Cryptocurrency investing has come a long way from its early days of skepticism and volatility. In 2025, the digital asset market continues to evolve, offering a mix of established giants and promising newcomers that cater to both cautious investors and risk-tolerant enthusiasts. With market trends signaling long-term growth potential, choosing the right cryptocurrencies for holding has become more crucial than ever. In this article, we’ll explore the top cryptocurrencies poised for long-term success, highlighting their unique strengths, market performance, and growth potential. Whether you’re a seasoned crypto investor or just starting your journey, this guide will help you make informed decisions for building a resilient and profitable portfolio in 2025.

What Makes a Cryptocurrency Ideal for Long-Term Holding?

When it comes to long-term cryptocurrency holding, not all digital assets are created equal. While the crypto market offers countless opportunities, only a select few stand out as reliable choices for sustained growth over time. An ideal cryptocurrency for long-term holding goes beyond hype—it combines strong fundamentals, real-world utility, and a dedicated community. These key factors ensure that the asset can weather market volatility, adapt to changing trends, and deliver value over the years. Long-term holding requires patience, a clear understanding of the asset’s potential, and confidence in its ability to maintain relevance in an ever-evolving market. Below are the critical characteristics that make a cryptocurrency a strong candidate for long-term investment:

- Strong Utility and Real-World Use Cases: The cryptocurrency should serve a clear purpose or solve a significant problem, such as facilitating financial transactions, powering decentralized applications, or enhancing cross-border payments. A coin with a practical application is more likely to retain long-term demand and value.

- Robust Tokenomics: A well-designed token supply model, including limited supply or deflationary mechanisms, can help maintain and increase the asset’s value over time. Cryptocurrencies with capped supplies, like Bitcoin, often attract long-term investors seeking scarcity-driven value appreciation.

- Active Developer Community: A committed team of developers working on continuous improvements, security upgrades, and feature rollouts is crucial for long-term success. Regular updates and a proactive approach to solving problems ensure that the project stays competitive and relevant.

- Strategic Partnerships: Collaborations with established businesses, financial institutions, or technology firms can drive adoption, expand the user base, and enhance credibility. Partnerships also open avenues for integrating cryptocurrencies into real-world systems.

- Security and Transparency: A secure blockchain infrastructure, combined with transparent communication from the project team, builds investor confidence. Security breaches or a lack of transparency can significantly harm a cryptocurrency’s reputation and long-term prospects.

- Market Liquidity: High liquidity ensures that the cryptocurrency can be easily bought or sold without significant price fluctuations. Liquidity is often a sign of strong market interest and investor confidence.

- Resilience During Market Cycles: A strong long-term cryptocurrency can endure market downturns, adapt to changing regulations, and emerge stronger during bull cycles. Historical performance during past market crashes can often serve as an indicator of resilience.

- Community Support: An engaged and loyal community often drives adoption, awareness, and advocacy for the cryptocurrency. Strong community backing creates organic growth and minimizes the impact of external market factors.

- Clear Roadmap and Vision: A detailed, achievable roadmap with well-defined milestones indicates the project’s long-term goals and commitment to growth. Projects with a clear vision and transparent updates tend to instill more confidence in investors.

Top Cryptocurrencies for Long-Term Holding in 2025

The cryptocurrency market in 2025 continues to showcase a mix of well-established giants and promising newcomers, offering investors unique opportunities for long-term growth. With market trends indicating increased adoption, technological advancements, and growing institutional interest, selecting the right cryptocurrencies for long-term holding has never been more critical. Successful long-term investments often hinge on a project’s utility, scalability, developer activity, and resilience during market fluctuations. Below are the top cryptocurrencies that stand out as strong contenders for long-term holding in 2025:

1. Bitcoin (BTC)

Known as the original cryptocurrency, Bitcoin remains the most trusted digital asset in the market. With its limited supply of 21 million coins, increasing institutional adoption, and its role as “digital gold,” Bitcoin continues to serve as a reliable store of value and a hedge against inflation.

2. Ethereum (ETH)

As the largest platform for decentralized applications (dApps) and smart contracts, Ethereum remains a powerhouse in the blockchain space. Its transition to a Proof-of-Stake (PoS) consensus mechanism has improved scalability and reduced energy consumption, further solidifying its long-term potential.

3. Ripple (XRP)

XRP focuses on enabling fast, low-cost international payments. Backed by Ripple Labs, this cryptocurrency has established partnerships with financial institutions worldwide, positioning itself as a critical player in the cross-border payment industry.

4. Solana (SOL)

Renowned for its high-speed transactions and low fees, Solana has become a favorite for developers building decentralized applications and NFTs. Its robust infrastructure and growing ecosystem make it a strong contender for long-term holding.

5. Cardano (ADA)

Known for its scientific and peer-reviewed approach to blockchain technology, Cardano focuses on scalability, sustainability, and security. Its strong commitment to research-backed innovation sets it apart in the competitive blockchain landscape.

6. Polkadot (DOT)

Polkadot offers interoperability between different blockchains, allowing them to communicate and share information seamlessly. Its innovative approach to solving blockchain fragmentation makes it a valuable long-term investment.

7. Chainlink (LINK)

Chainlink serves as a bridge between blockchain technology and real-world data, enabling smart contracts to interact with external information. Its partnerships with major enterprises and its unique utility ensure strong long-term growth potential.

8. Avalanche (AVAX)

Known for its scalability and lightning-fast transactions, Avalanche is a key player in the decentralized finance (DeFi) space. Its ability to support multiple blockchain networks positions it for continued success.

9. Toncoin (TON)

Originally developed by Telegram, Toncoin has evolved into a robust blockchain network focusing on scalability and user-friendly applications. Its growing adoption makes it a cryptocurrency to watch in 2025.

10. Shiba Inu (SHIB)

While starting as a meme coin, Shiba Inu has grown into a larger ecosystem, including decentralized finance platforms and NFT projects. Its active community and ongoing development efforts keep it relevant for long-term holding.

Comparative Analysis of Top Cryptocurrencies

The cryptocurrency market is diverse and dynamic, with each asset offering unique strengths and characteristics. For investors and enthusiasts, understanding the comparative features of top cryptocurrencies can provide valuable insights for making informed decisions. From utility and scalability to adoption rates and market caps, a detailed analysis helps highlight which cryptocurrencies align with specific investment goals or use cases. Below is a comparative table showcasing key metrics and attributes of leading cryptocurrencies in 2025.

| Cryptocurrency | Key Feature | Market Cap (USD) | Use Case/Utility | Scalability | Consensus Mechanism | Launch Year |

| Bitcoin (BTC) | Digital Gold | $500B+ | Store of value, Inflation hedge | Moderate | Proof-of-Work (PoW) | 2009 |

| Ethereum (ETH) | Smart Contracts and dApps | $190B+ | Decentralized apps, DeFi, NFTs | High | Proof-of-Stake (PoS) | 2015 |

| Ripple (XRP) | Cross-Border Payments | $140B+ | Fast international transfers | High | Unique Consensus | 2012 |

| Solana (SOL) | High-Speed Transactions | $50B+ | dApps, NFTs, DeFi | Very High | Proof-of-History (PoH) | 2020 |

| Cardano (ADA) | Peer-Reviewed Blockchain | $40B+ | dApps, Smart Contracts | High | Proof-of-Stake (PoS) | 2017 |

| Polkadot (DOT) | Blockchain Interoperability | $30B+ | Multi-chain communication | High | Nominated Proof-of-Stake | 2020 |

| Chainlink (LINK) | Oracle Network | $15B+ | Smart contract data integration | Moderate | Hybrid Consensus | 2017 |

| Avalanche (AVAX) | Fast, Low-Cost Transactions | $20B+ | DeFi, Custom blockchains | Very High | Avalanche Consensus | 2020 |

| Toncoin (TON) | User-Friendly Blockchain | $15B+ | Scalable blockchain solutions | High | Proof-of-Stake (PoS) | 2018 |

| Shiba Inu (SHIB) | Meme Coin to Ecosystem | $16B+ | DeFi, NFTs, Community-driven | Moderate | Proof-of-Stake (PoS) | 2020 |

Emerging Cryptocurrencies to Watch in 2025

The cryptocurrency landscape in 2025 continues to evolve, with emerging digital assets capturing investor interest through innovative use cases, unique technologies, and growth potential. While established players like Bitcoin and Ethereum remain dominant, new cryptocurrencies are making waves with fresh approaches to scalability, security, and utility. These rising stars are not only challenging traditional market leaders but also creating new opportunities for long-term investment. Below are some of the most promising emerging cryptocurrencies to watch in 2025:

1. Qubetics (TICS)

Known for its innovative Layer-1 blockchain solutions, Qubetics aims to address scalability and developer adoption challenges. With tools like the QubeQode IDE, it simplifies blockchain development, making it accessible for both beginners and seasoned developers.

2. Superintelligence Alliance (ASI)

This AI-focused cryptocurrency combines the strengths of SingularityNET, Fetch.ai, and Ocean Protocol to revolutionize blockchain-based AI applications. Its integration across multiple platforms positions it as a leader in the AI-crypto convergence.

3. LuckHunter (LHUNT)

Focusing on the gaming and blockchain crossover, LuckHunter offers a platform where players can earn rewards and participate in staking. Its emphasis on gamified finance makes it a compelling choice for gaming enthusiasts and investors.

4. MoonBag (MBAG)

MoonBag is gaining traction in the decentralized finance (DeFi) space with automated portfolio management tools and yield farming opportunities. Its user-friendly interface attracts both casual and experienced investors.

5. Pepe Unchained (PEPE)

Building on the viral meme coin trend, Pepe Unchained has gained a loyal community and significant social media traction. Its ecosystem focuses on creating real utility for a traditionally speculative category of assets.

6. Thorchain (RUNE)

Thorchain is a decentralized liquidity protocol that enables seamless trading across blockchains. With its automated market maker (AMM) model, it’s becoming a key player in cross-chain exchanges.

7. Sei (SEI)

Sei is a blockchain designed for digital asset trading, offering ultra-fast transaction speeds and near-instant finality. Its focus on financial markets has drawn attention from institutional investors.

8. BlockDAG (BDAG)

Utilizing Directed Acyclic Graph (DAG) technology, BlockDAG addresses scalability challenges with impressive transaction throughput. Its innovative structure makes it a promising contender for widespread adoption.

9. Toncoin (TON)

Initially developed by Telegram, Toncoin focuses on scalability and user-friendliness, providing blockchain solutions for mainstream adoption. Its integration with a vast user base sets it apart from traditional platforms.

10. 888 ($888)

A memecoin with a unique narrative, 888 leverages symbolism and community-driven momentum to drive long-term value. Its ambitious growth targets have caught the attention of both retail and institutional investors.

Risks and Challenges in Long-Term Cryptocurrency Investment

Investing in cryptocurrencies for the long term offers the potential for substantial financial rewards, but it also comes with its own set of risks and challenges. The digital asset market remains one of the most volatile and unpredictable investment spaces, where fortunes can be made—or lost—overnight. Unlike traditional assets, cryptocurrencies operate in a rapidly evolving landscape shaped by technological advancements, market sentiment, and shifting regulations. For investors looking to hold digital assets for years or even decades, understanding these risks is essential for building a resilient investment strategy. Below are the key risks and challenges that every long-term cryptocurrency investor should be aware of:

- Market Volatility: Cryptocurrency prices are known for their extreme swings, driven by news events, regulatory announcements, or changes in investor sentiment. A single tweet or rumor can trigger price surges or crashes, causing emotional stress for long-term holders. Investors need to have a high tolerance for risk and a long-term perspective to weather these inevitable market fluctuations.

- Regulatory Uncertainty: Governments worldwide are still trying to define their stance on cryptocurrencies. Sudden regulatory crackdowns, restrictions on trading, or new tax policies can significantly impact cryptocurrency valuations and investor confidence. Long-term investors must stay informed about legal developments in their respective regions to avoid unforeseen complications.

- Security Risks: Digital assets are stored in wallets and traded on exchanges, both of which are vulnerable to cyberattacks, phishing scams, and hacking incidents. Even well-known cryptocurrency platforms have suffered from security breaches in the past, leading to billions of dollars in losses. Investors need to use secure wallets, enable multi-factor authentication, and remain vigilant against phishing scams.

- Technological Risks: Blockchain technology is still evolving, and vulnerabilities in code, smart contracts, or network protocols can pose significant risks. Issues like scalability, slow transaction speeds, or failed software upgrades can affect the value and performance of a cryptocurrency in the long term.

- Market Manipulation: Due to the relatively unregulated nature of the cryptocurrency market, it remains susceptible to manipulation. Activities such as pump-and-dump schemes, wash trading, and fake trading volumes can create misleading market signals, causing uninformed investors to make poor decisions.

- Liquidity Concerns: Some cryptocurrencies, especially newer or lesser-known tokens, may suffer from low liquidity. This makes it difficult for investors to buy or sell large amounts of a cryptocurrency without causing substantial price changes.

- Project Abandonment: Many cryptocurrency projects rely on active development teams for updates, maintenance, and adoption. If a project loses developer interest, faces funding issues, or the team decides to abandon it, the token’s value could plummet, leaving investors with worthless assets.

- Lack of Transparency: Not all cryptocurrency projects are transparent about their operations, leadership, or tokenomics. Hidden agendas, unclear roadmaps, or lack of communication from project teams can undermine investor trust and lead to financial losses.

- Investor Psychology: The emotional rollercoaster of cryptocurrency investing often leads to impulsive decisions. Fear of missing out (FOMO) during bull runs and panic selling during market crashes are common mistakes that can severely impact long-term investment performance.

- Scalability Issues: Many blockchain networks face scalability challenges as transaction volumes grow. Congestion, slow transaction processing, and rising fees can limit a cryptocurrency’s adoption and long-term utility.

- Environmental Concerns: Certain cryptocurrencies, particularly those relying on Proof-of-Work (PoW) consensus mechanisms, face criticism for their high energy consumption and environmental impact. This could lead to regulatory backlash or a decline in investor interest.

- Dependence on Technology Infrastructure: Cryptocurrencies rely on internet access, secure devices, and functional blockchain networks. Any disruption to these technological pillars—be it global internet blackouts or malicious attacks on blockchain networks—can affect cryptocurrency access and usage.

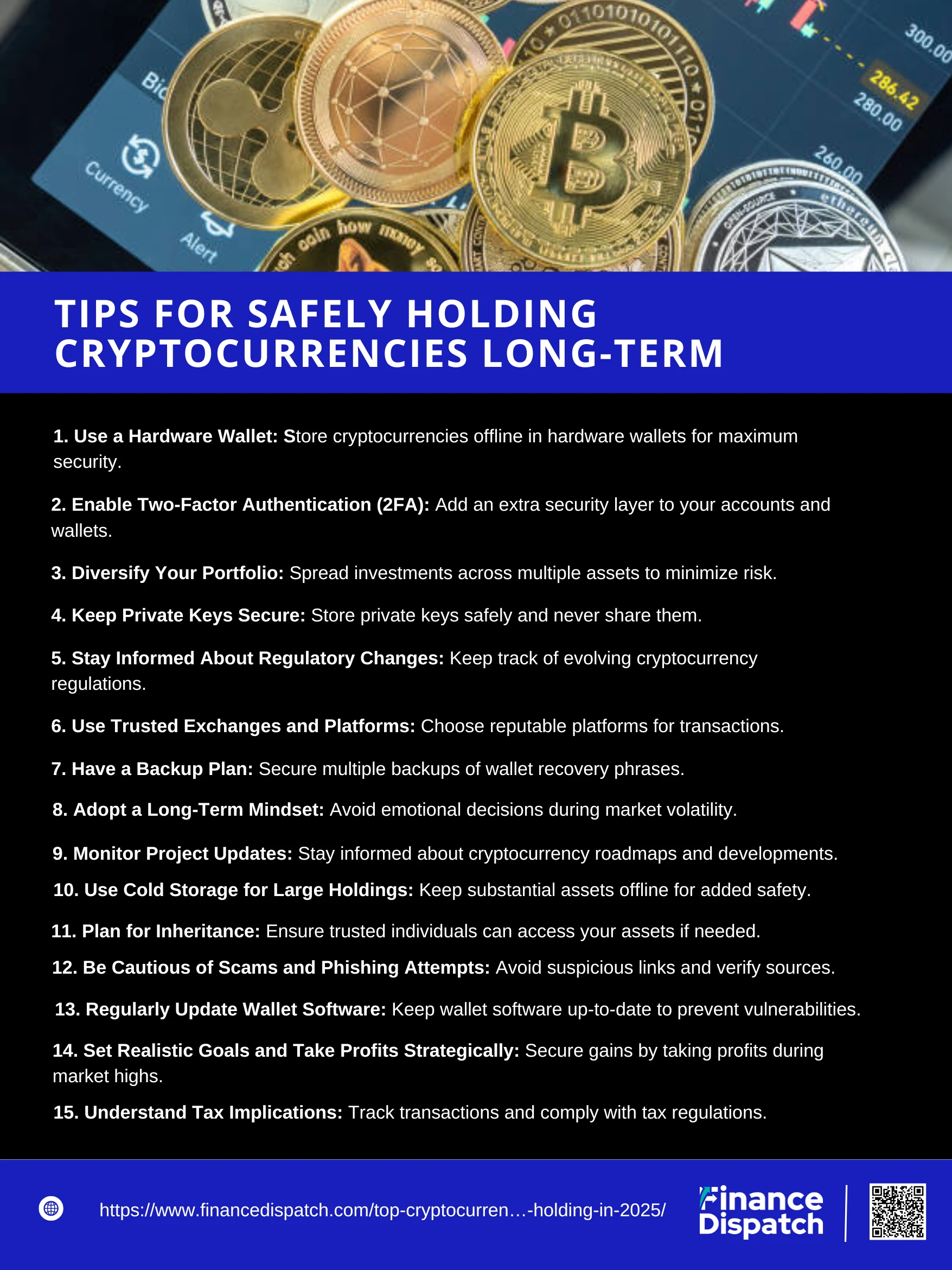

Tips for Safely Holding Cryptocurrencies Long-Term

Holding cryptocurrencies long-term can be a rewarding strategy, but it also comes with unique challenges and risks. Unlike traditional investments, cryptocurrencies require specific precautions to ensure security, stability, and peace of mind over extended periods. From secure storage solutions to disciplined investment strategies, long-term holders must adopt best practices to safeguard their assets and maximize potential gains. Below are essential tips for safely holding cryptocurrencies long-term:

1. Use a Hardware Wallet

Store your cryptocurrencies in a hardware wallet, such as Ledger or Trezor, rather than keeping them on an exchange. Hardware wallets are offline and significantly reduce the risk of hacking or unauthorized access.

2. Enable Two-Factor Authentication (2FA)

Always enable two-factor authentication (2FA) on your cryptocurrency accounts and wallets. This adds an extra layer of security beyond just a password.

3. Diversify Your Portfolio

Don’t put all your funds into one cryptocurrency. Diversify your holdings across multiple assets to reduce the risk associated with any single token or project failing.

4. Keep Private Keys Secure

Your private keys are the gateway to your cryptocurrencies. Store them securely in a physical format (e.g., written on paper) and avoid sharing them with anyone.

5. Stay Informed About Regulatory Changes

Cryptocurrency regulations vary by country and are often updated. Stay informed about the legal landscape to avoid unexpected challenges or restrictions.

6. Use Trusted Exchanges and Platforms

If you need to buy, sell, or transfer assets, only use reputable and well-reviewed cryptocurrency exchanges and wallets.

7. Have a Backup Plan

Ensure you have multiple backups of your wallet and recovery phrases. Store them in secure, separate locations to avoid losing access in case of theft, fire, or damage.

8. Adopt a Long-Term Mindset

Cryptocurrency prices are highly volatile. Avoid emotional decision-making during market dips or spikes, and stay committed to your long-term investment strategy.

9. Monitor Project Updates

Follow the progress and updates of the cryptocurrencies you hold. Stay informed about their development roadmaps, partnerships, and technological advancements.

10. Use Cold Storage for Large Holdings

For significant cryptocurrency holdings, consider cold storage options, which keep your assets completely offline and immune to cyber threats.

11. Plan for Inheritance

Ensure that your loved ones have instructions and access to your cryptocurrency assets in case of emergencies or unforeseen circumstances.

12. Be Cautious of Scams and Phishing Attempts

Scammers often target cryptocurrency holders with fake emails, websites, and messages. Always verify sources and avoid clicking suspicious links.

13. Regularly Update Wallet Software

Keep your wallet software and firmware up to date to protect against vulnerabilities and security threats.

14. Set Realistic Goals and Take Profits Strategically

While holding long-term is the goal, set realistic profit targets and take partial profits during market peaks to secure gains.

15. Understand Tax Implications

Cryptocurrencies are subject to taxation in many countries. Keep track of your transactions and consult a tax professional to remain compliant.

Conclusion

Long-term cryptocurrency investment offers exciting opportunities for substantial financial gains, but it also demands careful planning, patience, and a proactive approach to security and risk management. As the digital asset landscape continues to evolve, staying informed, using secure storage solutions, and adopting a disciplined mindset are essential for navigating the challenges of this dynamic market. Whether you’re holding established assets like Bitcoin and Ethereum or exploring emerging tokens with high growth potential, success in long-term cryptocurrency holding depends on a combination of strategic diversification, ongoing research, and emotional resilience. By understanding the risks, leveraging secure tools, and staying committed to your investment goals, you can position yourself for sustained growth and financial success in the ever-expanding world of cryptocurrencies.