Hedge funds have long been a fascinating yet elusive part of the investment world, often associated with high-risk strategies, elite investors, and the potential for substantial returns. Unlike traditional investment vehicles such as mutual funds, hedge funds employ aggressive techniques like leverage, short selling, and derivatives to maximize profits—sometimes regardless of market direction. However, these funds are not easily accessible to everyday investors due to high entry requirements and regulatory limitations. With the rise of hedge fund-like ETFs and alternative investment platforms, retail investors now have more opportunities to gain exposure to hedge fund strategies. But does that mean they should? In this article, we’ll explore what hedge funds are, how they work, their risks and rewards, and whether they make sense for retail investors.

What is a Hedge Fund?

A hedge fund is a privately managed investment fund that pools money from accredited investors to pursue high-return strategies, often with greater flexibility and risk than traditional investment vehicles. Unlike mutual funds, which are highly regulated and accessible to the general public, hedge funds operate with fewer restrictions, allowing fund managers to invest in a wide range of assets, including stocks, bonds, derivatives, commodities, and even real estate. The term “hedge” originates from the strategy of hedging risks by taking both long and short positions, though modern hedge funds employ a variety of aggressive tactics beyond simple risk management. These funds are known for their high fees, typically following the “2 and 20” model—charging a 2% annual management fee and a 20% performance fee on profits. Due to their complex nature and potential for high volatility, hedge funds are generally reserved for institutional investors and high-net-worth individuals who can withstand significant financial risk.

How Do Hedge Funds Work?

How Do Hedge Funds Work?

Hedge funds are specialized investment funds designed to generate high returns by using advanced trading strategies that go beyond traditional stock and bond investments. Unlike mutual funds, which primarily invest in publicly traded securities and follow strict regulations, hedge funds have a more flexible investment approach, allowing them to trade in derivatives, real estate, private equity, and even commodities. Their managers actively manage portfolios to maximize gains, often employing leverage, short selling, and arbitrage strategies. These funds are typically reserved for institutional investors and high-net-worth individuals due to their high-risk nature, complex structures, and hefty fees. While hedge funds offer the potential for significant profits, they also come with a higher level of volatility and liquidity restrictions, making them a unique but challenging investment choice.

How Hedge Funds Operate: Key Steps

1. Pooling Investor Capital

Hedge funds gather funds from accredited investors, such as wealthy individuals, pension funds, and institutional firms. The pooled capital is then actively managed according to the fund’s strategy.

2. Fund Structure and Management

Most hedge funds operate as limited partnerships, where the fund manager (general partner) is responsible for investment decisions, while investors (limited partners) provide capital but have limited control over day-to-day operations.

3. Active Investment Strategies

Unlike passive mutual funds, hedge funds use sophisticated investment strategies, such as long/short equity (betting on both rising and falling stocks), event-driven trading (capitalizing on mergers, bankruptcies, and acquisitions), and macroeconomic strategies (investing based on global financial trends).

4. Use of Leverage

Many hedge funds borrow money or use margin trading to amplify potential returns. While this strategy can significantly boost profits, it also increases risk exposure, leading to potential large losses if market conditions turn unfavorable.

5. Risk Management and Hedging

Hedge funds employ various risk management techniques to minimize losses, such as investing in assets that move in opposite directions or using options and futures contracts to hedge against market fluctuations.

6. Fee Structure (2 and 20 Model)

Hedge funds charge high fees compared to traditional investments. The standard model involves a 2% management fee on total assets under management (AUM) and a 20% performance fee on profits earned by the fund. This means investors must pay even if the fund underperforms.

7. Limited Liquidity and Lock-Up Periods

Unlike mutual funds, hedge funds often impose lock-up periods, requiring investors to commit their money for a fixed duration (often a year or more). Redemptions are typically allowed only at certain intervals, such as quarterly or annually.

8. Regulatory Flexibility

Hedge funds are not as heavily regulated as mutual funds, allowing them to take more risks and explore a broader range of investment opportunities. However, this also means less transparency, making it essential for investors to conduct thorough research before investing.

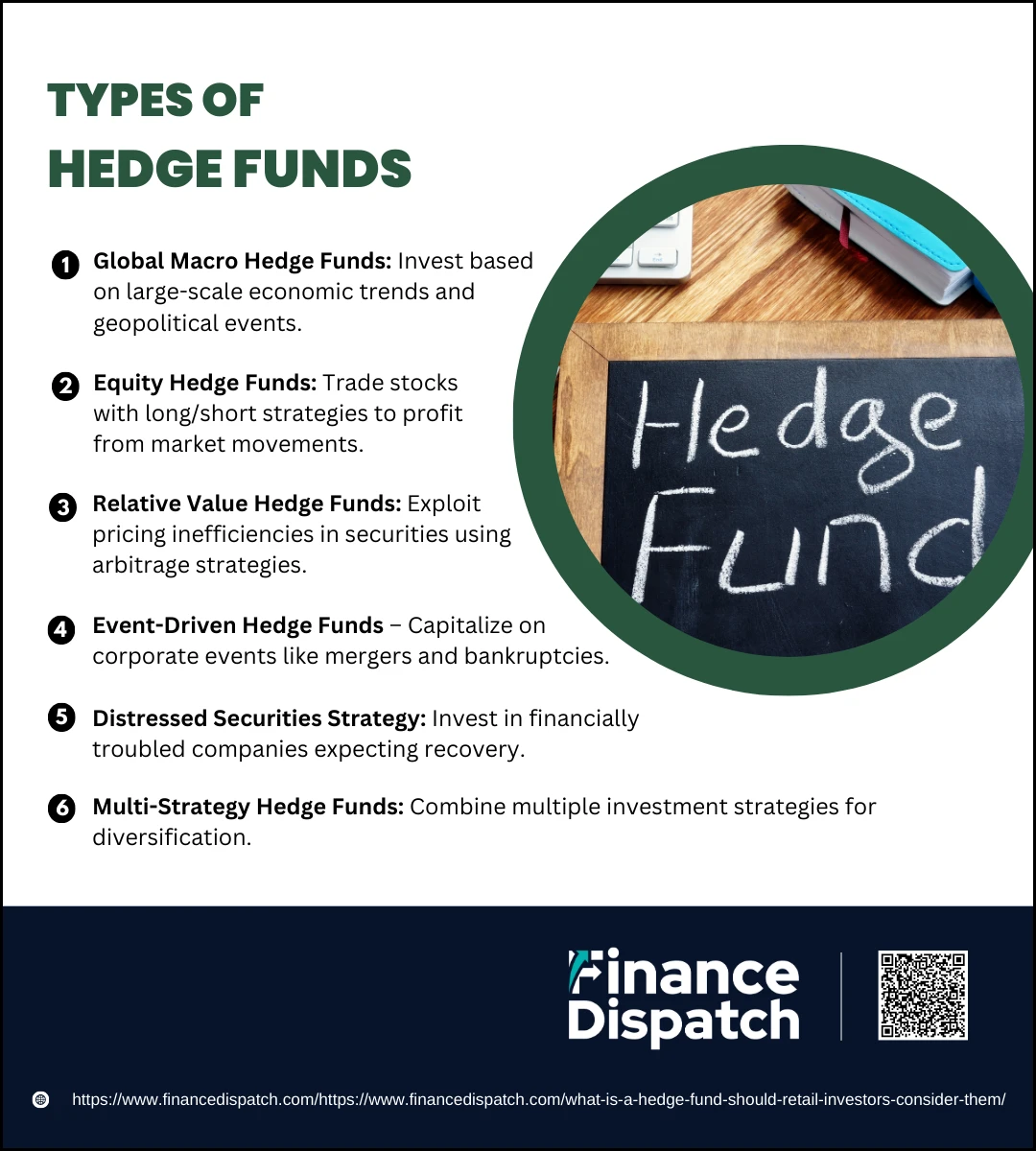

Types of Hedge Funds

Types of Hedge Funds

Hedge funds operate with various strategies, each designed to maximize returns while managing risks differently. Unlike traditional funds, hedge funds have the flexibility to invest in diverse asset classes, including equities, derivatives, commodities, and real estate. Their strategies range from macroeconomic forecasting to company-specific activism, allowing investors to choose funds that align with their risk tolerance and financial goals. Below are the primary types of hedge funds and how they function.

1. Global Macro Hedge Funds

These hedge funds focus on large-scale economic trends, such as changes in interest rates, political shifts, or currency fluctuations. Managers invest in a mix of asset classes, including bonds, currencies, and commodities, making bold bets based on macroeconomic analysis. Since these funds operate in global markets, they are highly speculative and can yield significant returns, but they also come with high risk due to their reliance on unpredictable economic conditions.

2. Equity Hedge Funds

Equity hedge funds primarily trade in stocks, aiming to profit from both rising and falling markets. These funds employ long and short positions—buying undervalued stocks while short-selling overvalued ones. Some equity hedge funds specialize in specific sectors, industries, or geographic regions. Their goal is to outperform the stock market by strategically selecting stocks that align with market trends and valuation metrics.

3. Relative Value Hedge Funds

These funds seek to exploit temporary price inefficiencies between related securities. They use arbitrage strategies, such as fixed-income arbitrage (profiting from interest rate differences), convertible arbitrage (trading convertible bonds and stocks), or volatility arbitrage (capitalizing on price fluctuations). While considered less risky than other hedge fund types, relative value strategies require precise timing and expertise to identify mispricings before they correct.

4. Event-Driven Hedge Funds

Event-driven hedge funds make investment decisions based on corporate events such as mergers, acquisitions, bankruptcies, or restructurings. They aim to profit from price movements that occur before or after these events. For example, merger arbitrage funds invest in companies involved in takeovers, betting on price changes as deals move toward completion. Distressed securities funds, another category, invest in struggling companies, hoping to gain if the business recovers or restructures successfully.

5. Activist Hedge Funds

Unlike other hedge funds that passively trade securities, activist hedge funds take large stakes in companies to influence management decisions. These funds aim to increase shareholder value by pushing for operational changes, cost-cutting measures, or restructuring. Some activist funds engage in proxy battles, advocating for board changes or executive replacements. While this approach can lead to substantial returns, it also involves a high level of involvement and strategic decision-making.

6. Multi-Strategy Hedge Funds

As the name suggests, multi-strategy hedge funds combine several investment approaches to diversify risk and maximize returns. They may simultaneously use macroeconomic trends, equity hedging, arbitrage, and event-driven tactics to balance their portfolio. These funds adapt their strategies based on market conditions, making them more flexible and resilient during different economic cycles.

Common Hedge Fund Strategies

Common Hedge Fund Strategies

Hedge funds use a variety of investment strategies to generate returns, often employing complex techniques beyond traditional stock and bond investments. Unlike mutual funds, which typically follow a buy-and-hold approach, hedge funds actively trade in equities, derivatives, commodities, and other financial instruments. Their goal is to maximize profits while managing risks through hedging, leverage, and arbitrage. Some strategies focus on macroeconomic trends, while others capitalize on company-specific events or pricing inefficiencies. Below are some of the most common hedge fund strategies and how they work.

1. Long/Short Equity Strategy

This is one of the most widely used hedge fund strategies. Managers take long positions in stocks they expect to rise in value while simultaneously short-selling stocks they anticipate will decline. By balancing these positions, they aim to generate returns regardless of overall market movements. For example, if a fund believes a technology company is undervalued, it will buy its stock while shorting a competitor that is overvalued.

2. Market Neutral Strategy

Similar to long/short equity, the market neutral strategy aims to eliminate exposure to market-wide risks by maintaining an equal balance between long and short positions. The goal is to make profits based on stock selection rather than overall market performance. This strategy often appeals to risk-averse investors since it minimizes broad market volatility.

3. Global Macro Strategy

Global macro hedge funds make investment decisions based on macroeconomic trends, such as interest rate movements, geopolitical events, or currency fluctuations. These funds trade across asset classes, including stocks, bonds, commodities, and foreign exchange. By analyzing global economic indicators, managers place strategic bets on market movements, making this a high-risk but potentially high-reward strategy.

4. Event-Driven Strategy

This strategy focuses on corporate events such as mergers, acquisitions, bankruptcies, and restructurings. Hedge funds using this approach invest in companies undergoing significant transitions, hoping to profit from stock price fluctuations before or after the event. There are several subcategories, including merger arbitrage, where funds buy shares of companies being acquired and short-sell the acquirer’s stock, expecting price adjustments post-merger.

5. Distressed Securities Strategy

Hedge funds employing this strategy invest in companies facing financial distress, such as those undergoing bankruptcy or restructuring. These funds buy distressed bonds or stocks at a steep discount, expecting them to increase in value if the company successfully recovers. While this approach can generate significant returns, it also carries a high risk, as the company may fail to turn around.

6. Fixed-Income Arbitrage Strategy

This strategy involves identifying mispricings in bond markets and exploiting interest rate differentials. Managers take both long and short positions in different fixed-income securities to profit from temporary price discrepancies. Since bonds are typically less volatile than stocks, fixed-income arbitrage is often seen as a lower-risk hedge fund strategy, though it still requires careful market analysis.

7. Convertible Arbitrage Strategy

Convertible arbitrage funds invest in convertible bonds, which can be converted into company shares. The strategy involves taking a long position in the bond while short-selling the company’s stock. This approach profits from pricing inefficiencies between the convertible bond and the underlying stock, offering potential returns with relatively lower risk.

8. Quantitative (Quant) Strategy

Quantitative hedge funds use computer models and algorithms to identify trading opportunities. These funds rely on big data, machine learning, and high-frequency trading to make investment decisions. Instead of traditional fundamental analysis, quant funds use statistical models to predict price movements and execute trades at high speeds.

9. Multi-Strategy Approach

Some hedge funds use a combination of multiple strategies to diversify risk and maximize returns. These funds might employ a mix of long/short equity, event-driven, macroeconomic, and arbitrage strategies, adjusting their approach depending on market conditions. This flexibility allows hedge funds to navigate different economic cycles effectively.

Hedge Funds vs. Mutual Funds: Key Differences

Hedge funds and mutual funds are both investment vehicles that pool money from multiple investors, but they differ significantly in terms of strategy, risk, accessibility, and regulation. Mutual funds are widely available to retail investors and focus on long-term, diversified investments in stocks, bonds, and other securities. They follow strict regulations and aim for steady growth with lower risk. In contrast, hedge funds use aggressive investment strategies, including leverage, short selling, and derivatives trading, to maximize returns. They are primarily accessible to accredited investors and operate with fewer regulatory constraints. Understanding the key differences between these two funds can help investors make informed financial decisions.

Comparison of Hedge Funds and Mutual Funds

| Feature | Hedge Funds | Mutual Funds |

| Investor Eligibility | Restricted to accredited investors (high-net-worth individuals and institutions) | Open to all investors, including retail investors |

| Investment Strategy | Uses high-risk strategies such as short selling, leverage, and derivatives | Focuses on diversified, long-term investments in stocks and bonds |

| Regulation | Lightly regulated by financial authorities, allowing for flexible investment approaches | Heavily regulated to protect retail investors and ensure transparency |

| Liquidity | Often imposes lock-up periods, restricting investor withdrawals | Highly liquid, allowing investors to redeem shares anytime |

| Risk Level | High risk due to aggressive strategies and market volatility | Lower risk, designed for stable, long-term growth |

| Fee Structure | “2 and 20” model: 2% management fee and 20% performance fee | Charges expense ratios, typically around 0.5%–1% |

| Transparency | Limited disclosure of holdings and strategies | Regularly discloses portfolio holdings and investment objectives |

| Leverage Usage | Frequently uses borrowed money to amplify returns | Limited or no leverage usage due to regulatory restrictions |

| Tax Efficiency | Can generate significant taxable events due to frequent trading | More tax-efficient, with managed distributions to minimize tax burdens |

| Objective | Aims for absolute returns, independent of market performance | Seeks to match or outperform market benchmarks |

Risks and Challenges of Hedge Funds

Hedge funds are known for their potential to generate high returns, but they also come with significant risks and challenges. Unlike traditional investment funds, hedge funds use aggressive strategies such as leverage, short selling, and derivatives trading, which can amplify both gains and losses. Their complex nature, high fees, and limited liquidity make them suitable primarily for institutional and high-net-worth investors. Additionally, hedge funds operate with less regulatory oversight, increasing the risk of mismanagement or fraud. Investors considering hedge funds must carefully weigh these risks before committing capital.

Key Risks and Challenges of Hedge Funds

- High Volatility – Hedge funds engage in speculative investments, which can lead to large swings in value, resulting in potential losses.

- Use of Leverage – Many hedge funds borrow money to increase investment exposure, which can magnify both gains and losses, leading to significant financial risk.

- Limited Liquidity – Unlike mutual funds, hedge funds often have lock-up periods, restricting investors from withdrawing funds for months or even years.

- High Fees – Hedge funds typically follow the “2 and 20” fee model, charging a 2% management fee and a 20% performance fee, reducing overall investor profits.

- Regulatory Risks – Hedge funds are subject to fewer regulations compared to mutual funds, increasing the risk of unethical practices, hidden fees, or conflicts of interest.

- Lack of Transparency – Many hedge funds do not disclose their full investment strategies or holdings, making it difficult for investors to assess risks accurately.

- Managerial Risk – The success of a hedge fund heavily depends on the expertise of fund managers. Poor decision-making or misjudged investments can lead to substantial losses.

- Market and Economic Risks – Hedge funds can be highly sensitive to economic downturns, interest rate changes, and geopolitical events, affecting their performance.

- Potential for Fraud – Due to minimal regulatory oversight, some hedge funds have been involved in fraudulent schemes, misleading investors about their actual performance.

- Tax Implications – Frequent trading within hedge funds can lead to complex tax situations, often resulting in higher tax burdens for investors.

Can Retail Investors Access Hedge Funds?

Traditionally, hedge funds have been reserved for institutional investors and high-net-worth individuals due to their high-risk nature, complex strategies, and substantial minimum investment requirements. Most hedge funds require investors to be accredited, meaning they must meet strict financial criteria, such as having a net worth exceeding $1 million (excluding primary residence) or an annual income of at least $200,000. However, in recent years, retail investors have gained indirect access to hedge fund-like strategies through investment vehicles such as hedge fund ETFs, liquid alternative funds, and mutual funds that replicate hedge fund techniques. These options provide exposure to some hedge fund strategies while offering more liquidity, lower fees, and regulatory protections. Despite these advancements, retail investors must still conduct thorough research and understand the risks before investing in hedge fund-related products, as they often carry higher fees and volatility compared to traditional mutual funds and ETFs.

Should Retail Investors Consider Hedge Funds?

Retail investors should carefully evaluate their financial goals, risk tolerance, and investment knowledge before considering hedge funds. While hedge funds offer the potential for high returns and diversification beyond traditional stocks and bonds, they also come with significant risks, including high fees, leverage, limited liquidity, and market volatility. Direct investment in hedge funds remains largely restricted to accredited investors, but retail investors can access hedge fund-like strategies through alternative investments such as hedge fund ETFs or mutual funds that mimic hedge fund approaches. However, these alternatives may still carry higher costs and risks compared to traditional investment options. For most retail investors, well-diversified portfolios consisting of index funds, ETFs, and traditional mutual funds may provide a more stable and cost-effective way to achieve long-term financial growth. Before investing in any hedge fund or hedge fund-like product, retail investors should conduct thorough research, assess their risk appetite, and, if necessary, seek advice from a financial professional.

Conclusion

Hedge funds are sophisticated investment vehicles that use advanced strategies to generate high returns, but they come with significant risks and barriers to entry. While traditionally limited to institutional and accredited investors, retail investors now have indirect access to hedge fund-like strategies through ETFs and mutual funds. However, these alternatives still carry higher risks, fees, and complexity compared to traditional investments. For most retail investors, a well-diversified portfolio with lower-cost options such as index funds and ETFs may be a more practical approach to wealth building. Before considering hedge fund investments, retail investors should thoroughly assess their risk tolerance, financial goals, and the potential downsides of these high-stakes investment strategies.