When you think about a business’s assets, it’s easy to picture cash, inventory, or accounts receivable. Yet, some of the most valuable assets in any company are the ones that physically drive its operations and production: plant assets. These are the long-term, fixed assets—like machinery, buildings, land, and equipment—that support a company’s core functions over many years. Unlike current assets, which are quickly converted to cash, plant assets are intended to last, providing steady value and utility in the form of production capabilities and operational support. In this article, you’ll discover what defines plant assets, why they are essential, and how understanding their role can help improve financial tracking and business efficiency.

Plant assets, also known as fixed assets, are long-term tangible assets that a company uses in its daily operations to generate revenue. Unlike current assets, which are expected to be used or sold within a year, plant assets serve a business over a prolonged period, often providing value and functionality for many years. These assets encompass items like land, buildings, machinery, vehicles, and equipment—resources that contribute directly to a company’s production and services. Plant assets hold significant monetary value, are generally depreciable over their useful life (with the exception of land), and are recorded on the balance sheet as part of the “property, plant, and equipment” category.

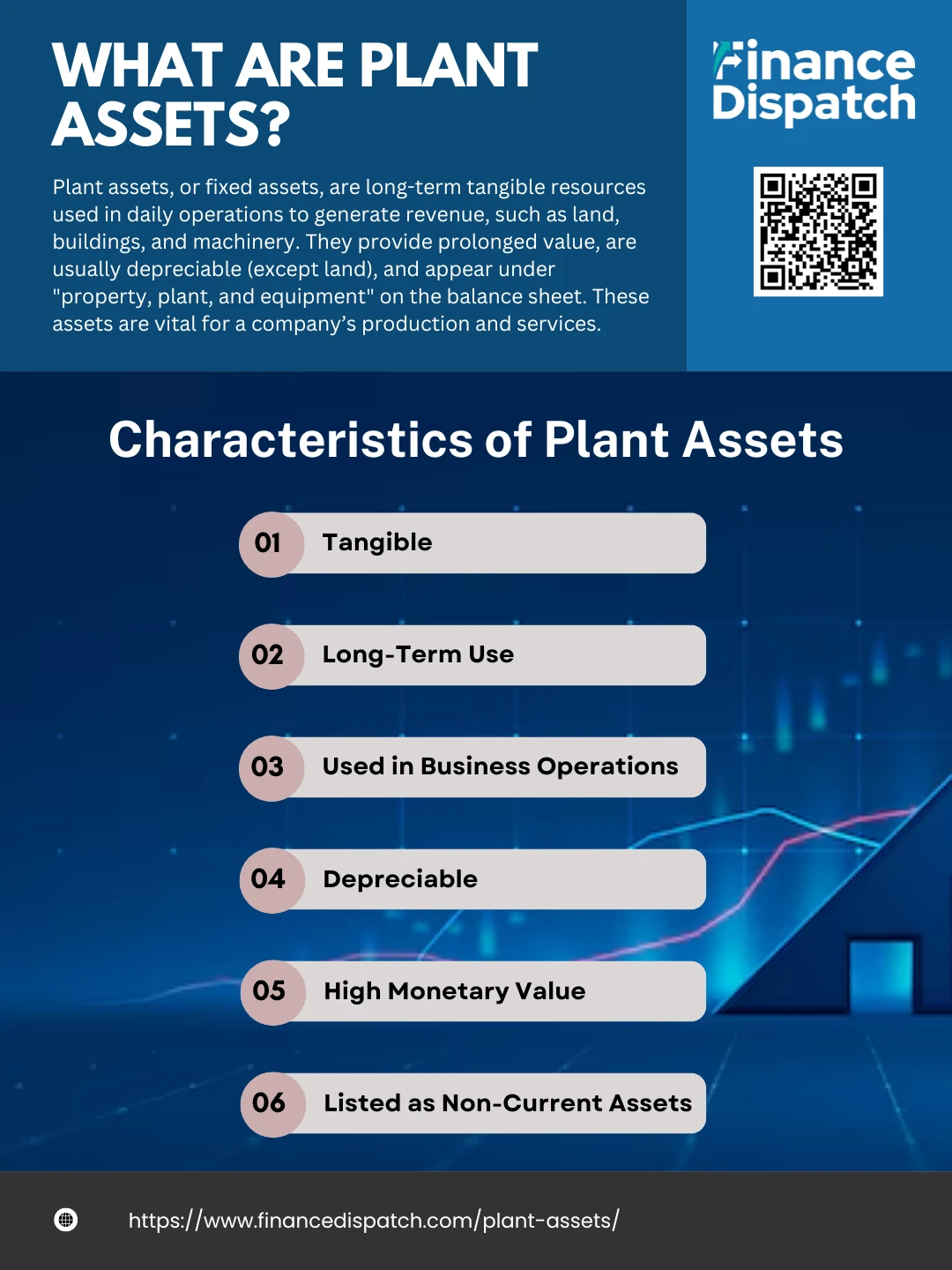

Characteristics of Plant Assets

Plant assets have distinct characteristics that set them apart from other types of business assets. These assets are essential to operations, often involve substantial investment, and have unique accounting requirements due to their long-term nature. Understanding these characteristics is key to managing them effectively.

Here are the main characteristics of plant assets:

1. Tangible

Plant assets are tangible, meaning they are physical items that occupy space and can be visually identified and physically touched. This tangibility differentiates plant assets from intangible assets, like patents or trademarks, which have no physical form but still hold value for a business. Tangibility is crucial for plant assets as it ensures that these items can support the production of goods or services directly. Examples include machinery that manufactures products, vehicles that transport goods, and office buildings that house employees.

2. Long-Term Use

Plant assets are meant to serve a business over an extended period, typically longer than one fiscal year. Unlike inventory or other short-term resources, which are used up or sold quickly, plant assets remain in use for several years to support continuous production or service delivery. This long-term usage makes them a stable part of a company’s asset base. For instance, a piece of machinery might have a useful life of five to ten years, providing consistent support in production for a sustained period. This longevity justifies the high cost and capital investment often associated with acquiring these assets.

3. Used in Business Operations

Unlike investments or resale items, plant assets are integral to the core activities of a business. They are directly involved in day-to-day operations, facilitating the production, delivery, or administration of the company’s offerings. For example, in a manufacturing company, the machines used to create products are plant assets because they enable the core function of production. Even office equipment like computers or printers can qualify as plant assets, as they contribute to internal operations that support revenue generation. Plant assets are not intended for resale; they are acquired and maintained to support operational needs consistently.

4. Depreciable

Since plant assets have a finite useful life, they experience gradual wear and tear, which decreases their value over time—a process known as depreciation. Depreciation is a crucial accounting practice as it allocates the cost of an asset across its useful life, matching the expense with the revenue it helps generate. This approach allows businesses to reflect the decreasing value of the asset accurately on financial statements. Various methods, like the straight-line or declining-balance method, are used to calculate annual depreciation. The exception is land, which typically does not depreciate because it doesn’t wear out or become obsolete over time.

5. High Monetary Value

Plant assets usually require a significant financial investment due to their essential role and durability in operations. This high monetary value is reflected in the initial cost of acquiring and setting up these assets. For instance, purchasing heavy machinery or a building often demands a substantial upfront cost that impacts a company’s cash flow and financial planning. As high-value assets, plant assets represent a considerable portion of a company’s long-term investments. Their value is not just in the initial purchase but in their ability to generate ongoing benefits for the business over many years.

6. Listed as Non-Current Assets

Plant assets are categorized as non-current assets on the balance sheet under “property, plant, and equipment” (PP&E). This classification distinguishes them from current assets, which are expected to be used or converted to cash within a year. As non-current assets, plant assets play a continuous role in operations, with their value recorded at historical cost, less accumulated depreciation. This categorization provides clarity in financial reporting, showing stakeholders the long-term resources a business relies on to maintain and grow its operations.

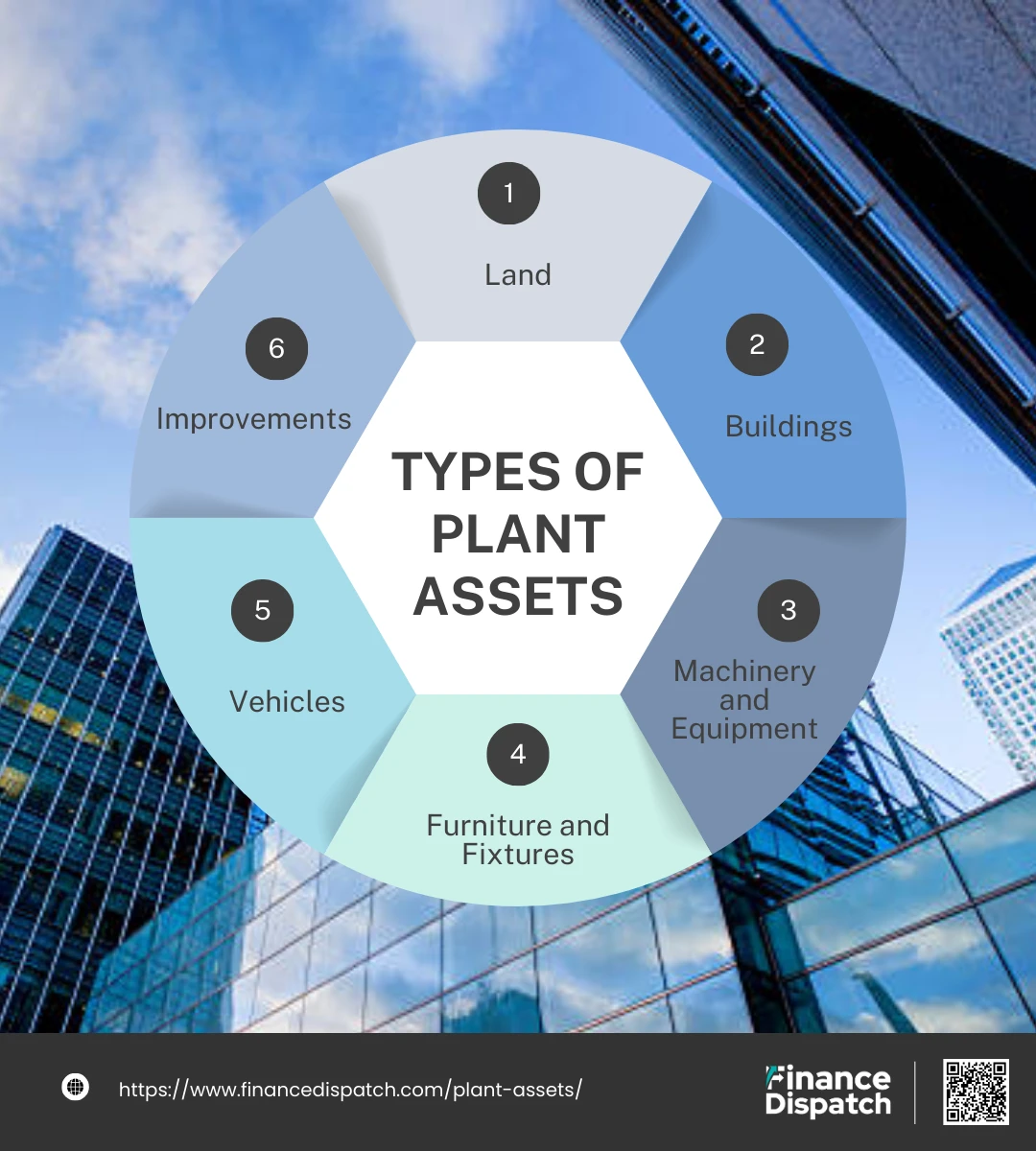

Types of Plant Assets

Plant assets come in various forms, each serving distinct purposes within a business’s operations. Recognizing the different types of plant assets helps in managing them effectively on the balance sheet, as well as in planning for maintenance, depreciation, and eventual replacement. Here are the primary types of plant assets:

1. Land

Land is one of the most valuable and unique plant assets, serving as the physical foundation for business operations. It may house production facilities, office spaces, warehouses, or retail outlets. Unlike other plant assets, land does not depreciate because it generally retains its value or even appreciates over time. However, the costs associated with improvements to the land, such as landscaping, fencing, and paving parking lots, are capitalized separately. Since land is crucial for businesses with physical operations, owning land can offer long-term stability and potential growth in asset value.

2. Buildings

Buildings are structures where a business conducts its activities, such as manufacturing plants, corporate offices, retail stores, and warehouses. These assets are typically significant investments and have long useful lives, but they do depreciate over time due to natural wear and tear. Companies may periodically invest in repairs or renovations to keep buildings safe, efficient, and compliant with regulations. Buildings are vital for housing employees, storing inventory, or hosting customers, and they may be repurposed or expanded as a business grows. Depreciation on buildings is calculated based on their expected useful life, which can vary depending on construction quality and maintenance.

3. Machinery and Equipment

Machinery and equipment include any machines, tools, and devices used in production, manufacturing, or service delivery. These assets are essential in industries like manufacturing, healthcare, and technology, where specialized equipment enables efficient production and service delivery. Machinery and equipment are typically among the highest-depreciating assets due to constant usage, which results in gradual wear and tear. Regular maintenance is often required to extend the life of these assets, and depreciation is calculated to reflect their decreasing value over time. Examples range from assembly-line machines in factories to diagnostic equipment in healthcare facilities.

4. Furniture and Fixtures

Furniture and fixtures cover items like desks, chairs, tables, shelving, cabinets, and lighting fixtures that create functional workspaces. Although generally lower in cost than machinery or buildings, these assets contribute to a productive and organized working environment. Furniture and fixtures are also depreciable over time, with their useful life depending on materials, design, and usage. While these assets might not directly contribute to production, they are essential for supporting employees in their roles and are often updated as a business grows or changes its office layout.

5. Vehicles

Vehicles include any company-owned cars, vans, trucks, or other transportation assets used for business purposes. In industries like logistics, delivery, and field services, vehicles are crucial for transporting goods, conducting on-site services, or allowing employees to travel between locations. Vehicles are subject to depreciation due to frequent use and exposure to external elements, and they require regular maintenance to stay operational. Some companies use a fleet management approach to track usage, maintenance schedules, and depreciation, ensuring the longevity and reliability of their vehicles.

6. Improvements

Improvements refer to significant enhancements made to existing assets, either to extend their useful life or increase their functionality. Examples include adding extra storage to a warehouse, upgrading lighting systems, or installing additional security features. Improvements are often considered separate assets because they represent a new investment beyond the original purchase. Improvements are depreciated over their own useful life, and, like buildings or equipment, they add substantial value by allowing a business to adapt its resources to changing operational needs. These investments help businesses maintain modern, efficient, and safe work environments, especially as they grow or modify operations.

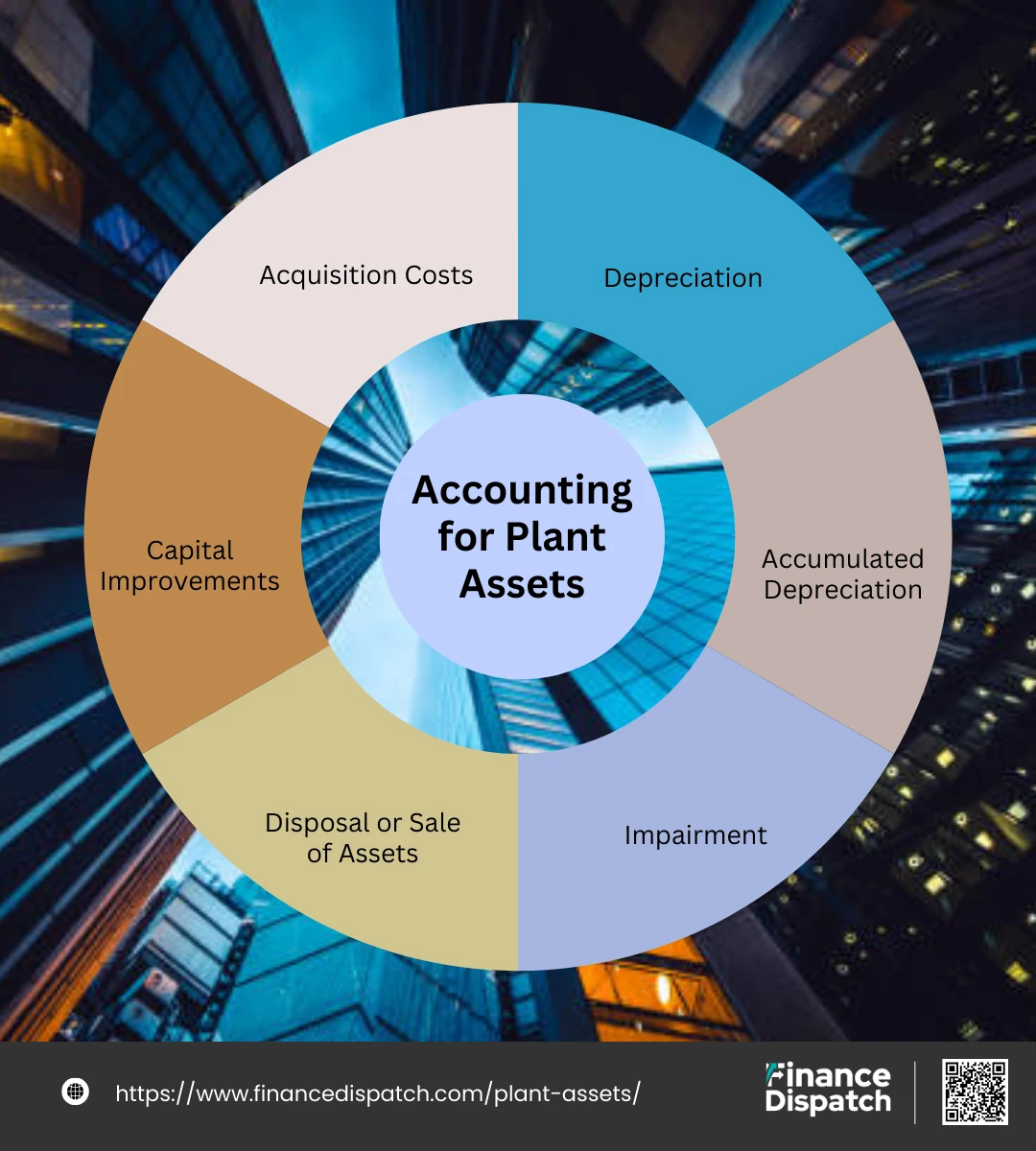

Accounting for Plant Assets

Accounting for plant assets involves more than just tracking their purchase costs. Since plant assets are long-term and play a continuous role in operations, they require specialized accounting methods to accurately reflect their value over time. This includes documenting the acquisition, tracking depreciation, and accounting for eventual disposal or sale. Here are the main accounting processes for plant assets:

1. Acquisition Costs

The acquisition cost of a plant asset includes not just the purchase price but also any additional expenses necessary to make the asset ready for use. This can include installation, transportation, legal fees, and other related costs. These initial costs are capitalized, meaning they are recorded as part of the asset’s value on the balance sheet rather than expensed immediately.

2. Depreciation

Depreciation allocates the cost of an asset over its useful life, spreading the expense to match the asset’s contribution to revenue. Common methods include the straight-line method, which spreads the cost evenly over time, and the declining balance method, which allocates a higher expense in the earlier years. Depreciation is essential in reflecting the wear and tear of an asset, and it helps maintain accurate financial reporting.

3. Accumulated Depreciation

As depreciation is recorded each period, it accumulates in a separate account called “Accumulated Depreciation.” This contra asset account offsets the plant asset’s original cost on the balance sheet, showing its current book value. Accumulated depreciation helps track the total amount of depreciation taken on an asset since its acquisition, indicating how much value has been consumed.

4. Impairment

Impairment occurs when an asset’s market value or utility has significantly declined, such as due to damage or technological obsolescence. If an impairment is identified, the asset’s book value must be adjusted to reflect this loss. This ensures the balance sheet presents a realistic view of the asset’s current value and prevents overstating assets.

5. Disposal or Sale of Assets

When a plant asset is no longer useful, it may be sold, traded, or discarded. At disposal, the asset is removed from the balance sheet, and any gain or loss on the disposal is recorded. The gain or loss is calculated as the difference between the asset’s book value and the sale proceeds, and this amount is recorded on the income statement.

6. Capital Improvements

When substantial improvements or upgrades are made to a plant asset, they are capitalized as part of the asset’s value rather than expensed immediately. These improvements extend the asset’s useful life or increase its productivity. Capital improvements are depreciated over their useful life, ensuring that the added value is reflected accurately in financial statements.

Importance of Plant Assets in Financial Statements

Plant assets hold significant importance in financial statements as they represent a substantial portion of a company’s long-term investments and play a central role in its operational capacity. These assets, including land, buildings, machinery, and equipment, are listed under the “Property, Plant, and Equipment” (PP&E) section of the balance sheet, showcasing their long-term value and impact on the business’s financial health. Plant assets are recorded at their acquisition cost and adjusted for accumulated depreciation over time, which helps reflect their true, declining value due to wear and tear. Accurately reporting plant assets is essential for stakeholders, as it offers insight into the company’s fixed capital and the productive resources that support revenue generation. This transparency also aids in financial analysis, where investors and management assess asset utilization, profitability, and future capital needs. Properly managing and accounting for plant assets ensures that financial statements are reliable, giving a realistic view of both the company’s stability and its long-term operational efficiency.

Plant Assets in Different Industries

Plant assets vary widely across industries, as each sector relies on specific physical assets to support its operations and generate revenue. In manufacturing, plant assets like heavy machinery, assembly lines, and warehouses are essential for producing goods efficiently. In retail, store buildings, shelving, and point-of-sale equipment play a significant role in customer service and sales. For the transportation and logistics industry, vehicles, warehouses, and loading equipment are critical assets that enable the movement of goods. Similarly, in healthcare, plant assets include medical equipment, diagnostic machines, and specialized facilities that support patient care. Even in technology sectors, plant assets can include server farms, computer hardware, and office spaces that house research and development. Each industry tailors its asset management to meet operational needs, balancing the cost, maintenance, and efficiency of these assets to stay competitive and maintain service standards. Properly accounting for these diverse plant assets across industries provides insight into each company’s operational framework and financial stability.

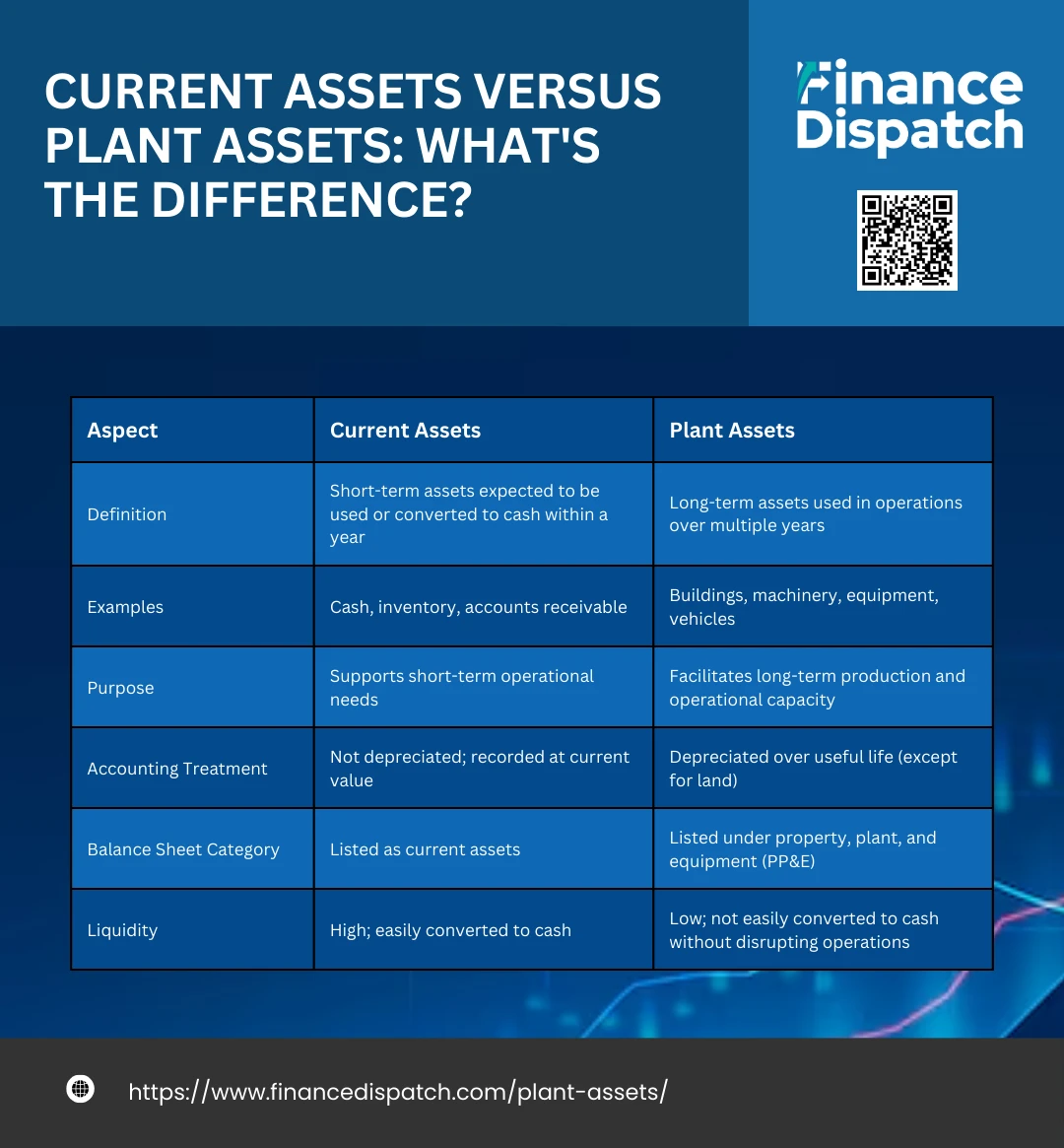

Current Assets versus Plant Assets: What’s the Difference?

Current assets and plant assets represent two distinct types of assets on a company’s balance sheet, each serving different financial and operational roles. Current assets, such as cash, inventory, and accounts receivable, are short-term assets expected to be converted to cash or used up within one year, supporting the day-to-day operational needs of the business. In contrast, plant assets are long-term assets like buildings, machinery, and equipment that contribute to the company’s core operations over multiple years. These differences impact how each asset type is managed, valued, and reported in financial statements.

| Aspect | Current Assets | Plant Assets |

| Definition | Short-term assets expected to be used or converted to cash within a year | Long-term assets used in operations over multiple years |

| Examples | Cash, inventory, accounts receivable | Buildings, machinery, equipment, vehicles |

| Purpose | Supports short-term operational needs | Facilitates long-term production and operational capacity |

| Accounting Treatment | Not depreciated; recorded at current value | Depreciated over useful life (except for land) |

| Balance Sheet Category | Listed as current assets | Listed under property, plant, and equipment (PP&E) |

| Liquidity | High; easily converted to cash | Low; not easily converted to cash without disrupting operations |

Conclusion

In conclusion, plant assets are a foundational component of any business, providing the essential infrastructure and tools needed for long-term operations and revenue generation. From land and buildings to machinery and vehicles, these assets support a company’s core functions, offering value over multiple years and requiring careful management and accounting. Differentiating plant assets from current assets on the balance sheet offers stakeholders a clearer understanding of a company’s operational strength and financial health. Properly accounting for plant assets through depreciation, impairment, and disposal helps ensure accurate financial reporting, which is vital for making informed investment, budgeting, and maintenance decisions. Recognizing the value of plant assets and integrating a robust asset management plan can ultimately enhance productivity, extend asset lifespans, and drive sustained business success.

FAQs

1. How often should a business reassess the value of its plant assets?

Companies generally reassess plant asset values annually, especially for impairment purposes, or if significant changes, such as major repairs or updates, occur. Regular reassessment ensures that financial statements reflect the true value of assets.

2. What factors influence the choice of depreciation method for plant assets?

The choice of depreciation method depends on factors like the asset’s expected usage pattern, industry standards, and financial reporting requirements. For example, assets with higher initial usage may benefit from accelerated depreciation methods like the declining balance method.

3. Can a plant asset be reclassified as a current asset?

Typically, plant assets remain classified as long-term assets; however, if an asset is held for sale and expected to be disposed of within a year, it may be reclassified as a current asset on the balance sheet under “Assets Held for Sale.”

4. How do businesses decide when to replace a plant asset instead of repairing it?

Companies evaluate the cost-effectiveness of repairs versus replacement, considering factors such as maintenance costs, downtime, asset age, and advances in technology. If repair costs outweigh the benefits of keeping the asset, replacement may be more practical.

5. Are there tax benefits associated with plant asset depreciation?

Yes, depreciation on plant assets can offer tax benefits by reducing taxable income. Businesses can often deduct annual depreciation expenses, which lowers the overall tax burden, depending on tax laws and regulations applicable to asset depreciation.