You’ve worked hard to build your financial security, but in today’s digital world, scammers are becoming increasingly sophisticated in their tactics to deceive and exploit unsuspecting individuals. From phishing emails that mimic trusted institutions to fraudulent investment opportunities that seem too good to be true, financial scams are everywhere, and anyone can fall victim. Understanding these scams and knowing how to protect yourself is key to safeguarding your hard-earned money. In this article, you’ll learn about the most common financial scams and practical steps you can take to avoid becoming a target. Empower yourself with knowledge and take control of your financial safety.

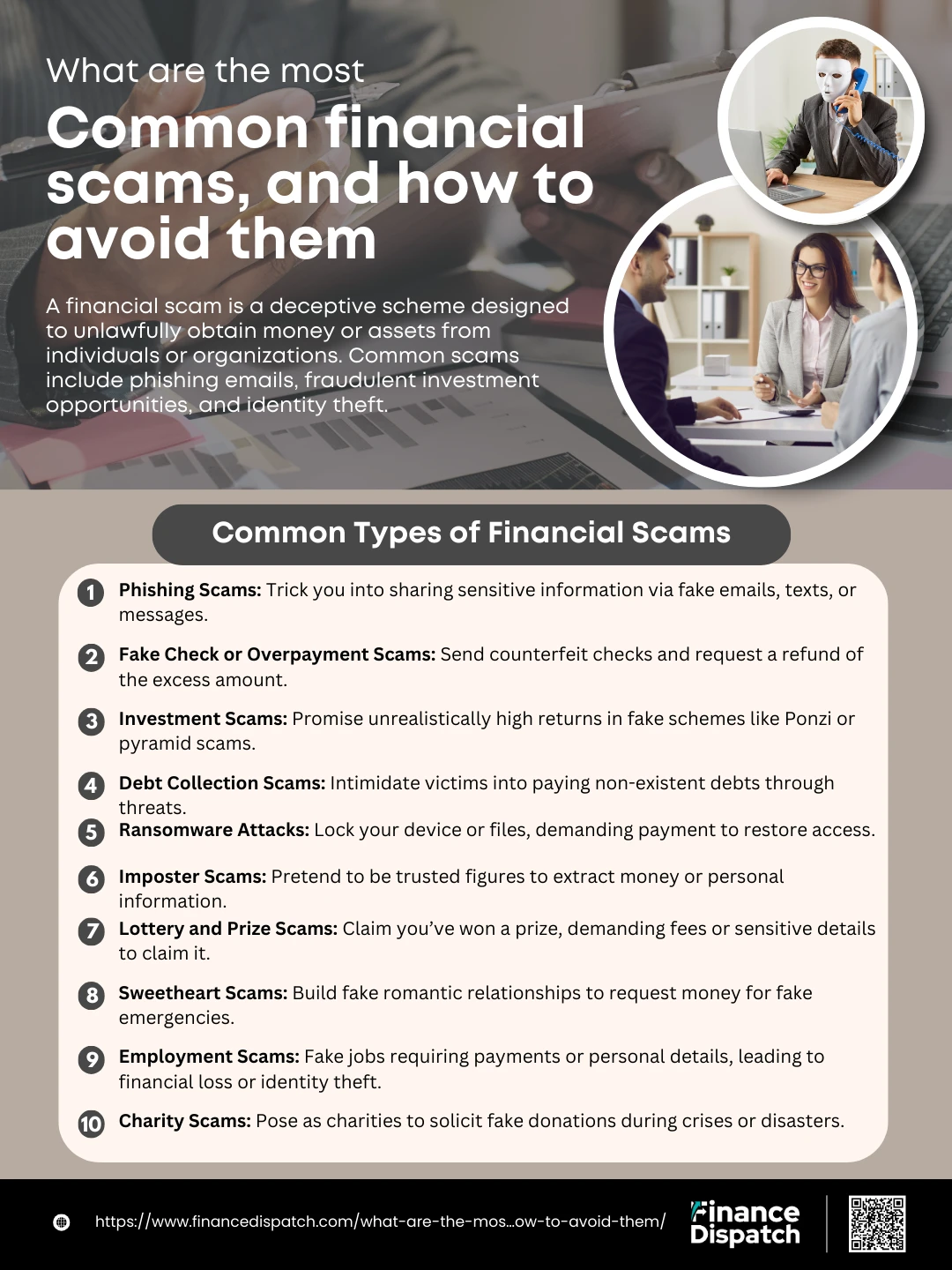

What is a Financial Scam?

A financial scam is a deceptive scheme designed to trick individuals into giving away money, sensitive information, or access to valuable assets. Scammers use a variety of tactics to create a sense of urgency, trust, or fear, manipulating their victims to achieve their malicious goals. These scams can take many forms, such as fake investment opportunities, phishing emails, fraudulent debt collection attempts, or impersonation of trusted organizations. The objective is always the same: to exploit your trust and steal your hard-earned resources. By recognizing the warning signs and staying informed, you can protect yourself from falling victim to these deceitful schemes.

Common Types of Financial Scams

Financial scams are diverse and cleverly designed to exploit vulnerabilities. Scammers often use psychological tactics, such as creating a sense of urgency or trust, to manipulate their victims. These scams can target anyone, regardless of age or financial status, and they evolve as technology and communication methods advance. Let’s explore some of the most common types of financial scams and how they work:

1. Phishing Scams

These scams typically come in the form of emails, texts, or social media messages that appear to be from legitimate entities, such as your bank, government agencies, or well-known companies. The goal is to trick you into clicking on malicious links or sharing sensitive information, like passwords or account numbers. Once the scammer has your information, they can use it for identity theft or unauthorized transactions.

2. Fake Check or Overpayment Scams

Scammers send counterfeit checks, often for more than the agreed-upon amount, and ask you to send back the difference. Once the check bounces, you’re left covering the loss. These scams often target online sellers or people seeking part-time jobs.

3. Investment Scams

These scams prey on individuals looking to grow their wealth. Scammers promise unrealistically high returns with little or no risk, luring victims into fake investment schemes like Ponzi or pyramid schemes. Often, the money is siphoned off, leaving victims with nothing.

4. Debt Collection Scams

Posing as legitimate debt collectors, fraudsters intimidate victims by claiming they owe unpaid debts. They may use threats of legal action or arrest to coerce payment. Often, these debts don’t even exist, and the scammers vanish once they’ve received the money.

5. Ransomware Attacks

This type of scam involves malicious software that locks your device or encrypts your files, demanding payment to regain access. These attacks often come through infected email attachments or links, making it critical to avoid clicking on suspicious content.

6. Imposter Scams

Scammers impersonate trusted figures, such as government officials, utility companies, or even loved ones, to convince you to send money or disclose personal information. For example, they may claim to be the IRS demanding unpaid taxes or a grandchild in urgent need of financial help.

7. Lottery and Prize Scams

Victims receive messages claiming they’ve won a lottery, sweepstakes, or prize. To claim the reward, they’re asked to pay fees or share sensitive details. In reality, there’s no prize, and the scammers disappear after collecting the money.

8. Sweetheart Scams

These scams target individuals through dating apps or social media, where scammers build fake romantic relationships over time. Once trust is established, they request money for fabricated emergencies, like medical bills or travel expenses.

9. Employment Scams

Fake job postings or unsolicited job offers lure victims with promises of high pay and flexible work. Victims may be asked to pay for training, provide personal information, or deposit fake checks, ultimately losing money or falling victim to identity theft.

10. Charity Scams

Exploiting people’s goodwill, scammers pose as charitable organizations, especially during crises or disasters. They solicit donations through phone calls, emails, or fake websites, diverting funds meant for genuine causes into their own pockets.

How to avoid financial scams

Avoiding financial scams requires awareness, vigilance, and a healthy dose of skepticism. Scammers rely on quick decision-making and emotional manipulation, but you can outsmart them by staying informed and taking proactive steps to protect yourself. Here are practical strategies to help you steer clear of common financial scams:

1. Be Skeptical of Unsolicited Contacts

If someone contacts you unexpectedly, whether through phone, email, or text, claiming to be from a trusted organization, pause before taking any action. Verify their identity by independently finding their contact information and reaching out directly.

2. Don’t Share Personal Information

Never provide sensitive details like Social Security numbers, passwords, or banking information to unknown parties, especially over the phone or through email. Legitimate institutions will not ask for this information unsolicited.

3. Double-Check Links and Email Addresses

Scammers often use fake links or spoofed email addresses that appear authentic. Always hover over links to verify their destination and scrutinize email addresses for subtle misspellings or inconsistencies.

4. Avoid Quick Decisions

Scammers create a sense of urgency to pressure you into acting immediately. Take your time to think things through, verify claims, and consult with someone you trust before making financial decisions.

5. Use Secure Payment Methods

Avoid payment methods like wire transfers or gift cards that are difficult to trace. Opt for credit cards, which offer fraud protection and are easier to dispute in case of unauthorized transactions.

6. Educate Yourself on Common Scams

Stay informed about the latest scam tactics by following trusted sources like the Federal Trade Commission (FTC) or local consumer protection agencies. Knowledge is your best defense against fraud.

7. Protect Your Devices and Accounts

Keep your software and antivirus programs updated to guard against ransomware and phishing attempts. Use strong, unique passwords for each account, and enable two-factor authentication where possible.

8. Be Wary of “Too Good to Be True” Offers

Whether it’s a high-return investment or a lottery win, if an offer sounds too good to be true, it likely is. Research thoroughly before making any commitments.

9. Verify Charities and Causes

Before donating to a charity, especially during crises, confirm its legitimacy through organizations like Charity Navigator or GuideStar. Avoid donating via unsolicited calls or emails.

10. Regularly Monitor Your Financial Accounts

Keep an eye on your bank and credit card statements for unauthorized charges. Reporting suspicious activity early can minimize damage and increase the chances of recovery.

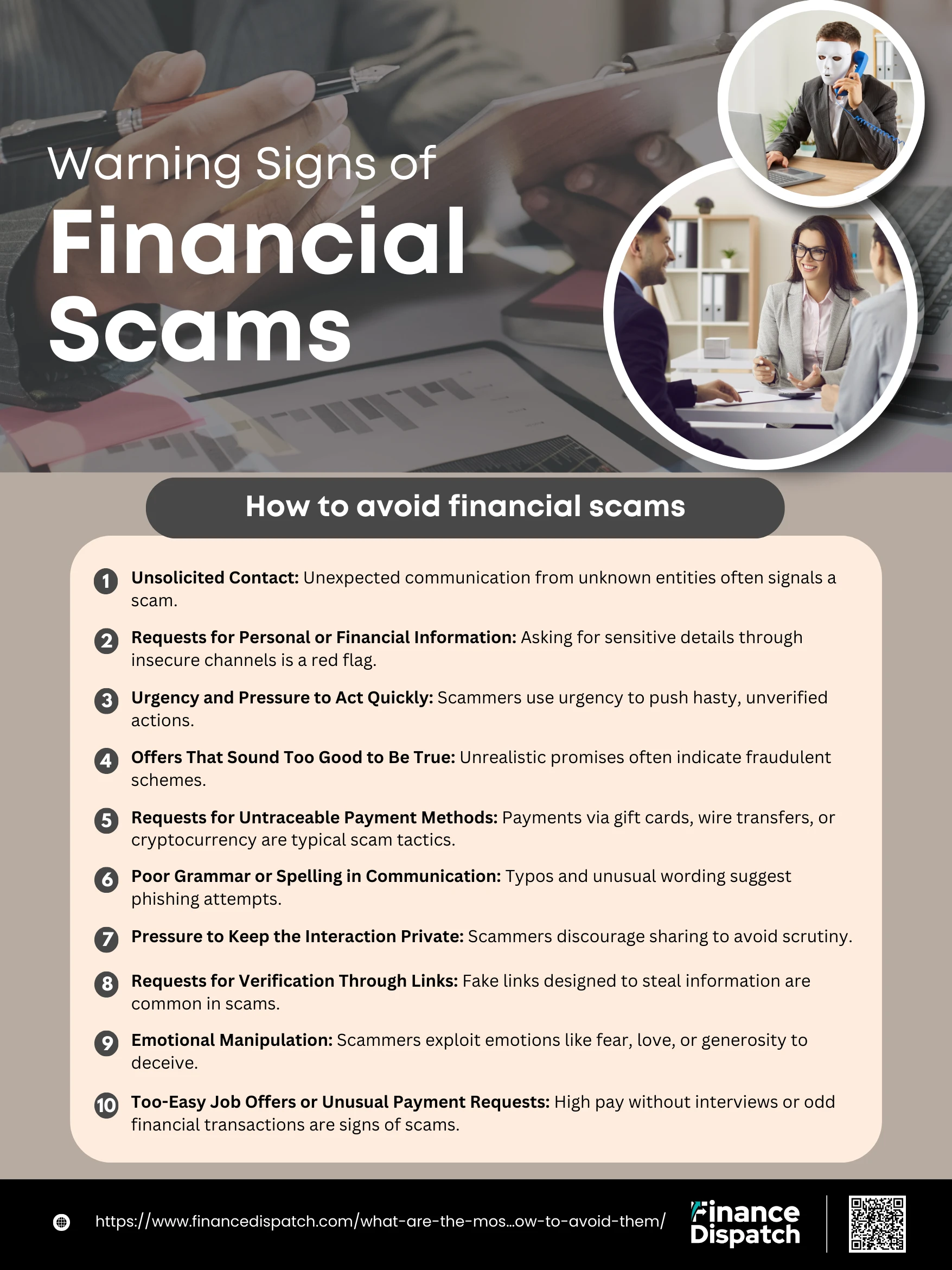

Warning Signs of Financial Scams

Financial scams are designed to deceive and manipulate, often blending seamlessly into legitimate communications or opportunities. Recognizing the warning signs is crucial to protecting yourself and your finances. Scammers rely on creating urgency, building false trust, and exploiting vulnerabilities, but with a keen eye and cautious approach, you can avoid becoming a victim. Here are the most common red flags to watch for:

- Unsolicited Contact

If you receive unexpected emails, calls, or messages from someone claiming to represent a bank, government agency, or business, it’s often a sign of a scam. Legitimate institutions rarely initiate contact without prior communication. - Requests for Personal or Financial Information

Be cautious if someone asks for sensitive details like your Social Security number, bank account information, or passwords over email, text, or phone. Trustworthy organizations will not ask for such information through insecure channels. - Urgency and Pressure to Act Quickly

Scammers create a sense of urgency, claiming immediate action is needed to avoid penalties, secure a prize, or prevent an account from being locked. This tactic is meant to bypass your critical thinking. - Offers That Sound Too Good to Be True

Promises of guaranteed high returns on investments, unexpected lottery winnings, or exclusive opportunities often indicate a scam. If it seems too good to be true, it probably is. - Requests for Untraceable Payment Methods

Scammers often ask for payment via gift cards, wire transfers, or cryptocurrency, as these methods are difficult to trace or reverse. Legitimate businesses or institutions typically don’t use these forms of payment. - Poor Grammar or Spelling in Communication

Emails or messages with noticeable typos, unusual sentence structures, or incorrect branding are a common sign of phishing scams. - Pressure to Keep the Interaction Private

Scammers may insist that you don’t discuss the situation with others, often to prevent you from verifying their claims. - Requests for Verification Through Links

Scammers may send fake links asking you to verify account details or reset passwords. These links often lead to fraudulent websites designed to steal your information. - Emotional Manipulation

Scams often rely on emotional triggers, such as fear, love, or generosity. Examples include threatening arrest for unpaid taxes, pretending to be a loved one in distress, or soliciting donations for fake charities. - Too-Easy Job Offers or Unusual Payment Requests

If you’re offered a high-paying job without an interview or asked to handle unusual financial transactions (like cashing a check and sending a portion elsewhere), it’s likely a scam.

Real-Life Examples of Financial Scams

Scammers employ creative and manipulative tactics to exploit their victims, often leaving a lasting impact on their finances and emotional well-being. These real-life examples illustrate how scams unfold and emphasize the importance of vigilance and skepticism:

- The Grandparent Call:

A worried grandmother wired $5,000 to someone claiming to be her grandson who was allegedly arrested and needed bail money. The “grandson” begged her to keep it a secret, only for her to later discover it was a scam. - The Phishing Email:

A small business owner received an email appearing to be from her bank, asking her to verify account details. After entering her credentials on a fake website, scammers accessed her account and stole thousands. - The Romance Scam:

A widower connected with a romantic interest online who, after weeks of building trust, claimed to need $10,000 for an emergency abroad. He sent the money, only to find out the profile was fake and the scammer disappeared. - The Fake Job Offer:

A recent graduate was “hired” for a remote job and sent a check to buy supplies. She was asked to deposit the check and send the remaining funds to a vendor. The check bounced, and she was left responsible for the loss. - The Prize Scam:

A man was told he’d won a lottery but had to pay $3,000 in taxes and fees upfront. Excited, he complied, only to realize later that there was no prize, and the scammers vanished. - The Investment Fraud:

A retiree was convinced to invest $50,000 in a “guaranteed” high-return scheme by a seemingly legitimate advisor. It turned out to be a Ponzi scheme, and the money was gone. - The Charity Scam:

After a natural disaster, a couple donated to what they believed was a relief organization. The emotional appeal worked, but the charity was fake, and their credit card information was misused for fraudulent charges.

The Importance of Education in Avoiding Financial Scams

Education is one of the most powerful tools in protecting yourself against financial scams. Scammers rely on a lack of awareness to exploit their victims, often using sophisticated tactics that can deceive even the most cautious individuals. By staying informed about common scams and understanding how fraudsters operate, you can recognize warning signs and avoid falling into their traps. Education empowers you to ask the right questions, verify suspicious claims, and take preventive steps like safeguarding personal information and using secure payment methods. When you know what to look out for, you’re better equipped to protect your hard-earned money and help others avoid similar risks. Sharing this knowledge with friends, family, and your community strengthens everyone’s defenses against scams, creating a ripple effect of awareness and protection.

What to Do If You’ve Been Scammed

Realizing you’ve fallen victim to a scam can be unsettling, but taking the right steps quickly can help minimize the damage. Whether it’s a financial fraud, identity theft, or another type of scam, it’s essential to act promptly and methodically to safeguard your assets and personal information. Here’s what you can do:

- Stop Communication Immediately: Cease all interactions with the scammer to prevent further manipulation or losses.

- Gather Evidence: Save all emails, messages, transaction receipts, and any other relevant documentation. This will be vital when reporting the scam.

- Inform Your Bank or Credit Card Provider: Contact your financial institution as soon as possible. They may be able to halt or reverse transactions and secure your accounts.

- Report the Scam: File a report with local authorities and relevant online platforms, such as the Federal Trade Commission (FTC) or the Internet Crime Complaint Center (IC3).

- Monitor Your Financial Accounts: Regularly review your bank accounts, credit card statements, and credit reports for unauthorized activities.

- Change Passwords and Secure Accounts: Update passwords for affected accounts and enable two-factor authentication to enhance security.

- Notify Credit Bureaus: Place a fraud alert on your credit file to prevent scammers from opening new accounts in your name.

- Educate Yourself: Learn about common scams and red flags to avoid falling victim again in the future.

Comparison of Common Scams and their Avoidance Strategies

Scammers use a variety of tactics to deceive unsuspecting individuals, exploiting trust, urgency, or lack of knowledge to achieve their objectives. Each type of scam operates differently, but all share a common goal: to defraud victims of money, personal information, or assets. Understanding the differences between common scams and knowing how to avoid them can help you stay safe.

Comparison Table of Common Scams and Their Avoidance Strategies

| Type of Scam | Description | Avoidance Strategy | |||

| Phishing Emails | Fraudulent emails that appear to be from reputable sources, asking for sensitive information. | Verify the sender’s email address, avoid clicking on suspicious links, and never share personal data. | |||

| Phone Scams | Fraudulent calls claiming urgent matters like unpaid taxes or lottery wins. | Hang up on unsolicited calls, avoid sharing personal details, and verify claims independently. | |||

| Online Shopping Scams | Fake e-commerce websites selling counterfeit or non-existent products. | Shop on trusted websites, read reviews, and avoid deals that seem too good to be true. | |||

| Investment Scams | Promises of high returns with little or no risk in fraudulent investment schemes. | Research the investment thoroughly, consult with a financial advisor, and avoid pressure to act quickly. | |||

| Romance Scams | Fraudsters pretending to form romantic relationships to exploit victims emotionally and financially. | Be cautious with online relationships, avoid sharing financial details, and verify their identity. | |||

| Tech Support Scams | Calls or pop-ups claiming your device is infected and offering to fix it for a fee. | Avoid unsolicited tech support offers, use trusted antivirus software, and don’t grant remote access. | |||

| Lottery Scams | Fake notifications about winning a lottery you didn’t enter. | Ignore messages about unsolicited wins, and never pay fees to claim a prize. | |||

| Charity Scams | Fraudulent charities soliciting donations, especially after disasters. | Verify charities through trusted platforms like Charity Navigator and donate directly via official websites. | |||

| Type of Scam | Common Tactics | How to Avoid | |||

| Phishing Emails | Fake links, urgent messages | Verify sender, don’t click unknown links | |||

| Investment Scams | High returns, no risk | Research thoroughly, consult experts | |||

| Identity Theft | Data breaches, phishing | Use secure sites, monitor accounts | |||

Conclusion

In conclusion, understanding the different types of scams and their associated risks is essential in today’s digital and interconnected world. Awareness and vigilance are your best defenses against falling victim to these fraudulent schemes. By recognizing common tactics used by scammers and implementing simple but effective avoidance strategies, you can protect your personal information, finances, and peace of mind. Remember, staying informed and cautious can make all the difference in ensuring your safety and that of your loved ones. Always verify before you trust, and never hesitate to report suspicious activities.