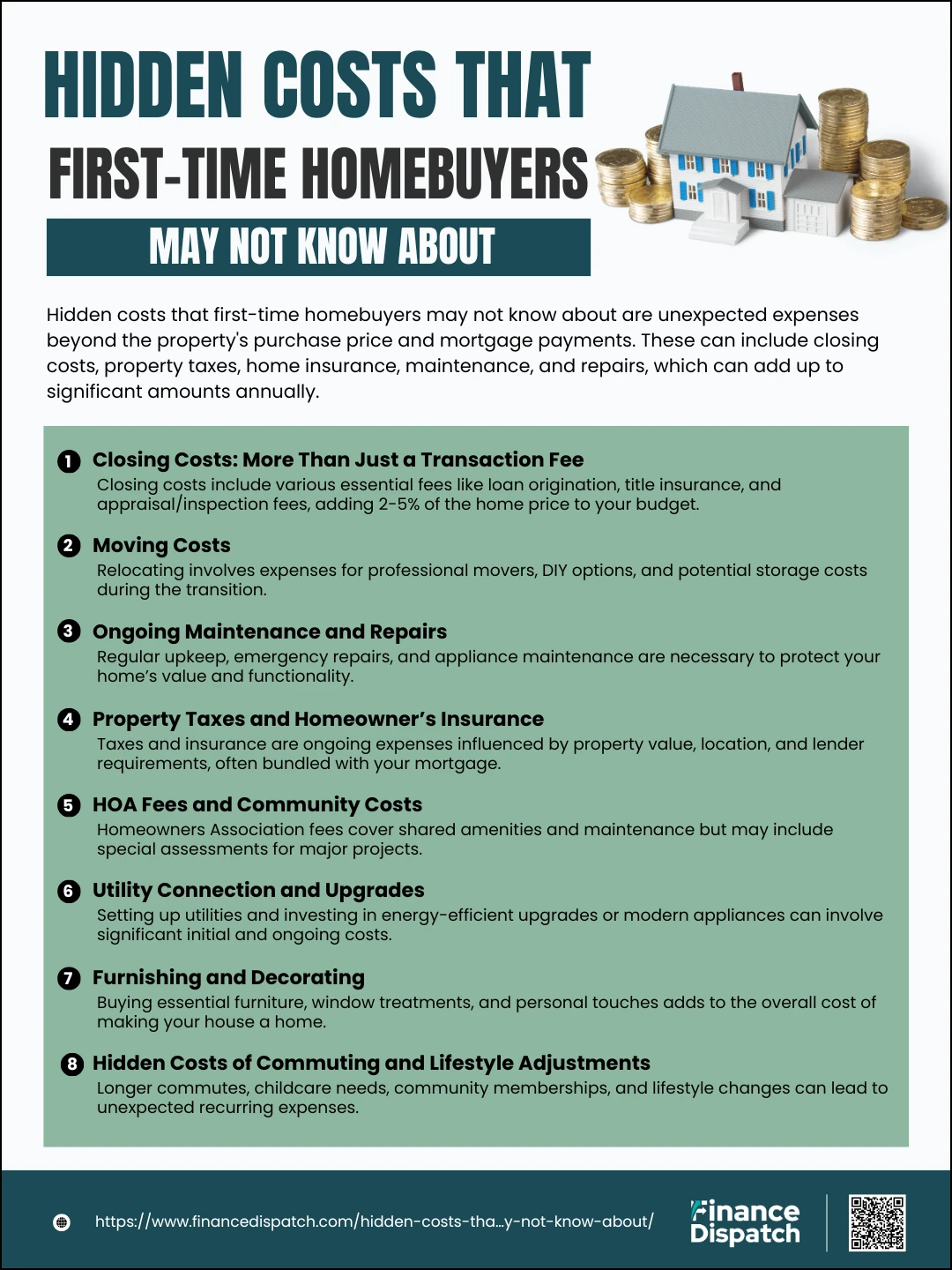

Buying your first home is an exciting milestone, but it’s easy to overlook the financial surprises that come with it. Beyond the down payment and mortgage, there are numerous hidden costs that can catch first-time homebuyers off guard. From closing fees and property taxes to maintenance and utility expenses, these additional charges can quickly add up, making your dream home more expensive than anticipated. Understanding these hidden costs is essential to avoid unexpected financial stress and to ensure you’re fully prepared for the realities of homeownership. Let’s explore these lesser-known expenses to help you plan wisely and confidently step into this new chapter of your life.

#1. Closing Costs: More Than Just a Transaction Fee

When it comes to buying your first home, closing costs are more than just a simple transaction fee—they’re a collection of essential charges that finalize your home purchase. While they might seem like an afterthought during the home-buying process, these costs can significantly impact your budget. Let’s break down a few key components of closing costs.

1. Loan Origination Fees

Loan origination fees cover the administrative expenses your lender incurs while processing your mortgage application. This fee typically ranges from 0.5% to 1% of your loan amount. It’s essentially the cost of setting up your mortgage, including verifying your financial background, preparing necessary documents, and coordinating the loan process. While it may seem like an added burden, this fee is crucial to ensure your lender has done their due diligence in securing your loan.

2. Title Insurance

Title insurance protects both you and your lender from potential legal issues related to your home’s title. Here are the main points to consider:

- Ensures the seller has the legal right to transfer ownership.

- Protects against undisclosed liens or disputes over property ownership.

- Typically includes two types: lender’s title insurance (mandatory) and owner’s title insurance (optional but recommended).

- Costs range from 0.5% to 1% of the home’s purchase price.

3. Appraisal and Inspection Fees

- Appraisal Fee: A professional appraiser assesses your home’s market value to ensure the loan amount aligns with the property’s worth. This fee typically ranges from $300 to $500, depending on the property size and location.

- Inspection Fee: A home inspection identifies any structural or mechanical issues that could impact the property’s value or safety. Inspection fees generally cost between $300 and $600 but are invaluable for avoiding costly surprises after purchase.

#2. Moving Cost

Relocating to your first home involves more than packing boxes; it requires careful planning and budgeting to account for the associated costs. Whether you’re hiring professional movers or opting for a DIY approach, understanding the financial implications is key. Additionally, temporary storage solutions may come into play during the transition. Here’s a breakdown to help you navigate this phase smoothly.

1. Professional Movers vs. DIY

| Factor | Professional Movers | DIY Approach |

| Cost | $1,000–$1,500 (local move); $4,000–$10,000+ (long-distance) | $130–$500 (truck rental); fuel and equipment extra |

| Time | Quick and efficient; handled by a skilled team | Time-intensive; requires planning and physical effort |

| Effort | Minimal for you; movers handle packing, loading, and unloading | High; you are responsible for all aspects of the move |

| Convenience | High; includes additional services like packing materials | Low; requires coordinating rentals, helpers, and schedules |

| Damage Risk | Insured and professionally handled | Greater risk of damage due to inexperience |

2. Storage Costs During Transition

If there’s a gap between leaving your current residence and moving into your new home, storage costs can be an additional expense to consider. Here are key points to keep in mind:

- Short-term storage unit rentals: Costs range from $50 to $300 per month, depending on the unit size and location.

- Portable storage containers: Typically $150 to $300 for delivery, pickup, and one month of storage.

- Additional insurance: Optional coverage for stored belongings may cost $10 to $20 per month.

- Access fees: Some facilities charge extra if you need frequent access to your unit.

- Long-term storage: Discounts may be available for extended rental periods.

#3. Ongoing Maintenance and Repair Cost

Owning a home means taking on the responsibility of keeping it in good condition over time. While buying a house is a significant investment, maintaining it is just as important to protect its value and avoid costly surprises. Regular upkeep, planning for unexpected repairs, and having a clear strategy for ongoing maintenance can help you manage these responsibilities with ease.

- Routine Maintenance: Schedule regular upkeep for critical systems like HVAC, plumbing, and roofing to avoid long-term damage.

- Exterior Care: Inspect and maintain the roof, siding, and paint annually to protect against weather-related wear and tear.

- Lawn and Landscaping: Regularly mow the lawn, trim trees, and maintain plants to keep your property looking its best and to prevent pest issues.

- Interior Updates: Check for drafts around windows and doors, and reseal as needed to improve energy efficiency and reduce utility costs.

- Emergency Repairs Fund: Set aside 1–3% of your home’s value each year for unexpected repairs like HVAC breakdowns or roof replacements.

- Appliance Maintenance: Extend the life of your appliances by cleaning and servicing them periodically.

- Pest Control: Schedule inspections to prevent infestations and mitigate potential structural damage.

#4. Property Taxes and Homeowner’s Insurance Cost

When you own a home, property taxes and homeowner’s insurance become an integral part of your financial planning. These costs are often bundled with your mortgage payment, but they can fluctuate over time due to changes in tax rates, property assessments, or insurance premiums. Understanding these expenses and planning ahead can help you manage them effectively.

1. Property Taxes

- Assessed Value-Based: Property taxes are calculated based on the assessed value of your home, which may increase over time.

- Local Variations: Rates vary by location, so research the tax implications before purchasing a home.

- Supplemental Bills: Be prepared for potential additional taxes if your property’s assessed value rises post-purchase.

2. Homeowner’s Insurance

- Mandatory Coverage: Most mortgage lenders require homeowner’s insurance to protect their investment.

- Location Matters: Insurance premiums depend on factors like your home’s location, size, and construction.

- Natural Disaster Coverage: Additional policies, such as flood or earthquake insurance, may be necessary based on regional risks.

3. Combined Payments

- Escrow Account: Many homeowners pay property taxes and insurance through an escrow account managed by their lender.

- Monthly Adjustments: Expect adjustments to your escrow contributions if taxes or insurance premiums change.

4. Tax Deductions

- Potential Savings: In some cases, property taxes and mortgage interest may be deductible on your income tax return.

#5. HOA Fees and Community Costs

If you’re buying a home in a community with a Homeowners Association (HOA), you’ll likely encounter additional costs beyond your mortgage and property taxes. HOA fees are designed to cover the maintenance of shared spaces and amenities, ensuring the community remains well-kept and enjoyable for all residents. While these fees offer benefits, they can vary widely in cost and scope, so understanding them is essential before committing to a property.

- Monthly or Annual Fees: HOA fees are typically collected monthly or annually and can range from $200 to over $1,000, depending on the community and amenities offered.

- What Fees Cover: These often include maintenance of common areas (e.g., landscaping, pools, and clubhouses), security services, and sometimes utilities like water or trash collection.

- Special Assessments: Occasionally, HOAs charge one-time fees for major projects like road repairs or amenity upgrades, which can be a significant financial surprise.

- Rules and Regulations: HOAs enforce community rules, such as landscaping standards or parking restrictions, to maintain property values. Non-compliance can lead to fines.

- Amenities and Services: Some HOAs provide high-end amenities like fitness centers, tennis courts, and concierge services, which can justify higher fees.

- Transparency and Budgeting: Before purchasing a property, request the HOA’s financial statements and budget to understand how funds are managed and assess any upcoming expenses.

#6. Utility Connection and Upgrade Cost

Moving into a new home means more than just unpacking—it involves setting up essential utilities and possibly upgrading outdated systems. Utility connection fees and the costs of improving energy efficiency or modernizing appliances can quickly add up. Planning ahead for these expenses will ensure a smoother transition and help you optimize your home for comfort and efficiency.

1. Connection Fees:

- Electricity: $30–$100 for initial setup, plus a possible security deposit.

- Water and Sewer: $20–$100, with additional fees for new meter installation.

- Gas: $30–$70 for activation, depending on your provider.

2. Internet and Cable Setup:

- Installation fees typically range from $50 to $150, with additional costs for equipment like routers or modems.

3. Energy Efficiency Upgrades:

- Smart Thermostats: Cost between $150–$300 but can lower energy bills over time.

- LED Lighting: An initial investment of $50–$200 for the whole home, reducing electricity usage.

- Insulation Improvements: Upgrading insulation costs $1,000–$2,000 but can save on heating and cooling.

4. Appliance Upgrades:

- Energy-efficient refrigerators, washing machines, or dishwashers cost more upfront but reduce utility bills over the long term.

5. Utility Planning:

- Budget for higher bills during the first month, as utility companies often prorate services or require deposits.

- Research potential rebates or incentives for energy-efficient upgrades, which can offset initial costs.

#7. Furnishing and Decorating Cost

Turning a house into a home requires thoughtful furnishing and decorating to suit your style and needs. However, these expenses can quickly add up, especially for first-time homeowners transitioning to a larger space. To make the process manageable and enjoyable, it’s important to prioritize your purchases and plan your budget effectively.

1. Start with Essentials

Begin by purchasing the basics, such as a bed, dining table, and seating. These foundational pieces ensure you can live comfortably while you work on completing your space.

2. Focus on High-Traffic Areas

Furnish and decorate the most-used spaces, like the living room and bedroom, before moving on to less critical areas such as guest rooms or home offices.

3. Budget for Window Treatments

Curtains, blinds, or shades not only enhance privacy but also help regulate light and temperature. These are often overlooked but essential for both function and design.

4. Invest in Lighting

Purchase a mix of lighting options, including overhead fixtures, table lamps, and accent lights, to create a welcoming and functional ambiance.

5. Add Personal Touches Gradually

Incorporate artwork, photos, and decorative items over time to reflect your personality and make the space truly feel like home.

6. Plan for Seasonal Needs

Depending on your location, budget for items like rugs, heavy curtains, or outdoor furniture to adapt your space to different seasons.

7. Shop Smart

Take advantage of sales, second-hand options, and online marketplaces to save money on quality items without compromising on style.

#8. Commuting and Lifestyle Adjustment Cost

Relocating to a new home often comes with unexpected expenses that extend beyond the property purchase itself. Commuting costs and lifestyle adjustments can significantly impact your budget and daily routines. Below is a detailed look at these often-overlooked expenses and how they might affect you.

1. Higher Transportation Costs

If your new home is farther from work, school, or other daily destinations, you’ll likely face higher transportation costs. Increased fuel consumption, more frequent oil changes, and general wear and tear on your vehicle can add up quickly. Those relying on public transit may need to budget for monthly passes or individual trip costs, which can vary based on distance and frequency. Additionally, if carpooling or ride-sharing becomes a necessity, those expenses should be factored into your overall commuting budget.

2. Parking Fees

Living in or near an urban area often means dealing with additional parking costs. Whether you’re paying for a monthly parking spot near your workplace, daily parking fees, or residential street permits, these costs can escalate depending on the area. Some communities even charge for parking at train or bus stations, adding another layer of expense to your daily commute.

3. Childcare Adjustments

A longer commute can mean leaving home earlier or arriving back later, potentially requiring extended childcare services. Before- or after-school programs, babysitters, or daycare can quickly become necessary, leading to increased expenses. In some cases, these adjustments might also involve paying for additional activities to keep children occupied during longer waiting periods.

4. New Community Memberships

Moving to a new area often means finding ways to engage with your new community. This might involve joining local gyms, recreation centers, or social clubs, many of which require memberships or recurring fees. While these can enhance your quality of life, they represent an additional cost that should be accounted for in your new budget.

5. Dining and Entertainment

With changes in your routine, you may find yourself dining out more often, particularly if your commute leaves little time for cooking at home. Exploring local restaurants, attractions, or entertainment options in your new area can also lead to unplanned spending. These costs can add up quickly, especially in areas with a vibrant dining or entertainment scene.

6. Home Office Investments

If you’re working remotely or in a hybrid capacity, moving may necessitate setting up a functional home office. Expenses can include purchasing new furniture, upgrading your internet speed, or investing in better lighting and ergonomic equipment. These costs can be significant, particularly if your previous setup wasn’t sufficient for long-term use.

7. Climate-Related Expenses

The climate of your new location can also affect your utility and maintenance costs. Homes in colder regions may require additional heating, snow removal services, or winterizing equipment, while hotter climates could mean higher cooling bills or costs associated with maintaining a pool or shaded outdoor spaces. These recurring expenses can significantly impact your monthly budget.

Conclusion

Relocating to a new home is an exciting milestone, but it comes with more than just the visible costs of purchasing the property. Hidden expenses, such as commuting adjustments, lifestyle changes, and unexpected utility upgrades, can significantly impact your budget if not accounted for. By understanding these potential financial challenges and planning ahead, you can make a smoother transition and avoid unnecessary stress. Whether it’s budgeting for higher transportation costs, adapting to a new community, or setting up a functional home office, being proactive ensures you’re fully prepared for this new chapter. Thoughtful planning allows you to embrace the opportunities of your new home while maintaining financial stability and peace of mind.