Retirement is a time to embrace new adventures, explore different cultures, and enjoy the fruits of your labor without financial stress. For many, the dream of retiring abroad offers the opportunity to stretch savings further while maintaining or even improving quality of life. But where can you find that perfect balance of affordability, comfort, and adventure? In this article, we’ll explore some of the most affordable countries for retirement, where you can enjoy a fulfilling lifestyle, access excellent amenities, and make your retirement savings last longer. Whether you’re seeking tropical beaches, rich cultural experiences, or tranquil mountain views, these destinations offer something for every retiree.

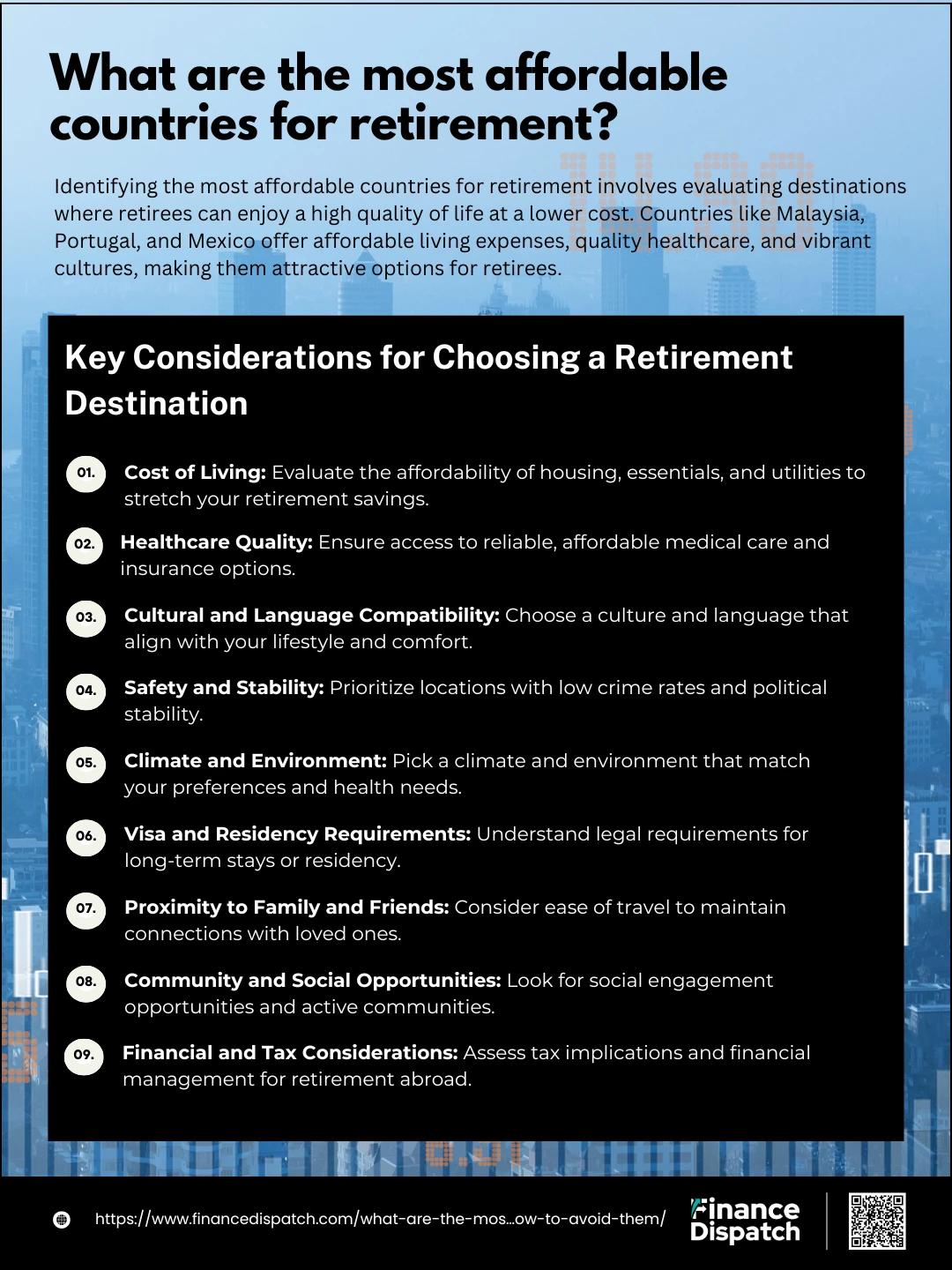

Key Considerations for Choosing a Retirement Destination

Choosing where to spend your retirement years is a deeply personal decision, shaped by your lifestyle preferences, financial goals, and long-term needs. While the idea of relocating to an affordable, picturesque destination is exciting, there are multiple layers to consider beyond just cost. A well-chosen retirement destination can enhance your quality of life, providing comfort, safety, and opportunities for exploration. By carefully weighing various factors, you can ensure that your new home aligns with your priorities and allows you to enjoy your retirement to the fullest.

Here are some key considerations to guide your decision:

- Cost of Living: Retirement savings need to last, so understanding the overall affordability of a destination—including housing, groceries, transportation, and utilities—is essential. Opting for a country with a lower cost of living can significantly enhance your purchasing power.

- Healthcare Quality: Reliable and affordable healthcare is critical, especially as health needs may grow with age. Research the availability of medical facilities, insurance options, and the standard of care in your chosen destination.

- Cultural and Language Compatibility: Immersing yourself in a new culture is rewarding, but it’s important to feel comfortable in your surroundings. Consider whether the local culture aligns with your lifestyle and whether language barriers could pose challenges.

- Safety and Stability: A safe and politically stable environment is essential for a peaceful retirement. Check crime rates, political conditions, and the overall safety of the area before making a decision.

- Climate and Environment: From tropical beaches to cool mountain retreats, the climate and environment can greatly impact your daily life. Choose a location that suits your preferences and supports your health and well-being.

- Visa and Residency Requirements: Navigating visa processes and residency rules is a practical but critical aspect of retiring abroad. Understand the legal requirements for long-term stays or permanent residency to ensure a smooth transition.

- Proximity to Family and Friends: While living abroad offers adventure, staying connected to loved ones is important. Evaluate how easily you can visit or be visited by family and friends and how travel costs might impact those connections.

- Community and Social Opportunities: A fulfilling retirement often includes meaningful social interactions. Look for destinations with active expat communities or vibrant local cultures where you can engage socially and build connections.

- Financial and Tax Considerations: Retiring abroad may come with unique financial implications, including tax obligations and the management of pensions or investments. Consult a financial advisor to understand how these factors apply to your situation.

Top Affordable Countries for Retirement

Retiring abroad is more than just a way to stretch your savings—it’s an opportunity to reinvent your lifestyle, immerse yourself in new cultures, and enjoy a pace of life tailored to your preferences. For retirees seeking affordability without compromising on quality of life, certain countries stand out for their unique mix of low costs, excellent amenities, and welcoming environments. These destinations cater to expats and retirees with features like affordable healthcare, vibrant communities, and breathtaking surroundings. Let’s dive deeper into the top affordable countries for retirement and what makes each one special.

Here are the top affordable countries for retirement:

1. Malaysia

Malaysia combines modern infrastructure with a rich cultural tapestry. Retirees flock to Penang Island for its pristine beaches, affordable housing, and expat-friendly vibe. The capital, Kuala Lumpur, offers a cosmopolitan lifestyle at a fraction of Western costs. From its diverse cuisine to its vibrant festivals, Malaysia ensures you’ll never run out of things to enjoy.

2. Mexico

With its proximity to the U.S., Mexico is a convenient and affordable retirement haven. Its healthcare system is top-notch and far more cost-effective than in many Western countries. Cities like Puerto Vallarta and Mérida blend colonial charm with modern amenities, offering retirees vibrant markets, stunning beaches, and warm hospitality.

3. Portugal

Portugal’s tranquil lifestyle, sunny climate, and European charm attract retirees from around the globe. The Algarve region boasts golden beaches, friendly locals, and affordable healthcare options. With its Non-Habitual Residence program, Portugal also offers tax benefits for expats, making it even more appealing.

4. Panama

Known for its retiree-friendly Pensionado Visa, Panama provides significant discounts on healthcare, transportation, and entertainment. Its year-round tropical climate and proximity to the U.S. make it a practical and enjoyable retirement destination. Popular areas like Panama City and Boquete offer a balance of modern living and serene nature.

5. Thailand

Thailand offers a unique mix of cultural richness and natural beauty. Retirees are drawn to Chiang Mai for its temperate climate, low living costs, and robust expat community. For those seeking island life, Phuket delivers stunning beaches, world-class dining, and an affordable cost of living.

6. Philippines

The Philippines is ideal for retirees looking for a warm climate and English-speaking communities. Its low cost of living allows retirees to enjoy luxurious housing, tropical beaches, and a welcoming expat network. Cities like Cebu and Davao balance affordability with access to quality healthcare and leisure activities.

7. Vietnam

Vietnam’s affordability and charm make it a rising star among retirees. Coastal cities like Da Nang and Nha Trang offer serene beaches, fresh seafood, and affordable healthcare. The country’s rich history and vibrant culture ensure there’s always something new to explore.

8. Costa Rica

Known for its “pura vida” lifestyle, Costa Rica is a paradise for nature enthusiasts. Retirees appreciate its strong healthcare system, eco-friendly initiatives, and affordable living costs. Areas like San José and Tamarindo cater to expats, offering a blend of urban conveniences and natural beauty.

9. Ecuador

Ecuador offers retirees scenic beauty, from the Andes Mountains to the Galápagos Islands. Its retiree-friendly benefits include discounted public services and affordable healthcare. Cities like Cuenca are known for their colonial charm and vibrant expat communities.

10. Colombia

Colombia combines affordability with diverse climates and landscapes. Medellín, the “City of Eternal Spring,” is a favorite among retirees for its temperate weather, modern infrastructure, and affordable luxury. The country also boasts excellent healthcare, ranked among the best in the region.

Cost of Living Comparison

When planning for retirement, understanding the cost of living in potential destinations is crucial. Comparing costs such as housing, groceries, healthcare, and transportation can help you determine where your retirement savings will stretch the furthest. Below is a cost of living comparison for some of the most affordable countries for retirement, highlighting key expenses like average monthly rent, meals, and healthcare.

Cost of Living Comparison Table

| Country | Average Monthly Rent (1-Bedroom Apartment) | Meal at Inexpensive Restaurant | Monthly Transportation Costs | Healthcare Quality Rating |

| Malaysia | $300 – $500 | $3 – $5 | $20 – $30 | High |

| Mexico | $400 – $600 | $5 – $10 | $25 – $40 | High |

| Portugal | $500 – $800 | $10 – $15 | $40 – $60 | Excellent |

| Panama | $500 – $700 | $6 – $10 | $20 – $35 | High |

| Thailand | $250 – $500 | $2 – $5 | $15 – $30 | High |

| Philippines | $200 – $400 | $3 – $5 | $10 – $20 | Moderate |

| Vietnam | $250 – $450 | $1 – $3 | $10 – $20 | Moderate |

| Costa Rica | $400 – $700 | $7 – $10 | $25 – $40 | Excellent |

| Ecuador | $300 – $500 | $3 – $6 | $15 – $25 | High |

| Colombia | $350 – $600 | $4 – $8 | $20 – $30 | High |

Healthcare Quality and Costs in Affordable Retirement Destinations

Healthcare is a critical consideration when choosing an affordable retirement destination. Many popular locations offer high-quality medical services at a fraction of the cost compared to Western countries. For example, countries like Portugal and Costa Rica boast excellent healthcare systems, often ranked among the best globally, with affordable insurance options and modern facilities. In Malaysia, expats can access private hospitals with top-tier care and English-speaking staff for a fraction of U.S. prices. Similarly, Thailand and Colombia provide advanced medical services at significantly reduced costs, making them popular choices for retirees. While the Philippines and Vietnam offer lower healthcare costs, their medical infrastructure may require careful research to ensure proximity to reputable facilities. Understanding the healthcare system in your chosen destination ensures peace of mind and access to reliable medical care throughout your retirement years.

Real-Life Experiences of Retirees

The stories of retirees who have made the leap to live abroad provide invaluable insights into the realities of retiring in affordable destinations. Many retirees in Panama praise the Pensionado Visa program, which not only eases residency requirements but also provides significant discounts on healthcare, utilities, and travel. In Portugal, expats often highlight the welcoming local culture and easy access to world-class healthcare. Retirees in Malaysia frequently share their love for the vibrant street food scene, affordable luxury living, and modern medical facilities. Meanwhile, those in Mexico emphasize the sense of community in expat hubs like San Miguel de Allende and the joy of immersing in a rich, colorful culture. Each retiree’s experience underscores the importance of aligning personal priorities—such as healthcare, cost of living, and community—when choosing the perfect place to call home during retirement.

Tips for Planning Your Retirement Abroad

Planning your retirement abroad can be a transformative and fulfilling experience, offering you the chance to embrace new cultures, lower living costs, and a relaxed lifestyle. However, to ensure a seamless transition, thorough planning and preparation are essential. From managing your finances to understanding local laws and cultural norms, each step plays a crucial role in shaping a stress-free retirement. Below are detailed tips to guide you through the process and help you make informed decisions for your dream retirement abroad:

1. Evaluate Your Finances

Start by assessing your financial readiness for retiring abroad. Calculate your monthly income from pensions, savings, or investments and compare it to the estimated expenses in your chosen destination. Include additional costs like international travel, potential currency exchange fluctuations, and unforeseen medical needs to ensure your budget is robust.

2. Research the Cost of Living

Not all affordable destinations are created equal. Explore the average costs of housing, food, transportation, and utilities in your target countries. Use tools like Numbeo to compare living costs across multiple locations. This step will help you pinpoint destinations that offer the best value for your retirement funds.

3. Understand Healthcare Systems

Healthcare is a priority during retirement, so research the quality and cost of medical services in your desired location. Investigate whether you’ll need private health insurance or if the country’s public healthcare system will suffice. Access to reliable and affordable healthcare can significantly impact your quality of life.

4. Consider Visa and Residency Requirements

Each country has specific requirements for retirees, often through specialized visas like Panama’s Pensionado Visa or Portugal’s D7 Visa. Understand the residency application process, including the necessary documentation, fees, and financial thresholds. Knowing these details upfront will prevent last-minute complications.

5. Visit Before You Commit

A trial stay in your chosen destination can reveal more than research alone. Spend a few weeks or months living there to experience the climate, community, and amenities firsthand. This hands-on experience can confirm whether the location matches your expectations.

6. Plan for Language and Cultural Adaptation

Living abroad often means adapting to a new language and culture. While English-speaking communities exist in many popular retirement spots, learning the local language can enhance your experience and help you integrate better. Familiarize yourself with cultural norms to build meaningful connections with locals.

7. Factor in Taxes

Understand how retiring abroad will affect your tax situation. Research the tax treaties between your home country and your retirement destination to avoid double taxation. Seek advice from a financial advisor to plan for pension withdrawals, foreign income, and inheritance laws.

8. Stay Connected with Loved Ones

Moving abroad doesn’t mean losing touch with family and friends. Plan regular visits back home, or invite loved ones to visit you. Invest in reliable communication tools and services to maintain strong relationships, no matter the distance.

9. Secure Accommodations

Decide whether to rent or buy property in your new home. Renting allows flexibility, while buying may be a better long-term investment. Research local real estate markets, legal requirements for foreign buyers, and the pros and cons of various neighborhoods.

10. Prepare for the Unexpected

Life abroad comes with uncertainties, so it’s vital to have contingency plans. Set aside an emergency fund to cover unexpected events such as medical crises or sudden travel needs. Know the process for returning home if circumstances change, and keep essential documents easily accessible.

Conclusion

Retiring abroad can be a life-changing decision, offering you the chance to embrace new cultures, enjoy a lower cost of living, and create meaningful experiences in your golden years. However, careful planning and thorough research are essential to ensure a smooth transition and a fulfilling lifestyle. By evaluating your finances, understanding healthcare systems, navigating visa requirements, and considering cultural adaptation, you can set the foundation for a stress-free retirement. Whether you dream of relaxing on tropical beaches, exploring historic cities, or immersing yourself in vibrant communities, the right preparation will allow you to enjoy a rewarding and worry-free retirement abroad. This new chapter of life is your opportunity to thrive, explore, and savor every moment in a destination that feels like home.