When it comes to filing taxes, understanding the 1099 form is crucial for both businesses and individuals earning non-employee income. The IRS Form 1099 is used to report various types of income received outside of traditional wages, such as freelance earnings, rental income, investment returns, and government payments. Unlike a W-2 form, which reports wages from an employer, a 1099 form is issued by businesses, financial institutions, or government agencies to individuals who receive taxable payments. But who exactly needs to file a 1099 form, and what is its purpose? This guide breaks down everything you need to know, including who must issue a 1099, who receives it, and why it’s an essential part of tax compliance.

What is a 1099 Form?

A 1099 form is an IRS tax document used to report income received outside of traditional employment. Unlike a W-2 form, which is issued to employees and includes tax withholdings, a 1099 form is given to individuals or businesses that have received payments for services, investments, or other taxable income sources. It serves as a record for the IRS to track income that may not have been automatically taxed. Freelancers, independent contractors, landlords, investors, and even individuals receiving government payments often receive a 1099 form. Since taxes are not typically withheld from these earnings, recipients are responsible for reporting the income and paying any applicable taxes when filing their tax returns.

Who Receives a 1099 Form?

A 1099 form is issued to individuals and businesses who receive income outside of traditional wages. It is commonly used for freelancers, independent contractors, investors, and other non-employee income earners. Since taxes are not typically withheld from these payments, recipients are responsible for reporting the income and paying taxes accordingly. Below are the most common types of individuals and entities who may receive a 1099 form.

- Freelancers & Independent Contractors – Anyone earning $600 or more from a client for services performed.

- Self-Employed Individuals & Gig Workers – Rideshare drivers, delivery workers, consultants, and other gig economy workers.

- Business Owners Hiring Non-Employees – Businesses that make payments to vendors, freelancers, or service providers.

- Investors – Those receiving interest (1099-INT), dividends (1099-DIV), or capital gains from the sale of stocks or assets.

- Landlords – Receiving rental income from real estate investments.

- Government Benefit Recipients – Those who receive unemployment benefits (1099-G) or taxable grants.

- Real Estate Sellers – Individuals who sell real estate and receive proceeds (1099-S).

- Payment App Users & Online Sellers – Those earning more than $5,000 (2024) or $600 (2026) via third-party payment platforms like PayPal, Venmo, or eBay (1099-K).

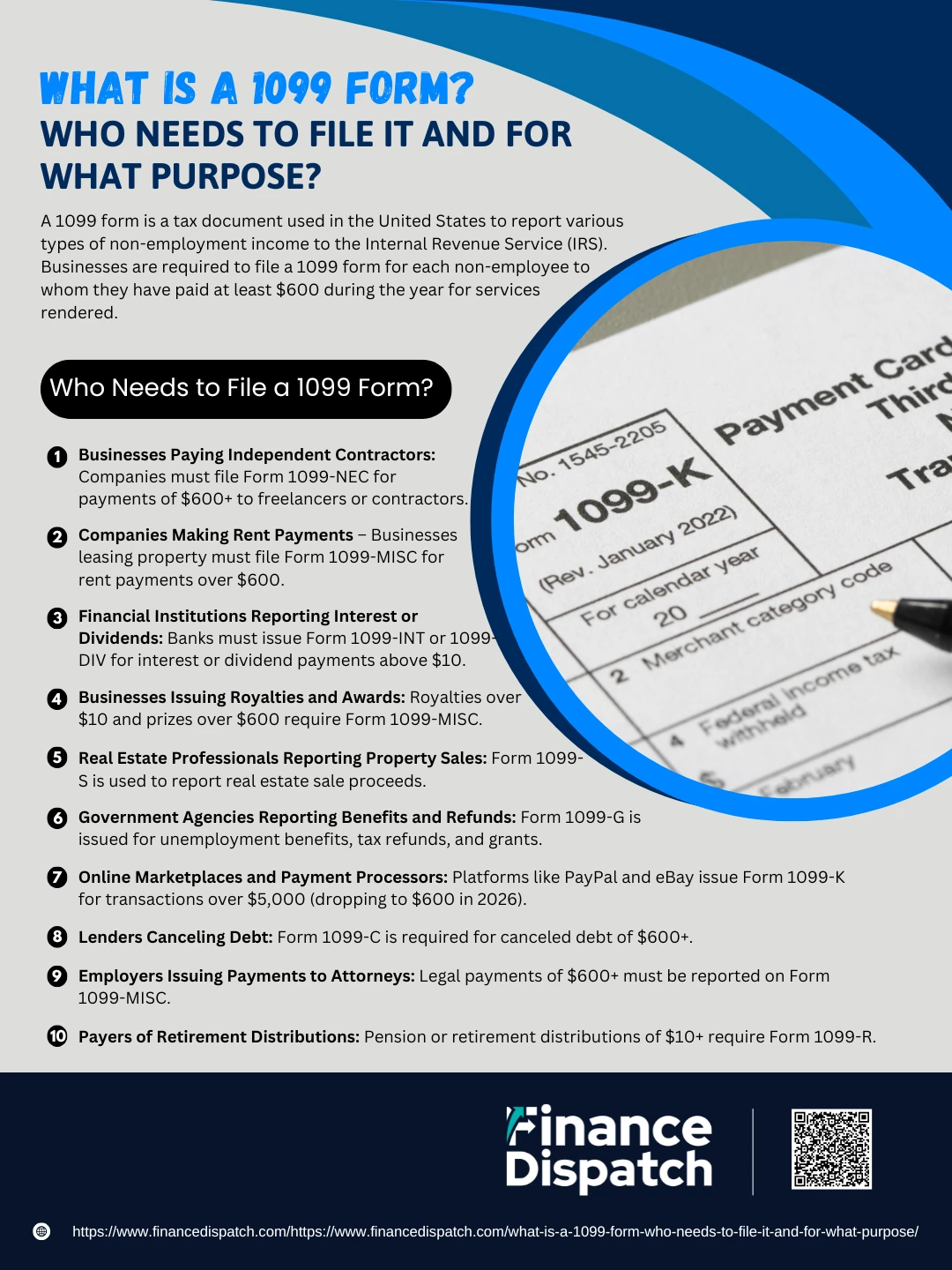

Who Needs to File a 1099 Form?

Who Needs to File a 1099 Form?

A 1099 form is an essential tax document used to report income paid to individuals or businesses who are not traditional employees. It is typically required for payments of $600 or more made throughout the tax year that are not subject to withholding taxes. Businesses, organizations, financial institutions, and even individuals must file a 1099 form when making qualifying payments. Filing this form ensures that the IRS is notified of taxable income, preventing underreporting or tax evasion. Below are the main situations where filing a 1099 form is mandatory.

1. Businesses Paying Independent Contractors

If a business pays $600 or more to an independent contractor, freelancer, or consultant for services rendered, they must file Form 1099-NEC (Nonemployee Compensation). This includes payments for graphic design, consulting, marketing, IT services, and other contract work. Unlike employees, independent contractors do not receive W-2 forms, meaning they must report their own income and pay self-employment taxes.

2. Companies Making Rent Payments

Businesses that lease commercial office space, buildings, equipment, or land from an individual or a partnership must file Form 1099-MISC (Miscellaneous Income) if their total payments exceed $600 in a year. This rule applies even if the property owner is not actively engaged in a rental business. However, rental payments made to corporations are generally exempt from 1099 filing requirements.

3. Financial Institutions Reporting Interest or Dividends

Banks, credit unions, investment firms, and other financial entities must issue Form 1099-INT (for interest payments) and Form 1099-DIV (for dividend payments) when individuals earn more than $10 in interest or dividends. These forms help the IRS track investment income and ensure that it is properly taxed.

4. Businesses Issuing Royalties and Awards

If a company pays at least $10 in royalties for book publishing, music streaming, patents, oil and gas rights, or other intellectual property, they must file Form 1099-MISC. Additionally, businesses that provide prizes, awards, or winnings of $600 or more must also report these amounts to the IRS. This applies to cash prizes, sweepstakes, and non-cash rewards with a fair market value above $600.

5. Real Estate Professionals Reporting Property Sales

Real estate agents, brokers, and title companies must file Form 1099-S to report proceeds from real estate transactions. This includes the sale of homes, commercial properties, and land. The form is issued to sellers and helps ensure that any capital gains from property sales are correctly reported for tax purposes.

6. Government Agencies Reporting Benefits and Refunds

State and federal agencies must issue Form 1099-G to individuals who receive government payments such as unemployment compensation, state or local tax refunds, taxable grants, or agricultural subsidies. This form ensures that recipients report taxable government income correctly.

7. Online Marketplaces and Payment Processors

Payment platforms such as PayPal, Venmo, Stripe, Etsy, and eBay must file Form 1099-K for users who process over $5,000 in transactions in 2024 (reducing to $600 in 2026). This applies to sellers, freelancers, or businesses accepting payments through digital platforms. The form helps the IRS track self-employment income and business earnings made through third-party processors.

8. Lenders Canceling Debt

When a lender forgives or cancels a debt of $600 or more, they must file Form 1099-C (Cancellation of Debt). Canceled debt is generally considered taxable income, meaning borrowers may owe taxes on the forgiven amount. This applies to credit card settlements, personal loans, mortgage foreclosures, and student loan forgiveness.

9. Employers Issuing Payments to Attorneys

Any business that pays an attorney $600 or more in a year for legal services, settlements, or lawsuit payments must file Form 1099-MISC, regardless of whether the attorney’s firm is incorporated. This helps track taxable legal fees and settlement amounts.

10. Payers of Retirement Distributions

If an individual receives pension, annuity, IRA distributions, or other retirement benefits totaling $10 or more, the entity making the payments must file Form 1099-R. This includes withdrawals from 401(k) plans, pension funds, and life insurance contracts. While some distributions are tax-free, others may be subject to income tax and penalties if withdrawn early.

Different Types of 1099 Forms

The IRS Form 1099 series consists of various forms used to report different types of non-employment income. These forms help track payments made to freelancers, contractors, landlords, investors, and others who earn taxable income outside of traditional wages. Each type of 1099 form serves a specific purpose, such as reporting interest, dividends, rent, or payments for services. Businesses, financial institutions, and government agencies must issue the appropriate 1099 form to recipients and the IRS. Below is a table outlining the most common types of 1099 forms, their purpose, and who files them.

Table: Common Types of 1099 Forms

| 1099 Form | Purpose | Who Files It? | Minimum Payment Threshold |

| 1099-NEC | Reports payments to independent contractors, freelancers, and gig workers | Businesses hiring contractors | $600+ per year |

| 1099-MISC | Reports miscellaneous income such as rent, royalties, prizes, and legal settlements | Businesses, landlords, insurance companies | $600+ (general), $10+ (royalties) |

| 1099-K | Reports payments received through third-party payment processors like PayPal, Venmo, eBay, and Stripe | Online platforms, payment processors | $5,000+ (2024), $600+ (2026) |

| 1099-INT | Reports interest income from bank accounts, savings accounts, and investments | Banks, credit unions, investment firms | $10+ per year |

| 1099-DIV | Reports dividends and capital gain distributions from investments | Brokerage firms, mutual funds, corporations | $10+ per year |

| 1099-B | Reports proceeds from the sale of stocks, bonds, or other securities | Brokerage firms, financial institutions | No minimum threshold |

| 1099-S | Reports proceeds from real estate transactions, such as home or land sales | Real estate brokers, title companies, closing agents | No minimum threshold |

| 1099-G | Reports government payments like unemployment benefits, state tax refunds, or grants | State or federal government agencies | $10+ per year |

| 1099-C | Reports canceled or forgiven debt, which may be considered taxable income | Banks, credit card companies, lenders | $600+ per year |

| 1099-R | Reports distributions from pensions, annuities, IRAs, and retirement plans | Insurance companies, pension administrators, financial institutions | $10+ per year |

| 1099-Q | Reports distributions from education savings accounts like 529 plans | Financial institutions managing 529 plans or Coverdell ESAs | No minimum threshold |

| 1099-LTC | Reports payments from long-term care insurance or accelerated death benefits | Insurance companies, healthcare providers | No minimum threshold |

| 1099-PATR | Reports cooperative patronage dividends from co-op organizations | Cooperatives, agricultural groups | $10+ per year |

What is a 1099 Form Used For?

What is a 1099 Form Used For?

A 1099 form is used to report various types of non-employee income to the IRS. It serves as a record for individuals and businesses that receive payments outside of traditional wages and helps ensure that taxable income is properly reported. Since taxes are not typically withheld from these payments, recipients are responsible for reporting the income on their tax returns. Whether it’s freelance earnings, investment income, rental payments, or government benefits, a 1099 form is essential for accurate tax filing and compliance. Below are the key purposes for which a 1099 form is used.

1. Reporting Independent Contractor and Freelancer Income

Businesses use Form 1099-NEC to report payments of $600 or more made to independent contractors, freelancers, and gig workers. This ensures that self-employed individuals properly report their earnings and pay self-employment taxes.

2. Tracking Rental and Royalty Payments

Landlords and businesses must file Form 1099-MISC if they pay $600 or more in rent to non-corporate property owners. Additionally, royalty payments of $10 or more (e.g., book royalties, oil and gas revenues) must be reported using the same form.

3. Declaring Interest and Dividend Income

Banks and investment firms issue Form 1099-INT to report interest payments of $10 or more and Form 1099-DIV for dividends or capital gain distributions received by investors. This helps the IRS track taxable investment income.

4. Documenting Stock and Securities Transactions

Form 1099-B is used by brokerage firms to report the sale of stocks, bonds, and other securities. It includes details about gains, losses, and transaction dates, helping taxpayers calculate their capital gains taxes.

5. Recording Payment Card and Third-Party Transactions

Payment processors like PayPal, Venmo, Stripe, and eBay use Form 1099-K to report business-related transactions for users who process over $5,000 in 2024 (reducing to $600 in 2026). This ensures that online sellers and gig economy workers report their taxable income.

6. Reporting Government Payments and Unemployment Benefits

State and federal agencies issue Form 1099-G to report government payments such as unemployment benefits, tax refunds, and taxable grants. Recipients must report this income and pay any required taxes.

7. Declaring Real Estate Sale Proceeds

Real estate brokers and title companies use Form 1099-S to report proceeds from the sale of homes, land, or other property. Sellers must use this form to determine whether they owe capital gains taxes.

8. Tracking Canceled Debt as Taxable Income

If a lender forgives or cancels $600 or more in debt, they must issue Form 1099-C to the borrower. The IRS treats canceled debt as taxable income, meaning recipients may need to pay taxes on the forgiven amount.

9. Reporting Retirement and Pension Distributions

Financial institutions issue Form 1099-R for distributions from pensions, annuities, IRAs, and retirement plans. If taxpayers withdraw funds before retirement age, they may also face penalties in addition to taxes.

10. Documenting Educational Savings Account Withdrawals

If funds are withdrawn from a 529 plan or Coverdell ESA, Form 1099-Q is used to report the distribution. If the funds are used for qualified education expenses, they may be tax-free.

How to File a 1099 Form?

How to File a 1099 Form?

Filing a 1099 form is essential for businesses, financial institutions, and individuals who need to report non-employee income to the IRS. If you have made payments of $600 or more to independent contractors, freelancers, or other recipients, you are required to file a 1099 form. The filing process involves collecting accurate information, selecting the correct form, submitting it to the IRS, and providing a copy to the recipient. Below is a step-by-step guide to properly filing a 1099 form.

1. Determine Who Needs a 1099 Form

Before filing, confirm whether you are required to issue a 1099 form. You must file a 1099-NEC if you paid a freelancer, contractor, or self-employed worker $600 or more for services. Other 1099 forms apply to rental payments, dividends, interest income, real estate sales, and other transactions.

2. Collect the Recipient’s Tax Information

To accurately file a 1099 form, request the recipient’s Taxpayer Identification Number (TIN), legal name, and address using Form W-9. This ensures the correct reporting of their income to the IRS.

3. Choose the Correct 1099 Form

There are different types of 1099 forms, and selecting the right one is crucial:

- 1099-NEC – For non-employee compensation (freelancers, contractors).

- 1099-MISC – For rent, royalties, prizes, and legal settlements.

- 1099-INT – For interest income from banks or investments.

- 1099-DIV – For dividend payments and capital gain distributions.

- 1099-K – For third-party payment transactions (PayPal, Venmo, eBay).

4. Fill Out the 1099 Form Accurately

Complete the form with correct details, including:

- Payer’s information (Your business name, address, and TIN).

- Recipient’s details (Their legal name, TIN, and address).

- Total amount paid to the recipient.

- Type of payment (services, rent, dividends, interest, etc.).

5. Submit the 1099 Form to the IRS

You can file the 1099 form with the IRS in two ways:

- Paper Filing – Use Form 1096 (Summary Form) when mailing paper copies. Must be sent by February 28.

- Electronic Filing – Recommended for businesses filing 10 or more The deadline for e-filing is March 31.

6. Provide a Copy to the Recipient

The IRS requires that recipients receive a copy of their 1099 form by January 31. This allows them to report the income on their tax return. You can send the form by mail, email (with recipient consent), or through an online portal.

7. Verify Filing Deadlines and Avoid Penalties

Missing the 1099 filing deadline can result in penalties ranging from $60 to $660 per form, depending on how late it is filed. Intentional failure to file can result in unlimited penalties. Stay compliant by filing before the due dates.

8. Correct Any Errors Promptly

If you realize a mistake after filing, submit a corrected 1099 form to the IRS. Incorrect reporting can result in IRS audits and penalties.

Deadlines for Filing 1099 Forms

Filing 1099 forms on time is crucial to avoid IRS penalties and ensure proper tax reporting. The deadlines vary depending on the method of filing (paper or electronic) and the type of 1099 form being submitted. Generally, recipients must receive their copies by January 31, while businesses must submit the forms to the IRS by January 31, February 28, or March 31, depending on the filing method. Missing these deadlines can result in fines ranging from $60 to $660 per form, with higher penalties for intentional disregard. Below is a detailed table outlining the 1099 filing deadlines.

Table: 1099 Form Filing Deadlines

| 1099 Form Type | Recipient Deadline (Copy to Payee) | Paper Filing Deadline (IRS) | Electronic Filing Deadline (IRS) |

| 1099-NEC (Non-Employee Compensation) | January 31 | January 31 | January 31 |

| 1099-MISC (Miscellaneous Income) | January 31 | February 28 | March 31 |

| 1099-INT (Interest Income) | January 31 | February 28 | March 31 |

| 1099-DIV (Dividend and Capital Gains) | January 31 | February 28 | March 31 |

| 1099-K (Third-Party Payment Transactions) | January 31 | February 28 | March 31 |

| 1099-B (Stock and Securities Transactions) | February 15 | February 28 | March 31 |

| 1099-S (Real Estate Transactions) | February 15 | February 28 | March 31 |

| 1099-G (Government Payments) | January 31 | February 28 | March 31 |

| 1099-C (Canceled Debt) | January 31 | February 28 | March 31 |

| 1099-R (Retirement Distributions) | January 31 | February 28 | March 31 |

| 1099-Q (Education Savings Plan Distributions) | January 31 | February 28 | March 31 |

Common Mistakes to Avoid When Filing a 1099

Common Mistakes to Avoid When Filing a 1099

Filing a 1099 form is an important step in reporting non-employee income to the IRS. However, many businesses and individuals make mistakes that can lead to penalties, delays, or incorrect tax reporting. Errors such as missing deadlines, incorrect information, or filing the wrong type of 1099 can create unnecessary complications. To ensure compliance and accuracy, here are some of the most common mistakes to avoid when filing a 1099 form.

1. Missing the Filing Deadline

One of the most frequent mistakes is not filing on time. The recipient copy is due by January 31, while IRS filing deadlines vary depending on the filing method (paper by February 28, electronic by March 31). Late filings can result in penalties ranging from $60 to $660 per form, with higher fines for intentional disregard.

2. Filing the Wrong Type of 1099 Form

There are several types of 1099 forms, and choosing the wrong one can lead to misreporting. For example:

- Use 1099-NEC for independent contractors and freelancers.

- Use 1099-MISC for rent, royalties, or prize winnings.

- Use 1099-K for third-party payment transactions (PayPal, Venmo, eBay).

3. Entering Incorrect Taxpayer Information

Mismatched or incorrect Taxpayer Identification Numbers (TINs), Social Security Numbers (SSNs), or names can lead to IRS rejection. Always collect accurate details from payees using Form W-9 before issuing a 1099 form.

4. Forgetting to Provide a Copy to the Recipient

Businesses must send a copy of the 1099 form to recipients by January 31. Failing to do so can create confusion for payees and may lead to IRS inquiries if the reported income does not match.

5. Reporting Incorrect Payment Amounts

Entering wrong dollar amounts can result in tax discrepancies for both the payer and recipient. Verify all payment records, bank statements, and invoices before filing to ensure accuracy.

6. Not Filing 1099 Forms for Eligible Payments

Some businesses mistakenly believe they don’t need to issue a 1099 form if they paid by credit card or through third-party platforms like PayPal. However, only payment processors issue 1099-K forms for qualifying transactions. Businesses must still issue a 1099-NEC or 1099-MISC for direct payments over $600.

7. Failing to Use Form 1096 for Paper Filings

If filing paper forms, you must include Form 1096, which serves as a summary of all submitted 1099s. Failing to attach Form 1096 can result in processing delays or rejections.

8. Ignoring Backup Withholding Requirements

If a payee fails to provide a correct TIN or SSN, the IRS requires businesses to withhold 24% of their payments as backup withholding. Neglecting this rule can result in IRS penalties.

9. Not Correcting Errors in Time

If you discover an error after filing, promptly submit a corrected 1099 form to the IRS. Errors left uncorrected can lead to IRS audits and additional fines.

10. Filing by Paper Instead of E-Filing When Required

The IRS requires electronic filing if submitting 10 or more 1099 forms. Failing to comply can lead to penalties unless an exemption is granted.

What Happens If You Don’t File a 1099?

Failing to file a 1099 form can result in IRS penalties, fines, and potential audits. If you are required to file a 1099-NEC, 1099-MISC, 1099-INT, or any other 1099 form and fail to do so, the IRS may impose penalties ranging from $60 to $660 per form, depending on how late the filing is. If the IRS determines that you intentionally disregarded the requirement, there is no maximum penalty limit, meaning fines can be substantial. Additionally, if a business fails to send a 1099 form to a recipient, that person may underreport income, triggering IRS scrutiny for both parties. Businesses may also face backup withholding requirements, forcing them to withhold 24% of payments for future transactions. Non-compliance with IRS filing rules can lead to audits, increased financial liabilities, and potential legal consequences, making it crucial to file 1099 forms accurately and on time.

Conclusion

Filing a 1099 form is an essential responsibility for businesses, financial institutions, and individuals who make qualifying payments to non-employees. Whether reporting freelancer earnings, rental income, interest, dividends, or other taxable payments, proper 1099 filing ensures IRS compliance and prevents penalties. Missing deadlines, providing incorrect information, or failing to file altogether can lead to financial penalties, IRS audits, and legal consequences. By understanding who needs to file, which form to use, and how to submit it correctly, businesses and taxpayers can avoid complications and ensure accurate tax reporting. Staying compliant with IRS regulations not only prevents costly mistakes but also helps maintain clear financial records and transparency in income reporting.