Phishing is a deceptive cybercrime where scammers impersonate trusted entities to trick individuals into revealing sensitive information, such as passwords, private keys, or financial details. In the crypto world, phishing often targets users’ online wallets, exchanges, or other platforms, exploiting their trust through fake emails, websites, or messages. These schemes commonly involve social engineering tactics that create a sense of urgency or fear, prompting victims to act without scrutiny. Once attackers gain access to this information, they can steal funds or compromise accounts, leaving victims with little to no recourse due to the irreversible nature of cryptocurrency transactions.

What Are Phishing Scams in Crypto?

Phishing scams in crypto are malicious schemes designed to deceive users into revealing sensitive information, such as private keys, wallet credentials, or recovery phrases, often resulting in the loss of their cryptocurrency. These scams exploit the decentralized and irreversible nature of blockchain technology, targeting wallets, exchanges, and initial coin offerings (ICOs). Common methods include fake emails, counterfeit websites, or messages that mimic trusted platforms, urging users to act quickly under the guise of security alerts or lucrative offers. As scammers become increasingly sophisticated, understanding their tactics is vital to protecting your digital assets from theft.

How to Identify a Crypto Phishing Scam

Recognizing a crypto phishing scam early can save you from financial loss and safeguard your digital assets. Scammers employ deceptive tactics to appear legitimate, often mimicking trusted platforms or using psychological tricks like urgency and fear. By staying alert and knowing the warning signs, you can avoid falling victim to these malicious schemes.

1. Suspicious Email or Message Content

Phishing emails and messages often create a sense of urgency or appeal to your emotions. Common examples include claims that your account has been compromised, warnings of unauthorized activity, or promises of lucrative rewards. These messages are crafted to grab your attention and compel you to take immediate action without verifying their authenticity.

2. Unverified Sender Addresses

Scammers use email addresses or phone numbers that appear similar to legitimate ones but have slight alterations. For example, an email from “support@binanc.com” instead of the actual “support@binance.com” might go unnoticed if you’re not paying close attention. Always check the sender’s details carefully, as minor inconsistencies are a common red flag.

3. Generic Greetings and Poor Language

Legitimate organizations often personalize their communications. Messages that start with generic greetings like “Dear Customer” or “Hello User” are likely scams. Additionally, phishing emails often contain poor grammar, awkward phrasing, or spelling errors, indicating they were rushed or created by non-native speakers.

4. Misleading Links or URLs

Scammers frequently include hyperlinks in their messages that appear legitimate but direct you to malicious websites. Always hover over links to preview the actual URL. Fraudulent links may have slight variations, such as replacing a letter with a number (e.g., “bitco1n.com” instead of “bitcoin.com”). Never click on a link unless you are confident it is authentic.

5. Requests for Sensitive Information

No legitimate crypto platform will ever ask for your private keys, recovery phrases, or account passwords via email, text, or phone. Any communication requesting such details is a clear sign of a phishing attempt, as these are critical pieces of information that give direct access to your funds.

6. Too-Good-To-Be-True Offers

Scammers often lure victims with promises of free cryptocurrency, guaranteed high returns, or exclusive investment opportunities. For example, they may claim you can double your Bitcoin by sending it to a specific wallet address. If an offer seems unrealistic or overly enticing, it is almost certainly fraudulent.

7. Fake Urgency or Fear Tactics

Messages designed to create panic or urgency—such as “Your account will be locked in 24 hours” or “Unusual login detected”—are common phishing tactics. These scams pressure you into acting quickly without taking time to verify the legitimacy of the communication.

8. Unusual Attachments

Phishing emails often contain unexpected attachments, such as executable files (.exe) or compressed files (.zip), which may install malware on your device. Even seemingly harmless files like PDFs can contain malicious code. Avoid opening attachments unless you are certain of the sender’s authenticity.

9. Mismatched Branding or Style

Legitimate organizations take care to maintain consistent branding. If an email or website includes logos, colors, or fonts that seem slightly off, it may be a phishing attempt. Look for discrepancies, such as a blurry logo or mismatched design elements, as these often indicate fraudulent communication.

10. Non-Secure Websites

Before entering any sensitive information, check the website’s security. A legitimate site should use “https://” and display a padlock icon in the address bar. Be cautious of websites with “http://” or those lacking a security certificate, as they are often used by scammers to collect private data.

How to Prevent Phishing Scams

Preventing phishing scams in the crypto space requires a proactive approach to safeguarding your digital assets and personal information. By being vigilant and implementing robust security practices, you can significantly reduce the risk of falling victim to these scams. Here are some best practices to help you stay secure in the evolving world of cryptocurrency.

1. Verify All Communications

Scammers often impersonate trusted entities like crypto exchanges or wallet providers to trick you into revealing sensitive information. Always double-check the sender’s email address or phone number and cross-reference it with the official website or contact details of the organization. Be wary of slight misspellings or suspicious domains that mimic legitimate ones. If unsure, contact the organization directly through their official channels to confirm the communication’s authenticity.

2. Avoid Clicking on Links

Phishing emails and messages often include links that lead to fake websites designed to steal your credentials. Instead of clicking on these links, type the website’s URL directly into your browser or use bookmarks for frequently visited sites. This minimizes the risk of being redirected to a malicious site that looks identical to the legitimate one.

3. Enable Two-Factor Authentication (2FA)

Two-factor authentication adds an extra layer of security by requiring a second form of verification, such as a code from an authenticator app or a hardware key. Even if a scammer obtains your password, they won’t be able to access your account without the 2FA code. Avoid using SMS-based 2FA, as it is vulnerable to SIM-swapping attacks, and opt for app-based authenticators like Google Authenticator or Authy.

4. Keep Software Updated

Outdated software is a common target for phishing and malware attacks. Regularly update your operating system, web browser, and crypto-related applications to ensure you have the latest security patches. Updates often fix vulnerabilities that attackers could exploit, so keeping your software current is a critical defense mechanism.

5. Be Wary of Public Wi-Fi

Public Wi-Fi networks, such as those in cafes or airports, are often insecure and can be used by attackers to intercept your data. Avoid accessing sensitive crypto accounts or making transactions on public Wi-Fi. If you must use it, protect your connection with a Virtual Private Network (VPN), which encrypts your internet traffic and shields it from potential eavesdroppers.

6. Use Reputable Crypto Tools

Only download wallets, browser extensions, and apps from official sources or verified app stores. Third-party sites or unverified platforms may host malicious software that can steal your sensitive information. Always verify the legitimacy of the tool or app before installing it, and read user reviews to identify potential red flags.

7. Examine URLs Carefully

Phishing websites often use URLs that are nearly identical to legitimate ones, with minor differences such as an extra letter, a replaced character, or a different domain extension (e.g., “.net” instead of “.com”). Always check the URL for accuracy and ensure it starts with “https://” and displays a padlock icon, indicating a secure connection.

8. Educate Yourself and Stay Updated

The tactics used by scammers are constantly evolving, making it essential to stay informed about the latest phishing methods. Follow trusted crypto news sources and security blogs to learn about new threats and preventive measures. Awareness of the most recent scams can help you identify and avoid them.

9. Never Share Private Keys or Recovery Phrases

Private keys and recovery phrases are the keys to your crypto assets, and no legitimate platform or representative will ever ask for them. Store these details securely offline, such as in a hardware wallet or written in a secure location, and never share them with anyone, even if they claim to be from customer support.

10. Test Small Transactions First

Before transferring a large amount of cryptocurrency, send a small test transaction to verify the recipient’s address. This precaution ensures you’re sending funds to the intended recipient and helps detect any potential errors or fraudulent redirections. Once you confirm the transaction’s success, proceed with the full amount.

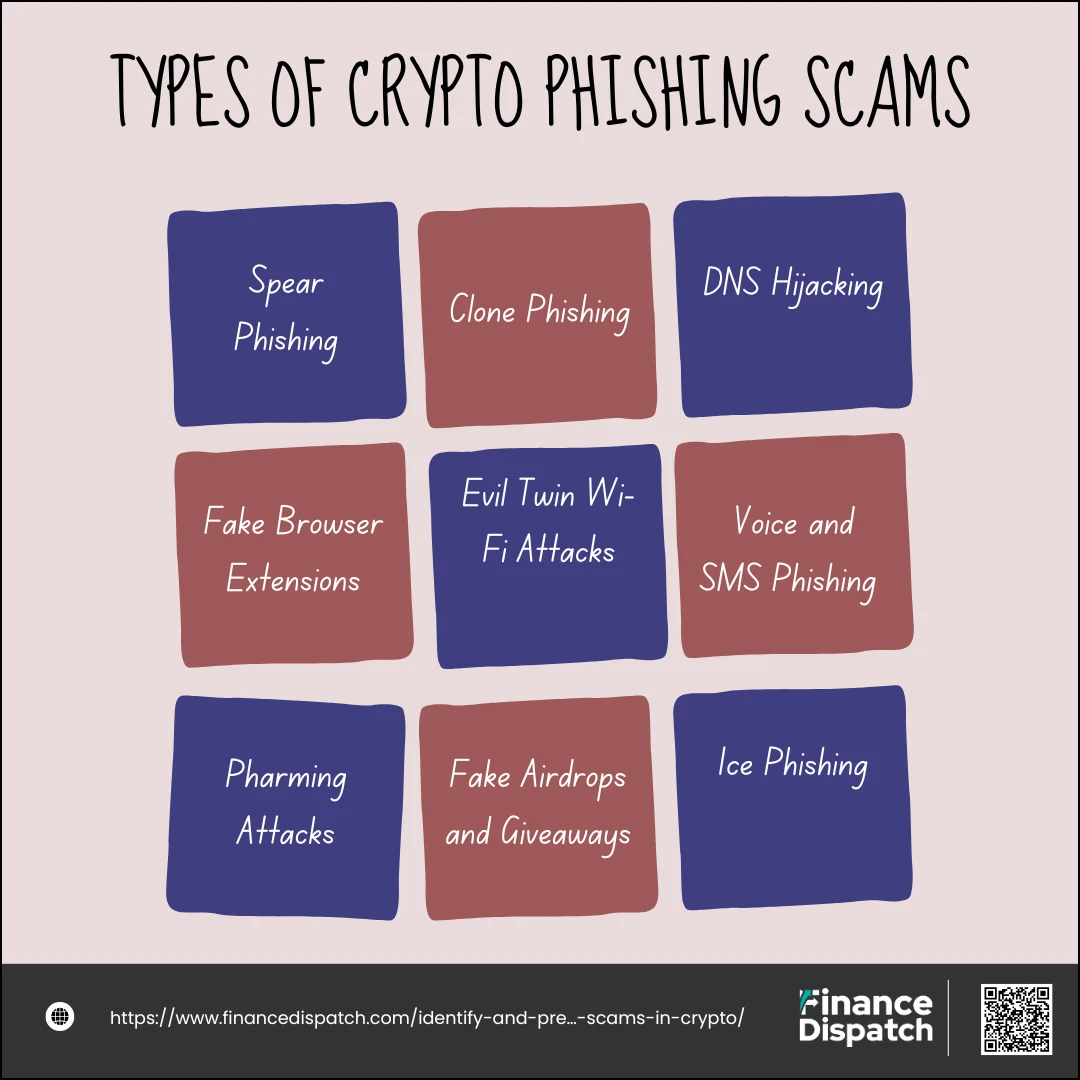

Types of Crypto Phishing Scams

Crypto phishing scams come in many forms, each leveraging different tactics to deceive users and gain access to their digital assets. These scams often exploit the complexity of blockchain technology and the trust users place in seemingly legitimate platforms. Recognizing the various types of phishing scams can help you stay vigilant and protect your funds.

1. Spear Phishing

This is a highly targeted form of phishing that focuses on specific individuals or organizations. Attackers gather personal details about their target from public records, social media, or previous data breaches to craft convincing messages. These messages often appear to come from a trusted source, like a colleague, service provider, or official entity, making them more likely to trick the victim. For example, a scammer may send an email mimicking a crypto exchange, urging the user to update their account credentials urgently.

2. Clone Phishing

Clone phishing involves duplicating a legitimate email or message the victim has previously received. The attacker replaces original links or attachments with malicious ones, making the communication appear familiar and trustworthy. Victims may not notice the subtle changes, such as altered links, leading them to inadvertently provide sensitive information or download malware.

3. DNS Hijacking

In a DNS hijacking attack, scammers manipulate the domain name system (DNS) to redirect victims from a legitimate website to a fake one, even if they type the correct URL. These fake websites are designed to look identical to the real ones, tricking users into entering their credentials or private keys. This type of attack is particularly dangerous because it can be challenging to detect until it’s too late.

4. Fake Browser Extensions

Attackers create browser extensions that mimic legitimate crypto tools, such as wallet applications or portfolio trackers. Once installed, these malicious extensions can capture sensitive data like login credentials or private keys. In some cases, they may redirect cryptocurrency transactions to the attacker’s wallet address, causing significant losses for the user.

5. Evil Twin Wi-Fi Attacks

In this type of scam, attackers set up a rogue Wi-Fi network that mimics a legitimate one, such as the free Wi-Fi offered at coffee shops or airports. When victims connect to the fake network, attackers can intercept data transmitted over the connection, including sensitive login credentials and wallet information.

6. Voice and SMS Phishing (Vishing and Smishing)

These attacks involve phone calls or text messages where scammers impersonate trusted entities, such as customer support from a crypto exchange or wallet provider. They use fear tactics or urgent requests to convince victims to share sensitive details, such as recovery phrases or account passwords, over the phone or via SMS.

7. Pharming Attacks

Pharming uses malware or compromised DNS servers to redirect users from legitimate websites to fake ones. Unlike DNS hijacking, this type of phishing often happens without the victim’s knowledge, as the malicious redirect occurs in the background.

8. Fake Airdrops and Giveaways

Scammers promote false promises of free cryptocurrency through social media or fake websites, often requiring victims to provide their wallet addresses or make small payments to qualify. These scams are designed to exploit the excitement around airdrops and giveaways, tricking users into giving up their assets or sensitive information.

9. Ice Phishing

A unique form of phishing specific to the crypto space, ice phishing involves tricking victims into signing a seemingly legitimate transaction. However, the transaction is crafted to transfer control of their funds or tokens to the scammer. Victims often don’t realize they’ve been scammed until their funds are gone.

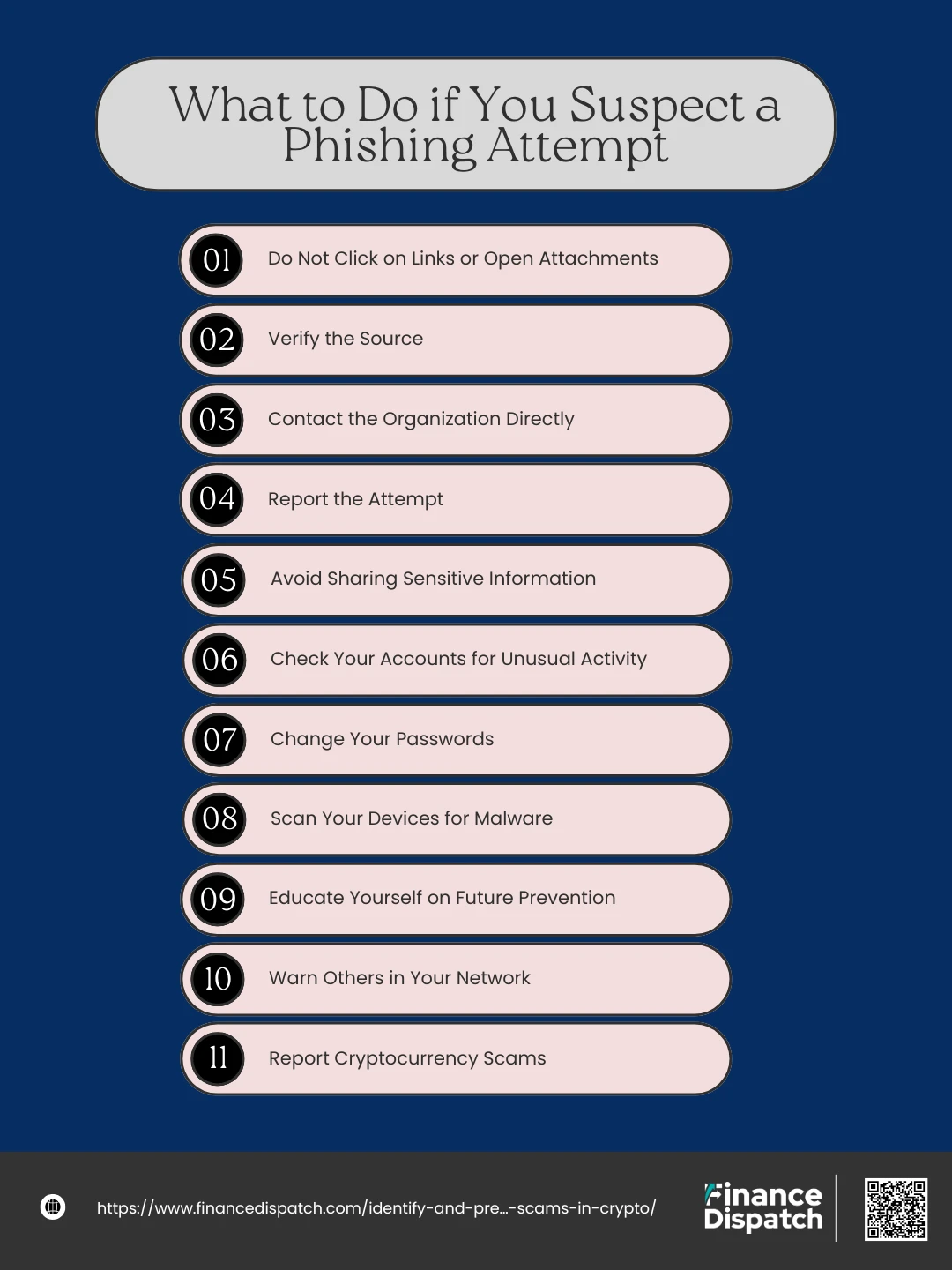

What to Do if You Suspect a Phishing Attempt

If you suspect a phishing attempt, acting quickly and cautiously can help protect your sensitive information and assets. Phishing scams often rely on exploiting urgency or fear, so staying calm and methodical is crucial. By following a few practical steps, you can prevent falling victim and ensure your accounts and funds remain secure.

1. Do Not Click on Links or Open Attachments

Phishing messages often contain links to fake websites or attachments with malware. Avoid clicking on any hyperlinks or opening files, even if they appear to come from a trusted source. Interacting with these elements can compromise your device or lead to the theft of sensitive information. Instead, close the message and proceed to verify its authenticity through other means.

2. Verify the Source

Always inspect the sender’s email address, phone number, or website URL for subtle inconsistencies. Scammers often use addresses that mimic legitimate ones by swapping letters or adding extra characters. For instance, “support@crypt0exchange.com” instead of “support@cryptoexchange.com.” Hover over links to preview their destination and ensure they match the expected domain.

3. Contact the Organization Directly

Instead of replying to the suspicious message, reach out to the company through their official communication channels, such as the contact information on their verified website. Explain the content of the suspicious message and ask if it’s genuine. Legitimate organizations will confirm whether they sent the communication and advise on the next steps.

4. Report the Attempt

Most platforms and email providers have reporting tools for phishing scams. For example, you can forward suspicious emails to phishing-reporting addresses like “reportphishing@yourprovider.com” or use built-in reporting options in your email client. Additionally, notify the impersonated organization so they can investigate and take action against the scammer.

5. Avoid Sharing Sensitive Information

Phishers rely on victims willingly providing sensitive details like passwords, recovery phrases, or private keys. If the message asks for this information, it is a clear indicator of a scam. Do not share such details, even if the communication appears urgent or official.

6. Check Your Accounts for Unusual Activity

If you suspect a phishing attempt, log in to your crypto wallets, exchange accounts, and email accounts to check for unauthorized access or transactions. Look for any changes you did not make, such as logins from unfamiliar locations, updates to account settings, or withdrawals.

7. Change Your Passwords

If you’ve interacted with a phishing message or believe your account credentials may have been compromised, update your passwords immediately. Use strong, unique passwords that combine upper and lowercase letters, numbers, and special characters. Consider using a password manager to generate and store complex passwords securely.

8. Scan Your Devices for Malware

Run a thorough antivirus or anti-malware scan on your devices, especially if you’ve clicked a suspicious link or downloaded an attachment. Malware can silently track your keystrokes, steal sensitive data, or take control of your accounts. Removing it promptly is critical to preventing further damage.

9. Educate Yourself on Future Prevention

Use the phishing attempt as an opportunity to learn about common scams and how to identify them. Familiarize yourself with red flags like generic greetings, urgent requests, or unusual URLs. Staying informed will help you avoid falling for similar tactics in the future.

10. Warn Others in Your Network

If the phishing attempt targets a group or community you belong to, such as coworkers or fellow crypto investors, inform them immediately. Share details about the scam and encourage others to stay vigilant. Raising awareness can prevent further incidents and strengthen collective security.

11. Report Cryptocurrency Scams

Reporting cryptocurrency scams is critical for protecting others, combating fraud, and potentially recovering lost funds. To effectively report a scam, start by gathering comprehensive evidence, including transaction details and communications, and promptly inform the platform where the scam occurred. Notify local authorities, regulatory bodies, and specialized crypto watchdogs, such as CryptoScamDB or Chainabuse, to assist in broader investigations. If social media or financial institutions are involved, report fraudulent accounts and transactions using their tools. Sharing your experience in crypto communities raises awareness and deters future scams. Leveraging blockchain analysis tools and monitoring updates can further aid in tracking stolen assets and understanding scam evolution.

Conclusion

In the rapidly evolving world of cryptocurrency, staying vigilant against phishing scams and fraudulent schemes is essential to protect your investments and personal information. While scammers continuously refine their tactics, understanding their methods and adopting proactive security measures can significantly reduce your risk. By identifying red flags, implementing strong account protections, and reporting scams to the appropriate authorities, you contribute to a safer crypto ecosystem. Awareness and education are your strongest allies in navigating this digital frontier with confidence and safeguarding your assets against ever-present threats.

FAQs

1. How Can I Safely Participate in Crypto Giveaways or Airdrops?

Participating in crypto giveaways or airdrops requires caution. Always verify the authenticity of the event through official channels, such as the project’s website or verified social media accounts. Avoid giveaways that require upfront payments, private key submissions, or recovery phrase sharing. If an offer seems too good to be true, it likely is.

2. What Should I Do if My Private Keys Are Compromised?

If you suspect your private keys have been compromised, act immediately by transferring your funds to a new wallet with fresh keys. Avoid using the compromised wallet for any future transactions and review your security practices to prevent similar incidents.

3. How Do I Identify a Legitimate Crypto Exchange or Wallet?

Look for exchanges and wallets with strong reputations, transparent teams, and clear security measures. Check for reviews on trusted forums, ensure they have valid SSL certificates, and verify they are not on any known scam lists. Reputable platforms often have clear contact details and customer support.

4. What Are Some Common Warning Signs of Fake Customer Support?

Fake support agents often reach out unsolicited via social media, email, or direct messages. They may ask for sensitive details like recovery phrases or private keys, which legitimate support will never request. Genuine support typically operates through official websites or verified apps, not third-party channels.

5. How Can I Safeguard My Crypto When Using Decentralized Finance (DeFi) Platforms?

When engaging with DeFi platforms, verify the legitimacy of smart contracts and avoid platforms with unaudited code. Use hardware wallets for transactions, and always double-check website URLs to ensure you’re on the official platform. Limit your exposure by investing only what you can afford to lose in high-risk environments.