Hearing the words “tax audit” can send a chill down anyone’s spine—but understanding what a tax audit actually is can take much of the fear out of the equation. A tax audit is not always a sign of wrongdoing; instead, it’s a review process the Internal Revenue Service (IRS) uses to verify that the information reported on a tax return is accurate and complete. Whether selected randomly, flagged by a discrepancy, or triggered by specific patterns, audits help ensure fairness in the tax system. In this article, we’ll break down what a tax audit involves and explore the common reasons the IRS might choose to audit someone—so you can stay informed, prepared, and confident.

What Is a Tax Audit?

A tax audit is a formal examination conducted by a tax authority—such as the Internal Revenue Service (IRS)—to verify the accuracy of an individual’s or business’s tax return. During this process, the IRS reviews financial records, income reports, deductions, and other tax-related details to ensure everything has been reported correctly under federal tax laws. Unlike routine financial audits initiated by companies themselves, tax audits are initiated by the IRS and often involve a deeper investigation into specific items that appear inconsistent, incomplete, or unusually high or low. The goal is not only to catch potential errors or omissions but also to maintain compliance and integrity within the tax system.

Who Conducts Tax Audits?

Tax audits are conducted by government tax authorities tasked with ensuring individuals and businesses comply with tax regulations. In the United States, the Internal Revenue Service (IRS) is responsible for performing tax audits. However, other countries have their own agencies that oversee this process, and each operates under different regulations and procedures. While the specific authority may vary, the core purpose remains the same: to verify accurate tax reporting and enforce tax compliance.

Here’s a comparison of tax audit authorities across several countries:

| Country | Tax Authority |

| United States | Internal Revenue Service (IRS) |

| United Kingdom | HM Revenue and Customs (HMRC) |

| Germany | Bundeszentralamt für Steuern (BZSt) |

| France | Direction Générale des Finances Publiques (DGFiP) |

| Australia | Australian Taxation Office (ATO) |

Why Might the IRS Choose to Audit Someone?

Why Might the IRS Choose to Audit Someone?

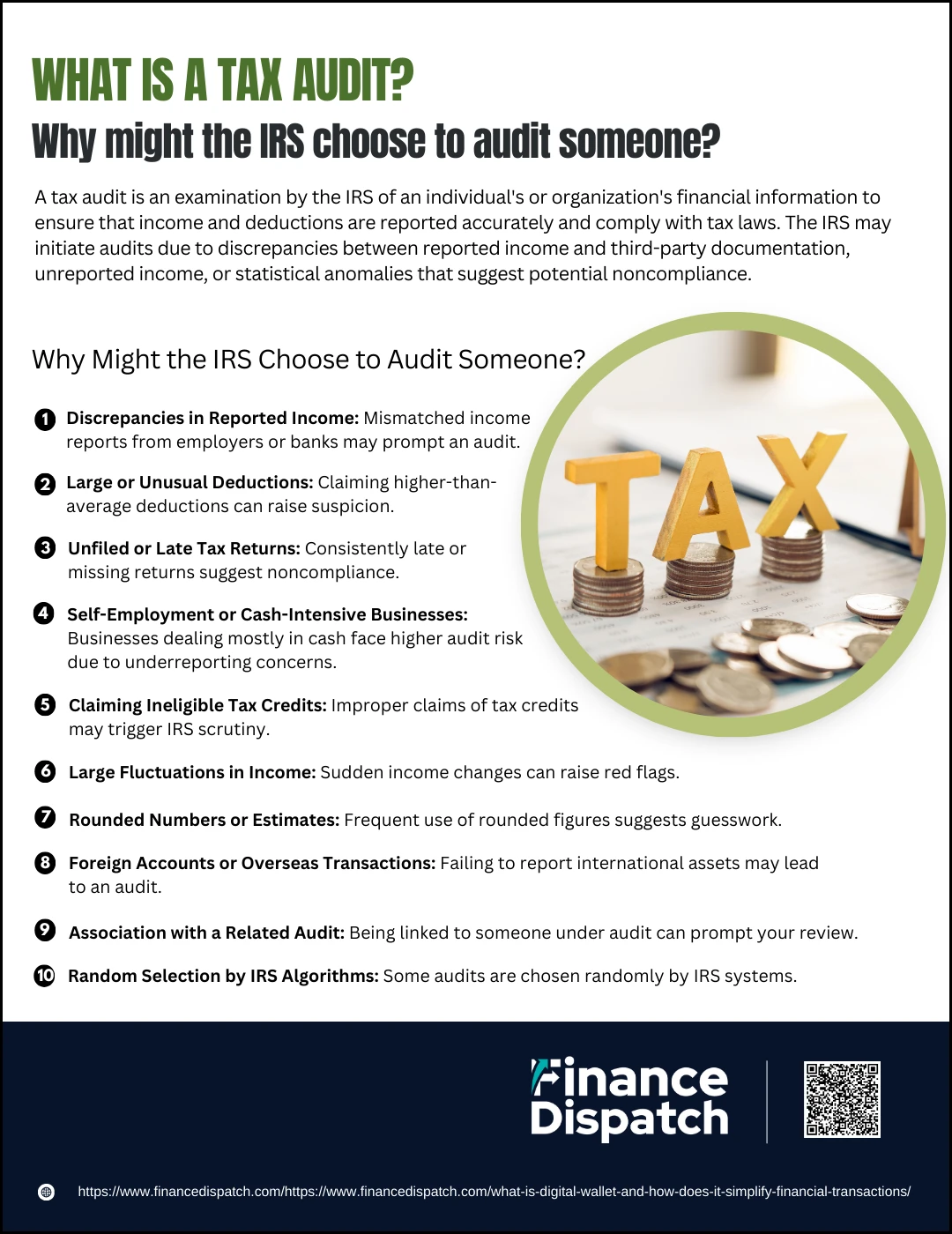

An IRS audit might seem intimidating, but it’s often simply a way for the government to double-check that tax returns are accurate and complete. While some audits are randomly selected through a computerized scoring system, others are triggered by inconsistencies, unusual patterns, or specific behaviors that suggest something on the return needs a closer look. By understanding what draws IRS attention, taxpayers can be more careful when preparing their returns and reduce the likelihood of being audited.

Here are ten common reasons the IRS might audit someone:

1. Discrepancies in Reported Income

The IRS cross-checks the income reported on your tax return with forms submitted by employers, banks, and other third parties. If the numbers don’t match, such as forgetting to include a 1099 or W-2, it may trigger an audit.

2. Large or Unusual Deductions

Claiming significantly higher deductions than average for your income level—especially for charitable donations, business expenses, or home office write-offs—can raise a red flag and prompt the IRS to ask for proof.

3. Unfiled or Late Tax Returns

Failing to submit your tax return or filing it past the due date repeatedly signals poor compliance and may prompt the IRS to examine your records.

4. Self-Employment or Cash-Intensive Businesses

Freelancers, gig workers, and those who operate in cash-heavy industries (like restaurants, salons, or car dealerships) face greater audit risk due to the possibility of underreported income.

5. Claiming Ineligible Tax Credits

Overstating or incorrectly claiming credits such as the Earned Income Tax Credit (EITC) or Child Tax Credit may draw scrutiny, especially when documentation doesn’t match.

6. Large Fluctuations in Income

A sudden drop or spike in income compared to previous years may seem suspicious to the IRS and lead them to question whether all income has been reported or if expenses are being inflated.

7. Rounded Numbers or Estimates

Using round numbers (e.g., $5,000 instead of $5,172) too frequently may indicate guesswork rather than exact reporting—something the IRS watches for when selecting returns for audit.

8. Foreign Accounts or Overseas Transactions

U.S. taxpayers with international income or offshore accounts must follow strict reporting requirements. Failing to file forms like FBAR or FATCA can prompt an audit.

9. Association with a Related Audit

If a business partner, employer, or even a spouse is being audited and your return is connected, the IRS may also review your filings to verify consistency and accuracy.

10. Random Selection by IRS Algorithms

Sometimes, your return is chosen through the IRS’s Discriminant Function System (DIF), which scores returns based on their likelihood of having errors—even if everything looks fine on the surface.

Types of IRS Tax Audits

Not all IRS audits are created equal. Depending on the circumstances and the complexity of the issues involved, the IRS uses different types of audits to examine tax returns. Some audits are simple and handled entirely by mail, while others are more involved and require in-person meetings. Knowing the different types of audits can help taxpayers understand what to expect and how to prepare.

Here are the main types of IRS tax audits:

1. Correspondence Audit

This is the most common and least invasive type of audit. The IRS conducts it by mail and typically requests clarification or documentation for specific items on a tax return—such as charitable donations or income from freelance work. If the taxpayer provides the requested documents and everything checks out, the matter is usually resolved quickly.

2. Office Audit

In an office audit, the taxpayer is asked to appear in person at a local IRS office. These audits are more detailed and often involve multiple areas of the tax return. You may be asked to bring financial records, receipts, and bank statements to support your claims. Having a tax professional with you is often helpful during these meetings.

3. Field Audit

This is the most comprehensive type of IRS audit. An IRS agent visits your home, place of business, or accountant’s office to examine your records on-site. Field audits typically involve complex issues or large sums of money, and they may span multiple years of tax filings. Due to their in-depth nature, it’s wise to have a qualified tax professional present.

4. Taxpayer Compliance Measurement Program (TCMP) Audit

This rare and detailed audit is designed for research purposes. The IRS selects returns at random and examines every single line item. You’ll be required to provide documentation for all entries, including income, deductions, and credits. While not triggered by red flags, TCMP audits are time-consuming and demanding.

The IRS Tax Audit Process

The IRS Tax Audit Process

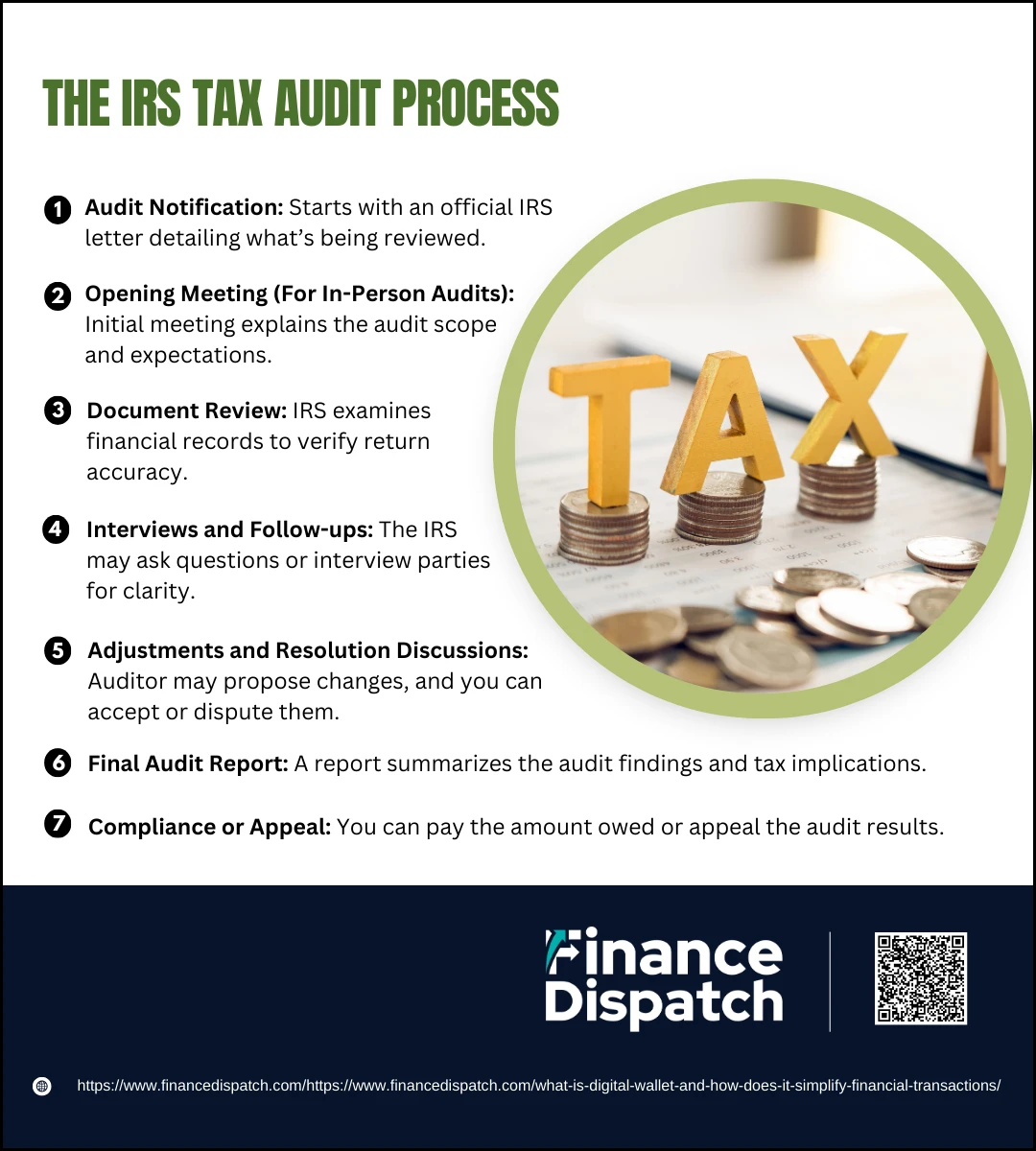

Being audited by the IRS may sound daunting, but the process is more structured and predictable than many people realize. It begins with a formal notification and involves a series of clearly defined steps that give taxpayers the opportunity to respond, clarify, and correct any issues found in their tax filings. Whether the audit is conducted by mail or in person, it’s essential to understand each phase to ensure you’re prepared and protected. The better your documentation and cooperation, the smoother the process is likely to be.

Here’s a more detailed look at the typical IRS tax audit process:

1. Audit Notification

The audit process always starts with an official notice from the IRS, sent by mail. This letter will include the tax year(s) being audited, the specific items under review, and whether the audit will be handled by mail (correspondence audit), at an IRS office (office audit), or at your home or business (field audit). It’s important to read this notice carefully and respond promptly.

2. Opening Meeting (For In-Person Audits)

If your audit involves an office or field meeting, the IRS will schedule an opening conference. During this meeting, the auditor explains the scope of the audit, what documents are needed, and the timeline. This is also your opportunity to ask questions and understand what to expect.

3. Document Review

The core of the audit involves reviewing your financial documents. These may include W-2s, 1099s, receipts, invoices, bank statements, payroll records, and other supporting materials. The IRS uses these to verify the accuracy of your tax return. If more information is needed, the agent will follow up with specific requests.

4. Interviews and Follow-ups

In some audits—especially field audits—the IRS may interview you, your accountant, or employees to gain additional insight into your financial activities or clarify inconsistencies. These interviews help the auditor determine whether your reporting aligns with your actual income, deductions, and tax obligations.

5. Adjustments and Resolution Discussions

After reviewing all documentation, the auditor may propose changes to your tax return. This could result in you owing additional taxes, receiving a refund, or no change at all. The IRS will provide an explanation of any adjustments, and you’ll have the opportunity to accept or contest their findings.

6. Final Audit Report

If changes are proposed and agreed upon—or if the audit ends with no changes—the IRS will issue a final report summarizing the audit results. This report outlines any additional taxes due, as well as potential penalties or interest. You’ll also receive instructions on how to pay or challenge the findings.

7. Compliance or Appeal

Once the final report is issued, you can either comply by paying any assessed amount or formally appeal if you disagree. Appeals can be made within the IRS, and if necessary, further reviewed in U.S. Tax Court. It’s often wise to consult with a tax professional at this stage to determine the best course of action.

Legal Framework and Obligations of Tax Audit

Tax audits are not just administrative procedures—they are governed by legal requirements that both taxpayers and tax authorities must follow. These laws ensure the process is fair, transparent, and consistent, while also placing specific obligations on individuals and businesses under audit. Understanding these legal responsibilities is critical for staying compliant and avoiding unnecessary penalties or legal action.

Here are some key legal obligations that apply during a tax audit:

1. Maintain Financial Records

Taxpayers must keep accurate financial records, including receipts, invoices, bank statements, and tax returns, for a legally required period (typically three to seven years, depending on the jurisdiction and transaction).

2. Provide Access to Documents

During an audit, the taxpayer is legally obligated to provide the IRS or relevant tax authority with requested documentation and information that supports items reported on the tax return.

3. Cooperate with the Audit Process

You are required to cooperate fully with auditors, including attending scheduled meetings (if applicable), responding to inquiries, and supplying additional information when requested.

4. Disclose Relevant Information

Taxpayers must disclose all relevant and truthful information related to their income, deductions, credits, and any other tax-related items being examined.

5. Comply with Reporting Standards

Individuals and businesses must adhere to specific accounting and tax reporting standards as required by law, such as Generally Accepted Accounting Principles (GAAP) or other jurisdictional rules.

6. Retain Records for the Prescribed Timeframe

The law often requires records to be retained for a specific duration—e.g., five years in the UK or three to six years in the U.S.—to ensure availability during potential audits.

7. Understand the Right to Appeal

Taxpayers have the legal right to appeal audit findings and must follow the official appeals process if they disagree with the results.

How to Prepare for a Tax Audit

How to Prepare for a Tax Audit

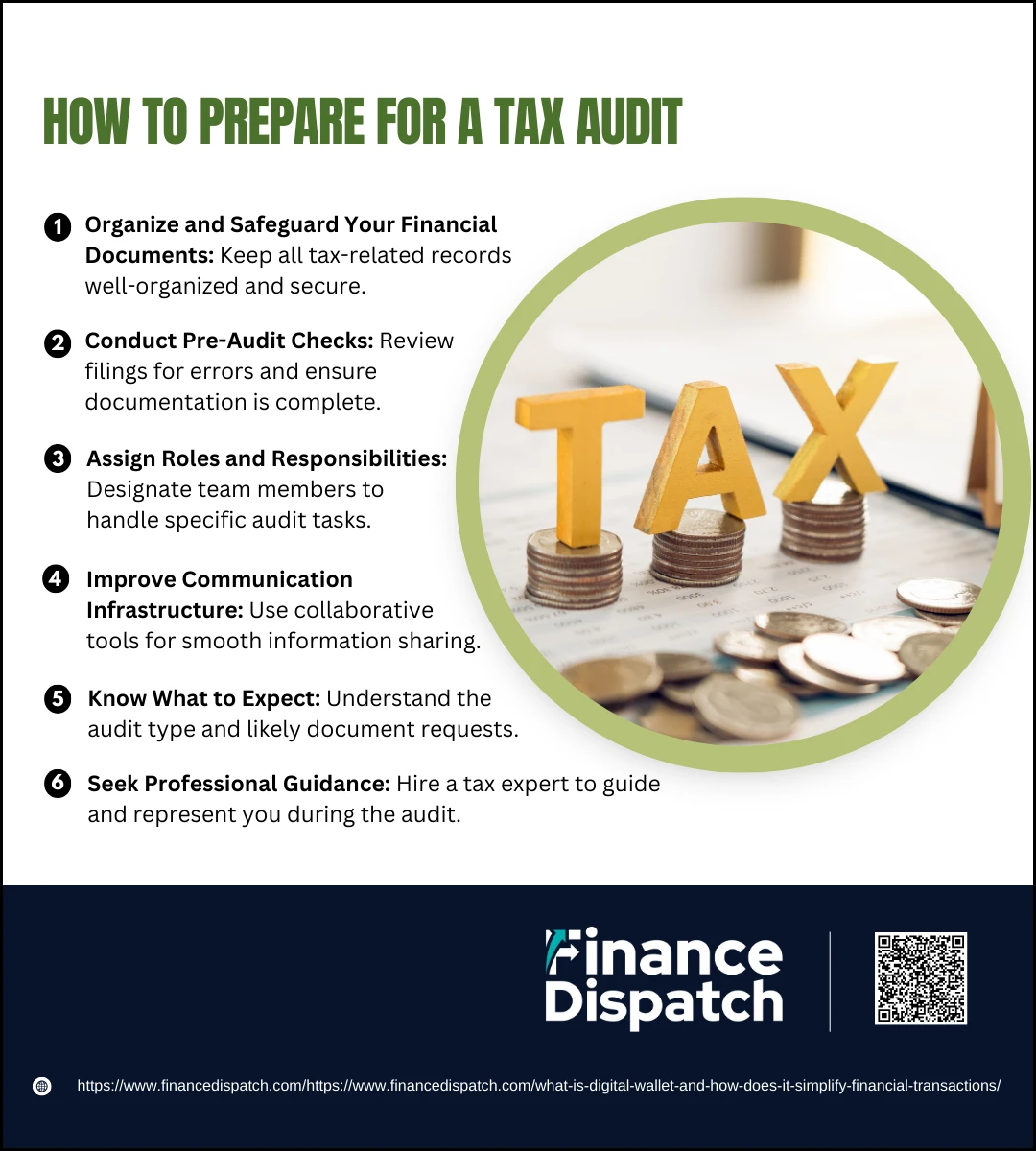

Preparation is key to handling a tax audit efficiently and with minimal stress. Whether the IRS notifies you of a correspondence, office, or field audit, being organized and proactive can significantly improve the outcome. Proper preparation involves more than just having paperwork ready—it includes understanding the process, assigning responsibilities, and ensuring clear communication across all parties involved.

Here are some essential ways to prepare for a tax audit:

1. Organize and Safeguard Your Financial Documents

Gather and securely store all relevant records, including tax returns, receipts, invoices, bank statements, payroll records, and previous correspondence with the IRS. Use a centralized, cloud-based system if possible to allow easy access and quick sharing.

2. Conduct Pre-Audit Checks

Before the audit begins, review your tax filings for accuracy. Create a checklist of common audit items and verify that each one has proper documentation. Identifying and resolving errors in advance can prevent unpleasant surprises.

3. Assign Roles and Responsibilities

If you’re part of a business, delegate tasks to specific team members—such as your accountant, bookkeeper, or legal counsel—so everyone knows who is responsible for gathering documents, attending meetings, or responding to the auditor.

4. Improve Communication Infrastructure

Avoid messy email threads and opt for collaborative tools like secure messaging apps and shared drives. This ensures that all stakeholders, including your tax advisor or legal team, stay informed and can access key documents in real time.

5. Know What to Expect

Familiarize yourself with the type of audit you’re facing and what the IRS is likely to ask for. Understanding the process and its timeline helps you stay calm, focused, and ready to meet expectations.

6. Seek Professional Guidance

Hire a qualified tax professional or attorney, especially for complex audits. Their experience can help you avoid missteps, interpret audit requests correctly, and respond confidently to any proposed adjustments.

Outcomes of a Tax Audit

A tax audit doesn’t always end in bad news. In fact, the outcome of an audit depends entirely on the accuracy of your tax return and how well you support your claims with proper documentation. After the IRS reviews your records and completes its examination, they will issue one of a few possible conclusions. These outcomes can range from no change at all to adjustments that result in additional taxes, interest, penalties—or even a refund. Understanding these possible results can help you prepare for what comes next.

Here are the most common outcomes of a tax audit:

- No Change

The IRS agrees with your original return, and no changes are made. This means you provided sufficient documentation to support your reported income, deductions, and credits. - Agreed Adjustment

The IRS proposes changes to your return, and you agree with them. This might result in paying additional taxes, receiving a reduced refund, or adjusting reported figures. - Disagreed Adjustment

The IRS proposes changes, but you disagree with their findings. In this case, you can request a conference with an IRS manager or proceed with a formal appeal. - Refund Issued

In rare cases, the IRS determines you overpaid your taxes and issues a refund. This can happen if deductions or credits were underreported. - Additional Tax Liability with Penalties and Interest

If discrepancies are found and you owe more tax, the IRS may add penalties and interest, especially in cases of negligence, substantial understatement, or fraud.

Potential Consequences of a Failed Audit

A failed tax audit can have serious financial and legal consequences, especially if the IRS uncovers significant errors, omissions, or signs of intentional wrongdoing. The most immediate outcome is often a tax bill for underpaid taxes, along with interest that accrues from the original due date of the return. In addition, the IRS may impose penalties ranging from accuracy-related fines to more severe civil fraud penalties. In extreme cases involving deliberate tax evasion, falsified documents, or refusal to cooperate, criminal prosecution is also possible—leading to hefty fines or even imprisonment. Even when fraud is not involved, failing to respond adequately or on time can escalate the situation and result in additional scrutiny or loss of appeal rights. That’s why it’s essential to take every audit seriously, respond honestly, and seek professional guidance when necessary.

Dealing with Audit Recommendations and Appeals

Once a tax audit is complete, the IRS will issue a report detailing its findings and any recommended adjustments to your tax return. It’s important to carefully review this report and understand what changes are being proposed—whether it’s additional taxes owed, disallowed deductions, or other corrections. If you agree with the findings, you can settle the balance and close the case. However, if you disagree, you have the right to appeal. Before initiating an appeal, it’s often helpful to discuss the issue with the auditor directly to resolve misunderstandings. If no resolution is reached, you can file a formal appeal with the IRS Office of Appeals, providing documentation and a written explanation of your position. In more complex cases, legal representation or a tax professional can be invaluable in guiding you through the appeals process and protecting your rights. Regardless of the outcome, it’s essential to address all audit recommendations promptly and keep a clear record of your responses and actions taken.

Conclusion

A tax audit may seem intimidating at first, but with the right knowledge and preparation, it becomes a manageable process. Whether you’re an individual or a business, understanding what triggers an audit, the types of audits the IRS conducts, and how the process unfolds can help you stay ahead and avoid costly mistakes. Even if you are audited, cooperating with the IRS, keeping accurate records, and knowing your rights can make a significant difference in the outcome. Ultimately, tax audits serve an important purpose in ensuring fairness and transparency in the tax system—and being audit-ready is one of the smartest ways to protect yourself and your finances.