liquidity without sacrificing returns. - Do Shop Around for the Best Rates

Don’t settle for the first CD rate you find at your local bank. Online banks and credit unions often offer higher rates, and it pays to compare. Shopping around can help you find the most competitive APYs, ensuring you earn the best return possible on your investment. - Do Use CDs for Short-Term Excess Funds

CDs are ideal for funds you don’t need to access immediately but still want to grow safely. Whether it’s extra cash from savings or proceeds you’ve earned elsewhere, placing these in a CD can earn you more than a regular savings account, without tying up your money for too long. - Do Take Advantage of Tax-Advantaged Accounts

If possible, consider opening a CD within a tax-advantaged account, like an IRA. This can help you defer taxes on the interest earned, making your savings grow even more efficiently. Just be mindful of contribution limits and withdrawal rules associated with these accounts. - Do Plan around Maturity Dates

Timing is important with CDs, especially when you’re approaching or in retirement. Plan around the maturity dates to ensure you have access to funds when you need them. This will help you avoid early withdrawal penalties and better manage your cash flow during retirement.

Don’ts When Using CDs for Retirement

While certificates of deposit (CDs) can be a safe and reliable part of your retirement strategy, there are some common mistakes you should avoid to make the most of your investment. Being aware of these “don’ts” will help you sidestep potential pitfalls, protect your returns, and ensure that your savings strategy remains on track.

- Don’t Put All Your Money in CDs

Diversification is key in any investment strategy. While CDs offer stability, relying solely on them might limit your growth potential. Consider balancing your portfolio with other assets like stocks or bonds to protect against inflation and maximize your returns over time. - Don’t Ignore Early Withdrawal Penalties

CDs are meant to keep your money locked in for a fixed term, and withdrawing funds early can result in significant penalties. To avoid losing interest (and possibly some of your principal), make sure you’re comfortable with the term length before committing to a CD. - Don’t Automatically Renew Without Checking Rates

When a CD matures, many banks will automatically renew it for the same term, often at a lower rate. Before letting your CD roll over, take the time to shop around and see if you can find a better rate elsewhere. This way, you won’t miss out on potentially higher returns. - Don’t Forget About Taxes on Interest Earned

Interest earned on CDs is considered taxable income, and you’ll need to report it, even if you don’t withdraw the funds. Plan ahead for this tax obligation, and if possible, explore options like IRA CDs, which can offer tax advantages. - Don’t Overlook Shorter-Term Options

While longer-term CDs usually offer higher rates, they aren’t always the best choice. If interest rates are rising, locking into a long-term CD could mean missing out on better opportunities down the line. Consider a mix of short-term CDs or a CD ladder to keep your options open.

Pros and Cons of Using CDs for Retirement

Certificates of deposit (CDs) can be a useful tool for retirement savings, offering a safe and predictable way to grow your money. However, like any financial product, CDs come with their own set of advantages and disadvantages. Understanding these pros and cons will help you decide whether they fit into your retirement strategy.

Pros

- Stability and Security

CDs provide a fixed interest rate for a set period, which means you know exactly how much you’ll earn by the end of the term. Plus, they are FDIC-insured up to $250,000, offering peace of mind that your principal is protected. - Predictable Income

For retirees looking to generate steady income, CDs are a reliable option. The fixed rate allows you to plan your finances without worrying about market fluctuations, making it easier to manage your cash flow in retirement. - Higher Interest Rates Compared to Regular Savings Accounts

CDs often offer better interest rates than traditional savings accounts, especially for longer terms. This can help your savings grow faster if you’re willing to lock up your money for a period of time.

Cons

- Limited Liquidity

One of the main drawbacks of CDs is that your funds are locked in until the maturity date. If you need to access your money early, you’ll face penalties that can significantly cut into your returns. - Lower Returns Compared to Other Investments

While CDs are safe, their returns are generally lower than higher-risk investments like stocks or mutual funds. Over the long term, this can limit your growth potential, especially if inflation outpaces the interest rate you’re earning. - Interest Rate Risk

If you lock into a long-term CD when rates are low, you might miss out on higher rates if they increase later. This can be a disadvantage, particularly during periods of rising interest rates.

Managing Maturing CDs

When your certificate of deposit (CD) reaches maturity, it’s important to have a plan in place to manage the funds effectively. At this point, you’ll have the option to withdraw your money, reinvest it in a new CD, or explore other savings or investment opportunities. Without proper planning, you could miss out on better returns or get stuck with unfavorable terms. Here are some key steps to take when managing maturing CDs.

- Start Shopping around Before Maturity

As your CD nears maturity, begin researching other available options. Interest rates may have changed since you first opened the CD, so shopping around for a new CD or a different savings product can help you find better rates and terms. - Evaluate Your Financial Needs

Before reinvesting your funds, consider your current financial situation. Do you need more liquidity in the near future, or can you afford to lock up your money for another term? Assess your short- and long-term goals to decide whether another CD, a high-yield savings account, or another investment makes sense for you. - Avoid Automatic Rollovers

Many banks automatically renew CDs when they mature, but this can often result in lower interest rates or less favorable terms. Set a reminder to act before the maturity date, and avoid letting your CD roll over without checking to see if better options are available. - Plan for Tax Obligations

Interest earned on CDs is taxable, even if you don’t withdraw the funds. Make sure to account for this in your tax planning to avoid surprises. If you’re looking for tax advantages, consider reinvesting your funds into a tax-advantaged account, such as an IRA CD.

Additional Tips for Maximizing CD Benefits

To get the most out of your certificates of deposit (CDs), it’s essential to think strategically about how and when you invest. Simple practices, like shopping around for the best rates or using different CD strategies, can make a big difference in your overall returns. Here are some additional tips to help you maximize the benefits of CDs.

- Diversify with a CD Ladder

A CD ladder involves investing in multiple CDs with staggered maturity dates. This strategy allows you to take advantage of higher rates on longer-term CDs while still having access to funds at regular intervals. It’s a smart way to balance liquidity and earning potential. - Take Advantage of Promotional Rates

Sometimes banks offer promotional rates for new CD accounts. These rates can be significantly higher than the standard ones, so it pays to shop around. Just make sure to read the terms carefully to understand if there are any conditions or restrictions. - Consider Shorter-Term CDs in a Rising Rate Environment

If interest rates are expected to rise, locking into a long-term CD might not be the best move. Instead, consider shorter-term CDs that allow you to reinvest at higher rates when they mature, helping you capitalize on an upward rate trend. - Look into No-Penalty CDs

No-penalty CDs allow you to withdraw your funds before the end of the term without facing a penalty. While they may have slightly lower interest rates than regular CDs, they offer more flexibility, which can be beneficial if you need quicker access to your money.

Conclusion

Certificates of deposit (CDs) can be a valuable part of your retirement savings plan, offering stability, predictable returns, and protection from market volatility. However, to truly maximize their benefits, it’s essential to understand how they work, carefully choose your terms, and implement strategies like CD ladders. While CDs may not provide the highest returns, their low-risk nature makes them a reliable choice for those nearing retirement or seeking to preserve their savings. By being mindful of the do’s and don’ts, shopping around for the best rates, and planning ahead, you can use CDs effectively to complement your overall retirement strategy.