Financial markets play a pivotal role in the global economy, serving as platforms where securities are issued, bought, and sold. These markets are essential for channeling savings into productive investments, fostering economic growth, and enabling businesses to expand. Among the many types of financial markets, the primary and secondary markets stand out for their distinct functions and contributions to the trading ecosystem. While the primary market facilitates the issuance of new securities directly by issuers to investors, the secondary market provides a venue for trading existing securities among investors. Understanding the differences between these two markets is crucial for grasping how capital flows and liquidity are managed in the financial world. This article delves into the fundamental aspects of the primary and secondary markets, highlighting their roles, features, and interdependencies.

What is a Primary Market?

The primary market is the segment of the financial market where new securities are created and sold for the first time. It serves as a platform for companies, governments, and other entities to raise funds directly from investors by issuing stocks, bonds, or other financial instruments. This process is often associated with Initial Public Offerings (IPOs), where companies go public by offering their shares to the public for the first time. Unlike the secondary market, where previously issued securities are traded among investors, the primary market establishes a direct relationship between the issuer and the buyer. This market plays a crucial role in capital formation, enabling businesses to finance expansion projects and governments to fund infrastructure and development initiatives. By mobilizing resources from investors, the primary market lays the foundation for economic growth and development.

What is a Secondary Market?

The secondary market is the financial marketplace where existing securities, such as stocks, bonds, and derivatives, are bought and sold among investors. Unlike the primary market, where securities are issued directly by the company or government, the secondary market facilitates trading between investors, providing liquidity and price discovery. Well-known stock exchanges like the New York Stock Exchange (NYSE) and NASDAQ are prime examples of secondary markets. This market ensures that investors can easily buy or sell their holdings, fostering confidence in investing and enabling efficient allocation of capital. By offering a platform for continuous trading, the secondary market not only supports the needs of individual investors but also contributes to the overall stability and dynamism of the financial system.

Key Differences Between Primary and Secondary Markets

The primary and secondary markets serve distinct yet interconnected roles in the financial ecosystem. While the primary market is where new securities are issued and sold directly by the issuer to investors, the secondary market facilitates the trading of these securities among investors. These differences highlight how the two markets complement each other in promoting liquidity, capital formation, and efficient allocation of resources. Below is a table summarizing the key differences between the two markets:

| Aspect | Primary Market | Secondary Market |

| Definition | Market for the issuance of new securities. | Market for trading existing securities. |

| Participants | Issuers and investors. | Investors only (buyers and sellers). |

| Purpose | To raise capital for issuers. | To provide liquidity and enable trading of securities. |

| Pricing | Determined by the issuer, often through IPOs or auctions. | Determined by market forces based on supply and demand. |

| Ownership Transfer | Securities move from issuer to investors for the first time. | Securities are traded among investors. |

| Example | Initial Public Offerings (IPOs), government bond auctions. |

Importance of Both Markets in the Financial System

The primary and secondary markets are essential components of the financial system, working together to support economic growth and stability. The primary market provides a platform for organizations to raise fresh capital, enabling them to fund expansion projects, innovate, and contribute to economic development. This initial capital formation is vital for businesses and governments alike. On the other hand, the secondary market ensures liquidity and price discovery, allowing investors to trade securities efficiently and confidently. By providing an avenue for continuous trading, the secondary market increases the attractiveness of the primary market, as investors are assured of the ability to exit their investments if needed. Together, these markets create a robust ecosystem that mobilizes resources, supports investment, and fosters long-term financial stability.

Key Features of a Primary Market

The primary market plays a pivotal role in the financial system by facilitating the direct issuance of new securities to investors. It serves as a crucial mechanism for raising capital, allowing businesses, governments, and other entities to secure funding for growth, development, and other initiatives. Below are the key features that define the primary market:

1. Direct Transactions Between Issuer and Investor

The primary market facilitates the direct sale of securities from issuers to investors without involving intermediaries like brokers for trading. This direct connection establishes a foundational trust between the two parties.

2. Exclusive Platform for New Securities

All securities in the primary market are new creations, offered to the public for the first time. This exclusivity allows investors to access opportunities that are not yet available in secondary markets.

3. Capital Mobilization

The primary market is instrumental in channeling funds from surplus areas (investors) to deficit areas (issuers), fueling economic activities such as expanding operations, funding R&D, or launching public projects.

4. Initial Public Offerings (IPOs) and Other Mechanisms

While IPOs are the most recognized form of primary market transactions, other methods like private placements, rights issues, and preferential allotments are also commonly used.

5. Pre-Determined Pricing

Issuers, often in collaboration with underwriters, determine the price of securities through fixed pricing or book-building processes. This ensures fairness and reflects the valuation of the offering.

6. Regulated Environment

The primary market operates under stringent oversight by regulatory bodies like the Securities and Exchange Commission (SEC) to ensure investor protection, prevent fraud, and maintain market integrity.

7. Foundation for Secondary Market Activity

Securities issued in the primary market eventually enter the secondary market, where they can be traded among investors. This sequential process ensures liquidity and continuous price discovery.

8. Investor Confidence Building

By offering a well-structured, transparent, and regulated platform, the primary market fosters trust among investors, encouraging broader participation and long-term investment.

How Does a Primary Market Work?

The primary market is the initial platform where issuers introduce new securities to investors. The process is meticulously structured to ensure compliance, transparency, and fairness for all parties involved. Here’s a detailed explanation of each step in the process:

1. Decision to Raise Capital

The journey begins when a company, government, or other entity decides to raise funds for specific objectives. These objectives could range from business expansion, research and development, or infrastructure projects to refinancing debt or improving operational capacity. The decision often stems from strategic planning sessions and is aimed at fulfilling immediate or long-term financial goals.

2. Appointment of Intermediaries

Issuers bring on board financial experts, such as investment banks or underwriters, to manage the process. These intermediaries play a critical role in structuring the securities, determining pricing strategies, and navigating the regulatory landscape. They also act as advisors, ensuring the offering aligns with market conditions and investor expectations.

3. Regulatory Approvals

Before launching the securities, issuers must comply with stringent regulations set by authorities like the Securities and Exchange Commission (SEC). Regulatory bodies review the offering to ensure transparency and fairness, requiring detailed disclosures about the issuer’s financial health, risks, and the intended use of the funds.

4. Preparation of Offering Documents

Key documents such as a prospectus are prepared during this stage. The prospectus contains vital information, including details about the issuer, the nature of the securities, the pricing mechanism, and the objectives of the capital being raised. These documents provide potential investors with the data needed to make informed decisions.

5. Price Determination

Pricing is a crucial step and can be handled in different ways. In fixed pricing, the issuer sets a predetermined price for the securities. Alternatively, the book-building process involves gauging investor interest and demand during the subscription phase to arrive at a dynamic, market-driven price.

6. Marketing and Promotion

To attract potential investors, the offering is widely promoted through roadshows, advertising, and presentations. Issuers and their intermediaries engage in active communication with institutional investors, retail investors, and analysts to explain the investment opportunity and its potential benefits.

7. Subscription Period

Investors are invited to subscribe to the securities within a specified timeframe. They express their interest by submitting applications or bids, detailing the number of shares or bonds they wish to purchase. The subscription phase helps the issuer understand demand levels and adjust allocation strategies if needed.

8. Allocation of Securities

Once the subscription period closes, securities are allotted to investors based on their applications. In cases of oversubscription, where demand exceeds supply, allocation may be scaled down proportionately to ensure fairness among investors.

9. Funds Transfer and Issuance

After allocation, investors transfer the agreed-upon funds to the issuer. In exchange, the issuer officially transfers ownership of the securities to the investors. This step completes the primary transaction and allows the issuer to utilize the raised capital for its intended purpose.

10. Transition to Secondary Market

Once the securities are issued, they are listed on stock exchanges or other trading platforms. This listing facilitates their entry into the secondary market, where they can be freely traded among investors. This transition ensures liquidity and allows the initial investors to sell their holdings if needed.

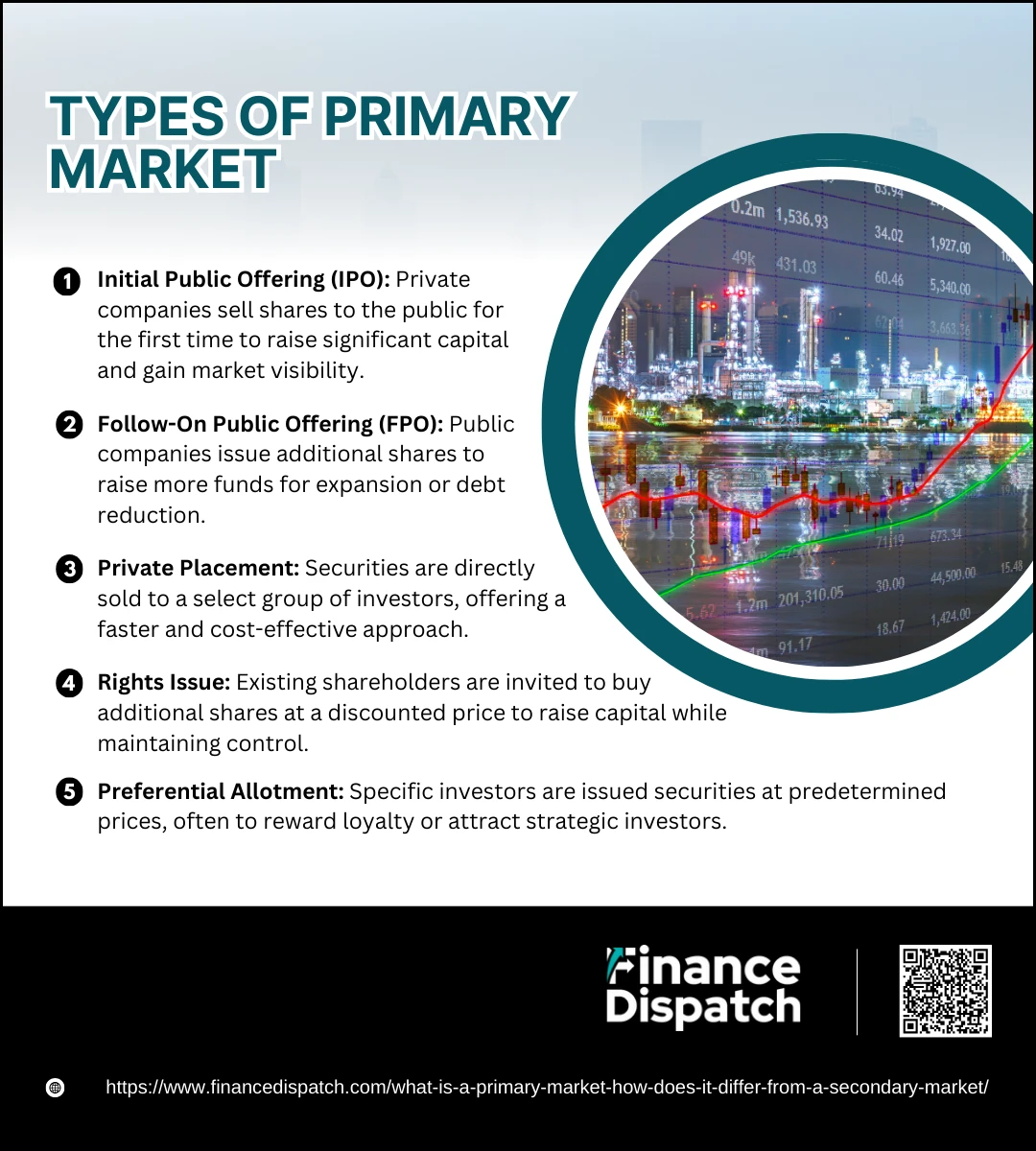

Types of Primary Market

The primary market offers a variety of mechanisms through which issuers can introduce new securities to investors. Each type serves distinct purposes, catering to the diverse needs of companies, governments, and other entities seeking to raise capital. By understanding these types, investors can better navigate the opportunities presented by the primary market. Below are the main types of primary market transactions:

1. Initial Public Offering (IPO)

A process where a private company offers its shares to the public for the first time, transitioning into a publicly traded entity. IPOs are often used to raise substantial capital and enhance the company’s visibility and credibility.

2. Follow-On Public Offering (FPO)

This occurs when an already public company issues additional shares to raise more funds. FPOs enable companies to expand their investor base and finance ongoing projects or reduce debt.

3. Private Placement

Securities are sold directly to a select group of investors, such as institutional investors or high-net-worth individuals, rather than the general public. This approach is faster and less expensive but limited in scope.

4. Rights Issue

Existing shareholders are offered the opportunity to purchase additional shares at a discounted price. Rights issues are typically used to raise funds while maintaining control within the current shareholder base.

5. Preferential Allotment

Securities are issued to a specific group of investors at a price determined by the issuer. This method is often used to bring strategic investors on board or to reward loyal shareholders.

Advantages and Challenges of the Primary Market

The primary market serves as the initial stage for securities issuance, providing a structured avenue for issuers to raise capital and for investors to access new opportunities. While it offers notable advantages for both parties, certain challenges also arise, making it essential to evaluate its impact holistically. Below is a detailed explanation of the advantages and challenges of the primary market:

Advantages of the Primary Market

1. Capital Formation

The primary market is a vital channel for raising funds directly from investors. Businesses use these funds for expanding operations, launching new products, or entering new markets, while governments utilize them for public infrastructure or development projects. This ability to mobilize resources plays a critical role in economic development.

2. Direct Investment Opportunities

Investors get the unique chance to buy securities at their initial offering price, which can lead to significant returns if the securities perform well. This direct access to new securities often attracts both retail and institutional investors looking to capitalize on early-stage opportunities.

3. Enhanced Transparency

Issuers in the primary market are required to comply with strict disclosure norms and regulatory requirements, ensuring that investors have access to detailed information about the offering. This transparency fosters trust and reduces the likelihood of fraud.

4. Facilitates Growth

The capital raised through the primary market enables companies to fund long-term growth initiatives. This includes investments in research and development, mergers and acquisitions, and workforce expansion, which collectively contribute to economic advancement.

5. Access to a Broader Investor Base

The primary market provides issuers with the opportunity to reach a diverse pool of investors, ranging from individual retail investors to large institutional players. This diversified funding source enhances financial stability and reduces dependency on a limited group of stakeholders.

Challenges of the Primary Market

1. High Regulatory Requirements

The primary market operates under stringent regulatory oversight, requiring issuers to provide extensive disclosures, file legal documentation, and undergo approvals from authorities like the Securities and Exchange Commission (SEC). These processes can be time-consuming and financially burdensome.

2. Pricing Risks

Determining the correct price for a new security is complex. Underpricing may result in issuers raising less capital than anticipated, while overpricing can deter investors and lead to poor demand. Striking the right balance is a critical challenge.

3. Limited Liquidity

Securities issued in the primary market are not immediately tradable. Investors must wait until the securities are listed on secondary markets, creating a temporary lack of liquidity and limiting the ability to exit investments.

4. Market Volatility

The success of primary market offerings is often tied to broader market conditions. Economic instability, geopolitical events, or changes in investor sentiment can adversely affect demand and pricing for new securities.

5. Risk of Oversubscription or Undersubscription

Oversubscription occurs when investor demand exceeds the number of available securities, leading to partial allocation and dissatisfaction. Conversely, undersubscription can signal weak demand, damaging the issuer’s credibility and impacting future fundraising efforts.

6. Investor Uncertainty

New securities in the primary market often lack historical performance data, making it difficult for investors to assess their risk and potential returns. This uncertainty can make investors hesitant to participate, particularly in volatile market conditions.

Why is Trading Conducted in Primary Market?

Trading in the primary market is conducted to enable the issuance of new securities directly from issuers to investors, fulfilling a critical role in capital formation. This market provides organizations such as companies, governments, and public institutions with a platform to raise funds for specific purposes, such as business expansion, infrastructure development, or debt repayment. Unlike the secondary market, where securities are exchanged among investors, the primary market facilitates the initial creation and sale of securities, establishing a direct relationship between the issuer and the buyer. This direct trade ensures that issuers can access much-needed resources while investors gain an opportunity to invest in new ventures at the ground level. The primary market’s structure ensures transparency, regulatory oversight, and efficient pricing, which collectively build trust and encourage participation in the financial ecosystem. By mobilizing resources efficiently, trading in the primary market supports economic growth and innovation.

Conclusion

The primary market serves as a cornerstone of the financial ecosystem, offering a platform for the direct issuance of new securities that fuels economic growth and innovation. By facilitating capital formation, it empowers businesses, governments, and other entities to achieve their financial goals while providing investors with opportunities to engage in new ventures. Despite its challenges, such as regulatory demands and pricing complexities, the primary market remains a vital mechanism for mobilizing resources and fostering transparency in financial transactions. Its interconnected role with the secondary market ensures a seamless flow of capital and liquidity, reinforcing its significance in building a robust and sustainable financial system. Understanding the dynamics of the primary market is essential for issuers and investors alike, as it paves the way for strategic financial planning and long-term success.