When you step into the world of cryptocurrency, terms like “coins” and “tokens” are often thrown around interchangeably, creating confusion for newcomers and even some seasoned investors. But here’s the thing: while they might seem similar at first glance, coins and tokens play distinct roles in the crypto ecosystem. Coins operate on their own blockchain and act primarily as digital currencies, while tokens are built on existing blockchains and offer a wide range of functionalities beyond just transactions. Understanding the difference between these two digital assets isn’t just technical trivia—it’s essential for making informed investment decisions, navigating blockchain platforms, and fully grasping how value moves in the digital economy. In this article, you’ll uncover the key differences between tokens and coins, breaking down complex concepts into simple insights you can actually use.

What are Coins in Cryptocurrency?

In cryptocurrency, coins are digital assets that operate on their own independent blockchain. Think of Bitcoin, Ethereum, or Litecoin—they each have their dedicated blockchain networks where transactions are verified and recorded. Coins are primarily designed to function as a medium of exchange, similar to traditional currencies, allowing you to buy goods, services, or transfer value across the globe without intermediaries. Beyond their role in transactions, coins often serve as a store of value, with many investors holding them in hopes of future price appreciation. What sets coins apart is their deep integration into their respective blockchains—they aren’t just digital money but also play a crucial role in maintaining the security and operation of their networks. For example, Bitcoin relies on proof-of-work mining, while Ethereum has shifted to a proof-of-stake model to validate transactions and maintain blockchain integrity. Simply put, if an asset operates on its own blockchain and drives its functionality, it’s a coin.

What are Tokens in Cryptocurrency?

In the world of cryptocurrency, tokens are digital assets that are built on top of an existing blockchain, rather than having their own independent network. The Ethereum blockchain is one of the most popular platforms for creating tokens, with standards like ERC-20 and ERC-721 enabling developers to design tokens for various purposes. Unlike coins, which primarily act as digital currencies, tokens serve a wider range of functions. They can represent ownership of assets, provide access to specific services or platforms, or even grant voting rights in decentralized projects. For example, utility tokens give users access to specific features within an application, while governance tokens allow holders to participate in decision-making processes. Tokens can also represent real-world assets, like real estate or stocks, through tokenization. They are often issued through mechanisms like Initial Coin Offerings (ICOs) as a way for projects to raise funds. In short, tokens are incredibly versatile, acting as tools that power decentralized applications (dApps) and bridge the gap between digital and real-world assets.

Key Differences between Coins and Tokens

At first glance, coins and tokens might seem similar because both are digital assets operating within the cryptocurrency ecosystem. However, their core functions and technical foundations set them apart. Coins are native to their own blockchains and primarily act as a medium of exchange or store of value. On the other hand, tokens are built on existing blockchains and serve a variety of purposes, including representing assets, enabling governance, or granting access to platform-specific services. Understanding these differences is crucial for navigating the crypto space effectively, whether you’re investing, trading, or simply exploring blockchain technology.

| Aspect | Coins | Tokens |

| Blockchain | Have their own blockchain | Built on an existing blockchain |

| Primary Purpose | Medium of exchange and store of value | Serve utility, governance, or asset representation |

| Creation Process | Requires developing a new blockchain | Created using smart contracts |

| Examples | Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) | Tether (USDT), Chainlink (LINK), Uniswap (UNI) |

| Transaction Fees | Paid in the native coin | Paid in the blockchain’s native coin |

| Use Cases | Digital currency, payments, staking | Access to dApps, governance, asset representation |

| Complexity | More complex to create | Easier and cheaper to create |

| Volatility | Generally more stable | Tend to be more volatile |

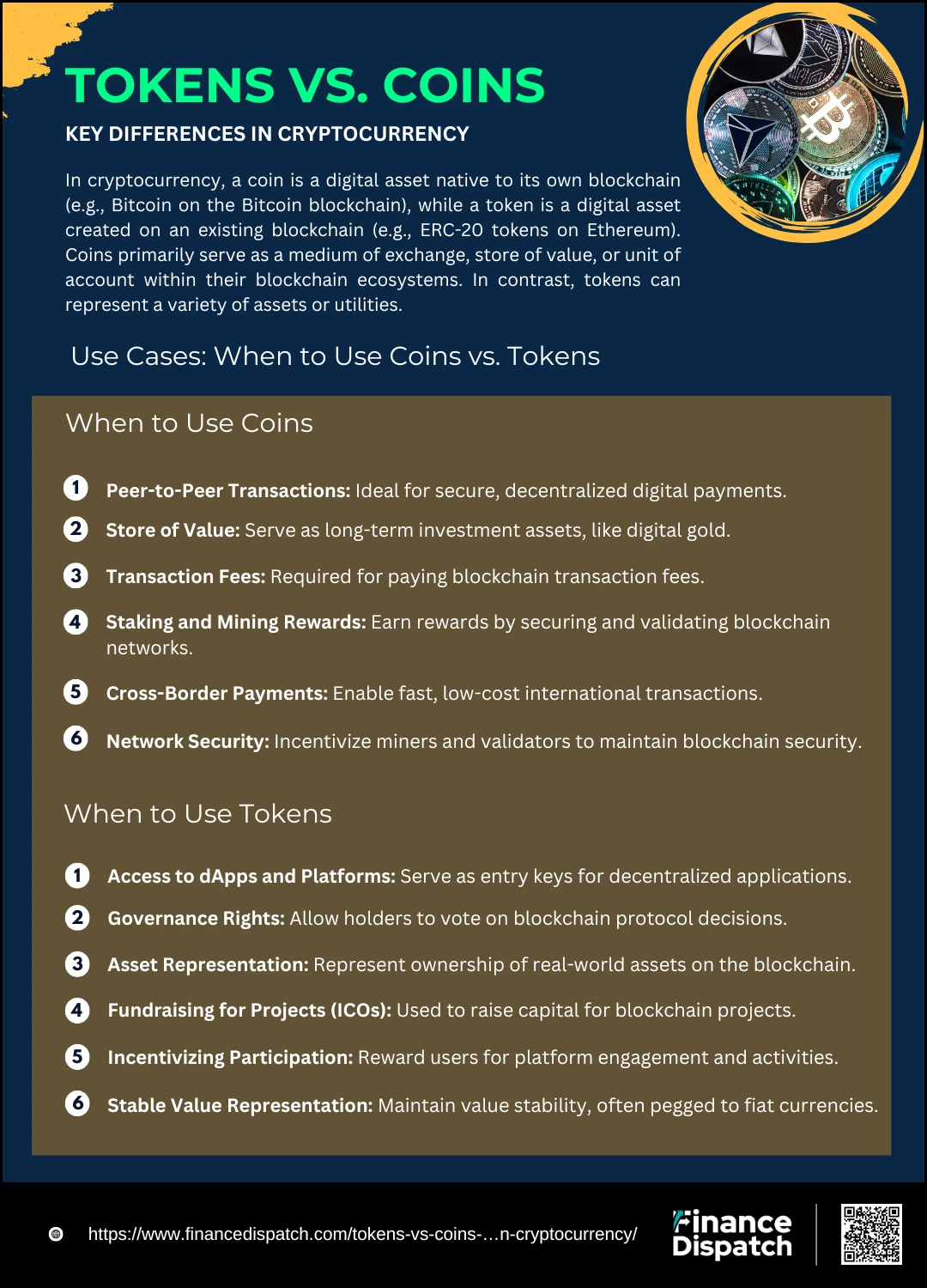

Use Cases: When to Use Coins vs. Tokens

In the cryptocurrency world, both coins and tokens serve unique purposes, each excelling in different scenarios. Coins, being native to their own blockchains, are primarily used for financial transactions, store of value, and powering blockchain networks. On the other hand, tokens, built on existing blockchains, offer more versatility, including access to decentralized services, governance rights, and representation of real-world assets. Knowing when to use a coin versus a token depends on your specific goals—whether you’re making a simple payment, investing, participating in a blockchain project, or accessing exclusive platform services. Below are common use cases for both coins and tokens to help you understand their roles better.

When to Use Coins

1. Peer-to-Peer Transactions

Coins are primarily designed as a digital currency for secure and decentralized transactions. For example, Bitcoin (BTC) can be used for direct peer-to-peer payments, eliminating the need for intermediaries like banks or payment processors. This makes coins an ideal choice for international transfers, reducing costs and delays associated with traditional financial systems.

2. Store of Value

Coins like Bitcoin (BTC) are often referred to as “digital gold” because they serve as a store of value. Investors hold these coins to hedge against inflation, economic instability, or fiat currency devaluation. Their limited supply (e.g., Bitcoin’s 21 million coin cap) often drives their value over time, making them attractive for long-term investment.

3. Transaction Fees

Native coins are essential for paying transaction fees on their respective blockchains. For example, Ethereum (ETH) is required to pay gas fees when executing transactions or interacting with decentralized applications (dApps) on the Ethereum network.

4. Staking and Mining Rewards

Many blockchain networks, like Cardano (ADA) and Ethereum (ETH), reward users with coins for participating in staking or mining activities. By staking coins or contributing computational power, users help secure the network and validate transactions, earning rewards in return.

5. Cross-Border Payments

Coins simplify cross-border transactions, enabling quick and low-cost international payments compared to traditional banking systems. Cryptocurrencies like Ripple (XRP) are specifically designed to make cross-border payments seamless and efficient.

6. Network Security

Coins are critical for maintaining blockchain security. Networks using Proof of Work (PoW) or Proof of Stake (PoS) consensus mechanisms rely on native coins to incentivize miners and validators, ensuring the blockchain remains secure and tamper-proof.

When to Use Tokens

1. Access to dApps and Platforms

Tokens are often used as a gateway to decentralized applications (dApps). For example, UNI (Uniswap) tokens allow users to interact with the Uniswap platform, providing liquidity, trading assets, or accessing specific platform features. Without these tokens, many dApps remain inaccessible.

2. Governance Rights

Governance tokens, like MakerDAO’s MKR, allow holders to participate in protocol governance. This includes voting on proposals, budget allocations, or network upgrades. Holding governance tokens gives you a voice in shaping the direction of a blockchain project.

3. Asset Representation

Tokens can be used to represent real-world assets on the blockchain. For instance, they can represent ownership of real estate, artwork, stocks, or bonds. This process, known as tokenization, allows for greater transparency, liquidity, and ease of transferring asset ownership.

4. Fundraising for Projects (ICOs)

Tokens are commonly used for raising funds through Initial Coin Offerings (ICOs). During an ICO, a blockchain project issues tokens to early investors in exchange for funding. These tokens often provide future utility within the project’s ecosystem.

5. Incentivizing Participation

Tokens are often used as rewards for participation in blockchain platforms. For example, users might receive tokens for staking assets, providing liquidity, completing tasks, or voting on governance proposals. This creates an ecosystem where active participants are incentivized and rewarded.

6. Stable Value Representation

Stablecoins, like USDT (Tether) and USDC (USD Coin), are tokens designed to maintain a stable value by being pegged to fiat currencies like the US dollar. These tokens are commonly used in DeFi protocols, cross-border transactions, and as a safe haven during market volatility.

Advantages and Disadvantages of Coins and Tokens

When diving into the cryptocurrency space, it’s crucial to understand the pros and cons of coins and tokens. While coins excel as a form of digital currency with independent blockchains, tokens stand out for their versatility and use cases on existing blockchain platforms. However, both have their limitations. Coins often require more complex infrastructure and can be less flexible than tokens. Meanwhile, tokens rely on the performance and stability of the underlying blockchain. Below, we’ll explore the advantages and disadvantages of both coins and tokens to help you weigh their strengths and weaknesses.

Advantages of Coins

1. Independence: Coins operate on their own blockchain, giving them complete control over their network’s rules, protocols, and functionality. This independence ensures stability and the ability to scale without relying on third-party platforms.

2. Security: Blockchain networks supporting coins, such as Bitcoin (BTC) and Ethereum (ETH), are built with robust security mechanisms like Proof of Work (PoW) or Proof of Stake (PoS). These security measures reduce vulnerabilities and ensure trustless, secure transactions.

3. Widespread Adoption: Major coins are widely accepted for transactions, payments, and online purchases. Many global businesses and platforms, such as PayPal and Tesla, recognize coins like Bitcoin as legitimate payment options.

4. Stability: Compared to tokens, established coins generally experience less volatility. Coins like Bitcoin (BTC) and Ethereum (ETH) have stronger market positions, reducing their exposure to short-term price swings.

5. Investment Potential: Coins are often viewed as long-term investments or stores of value, especially Bitcoin, which is frequently referred to as “digital gold.” Their limited supply and high adoption rate often drive long-term value appreciation.

Disadvantages of Coins

1. Complex Creation Process: Developing a cryptocurrency coin requires building an entire blockchain infrastructure from scratch. This process is technically demanding, resource-intensive, and costly.

2. Limited Use Cases: Coins are primarily used for transactions, payments, and store of value, limiting their functionality compared to the wide range of applications possible with tokens.

3. Scalability Challenges: Many coins face scalability issues, especially during high network activity. For instance, Ethereum’s high gas fees and Bitcoin’s slow transaction speed can hinder mass adoption.

4. Energy Consumption: Coins utilizing Proof of Work (PoW) consensus mechanisms, such as Bitcoin, often require massive amounts of energy for mining operations, raising concerns about their environmental impact.

Advantages of Tokens

1. Ease of Creation: Tokens can be easily created on existing platforms like Ethereum (ERC-20) or Binance Smart Chain (BEP-20) using smart contracts. This significantly reduces technical complexity and cost.

2. Versatility: Tokens can serve multiple purposes, from enabling transactions on decentralized apps (dApps) to representing real-world assets, granting governance rights, or functioning as in-app currencies.

3. Cost-Effective: Since tokens rely on an existing blockchain infrastructure, there’s no need to build an entirely new network. This makes token creation a cheaper and faster process.

4. Innovation-Friendly: Tokens drive innovation across blockchain ecosystems, particularly in sectors like Decentralized Finance (DeFi), gaming, NFTs, and governance protocols.

5. Interoperability: Tokens can often interact seamlessly across different applications on the same blockchain network, enhancing their usability and adoption across multiple platforms.

Disadvantages of Tokens

1. Dependence on Blockchain: Tokens are heavily reliant on the performance and stability of their host blockchain. If the host network experiences congestion, downtime, or security breaches, tokens are directly affected.

2. Volatility: Many tokens, especially those tied to new projects or ICOs, are subject to extreme price volatility due to speculation, low liquidity, or limited real-world use cases.

3. Limited Liquidity: Tokens often suffer from low liquidity, especially when tied to niche projects or ecosystems with limited adoption and active users.

3. Regulatory Risks: Tokens issued via Initial Coin Offerings (ICOs) or Security Token Offerings (STOs) are under increasing regulatory scrutiny, especially when classified as securities.

4. Scalability Constraints: Tokens inherit the limitations of their underlying blockchain. For example, if an Ethereum-based token faces congestion on the network, transaction fees and processing times increase significantly.

Real-World Examples of Coins and Tokens

Understanding the difference between coins and tokens becomes clearer through real-world examples. Coins, like Bitcoin (BTC) and Ethereum (ETH), operate on their own blockchains and are primarily used for transactions, network fees, and as a store of value. In contrast, tokens, like Tether (USDT) and Uniswap (UNI), are built on existing blockchains and serve specific purposes, such as enabling access to dApps, representing assets, or granting governance rights.

Examples of Coins:

- Bitcoin (BTC): Digital gold and a global payment system.

- Ethereum (ETH): Powers transactions and smart contracts on the Ethereum blockchain.

- Litecoin (LTC): Fast and cost-effective digital payments.

- Ripple (XRP): Streamlined cross-border transactions.

- Cardano (ADA): Supports staking and smart contract operations.

Examples of Tokens:

- Tether (USDT): Stablecoin pegged to the US dollar, used in trading.

- Chainlink (LINK): Connects smart contracts with real-world data.

- Uniswap (UNI): Governance token for Uniswap’s decentralized exchange.

- Shiba Inu (SHIB): Meme token with utility in the ShibaSwap ecosystem.

- Decentraland (MANA): Virtual currency for purchasing assets in the metaverse.

How to Decide Between Coins and Tokens for Investment

When stepping into the world of cryptocurrency investment, deciding between coins and tokens can be a challenging task. Both serve unique purposes and carry their own set of opportunities and risks. Coins, like Bitcoin (BTC) and Ethereum (ETH), operate on their own blockchain networks and are primarily used for transactions, store of value, and securing blockchain operations. On the other hand, tokens, such as Tether (USDT) and Uniswap (UNI), are built on existing blockchain platforms and are often tied to specific applications, governance rights, or real-world assets. Choosing the right one depends on your investment strategy, risk appetite, and understanding of their use cases. Below are the key steps to help you make an informed decision.

1. Identify Your Investment Goals

Start by defining what you aim to achieve with your investment. If you’re looking for a long-term store of value or a digital currency for transactions, coins like Bitcoin (BTC) or Ethereum (ETH) are strong choices. However, if you want to participate in decentralized finance (DeFi) projects, gain voting rights in blockchain governance, or access specific features of decentralized applications (dApps), tokens are often the better option.

2. Understand the Underlying Blockchain

Coins operate on their own blockchain, offering more control over network protocols and security. Tokens, however, rely on host blockchains like Ethereum (ERC-20 tokens) or Binance Smart Chain (BEP-20 tokens). The performance, scalability, and security of the host blockchain will directly affect the token’s value and reliability.

3. Analyze the Use Case and Utility

Evaluate the real-world use case of the coin or token. Coins are primarily used for payments, network fees, and staking rewards, while tokens can represent ownership, access to services, or even real-world assets. For example, UNI tokens allow governance participation on the Uniswap platform, while USDT tokens are stablecoins pegged to fiat currency.

4. Assess Market Adoption and Liquidity

Coins like Bitcoin and Ethereum enjoy global recognition, liquidity, and widespread adoption. Tokens, on the other hand, might be tied to niche projects and may lack the same level of market reach. Ensure the asset you’re considering has sufficient liquidity for buying and selling without large price fluctuations.

5. Evaluate the Team and Project Roadmap

For tokens, researching the team behind the project, their roadmap, and their vision is essential. Look for transparency, regular updates, and a clear plan for future growth. Coins generally have a more established infrastructure, but emerging altcoins may still require careful evaluation.

6. Understand the Risk-Reward Profile

Coins are often less volatile due to their established market presence, whereas tokens, especially those tied to newer projects, can be highly volatile. Tokens can offer high returns, but they also carry significant risks if the project fails to deliver on its promises.

7. Regulatory Compliance

Be aware of regulatory risks, especially with tokens issued through Initial Coin Offerings (ICOs) or Security Token Offerings (STOs). Coins typically have more established legal precedents, while tokens can fall under stricter regulatory scrutiny, depending on their functionality and classification.

8. Diversify Your Portfolio

Diversification is key to managing risks. A well-balanced portfolio might include established coins for stability and promising tokens for high-growth opportunities. This approach helps mitigate losses from underperforming assets while maximizing gains from successful projects.

9. Research Exchange Availability

Not all tokens are available on major exchanges, and some may have limited trading pairs. Coins are usually listed on most major exchanges, providing better liquidity and ease of trading.

10. Stay Informed and Updated

The cryptocurrency market evolves rapidly. Stay updated with market trends, project developments, and regulatory changes to adapt your investment strategy. Active engagement with community forums, news sources, and official updates can provide valuable insights.

Conclusion

Deciding between coins and tokens for your cryptocurrency investment ultimately depends on your goals, risk tolerance, and understanding of their utility. Coins, like Bitcoin (BTC) and Ethereum (ETH), offer stability, security, and a proven track record, making them ideal for long-term investments, global transactions, and as a store of value. On the other hand, tokens, such as Tether (USDT) and Uniswap (UNI), provide flexibility, specialized functions, and exposure to innovative blockchain projects, including DeFi platforms, governance systems, and asset tokenization. While coins serve as the backbone of blockchain networks, tokens unlock creative and functional possibilities within those ecosystems. A balanced investment strategy that includes both coins and tokens can help you mitigate risks while capturing growth opportunities. As the cryptocurrency space continues to evolve, staying informed, adaptable, and strategic will be the key to making sound investment decisions.