In 2025, cryptocurrency mining presents an exciting yet challenging opportunity for those looking to turn computational power into profit. With a dynamic market, evolving technology, and increasing mining difficulty, choosing the most profitable cryptocurrency to mine is a crucial decision. Whether you’re a seasoned miner or just starting, this guide will help you navigate the ever-changing landscape, highlighting the most rewarding coins, key factors influencing profitability, and practical strategies to maximize your returns. By staying informed and adapting to trends, you can uncover the to p opportunities in crypto mining for 2025.

What is cryptocurrency mining?

Cryptocurrency mining is the process of using specialized computer hardware to validate and secure transactions on a blockchain network. Miners compete to solve complex mathematical problems, and the first to succeed gets the opportunity to add a new block of transactions to the blockchain. In return for their efforts, miners are rewarded with cryptocurrency tokens. This process not only verifies transactions but also ensures the decentralized nature and security of the blockchain network. Different cryptocurrencies require different mining equipment, with some relying on powerful ASIC miners while others remain accessible through GPUs or even standard CPUs. However, energy efficiency, hardware capability, and electricity costs play significant roles in determining mining profitability.

Top Cryptocurrencies to Mine in 2025

As the cryptocurrency landscape continues to evolve, selecting the right coin to mine in 2025 is more important than ever. With rising energy costs, shifting market trends, and technological advancements, miners must carefully evaluate their options to maximize profits. Below are some of the most profitable and promising cryptocurrencies for mining in 2025, each offering unique advantages and mining requirements.

1. Bitcoin (BTC) remains the flagship cryptocurrency and a top choice for miners due to its strong market value and wide adoption. However, mining Bitcoin requires advanced ASIC hardware, substantial initial investment, and access to affordable electricity to remain profitable. Despite increasing mining difficulty, its high market price and historical performance make it a reliable long-term option.

2. Monero (XMR) stands out for its focus on privacy and its ASIC-resistant RandomX algorithm. Unlike Bitcoin, Monero can be efficiently mined using standard CPUs or GPUs, making it accessible to at-home miners. Its consistent block rewards and lower energy demands ensure it remains a strong contender for profitability.

3. Litecoin (LTC) offers faster transaction processing and uses the energy-efficient Scrypt algorithm. With a dedicated mining community and consistent value growth, Litecoin remains a reliable choice. Mining LTC often involves ASIC hardware, and its integration with Dogecoin mining through merged mining provides additional profit potential.

4. Dogecoin (DOGE), originally a meme coin, has grown into a profitable mining option. It operates on the Scrypt algorithm and can be mined alongside Litecoin, boosting efficiency. With a strong community and increasing real-world adoption, Dogecoin remains a playful yet lucrative option for miners.

5. Ravencoin (RVN) is a GPU-friendly cryptocurrency designed to resist ASIC mining through its KAWPOW algorithm. It’s particularly popular among small-scale miners due to its accessibility and consistent block rewards. Ravencoin’s focus on enabling decentralized asset transfers further enhances its long-term potential.

6. Ethereum Classic (ETC) continues to provide Proof-of-Work mining opportunities after Ethereum’s transition to Proof-of-Stake. With moderate mining difficulty and stable network activity, ETC remains an appealing choice for GPU and ASIC miners. Its role in supporting decentralized applications adds to its value.

7. Zcash (ZEC) is known for its advanced privacy features enabled by the Equihash algorithm. It supports both GPU and ASIC mining, making it versatile for different mining setups. Zcash’s focus on secure, anonymous transactions continues to attract miners looking for profitable alternatives to mainstream cryptocurrencies.

8. Dash (DASH) offers quick and private transactions, leveraging its X11 algorithm for mining. It’s compatible with ASIC miners, and its unique masternode system ensures long-term stability and security for its network. Miners who focus on efficiency and consistency often favor Dash.

9. Kaspa (KAS) is an emerging cryptocurrency utilizing the kHeavyHash algorithm, known for its energy efficiency and scalability. With specialized ASIC hardware, Kaspa offers significant daily profit potential. Its rapid block times and innovative approach to scalability make it an exciting option for forward-thinking miners.

10. Flux (FLUX) focuses on decentralized cloud infrastructure and relies on the ZelHash algorithm for mining. It remains GPU-friendly, offering opportunities for efficient miners to capitalize on lower competition and steady rewards. Its real-world use cases in decentralized computing add to its long-term value.

How to Calculate Profit in Crypto Mining

Calculating profit in cryptocurrency mining isn’t just about counting the coins you’ve earned—it’s a careful balance of hardware performance, energy costs, mining difficulty, and market prices. With the mining landscape becoming increasingly competitive in 2025, understanding these key factors is essential for determining if your mining operation is profitable. Whether you’re using an ASIC rig, GPU setup, or joining a mining pool, a clear calculation can help you maximize returns and avoid costly missteps. Below, we break down the essential steps to calculate your mining profits effectively.

1. Determine Your Hash Rate

Your hash rate measures how quickly your hardware can solve the cryptographic puzzles required for mining. A higher hash rate increases your chances of earning rewards. Mining hardware specifications usually list the hash rate, and online tools like WhatToMine can help estimate your potential earnings based on this metric.

2. Calculate Electricity Costs

Electricity is one of the most significant ongoing expenses in mining. Measure your hardware’s power consumption (in kilowatts per hour, kWh) and multiply it by your local electricity rate. Efficient hardware and access to lower electricity costs can greatly improve profitability.

3. Factor in Pool Fees

If you’re mining in a pool, fees are typically deducted from your earnings. These fees usually range from 1% to 3% and should be included in your cost calculations to avoid overestimating profits.

4. Consider Hardware and Maintenance Costs

The cost of purchasing mining hardware, as well as ongoing maintenance and potential repairs, should be spread across its expected lifespan. This helps you calculate your daily or monthly profit more accurately.

5. Check Current Coin Prices and Block Rewards

Mining profitability is directly tied to the market price of the cryptocurrency you’re mining. Additionally, block rewards—the coins awarded for each successfully mined block—can fluctuate, especially after events like Bitcoin halving.

6. Use a Mining Profitability Calculator

Online tools, like WhatToMine or CryptoCompare, allow you to input your hash rate, power consumption, electricity cost, and pool fees. These calculators provide an estimated daily, weekly, and monthly profit, giving you a clear picture of your earnings potential.

7. Monitor Market Trends and Adjust Strategies

Cryptocurrency prices, mining difficulty, and network activity are constantly changing. Regularly reviewing these factors and adjusting your mining strategy—such as switching coins or upgrading hardware—can help you stay profitable.

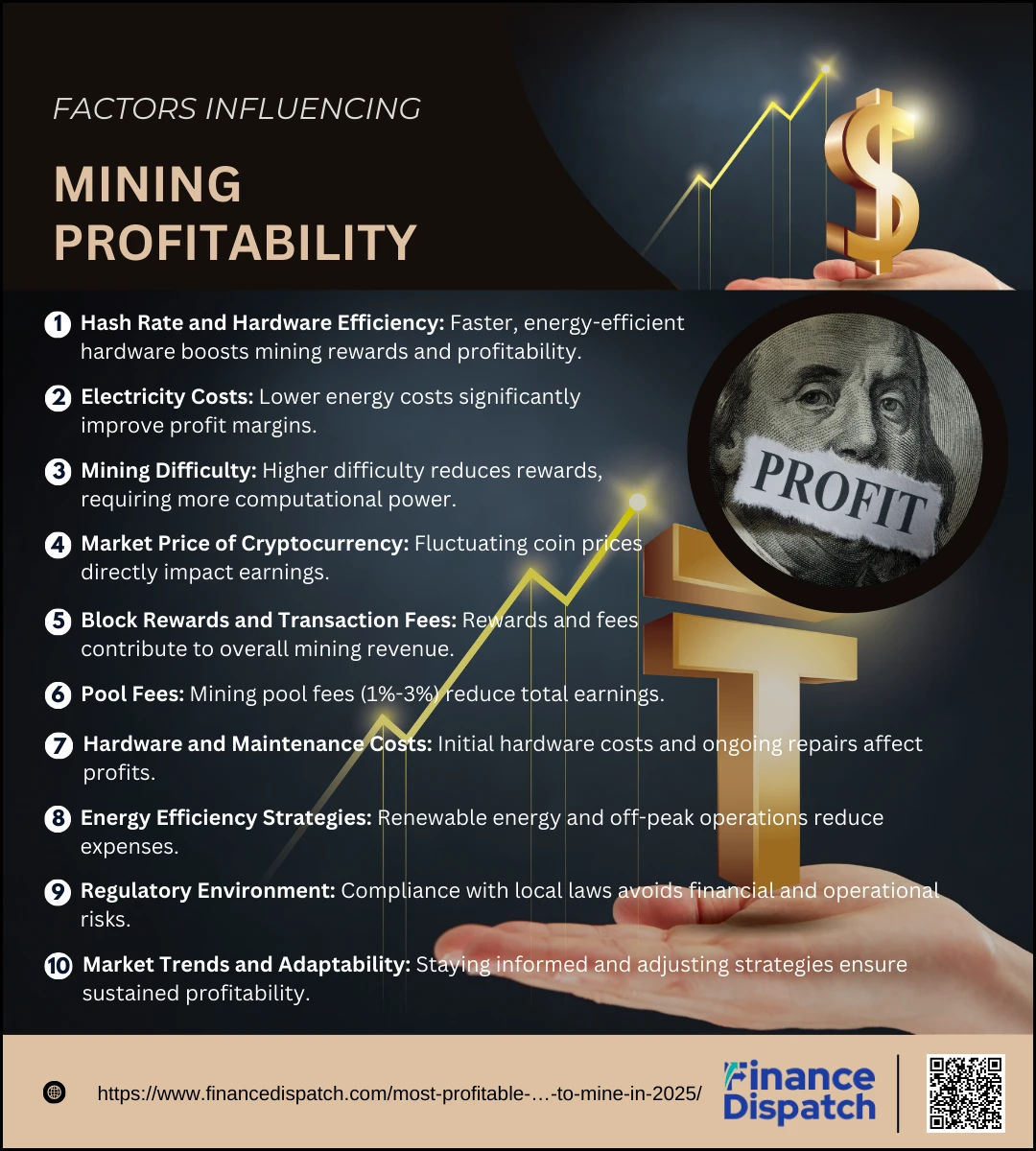

Factors Influencing Mining Profitability

Mining cryptocurrency can be a lucrative venture, but profitability isn’t guaranteed. In 2025, several key factors play a significant role in determining whether your mining efforts will yield positive returns. From hardware efficiency and energy costs to market trends and mining difficulty, every detail counts. Understanding these factors will help you make informed decisions, optimize your operations, and stay competitive in an ever-changing market. Below are the primary factors influencing mining profitability:

- Hash Rate and Hardware Efficiency: The speed and efficiency of your mining equipment determine how quickly you can solve cryptographic puzzles and earn rewards. High hash rates and energy-efficient hardware are essential for maximizing profits.

- Electricity Costs: Energy consumption is one of the largest expenses in mining. Lower electricity costs can significantly boost profitability, while high rates can quickly erode potential earnings.

- Mining Difficulty: As more miners join a network, the mining difficulty adjusts, making it harder to mine new blocks. Increased difficulty requires more computational power, reducing profit margins.

- Market Price of Cryptocurrency: The value of the coin you’re mining directly impacts your earnings. Fluctuations in cryptocurrency prices can quickly turn a profitable operation into a loss-making one.

- Block Rewards and Transaction Fees: The rewards for successfully mining a block and any associated transaction fees contribute to your overall revenue. Events like Bitcoin halving reduce block rewards, affecting long-term profitability.

- Pool Fees: If you’re mining through a pool, a percentage of your earnings goes to pool operators. These fees, typically between 1% and 3%, should be factored into your calculations.

- Hardware and Maintenance Costs: The initial investment in mining rigs and ongoing maintenance expenses, including repairs and upgrades, add to your operational costs.

- Energy Efficiency Strategies: Using renewable energy sources or operating during off-peak hours can reduce energy expenses and improve your profit margins.

- Regulatory Environment: Government regulations, taxes, and restrictions on mining activities vary by region. Compliance with local laws is crucial to avoid financial penalties.

- Market Trends and Adaptability: The cryptocurrency market is highly dynamic. Staying updated with trends, adjusting strategies, and being agile in switching coins or equipment are vital for sustained profitability.

Comparison of Profitability in cryptocurrency mining

Profitability in cryptocurrency mining varies significantly depending on the coin you choose, the type of hardware you use, and other factors like electricity costs and market value. Certain cryptocurrencies, like Bitcoin, require high-end ASIC miners and access to cheap electricity to remain profitable. Others, like Monero and Ravencoin, cater to miners with lower budgets by offering ASIC resistance and supporting GPU or CPU mining. Below is a comparison of some of the most popular cryptocurrencies for mining in 2025, including their mining algorithms, average daily profits, and the hardware typically required.

| Cryptocurrency | Algorithm | Mining Hardware | Daily Profit (USD) | Days to Profitability |

| Bitcoin (BTC) | SHA-256 | ASIC (e.g., Antminer S21) | $2.89 | ~1,937 |

| Monero (XMR) | RandomX | CPU or GPU | $2.49 | ~1,149 |

| Litecoin (LTC) | Scrypt | ASIC (e.g., Antminer L9) | $17.72 | ~374 |

| Dogecoin (DOGE) | Scrypt | ASIC (merged with LTC) | $17.72 | ~374 |

| Ravencoin (RVN) | KAWPOW | GPU | $3–$5 per card | ~365–550 |

| Ethereum Classic (ETC) | Etchash | GPU or ASIC | $1.19 | ~2,101 |

| Zcash (ZEC) | Equihash | GPU or ASIC (e.g., Z15 Pro) | $1.69 | ~1,183 |

| Dash (DASH) | X11 | GPU or ASIC | $2.03 | ~985 |

| Kaspa (KAS) | kHeavyHash | ASIC (e.g., KS5 Pro) | $76.99 | ~136 |

| Flux (FLUX) | ZelHash | GPU | Varies by setup | Varies |

Choosing the Right Cryptocurrency to Mine

Selecting the right cryptocurrency to mine in 2025 is a decision that hinges on several critical factors, including your hardware capabilities, electricity costs, mining difficulty, and market trends. Coins like Bitcoin require powerful ASIC miners and access to low-cost electricity to remain profitable, while Monero and Ravencoin offer opportunities for those using standard GPUs or CPUs. Additionally, market volatility plays a significant role—coins with consistent demand and active communities, such as Litecoin and Dogecoin, often offer more predictable returns. Mining newcomers may prefer coins with lower entry barriers, while seasoned miners might focus on high-reward options like Kaspa. It’s also essential to stay informed about upcoming halving events, network difficulty adjustments, and technological advancements in mining hardware. By carefully assessing your resources and aligning them with the unique characteristics of each cryptocurrency, you can make an informed choice that maximizes profitability and long-term success.

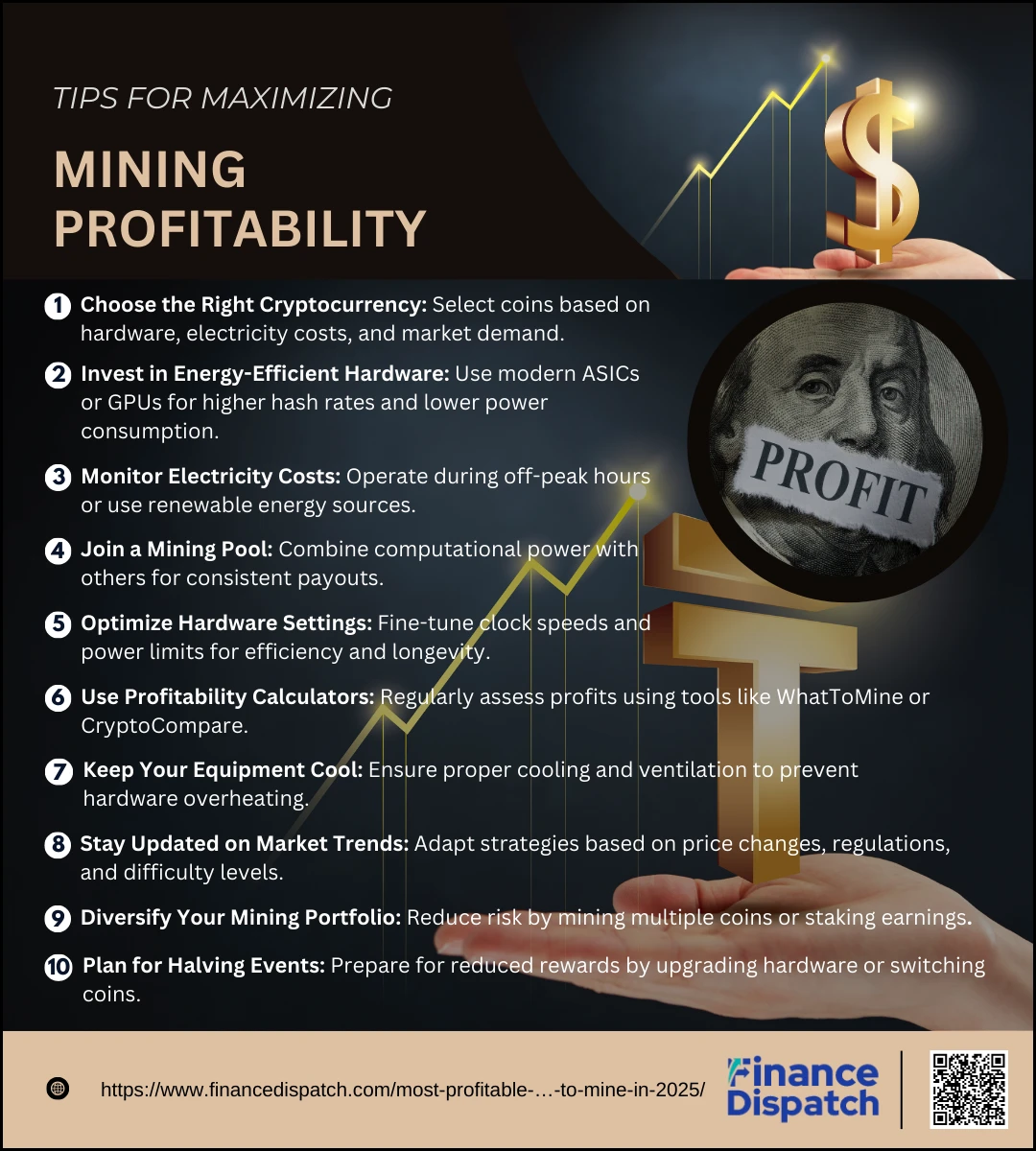

Tips for Maximizing Mining Profitability

In the competitive world of cryptocurrency mining, maximizing profitability goes beyond simply running your hardware day and night. Success requires a combination of strategic planning, efficient resource management, and staying informed about evolving market trends. With rising electricity costs, fluctuating cryptocurrency prices, and ever-increasing mining difficulty, miners must adopt smart practices to stay ahead. Whether you’re mining with ASICs, GPUs, or CPUs, optimizing your approach can make a significant difference in your returns. Below are detailed tips to help you fine-tune your mining operations and boost long-term profitability.

- Choose the Right Cryptocurrency: Selecting the most profitable cryptocurrency to mine depends on your hardware, electricity costs, and overall goals. Coins like Bitcoin require powerful ASIC miners and cheap electricity, while coins like Monero or Ravencoin are more accessible to miners using standard CPUs or GPUs. Always research coins with lower mining difficulty, active developer communities, and stable market demand.

- Invest in Energy-Efficient Hardware: Hardware efficiency plays a critical role in profitability. Modern ASIC miners and GPUs are engineered to deliver higher hash rates with lower power consumption. Investing in updated, energy-efficient mining rigs may require an upfront cost, but it significantly reduces long-term operational expenses.

- Monitor Electricity Costs: Electricity is one of the largest recurring expenses in mining. Consider operating your rigs during off-peak hours when electricity rates are lower, or explore renewable energy options like solar or wind power to reduce your reliance on traditional energy sources.

- Join a Mining Pool: Solo mining can be highly unpredictable and time-consuming, especially for coins with high difficulty levels. By joining a mining pool, you combine your computational power with other miners, increasing the chances of successfully mining blocks and earning regular payouts.

- Optimize Hardware Settings: Fine-tuning your mining hardware’s performance, including adjusting clock speeds, voltages, and power limits, can improve energy efficiency and extend hardware lifespan. Use mining software that allows you to tweak these settings for maximum output.

- Use Profitability Calculators: Online tools like WhatToMine and CryptoCompare let you calculate potential earnings based on factors like hash rate, electricity costs, and coin value. Regularly updating these calculations ensures you’re always mining the most profitable cryptocurrency.

- Keep Your Equipment Cool: Overheating can drastically reduce the efficiency and lifespan of your mining hardware. Invest in reliable cooling systems, use thermal paste, and ensure good ventilation to prevent your rigs from overheating.

- Stay Updated on Market Trends: Cryptocurrency prices, mining difficulty, and regulatory environments are constantly changing. Follow credible news sources, social media channels, and forums to stay informed and adapt your strategy quickly.

- Diversify Your Mining Portfolio: Mining only one cryptocurrency can expose you to higher risks if that coin’s value suddenly drops. Diversify by mining multiple coins, switching between profitable coins, or even staking some of your mined earnings.

- Plan for Halving Events: For cryptocurrencies like Bitcoin and Litecoin, halving events reduce mining rewards periodically. Understand how these events affect profitability and prepare by upgrading your hardware, reducing energy costs, or exploring alternative coins in advance.

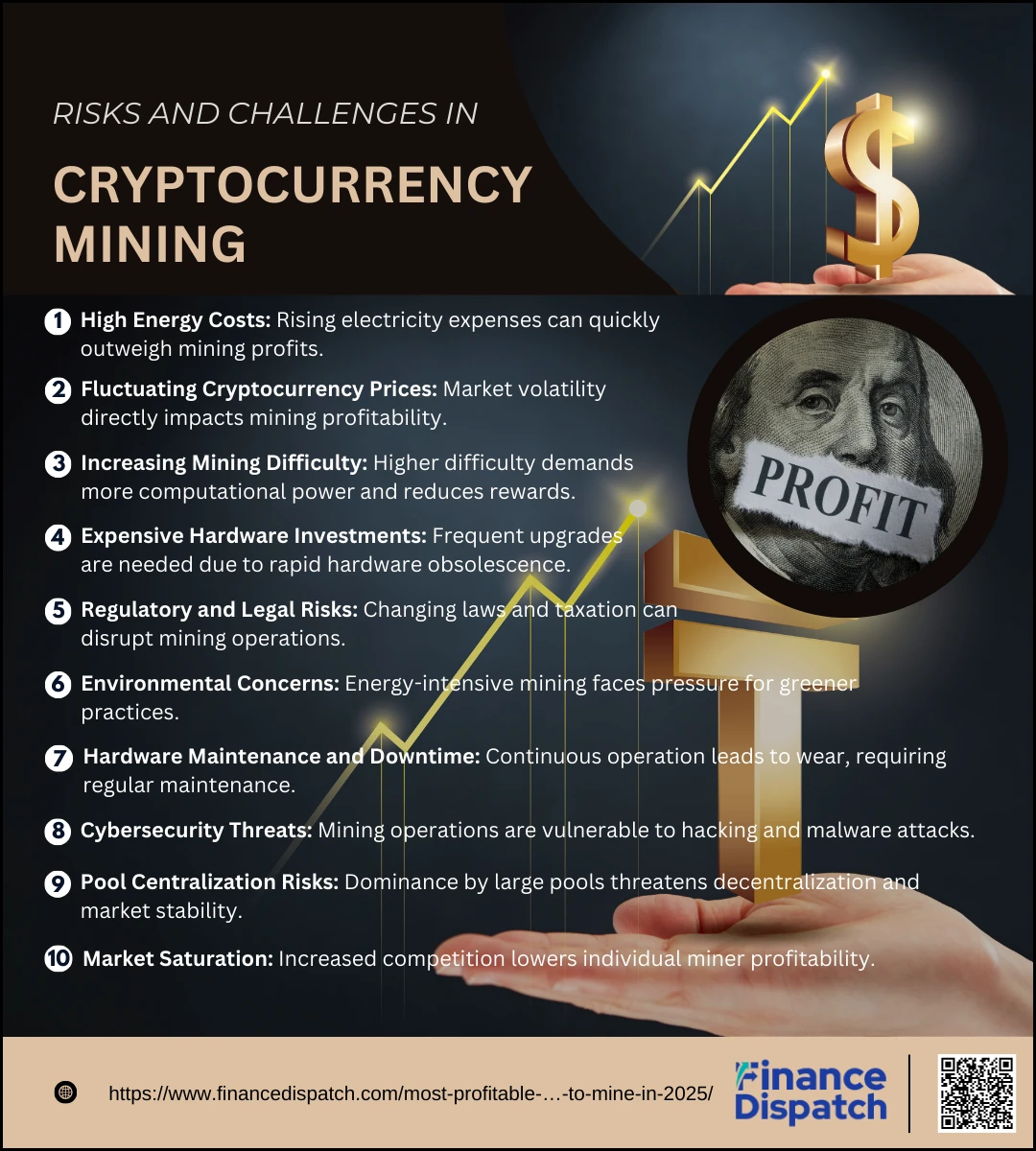

Risks and Challenges in Cryptocurrency Mining

Cryptocurrency mining may appear lucrative, but it is not without its risks and challenges. From rising operational costs to evolving regulations, miners must navigate a complex landscape to maintain profitability. Additionally, technological advancements and market volatility can significantly impact the sustainability of mining operations. To thrive in this competitive field, it’s essential to understand the key risks and develop strategies to mitigate them. Below are some of the most pressing challenges faced by cryptocurrency miners in 2025.

1. High Energy Costs

Mining cryptocurrency consumes a tremendous amount of electricity. For miners operating in regions with high electricity rates, energy costs can quickly outweigh the potential profits. This is especially true for high-powered ASIC miners, which require substantial energy to maintain peak performance.

2. Fluctuating Cryptocurrency Prices

The volatility of cryptocurrency prices directly affects mining profitability. A sudden drop in the market value of a coin can turn a profitable operation into a loss-making endeavor, particularly for miners who rely on a single cryptocurrency.

3. Increasing Mining Difficulty

As more miners join a network, the mining difficulty adjusts upward, requiring more computational power to mine new blocks. This reduces the likelihood of earning rewards, particularly for miners with older or less efficient hardware.

4. Expensive Hardware Investments

Mining equipment, especially ASIC rigs, requires significant upfront investment. The rapid pace of technological advancements often renders hardware obsolete within a few years, forcing miners to continually upgrade their equipment to stay competitive.

5. Regulatory and Legal Risks

Cryptocurrency mining is under increasing scrutiny from governments worldwide. Regulations on energy consumption, environmental impact, and taxation can impose additional costs or even ban mining operations in certain jurisdictions.

6. Environmental Concerns

The energy-intensive nature of mining has raised concerns about its environmental impact. Public and regulatory pressure to adopt greener practices can lead to increased operational costs or restrictions for miners reliant on traditional energy sources.

7. Hardware Maintenance and Downtime

Mining rigs operate continuously, leading to wear and tear that requires regular maintenance. Hardware failures or downtime can result in significant losses, particularly for large-scale operations.

8. Cybersecurity Threats

Mining operations are prime targets for cyberattacks, including malware, ransomware, and hacking attempts. These threats can compromise mining rigs or wallets, resulting in loss of funds or operational disruptions.

9. Pool Centralization Risks

Mining pools offer more consistent rewards, but they also create centralization risks. A few large pools dominating the network can threaten the decentralized nature of certain cryptocurrencies, potentially destabilizing the market.

10. Market Saturation

With the increasing popularity of mining, the competition has become fierce. Saturated markets reduce individual miner profitability and make it difficult for smaller operations to compete with industrial-scale mining farms.

Conclusion

Cryptocurrency mining in 2025 offers exciting opportunities but also presents significant challenges. Success in this ever-evolving space requires more than just powerful hardware—it demands strategic planning, adaptability, and a deep understanding of the factors that influence profitability. From selecting the right cryptocurrency and managing electricity costs to staying informed about market trends and navigating regulatory hurdles, every decision plays a crucial role in determining long-term success. While risks like rising energy costs, fluctuating coin prices, and increasing mining difficulty remain constant, they can be mitigated with efficient hardware, optimized energy use, and a flexible approach to mining strategies. Whether you’re an experienced miner or a newcomer, staying informed, proactive, and adaptable will be key to thriving in the dynamic world of cryptocurrency mining.