When it comes to protecting yourself, your loved ones, or your assets, insurance is an essential financial tool. At the heart of every insurance policy is the concept of the premium – the cost you pay to secure coverage. Whether it’s health, auto, home, or life insurance, the premium is what keeps your policy active and ensures that your insurer is ready to step in when needed. But what exactly is an insurance premium, and why does it vary from one person to another? In this article, we’ll demystify the meaning of an insurance premium and explore the factors that influence its cost, helping you make informed decisions about your coverage.

What is an Insurance Premium?

An insurance premium is the amount of money you pay to an insurance company in exchange for coverage under a specific policy. It serves as a financial agreement between you and the insurer, ensuring that you are protected against potential risks outlined in the policy terms. Whether you pay it monthly, quarterly, annually, or as a one-time amount, the premium is essential to maintaining your coverage. The cost of this premium is determined based on several factors, including the type of insurance, the coverage level, and your individual risk profile. In essence, it’s the price you pay for peace of mind, knowing that in the event of unforeseen circumstances, your financial stability is safeguarded.

Types of Insurance Premiums

Insurance premiums come in different forms to accommodate various financial needs, policy types, and payment preferences. The structure of an insurance premium can impact how you manage your policy, how much flexibility you have, and how costs are distributed over time. Understanding the types of premiums can help you make informed decisions about the insurance coverage that best suits your lifestyle and financial situation. Below are the main types of insurance premiums with a more detailed explanation:

1. Fixed Premiums

Fixed premiums remain constant throughout the policy term, ensuring that the amount you pay does not fluctuate. This predictability makes budgeting easier and is particularly common in life insurance and other long-term policies.

2. Flexible Premiums

With flexible premiums, policyholders have the option to adjust their payments. This is especially beneficial in policies like universal life insurance, where you can increase, decrease, or even skip payments under certain conditions, giving you control over your contributions.

3. Single Premiums

A single premium is a one-time lump sum payment made at the start of the policy. This type of premium is common in investment-linked insurance and some life insurance plans, offering the convenience of no recurring payments. However, it requires a significant upfront cost.

4. Recurring Premiums

These premiums are paid periodically, such as monthly, quarterly, or annually, and are commonly used in policies like health, auto, and home insurance. This payment structure allows for more manageable installments rather than a large, one-time expense.

5. Level Premiums

Level premiums remain unchanged for a specified period, regardless of changes in risk factors. This type of premium is often associated with term life insurance policies, providing consistency and peace of mind for the insured.

6. Adjustable Premiums

Adjustable premiums may fluctuate based on factors like market performance, policyholder risk assessment, or changes in coverage needs. They are often seen in variable insurance products, providing both opportunities and risks depending on external conditions.

How Are Insurance Premiums Calculated?

Insurance premiums are the payments you make to maintain coverage under an insurance policy. Calculating these premiums involves a complex assessment of risks and other influencing factors. Insurers use a combination of actuarial science, statistical data, and personal details to arrive at a fair and sustainable premium amount. This ensures the insurer can cover potential claims while keeping the system equitable for all policyholders. Below are the detailed factors that play a role in determining insurance premiums:

1. Risk Assessment

Insurers analyze your risk profile based on details such as your age, gender, health status, driving history, or the safety of your property. For example, younger drivers or individuals with pre-existing health conditions might face higher premiums due to increased risks.

2. Type of Insurance

The kind of insurance policy you purchase—be it life, health, auto, or home insurance—affects the premium calculation. Each type of insurance considers specific risk factors unique to the coverage it provides.

3. Coverage Amount and Limits

The more extensive the coverage you choose, the higher the premium. For example, policies with higher limits for liability or more comprehensive protection against various risks will generally cost more.

4. Deductibles

Deductibles refer to the portion of a claim that you agree to pay out of pocket before the insurance kicks in. Choosing a higher deductible lowers your premium, but it also means you bear more financial responsibility in case of a claim.

5. Claims History

Your history with previous insurance policies plays a significant role. If you’ve filed frequent claims in the past, insurers may view you as a higher risk and charge more. Conversely, a clean claims record might earn discounts.

6. Geographical Location

Where you live can significantly impact premiums, particularly for auto and home insurance. High-crime areas or locations prone to natural disasters often result in higher insurance costs.

7. Credit Score

A good credit score is considered an indicator of financial responsibility. For certain types of insurance, individuals with higher credit scores may qualify for lower premiums.

8. Lifestyle and Habits

Lifestyle choices, such as smoking or participation in high-risk hobbies (like extreme sports), can increase premiums for life and health insurance.

9. Economic and Market Conditions

External factors, such as inflation and industry-wide claims trends, can also influence the cost of premiums. For example, inflation may lead to higher costs for repairs or replacements, indirectly affecting premium rates.

Factors That Influence the Cost of an Insurance Premium

The cost of an insurance premium depends on multiple factors that insurers evaluate to determine the level of risk and financial coverage required. Each of these factors plays a role in shaping the amount you pay, ensuring fairness while accounting for individual circumstances. Let’s explore these factors in detail:

1. Age

Age is a significant determinant in many types of insurance. For instance, younger drivers often face higher auto insurance premiums due to their inexperience and increased likelihood of accidents. Similarly, older individuals may pay more for health and life insurance because age correlates with greater health risks. Insurance providers use statistical data to establish risk levels for various age groups, which directly impacts premium costs.

2. Health and Medical History

For health and life insurance, your current health status and medical history play a vital role in determining premiums. Chronic illnesses, pre-existing conditions, and even genetic predispositions to certain diseases can increase risk for insurers, resulting in higher premiums. A person in excellent health may benefit from lower premiums as they are less likely to file a claim.

3. Type of Coverage

The scope and type of coverage you select directly affect your premium costs. Comprehensive policies that cover a wide range of risks are generally more expensive than basic plans. For instance, full coverage auto insurance, which includes liability, collision, and comprehensive coverage, costs more than a policy that only meets the minimum legal requirements.

4. Claims History

Insurers view individuals with frequent claims as higher-risk clients. If you have a history of multiple claims, whether for auto, home, or health insurance, it signals a greater likelihood of future claims, leading to higher premiums. Conversely, maintaining a clean claims record can result in discounts or rewards, such as no-claims bonuses.

5. Geographical Location

Your place of residence has a direct impact on premiums, especially for property and auto insurance. Living in areas prone to natural disasters (e.g., floods, hurricanes, or earthquakes) or with high crime rates often leads to increased premiums. For auto insurance, urban areas with heavy traffic congestion may result in higher costs compared to rural locations.

6. Credit Score

Many insurers use your credit score as an indicator of financial responsibility. Individuals with high credit scores are perceived as lower risk, often resulting in reduced premiums. Conversely, poor credit scores can lead to higher costs as they suggest potential financial instability, which insurers may associate with higher claim likelihood.

7. Driving Record

In auto insurance, your driving history is one of the most critical factors. A clean driving record with no accidents or traffic violations shows that you’re a low-risk driver, often leading to lower premiums. However, a history of speeding tickets, DUIs, or at-fault accidents can significantly increase the cost of your auto insurance.

8. Deductible Amount

The deductible is the amount you agree to pay out of pocket before your insurance covers a claim. Opting for a higher deductible reduces the insurer’s financial responsibility, resulting in lower premiums. However, this comes with the trade-off of higher upfront costs during a claim.

9. Lifestyle and Occupation

High-risk lifestyles and jobs can increase insurance premiums, particularly for life and health insurance. For example, individuals who smoke, engage in extreme sports, or work in hazardous environments (e.g., construction or firefighting) are at a higher risk of injuries or health issues, which insurers account for when setting premium rates.

10. Policy Features

Customizing your insurance policy with additional riders, benefits, or extended terms can increase premiums. For instance, adding critical illness coverage to a life insurance policy or opting for zero depreciation coverage in auto insurance will raise the overall cost.

11. Economic Factors

External influences, such as inflation or changes in market trends, can indirectly affect premium costs. For instance, rising healthcare costs may lead to increased health insurance premiums, while a surge in natural disasters can elevate property insurance rates due to higher claims payouts by insurers.

How to Lower Your Insurance Premium

Insurance premiums can add up over time, but there are effective ways to reduce these costs without compromising on the coverage you need. Whether you’re insuring your home, car, health, or life, insurers often offer discounts or rewards for behaviors that lower their risk. Understanding these strategies can help you save money while ensuring you’re adequately protected. Below are detailed tips to lower your insurance premiums:

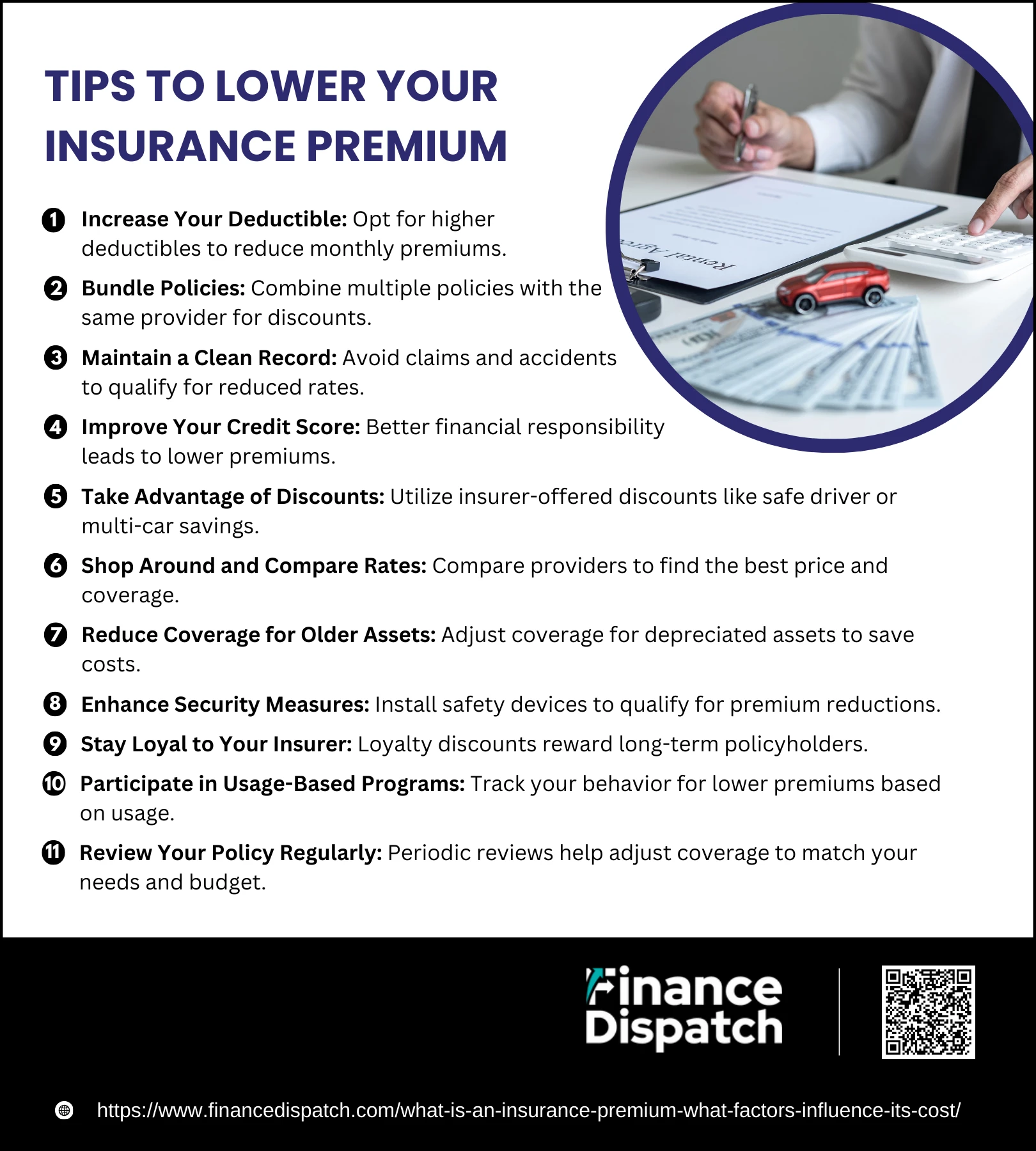

Tips to Lower Your Insurance Premium

1. Increase Your Deductible

Choosing a higher deductible lowers the insurer’s risk by requiring you to pay more out-of-pocket in the event of a claim. For example, raising your auto insurance deductible from $500 to $1,000 could significantly reduce your monthly premium. Be sure you have the financial ability to cover the higher deductible if needed.

2. Bundle Policies

Combining policies, such as home and auto insurance, under one provider often results in discounts. This not only simplifies managing your coverage but also lowers the overall cost. Insurers appreciate the loyalty and reward customers with savings.

3. Maintain a Clean Record

For auto insurance, a history free of accidents or traffic violations can lead to reduced rates. Similarly, for home insurance, fewer claims demonstrate lower risk, which insurers may reward with discounts or bonuses.

4. Improve Your Credit Score

A strong credit score signals financial responsibility, which insurers often use as a factor in determining premiums. Paying bills on time, reducing outstanding debt, and regularly reviewing your credit report can help you achieve a better score and, consequently, lower premiums.

5. Take Advantage of Discounts

Many insurers offer a variety of discounts tailored to specific circumstances. These can include safe driver discounts, good student discounts, multi-car discounts, and discounts for being a member of certain organizations. Check with your insurer to maximize savings.

6. Shop Around and Compare Rates

Not all insurance companies calculate premiums in the same way. Comparing quotes from multiple providers can help you find the best rate for the same level of coverage. Websites and comparison tools make this process easier and more efficient.

7. Reduce Coverage for Older Assets

If your car or property has depreciated significantly, consider reducing optional coverages like collision or comprehensive insurance. For example, an older car with a market value of $2,000 may not need full coverage if the repair costs exceed its worth.

8. Enhance Security Measures

Installing safety features like anti-theft devices, alarm systems, or fire sprinklers can lower the risk of loss or damage. Many insurers provide discounts for these upgrades, as they reduce the likelihood of claims.

9. Stay Loyal to Your Insurer

Loyalty discounts are often available for customers who stick with the same insurance company over time. Some insurers even offer increasing discounts for each consecutive renewal period without claims.

10. Participate in Usage-Based or Pay-As-You-Go Programs

Programs that track your actual usage or behavior, like telematics in auto insurance, can lower premiums for safe drivers or low-mileage drivers. Similarly, some health insurance providers offer discounts for maintaining a healthy lifestyle.

11. Review Your Policy Regularly

Over time, your needs and circumstances may change. Periodically reviewing your policy allows you to eliminate unnecessary add-ons, adjust coverage levels, or take advantage of newly available discounts.

The Importance of Comparing Insurance Premiums

Comparing insurance premiums is a critical step in finding the right policy at the best price. Premiums for similar coverage can vary significantly between providers due to differences in risk assessment, coverage options, and discounts. By comparing quotes, you gain insight into what each insurer offers, helping you identify the most cost-effective option without sacrificing necessary coverage. Additionally, comparison shopping allows you to understand industry standards, negotiate better deals, and ensure transparency in pricing. It’s not just about saving money—it’s about making informed decisions that align with your budget and insurance needs, ensuring you get the best value for your investment.

Conclusion

Insurance premiums are a vital part of securing financial protection and peace of mind, but understanding how they work and what factors influence their cost is equally important. Whether you’re looking to save money, customize your coverage, or find the right provider, being informed empowers you to make better decisions. Comparing premiums, maintaining a clean record, and leveraging available discounts are just some of the ways to optimize your insurance plan. By taking a proactive approach, you can ensure that your policy not only fits your budget but also provides the comprehensive coverage you need when it matters most.