When you think about charitable donations, the focus is often on the positive impact they have on communities and causes in need. But did you know that giving strategically can also offer significant financial advantages? Strategic charitable donations allow you to align your generosity with thoughtful planning, helping you maximize tax benefits, enhance financial efficiency, and even strengthen your personal or corporate reputation. By making informed choices about when, how, and where to give, you can create a win-win situation—one where your contributions make a difference while also advancing your financial goals.

What Makes Charitable Donations Strategic?

Charitable donations become strategic when they go beyond spontaneous acts of generosity and involve thoughtful planning and alignment with broader goals. Whether you’re an individual or a business, strategic giving means identifying causes that reflect your values, ensuring your contributions have a meaningful and measurable impact. It also involves leveraging financial tools like tax-efficient giving methods, such as donating appreciated assets or setting up charitable trusts, to maximize the benefits. By adopting a strategic approach, you not only amplify the positive outcomes for the recipients but also optimize the personal or corporate financial advantages tied to your philanthropy.

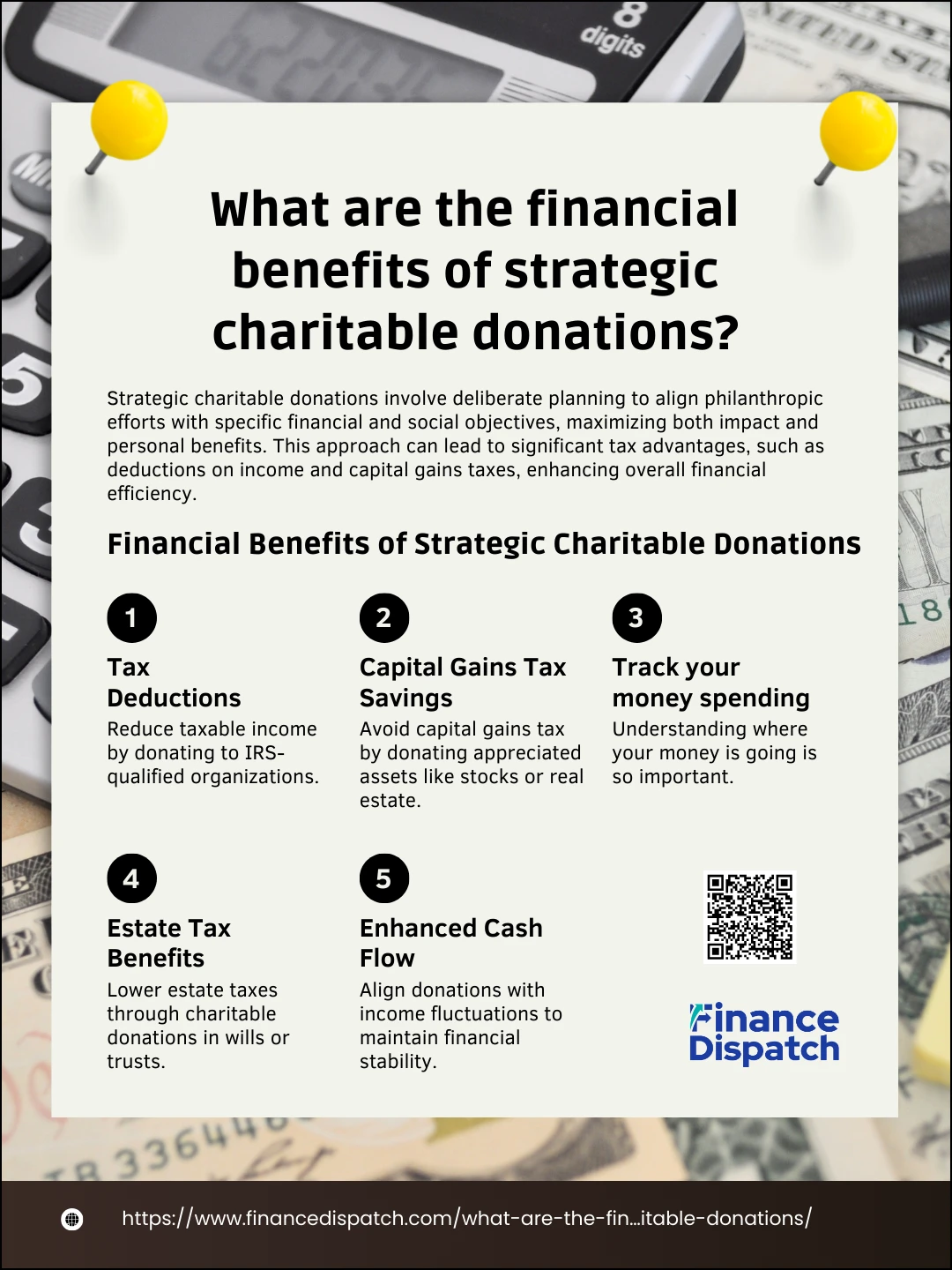

Financial Benefits of Strategic Charitable Donations

Strategic charitable donations offer more than just the satisfaction of giving back—they can also yield significant financial rewards. By carefully planning your contributions, you can unlock a range of monetary benefits that align with your financial and philanthropic goals.

Financial Benefits of Strategic Charitable Donations:

1. Tax Deductions

One of the most immediate financial benefits of charitable donations is the ability to deduct contributions from your taxable income. By donating to IRS-qualified organizations, you can lower the amount of income subject to taxation, potentially moving into a lower tax bracket. This applies to cash donations, as well as non-cash contributions like clothing or goods, as long as they are properly documented. Strategic planning ensures that you maximize these deductions without exceeding IRS limits, which can vary based on the type and value of the donation.

2. Capital Gains Tax Savings

If you donate appreciated assets, such as stocks or real estate, you can avoid paying capital gains tax on the increased value of those assets. For instance, if you’ve held stocks that have significantly appreciated over time, donating them directly to a charity allows you to deduct the full fair market value of the asset while sidestepping the tax you’d owe if you sold it. This method not only benefits the charity but also maximizes your giving potential while reducing your tax liability.

3. Estate Tax Benefits

Charitable giving can be an essential part of estate planning, offering a way to reduce estate taxes while supporting causes you care about. By designating donations to charities in your will or creating a charitable trust, you can lower the taxable value of your estate. This strategy ensures that a portion of your wealth goes to meaningful causes instead of being consumed by taxes, preserving more of your legacy for both charities and loved ones.

4. Enhanced Cash Flow

Strategic charitable giving doesn’t have to strain your finances. By timing your donations to align with income fluctuations or periods of higher taxable earnings, you can maintain a healthy cash flow while still reaping financial benefits. For example, making contributions during high-income years can offset tax burdens more effectively, providing relief when you need it most.

5. Corporate Tax Advantages

For businesses, charitable contributions are not only a way to give back but also an opportunity to reduce taxable income. Companies can deduct up to a certain percentage of their adjusted gross income for donations made to qualifying charities. Beyond tax savings, corporate giving can enhance brand reputation, build customer loyalty, and even improve employee morale—all of which contribute to long-term financial success. Strategic corporate giving ensures these benefits are maximized while making a tangible impact on communities.

Strategic Timing for Maximum Financial Gains

Timing plays a crucial role in maximizing the financial gains of charitable donations. By carefully planning when to give, you can align your contributions with periods of higher taxable income, allowing you to offset your tax liability more effectively. For instance, making donations at the end of the year can help reduce taxable income before filing taxes, while contributions during significant financial events, such as selling an asset or receiving a bonus, can provide additional tax relief. Strategic timing also considers fluctuations in market conditions, ensuring that appreciated assets are donated when their value is at its peak. This thoughtful approach allows you to optimize both the impact of your generosity and the financial benefits you receive.

Comparative Benefits of Giving Methods

When it comes to charitable giving, the method you choose can significantly affect both the impact of your contribution and the financial benefits you receive. From cash donations to non-cash assets and setting up charitable trusts, each method has unique advantages. Understanding these options allows you to select the approach that aligns best with your financial goals and philanthropic intentions.

Comparative Benefits of Giving Methods

| Giving Method | Key Benefits | Considerations |

| Cash Donations | Simple and immediate tax deductions; easy to track and document. | Limited to available liquid funds; deduction capped at certain income levels. |

| Appreciated Assets | Avoid capital gains tax; deduct full market value; high tax efficiency. | Requires proper valuation and transfer process. |

| Charitable Trusts | Provides ongoing tax benefits; supports long-term giving; estate tax reduction. | Complex setup requiring legal and financial advice; long-term commitment. |

| Donor-Advised Funds | Allows flexibility in timing of donations; immediate tax deduction on funding. | Contributions are irrevocable; administrative fees may apply. |

| In-Kind Donations | Supports causes with specific needs; eligible for tax deductions. | Must be in good condition; valuation can be challenging. |

Comparative Benefits of Giving Methods

When it comes to charitable giving, there’s no one-size-fits-all approach. The method you choose can significantly influence both the impact of your contribution and the financial benefits you receive. From straightforward cash donations to more complex options like donor-advised funds or charitable trusts, each method offers unique advantages. By understanding and comparing these giving methods, you can tailor your approach to align with your financial goals and philanthropic values.

Key Comparative Benefits of Giving Methods:

- Cash Donations

- Simplest method with immediate impact.

- Allows for easy tracking and documentation.

- Offers straightforward tax deductions, though limited to a percentage of your income.

- Donating Appreciated Assets

- Avoids capital gains tax while providing a deduction for the asset’s fair market value.

- Ideal for stocks, real estate, or other highly appreciated investments.

- Requires proper valuation and adherence to IRS guidelines.

- Charitable Trusts

- Provides long-term financial benefits and reduces estate taxes.

- Offers a way to support charities consistently over time.

- Requires professional advice for setup and management.

- Donor-Advised Funds (DAFs)

- Allows immediate tax benefits upon funding while giving flexibility to choose recipients later.

- Streamlined for those who want a structured approach to charitable giving.

- Contributions are irrevocable, with potential administrative fees.

- In-Kind Donations

- Supports specific needs with tangible goods or services.

- Eligible for tax deductions based on fair market value.

- Requires accurate valuation and condition verification.

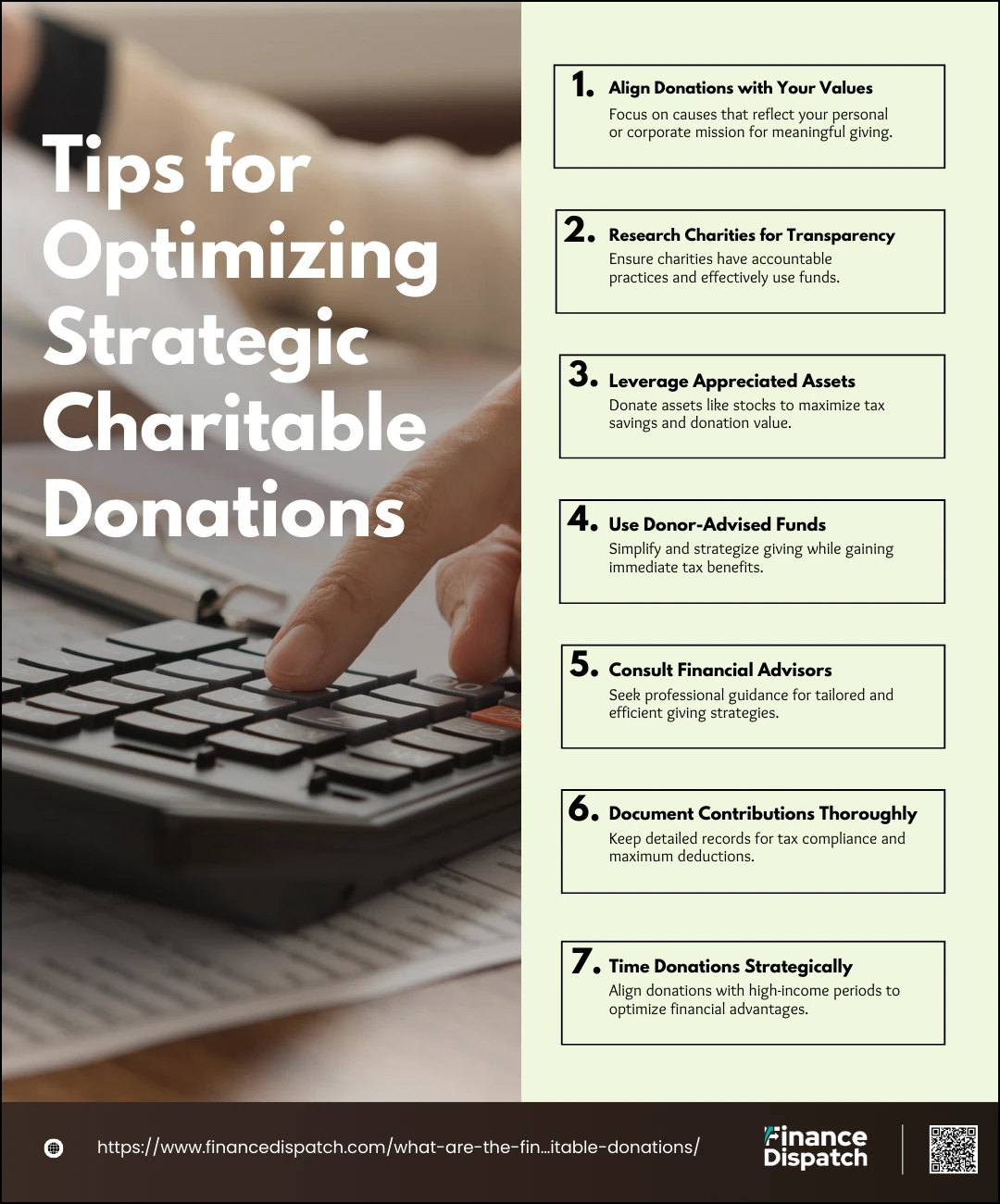

Tips for Optimizing Strategic Charitable Donations

Strategic charitable donations not only benefit the causes you care about but also offer financial advantages when approached thoughtfully. By following proven strategies, you can ensure your giving is both impactful and efficient. Here are some essential tips to help you optimize your charitable contributions while maximizing the financial benefits.

1. Align Donations with Your Values

Supporting causes that align with your personal or corporate values ensures your contributions are meaningful and impactful. Whether it’s environmental conservation, education, or healthcare, focusing on areas that resonate with your mission helps create a sense of purpose while fostering a long-term commitment to philanthropy.

2. Research Charities for Transparency

Not all charities are equally effective or accountable. Research organizations thoroughly to ensure they allocate a significant portion of their resources directly to their programs and have transparent financial practices. Tools like charity rating websites can help you evaluate their impact and efficiency, giving you confidence that your money is being well-utilized.

3. Leverage Appreciated Assets

Donating appreciated assets, such as stocks, mutual funds, or real estate, can significantly enhance the financial benefits of your giving. You can avoid capital gains tax while also claiming a deduction for the asset’s full market value. This approach increases the value of your donation for the charity while optimizing your tax savings.

4. Use Donor-Advised Funds

Donor-advised funds (DAFs) offer a flexible and streamlined way to manage your charitable giving. You can make a single donation to the fund and receive an immediate tax deduction, then allocate the funds to different charities over time. This method is particularly useful if you want to make a large contribution during a high-income year but distribute it strategically.

5. Consult Financial Advisors

Professional advice can help you navigate complex giving strategies, such as setting up charitable trusts, endowments, or planned giving programs. Financial advisors or estate planners can tailor these tools to your unique situation, ensuring you maximize both your impact and the financial advantages of your giving.

6. Document Contributions Thoroughly

Maintaining detailed records of all charitable contributions is essential for IRS compliance and maximizing deductions. Keep receipts, acknowledgment letters, and any required forms to avoid issues during tax filing. Proper documentation ensures you can substantiate your claims and fully leverage the financial benefits of your giving.

7. Time Donations Strategically

The timing of your donations can significantly affect the financial benefits you receive. Donating during high-income years or when you’re expecting a significant financial transaction can help offset taxable income. Strategic timing ensures you get the most value from your contributions while maintaining a steady cash flow.

The Broader Economic Impact of Charitable Giving

Charitable giving extends beyond individual or corporate benefits; it plays a vital role in driving broader economic growth and social stability. Contributions to charities fund essential programs in education, healthcare, environmental protection, and community development, which create jobs and stimulate local economies. Nonprofit organizations often rely on these donations to sustain operations, support underprivileged groups, and address systemic issues. Additionally, charitable giving fosters innovation by funding research and initiatives that might not otherwise receive investment. As generosity spreads through communities, it inspires a culture of giving, multiplying the positive effects and creating a ripple that benefits society as a whole.

Conclusion

Strategic charitable giving is more than an act of kindness—it’s a thoughtful approach that amplifies the impact of your contributions while offering significant financial advantages. By aligning your donations with your values, choosing the right methods, and timing your giving strategically, you can maximize both the personal satisfaction and the broader economic benefits of philanthropy. Whether you’re an individual seeking to make a difference or a business aiming to enhance your social responsibility, strategic giving ensures your generosity creates lasting value for both the causes you support and your financial goals.