In the digital age, ownership has taken on a new meaning with the rise of Non-Fungible Tokens (NFTs)—unique digital assets stored on blockchain technology. Unlike traditional digital files that can be copied endlessly, NFTs provide verifiable proof of authenticity and ownership, revolutionizing the way people buy, sell, and trade digital content. From digital art and music to virtual real estate and gaming assets, NFTs have disrupted multiple industries, empowering creators with new ways to monetize their work while giving buyers exclusive rights to digital assets. This article explores what NFTs are, how they work, and their profound impact on digital ownership and the art world.

What is a Non-Fungible Token (NFT)?

A Non-Fungible Token (NFT) is a unique digital asset that represents ownership or proof of authenticity of a specific item, secured by blockchain technology. Unlike cryptocurrencies such as Bitcoin or Ethereum, which are fungible and can be exchanged on a one-to-one basis, NFTs are non-fungible, meaning each token is distinct and cannot be replaced by another of equal value. NFTs can represent digital art, music, videos, virtual real estate, collectibles, gaming items, and even real-world assets. Each NFT is embedded with metadata and a unique identifier, ensuring that its authenticity, ownership, and transaction history are securely recorded on the blockchain. This innovation has transformed the digital economy by enabling true digital ownership, empowering creators, and opening new opportunities in art, gaming, and beyond.

History of NFTs

The concept of Non-Fungible Tokens (NFTs) dates back to 2012 with the introduction of Colored Coins on the Bitcoin blockchain, which attempted to represent real-world assets digitally. However, NFTs as we know them began taking shape in 2014 when digital artist Kevin McCoy created the first known NFT, “Quantum”, on the Namecoin blockchain. The NFT space gained momentum in 2017 with projects like CryptoPunks, a collection of 10,000 unique pixelated characters, and CryptoKitties, a blockchain-based game that allowed users to collect and breed digital cats. These early experiments showcased NFTs’ potential in digital ownership, leading to an explosion of NFT marketplaces and applications. By 2021, NFTs had entered mainstream consciousness, with multimillion-dollar sales such as Beeple’s “Everydays: The First 5000 Days”, which sold for $69 million at a Christie’s auction. Since then, NFTs have evolved beyond digital art into gaming, music, virtual real estate, and even identity verification, reshaping the landscape of digital ownership and creativity.

How NFTs Work

How NFTs Work

Non-Fungible Tokens (NFTs) function through blockchain technology, providing a secure and decentralized way to authenticate and verify digital ownership. Unlike regular digital files that can be copied or shared without proof of origin, NFTs are unique, with each token carrying a distinct identifier stored on a blockchain. This ensures that ownership and transaction history are transparent and tamper-proof. NFTs are primarily created, bought, and sold using smart contracts, which automate the process of transferring ownership and enforcing creator royalties. Below is a step-by-step breakdown of how NFTs work.

1. Creation (Minting)

The process of creating an NFT begins when a digital asset, such as artwork, music, or a video, is uploaded to an NFT marketplace. The asset is then tokenized, which means it is converted into a unique cryptographic token linked to blockchain technology. During this process, important metadata such as the creator’s details, asset description, and ownership rights are embedded into the NFT.

2. Blockchain Storage

Once the NFT is minted, it is stored on a blockchain, such as Ethereum, Solana, or Binance Smart Chain. The blockchain acts as an immutable ledger that records the NFT’s unique identification number and all ownership transactions. While the NFT itself is on the blockchain, the actual digital file may be stored off-chain using decentralized storage solutions like IPFS (InterPlanetary File System) to reduce congestion on the blockchain.

3. Smart Contracts Execution

NFTs operate through smart contracts, which are self-executing programs coded into the blockchain. These contracts establish ownership rights, define how transactions are processed, and often include royalty mechanisms. This means that whenever an NFT is resold, a percentage of the sale automatically goes to the original creator, ensuring continuous earnings.

4. Buying and Selling

NFT marketplaces like OpenSea, Rarible, and Foundation facilitate the buying and selling of NFTs. Users list NFTs for sale by setting a fixed price or placing them up for auction. Buyers purchase NFTs using cryptocurrencies, and each transaction is recorded on the blockchain, ensuring transparency and authenticity.

5. Ownership Verification

One of the most significant advantages of NFTs is their ability to prove ownership. Since all transactions are recorded on a blockchain, anyone can verify who currently owns an NFT and trace its history. This prevents duplication or forgery, which is common in traditional digital assets.

6. Reselling and Trading

After purchasing an NFT, the owner can choose to keep it, trade it, or resell it on another marketplace. The resale value depends on demand, rarity, and the perceived value of the NFT. Since smart contracts govern transactions, each sale is seamless and does not require intermediaries.

7. Interoperability and Usage

Many NFTs have practical use cases beyond simple ownership. They can serve as access passes to exclusive events, virtual lands in metaverse platforms, in-game assets, or even proof of digital identity. Their interoperability allows them to be used across different platforms, enhancing their functionality and value.

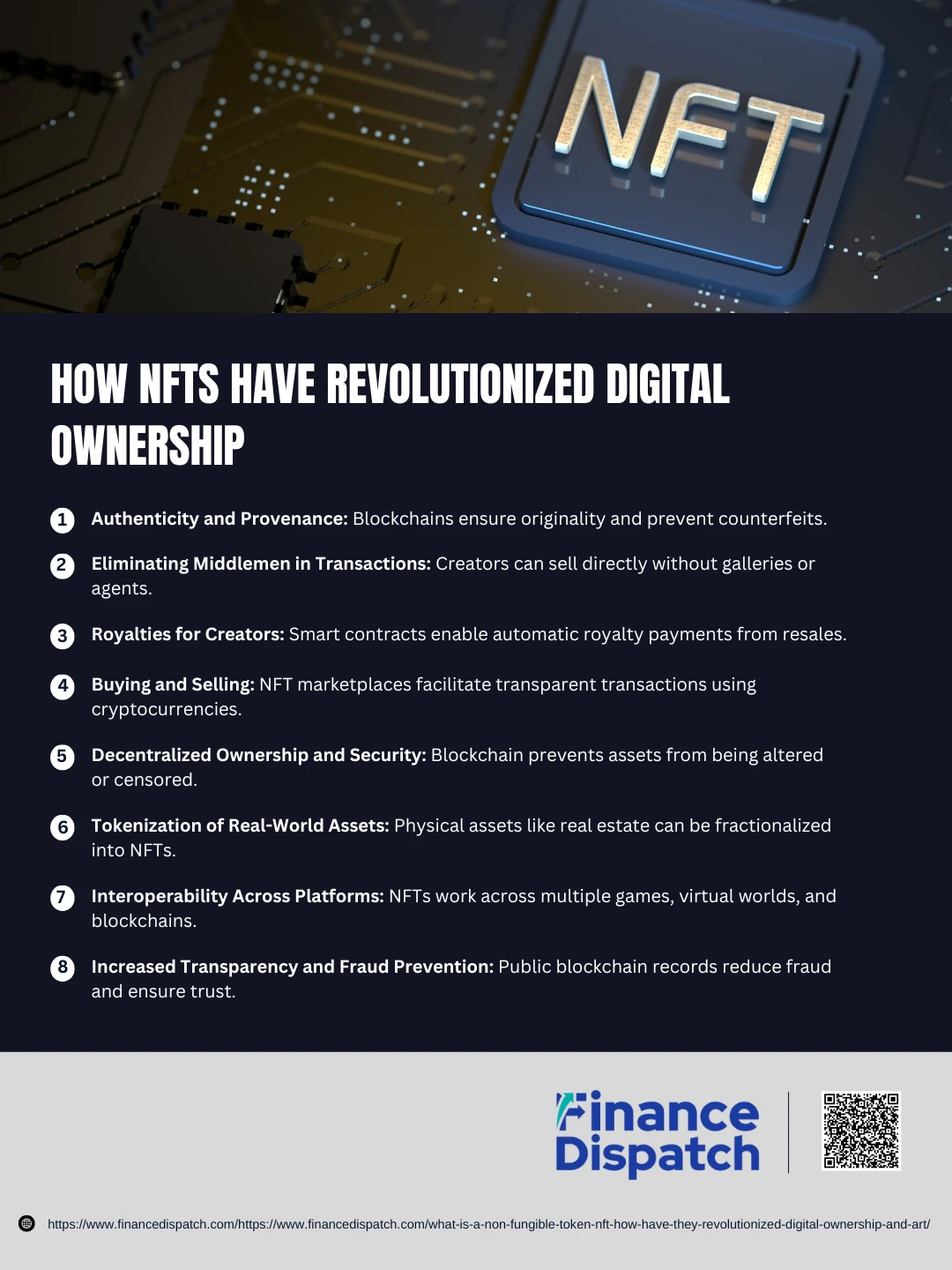

How NFTs Have Revolutionized Digital Ownership

How NFTs Have Revolutionized Digital Ownership

The concept of ownership has drastically changed with the advent of Non-Fungible Tokens (NFTs). Unlike traditional digital assets that can be copied and distributed without limitations, NFTs provide a verifiable and immutable record of ownership on a blockchain. This has empowered creators, collectors, and businesses by ensuring authenticity, exclusivity, and transparency in digital asset transactions. NFTs have redefined digital ownership across various industries, from art and music to gaming, real estate, and intellectual property. Below is a step-by-step breakdown of how NFTs have transformed digital ownership.

1. Authenticity and Provenance

NFTs ensure that digital assets have a verifiable origin and history. The blockchain records every transaction, making it easy to trace the original creator and past owners. This eliminates issues like plagiarism and counterfeit digital assets, ensuring authenticity and trust in ownership.

2. Eliminating Middlemen in Transactions

Traditionally, artists, musicians, and content creators relied on intermediaries like galleries, record labels, and agents to distribute and sell their work. NFTs enable direct-to-consumer transactions, allowing creators to retain full control over their work and maximize earnings without having to share profits with intermediaries.

3. Royalties for Creators

Smart contracts allow NFT creators to earn royalties from secondary sales. Every time an NFT is resold, a predefined percentage of the transaction automatically goes to the original creator. This ensures continuous revenue generation, which was previously impossible in traditional digital markets.

4. True Digital Ownership

Before NFTs, purchasing digital items such as e-books, music, or in-game assets meant users only had access rather than true ownership. NFTs provide exclusive ownership rights that are transferable, resellable, and verifiable on the blockchain, giving users full control over their digital assets.

5. Decentralized Ownership and Security

Since NFTs are stored on decentralized blockchains, ownership is permanent and cannot be altered or manipulated by any single entity. This prevents digital assets from being deleted, censored, or revoked by centralized platforms, ensuring long-term ownership security.

6. Tokenization of Real-World Assets

Beyond digital assets, NFTs have enabled the tokenization of physical assets like real estate, luxury goods, and intellectual property. This makes it possible to divide high-value assets into fractional ownership, allowing more people to invest and trade in assets that were once limited to high-net-worth individuals.

7. Interoperability Across Platforms

NFTs are not restricted to a single platform; they can be used, sold, or transferred across multiple blockchain networks, games, virtual worlds, and marketplaces. This cross-platform functionality enhances their utility and increases their value in the metaverse, gaming, and digital identity sectors.

8. Increased Transparency and Fraud Prevention

Every NFT transaction is publicly recorded on a blockchain, making it nearly impossible to forge or duplicate assets. This increases transparency in digital ownership and prevents fraud, benefiting artists, collectors, and investors who seek a secure and trustworthy marketplace.

NFTs in Art and Creativity

NFTs in Art and Creativity

The rise of Non-Fungible Tokens (NFTs) has transformed the art and creative industries by providing a new digital ownership model that benefits artists, musicians, and content creators. Traditionally, digital art and media faced challenges related to piracy, lack of exclusivity, and difficulty in monetization. NFTs solve these issues by allowing creators to tokenize their work, ensuring authenticity, scarcity, and direct sales without intermediaries. As a result, NFTs have opened new opportunities for artists to sell their work globally, earn royalties, and establish provable ownership. Below are some of the ways NFTs are revolutionizing art and creativity.

1. Digital Art Tokenization

NFTs enable artists to mint their digital artworks on a blockchain, creating unique and verifiable ownership records. Unlike traditional digital images that can be copied, NFTs ensure that the original artwork remains distinct and valuable. Platforms like OpenSea, Foundation, and SuperRare allow artists to sell their tokenized works directly to collectors.

2. Artist Royalties on Secondary Sales

One of the most significant advantages of NFTs is the ability for artists to earn royalties whenever their work is resold. Smart contracts automatically allocate a percentage of each resale back to the original creator, providing long-term revenue streams that were previously unavailable in traditional art markets.

3. Elimination of Art Market Gatekeepers

Before NFTs, artists had to rely on galleries, auction houses, and agents to sell their work, often losing a significant portion of their earnings in commissions. With NFTs, creators can sell their art directly to collectors, bypassing intermediaries and retaining full control over pricing and distribution.

4. Expansion of Digital Collectibles and 3D Art

NFTs have expanded beyond traditional 2D artwork to include 3D models, digital sculptures, and virtual reality (VR) art. Creators can now sell interactive and immersive experiences as NFTs, offering collectors new ways to engage with digital art in the metaverse and virtual galleries.

5. Collaborative and Generative Art

The blockchain allows multiple artists to collaborate on NFT projects, creating co-owned artworks that are automatically divided into fractional ownership shares. Generative art, which uses algorithms and artificial intelligence (AI) to create unique NFTs, has also gained popularity, with projects like Art Blocks showcasing the potential of algorithmically generated digital art.

6. Music NFTs and Ownership Rights

Musicians and sound designers have embraced NFTs to sell their work as limited-edition audio tracks, albums, or concert experiences. Instead of relying on streaming platforms that take a large cut of their earnings, artists can sell exclusive music NFTs that grant fans ownership and special perks, such as backstage passes or signed digital memorabilia.

7. NFT-Based Photography Marketplaces

Photographers can mint and sell their work as NFTs, ensuring exclusivity and preventing unauthorized use. NFT platforms dedicated to photography, such as Sloika and Quantum Art, provide a marketplace where photographers can retain copyright ownership while profiting from sales.

8. Fashion and Wearable NFTs

Fashion designers are creating digital clothing, accessories, and wearables for avatars in virtual worlds and games. These NFTs allow users to customize their digital identities while artists and brands monetize their designs. High-end fashion companies like Dolce & Gabbana and Gucci have already entered the NFT space with exclusive digital collections.

9. Virtual Art Galleries and Exhibitions

NFTs have enabled the creation of virtual galleries and museums in the metaverse, where artists can showcase their work in decentralized, 3D spaces. Platforms like Decentraland and Cryptovoxels allow users to buy virtual land and curate exhibitions, creating a new era of digital art experiences.

10. Ownership and Digital Scarcity in Creative Works

NFTs have introduced the concept of digital scarcity, making digital artworks more valuable and collectible. Each NFT is uniquely identified on the blockchain, proving its authenticity and originality. This has shifted the perception of digital art from easily reproducible files to limited-edition, investment-worthy assets.

Real-World Applications of NFTs

NFTs have expanded beyond digital collectibles, revolutionizing various industries by providing secure ownership, transparency, and authenticity through blockchain technology. From real estate and digital identity to supply chain management and entertainment, NFTs are transforming how assets are verified, bought, and sold.

- Real Estate – Enables fractional ownership and secure property transactions.

- Digital Identity & Certifications – Stores academic degrees, licenses, and IDs on blockchain.

- Event Ticketing – Prevents fraud with tamper-proof, resellable digital tickets.

- Supply Chain Management – Ensures product authenticity and traceability.

- Intellectual Property Protection – Secures ownership rights for digital content.

- Luxury Goods Authentication – Verifies real-world assets to prevent counterfeiting.

- Gaming & Virtual Assets – Powers in-game economies and digital ownership.

- Music & Entertainment – Allows artists to sell exclusive content and earn royalties.

- Healthcare – Secures medical records for privacy and accessibility.

- Metaverse & Virtual Land – Facilitates buying and selling of virtual real estate.

Benefits of NFTs

Non-Fungible Tokens (NFTs) have revolutionized digital ownership by providing a secure, transparent, and decentralized way to verify and trade assets. Unlike traditional digital files that can be copied and shared without restriction, NFTs ensure authenticity, uniqueness, and ownership rights through blockchain technology. This has created new opportunities for artists, investors, businesses, and collectors across multiple industries. Below are some of the key benefits of NFTs.

1. Proof of Ownership and Authenticity

Each NFT is recorded on a blockchain ledger, providing a verifiable certificate of ownership. This ensures that the asset is unique, cannot be duplicated, and can always be traced back to its rightful owner.

2. Creator Royalties on Resales

NFTs use smart contracts to automatically pay royalties to original creators every time their work is resold. This allows artists, musicians, and content creators to earn ongoing revenue beyond the initial sale.

3. Direct Monetization for Creators

NFTs eliminate middlemen, allowing artists, musicians, and influencers to sell their work directly to buyers. This gives creators more control over pricing and distribution while maximizing their earnings.

4. Security and Immutability

Since NFTs exist on a blockchain, they are tamper-proof and cannot be altered. This provides a high level of security for digital assets, preventing fraud, forgery, and counterfeiting.

5. Scarcity and Exclusivity

NFTs introduce digital scarcity, making each asset unique or limited-edition. This increases the value and collectibility of digital art, music, and virtual goods, creating demand among collectors and investors.

6. Cross-Platform Compatibility

NFTs are interoperable, meaning they can be used across different platforms, games, and metaverses. This allows users to trade, sell, or display their NFTs in various digital environments.

7. Fractional Ownership

High-value assets like real estate, luxury goods, and artwork can be fractionalized into NFTs, allowing multiple people to invest in and own a portion of an expensive asset.

8. Transparency and Traceability

All NFT transactions are publicly recorded on the blockchain, ensuring full transparency. Buyers and sellers can track ownership history, pricing, and authenticity, reducing the risk of scams.

9. Enhanced Liquidity for Digital Assets

NFTs create liquidity for traditionally illiquid assets like art and collectibles. They can be easily bought, sold, or traded on NFT marketplaces, making digital assets more accessible.

10. Expanding Use Cases Across Industries

NFTs are being used in gaming, virtual real estate, identity verification, music, fashion, ticketing, and supply chain management, proving their widespread applications and long-term potential.

Challenges and Criticisms of NFTs

While Non-Fungible Tokens (NFTs) have introduced new possibilities in digital ownership and monetization, they also face significant challenges and criticisms. Issues related to environmental impact, market volatility, security risks, and lack of regulation have raised concerns among investors, creators, and policymakers. As NFTs continue to evolve, addressing these challenges will be crucial for their long-term adoption and sustainability. Below are some of the key challenges and criticisms of NFTs.

1. Environmental Impact: Many NFTs operate on energy-intensive blockchains, such as Ethereum, which use Proof-of-Work (PoW) mechanisms. This high energy consumption contributes to carbon emissions and environmental concerns.

2. Market Volatility and Speculation: NFT prices are highly speculative and unpredictable, leading to boom-and-bust cycles. Many investors buy NFTs hoping for quick profits, but market crashes have resulted in massive losses.

3. Lack of Regulation and Legal Uncertainty: The NFT space is largely unregulated, creating risks of fraud, money laundering, and intellectual property theft. Without clear legal frameworks, buyers and sellers face uncertainties in ownership rights and disputes.

4. Copyright and Intellectual Property Issues: NFTs do not always guarantee legal ownership of the underlying content, leading to cases where stolen or unauthorized works are minted and sold without the creator’s permission.

5. Security Risks and Fraud: Phishing scams, hacked marketplaces, and smart contract vulnerabilities pose risks to NFT buyers and collectors. Many users have lost valuable assets due to cyberattacks.

6. Illiquidity and Low Resale Value: Unlike cryptocurrencies, NFTs are not easily convertible into cash, and many projects lose value over time, making it difficult for sellers to find buyers.

7. Market Saturation and Oversupply: The rapid increase in NFT projects has led to oversaturation, making it harder for individual creators to stand out and sustain long-term value.

8. Scams and Pump-and-Dump Schemes: Some NFT collections are artificially hyped by creators and influencers, leading to inflated prices before the value crashes, leaving unsuspecting buyers with worthless assets.

9. Digital Asset Longevity: While NFTs are stored on a blockchain, the actual digital files (art, music, videos) are often hosted off-chain, meaning they could become inaccessible if the hosting service shuts down.

10. Exclusion Due to High Costs: NFT transaction fees (gas fees) and high listing prices limit accessibility, making it difficult for smaller artists and buyers to participate in the NFT market.

Future of NFTs

The future of Non-Fungible Tokens (NFTs) is poised for significant evolution, expanding beyond digital art and collectibles into industries such as real estate, finance, healthcare, and supply chain management. With the development of more scalable and energy-efficient blockchains, such as Ethereum 2.0 and Layer 2 solutions, concerns about high gas fees and environmental impact may be mitigated. Interoperability between different blockchain networks will enable NFTs to function seamlessly across multiple platforms, enhancing their utility in the metaverse, gaming, and virtual identity sectors. Additionally, regulatory frameworks are expected to evolve, offering better consumer protection and legal clarity around NFT ownership and intellectual property rights. Businesses and brands are increasingly adopting NFT-based loyalty programs, digital assets, and tokenized memberships, further integrating NFTs into mainstream commerce. As the technology matures, NFTs could redefine how people interact with digital assets, proving ownership, enabling decentralized finance (DeFi) applications, and revolutionizing content distribution. While challenges remain, continuous innovation in blockchain technology and real-world adoption suggest that NFTs will play a crucial role in shaping the future digital economy.

Conclusion

NFTs have transformed digital ownership, offering a revolutionary way to authenticate, trade, and monetize digital and real-world assets. From art and music to real estate, gaming, and identity verification, NFTs have created new opportunities for creators, investors, and businesses. However, challenges such as market volatility, security risks, environmental concerns, and legal uncertainties must be addressed for long-term sustainability. As blockchain technology advances, solutions like scalable networks, regulatory frameworks, and improved interoperability will shape the next phase of NFT adoption. Whether as a tool for decentralization, a medium for creative expression, or a foundation for the metaverse, NFTs are set to play a pivotal role in the evolving digital economy.