Understanding tax deductions is crucial for small business owners because it directly impacts their financial health and operational success. Tax deductions reduce taxable income, allowing businesses to lower their tax liabilities and retain more of their hard-earned revenue. By leveraging available deductions, such as those for business-related expenses like office supplies, travel, or employee benefits, small business owners can reinvest savings back into their operations to drive growth. Additionally, understanding deductions ensures compliance with tax laws, minimizing the risk of audits or penalties. This knowledge not only boosts profitability but also empowers entrepreneurs to make informed financial decisions and achieve long-term stability.

What Are Tax Deductions?

Tax deductions, often referred to as tax write-offs, are specific expenses that individuals or businesses can subtract from their total taxable income. By reducing the amount of income subject to taxation, deductions effectively lower the overall tax bill. For small business owners, these deductions can include costs directly related to operating the business, such as office supplies, advertising, travel, or employee salaries. The IRS defines deductible expenses as “ordinary and necessary” for conducting business, ensuring they are both common in the industry and essential to its operations. Understanding and utilizing tax deductions allows businesses to maximize savings, reinvest in growth, and maintain financial health.

Purpose of tax deductions

Tax deductions serve the purpose of reducing taxable income, which in turn lowers the overall tax liability for individuals or businesses. They are designed to support business growth by allowing owners to deduct legitimate expenses incurred while running their operations. By recognizing and utilizing these deductions, businesses can save money and reinvest in key areas to ensure sustainability and success.

- Lower Tax Liability: Deductions reduce the amount of income subject to taxes, enabling businesses to pay less overall.

- Encourage Business Growth: By allowing businesses to keep more of their earnings, deductions provide extra capital for reinvestment in equipment, technology, or personnel.

- Support Compliance: Clear guidelines on deductions help business owners stay compliant with tax regulations, reducing the risk of penalties or audits.

- Boost Financial Health: Retaining more income supports long-term stability, ensuring businesses can manage operational costs effectively.

- Encourage Economic Development: Deductions incentivize spending on business operations, indirectly boosting the economy by fostering innovation and job creation.

Difference between Tax Deductions and Tax Credits

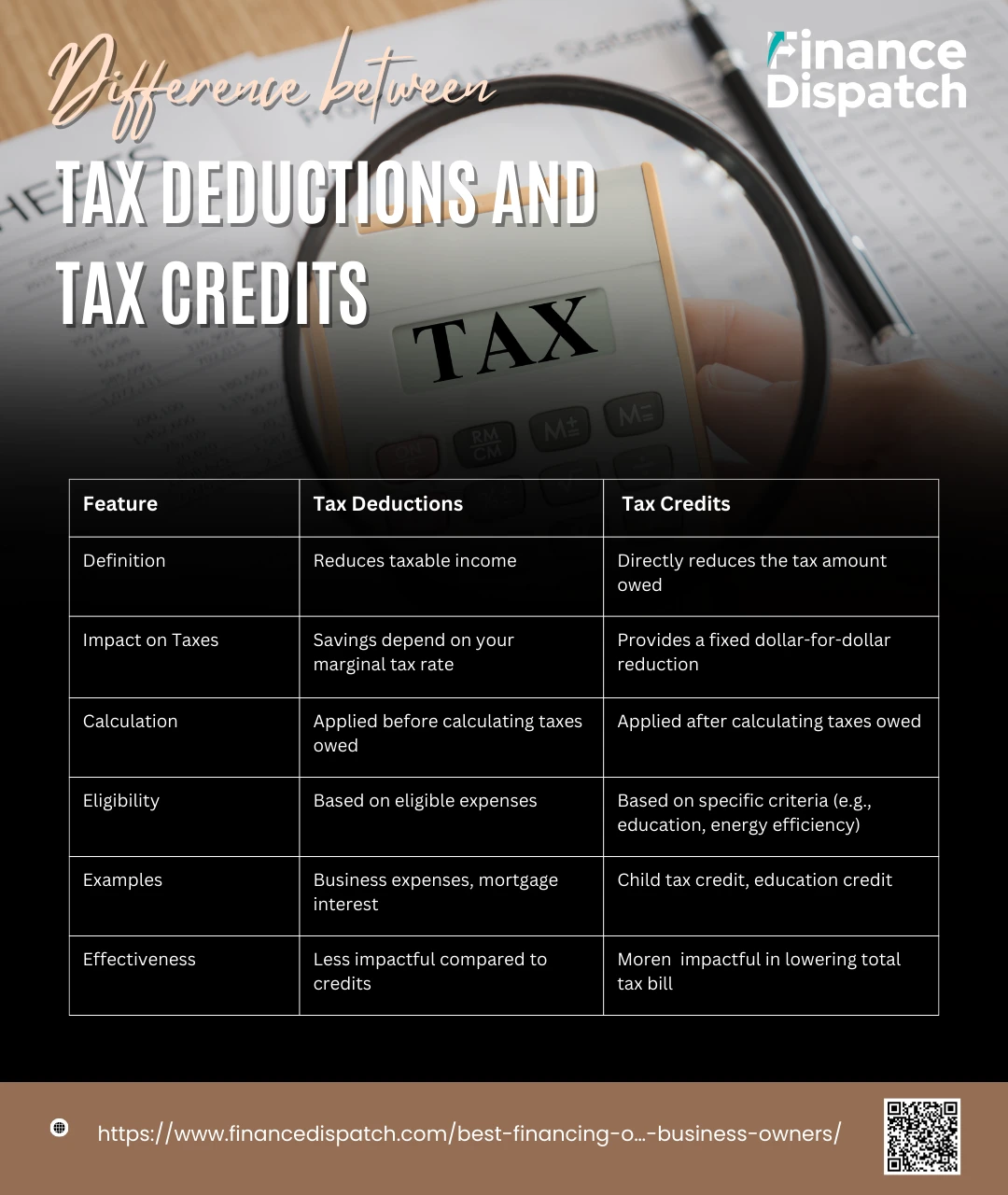

Tax deductions and tax credits both help reduce the amount of taxes you owe, but they work in fundamentally different ways. A tax deduction reduces your taxable income, which indirectly lowers your tax bill based on your tax rate. In contrast, a tax credit directly reduces your tax liability dollar-for-dollar, making it more impactful in lowering your total tax bill. Understanding the distinction between the two is essential for maximizing tax savings and effectively planning finances.

| Feature | Tax Deductions | Tax Credits |

| Definition | Reduces taxable income | Directly reduces the tax amount owed |

| Impact on Taxes | Savings depend on your marginal tax rate | Provides a fixed dollar-for-dollar reduction |

| Calculation | Applied before calculating taxes owed | Applied after calculating taxes owed |

| Eligibility | Based on eligible expenses | Based on specific criteria (e.g., education, energy efficiency) |

| Examples | Business expenses, mortgage interest | Child tax credit, education credit |

| Effectiveness | Less impactful compared to credits | More impactful in lowering total tax bill |

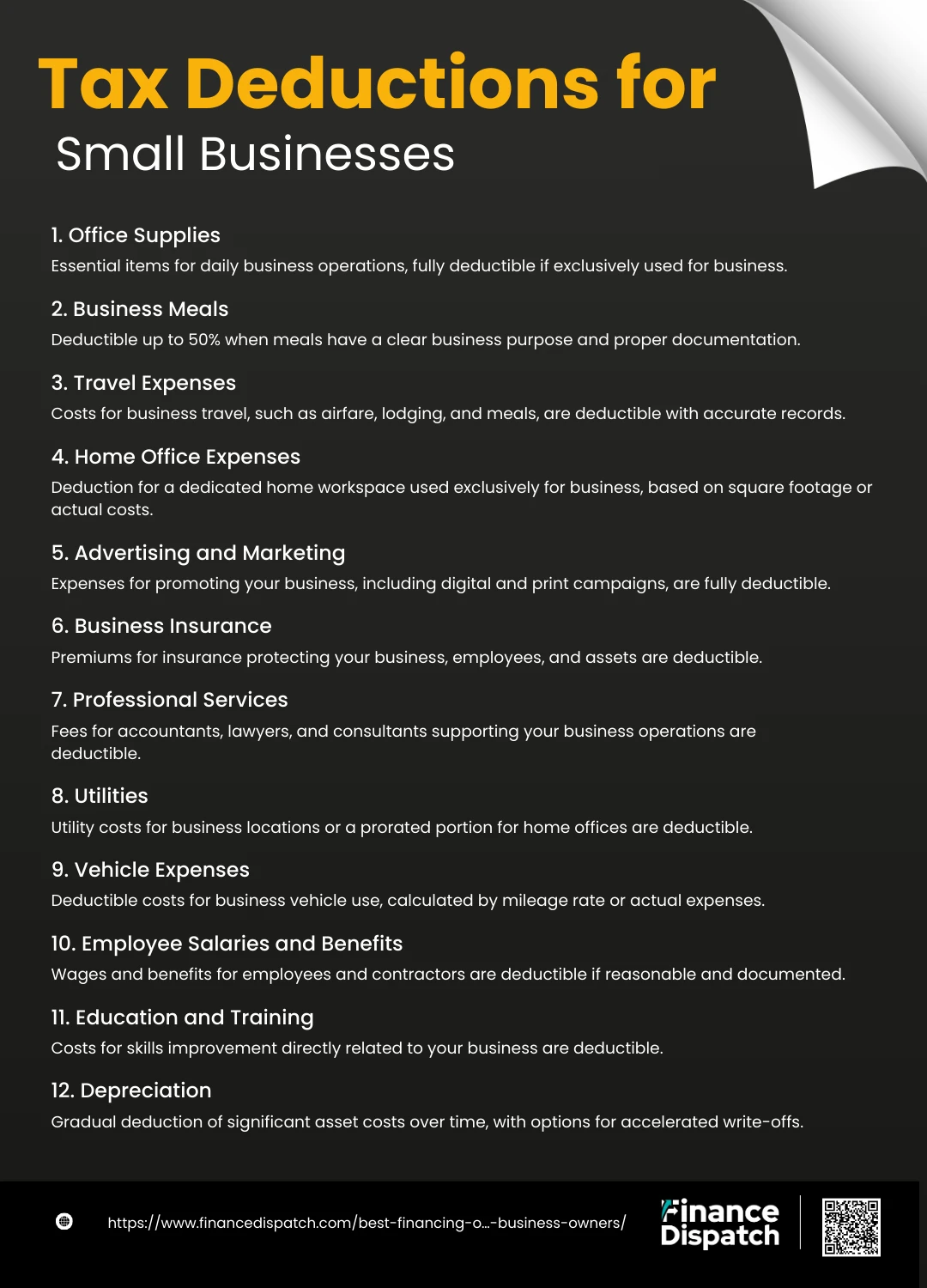

Tax Deductions for Small Businesses

Small businesses can significantly lower their tax liabilities by identifying and claiming common deductible expenses. These expenses cover various operational costs that are deemed both ordinary and necessary for running a business. By staying informed and keeping accurate records, small business owners can maximize their deductions and retain more revenue for growth.

1. Office Supplies

These are essential items needed for the daily operations of your business. Examples include stationery, notebooks, pens, paper, printer ink, and even more significant purchases like printers or filing cabinets. As long as these supplies are used exclusively for business purposes, they are fully deductible in the year they are purchased.

2. Business Meals

Business-related meals with clients, prospects, or employees are deductible, typically up to 50% of the total cost. To qualify, the meal must have a clear business purpose, and either you or a business representative must be present. Keep detailed records, including the receipt, the date, the location, and the purpose of the meeting.

3. Travel Expenses

Expenses incurred while traveling for business purposes can be deducted. These include airfare, lodging, car rentals, parking fees, and meals during travel. Travel must be primarily for business, and personal activities during the trip must not exceed business-related activities. Proper documentation, such as receipts and a log of the trip’s purpose, is essential.

4. Home Office Expenses

If you work from a dedicated space in your home used exclusively and regularly for your business, you can claim a portion of home-related expenses. This includes rent or mortgage interest, utilities, property taxes, insurance, and maintenance costs. The deduction can be calculated using the simplified method ($5 per square foot, up to 300 square feet) or the standard method (actual expenses prorated by the percentage of home used for business).

5. Advertising and Marketing

Promoting your business is crucial for growth, and the associated costs are deductible. This includes expenses for digital advertising, social media campaigns, printed flyers, business cards, brochures, sponsorships, and even website development and maintenance. These deductions ensure that your marketing investments contribute to your bottom line.

6. Business Insurance

Premiums for various types of insurance required to protect your business are deductible. Common examples include liability insurance, property insurance, health insurance for employees, and workers’ compensation insurance. Additionally, specialized insurance like cyber liability or business interruption insurance can also be deducted.

7. Advertising and Marketing

The fees you pay to external professionals who support your business are deductible. This includes accountants, lawyers, bookkeepers, tax preparers, consultants, and other experts. These services are considered ordinary and necessary expenses for maintaining and growing your business.

8. Utilities

Utility costs, such as electricity, water, internet, and phone services, are deductible for your business location. If you run your business from home, you can deduct a portion of these costs based on the percentage of your home used for business purposes. Accurate records are vital for splitting personal and business use.

9. Vehicle Expenses

If you use a car or another vehicle for business purposes, you can deduct related expenses. There are two methods to calculate this: the standard mileage rate, which for 2024 is $0.67 per mile, or the actual expense method, which includes costs for gas, maintenance, insurance, and depreciation. Keep a mileage log and detailed records to support your claim.

10. Employee Salaries and Benefits

The wages you pay to your employees are deductible, as well as benefits like health insurance, retirement contributions, and vacation pay. To qualify, the salary must be reasonable and for services actually rendered. Payments to independent contractors may also qualify, provided proper documentation, such as 1099 forms, is submitted.

11. Education and Training

Costs associated with improving your skills or those of your employees are deductible. Examples include fees for attending workshops, webinars, conferences, certification courses, and subscriptions to industry-related publications. These expenses must be directly related to your business and aimed at enhancing expertise in your field.

12. Depreciation

Depreciation accounts for the gradual loss of value of significant business assets, such as machinery, vehicles, and office furniture, over time. Instead of deducting the full cost in the year of purchase, depreciation allows you to spread the expense across the asset’s useful life. Specific rules, like Section 179 or bonus depreciation, can allow immediate write-offs for certain assets, depending on your business needs.

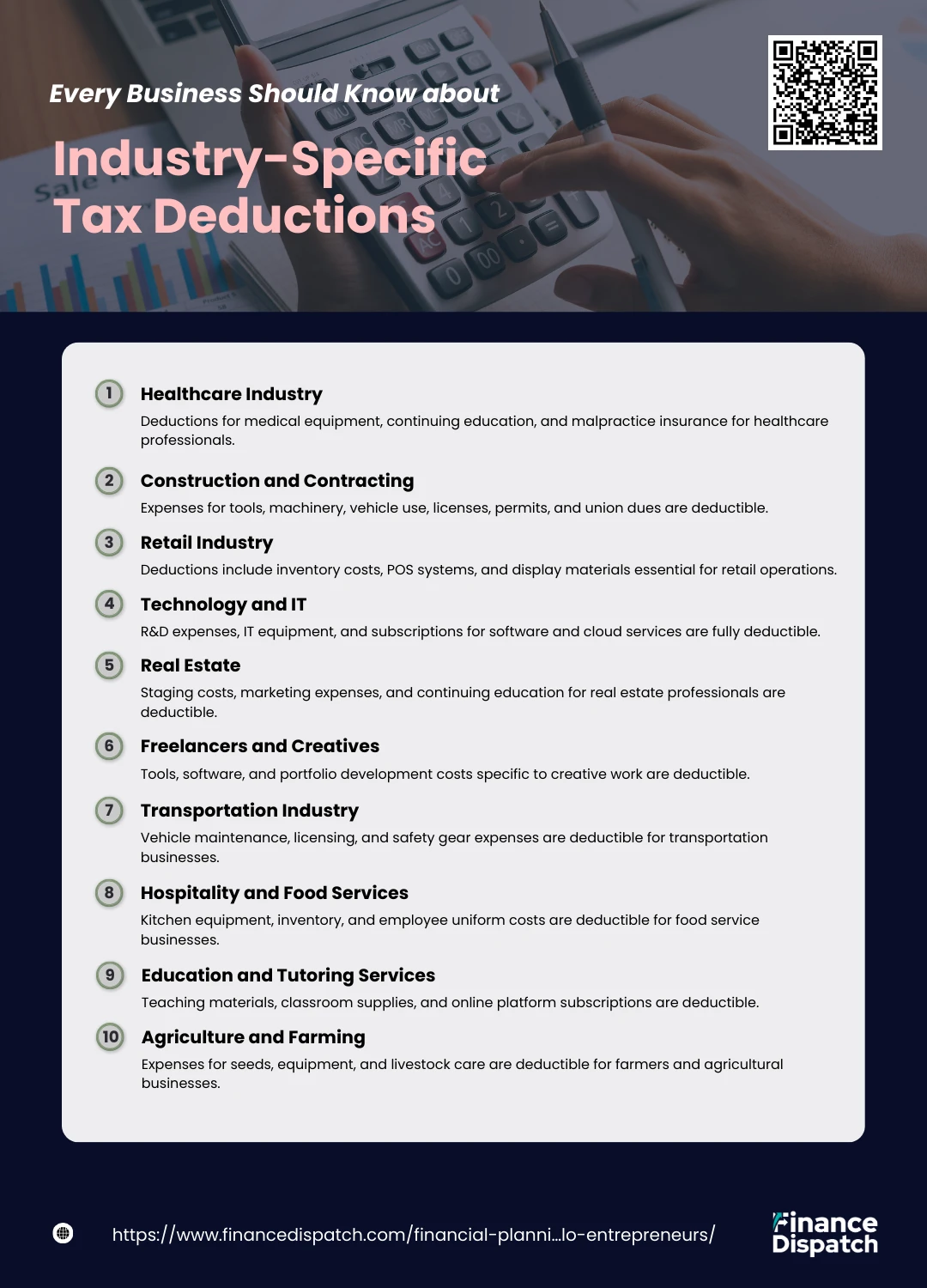

Industry-Specific Tax Deductions Every Business Should Know

Industry-specific tax deductions are tailored to address the unique needs and expenses of different sectors, providing targeted relief and encouraging growth. These deductions help businesses in specific industries reduce their tax burdens by acknowledging costs that are particular to their operations. Knowing the deductions specific to your industry ensures that you don’t miss out on valuable opportunities to save.

1. Healthcare Industry

Healthcare professionals incur unique expenses essential to their practice. Deductions include costs for medical equipment like stethoscopes, diagnostic tools, and lab coats. Continuing education, such as specialized certifications or workshops to maintain licensing, is also deductible. Additionally, malpractice insurance premiums, often significant in this field, are fully deductible as a necessary business expense.

2. Construction and Contracting

In the construction industry, tools and machinery are critical to completing projects and are fully deductible, whether they’re hand tools or larger equipment like forklifts. Vehicle expenses for transporting materials and tools to job sites can be claimed, either through mileage rates or actual expenses. Expenses for licenses, permits, and union dues specific to the trade are also considered ordinary and necessary deductions.

3. Retail Industry

Retailers benefit from deductions tied to their inventory, including costs for purchasing goods and accounting for shrinkage (loss from theft or damage). Investments in point-of-sale (POS) systems, software, and display materials like shelving or mannequins to showcase products are also deductible. These deductions support the operational and promotional aspects of retail businesses.

4. Technology and IT

For technology-focused businesses, research and development (R&D) expenses related to creating new products or software are a significant deduction. Subscriptions for cloud storage, cybersecurity, or SaaS platforms directly used in the business are fully deductible. Specialized IT equipment, such as servers, routers, and data storage solutions, also qualify, ensuring these businesses remain competitive and secure.

5. Real Estate

Real estate professionals can deduct costs associated with staging properties, including furniture rentals and professional photography for listings. Marketing expenses for open houses, advertisements, and promotional materials are also deductible. Continuing education costs, such as renewing real estate licenses or attending training sessions, further reduce tax liabilities for agents and brokers.

6. Freelancers and Creatives

Freelancers and creative professionals, such as artists, photographers, and designers, can claim deductions for tools and software specific to their craft, like Adobe Creative Suite or Canva subscriptions. Art supplies, cameras, or musical instruments purchased for professional use are deductible. Expenses incurred for portfolio development, including website hosting or printing physical portfolios, also qualify.

7. Transportation Industry

Businesses in the transportation sector can deduct costs for maintaining and fueling commercial vehicles. This includes repairs, tires, oil changes, and cleaning services. Licensing and permits required for operating commercial vehicles are also deductible. Uniforms and safety gear mandated by the job are additional deductible expenses.

8. Hospitality and Food Services

Restaurants, cafes, and other food service providers can deduct costs for kitchen equipment, utensils, and appliances. Inventory expenses for purchasing raw food and beverages are deductible as they are essential to operations. Employee uniforms and the associated cleaning or laundering costs also qualify as deductions.

9. Education and Tutoring Services

Educators and tutors can deduct expenses for materials like textbooks, workbooks, and flashcards used in their teaching. Classroom supplies, such as whiteboards, markers, and teaching aids, are also deductible. Subscriptions for online platforms and tools used for virtual teaching, like Zoom or specialized educational software, are considered business expenses.

10. Agriculture and Farming

Farmers and agricultural businesses can deduct costs related to their crops, including seeds, fertilizers, and pesticides. Equipment used in farming, such as tractors and irrigation systems, qualifies for depreciation or immediate deductions under Section 179. Livestock-related expenses, such as feed, veterinary services, and breeding costs, are also eligible for deduction.

Common Mistakes to Avoid

When claiming tax deductions, small business owners often make mistakes that can lead to missed opportunities, audits, or penalties. These errors typically stem from a lack of proper documentation, misclassification of expenses, or misunderstanding tax laws. By being aware of common pitfalls, you can ensure accurate filings and maximize your deductions.

1. Failing to Keep Proper Records

Neglecting to maintain organized receipts and documentation can result in disallowed deductions during an audit. Use digital tools or accounting software to track expenses and store receipts.

2. Mixing Personal and Business Expenses

Combining personal and business expenditures makes it difficult to substantiate deductions. Always maintain separate accounts for business transactions to avoid confusion and potential legal issues.

3. Not Classifying Employees Correctly

Misclassifying workers as independent contractors instead of employees can lead to penalties. Ensure proper classification based on the IRS guidelines.

4. Overlooking Small Deductions

Expenses like bank fees, software subscriptions, or office supplies may seem minor but can add up. Track all small business-related expenses to maximize deductions.

5. Claiming Ineligible Expenses

Some expenses, like personal meals or lavish entertainment, are not deductible. Ensure all claimed deductions meet the IRS criteria of being “ordinary and necessary” for your business.

6. Misunderstanding Home Office Deductions

Claiming a home office deduction without meeting the exclusive and regular use criteria can trigger an audit. Only dedicate and claim a clearly defined space used solely for business.

7. Failing to Track Mileage Accurately

Inaccurate or estimated mileage logs for business vehicle use can result in rejected claims. Use apps or maintain a detailed logbook to record all business-related travel.

8. Neglecting to Depreciate Assets

Larger business purchases like equipment or furniture often require depreciation rather than full deduction in the year of purchase. Missing depreciation schedules can lead to overpayments.

9. Missing Deadlines

Filing taxes late or missing deadlines for quarterly estimated payments can incur penalties. Stay on top of filing dates and set reminders to avoid unnecessary fees.

10. Skipping Professional Advice

Attempting to navigate complex tax laws without expert help can lead to costly errors. Work with a CPA or tax professional to ensure compliance and optimize deductions.

How to Maximizing Tax Deductions

Maximizing tax deductions is essential for small business owners who want to reduce their tax liability and reinvest savings into their business. To do this effectively, you need to understand applicable deductions, maintain accurate records, and use strategic planning throughout the year. Here are actionable tips to ensure you take full advantage of every deduction available.

1. Maintain Organized Records

Keep detailed records of all business transactions, including receipts, invoices, and bank statements. Using accounting software or apps can streamline this process and ensure nothing is overlooked.

2. Separate Personal and Business Finances

Open a dedicated business bank account and credit card to clearly differentiate personal and business expenses. This simplifies tracking and reduces the risk of errors during tax filing.

3. Track Business Mileage

Use a mileage tracking app or logbook to document business-related travel. Record the date, purpose, destination, and miles traveled to claim vehicle expenses accurately.

4. Use the Right Deduction Methods

Evaluate whether the simplified or actual expense method works better for deductions like home office or vehicle expenses. Choose the option that maximizes your savings.

5. Leverage Depreciation for Large Purchases

For big-ticket items like equipment or machinery, take advantage of depreciation rules or Section 179 expensing to spread out or immediately claim costs.

6. Document Business Meals Thoroughly

When claiming meal expenses, note the date, location, business purpose, and attendees. Retain receipts to substantiate these deductions in case of an audit.

7. Invest in Professional Advice

Work with a CPA or tax professional who understands your industry and can help identify less obvious deductions. Their expertise can save you time and money.

8. Claim Industry-Specific Deductions

Research deductions unique to your field, such as R&D credits for tech companies or equipment costs for contractors. These targeted deductions can significantly reduce taxable income.

9. Plan for Retirement Contributions

Set up a retirement plan, such as a SEP IRA or solo 401(k), and contribute regularly. These contributions not only secure your future but also lower your taxable income.

10. Review Tax Laws Annually

Stay updated on changes to tax regulations that could impact your deductions. Tax laws evolve frequently, and missing updates can result in lost opportunities.

11. Take Advantage of Year-End Planning

Before the tax year closes, review your expenses and consider making necessary purchases or paying for services in advance to maximize current-year deductions.

12. Bundle Expenses Strategically

If possible, group deductible expenses into one tax year to exceed thresholds, such as for medical or education costs, and maximize the deduction’s impact.

Tools and Resources for Small Businesses

Managing taxes and deductions effectively requires the right tools and resources, especially for small business owners juggling multiple responsibilities. From accounting software to educational materials, leveraging these tools can streamline operations, reduce errors, and save time. Here are some essential tools and resources to help small businesses manage their finances and maximize tax efficiency.

- Accounting Software: Platforms like QuickBooks, Xero, and Wave simplify tracking income, expenses, and deductions. These tools also generate reports, making tax preparation more straightforward.

- Mileage Tracking Apps: Apps such as MileIQ and Everlance automatically log business mileage, helping you maximize vehicle expense deductions with accurate records.

- Tax Preparation Software: Solutions like TurboTax Self-Employed or H&R Block provide step-by-step guidance tailored to small businesses, ensuring compliance and optimized deductions.

- Online Bookkeeping Services: Services like Bench or Bookkeeper360 offer professional bookkeeping support, helping small business owners maintain accurate financial records year-round.

- Expense Tracking Tools: Apps like Expensify and Zoho Expense allow you to easily track and categorize expenses, capture receipts, and generate detailed reports for tax purposes.

- Educational Resources: Websites like the IRS Small Business and Self-Employed Tax Center provide valuable insights into tax laws, deductions, and credits specific to small businesses.

- Payroll Management Software: Tools such as Gusto and ADP help manage payroll, calculate taxes, and ensure compliance with state and federal requirements, simplifying employee management.

- Tax Consultation Services: Working with CPAs or tax advisors experienced in small business taxation ensures personalized advice, compliance, and strategies to maximize savings.

- Time Tracking Software: Tools like Toggl or TSheets help monitor billable hours and allocate costs for client-based projects, making it easier to track and deduct work-related expenses.

- Business Budgeting Tools: Software like PlanGuru or Microsoft Excel helps you create financial forecasts, plan budgets, and monitor cash flow, aiding in better financial decision-making.

- Cloud Storage Solutions: Services like Google Drive and Dropbox allow you to securely store financial documents, receipts, and tax records, ensuring easy access during tax season.

- Industry-Specific Tools: Some industries have specialized tools, such as construction management software for contractors or inventory systems for retail businesses, which can also help track deductible expenses.

Conclusion

Effectively managing taxes and maximizing deductions is a cornerstone of financial success for small businesses. By understanding the tax system, leveraging available tools, and staying informed about industry-specific deductions, you can reduce your tax liabilities and reinvest savings back into your business. Maintaining accurate records, seeking professional advice, and staying proactive throughout the year are essential steps to avoid common pitfalls and ensure compliance. With a strategic approach to taxes, you can not only optimize your financial health but also position your business for long-term growth and stability.

Purpose of tax deductions

- Lower Tax Liability: Deductions reduce the amount of income subject to taxes, enabling businesses to pay less overall.

- Encourage Business Growth: By allowing businesses to keep more of their earnings, deductions provide extra capital for reinvestment in equipment, technology, or personnel.

- Support Compliance: Clear guidelines on deductions help business owners stay compliant with tax regulations, reducing the risk of penalties or audits.

- Boost Financial Health: Retaining more income supports long-term stability, ensuring businesses can manage operational costs effectively.

- Encourage Economic Development: Deductions incentivize spending on business operations, indirectly boosting the economy by fostering innovation and job creation.