Protecting and growing your wealth requires more than just accumulating assets; it demands a well-thought-out strategy tailored to your unique financial situation. As a high-net-worth individual, your financial goals extend beyond the present, encompassing long-term security, legacy building, and sustainable growth. By understanding the risks and opportunities that come with substantial wealth, you can implement effective measures to safeguard your assets and maximize your returns. This article delves into practical strategies designed to help you achieve financial resilience and prosperity while navigating the complexities of wealth management.

What is Wealth Protection and Growth?

Wealth protection and growth are two essential pillars of sound financial management for high-net-worth individuals. Wealth protection focuses on safeguarding your assets from risks such as economic downturns, legal disputes, and unexpected events, ensuring your financial stability remains intact. On the other hand, wealth growth involves strategically increasing the value of your assets through investments, business opportunities, and financial planning. Together, these concepts form a comprehensive approach to managing your wealth, balancing the need for security with the pursuit of opportunities that can enhance your financial future. By prioritizing both protection and growth, you can create a robust and resilient financial foundation.

Why Wealth Protection Matters

Wealth protection is a critical aspect of financial planning, especially for high-net-worth individuals. It ensures that your hard-earned assets are shielded from unforeseen challenges, allowing you to maintain financial stability and achieve long-term goals. Without proper protection, your wealth can be vulnerable to risks such as economic volatility, legal claims, or mismanagement.

- Safeguards against Market Fluctuations: Protects your assets from unpredictable economic downturns.

- Preserves Your Legacy: Ensures that your wealth is passed on to future generations as intended.

- Minimizes Legal and Financial Risks: Shields your finances from lawsuits, fraud, and other liabilities.

- Maintains Financial Stability: Provides a safety net during emergencies or unexpected life events.

- Supports Long-term Goals: Keeps your financial plan on track despite external challenges.

Key Strategies for Protecting Wealth

Protecting your wealth goes beyond simply holding onto your assets; it involves actively preparing for uncertainties and shielding your financial future from risks. For high-net-worth individuals, strategic wealth protection is a combination of risk management, legal safeguards, and informed decision-making. Here’s a deeper look at the essential strategies for safeguarding your financial foundation:

1. Diversify Your Investments

Diversification is a cornerstone of risk management. By spreading your assets across a range of investment classes—such as equities, fixed income, real estate, and commodities—you minimize the impact of poor performance in any one sector. This approach not only protects against market volatility but also creates opportunities to balance potential losses with gains from different sectors or asset types.

2. Establish an Asset Protection Plan

Asset protection involves setting up legal structures that separate your personal wealth from potential liabilities. Tools like irrevocable trusts, family limited partnerships (FLPs), and LLCs can protect assets from lawsuits or creditors while maintaining control over how they are used. These measures ensure that your wealth remains secure even in the face of legal challenges.

3. Maintain Adequate Insurance Coverage

Comprehensive insurance coverage acts as a safety net for unforeseen events. From liability insurance that protects against lawsuits to property insurance for safeguarding physical assets, having the right coverage ensures you won’t have to dip into your savings or investments during emergencies. High-net-worth individuals may also consider specialized coverage, such as umbrella insurance or private client insurance.

4. Engage in Regular Financial Reviews

Financial portfolios are dynamic and must evolve with changing personal goals, market conditions, and economic factors. Conducting regular financial reviews with your advisors helps identify vulnerabilities, rebalance portfolios, and align strategies with your objectives. Staying proactive ensures your wealth remains on track regardless of external changes.

5. Implement Tax Optimization Strategies

Tax optimization is crucial for preserving wealth. Leveraging tax-advantaged accounts, taking advantage of deductions and credits, and structuring investments to minimize taxable income can reduce the amount you owe. Charitable giving and estate planning also offer tax benefits while allowing you to contribute meaningfully to causes you value.

6. Plan for Estate and Legacy Preservation

Estate planning is essential to ensure your wealth is distributed according to your wishes. A well-crafted plan, including wills, trusts, and beneficiary designations, not only avoids potential disputes but also minimizes estate taxes. Legacy preservation ensures that your wealth continues to support your family and causes for generations to come.

7. Stay Informed About Financial Risks

Awareness is a powerful tool for wealth protection. Keeping up with economic shifts, regulatory updates, and emerging risks allows you to take timely actions. Whether it’s adjusting your portfolio to respond to inflation or safeguarding digital assets from cybersecurity threats, staying informed equips you to make decisions that protect your financial future.

Strategies to Grow Wealth

Growing wealth requires more than just accumulating assets; it involves adopting smart financial strategies that optimize opportunities for increasing your net worth. For high-net-worth individuals, these strategies focus on balancing risk, seizing lucrative opportunities, and maintaining a disciplined approach to financial management. Below are detailed explanations of key wealth growth strategies:

1. Invest in a Diversified Portfolio

Diversification helps spread risk across various asset classes. By investing in a mix of equities, fixed income, real estate, and alternative assets, you reduce your exposure to losses from any single investment. A diversified portfolio balances potential risks and rewards, ensuring steady growth over time.

2. Leverage Compound Interest

Compound interest is one of the most powerful tools for growing wealth. By reinvesting earnings, you allow your money to grow exponentially over time. Long-term investment vehicles like retirement accounts, index funds, or dividend-paying stocks are ideal for harnessing the benefits of compounding.

3. Explore High-Yield Investment Opportunities

Consider investments that offer higher potential returns, such as private equity, venture capital, or emerging markets. While these options carry higher risks, careful research and guidance from financial experts can help you capitalize on their significant growth potential.

4. Expand Business Ventures

Investing in or expanding businesses can yield substantial returns. Look for opportunities in growing industries or innovative sectors where your expertise and capital can drive success. Diversifying into multiple ventures can also spread risk while enhancing income potential.

5. Reinvest Profits

Reinvesting earnings from successful investments or business ventures allows your wealth to grow at an accelerated pace. By continually reinvesting, you capitalize on the compounding effect, expanding your financial portfolio over time.

6. Optimize Tax Efficiency

Tax-efficient strategies help you retain more of your earnings. Utilizing tax-deferred accounts, such as IRAs, or employing strategies like tax-loss harvesting, charitable donations, or income splitting can significantly reduce your tax liabilities and increase your net returns.

7. Invest in Education and Skills Development

Personal growth and education are investments that pay long-term dividends. Whether it’s financial management courses or learning about emerging markets, staying informed enhances your ability to identify and capitalize on profitable opportunities.

8. Engage Professional Advisors

Working with financial advisors, investment strategists, or portfolio managers can give you access to expert insights and exclusive opportunities. Their tailored guidance can help you optimize your investment choices and navigate complex financial markets.

9. Capitalize on Market Trends

Staying informed about technological advancements, economic trends, and emerging industries allows you to identify high-growth opportunities. Investing early in booming sectors like renewable energy, technology, or healthcare innovation can yield significant returns.

10. Build Passive Income Streams

Creating multiple passive income sources, such as rental properties, dividend-paying stocks, or royalties, provides a steady cash flow that can be reinvested for further growth. Passive income also offers financial stability and reduces reliance on active income.

The Role of Financial Advisors

Financial advisors play a pivotal role in helping high-net-worth individuals protect and grow their wealth. Their expertise provides valuable guidance on complex financial matters, from investment strategies to estate planning. A skilled advisor works closely with you to understand your unique financial goals and tailor strategies that align with your risk tolerance and aspirations. They help you navigate market fluctuations, optimize tax efficiency, and identify lucrative opportunities, ensuring your financial plan remains robust and adaptive. By leveraging their insights and experience, financial advisors act as trusted partners, empowering you to make informed decisions that secure your financial future.

Benefits Afforded to High-Net-Worth Individuals

High-net-worth individuals (HNWIs) enjoy a range of unique advantages that extend beyond financial opportunities. These benefits provide access to exclusive services, enhance wealth management, and create avenues for maintaining and growing their wealth while enjoying an elevated lifestyle. Below is a detailed look at the key benefits:

1. Access to Exclusive Investment Opportunities

HNWIs gain entry to high-yield investment options such as private equity funds, hedge funds, and venture capital that are often restricted to accredited investors. These opportunities often deliver superior returns and allow them to diversify their portfolios in ways not available to the average investor.

2. Tailored Financial Services

Private banking and wealth management services cater exclusively to HNWIs. These personalized solutions include customized investment strategies, dedicated financial advisors, and bespoke loan arrangements that address individual financial needs and goals.

3. Enhanced Credit and Financing Options

Due to their substantial assets, HNWIs enjoy preferential terms for loans, mortgages, and lines of credit. Financial institutions offer them lower interest rates, higher credit limits, and more flexible repayment structures, making financing large purchases or investments significantly easier.

4. Priority Access to Luxury Services

HNWIs receive tailored concierge services and exclusive access to luxury experiences, such as first-class travel, private events, and premium memberships. These services are designed to enhance convenience and provide unique lifestyle perks.

5. Comprehensive Estate Planning Solutions

HNWIs work with top-tier estate planning professionals to structure their wealth transfer strategies efficiently. This includes creating trusts, minimizing estate taxes, and ensuring their financial legacy aligns with their values and intentions for future generations.

6. Personalized Tax Strategies

High-net-worth individuals benefit from customized tax planning by leveraging experienced tax advisors. These strategies include utilizing tax shelters, optimizing charitable contributions, and implementing income deferral techniques to significantly reduce tax liabilities.

7. Networking and Business Expansion Opportunities

Wealth often comes with access to elite business circles and networking events. HNWIs can connect with influential entrepreneurs and investors, opening doors to partnerships, mergers, and new business ventures that can further expand their wealth.

8. Global Diversification of Assets

HNWIs have the financial capability to invest in international markets, real estate, and businesses. This global diversification spreads risk across multiple economies, reducing the impact of localized economic downturns and tapping into high-growth regions worldwide.

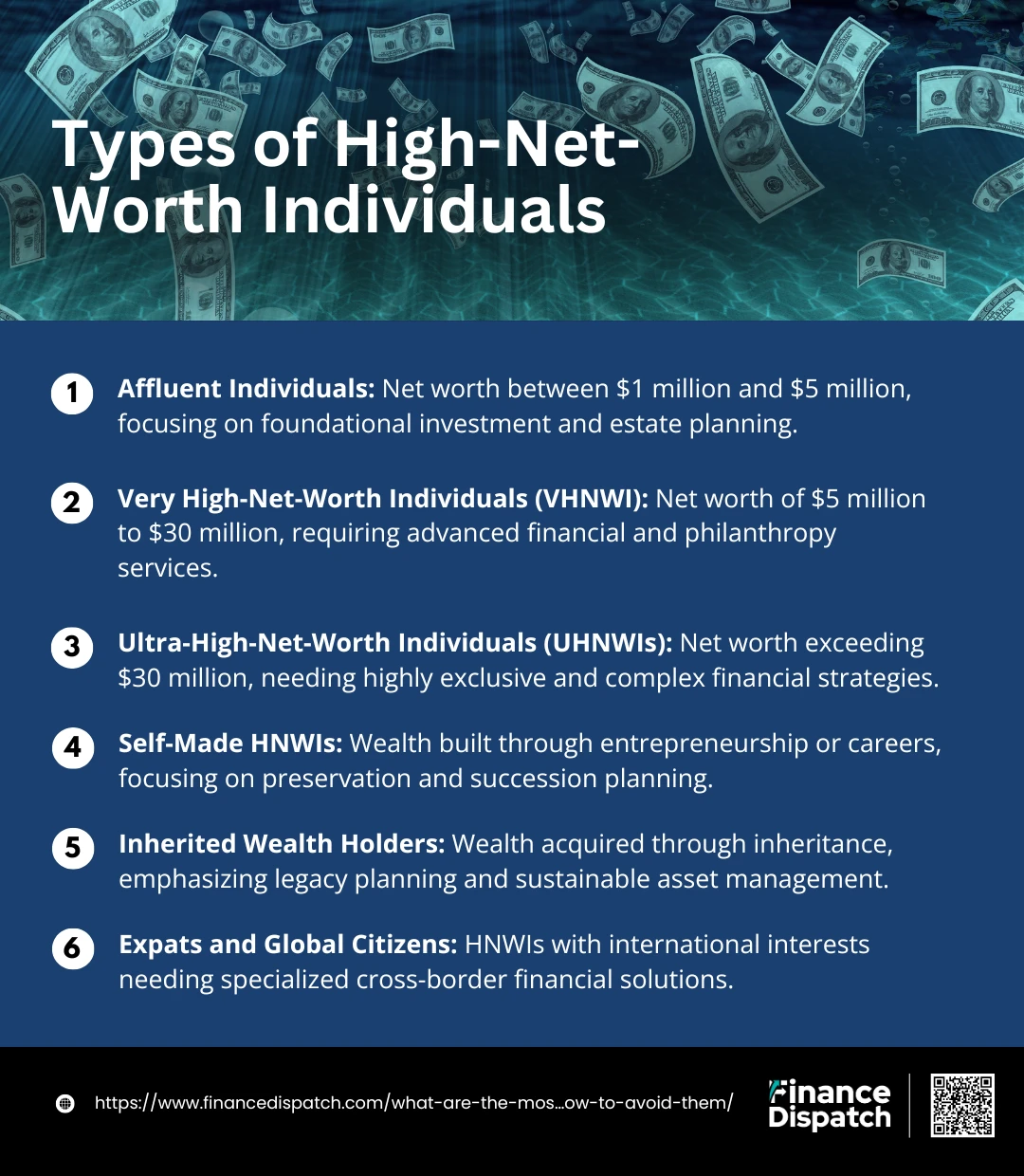

Types of High-Net-Worth Individuals

High-net-worth individuals (HNWIs) are categorized based on the extent of their wealth and the specific financial strategies they require. These classifications help financial institutions and advisors tailor services to meet their unique needs. Understanding these categories can provide better insights into the financial planning approaches suitable for each type. Below are the key classifications of HNWIs:

1. Affluent Individuals

These are individuals with a net worth between $1 million and $5 million. They often require assistance with investment strategies, tax planning, and foundational estate planning.

2. Very High-Net-Worth Individuals (VHNWI)

With a net worth ranging from $5 million to $30 million, VHNWIs typically need more advanced financial services, including complex investment portfolios, philanthropy planning, and private banking services.

3. Ultra-High-Net-Worth Individuals (UHNWIs)

Individuals with a net worth exceeding $30 million fall into this category. They often manage family offices, global investments, and intricate estate planning, requiring highly personalized and exclusive financial services.

4. Self-Made HNWIs

These are individuals who have accumulated wealth through entrepreneurship, investments, or professional careers. They focus on wealth preservation, business expansion, and succession planning.

5. Inherited Wealth Holders

Individuals who have acquired their wealth through inheritance often emphasize legacy planning and philanthropic endeavors while ensuring their assets are protected and sustainably managed.

6. Expats and Global Citizens

High-net-worth individuals living abroad or with global business interests require specialized services for international taxation, currency management, and cross-border investments.

Tax Optimization Techniques

For high-net-worth individuals, effective tax optimization is essential to preserve and grow wealth. By leveraging legal strategies and expert guidance, you can minimize your tax liabilities while maximizing your after-tax income. Tax optimization involves taking advantage of deductions, credits, and efficient structuring of investments to reduce your overall tax burden. Below is a table outlining some key tax optimization techniques:

| Technique | Description | Benefits |

| Tax-Deferred Accounts | Use accounts like IRAs and 401(k)s to defer taxes on contributions and investment growth. | Postpone taxes until withdrawal, often at a lower rate. |

| Tax-Loss Harvesting | Offset capital gains by selling underperforming investments at a loss. | Reduces taxable income from capital gains. |

| Charitable Contributions | Donate to qualified charities or establish donor-advised funds. | Offers deductions while supporting philanthropic goals. |

| Income Splitting | Shift income to family members in lower tax brackets or use trusts to redistribute income. | Minimizes overall family tax burden. |

| Investment Structuring | Invest in tax-efficient vehicles like municipal bonds or index funds. | Reduces tax liability on investment returns. |

| Estate Planning | Use trusts, gifts, or strategic bequests to transfer wealth tax-efficiently to heirs. | Minimizes estate and gift taxes while preserving wealth. |

| International Tax Planning | Optimize global income through tax treaties, offshore accounts, and foreign tax credits. | Reduces double taxation and enhances global income management. |

| Business Tax Deductions | Claim deductions for eligible business expenses, such as travel, equipment, and professional services. | Lowers taxable income for business owners. |

Building a Legacy: Wealth Transfer

Wealth transfer is a crucial part of building a legacy, ensuring that your assets are passed on to future generations in a meaningful and tax-efficient way. For high-net-worth individuals, this process goes beyond simply dividing assets—it involves thoughtful planning to preserve family wealth, minimize tax liabilities, and align with your values and vision. Proper wealth transfer strategies can safeguard your legacy and provide financial security for your loved ones.

- Create a Comprehensive Estate Plan: Outline your wishes clearly through wills, trusts, and beneficiary designations to ensure smooth asset distribution.

- Utilize Trust Structures: Leverage trusts, such as revocable or irrevocable trusts, to control how and when assets are distributed while minimizing estate taxes.

- Incorporate Charitable Giving: Establish foundations or donor-advised funds to leave a philanthropic legacy and gain tax benefits.

- Engage in Lifetime Gifting: Reduce estate taxes by gifting portions of your wealth during your lifetime within the allowed tax-free limits.

- Plan for Business Succession: Develop a clear strategy for passing on family businesses, including leadership transitions and ownership structures.

- Leverage Life Insurance: Use life insurance policies to provide liquidity for estate taxes or leave additional financial support for heirs.

- Communicate with Heirs: Discuss your legacy goals with family members to foster understanding and ensure alignment with your vision.

Monitoring and Adapting Strategies financial strategies

Monitoring and adapting your financial strategies is essential to ensure long-term success in protecting and growing your wealth. Economic conditions, market trends, and personal circumstances are constantly changing, and your financial plan must evolve to stay aligned with your goals. Regularly reviewing your investments, tax strategies, and estate plans helps identify potential risks and opportunities. By working closely with financial advisors and staying informed, you can make timely adjustments that keep your wealth resilient and adaptable. This proactive approach ensures that your financial strategies remain effective, no matter how the landscape shifts.

Conclusion

Protecting and growing your wealth requires a thoughtful and proactive approach that combines strategic planning, expert guidance, and adaptability. By focusing on key areas such as wealth protection, tax optimization, and legacy building, you can secure your financial future and create lasting value for generations to come. High-net-worth individuals face unique challenges, but with the right strategies in place, you can navigate these complexities with confidence. Remember, building and sustaining wealth is a journey that demands continuous monitoring, informed decisions, and a commitment to your goals. With careful planning, you can turn your financial success into a legacy that endures.