The rise of blockchain technology has unlocked endless opportunities, and creating your own cryptocurrency token is one of the most exciting ventures in this digital era. Whether you’re aiming to revolutionize an industry, build a decentralized application (DApp), or simply bring your creative vision to life, launching a cryptocurrency token offers a powerful tool to achieve your goals. While the process might seem complex and technical at first glance, advancements in token creation platforms and user-friendly tools have made it more accessible than ever before. In this guide, you’ll discover a step-by-step approach to creating and launching your own cryptocurrency token—from understanding the fundamentals to deploying your token on a blockchain network. So, let’s demystify the process and take the first step toward building your own digital asset.

What is Cryptocurrency Tokens?

Cryptocurrency tokens are digital assets created and managed on existing blockchain networks, such as Ethereum or Binance Smart Chain. Unlike native cryptocurrencies like Bitcoin or Ether, which operate on their own independent blockchains, tokens are built on top of these networks using predefined standards like ERC-20 or BEP-20. These tokens serve various purposes, ranging from representing ownership of real-world assets to enabling access to specific services within decentralized applications (DApps). Tokens can be categorized into different types, including utility tokens, security tokens, governance tokens, and even non-fungible tokens (NFTs), each serving unique roles in their respective ecosystems. At their core, cryptocurrency tokens rely on smart contracts—self-executing agreements written in code—that dictate how they function, transfer, and interact with other blockchain assets. This flexibility and programmability make tokens a vital component of the growing blockchain economy, empowering businesses, developers, and creators to innovate and redefine value exchange in the digital world.

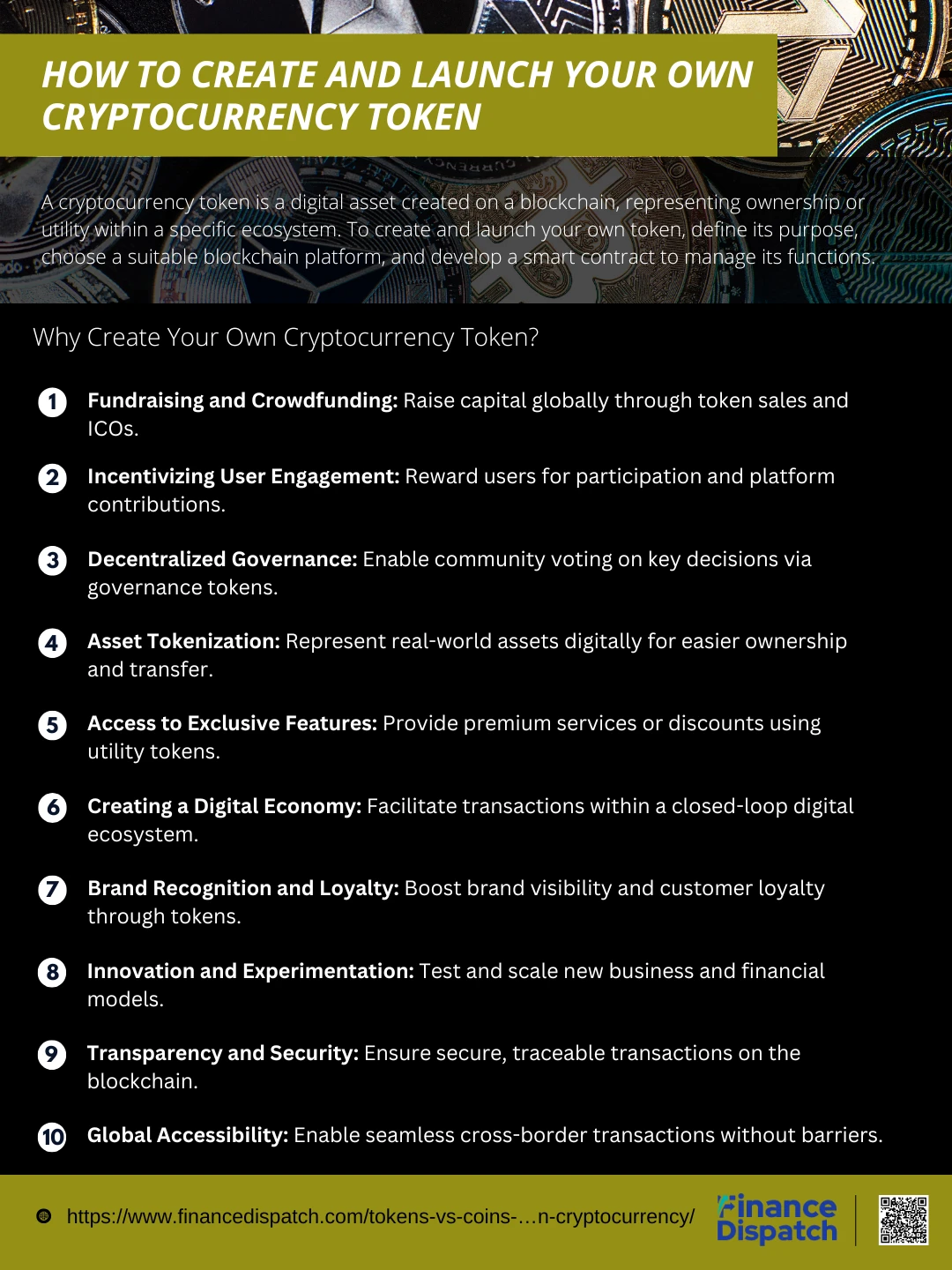

Why Create Your Own Cryptocurrency Token?

In today’s rapidly evolving digital economy, cryptocurrency tokens have emerged as powerful tools for innovation, fundraising, and community building. Whether you’re an entrepreneur aiming to launch a decentralized application (DApp), a business owner looking to tokenize assets, or a creator seeking to engage with your audience in new ways, creating your own cryptocurrency token can unlock endless possibilities. Beyond financial incentives, tokens can drive user engagement, enhance transparency, and facilitate seamless transactions across decentralized platforms. They offer businesses and individuals the ability to build decentralized ecosystems, reduce reliance on intermediaries, and establish a direct relationship with their users or stakeholders. Below are some key reasons why you might consider creating your own cryptocurrency token:

1. Fundraising and Crowdfunding

Tokens provide an innovative way to raise capital for projects through Initial Coin Offerings (ICOs) or token sales. By offering tokens to investors, businesses can secure funds globally without the limitations of traditional fundraising channels.

2. Incentivizing User Engagement

Cryptocurrency tokens can be used to reward users for their participation, referrals, or contributions to a platform. Whether it’s completing tasks, providing feedback, or promoting the platform, tokens serve as a powerful incentive mechanism.

3. Decentralized Governance

Governance tokens enable community members to participate in decision-making processes. Token holders can vote on key issues like protocol changes, feature upgrades, or fund allocations, ensuring transparency and decentralized control.

4. Asset Tokenization

Real-world assets such as real estate, art, or company shares can be tokenized, making ownership more accessible and transferable. Tokenization allows fractional ownership, reduces administrative barriers, and opens up new investment opportunities.

5. Access to Exclusive Features

Utility tokens can grant users access to premium services, advanced features, or discounted rates within a specific platform or ecosystem. This enhances user engagement and creates added value for token holders.

6. Creating a Digital Economy

Tokens can power an entire digital ecosystem, facilitating transactions, payments, and exchanges within a platform. They allow businesses to create closed-loop economies where tokens act as the primary medium of exchange.

7. Brand Recognition and Loyalty

A branded cryptocurrency token can help enhance brand visibility, build trust with customers, and foster loyalty. Tokens can also be used in loyalty programs, offering rewards for repeat purchases or platform engagement.

8. Innovation and Experimentation

Tokens provide a flexible framework for experimenting with new business models, decentralized finance (DeFi) systems, or reward mechanisms. They allow creators to test concepts and scale successful models effectively.

9. Transparency and Security

Every transaction made with cryptocurrency tokens is recorded on the blockchain, ensuring transparency, traceability, and security. This builds trust among users and stakeholders.

10. Global Accessibility

Cryptocurrency tokens operate on blockchain networks, allowing seamless cross-border transactions. This removes geographical and financial barriers, making your project accessible to a global audience.

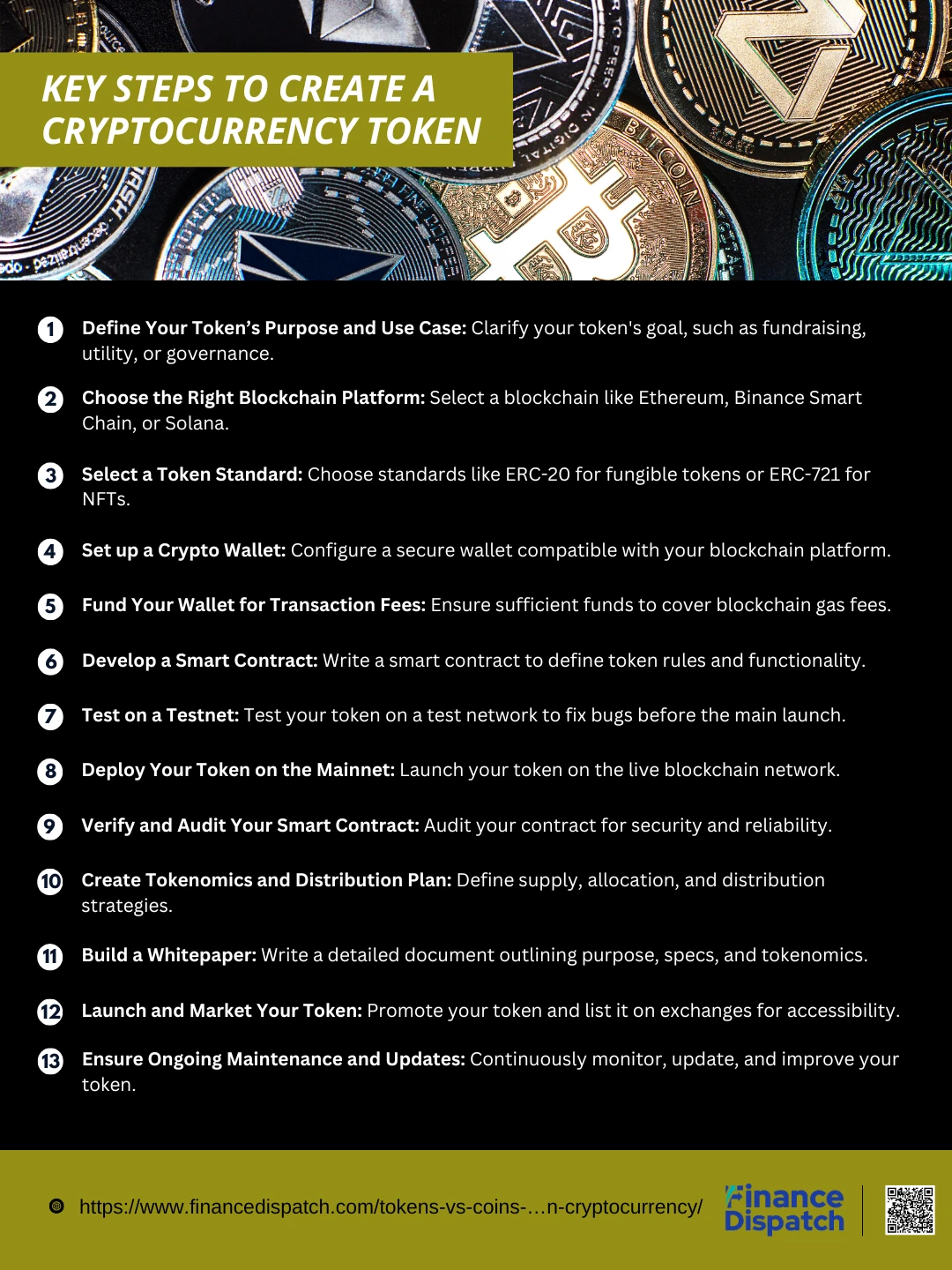

Key Steps to Create a Cryptocurrency Token

Creating your own cryptocurrency token may seem like a highly technical process, but with the right tools, knowledge, and guidance, it becomes an achievable goal. Whether you’re building a token for a decentralized application (DApp), raising funds for a project, or introducing a reward system for your community, each step plays a crucial role in ensuring success. From defining your token’s purpose to launching it on a blockchain network, this step-by-step guide will break down the process into manageable tasks. Below are the key steps to help you create your cryptocurrency token:

1. Define Your Token’s Purpose and Use Case

Begin by identifying the main goal of your token. Will it be used for fundraising, utility within a DApp, asset representation, or governance? Clearly defining its purpose will guide every decision throughout the creation process.

2. Choose the Right Blockchain Platform

Select a blockchain network that aligns with your project goals. Popular choices include Ethereum (ERC-20 tokens), Binance Smart Chain (BEP-20 tokens), and Solana. Each platform offers unique features, transaction speeds, and fee structures.

3. Select a Token Standard

Token standards define the rules and functionalities of your token. For example, ERC-20 is the standard for fungible tokens on Ethereum, while ERC-721 is used for non-fungible tokens (NFTs). Choose one that fits your requirements.

4. Set Up a Crypto Wallet

Create and configure a secure cryptocurrency wallet, such as MetaMask or Trust Wallet, to store and manage your tokens. Ensure it’s compatible with the blockchain you’ve chosen.

5. Fund Your Wallet for Transaction Fees

Blockchain networks require native cryptocurrency (e.g., ETH for Ethereum) to cover gas fees during the deployment of smart contracts. Ensure your wallet has sufficient funds.

6. Develop a Smart Contract

Smart contracts are the backbone of your token. They define the rules, functionality, and operations of your token (e.g., minting, burning, transferability). Use programming languages like Solidity (Ethereum) or Rust (Solana) to write your smart contract.

7. Test on a Testnet

Before deploying on the mainnet, test your smart contract on a testnet (e.g., Rinkeby for Ethereum). This helps identify and resolve bugs or vulnerabilities without risking real assets.

8. Deploy Your Token on the Mainnet

Once testing is complete, deploy your token on the main blockchain network. This step finalizes your token’s creation and makes it live for transactions.

9. Verify and Audit Your Smart Contract

Conduct a thorough audit of your smart contract code to identify vulnerabilities and ensure security. Third-party auditing services can help enhance trust and credibility.

10. Create Tokenomics and Distribution Plan

Define your token’s economic model, including total supply, allocation strategy, and distribution mechanisms (e.g., ICO, airdrops, or community rewards).

11. Build a Whitepaper

Write a comprehensive whitepaper that outlines your token’s purpose, technical specifications, tokenomics, and long-term vision. This document is essential for attracting investors and users.

12. Launch and Market Your Token

Promote your token through social media, forums, and crypto communities. Consider listing it on cryptocurrency exchanges like Binance or decentralized platforms like Uniswap for wider accessibility.

13. Ensure Ongoing Maintenance and Updates

Post-launch, monitor your token’s performance, address user concerns, and provide updates or improvements to ensure long-term sustainability.

Technical Requirements for Token Creation

Creating your own cryptocurrency token involves several technical requirements that ensure its functionality, security, and compatibility with the chosen blockchain network. These requirements range from selecting the right blockchain platform and adhering to token standards to setting up secure wallets and deploying smart contracts. Each technical component plays a crucial role in defining how your token operates, interacts with the network, and serves its intended purpose. Below is a table outlining the essential technical requirements for token creation and their key descriptions.

| Requirement | Description | Examples/Tools |

| Blockchain Platform | Choose a blockchain network for your token, based on speed, fees, and scalability. | Ethereum, Binance Smart Chain, Solana |

| Token Standard | Define the rules and functionalities of your token on the blockchain. | ERC-20, BEP-20, ERC-721 |

| Crypto Wallet | Set up a wallet to store and manage your token securely. | MetaMask, Trust Wallet, Coinbase Wallet |

| Native Cryptocurrency | Ensure you have enough native currency to pay for transaction and gas fees. | ETH (Ethereum), BNB (Binance Smart Chain) |

| Smart Contract Development | Develop a smart contract to define token operations, such as minting, burning, and transfers. | Solidity (Ethereum), Rust (Solana) |

| Testnet Deployment | Deploy the token on a test network to identify and resolve issues before the main launch. | Rinkeby (Ethereum), Testnet BSC |

| Smart Contract Audit | Conduct an audit to identify and fix vulnerabilities in your smart contract. | CertiK, OpenZeppelin Security Audit |

| Tokenomics Design | Define the economic model, including supply, distribution, and rewards. | Custom models based on project goals |

| Whitepaper | Create a detailed document outlining the token’s purpose, functionality, and roadmap. | Google Docs, Whitepaper Templates |

| Blockchain Explorer Integration | Ensure token visibility and transparency on a blockchain explorer. | Etherscan (Ethereum), BscScan (BSC) |

Legal and Regulatory Considerations for Creating and Launching Your Cryptocurrency Token

When creating and launching your cryptocurrency token, navigating the legal and regulatory landscape is a critical step that cannot be overlooked. The rules governing cryptocurrency tokens vary significantly across different countries and jurisdictions, making compliance a complex but essential part of the process. From determining whether your token is classified as a security to adhering to anti-money laundering (AML) regulations, every decision can have legal implications. Properly addressing these considerations not only ensures compliance but also builds trust with investors, users, and regulatory authorities. Below are the key legal and regulatory factors you must consider when creating and launching your cryptocurrency token:

- Token Classification: Clearly define whether your token is a utility token, security token, payment token, or non-fungible token (NFT). Different classifications are subject to different legal frameworks.

- Regulatory Compliance: Adhere to regulations set by authorities like the Securities and Exchange Commission (SEC) in the U.S. or equivalent bodies in other jurisdictions.

- Jurisdictional Variations: Understand the laws in each country where you plan to offer or promote your token. Some regions are crypto-friendly, while others have strict or unclear regulations.

- AML (Anti-Money Laundering) and KYC (Know Your Customer) Policies: Implement AML and KYC protocols to verify user identities and prevent financial crimes.

- Tax Obligations: Understand and comply with taxation laws related to token issuance, trading, and capital gains in your operating jurisdictions.

- Smart Contract Audits: Ensure your smart contracts are secure and have been audited by a reputable third party to prevent vulnerabilities and legal liabilities.

- Whitepaper Accuracy: Ensure your whitepaper does not contain misleading information, exaggerated claims, or unverifiable promises to avoid legal repercussions.

- Consumer Protection Laws: Adhere to consumer protection regulations, ensuring transparency and accountability in how tokens are marketed and distributed.

- Data Privacy Regulations: Comply with data privacy laws such as the General Data Protection Regulation (GDPR) in the European Union when handling user data.

- Cross-Border Transactions: Cryptocurrency tokens often have a global reach; ensure compliance with international financial laws and cross-border regulations.

- Legal Documentation: Prepare proper legal documentation, including disclaimers, terms of service, and privacy policies, to clearly outline your token’s use and legal boundaries.

- Licensing Requirements: Some jurisdictions may require licenses for issuing or trading tokens, especially if they are classified as securities.

- Engage Legal Experts: Work with legal professionals who specialize in cryptocurrency and blockchain technology to ensure your project adheres to all relevant regulations.

Marketing and Launch Strategies for Your Cryptocurrency Token

Successfully launching a cryptocurrency token isn’t just about building innovative technology—it’s about creating awareness, building trust, and attracting an active user base. In a competitive crypto landscape, having a well-thought-out marketing and launch strategy can make or break your project. A strong strategy goes beyond hype; it focuses on delivering clear communication, building a loyal community, and offering real value to your audience. From pre-launch buzz to post-launch engagement, every stage requires strategic planning and execution. Below are key marketing and launch strategies to ensure your cryptocurrency token gains traction and long-term success:

1. Define Your Unique Value Proposition (UVP)

Clearly articulate what makes your token unique. Whether it’s its utility, technological innovation, or specific use case, your value proposition must resonate with your target audience and set you apart from competitors.

2. Develop a Comprehensive Whitepaper

Your whitepaper is one of the most important documents for your token. It should include detailed information about your token’s purpose, technical specifications, tokenomics, team, and long-term roadmap. A well-written whitepaper builds credibility and attracts serious investors.

3. Build a Professional Website

A professional, well-designed website acts as your project’s digital storefront. It should provide easy access to your whitepaper, team bios, tokenomics, roadmap, and information on how users can purchase or engage with your token.

4. Leverage Social Media Channels

Social media platforms like Twitter, Telegram, Discord, Reddit, and LinkedIn are essential for building awareness and engaging with your community. Regular updates, engaging posts, and live interactions keep your audience informed and invested in your project.

5. Engage with Influencers and Thought Leaders

Partner with well-known crypto influencers, YouTubers, and thought leaders to expand your token’s reach. Influencers have the power to amplify your message to larger audiences and build trust within their communities.

6. Host Airdrops and Giveaways

Airdrops and token giveaways are excellent strategies for generating buzz and attracting new users. These initiatives reward early adopters and encourage them to participate actively in your ecosystem.

7. Conduct an Initial Coin Offering (ICO) or Token Sale

Token sales through ICO (Initial Coin Offering) or IEO (Initial Exchange Offering) are powerful fundraising tools. They not only raise capital but also attract committed investors who believe in your token’s potential.

8. List Your Token on Cryptocurrency Exchanges

Getting your token listed on reputable centralized exchanges (e.g., Binance, Kraken) and decentralized exchanges (e.g., Uniswap, PancakeSwap) improves its visibility, accessibility, and liquidity.

9. Build and Nurture a Community

Community is the backbone of any successful token project. Create active groups on platforms like Telegram and Discord, and engage with your community through AMAs (Ask Me Anything) sessions, polls, and direct interactions.

10. Content Marketing and Educational Resources

Educate your audience through high-quality blogs, explainer videos, case studies, and tutorials. Informative content builds trust and helps potential investors and users understand your token’s real-world value.

11. Launch Email Marketing Campaigns

Build an email list to keep stakeholders, investors, and community members updated with important announcements, progress updates, and special opportunities.

12. Collaborate with Strategic Partners

Form alliances with other blockchain projects, tech firms, or fintech platforms. Strategic partnerships can enhance credibility and provide access to wider user bases.

13. Attend Industry Events and Conferences

Participate in global blockchain conferences, expos, and networking events to showcase your token, connect with industry leaders, and attract potential investors.

14. Monitor and Analyze Performance Metrics

Use analytics tools to track the effectiveness of your campaigns. Monitor key metrics such as website traffic, social media engagement, token adoption rates, and user feedback. Make data-driven adjustments to improve results.

15. Offer Incentives for Early Adopters and Holders

Reward early supporters with perks such as bonus tokens, exclusive access to premium features, or other special privileges. This builds loyalty and encourages long-term token holding.

16. Create a Post-Launch Plan

The launch is only the beginning. Have a long-term plan for updates, feature rollouts, and ongoing engagement. Transparent communication and regular improvements keep your community excited and engaged.

Challenges in Token Creation and How to Overcome Them

Creating a cryptocurrency token is an exciting venture, but it’s not without its challenges. From technical hurdles and regulatory complexities to security vulnerabilities and market adoption struggles, every stage of token creation comes with obstacles that can make or break your project. Successfully launching a token requires not only technical expertise but also strategic planning, legal compliance, and effective community engagement. However, with the right approach and preparation, these challenges can be addressed effectively. Below are the most common challenges in token creation and practical ways to overcome them:

1. Technical Complexity

Challenge: Developing smart contracts, adhering to token standards, and ensuring compatibility with blockchain networks require advanced technical knowledge. Mistakes in smart contract code can lead to vulnerabilities and token failures.

Solution: Hire experienced blockchain developers or use no-code platforms like Token Tool and Cointool to simplify the creation process. Additionally, conduct rigorous testing on testnets before deployment.

2. Security Vulnerabilities

Challenge: Security flaws in smart contracts can be exploited by hackers, leading to financial losses and reputational damage.

Solution: Conduct comprehensive security audits with reputable firms like CertiK or OpenZeppelin. Use multi-signature wallets and follow best practices for secure coding.

3. Regulatory and Legal Compliance

Challenge: Different jurisdictions have varying regulations regarding cryptocurrency tokens, including security classifications, tax implications, and anti-money laundering (AML) requirements.

Solution: Consult legal experts specializing in blockchain and cryptocurrency laws. Ensure your token complies with AML/KYC protocols and prepare transparent documentation like whitepapers and disclaimers.

4. Tokenomics Design

Challenge: Poorly designed tokenomics can result in supply imbalances, lack of long-term incentives, and token devaluation.

Solution: Carefully design your tokenomics, including total supply, distribution strategy, staking rewards, and burn mechanisms. Conduct market research to understand successful token models.

5. Market Adoption and Awareness

Challenge: Even technically sound tokens may struggle with gaining user adoption and building a community if awareness is low.

Solution: Invest in a strong marketing strategy that includes social media campaigns, influencer partnerships, and educational content. Build an active community on platforms like Telegram and Discord.

6. Scalability Issues

Challenge: Popular blockchain networks, like Ethereum, can experience congestion and high gas fees, limiting token scalability.

Solution: Choose scalable blockchain networks such as Binance Smart Chain (BSC), Polygon, or Solana. Additionally, optimize smart contracts to reduce resource usage.

7. Lack of Liquidity

Challenge: Tokens with low liquidity face issues with price volatility and difficulty in trading on exchanges.

Solution: List your token on both centralized (e.g., Binance) and decentralized exchanges (e.g., Uniswap). Use liquidity pools to maintain stable trading environments.

8. User Trust and Credibility

Challenge: Scams and fraudulent token projects have created skepticism in the crypto community, making it difficult to gain user trust.

Solution: Be transparent about your team, roadmap, and project goals. Publish audited smart contracts, regularly communicate updates, and actively engage with your community.

9. Sustainability and Maintenance

Challenge: Post-launch maintenance, updates, and troubleshooting can be resource-intensive and challenging to manage.

Solution: Allocate resources for ongoing support, maintenance, and feature upgrades. Maintain open communication with the community and address issues promptly.

10. Competition in the Market

Challenge: The cryptocurrency space is highly competitive, with thousands of tokens being launched each year. Standing out is a significant challenge.

Solution: Focus on delivering a unique value proposition. Highlight your token’s purpose, utility, and advantages over competitors. Develop partnerships with established blockchain projects to boost credibility.

11. Managing Token Supply and Inflation

Challenge: Uncontrolled token minting or poor inflation management can lead to decreased token value and user dissatisfaction.

Solution: Implement clear rules for minting and burning tokens in your smart contracts. Design tokenomics to ensure long-term stability and value appreciation.

12. Integration with Existing Systems

Challenge: Ensuring seamless integration with wallets, exchanges, and DApps can pose technical difficulties.

Solution: Follow standardized token protocols (e.g., ERC-20, BEP-20). Test integrations extensively and provide documentation for third-party developers.

Conclusion

Creating and launching your own cryptocurrency token is an exciting and rewarding journey, but it comes with its fair share of challenges. From technical complexities and regulatory compliance to building trust and driving adoption, each step requires careful planning, expertise, and strategic execution. However, with the right tools, a well-defined roadmap, and a strong focus on transparency and community engagement, these obstacles can be effectively overcome. Success in the world of cryptocurrency tokens isn’t just about technology—it’s about creating real value, fostering trust, and building an ecosystem where users and stakeholders can thrive. Whether you’re launching a utility token, a governance token, or a tokenized asset, the key lies in combining technical precision with clear communication and long-term sustainability. As you embark on this journey, remember that innovation, adaptability, and a user-centric approach will be your strongest assets in navigating the dynamic world of blockchain technology.