When borrowing money, whether for a home, car, or personal expenses, understanding the type of loan you choose is crucial. Loans generally fall into two broad categories: secured loans and unsecured loans. A secured loan requires collateral—an asset like a house, car, or savings account—while an unsecured loan is granted based on creditworthiness alone. While secured loans often come with lower interest rates and higher borrowing limits, they also carry the risk of losing your asset if you default. On the other hand, unsecured loans provide more flexibility but typically come with stricter approval criteria and higher interest rates. This article will break down the key differences between secured and unsecured loans, their advantages and risks, and how to choose the right one for your financial needs.

What is a Secured Loan?

A secured loan is a type of loan that requires the borrower to provide collateral—an asset such as a home, car, or savings account—as security for the loan. This collateral serves as a guarantee for the lender, reducing their risk and allowing them to offer lower interest rates and higher borrowing limits compared to unsecured loans. Common examples of secured loans include mortgages, where the house being purchased acts as collateral, and auto loans, where the financed vehicle secures the loan. Because lenders have the right to seize the collateral if the borrower defaults, secured loans are generally easier to qualify for, even for those with lower credit scores. However, the risk of losing valuable assets makes it essential for borrowers to ensure they can meet the repayment terms before taking out a secured loan.

How Does a Secured Loan Work?

How Does a Secured Loan Work?

A secured loan is a borrowing option where the lender requires the borrower to pledge an asset—such as a house, car, or savings account—as collateral. This collateral acts as security, ensuring the lender can recover their money if the borrower defaults on repayment. Because secured loans present lower risk to lenders, they generally come with lower interest rates, higher borrowing limits, and longer repayment terms than unsecured loans. However, the biggest drawback is that failure to repay the loan can result in the loss of the collateral, meaning you could lose your home, car, or other valuable assets. Secured loans are commonly used for major purchases like homes, vehicles, and business equipment, but they also come in other forms, such as secured credit cards and home equity lines of credit (HELOCs). Understanding how a secured loan works can help you make informed financial decisions and avoid unnecessary risks.

Steps in the Secured Loan Process:

1. Application and Credit Check

The borrower submits an application to a lender, providing details such as income, employment, credit history, and the asset they are offering as collateral. While creditworthiness is still a factor, secured loans are generally easier to qualify for than unsecured loans because of the collateral provided.

2. Collateral Assessment and Loan Approval

The lender evaluates the asset pledged as collateral to determine its value and ensure it is sufficient to cover the loan amount. For example, in a mortgage, the lender will appraise the home, while in an auto loan, the lender will check the car’s market value. Based on this assessment, the lender decides the maximum loan amount they can offer.

3. Loan Agreement and Terms

Once approved, the borrower and lender agree on the loan terms, including interest rate, repayment schedule, loan duration, and any additional fees. These terms vary depending on the type of secured loan and the lender’s policies.

4. Disbursement of Funds

After signing the loan agreement, the lender disburses the loan amount. Depending on the loan type, the funds may be directly transferred to the borrower (as in personal loans) or paid to the seller (as in mortgages and auto loans).

5. Regular Repayments with Interest

The borrower must make monthly payments as per the agreed terms. Each payment typically includes a portion of the principal amount and interest. Some secured loans, like mortgages and auto loans, have fixed payments, while others, such as HELOCs or secured credit lines, may have variable payments based on usage.

6. Collateral Release or Seizure

- If the borrower successfully repays the entire loan amount, the lender releases the collateral, meaning the borrower regains full ownership of the asset without any lender claims.

- If the borrower fails to repay, the lender has the legal right to seize the collateral. This could result in foreclosure (for home loans), repossession (for car loans), or liquidation (for other secured assets). Defaulting on a secured loan can also severely impact the borrower’s credit score, making future borrowing more difficult.

Types of Secured Loans

Types of Secured Loans

Secured loans come in various forms, each designed to meet different financial needs. What they all have in common is the requirement for collateral, which acts as security for the lender in case the borrower fails to repay the loan. Because of this collateral, secured loans generally offer lower interest rates, higher borrowing limits, and easier approval compared to unsecured loans. Depending on your financial situation and borrowing purpose, you may choose from several types of secured loans.

Common Types of Secured Loans

1. Mortgage Loans

A mortgage loan is one of the most common types of secured loans, primarily used for purchasing a home or real estate property. The house itself serves as collateral, meaning that if the borrower fails to make payments, the lender has the legal right to foreclose and take ownership of the property. Mortgages generally offer long repayment terms, often spanning 15 to 30 years, and have relatively lower interest rates due to the secured nature of the loan.

2. Home Equity Loans & HELOCs (Home Equity Line of Credit)

Home equity loans allow homeowners to borrow against the equity they have built in their homes. The loan is provided as a lump sum, and the repayment is fixed over a set period. A HELOC, on the other hand, functions as a revolving credit line, allowing the borrower to withdraw funds as needed. Since the home serves as collateral for both types, failure to repay can result in foreclosure. These loans are often used for home improvements, debt consolidation, or other significant expenses.

3. Auto Loans

Auto loans are specifically designed to finance the purchase of vehicles, with the car itself serving as collateral. These loans are commonly offered by banks, credit unions, and dealership financing companies. If the borrower defaults on the loan, the lender has the right to repossess the vehicle and sell it to recover their money. Auto loans usually come with fixed interest rates and repayment terms ranging from three to seven years.

4. Secured Credit Cards

A secured credit card is a financial tool designed for individuals who are either building or repairing their credit. Unlike traditional credit cards, a secured credit card requires the cardholder to provide a cash deposit, which acts as collateral and determines the credit limit. This deposit reduces the lender’s risk, making approval easier for those with poor or limited credit history. Over time, responsible usage can help the borrower qualify for an unsecured credit card, at which point the initial deposit is refunded.

5. Car Title Loans

Car title loans are short-term, high-interest loans where the borrower uses their vehicle’s title as collateral. These loans are generally easy to obtain, even for individuals with poor credit. However, they carry a significant risk—if the borrower fails to repay within the agreed time, the lender can legally repossess the vehicle. Car title loans are often used for emergency expenses but should be approached cautiously due to their high interest rates and short repayment periods.

6. Pawnshop Loans

Pawnshop loans are a quick way to access cash by leaving valuables—such as jewelry, electronics, or collectibles—as collateral at a pawnshop. The loan amount is typically based on the appraised value of the item. Borrowers have a set period to repay the loan and reclaim their item. If they fail to repay, the pawnshop has the right to sell the item. While these loans provide immediate cash, they often come with high fees and short repayment terms.

7. Life Insurance Loans

Some permanent life insurance policies, such as whole life or variable life insurance, accumulate cash value over time. Policyholders can borrow against this cash value through a life insurance loan. Unlike other secured loans, there is no mandatory repayment schedule, as the borrowed amount can be deducted from the policy’s death benefit. However, unpaid loans may reduce the payout to beneficiaries, making it essential for policyholders to carefully consider borrowing against their life insurance.

8. Business Loans (Secured)

Businesses often take out secured loans to purchase equipment, real estate, or inventory. These loans require collateral, which may include business assets such as equipment, property, or even accounts receivable. In some cases, lenders may require a personal guarantee, meaning the business owner is personally responsible for repaying the loan if the business defaults. Secured business loans often come with competitive interest rates and longer repayment terms, making them a preferred financing option for expanding companies.

9. Savings-Secured or Share-Secured Loans

Savings-secured loans allow borrowers to use their savings account or certificate of deposit (CD) as collateral. These loans are often used by individuals with low credit scores who want to establish or rebuild credit. Since the lender holds the savings as collateral, the borrower cannot access those funds until the loan is fully repaid. Because the risk to the lender is minimal, these loans come with low interest rates and can be an excellent tool for credit-building.

What is an Unsecured Loan?

An unsecured loan is a type of loan that does not require any collateral or asset as security for borrowing. Instead, lenders approve unsecured loans based on the borrower’s creditworthiness, income, and financial history. Since there is no collateral to reduce the lender’s risk, unsecured loans typically have higher interest rates and stricter approval requirements compared to secured loans. Common examples of unsecured loans include personal loans, credit cards, student loans, and medical loans. While these loans offer flexibility and do not put personal assets at risk, failing to repay can result in credit score damage, higher penalties, and legal action from the lender. Borrowers considering unsecured loans should ensure they have a strong financial plan to repay the loan on time and avoid excessive debt accumulation.

Key Differences Between Secured and Unsecured Loans

When borrowing money, understanding the key differences between secured and unsecured loans is crucial. The main distinction lies in collateral—secured loans require an asset as security, while unsecured loans rely solely on the borrower’s creditworthiness. Because of this, secured loans usually offer lower interest rates, higher borrowing limits, and longer repayment terms, whereas unsecured loans come with higher interest rates and stricter approval criteria. Choosing between these two loan types depends on factors such as credit score, financial stability, loan amount, and risk tolerance. Below is a comparative table highlighting the major differences between secured and unsecured loans.

Comparison of Secured and Unsecured Loans

| Feature | Secured Loan | Unsecured Loan |

| Collateral Required | Yes (e.g., home, car, savings) | No collateral needed |

| Risk to Borrower | Risk of losing the collateral if loan is not repaid | No asset loss, but can damage credit score |

| Loan Amount | Higher borrowing limits | Typically lower borrowing limits |

| Interest Rates | Lower, due to reduced lender risk | Higher, since no collateral is involved |

| Approval Process | Easier approval, even with lower credit scores | Requires good credit history and financial stability |

| Repayment Terms | Longer repayment periods | Shorter repayment terms |

| Common Examples | Mortgages, auto loans, secured credit cards | Personal loans, credit cards, student loans |

| Impact of Default | Lender can seize collateral (e.g., foreclosure or repossession) | Lender may take legal action and report default to credit agencies |

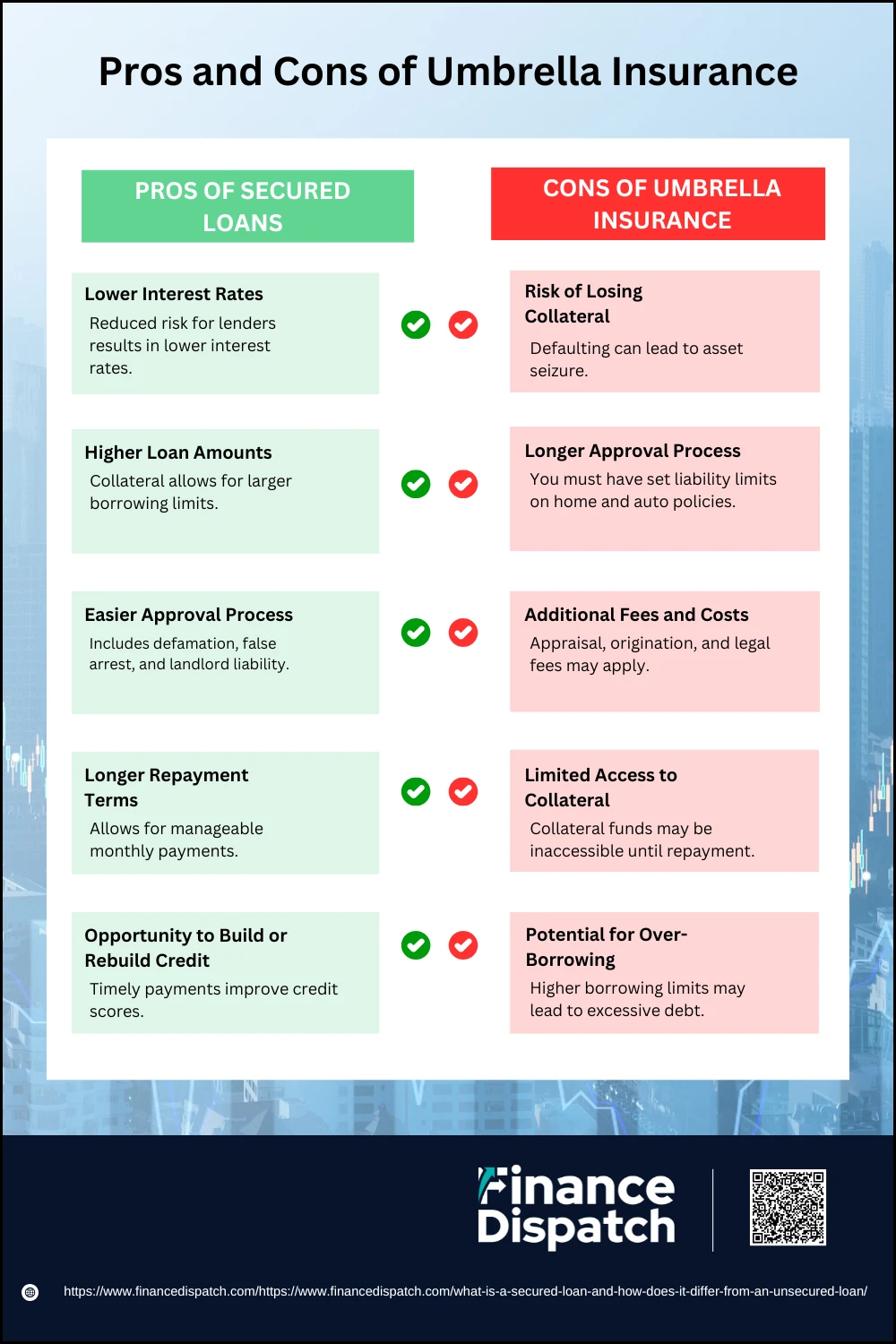

Pros and Cons of Secured Loans

Pros and Cons of Secured Loans

A secured loan is a type of loan backed by collateral, such as a house, car, or savings account. By offering collateral, borrowers provide lenders with a form of security, which lowers the lender’s risk and allows for better loan terms, such as lower interest rates and higher borrowing limits. However, the biggest drawback is that failure to repay the loan can lead to asset seizure, which may cause significant financial hardship. Secured loans are commonly used for home purchases (mortgages), auto financing, business investments, and secured credit cards. Before taking out a secured loan, it’s important to weigh the advantages and disadvantages to determine if it’s the right financial choice for you.

Pros of Secured Loans

1. Lower Interest Rates

Secured loans typically have lower interest rates compared to unsecured loans. Since the lender has collateral to fall back on, the risk is lower, and they can pass the savings on to the borrower in the form of reduced interest costs. This makes secured loans a more affordable option for those looking to finance big purchases.

2. Higher Loan Amounts

Lenders are usually willing to offer larger loan amounts with secured loans because they have an asset to secure their funds. This makes secured loans a great option for major expenses like buying a house, financing a car, or funding a business.

3. Easier Approval Process

If you have a low credit score or limited credit history, getting approved for an unsecured loan can be challenging. However, with a secured loan, lenders focus more on the value of the collateral rather than just your credit score. This makes it easier for individuals with poor or no credit to get loan approval.

4. Longer Repayment Terms

Unlike unsecured loans, which often have shorter repayment periods, secured loans usually come with longer repayment terms, sometimes stretching up to 30 years in the case of mortgages. This means lower monthly payments, making it easier to manage finances over time.

5. Opportunity to Build or Rebuild Credit

Making timely payments on a secured loan can help build or improve your credit score, which can open up better borrowing opportunities in the future. Secured credit cards, in particular, are an excellent way for individuals with bad credit to rebuild their financial reputation.

Cons of Secured Loans

1. Risk of Losing Collateral

The most significant disadvantage of a secured loan is that if you fail to make payments, the lender has the legal right to seize your asset. This could mean losing your home, car, savings, or any other valuable property used as collateral. Defaulting on a secured loan can lead to foreclosure (for mortgages) or repossession (for auto loans), which can have long-term financial consequences.

2. Longer Approval Process

Since secured loans require collateral evaluation, asset documentation, and legal verification, the approval process can take longer than unsecured loans. For example, home loans require property appraisals, title searches, and underwriting reviews before approval, which can delay loan disbursement.

3. Additional Fees and Costs

Some secured loans come with origination fees, appraisal charges, prepayment penalties, and legal documentation costs, increasing the overall cost of borrowing. Additionally, variable interest rate secured loans may lead to unexpected increases in repayment amounts over time.

4. Limited Access to Collateral

When using assets like savings accounts or certificates of deposit (CDs) as collateral, borrowers may lose access to these funds until the loan is fully repaid. This can create liquidity challenges, especially in emergencies when access to cash is needed.

5. Potential for Over-Borrowing

Because secured loans allow for higher borrowing limits, borrowers might take on more debt than they can afford to repay. This can lead to long-term financial stress, especially if unforeseen expenses arise or income levels change during the repayment period.

When Should You Choose a Secured Loan?

When Should You Choose a Secured Loan?

A secured loan can be a great option for borrowers who need larger loan amounts, lower interest rates, and longer repayment terms. Since these loans require collateral—such as a home, car, or savings account—they are often easier to qualify for, even if the borrower has a lower credit score. However, because the lender can seize the collateral if payments are missed, secured loans come with a significant level of risk. Choosing a secured loan should be based on your financial stability, borrowing needs, and ability to repay. Below are the key situations when opting for a secured loan makes sense.

When to Choose a Secured Loan:

1. When You Need a Large Loan Amount

If you require a significant sum of money—such as for buying a house, financing a vehicle, or funding a business expansion—a secured loan is often the best choice. Lenders are more willing to offer higher borrowing limits when collateral is involved.

2. When You Want Lower Interest Rates

Secured loans usually have lower interest rates than unsecured loans because the lender has collateral as security. This makes them a good option for borrowers looking to reduce long-term borrowing costs.

3. When You Have a Low Credit Score

If you have poor or limited credit history, getting approved for an unsecured loan can be challenging. Secured loans are easier to qualify for because the lender focuses more on the value of the collateral rather than just the borrower’s credit score.

4. When You Need a Longer Repayment Term

Secured loans often come with longer repayment periods, sometimes 10 to 30 years in the case of mortgages and home equity loans. This allows borrowers to spread out payments and reduce the monthly financial burden.

5. When You Want to Build or Rebuild Credit

If you are looking to improve your credit score, a secured loan (such as a secured credit card or savings-backed loan) can help. Making consistent, on-time payments demonstrates financial responsibility and can improve your creditworthiness over time.

6. When You Have Valuable Assets to Pledge

If you own an asset that you are comfortable using as collateral, a secured loan can be a practical financing option. However, it is essential to ensure that you can repay the loan on time to avoid losing the asset.

7. When You Want to Consolidate Debt

A secured loan can be used to consolidate high-interest debts, such as credit card balances or personal loans. By securing a lower interest rate through collateral, you can reduce overall interest costs and simplify repayments.

8. When You Are Starting or Expanding a Business

Many business owners use secured loans to purchase equipment, inventory, or commercial property. Lenders often require collateral for business loans, especially for startups or businesses with limited financial history.

Where to Get a Secured Loan?

Secured loans are widely available through various financial institutions, each offering different loan terms, interest rates, and collateral requirements. Banks and credit unions are traditional lenders that provide secured loans, including mortgages, auto loans, and home equity loans. These institutions often offer competitive interest rates and flexible repayment terms, especially for existing customers. Online lenders have become increasingly popular, offering secured personal loans and business loans with faster approval processes and minimal paperwork. Some online lenders even accept alternative forms of collateral, such as investments or savings accounts. Additionally, auto dealerships provide secured financing options for purchasing vehicles, while pawnshops and title loan lenders offer quick but high-risk secured loans using valuables or vehicle titles as collateral. Regardless of the lender, it’s essential to compare interest rates, repayment terms, fees, and collateral requirements before choosing a secured loan to ensure it aligns with your financial needs and repayment capability.

What Happens If You Default on a Secured Loan?

Defaulting on a secured loan can have serious financial consequences, as the lender has the legal right to seize the collateral used to secure the loan. If payments are missed, the lender may first impose late fees and report the delinquency to credit bureaus, which can significantly damage your credit score. If the default continues, the lender can initiate repossession or foreclosure, depending on the type of collateral. For example, if you default on a mortgage, the lender may start foreclosure proceedings, leading to the loss of your home. In the case of auto loans, the lender can repossess and sell your vehicle to recover the outstanding balance. Additionally, if the sale of the collateral does not cover the full loan amount, the borrower may still be responsible for paying the remaining balance, known as a deficiency balance. Beyond financial penalties, defaulting on a secured loan can make it difficult to qualify for future loans, as lenders may see you as a high-risk borrower. To avoid these consequences, it’s crucial to communicate with your lender if you’re struggling with payments, as they may offer options such as loan modification, refinancing, or payment deferrals.

Conclusion

Secured loans can be a valuable financial tool, offering lower interest rates, higher borrowing limits, and easier approval compared to unsecured loans. However, they also come with significant risks, as failure to make payments can result in the loss of collateral, whether it’s a home, car, or savings account. Choosing a secured loan should be based on your financial stability, borrowing needs, and ability to repay. Before taking out a secured loan, it’s crucial to compare lenders, understand the loan terms, and assess potential risks to ensure it aligns with your long-term financial goals. When used responsibly, a secured loan can help you finance major purchases, consolidate debt, or build credit, but careful planning is essential to avoid default and financial hardship.