In today’s fast-paced investment landscape, exchange-traded funds—better known as ETFs—have become a go-to option for both beginner and seasoned investors. But what exactly is an ETF, and why has it gained so much traction? Simply put, an ETF is a flexible, cost-effective way to invest in a basket of assets—like stocks, bonds, or commodities—without having to buy each one individually. Traded on stock exchanges just like regular stocks, ETFs combine the broad exposure of mutual funds with the liquidity of stock trading. This unique structure not only simplifies investing but also allows you to diversify your portfolio in a single transaction. In this article, we’ll explore what makes ETFs special and how they can help you achieve diversified exposure across markets, sectors, and asset classes.

What is an exchange-traded fund (ETF)?

An exchange-traded fund (ETF) is an investment vehicle that holds a collection of assets—such as stocks, bonds, commodities, or a mix of these—and trades on a stock exchange like a single stock. This means you can buy and sell ETF shares throughout the trading day at market prices, just like you would with shares of a company. Each ETF is designed to track the performance of a specific index, sector, or investment theme, offering investors a convenient way to gain exposure to a broad or targeted set of investments. By pooling together multiple securities in one fund, ETFs make it easier for investors to diversify their portfolios while enjoying the trading flexibility and transparency of the stock market.

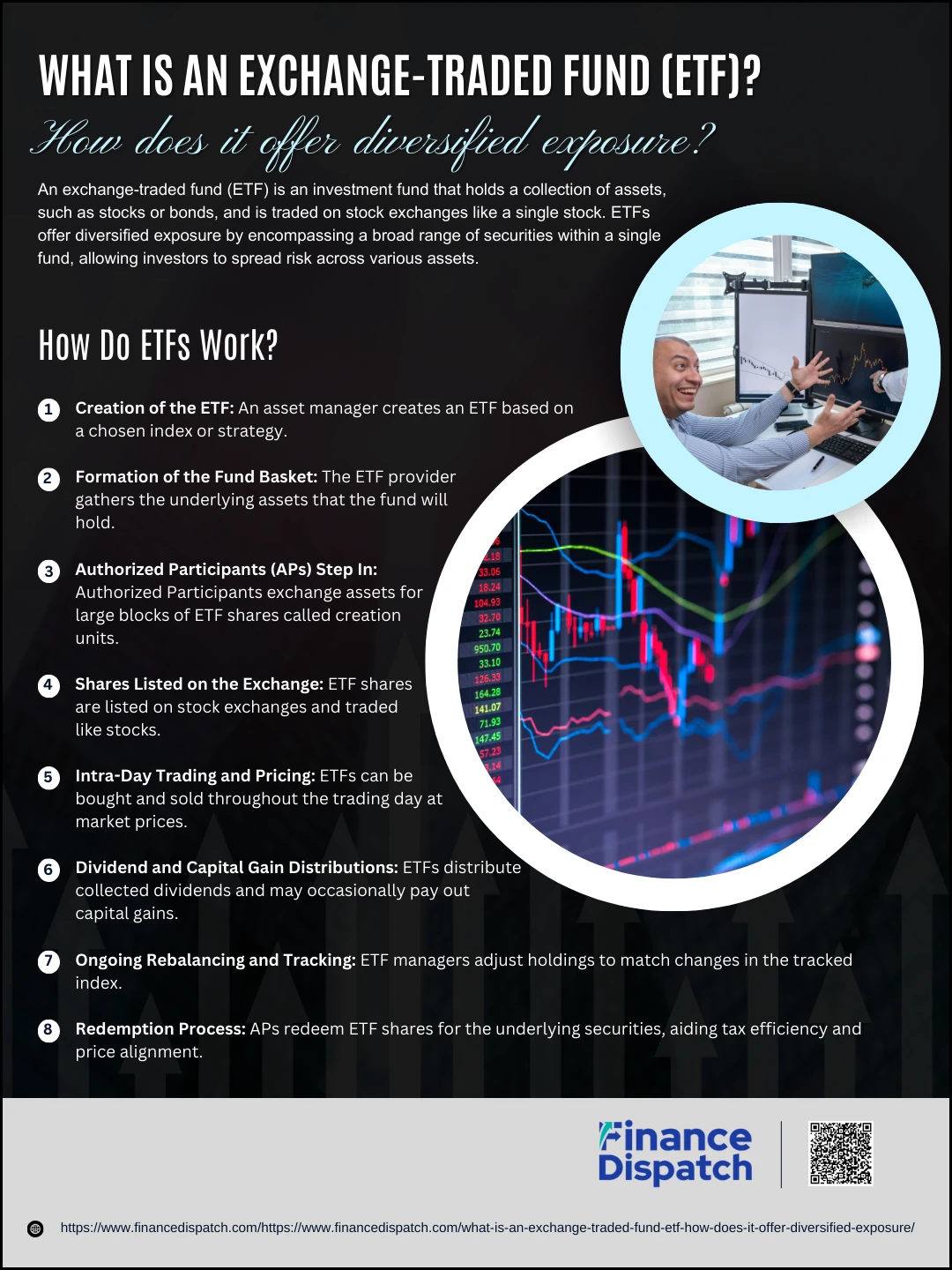

How Do ETFs Work?

How Do ETFs Work?

Exchange-traded funds (ETFs) are structured to offer a simple yet powerful way for investors to gain access to a broad range of assets with just one purchase. While they may appear similar to individual stocks on the surface—because they trade on exchanges throughout the day—the inner workings of ETFs involve a unique creation and redemption process that ensures they closely track their underlying assets. This structure not only supports liquidity and transparency but also helps maintain pricing efficiency and reduce taxable events compared to traditional mutual funds.

Here’s a deeper look at how ETFs work, step by step:

1. Creation of the ETF

An asset management company (like Vanguard, BlackRock, or State Street) decides to launch an ETF. It begins by selecting an index or strategy the fund will follow—such as the S&P 500 or a specific sector like technology. The fund is built to replicate or track that chosen benchmark.

2. Formation of the Fund Basket

The ETF provider assembles the underlying assets—these could be stocks, bonds, commodities, or other securities—that reflect the chosen strategy. This collection of assets becomes the foundation of the ETF.

3. Authorized Participants (APs) Step In

Large financial institutions known as Authorized Participants (APs) are critical to the ETF ecosystem. They deliver the underlying assets (the “creation basket”) to the ETF provider and, in return, receive large blocks of ETF shares called “creation units.” This creation process ensures the ETF has the right asset exposure.

4. Shares Listed on the Exchange

Once created, these ETF shares are listed on stock exchanges and become available to retail and institutional investors. Investors can then buy and sell these ETF shares during normal trading hours through any brokerage platform.

5. Intra-Day Trading and Pricing

Unlike mutual funds, which are priced just once a day, ETFs trade like stocks. Their price fluctuates throughout the day based on the value of their underlying assets and investor demand. This real-time pricing offers more flexibility and transparency.

6. Dividend and Capital Gain Distributions

ETFs often hold dividend-paying stocks or income-generating bonds. These payments are collected by the fund and distributed to shareholders, typically on a monthly or quarterly basis. Additionally, though rare, ETFs may distribute capital gains annually.

7. Ongoing Rebalancing and Tracking

To stay in sync with the index or strategy they track, ETF managers periodically rebalance the holdings. For example, if a company is added or removed from the underlying index, the ETF must reflect that change to maintain accurate exposure.

8. Redemption Process

When APs want to redeem shares, they return ETF shares to the provider and receive the underlying securities in exchange. This in-kind redemption mechanism helps minimize capital gains taxes for shareholders and keeps the ETF aligned with its net asset value (NAV).

ETF vs. Mutual Fund: Key Differences

While exchange-traded funds (ETFs) and mutual funds both offer investors a way to diversify their portfolios by pooling money into a wide selection of assets, they differ significantly in structure, pricing, and flexibility. Understanding these differences can help you choose the investment that best fits your financial goals, trading preferences, and budget. Below is a comparison of the key features of ETFs and mutual funds:

| Feature | ETF | Mutual Fund |

| Trading Method | Traded on stock exchanges throughout the day | Bought/sold through fund company at end-of-day NAV |

| Pricing | Price fluctuates intraday based on market demand | Priced once daily after market close |

| Minimum Investment | Often low (as little as the price of one share) | Typically $1,000 or more |

| Management Style | Mostly passively managed, some are active | Often actively managed, with some passive options |

| Expense Ratios | Generally lower | Generally higher due to active management |

| Tax Efficiency | More tax-efficient due to in-kind creation/redemption | Less tax-efficient, capital gains are distributed |

| Transparency | Holdings often disclosed daily | Holdings usually disclosed quarterly |

| Purchase Channels | Bought via brokerage account | Purchased through fund companies or financial advisors |

| Trading Flexibility | Can use limit orders, stop-loss, and trade anytime | Cannot trade during the day or use advanced order types |

Why ETFs Are Popular for Diversification

ETFs have gained widespread popularity among investors largely because of their built-in diversification. With a single ETF, you can gain exposure to dozens, hundreds, or even thousands of underlying assets—ranging from stocks and bonds to commodities and real estate. This spread of investments helps reduce the risk that comes with putting all your money into just one company or sector. Whether you’re looking to invest across global markets, specific industries, or various asset classes, there’s likely an ETF tailored to your needs. This ability to achieve broad or targeted diversification with minimal effort and low cost makes ETFs an attractive option for both beginners and experienced investors seeking to balance risk and return in their portfolios.

How Does an ETF Offer Diversified Exposure?

How Does an ETF Offer Diversified Exposure?

Diversification is a cornerstone of smart investing—it spreads your money across different assets to reduce the risk of a single poor performer dragging down your entire portfolio. Exchange-traded funds (ETFs) are especially effective at delivering diversification because they’re structured to hold multiple securities within a single fund. This means that with just one ETF, you can gain access to a wide range of investments—across sectors, geographies, asset types, and investment strategies. Whether you’re a beginner looking to keep it simple or a seasoned investor aiming for broad market exposure, ETFs provide a convenient and cost-efficient path to building a diversified portfolio.

Here’s a closer look at the different ways ETFs offer diversified exposure:

1. Asset-Level Diversification

Many ETFs are built to include different types of assets—such as stocks, bonds, real estate, or even commodities. For example, a balanced ETF might include both equity and fixed-income instruments, giving you exposure to growth and income in one package. This helps cushion your portfolio when one asset class underperforms.

2. Sector Diversification

Broad-market ETFs typically hold companies from multiple sectors like finance, healthcare, technology, industrials, and consumer goods. This ensures you’re not overly reliant on the performance of a single industry, which can be especially important during economic cycles where certain sectors rise while others fall.

3. Geographic Diversification

International or global ETFs provide exposure to foreign markets—both developed and emerging. This reduces the concentration risk of being invested in just one country and allows you to benefit from growth trends in other parts of the world.

4. Market Capitalization Diversification

Some ETFs include a mix of large-cap, mid-cap, and small-cap stocks. Large-cap companies offer stability, while mid- and small-cap stocks can offer higher growth potential. This blend helps balance the risk-return trade-off.

5. Strategy-Based Diversification

ETFs can also be structured around specific investment strategies, such as dividend-paying stocks, value stocks, growth stocks, or momentum-based investing. You can choose ETFs that align with your personal investing philosophy or combine several strategy-based ETFs to smooth out returns across different market environments.

6. Thematic or Goal-Based Diversification

Some ETFs focus on themes like clean energy, artificial intelligence, or ESG (Environmental, Social, and Governance) investing. These can complement core holdings and add exposure to future-oriented trends without needing to pick individual stocks.

Types of ETFs and Their Diversification Role

ETFs come in many forms, each designed to serve a different investment purpose. Whether you’re aiming for broad market exposure, income generation, or targeting specific sectors or themes, there’s likely an ETF built to match your goals. The wide variety of ETFs not only offers flexibility but also plays a crucial role in helping you diversify your portfolio. By mixing different types of ETFs, investors can reduce risk and improve their chances of long-term success through exposure to multiple asset classes, geographies, and investment strategies.

Here are some common types of ETFs and how they contribute to diversification:

1. Equity ETFs: Invest in a broad basket of stocks, often tracking a specific index like the S&P 500. They provide instant diversification across companies and industries.

2. Bond ETFs: Focus on fixed-income securities such as government, corporate, or municipal bonds. They help balance a portfolio with more stable income-generating assets.

3. Commodity ETFs: Offer exposure to physical commodities like gold, oil, or agricultural products, helping hedge against inflation and market downturns.

4. Sector ETFs: Target specific industries like technology, healthcare, energy, or financials. Useful for investors who want focused exposure to a particular market segment.

5. International ETFs: Include companies based outside your home country. These ETFs provide geographic diversification and help reduce country-specific risk.

6. Thematic ETFs: Built around investment themes such as clean energy, artificial intelligence, or blockchain. They allow you to align your portfolio with emerging trends and innovations.

7. Dividend ETFs: Focus on companies that consistently pay dividends. They offer a steady income stream and are popular among income-focused investors.

8. ESG ETFs: Invest in companies that meet Environmental, Social, and Governance standards. These appeal to socially conscious investors seeking ethical exposure.

9. Leveraged and Inverse ETFs: Use derivatives to amplify returns or profit from market declines. While they can be used for short-term diversification strategies, they carry higher risk and are best suited for experienced investors.

Advantages of ETFs

Advantages of ETFs

Exchange-traded funds (ETFs) have revolutionized the way people invest by offering a smart, flexible, and cost-effective alternative to traditional mutual funds and individual stocks. Their unique structure combines the diversification benefits of mutual funds with the real-time trading capabilities of stocks, making them an appealing choice for investors of all experience levels. Whether you’re aiming for long-term growth, stable income, or sector-specific exposure, ETFs provide an easy path to building a well-rounded portfolio. Below are the key advantages that make ETFs so popular:

1. Diversification in a Single Investment

ETFs give you exposure to a wide range of securities—such as stocks, bonds, or commodities—within one fund. Instead of buying dozens of individual assets, you can invest in one ETF and instantly spread your risk across many holdings. This reduces your reliance on the performance of any single investment and helps stabilize your overall returns.

2. Low Expense Ratios

Most ETFs are passively managed, meaning they track a specific index rather than trying to outperform it. This approach results in lower operating costs and expense ratios compared to actively managed mutual funds. Over time, lower fees can significantly boost your net returns.

3. Intraday Trading Flexibility

ETFs are bought and sold on stock exchanges just like individual stocks. This allows you to trade them throughout the day, take advantage of market movements, and use advanced order types like limit or stop-loss orders. Mutual funds, by contrast, can only be traded once a day after the market closes.

4. Tax Efficiency

ETFs are structured to be more tax-efficient than mutual funds. Through an “in-kind” creation and redemption process, ETFs can avoid triggering capital gains taxes as frequently as mutual funds do. This can result in fewer taxable events for long-term investors.

5. Transparency of Holdings

Most ETFs disclose their holdings on a daily basis, so investors always know what they’re invested in. This level of transparency helps you monitor your portfolio closely and make informed investment decisions.

6. No Minimum Investment Requirement

Unlike many mutual funds that require a minimum initial investment—often $1,000 or more—ETFs can be purchased with the price of a single share, which could be as low as $50 or even less. This makes ETFs accessible to beginners or anyone investing with a limited budget.

7. Access to a Wide Range of Markets

ETFs cover nearly every corner of the investment world. You can find ETFs that target broad market indexes, international markets, specific industries, commodities, currencies, or even emerging investment trends like clean energy or artificial intelligence. This gives you the ability to build a truly diversified portfolio across different regions and sectors.

8. Liquidity

Highly traded ETFs tend to be very liquid, meaning they have a high volume of buyers and sellers. This ensures you can easily enter or exit positions without significantly affecting the market price. Liquidity also typically results in tighter bid-ask spreads, which lowers trading costs.

Potential Disadvantages of ETFs

Potential Disadvantages of ETFs

Exchange-traded funds (ETFs) are widely recognized for their cost-efficiency, ease of trading, and diversification benefits. However, like any investment product, ETFs are not without their limitations. While they are an excellent choice for many investors, they may not always align with specific financial goals, trading styles, or portfolio needs. Certain risks—ranging from market volatility to complex fund structures—can catch investors off guard if not fully understood. Knowing these potential downsides is key to making informed and confident investment decisions.

Here are some of the main disadvantages of ETFs, explained in detail:

1. Trading Costs and Spreads

Even if your broker offers commission-free ETF trades, there can still be hidden costs—particularly the bid-ask spread, which is the difference between what a buyer is willing to pay and what a seller wants to receive. The lower the trading volume of an ETF, the wider this spread can be, making it more expensive to buy or sell. Active traders who make frequent trades may accumulate significant costs over time.

2. Tracking Error

ETFs are designed to mirror the performance of a specific index or benchmark. However, due to fund expenses, imperfect asset replication, or timing differences, an ETF may underperform its benchmark slightly. This is called tracking error. While often minor, it can affect returns over time, especially in funds with complex strategies or high fees.

3. Low Liquidity in Some ETFs

While many ETFs are highly liquid and easy to trade, others—especially those focused on niche markets or small sectors—may have low trading volumes. This can make it harder to enter or exit a position at your desired price, and in some cases, you might be forced to accept less favorable terms due to a lack of buyers or sellers.

4. Over-Diversification (Diworsification)

Some ETFs include such a wide variety of holdings that potential gains from high-performing assets are diluted by weaker ones. This over-diversification can lead to average returns and prevent your portfolio from outperforming the market. For investors seeking focused growth, too much diversification can work against their strategy.

5. Complexity of Leveraged and Inverse ETFs

Leveraged and inverse ETFs are designed to multiply daily returns or move opposite to a market index. These funds use financial derivatives and are often rebalanced daily, which can lead to unpredictable results over longer periods. They’re best suited for experienced, short-term traders—not for long-term investors, as compounding can lead to significant tracking errors.

6. Market Risk Still Applies

Despite offering diversification, ETFs are still vulnerable to overall market movements. If the entire market or a targeted sector experiences a downturn, your ETF investment will likely decline in value as well. ETFs are not a shield against broader economic risks or recessions.

7. Dividend Handling May Vary

Unlike many mutual funds that automatically reinvest dividends, ETFs may simply pay dividends in cash unless you actively opt into a dividend reinvestment plan (DRIP) through your broker. Missing this step could affect your long-term compounding and growth potential.

8. Short-Term Capital Gains Taxes

While ETFs are generally tax-efficient when held long-term, frequent trading of ETFs can trigger short-term capital gains taxes, which are taxed at a higher rate than long-term gains. This can significantly reduce your profits if you’re using ETFs for short-term trading in a taxable account.

How to Start Investing in ETFs

How to Start Investing in ETFs

Investing in exchange-traded funds (ETFs) is a smart and beginner-friendly way to build a diversified portfolio. Whether you’re planning for retirement, saving for a major purchase, or simply growing your wealth over time, ETFs offer an accessible entry point with low costs and broad market exposure. The process of getting started is straightforward, but it’s important to approach it with a clear plan and understanding of your investment goals. Here’s a step-by-step guide to help you begin your ETF investing journey with confidence:

1. Define Your Investment Goals

Before selecting any ETF, consider what you’re investing for—retirement, short-term growth, passive income, or capital preservation. Your financial goals will help determine the type of ETFs that best align with your needs and time horizon.

2. Open a Brokerage Account

To invest in ETFs, you’ll need a brokerage account. Choose a reputable online broker that offers commission-free ETF trading, a user-friendly platform, and educational resources. Many brokers also offer tools to help you research and compare ETFs.

3. Fund Your Account

After opening your brokerage account, deposit funds into it. You can start with a modest amount—many ETFs allow you to invest with the cost of just one share, making it easy for beginners to get started.

4. Research and Select ETFs

Use ETF screeners and comparison tools to find funds that match your investment goals. Consider key factors like the fund’s objective, expense ratio, underlying assets, historical performance, and the level of risk.

5. Check Fees and Expense Ratios

Look for ETFs with low expense ratios, especially if you plan to invest for the long term. Lower fees can make a big difference in your overall returns over time.

6. Place Your First Trade

Once you’ve selected an ETF, search for its ticker symbol on your brokerage platform. Decide how many shares to buy and place your order—just like you would with a stock. You can use different order types, such as market or limit orders, depending on your strategy.

7. Monitor Your Investment

After purchasing, keep an eye on your ETF’s performance. While ETFs are ideal for long-term investing, it’s important to review your portfolio periodically to ensure it still aligns with your financial goals and risk tolerance.

8. Consider Reinvestment Options

If your ETF pays dividends, check if your broker offers a dividend reinvestment plan (DRIP). This allows you to automatically reinvest dividends into more shares, helping your investment grow over time.

Sample Diversified ETF Portfolios

Building a diversified portfolio with ETFs is one of the most effective ways to manage risk while pursuing your financial goals. Whether you’re a conservative investor seeking stability, a growth-focused investor aiming for long-term capital appreciation, or someone looking for global exposure, ETFs can help you craft a strategy that fits your risk tolerance and time horizon. Below is a table outlining sample ETF portfolios tailored to different investment goals, showcasing how various types of ETFs can work together to achieve a balanced and diversified mix.

| Investor Goal | ETF Types Included | Diversification Benefit |

| Conservative | Bond ETFs, Dividend ETFs, Large-Cap Equity ETFs | Focus on income and stability with exposure to high-quality bonds and blue-chip stocks |

| Balanced | Total Market Equity ETFs, Bond ETFs, International ETFs | Mix of growth and income with both domestic and global exposure |

| Growth-Oriented | Large-Cap Growth ETFs, Mid/Small-Cap ETFs, Sector ETFs | Higher risk/reward potential through equities across sectors and market caps |

| Global Exposure | International Equity ETFs, Emerging Market ETFs, Currency ETFs | Access to developed and emerging markets, hedging against domestic economic downturns |

| Income-Focused | Dividend ETFs, REIT ETFs, Bond ETFs | Regular income from dividends, rental yields, and fixed-income securities |

| Thematic Investor | Clean Energy ETFs, Tech Sector ETFs, ESG ETFs | Targeted exposure to specific trends or values-driven investing |

Conclusion

Exchange-traded funds (ETFs) have transformed the way individuals invest by offering an accessible, low-cost, and flexible way to build a diversified portfolio. Whether you’re seeking long-term growth, steady income, or exposure to global markets and specific sectors, ETFs provide a wide range of options to match your financial goals. Their unique structure allows investors to gain broad market exposure with a single trade, while also benefiting from real-time pricing, tax efficiency, and transparency. By understanding how ETFs work, their advantages and potential drawbacks, and how to incorporate them into your strategy, you can take a confident step toward building a resilient and well-balanced investment portfolio.