When it comes to building wealth and securing your financial future, few opportunities are as compelling as property investment. From generating rental income to benefiting from long-term capital appreciation, investing in real estate has consistently proven to be a reliable and rewarding strategy. However, like any financial decision, buying property requires careful consideration, strategic planning, and an understanding of both its advantages and potential challenges. Whether you’re exploring this path for portfolio diversification or as a step toward financial independence, this article will help you navigate the essentials of property investment and determine if it aligns with your goals.

What is an investment property?

An investment property is a piece of real estate purchased not for personal use but as a means to generate income or achieve long-term financial gains. These properties can take various forms, such as houses, apartments, or commercial spaces, and are typically rented out to tenants to provide a steady income stream. Unlike a primary residence, an investment property is intended to serve as an asset for building wealth through rental income, appreciation, or a combination of both. Successful investment property ownership often involves careful research, sound financial planning, and ongoing management to maximize returns while mitigating risks.

The Benefits of Buying Property

Investing in property is more than just acquiring a piece of real estate; it’s a strategic move toward long-term financial growth and security. Property ownership has consistently been a preferred choice for investors due to its stability and versatility. Whether your goal is to create a passive income stream, diversify your portfolio, or safeguard your wealth against inflation, real estate offers numerous advantages. Let’s dive deeper into the key benefits of buying property:

1. Steady Rental Income

Investment properties can provide a reliable source of monthly income through rental payments. These earnings can cover your mortgage repayments, property management fees, and other expenses, leaving you with positive cash flow. Over time, as you adjust rent to match market trends, this income can grow, further strengthening your financial position.

2. Capital Appreciation

One of the most attractive aspects of property investment is its potential for value appreciation. Real estate values tend to increase over the long term, driven by factors like economic growth, increased demand, and limited supply. For example, purchasing a property in a growing area with planned infrastructure development can yield significant returns when you decide to sell.

3. Tax Advantages

Owning an investment property opens the door to several tax benefits. You can claim deductions on mortgage interest, depreciation, property management fees, and repair costs. These tax breaks can reduce your overall tax liability, allowing you to retain more of your rental income or investment gains.

4. Portfolio Diversification

Real estate offers a unique opportunity to diversify your investment portfolio. Unlike stocks or bonds, property is a tangible asset with a different risk profile, helping to balance volatility in your overall investments. This diversification ensures that your financial portfolio remains stable even when other markets fluctuate.

5. Hedge Against Inflation

Real estate is a proven hedge against inflation. As the cost of living rises, property values and rental income typically follow suit. This means that owning a property can help you maintain your purchasing power and protect your wealth during periods of economic uncertainty.

6. Leverage Opportunities

Real estate investments allow you to leverage borrowed money, such as through a mortgage, to purchase valuable assets. For instance, with a down payment, you can acquire a property worth several times that amount. As the property appreciates and generates rental income, you benefit from returns on the entire property value, not just your initial investment.

7. Tangible Asset

Unlike intangible investments like stocks or mutual funds, real estate is a physical, tangible asset. This offers investors a sense of security, as they can see and directly manage their investment. Additionally, improvements or renovations can increase the property’s value, giving you greater control over its growth.

8. Retirement Security

Real estate can serve as a cornerstone of your retirement planning. As you build equity in your investment property, you can choose to sell it for a lump sum or continue collecting rental income. This steady income stream can provide financial security and peace of mind during retirement.

9. Passive Income Potential

With the right property and effective management, real estate can become a source of passive income. Hiring property managers to handle tenant relations, maintenance, and rent collection allows you to enjoy the benefits of ownership without being involved in the day-to-day operations.

10. Emotional and Financial Stability

Owning property brings a sense of stability and accomplishment. Whether it’s a house, apartment, or commercial space, it represents a solid foundation for building wealth while providing the reassurance of owning a valuable, enduring asset.

Disadvantages of buying investment property

While buying an investment property can offer opportunities for income and long-term wealth, it’s not without its challenges. From high upfront costs to ongoing management demands, owning real estate requires careful planning and a clear understanding of the potential downsides. Here are the key disadvantages of buying an investment property:

1. High Initial Costs

Purchasing an investment property demands a significant upfront investment, including the down payment, closing costs, and often renovation expenses. These high costs can make it difficult to enter the market without substantial financial resources.

2. Ongoing Expenses

Owning property comes with recurring costs such as property taxes, insurance, maintenance, and potentially homeowner association fees. These expenses can erode profits if rental income isn’t sufficient to cover them.

3. Illiquidity

Real estate is not a liquid asset. Selling a property takes time, and in a financial emergency, you might be forced to sell at a loss or endure a lengthy sales process to access funds.

4. Market Volatility

Property values can fluctuate due to changes in the economy, interest rates, or local market conditions. An economic downturn can lead to declining property values and affect your investment’s profitability.

5. Tenant Challenges

Dealing with tenants can be unpredictable. Late payments, property damage, or extended vacancies can cause financial strain and stress, especially for inexperienced landlords.

6. Time-Consuming Management

Managing an investment property requires time and effort. Tasks such as finding tenants, addressing maintenance issues, and handling administrative work can be overwhelming, especially without professional assistance.

7. Risk of Over-Leveraging

Financing an investment property often involves taking on significant debt. If rental income isn’t sufficient to cover mortgage payments, you could face financial difficulties, particularly in a declining market.

8. Regulatory and Legal Risks

Real estate investments are subject to changing laws and regulations. Rent control, zoning restrictions, and increased property taxes can all impact profitability and complicate management.

9. Unforeseen Maintenance Costs

Properties often require unexpected repairs, which can be costly. Major issues like structural damage or plumbing failures can significantly impact your budget and returns.

10. Economic Dependency

Real estate investments are closely tied to the broader economy. Recessions, unemployment, or inflation can reduce rental demand, making it harder to achieve steady income or maintain property values.

11. Limited Diversification

Investing a large amount of capital in a single property reduces diversification in your portfolio. If the property underperforms, it can disproportionately affect your overall financial health.

12 . Location Risks

The success of a property investment often depends on its location. If the neighborhood deteriorates or demand decreases, the value and rental income potential of your property could decline significantly.

Risks Associated with Property Investment

While property investment offers numerous benefits, it’s not without its risks. Like any financial venture, real estate investments require careful planning and an understanding of potential challenges. From market fluctuations to unexpected expenses, several factors can impact the profitability of your investment. Here are the key risks associated with property investment:

1. Market Fluctuations

Property values are influenced by market conditions, and economic downturns or local market instability can lead to a drop in property prices. This can negatively affect your investment returns, particularly if you need to sell during a low market period.

2. High Entry Costs

The upfront costs of property investment, including down payments, legal fees, and stamp duties, can be substantial. These high entry barriers make real estate less accessible and require significant financial planning.

3. Liquidity Issues

Real estate is not a liquid asset, meaning it cannot be easily converted into cash. Selling a property often takes time, and in urgent situations, you may need to sell at a loss to access funds quickly.

4. Ongoing Expenses

Beyond the purchase price, properties come with ongoing costs, such as maintenance, property taxes, insurance, and sometimes homeowner association fees. These expenses can erode your profit margins if not carefully managed.

5. Tenant-Related Challenges

Dealing with tenants can be unpredictable. Late payments, property damage, or extended vacancies can lead to financial losses and stress. Bad tenants may require legal action, adding further costs and complications.

6. Interest Rate Increases

If your property is financed through a mortgage, fluctuations in interest rates can increase your repayment obligations, reducing profitability. Rising rates can also impact the demand for properties, further affecting prices.

7. Regulatory and Legal Risks

Real estate investments are subject to local laws and regulations, which may change over time. New policies, such as rent caps or increased property taxes, can affect the viability of your investment strategy.

8. Economic Dependency

Real estate markets are closely tied to the broader economy. Economic instability, unemployment, or inflation can lead to reduced property demand and rental income.

9. Property-Specific Issues

Unexpected problems like structural damages, zoning restrictions, or disputes over property boundaries can lead to costly repairs or legal battles. Conducting thorough due diligence is essential to minimize these risks.

10. Over-Leveraging

Using borrowed funds to invest in property can amplify your returns, but it also increases your exposure to financial risks. In a declining market, over-leveraged investments can lead to significant losses and even foreclosure.

11. Market Saturation

In areas with an oversupply of rental properties, finding tenants can be challenging, leading to longer vacancies and lower rental income.

12. Natural Disasters and Environmental Risks

Properties located in areas prone to floods, earthquakes, or other natural disasters face additional risks. Insurance can mitigate some of these costs, but premiums can be high, and not all damages may be covered.

13. Changing Consumer Preferences

Shifts in market demand, such as a preference for urban living or remote work-friendly homes, can affect the desirability and value of certain types of properties.

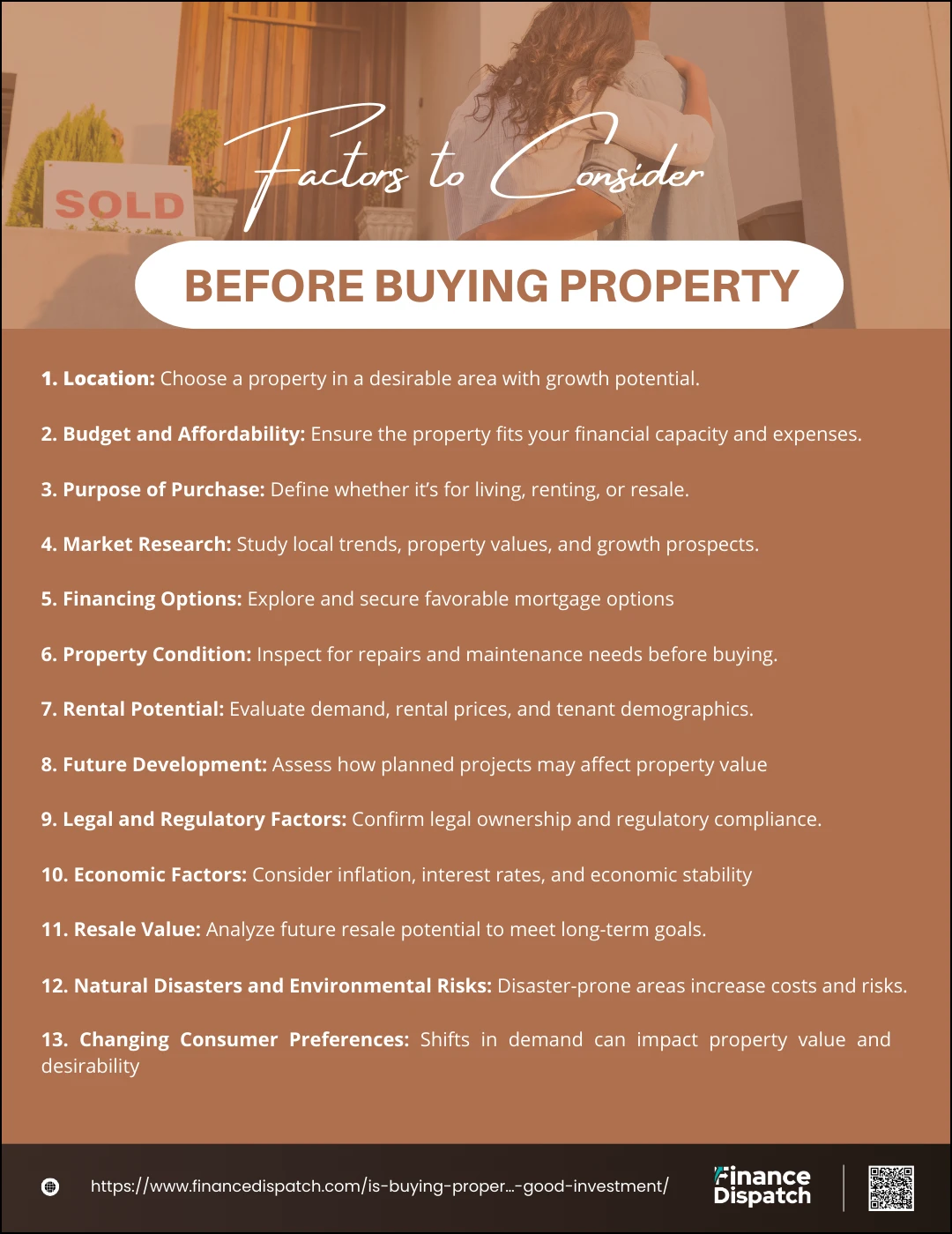

Factors to Consider Before Buying Property

Buying property is a significant financial decision that requires careful consideration. Whether you’re purchasing a home to live in or an investment property, thorough research and planning are essential to ensure it aligns with your goals. From evaluating the location to understanding the associated costs, here are the key factors to consider before buying property:

- Location

The property’s location is crucial and impacts its value, rental demand, and future appreciation. Consider factors like proximity to schools, transportation, amenities, and job opportunities. - Budget and Affordability

Assess your financial situation to determine how much you can afford, including the down payment, closing costs, and potential mortgage payments. - Purpose of Purchase

Clarify whether you’re buying the property as a primary residence, a rental property, or for future resale. Your investment goals will influence your choice of property. - Market Research

Study the local real estate market to understand current trends, property values, and potential growth in the area. - Financing Options

Explore mortgage options and interest rates to find the best financing solution for your needs. Pre-approval can give you a clear idea of your borrowing capacity. - Property Condition

Conduct a thorough inspection to check for structural issues, necessary repairs, and overall condition. Unexpected maintenance costs can impact your budget. - Rental Potential

If you’re purchasing an investment property, analyze rental demand, average rental prices, and tenant demographics in the area. - Future Development

Consider the impact of planned infrastructure, commercial developments, or zoning changes on the property’s value and desirability. - Legal and Regulatory Factors

Verify ownership documents, property titles, and compliance with local regulations. Be aware of any restrictions or liabilities associated with the property. - Economic Factors

Assess broader economic conditions, such as inflation, interest rates, and job market stability, as these can influence property values and rental demand. - Resale Value

Think about the property’s potential resale value and whether it aligns with your long-term investment goals. - Neighborhood Safety

Check the crime rate and overall safety of the area to ensure a secure environment for living or renting.

Comparing Property Investment to Other Investment Options

When deciding where to invest your money, it’s important to weigh the benefits and risks of various options. Property investment, often seen as a stable and tangible asset, stands out for its potential to generate rental income and appreciate in value. However, it comes with unique challenges, such as high upfront costs and limited liquidity. To make an informed decision, it’s helpful to compare property investment with other popular investment options like stocks, bonds, and mutual funds.

Comparison of Property Investment with Other Options

| Factor | Property Investment | Stocks | Bonds | Mutual Funds |

| Liquidity | Low – Selling property can take time | High – Easily bought or sold on stock markets | Moderate – Can be sold before maturity but may incur fees | High – Shares can be sold anytime |

| Risk | Moderate – Depends on market conditions and property type | High – Subject to market volatility | Low – Generally stable with fixed returns | Moderate – Risk varies based on the fund type |

| Upfront Costs | High – Requires a large down payment and additional fees | Low – Can start with small amounts | Low – Generally affordable entry points | Low – Initial investment varies |

| Income Potential | High – Rental income plus appreciation over time | Varies – Dividends and capital gains | Low – Fixed interest payments | Moderate – Depends on fund performance |

| Tax Benefits | High – Depreciation, mortgage interest, and expense deductions | Moderate – Tax advantages through retirement accounts | Moderate – Interest income may be taxable | Moderate – Tax efficiency depends on fund type |

| Management Effort | High – Requires time and effort for property management | Low – Requires minimal involvement | Low – Minimal effort needed after purchase | Low – Managed by professional fund managers |

| Inflation Hedge | High – Property values and rental income often rise with inflation | Low – Stock prices may not always match inflation | High – Fixed income loses value during inflation | Moderate – Depends on underlying assets |

| Diversification | Limited – Often involves a single property or location | High – Can spread across multiple sectors | Moderate – Typically tied to a specific issuer | High – Funds are diversified across assets |

Case Studies: Success and Failure Stories in Property Investment

Property investment has its fair share of triumphs and challenges, and learning from real-world examples can provide valuable insights. Below are cases that illustrate both success and failure in property investment:

Success Story: A Strategic Investment in a Growing Market

In 2015, Sarah, an investor, purchased a rental property in a developing suburban neighborhood near a new technology hub. She conducted thorough market research, ensuring the property was in a high-demand area with excellent infrastructure and job opportunities. Over five years, property values in the area soared due to increased demand from tech professionals, and rental income steadily increased. Sarah’s property appreciated by 40%, and her rental income covered mortgage payments and generated a positive cash flow. By 2020, she was able to refinance and purchase a second property, significantly expanding her portfolio.

Failure Story: Over-Leveraging in a Declining Market

On the flip side, John bought multiple properties in 2007 during a real estate boom, relying heavily on borrowed funds. However, he neglected to diversify his portfolio or account for potential market downturns. When the 2008 financial crisis hit, property values plummeted, and his rental income couldn’t cover mortgage payments. Over-leveraged and facing mounting debt, John was forced to sell several properties at a loss. This experience highlights the importance of maintaining financial flexibility and planning for market volatility.

Success Story: Renovation and Resale

In 2018, Maria purchased an older property in an up-and-coming urban area at a discounted price. She invested in renovations that modernized the home, including energy-efficient upgrades and stylish interiors. Within a year, Maria sold the property for a 25% profit, thanks to rising property demand in the area and the appeal of the renovations. This case demonstrates the potential of value-add strategies in boosting returns.

Failure Story: Neglecting Tenant Screening

Lisa invested in a rental property but underestimated the importance of tenant screening. She rented to tenants without verifying their credit history or references. Over time, the tenants fell behind on rent payments and caused significant property damage. Legal fees to evict them and repair costs eroded her profits. Lisa’s story underscores the need for due diligence in tenant selection and management.

Conclusion

Property investment can be a powerful tool for building wealth and achieving financial security, but it requires careful planning, thorough research, and ongoing management to maximize its potential. Success in real estate hinges on understanding market trends, evaluating risks, and aligning investments with your financial goals. While the rewards, such as steady rental income and long-term appreciation, are attractive, the challenges—ranging from high costs to tenant management—highlight the need for a well-informed approach. By learning from both successes and failures, and leveraging professional advice when needed, you can make property investment a rewarding part of your financial strategy. Whether you’re just starting or looking to expand your portfolio, real estate offers opportunities to create lasting value with the right preparation and mindset.