When tax season rolls around, one of the smartest ways to lower your tax bill is by understanding how tax exemptions work. A tax exemption allows you to legally exclude certain income, individuals, or organizations from taxation, which ultimately helps reduce your taxable income. Whether you’re an individual taxpayer, a homeowner, or part of a nonprofit organization, knowing how exemptions apply to your situation can lead to significant savings. In this article, we’ll break down what a tax exemption is, how it differs from deductions and credits, and how it can directly impact the amount of income you’re taxed on.

What is a Tax Exemption?

A tax exemption is a provision that allows certain income, individuals, or entities to be excluded from taxation by federal, state, or local governments. Unlike tax deductions, which reduce the amount of income subject to tax based on specific expenses, exemptions directly remove a portion of income from the taxable amount altogether. This means you may not have to pay taxes on that exempted income at all. Tax exemptions can apply to individuals based on their filing status, to specific types of income like interest from municipal bonds, or to organizations such as charities and educational institutions that meet criteria under IRS guidelines. By reducing the total income that’s considered taxable, exemptions can significantly lower your overall tax liability.

Types of Tax Exemptions

Types of Tax Exemptions

Tax exemptions are valuable tools that reduce the portion of your income subject to taxation, thereby lowering your overall tax liability. While some exemptions apply automatically based on your filing status, others require specific qualifications such as income level, disability, age, or the type of organization involved. These exemptions can apply to individuals, specific earnings like interest income, or even entire entities like charitable organizations. Knowing the different types of tax exemptions not only helps you keep more of your hard-earned money but also ensures you’re compliant with tax laws while making the most of available tax relief options.

Here are some of the most common types of tax exemptions:

1. Standard Deduction

This is the most widely claimed exemption and applies to most taxpayers. The IRS sets this amount annually based on inflation and filing status (single, married filing jointly, etc.). It automatically reduces your taxable income, making it a simple and efficient way to lower your tax bill.

2. Itemized Deductions

Instead of taking the standard deduction, taxpayers can choose to itemize qualified expenses if they exceed the standard deduction amount. These include costs such as mortgage interest, state and local taxes, medical expenses, and charitable donations.

3. Property Tax Exemptions

State and local governments often offer exemptions to reduce or eliminate property taxes for eligible homeowners. Common qualifiers include using the property as a primary residence, being a senior citizen, a veteran, or a person with a disability.

4. Tax-Exempt Organizations

Organizations that serve public, educational, religious, or charitable purposes may qualify for tax-exempt status under Section 501(c)(3). These groups are not required to pay federal income taxes on the donations and income they receive, provided they meet all IRS requirements.

5. Capital Gains Exemptions

When you sell your primary home, you may be eligible to exclude up to $250,000 of the gain ($500,000 for married couples filing jointly) from your taxable income, provided certain ownership and residency criteria are met.

6. Municipal Bond Interest

Interest income earned from municipal bonds, especially when issued by your home state or locality, is typically exempt from federal income tax. In some cases, it may also be exempt from state and local taxes.

7. Alternative Minimum Tax (AMT) Exemptions

High-income earners who are subject to the AMT may still qualify for a special exemption amount that reduces the income considered under this parallel tax system.

8. Dependent Exemptions (Pre-2018)

Before the Tax Cuts and Jobs Act of 2017, taxpayers could claim a personal exemption for themselves and each dependent, directly reducing taxable income. Although this exemption is currently suspended through 2025, it still applies to amended returns or previous tax years.

How Tax Exemptions Reduce Taxable Income

How Tax Exemptions Reduce Taxable Income

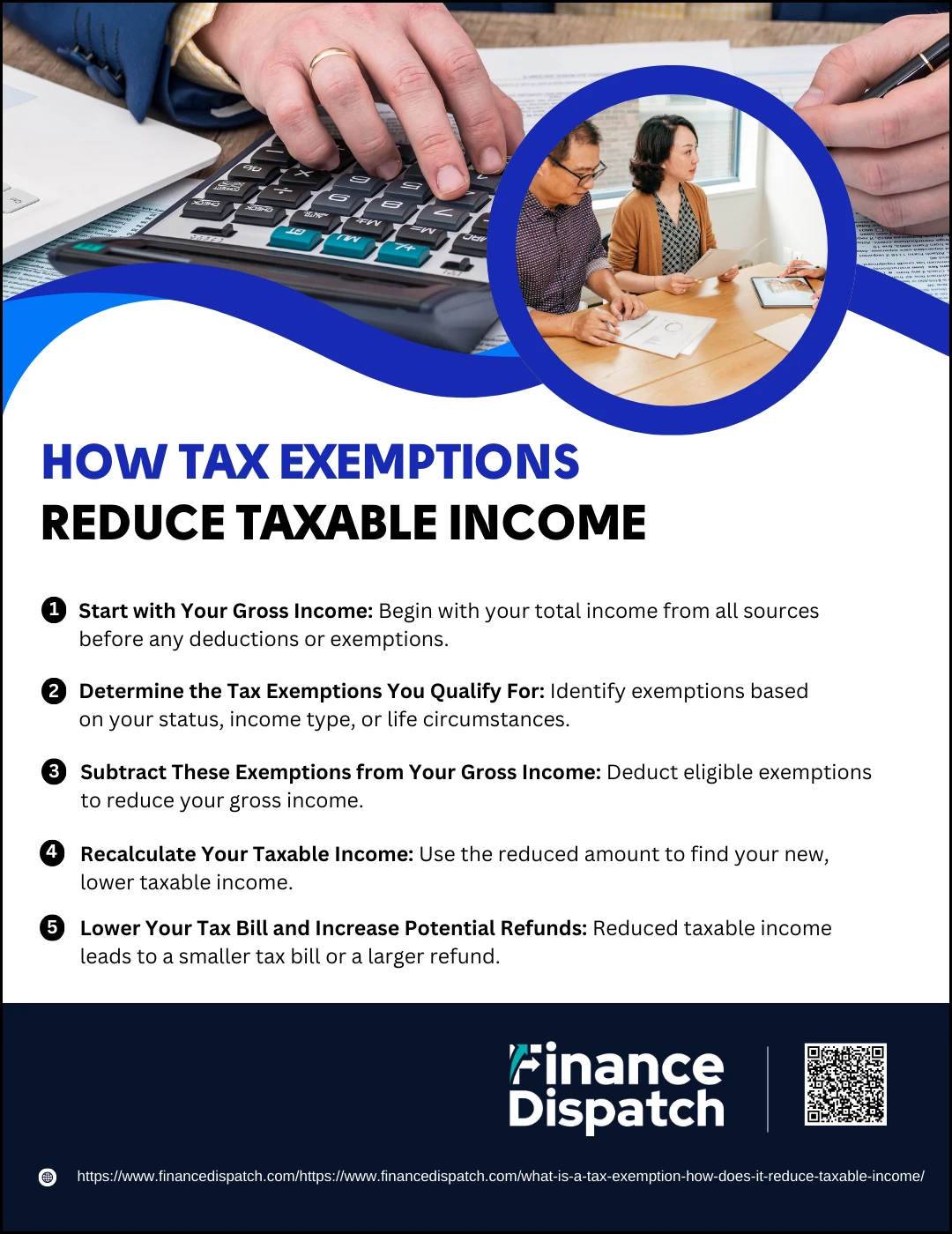

Tax exemptions serve as a critical financial advantage by legally allowing you to reduce the amount of income that is subject to taxation. Unlike tax deductions or credits, which require specific types of spending or eligibility criteria, tax exemptions often apply more broadly and automatically based on your income type, filing status, or life circumstances. When exemptions are applied, they lower your taxable income, which is the portion of your income the government actually uses to determine how much tax you owe. In essence, the more exemptions you’re eligible for, the less of your income is taxed—and the more money you get to keep in your pocket.

Let’s explore how this process works, step by step:

1. Start with Your Gross Income

This is your total income from all sources before any deductions or exemptions. It includes your salary, bonuses, rental income, dividends, interest, freelance payments, and more. For example, if your gross income is $80,000, this figure serves as the starting point for calculating your tax obligations.

2. Determine the Tax Exemptions You Qualify For

Based on your financial situation, filing status, and dependents, you may be eligible for several exemptions. These could include the standard deduction, tax-exempt interest from municipal bonds, property tax exemptions for seniors or veterans, or tax-exempt income from certain retirement accounts or benefits.

3. Subtract These Exemptions from Your Gross Income

Once you’ve identified your eligible exemptions, you subtract them from your gross income. If you qualify for a $15,000 standard deduction and $3,000 in tax-exempt income, your new taxable income would be $62,000 instead of $80,000. This reduces the base amount on which your taxes are calculated.

4. Recalculate Your Taxable Income

After exemptions are applied, your adjusted taxable income is significantly lower. This reduction can potentially move you into a lower tax bracket, which means not only is less income being taxed, but it might also be taxed at a lower rate.

5. Lower Your Tax Bill and Increase Potential Refunds

With less taxable income, your overall tax liability decreases. Depending on how much tax was withheld from your paycheck during the year, you may end up owing less or receiving a larger refund. For example, someone with $62,000 taxable income may owe thousands less than someone at $80,000 taxable income.

Who Qualifies for Tax Exemptions?

Tax exemptions aren’t available to everyone—but for those who meet certain qualifications, they can lead to substantial savings by reducing the amount of income subject to taxation. Eligibility for tax exemptions depends on a variety of factors, such as your income level, filing status, employment type, age, and whether you’re supporting dependents or operating as a qualifying organization. Some exemptions apply automatically, while others require documentation or specific applications. Knowing whether you qualify is the first step toward lowering your tax bill.

Here are some common individuals and entities who may qualify for tax exemptions:

1. Homeowners: Many states offer property tax exemptions to homeowners, particularly for their primary residence. Some also provide additional benefits for veterans, senior citizens, or individuals with disabilities.

2. Low- to Moderate-Income Taxpayers: Individuals with lower income levels may be eligible for exemptions on specific types of income, such as interest on municipal bonds or certain Social Security benefits.

3. Tax-Exempt Organizations: Nonprofit organizations, charities, religious institutions, and educational foundations may qualify for tax-exempt status under Section 501(c)(3) of the Internal Revenue Code.

4. Individuals with Dependents (Pre-2018 rules): Before the Tax Cuts and Jobs Act of 2017, taxpayers could claim personal and dependent exemptions. While currently suspended through 2025, these exemptions still apply to amended returns for previous tax years.

5. Veterans and Disabled Individuals: Many states provide tax exemptions or reductions for disabled veterans and other individuals receiving qualifying disability benefits.

6. Retirees: Certain types of retirement income—like distributions from Roth IRAs or qualified pensions—may be partially or fully exempt from taxation under specific conditions.

7. Students with Scholarships: Academic scholarships used to pay for tuition, books, and supplies are often considered tax-exempt income.

8. Organizations with Religious, Scientific, or Educational Purpose: Groups that serve the public interest and meet specific IRS guidelines can operate as tax-exempt entities and avoid paying federal income taxes.

Tax Exemptions vs Tax Deductions vs Tax Credits

When it comes to reducing your tax bill, it’s important to understand the difference between tax exemptions, tax deductions, and tax credits. While all three provide some form of tax relief, they do so in different ways. Tax exemptions exclude certain income from being taxed, tax deductions reduce your taxable income based on eligible expenses, and tax credits directly reduce the amount of tax you owe—often providing the most significant savings. Knowing how each one works can help you make smarter choices when filing your taxes.

Here’s a comparison to clarify the differences:

| Feature | Tax Exemption | Tax Deduction | Tax Credit |

| Purpose | Excludes specific income from taxation | Reduces taxable income based on qualified expenses | Directly reduces the amount of tax owed |

| Effect on Income | Decreases gross income before calculating taxes | Lowers adjusted gross income (AGI) | Has no impact on income, reduces final tax liability |

| Examples | Municipal bond interest, certain retirement distributions | Mortgage interest, student loan interest, charitable donations | Child Tax Credit, Earned Income Tax Credit, Education Credits |

| Form of Relief | Subtracts income from tax calculation | Subtracts expenses from income | Subtracts credit from total tax owed |

| Who Benefits Most | Individuals and organizations with qualifying income types | Taxpayers with eligible expenses | Taxpayers who meet specific criteria or life situations |

| Refundable? | Not refundable | Not refundable | Some credits are refundable (can increase your tax refund) |

Limitations and Considerations of Tax Exemptions

While tax exemptions can significantly lower your taxable income and reduce your overall tax liability, they come with certain limitations and rules that you need to be aware of. Not all income qualifies for exemptions, and some exemptions have been temporarily suspended or are subject to income thresholds and eligibility conditions. Additionally, improper use of exemptions—especially for organizations—can result in penalties or even the loss of tax-exempt status. Understanding the boundaries of tax exemptions is essential to ensure compliance and to make the most of available tax benefits.

Here are some key limitations and considerations to keep in mind:

1. Suspension of Personal and Dependent Exemptions: The Tax Cuts and Jobs Act suspended personal and dependent exemptions from 2018 through 2025 for federal tax purposes.

2. Eligibility Requirements Vary: Qualification for exemptions often depends on factors such as income level, filing status, age, disability status, or type of organization.

3. State and Federal Rules May Differ: Some exemptions apply only at the federal level, while others are specific to certain states or municipalities.

4. Documentation and Recordkeeping Are Essential: You must retain proper documentation to prove eligibility for exemptions, especially in the case of charitable donations or property tax exemptions.

5. Tax-Exempt Organizations Have Compliance Obligations: Nonprofits must adhere to strict IRS guidelines, including annual reporting and restrictions on political activity, to maintain their tax-exempt status.

6. Exemptions Don’t Always Lower Tax Brackets Significantly: Depending on your income, the actual tax savings from exemptions may be modest, especially when compared to tax credits.

7. Alternative Minimum Tax (AMT) May Negate Some Benefits: Certain tax-exempt income, such as private activity bond interest, may be added back into income calculations under the AMT.

8. Changes in Tax Law Can Affect Exemptions: Tax exemption rules are subject to change with new legislation, so staying updated is crucial for accurate planning.

Common Misconceptions about Tax Exemptions

Tax exemptions are often misunderstood, leading many taxpayers to miss out on benefits or misuse them unintentionally. Some assume that exemptions apply automatically, while others confuse them with deductions or credits. Misconceptions can also arise around who qualifies for exemptions and what types of income are truly exempt. To avoid costly mistakes or missed opportunities, it’s important to separate fact from fiction.

Here are some of the most common misconceptions about tax exemptions:

1. “Tax exemptions and tax deductions are the same.”

While both reduce taxable income, exemptions exclude certain income types entirely, while deductions reduce income based on qualified expenses.

2. “Everyone can claim personal and dependent exemptions.”

Personal and dependent exemptions have been suspended at the federal level from 2018 through 2025 under the Tax Cuts and Jobs Act.

3. “Tax-exempt income doesn’t need to be reported.”

Even if income is tax-exempt, like municipal bond interest, it still must be reported on your tax return for informational purposes.

4. “Nonprofit organizations are automatically tax-exempt.”

Nonprofits must apply to the IRS and meet strict criteria to obtain and maintain tax-exempt status under Section 501(c)(3).

5. “All retirement income is tax-exempt.”

Only certain types of retirement income, like qualified Roth IRA distributions, are tax-exempt. Most retirement distributions are still taxable.

6. “Being tax-exempt means you owe no taxes at all.”

Tax exemptions apply only to specific types of income. You may still owe taxes on other income or be subject to employment and sales taxes.

7. “Filing Form W-4 with ‘exempt’ means no taxes will ever be taken out.”

Claiming exempt on your W-4 only applies if you meet specific criteria and had no tax liability in the prior year. Misuse can lead to underpayment penalties.

How to Claim a Tax Exemption

How to Claim a Tax Exemption

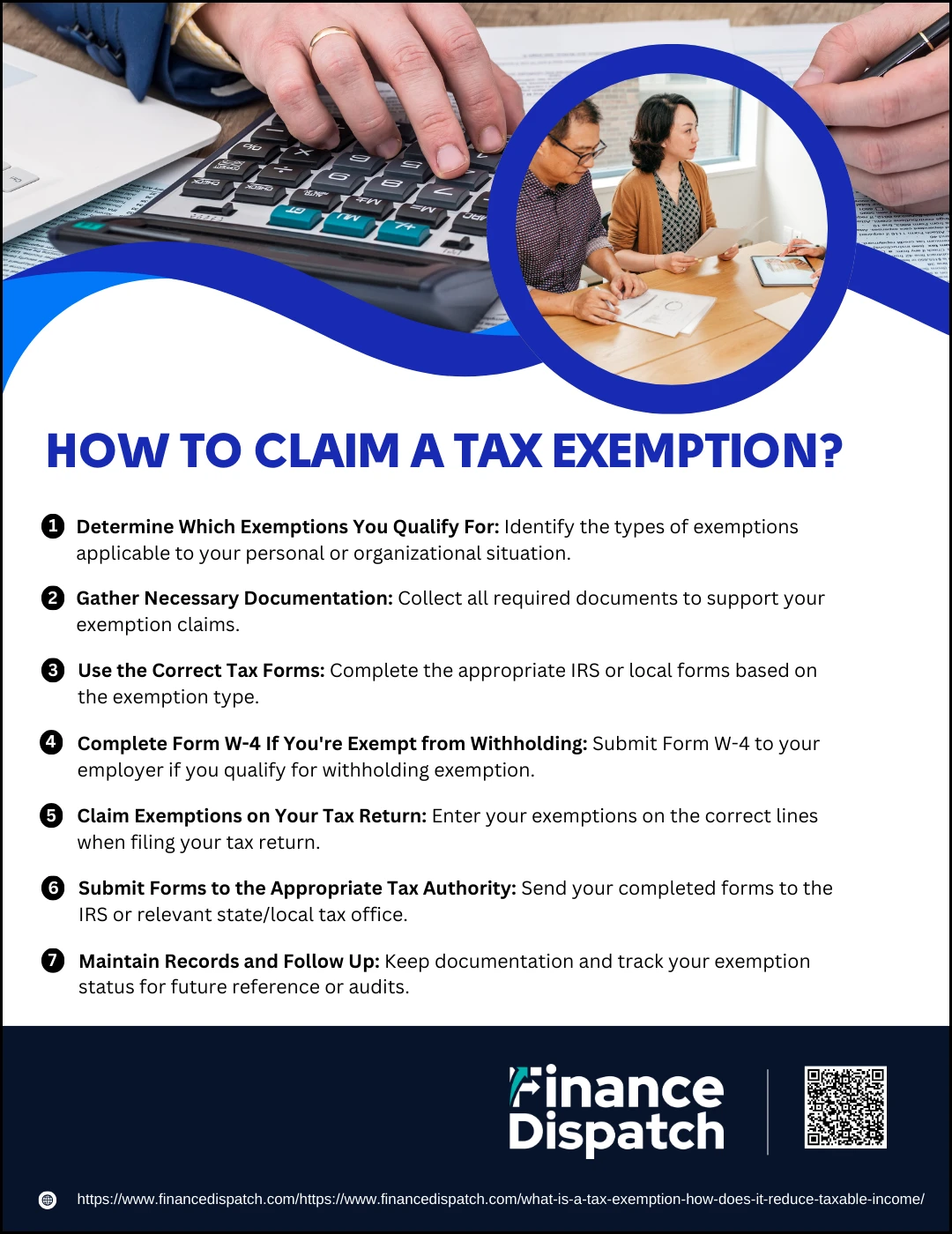

Claiming a tax exemption can offer significant financial relief by legally reducing the amount of your income that is subject to tax. However, the process isn’t always automatic, and understanding how to claim exemptions correctly is essential for both individuals and organizations. Whether you’re filing for the standard deduction, reporting exempt income, or applying for tax-exempt status as a nonprofit, each exemption type comes with its own set of rules and documentation requirements. Making an error or overlooking a required step could lead to delays, penalties, or even the loss of potential savings. Here’s a more detailed look at the steps to successfully claim a tax exemption:

1. Determine Which Exemptions You Qualify For

Start by identifying which types of exemptions apply to your situation. For individuals, this might include the standard deduction, tax-exempt interest from municipal bonds, or property tax exemptions based on age or disability. For organizations, this could mean applying for recognition as a 501(c)(3) tax-exempt nonprofit.

2. Gather Necessary Documentation

Compile the required documents to support your exemption claim. This might include proof of age, disability status, dependent information, or financial records for exempt income. Nonprofit organizations will need incorporation documents, bylaws, and detailed descriptions of their activities and mission.

3. Use the Correct Tax Forms

Most individuals will report exemptions on IRS Form 1040 when filing their annual return. If you are a nonprofit, you must file Form 1023 (or Form 1023-EZ for smaller organizations) to apply for federal tax-exempt status. Some exemptions, like those for veterans or seniors, may require separate applications to state or local agencies.

4. Complete Form W-4 If You’re Exempt from Withholding

If you expect to owe no federal income tax for the year and meet IRS criteria, you may claim exemption from withholding on IRS Form W-4. This form is given to your employer and ensures that no federal income tax is withheld from your paycheck.

5. Claim Exemptions on Your Tax Return

When filing your taxes, enter your qualified exemptions on the appropriate lines of your tax form. This may include the standard deduction or itemized deductions, as well as lines to report tax-exempt income such as municipal bond interest or qualified Roth IRA distributions.

6. Submit Forms to the Appropriate Tax Authority

File your completed federal tax return with the IRS, either electronically or by mail. For property tax or sales tax exemptions, submit your forms to your state or local tax office. Nonprofits must submit exemption applications to the IRS and, in many cases, to state agencies as well.

7. Maintain Records and Follow Up

Keep detailed records of all forms submitted, approvals received, and any correspondence with tax authorities. These may be needed in the event of an audit, or for future filings to maintain your exemption status.

Conclusion

Understanding tax exemptions is essential for anyone looking to minimize their tax liability and maximize their savings. Whether you’re an individual taxpayer seeking relief through standard or itemized deductions, or an organization applying for tax-exempt status, knowing how exemptions work—and how to properly claim them—can make a meaningful difference in your financial planning. While exemptions can reduce the amount of income subject to taxation, it’s important to stay informed about eligibility requirements, legal limitations, and current tax laws. By taking the time to understand and apply tax exemptions correctly, you can ensure compliance, avoid costly mistakes, and keep more of your hard-earned money.